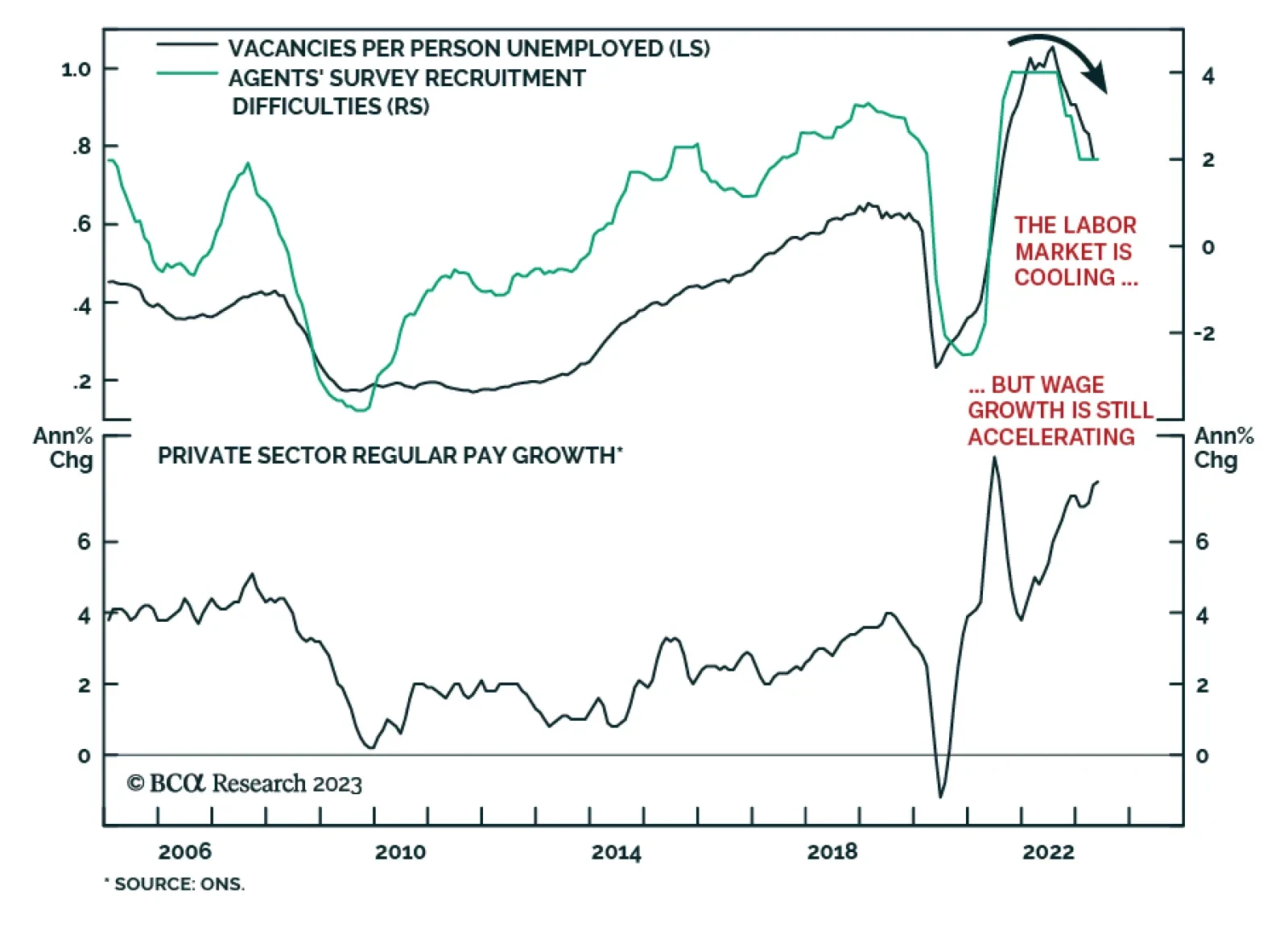

As expected, the Bank of England delivered another 25 basis point rate increase at its Thursday meeting, lifting the policy rate to 5.25%. Going forward, Bailey – not unlike his counterparts at the Fed and ECB –…

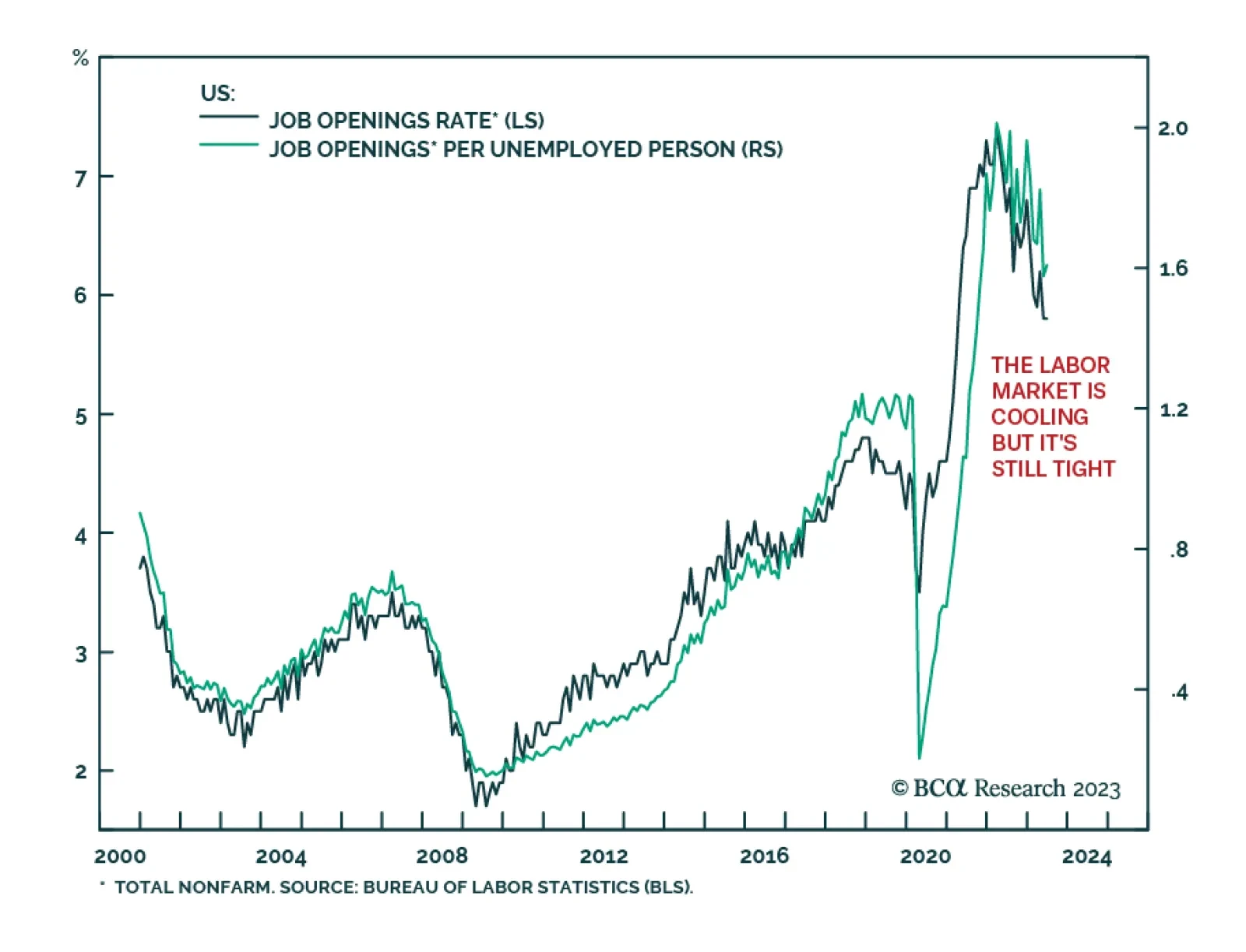

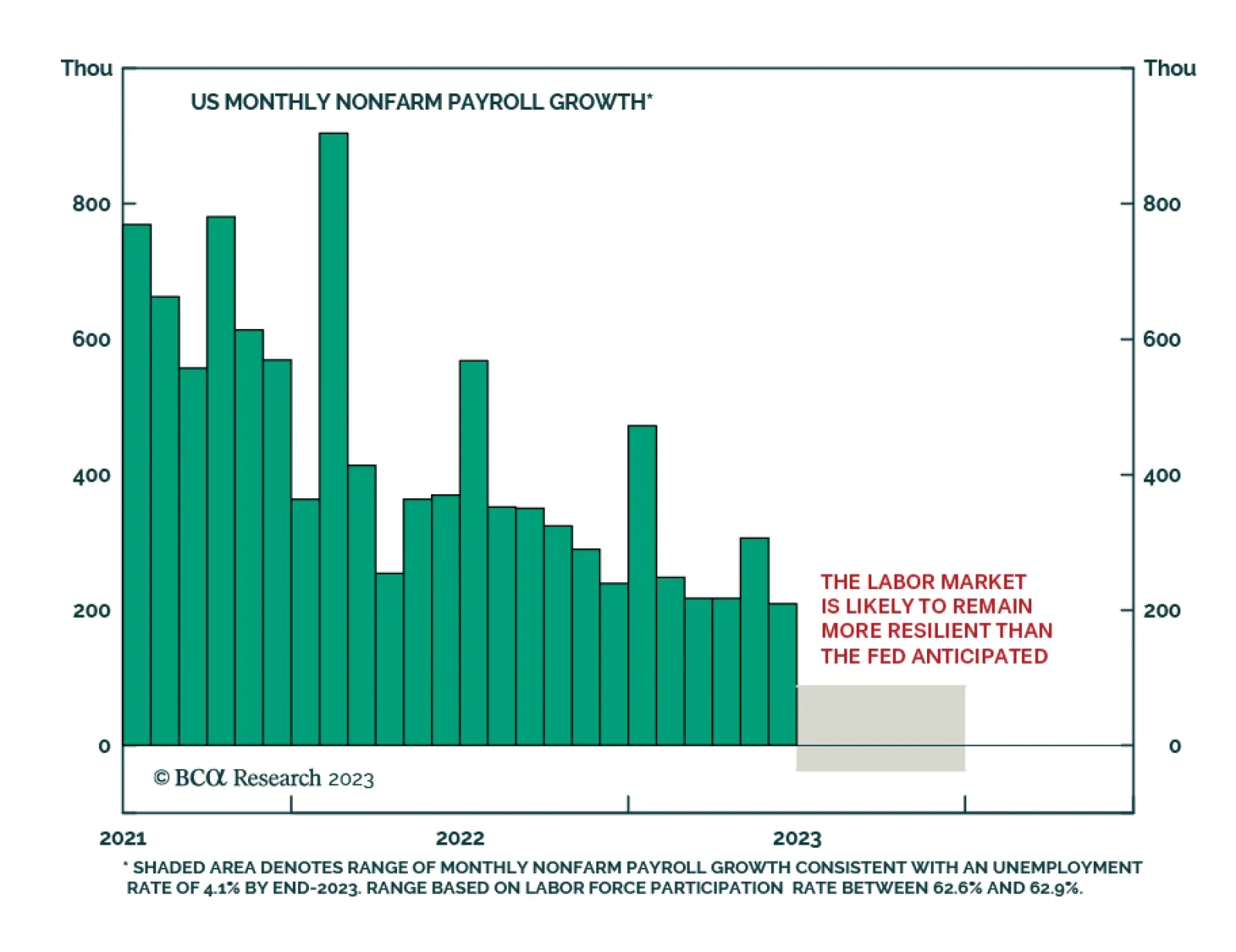

The ADP Jobs Report delivered a better-than-anticipated signal about the US labor market on Wednesday. The 324 thousand increase in private employment in July beat expectations of a 190 thousand rise and marks the second highest…

Collapsed complexity, plus the unwinding of favourable base effects and favourable seasonal adjustments to the inflation and jobs numbers, all pose a danger to the Goldilocks market.

History suggests that a “soft landing” is highly unlikely after such an aggressive Fed tightening cycle. The rally could continue for a little longer but, on the 12-month horizon, market risks are very skewed to the downside.

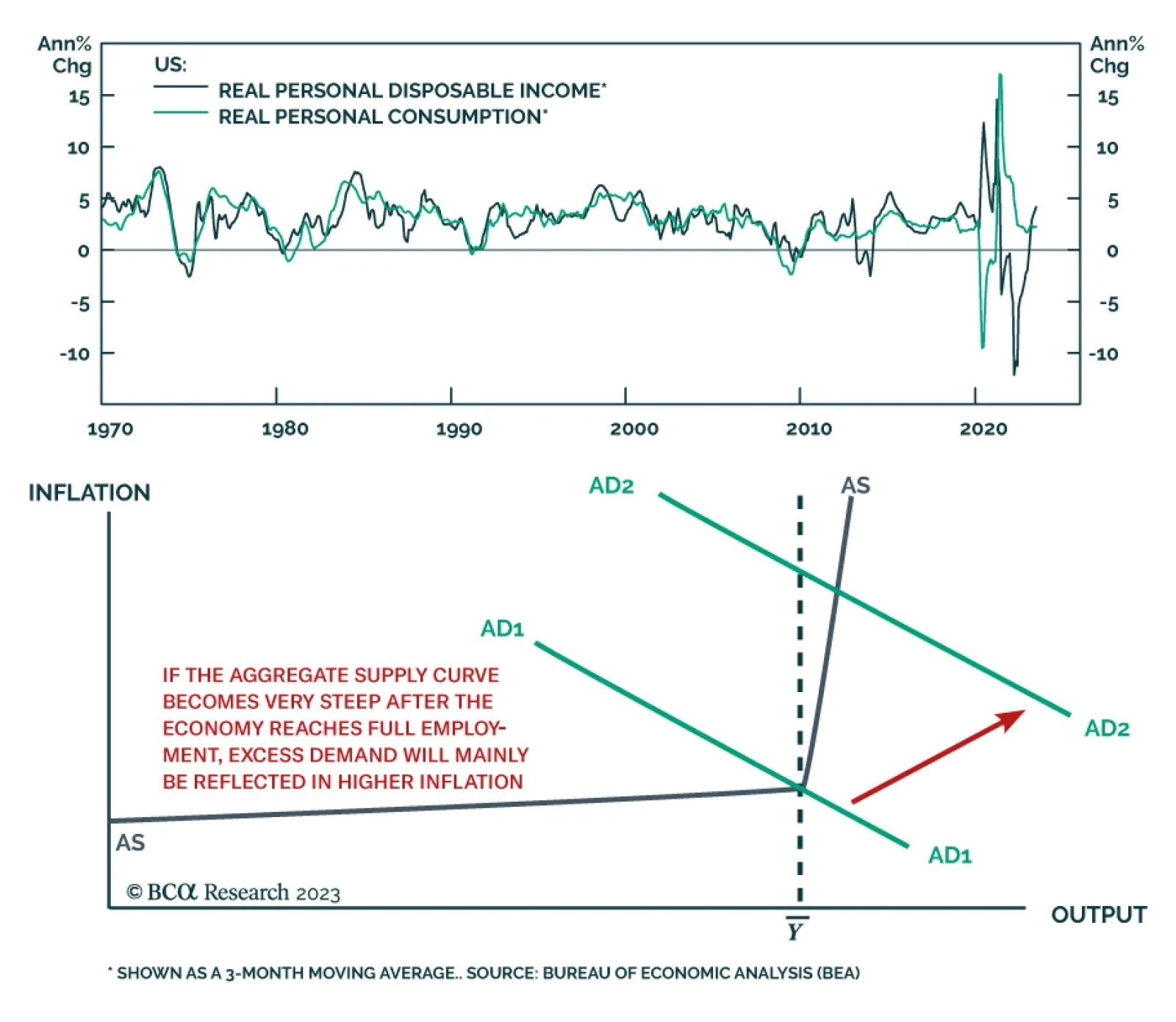

According to BCA Research’s Global Investment Strategy service, it is too early to conclude that the Fed can stop raising rates. Consumption and real income growth are highly correlated. If inflation continues to fall,…

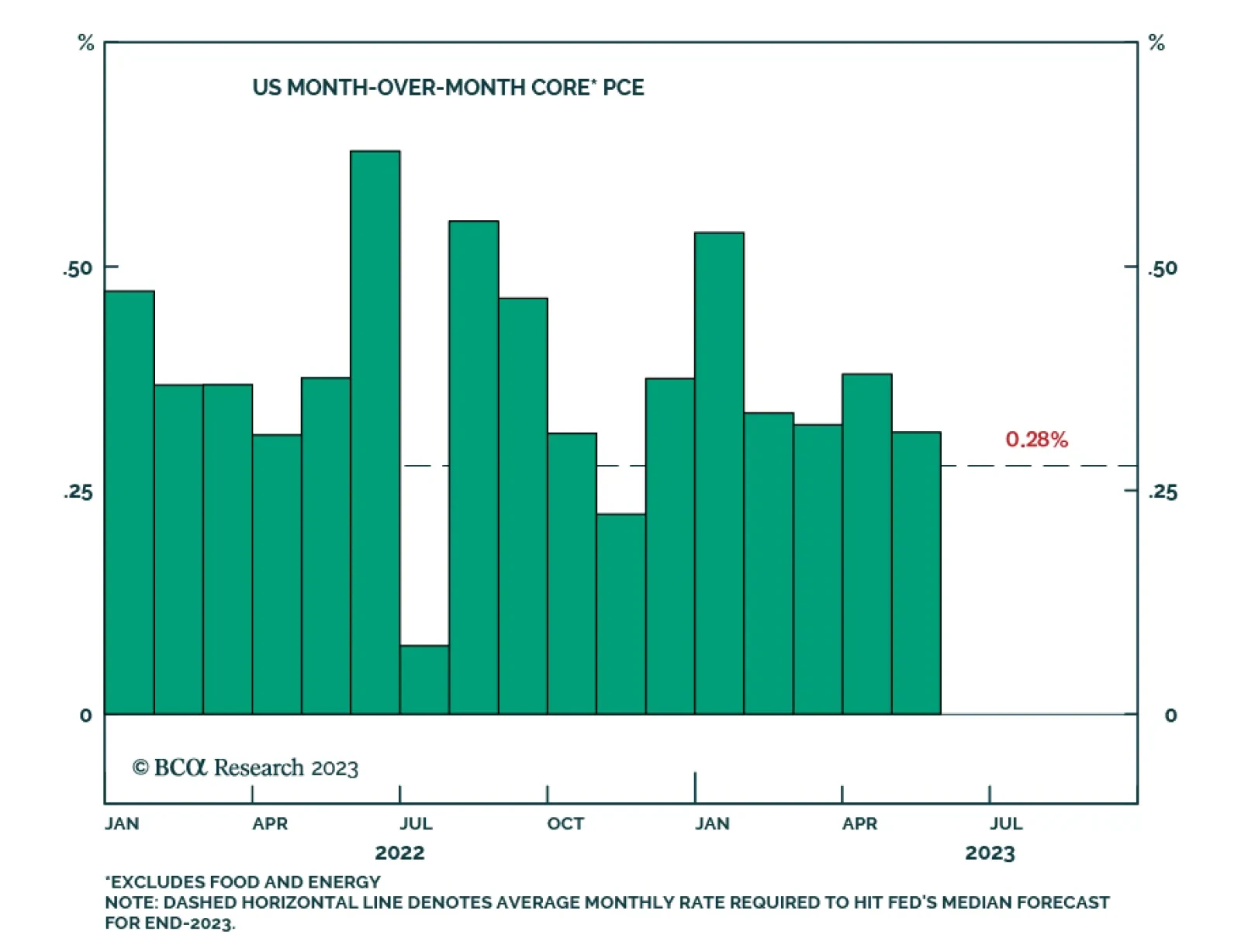

The US is not out of the woods when it comes to inflation, which means that it is too early to conclude that the Fed can stop raising rates. Any further increase in inflation risk would prompt us to turn more cautious on stocks.

A look at recent US data on economic growth and inflation, with an update on the implications for monetary policy and bond yields.

Looking at the complete picture of GDP growth, inflation, and unemployment, it is understandable to assume the Fed is doing much better than it expected. GDP growth is tracking to exceed the Fed's forecast, while the outlook…

The July FOMC meeting proceeded pretty much as expected. The Fed hiked by 25 basis points, bringing the target range for the funds rate up to 5.25%-5.50%. The forward rate guidance included in the post-meeting statement was also…

A brief recap of the July FOMC meeting and its investment implications.