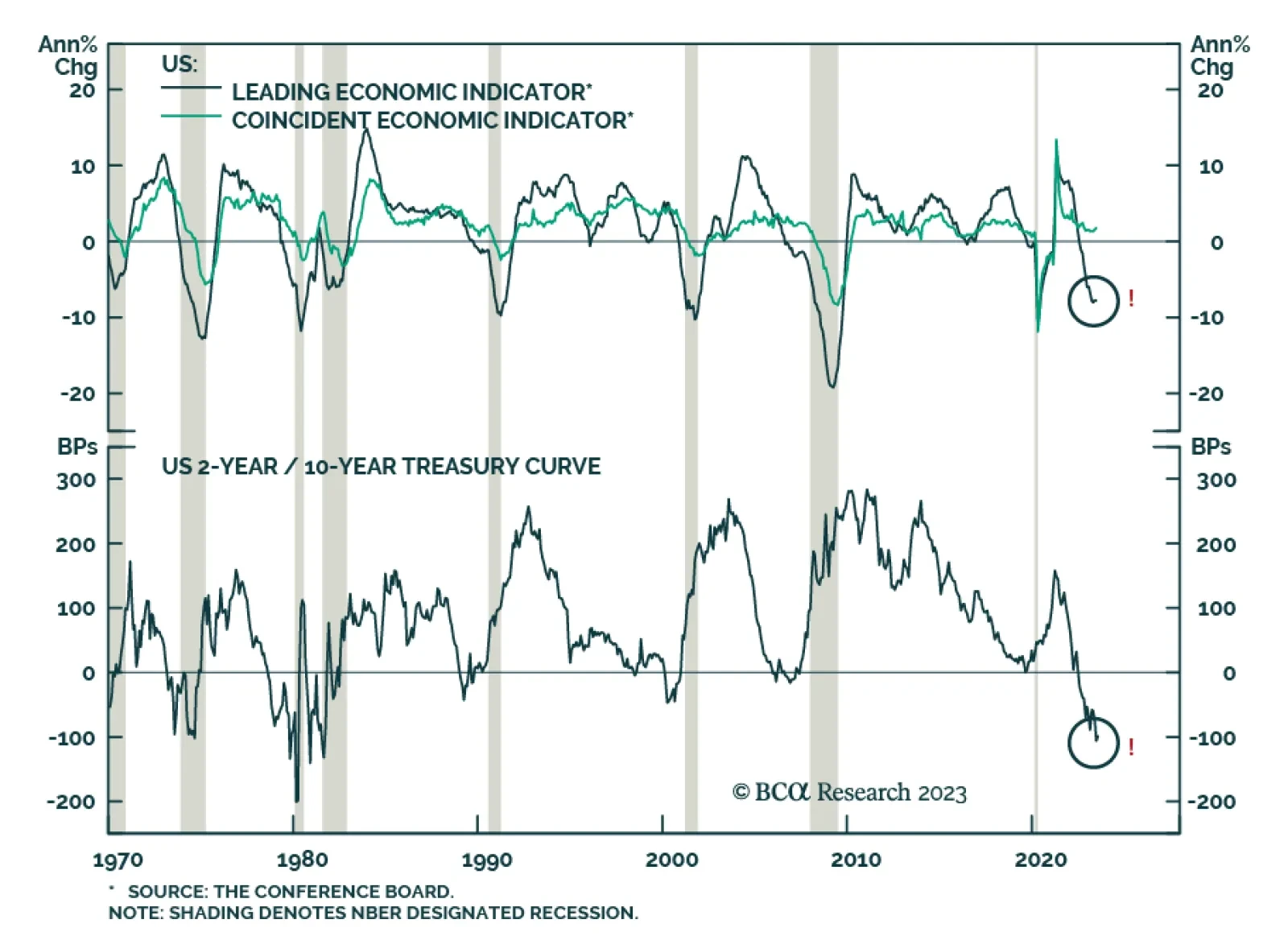

Although not our base case, there is a path for the US economy to avoid a recession over the next few years. We see the risks to stocks as tilted to the upside in the near term but to the downside over a 12-month horizon.

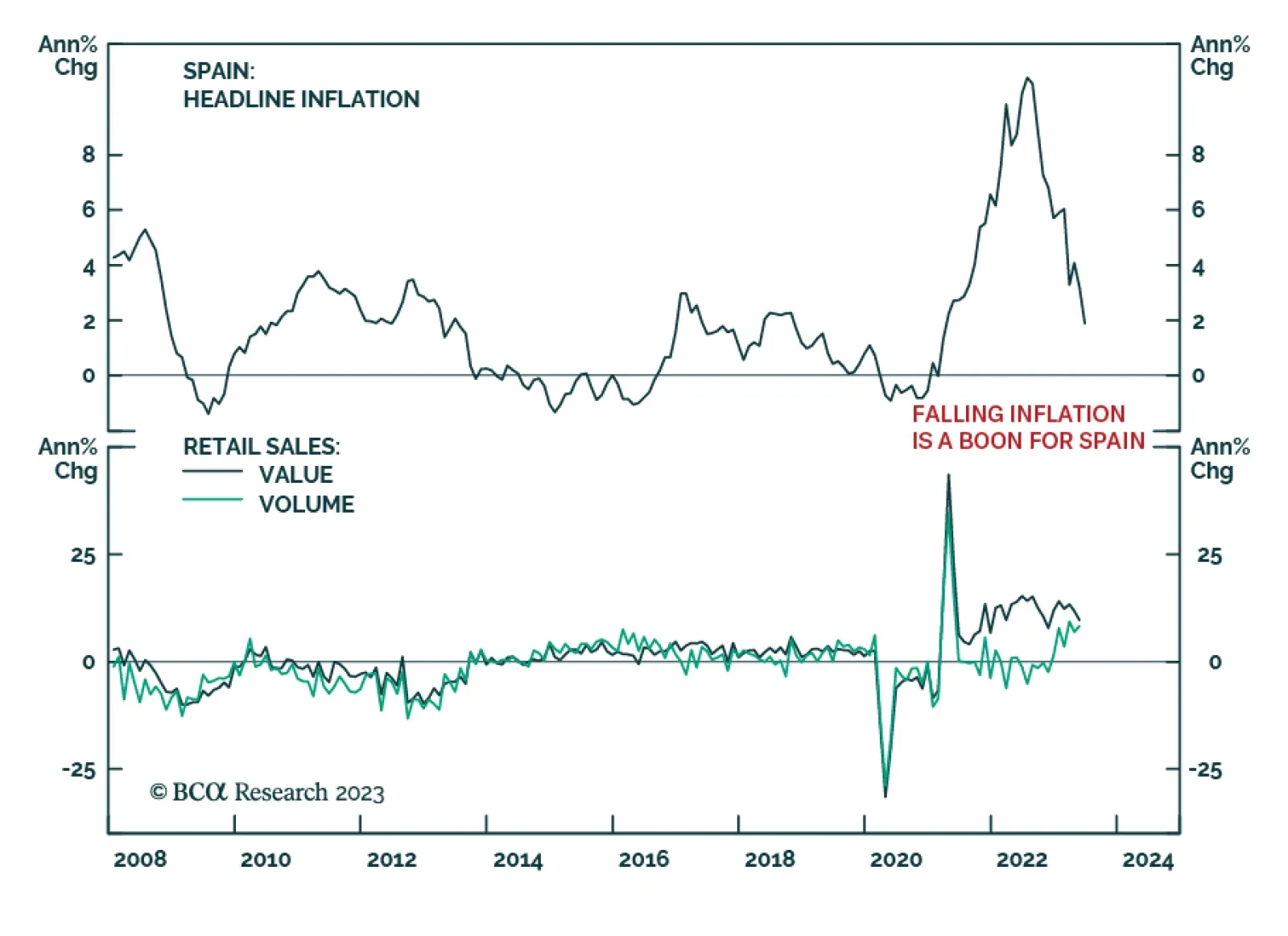

According to BCA Research’s Geopolitical Strategy and European Investment Strategy services, Spain’s economy is outperforming that of the Eurozone thanks to lower inflation and exploding tourism activity. These trends…

Investors have become increasingly more optimistic about the economic outlook. BoA’s Global Fund Manager Survey shows the share of investors surveyed expecting the global economy to experience a soft landing over the next…

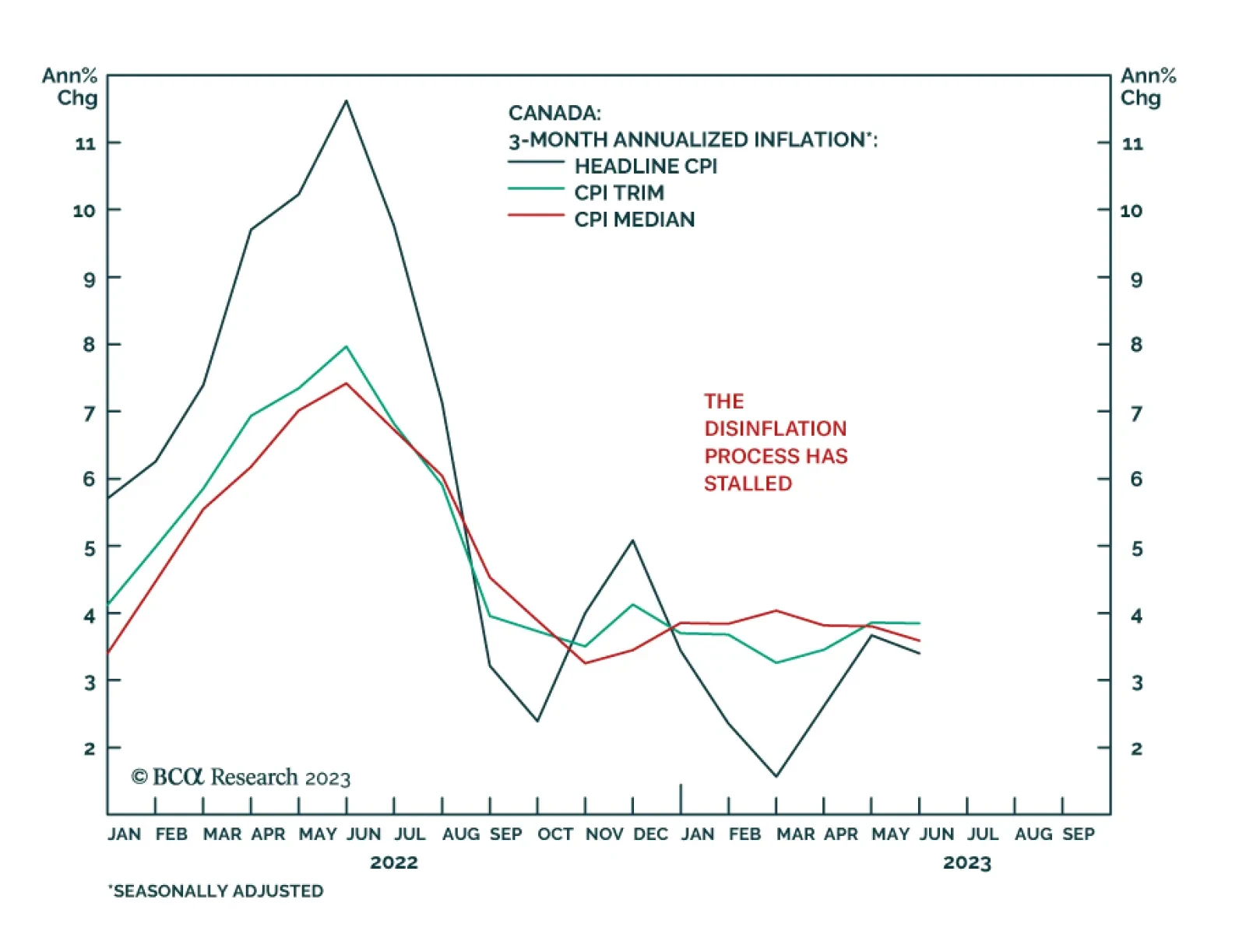

Canada’s CPI release showed headline CPI inflation cooled from 3.4% y/y to 2.8% in June – below estimates calling for a less pronounced moderation to 3.0% y/y. This marks inflation’s first return to the Bank of…

Stocks fare best when there is plenty of slack in the economy and growth is strong and getting stronger. The good news is that the economic growth score for the US in our MacroQuant model is above its historic average. The bad news…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

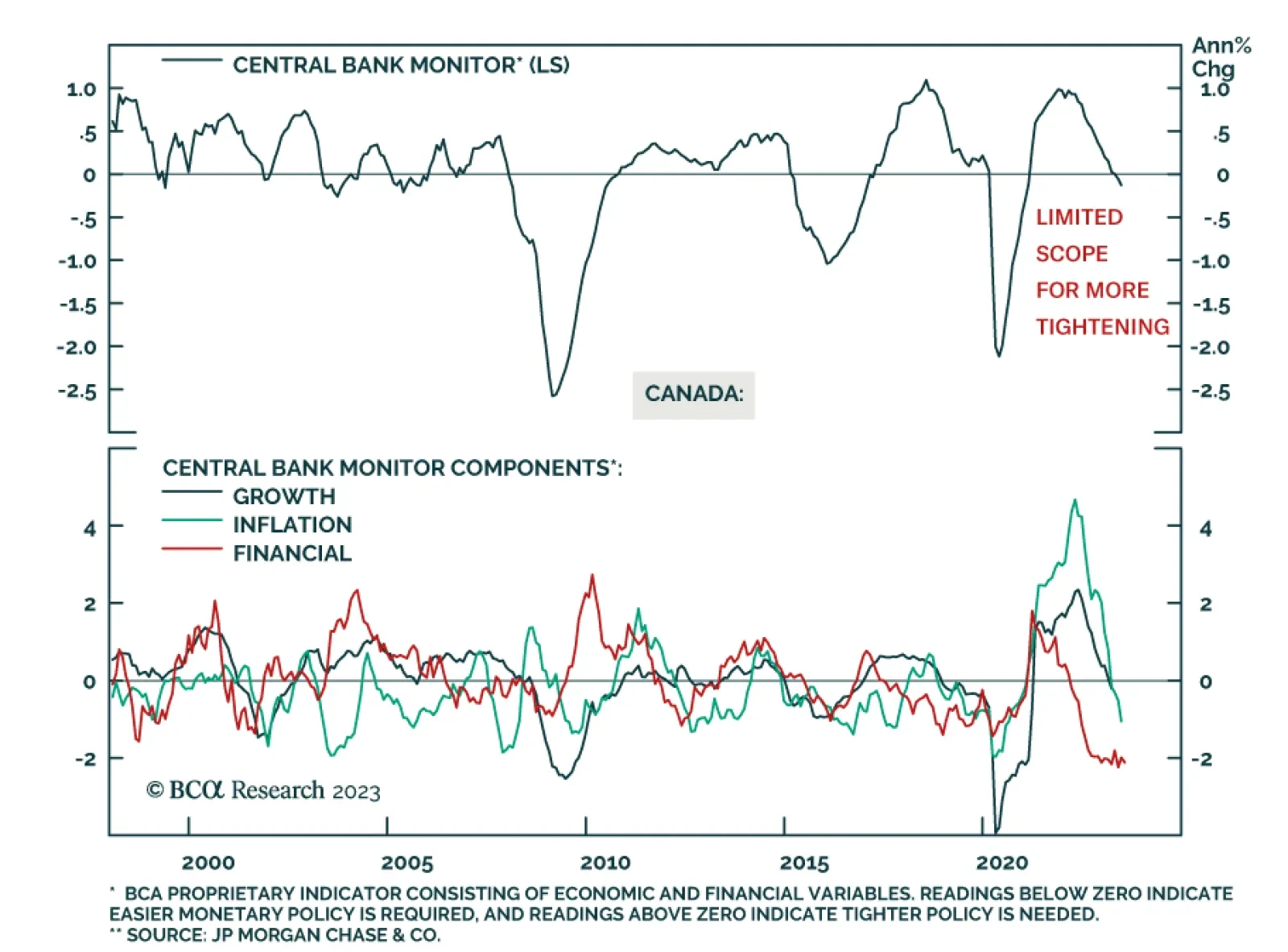

As expected, the Bank of Canada raised interest rates for the second consecutive month after restarting its tightening campaign last month. At 5.0%, the policy rate now stands 4.75 percentage points above where it was at the…

The stratospheric valuation of this year’s AI mania is likely to deflate, just as it did after the Web 1.0 mania of the late 90s. We go through some long-term and short-term investment implications.

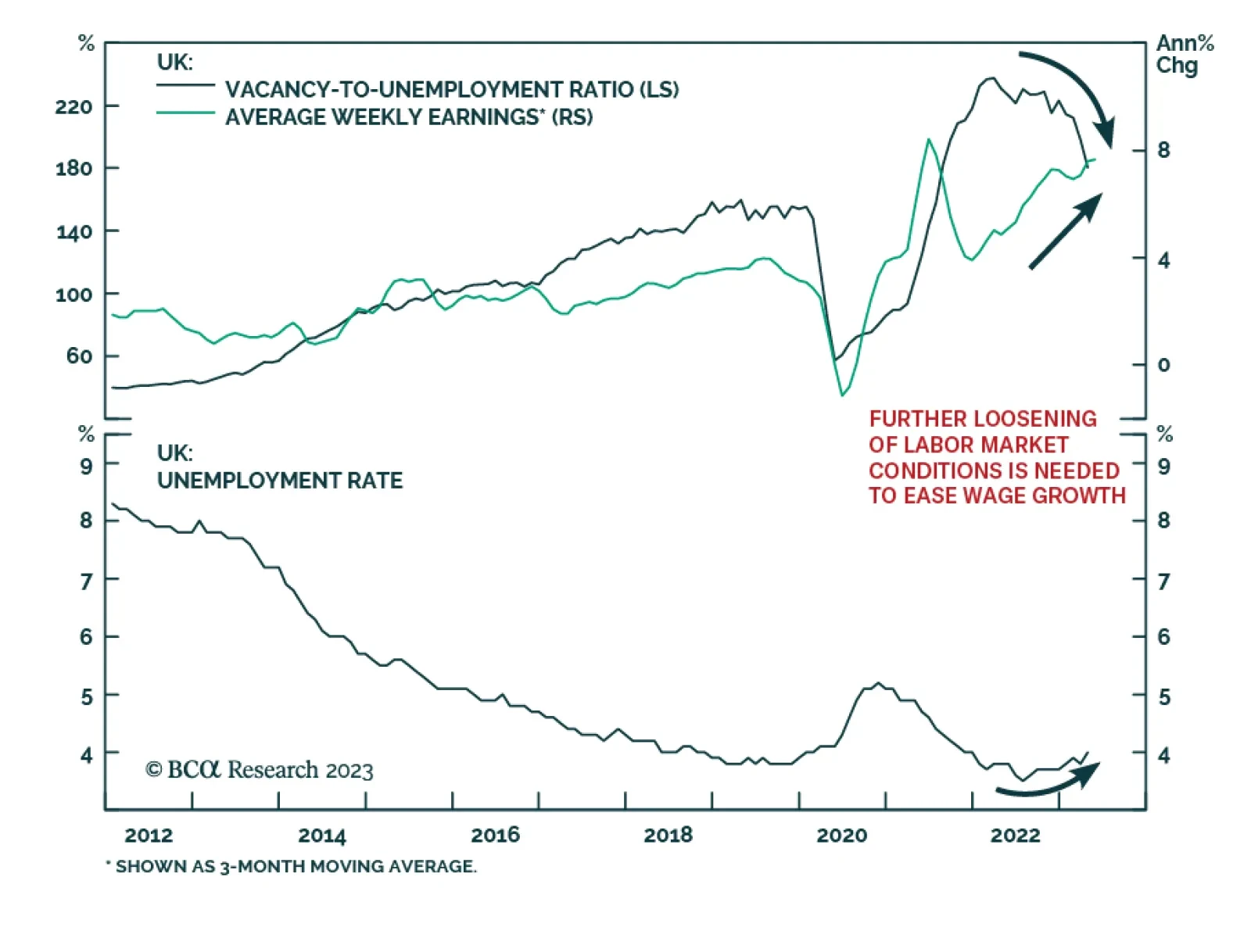

Hot UK wage data focused investors’ attention on the Bank of England’s battle against sticky inflationary pressures on Tuesday. The 7.3% y/y increase in weekly earnings (excluding bonuses) in the three months to May…

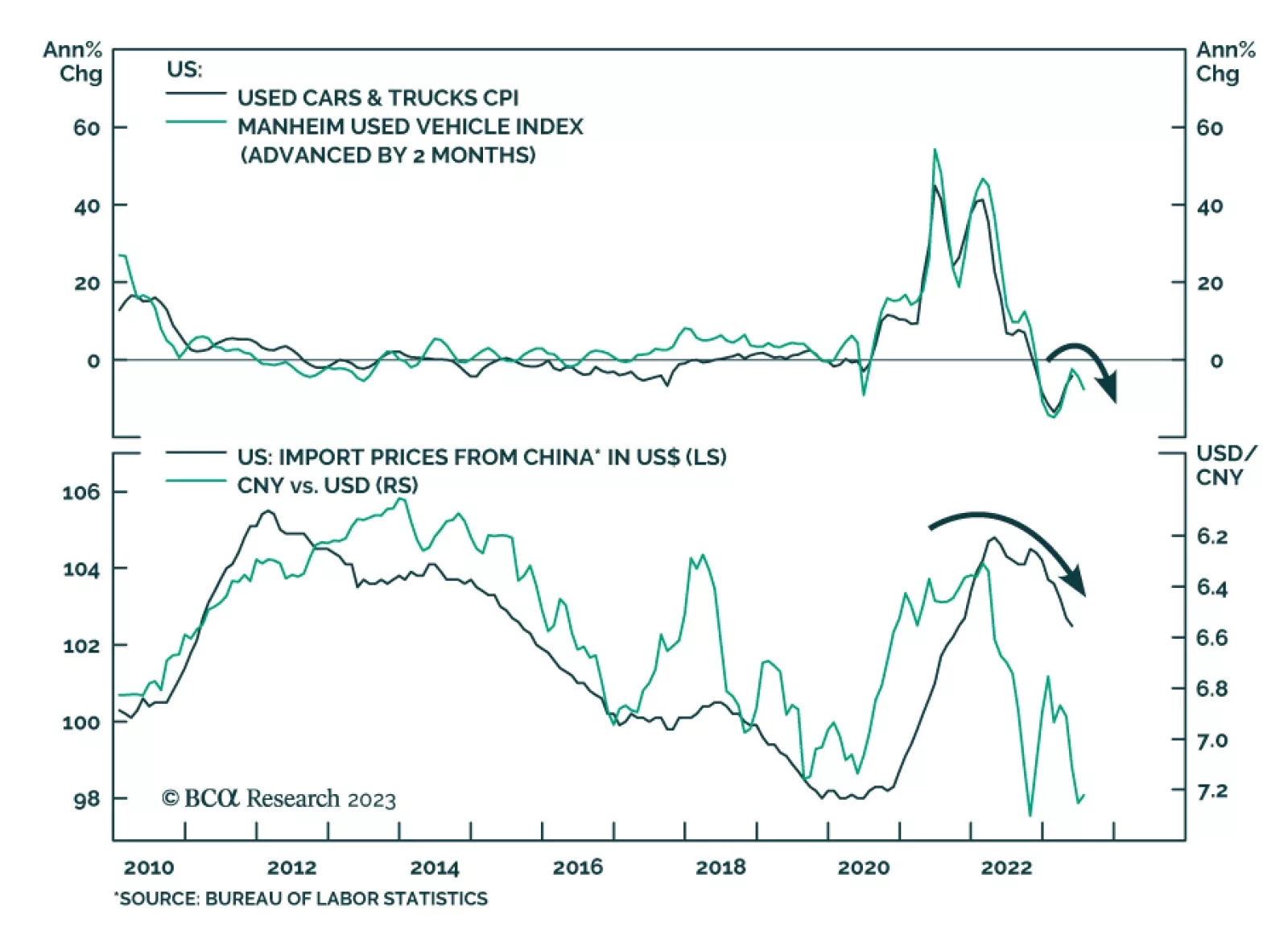

The latest update of the Manheim Used Vehicle Price Index provides a positive signal for US goods inflation. It shows used car prices fell by -4.2% m/m (-10.1% y/y) in June – its third consecutive monthly decline following…