US fiscal, monetary, and foreign policies are unlikely to deliver any dovish surprises for investors in Q4, due to the impending government shutdown, persistent inflation, and instability among OPEC+ and China.

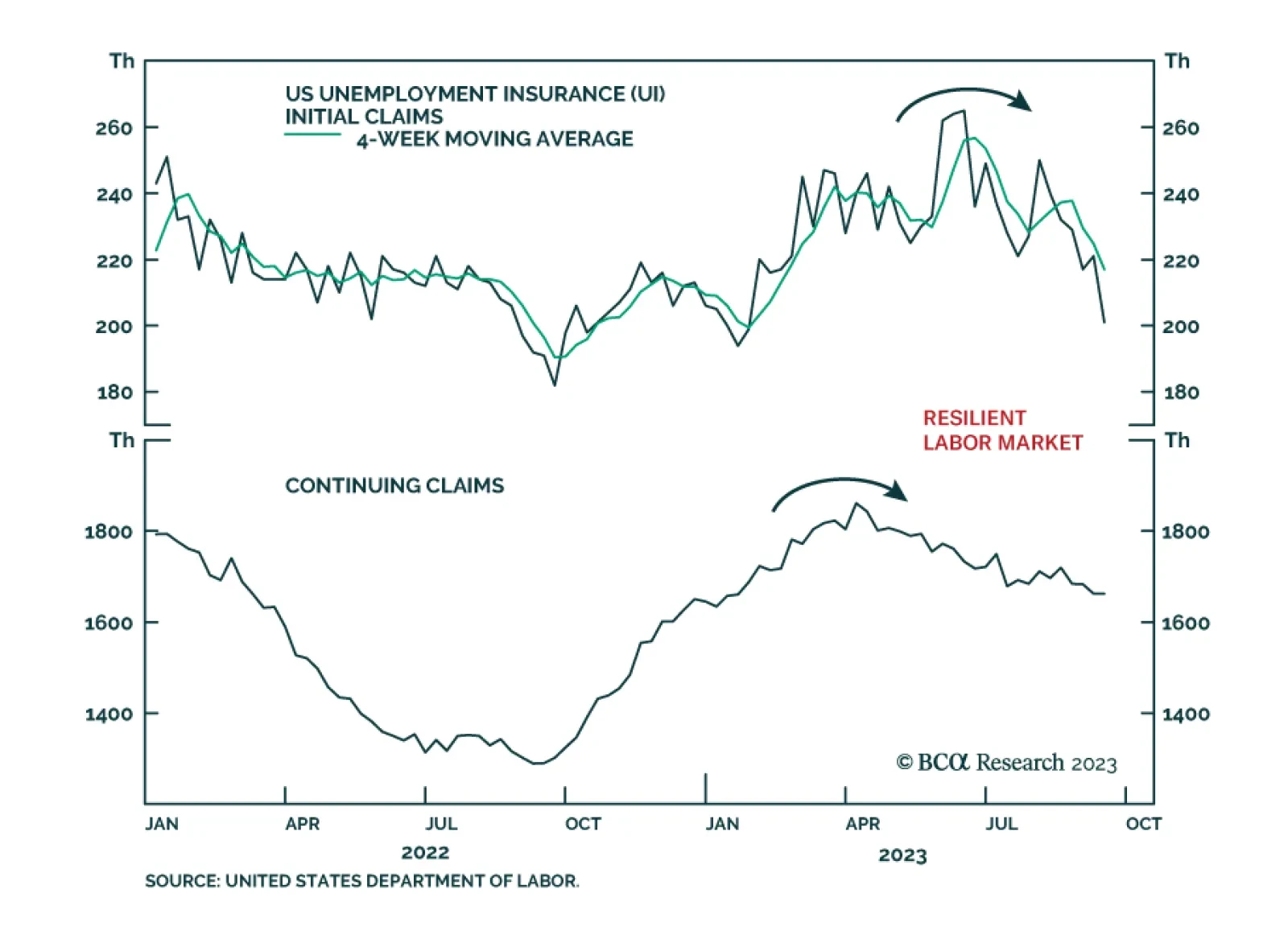

Thursday’s release of US weekly jobless claims and continuing claims delivered a positive surprise about labor market conditions. The decline in initial jobless claims to an eight-month low of 201 thousand came in below…

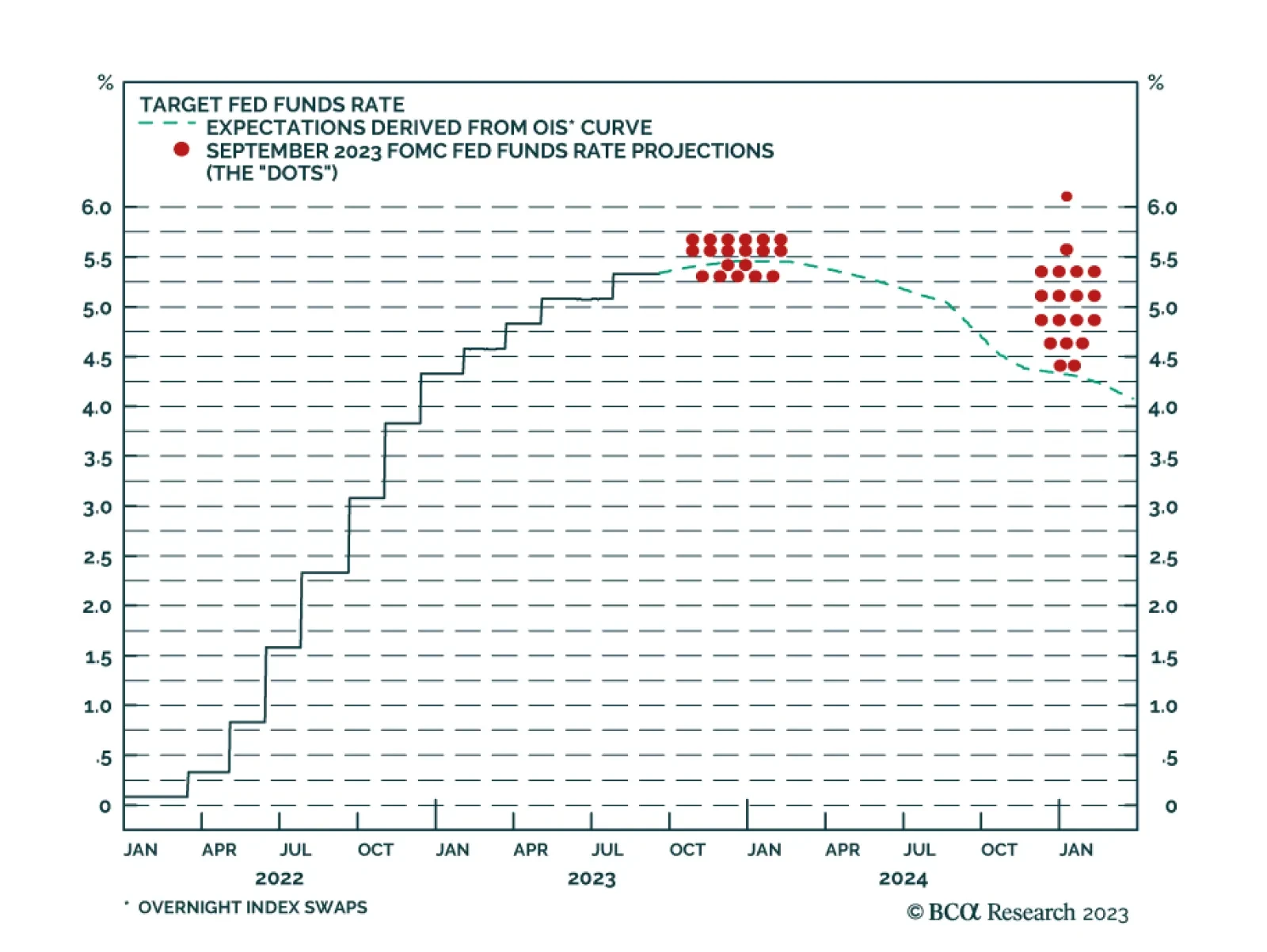

According to BCA Research’s US Bond Strategy service, the 2006/07 roadmap remains a good one for bond investors. The Fed held the funds rate steady this afternoon and made no material changes to its policy statement.…

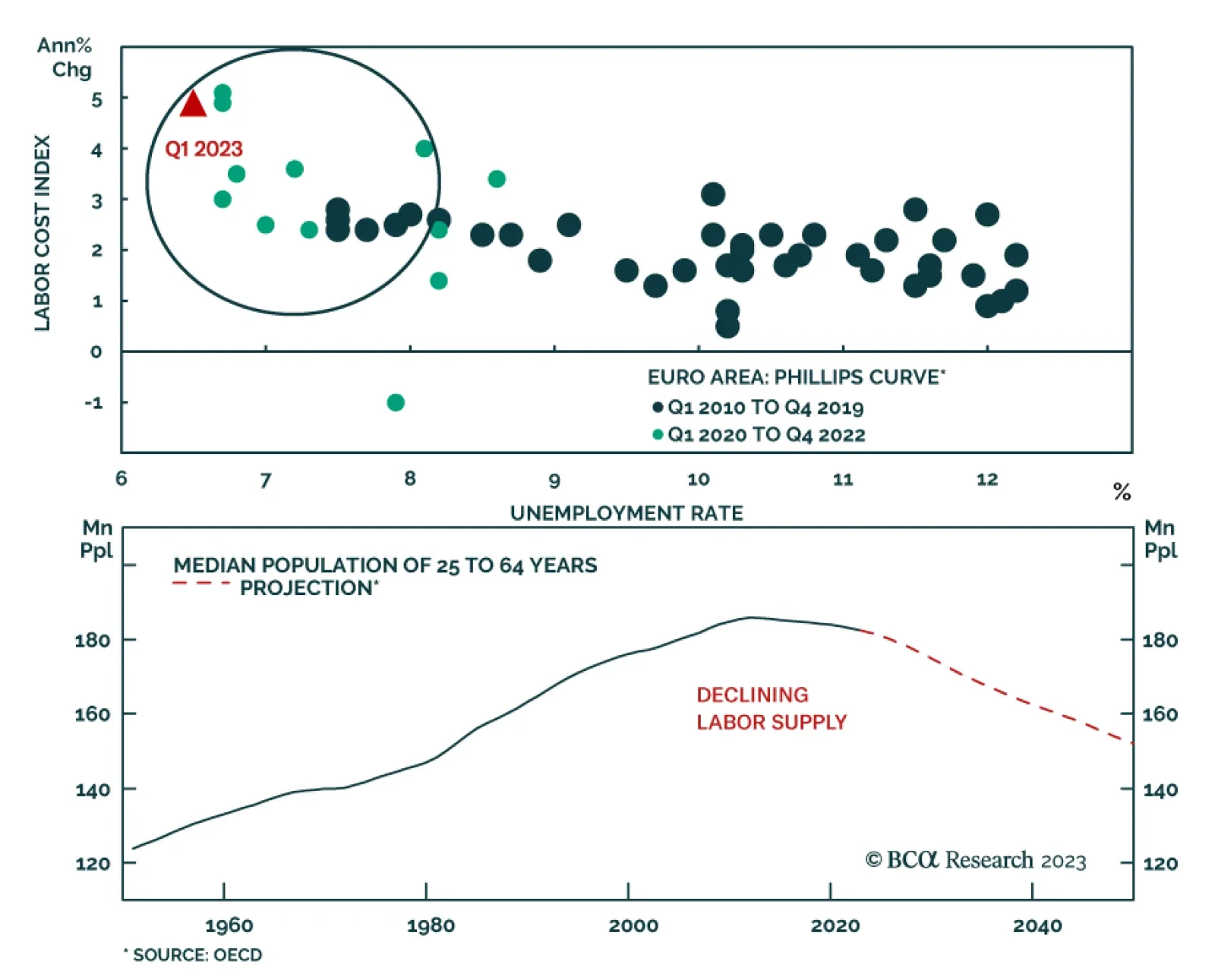

According to BCA Research’s European Investment Strategy service European inflation is likely to remain stubborn through the remainder of the decade, since the working-age population’s decline will keep the labor…

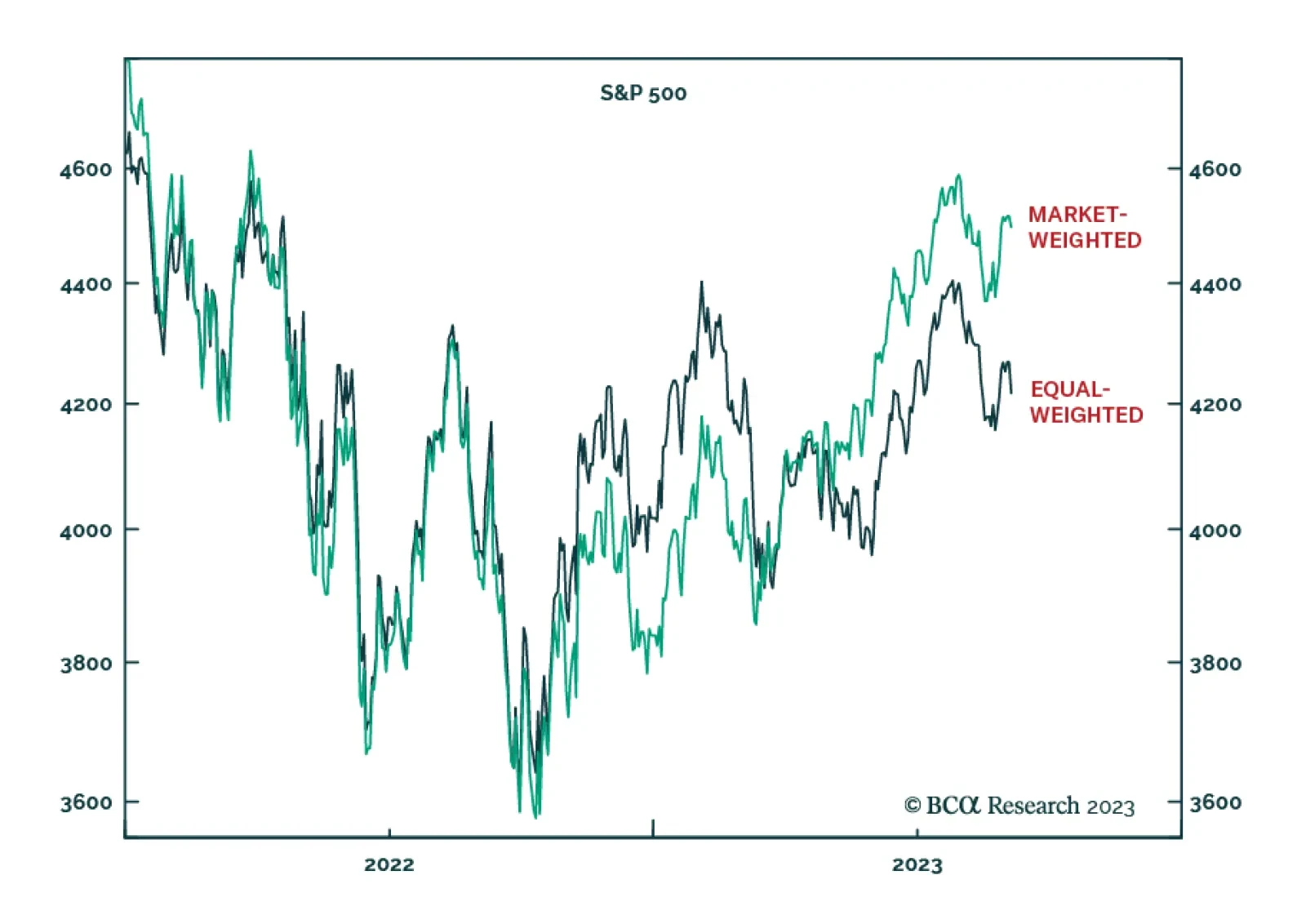

While we are sympathetic to the view that the Fed could temporarily achieve a soft landing, we are skeptical that it could stick that landing for very long. Stocks could strengthen into year-end, with small caps potentially leading…

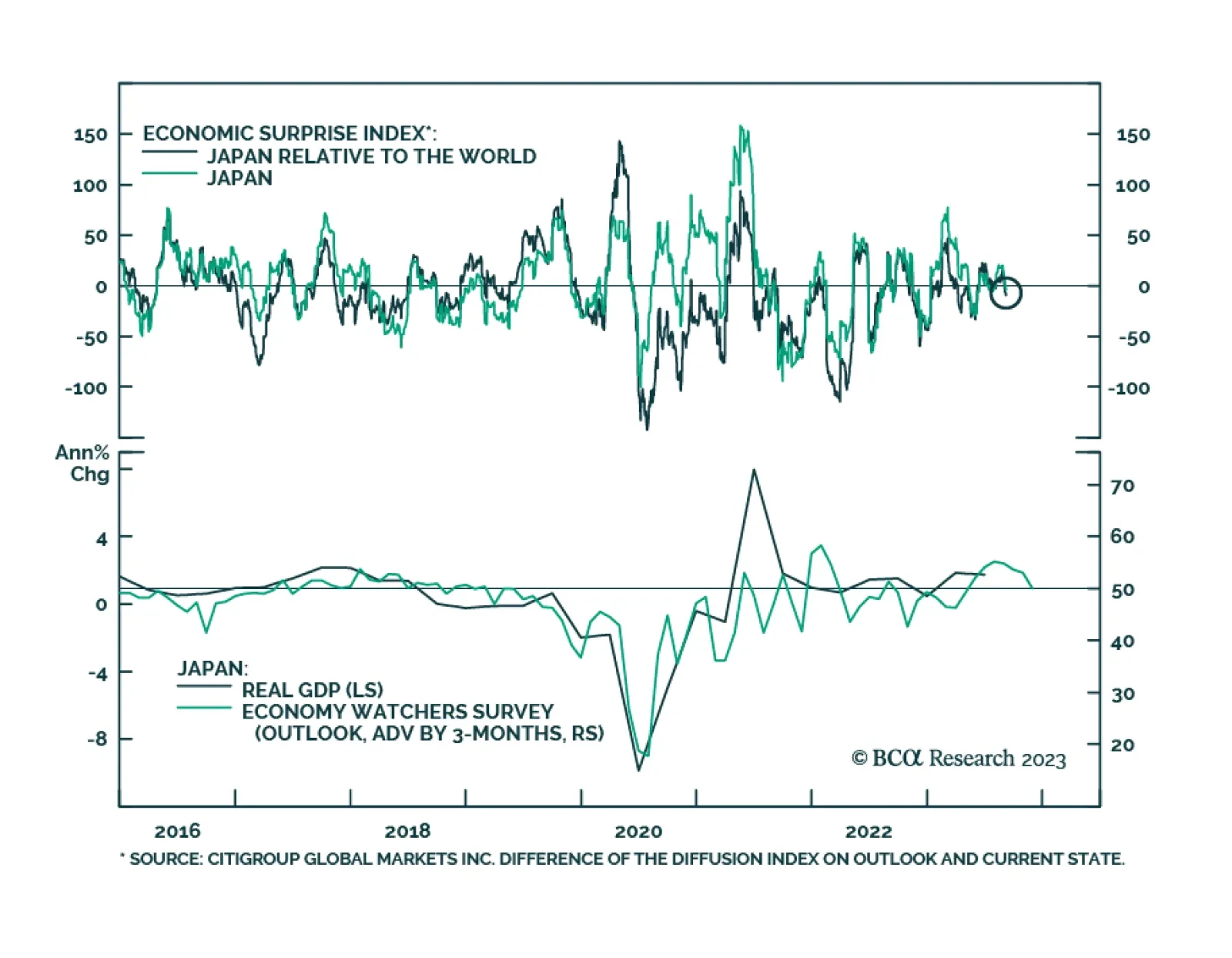

Japanese economic data delivered a negative surprise on Friday. Q2 GDP growth was revised down from 1.5% q/q to 1.2% q/q, below expectations of 1.4% q/q. The downwards revision reflects a 1% q/q decline in business spending (…

According to BCA Research’s Counterpoint service, Goldilocks is just a fairy tale. In the near-term, this will be negative for stocks, neutral for bonds, and positive for the dollar. The Fed can win the war against…

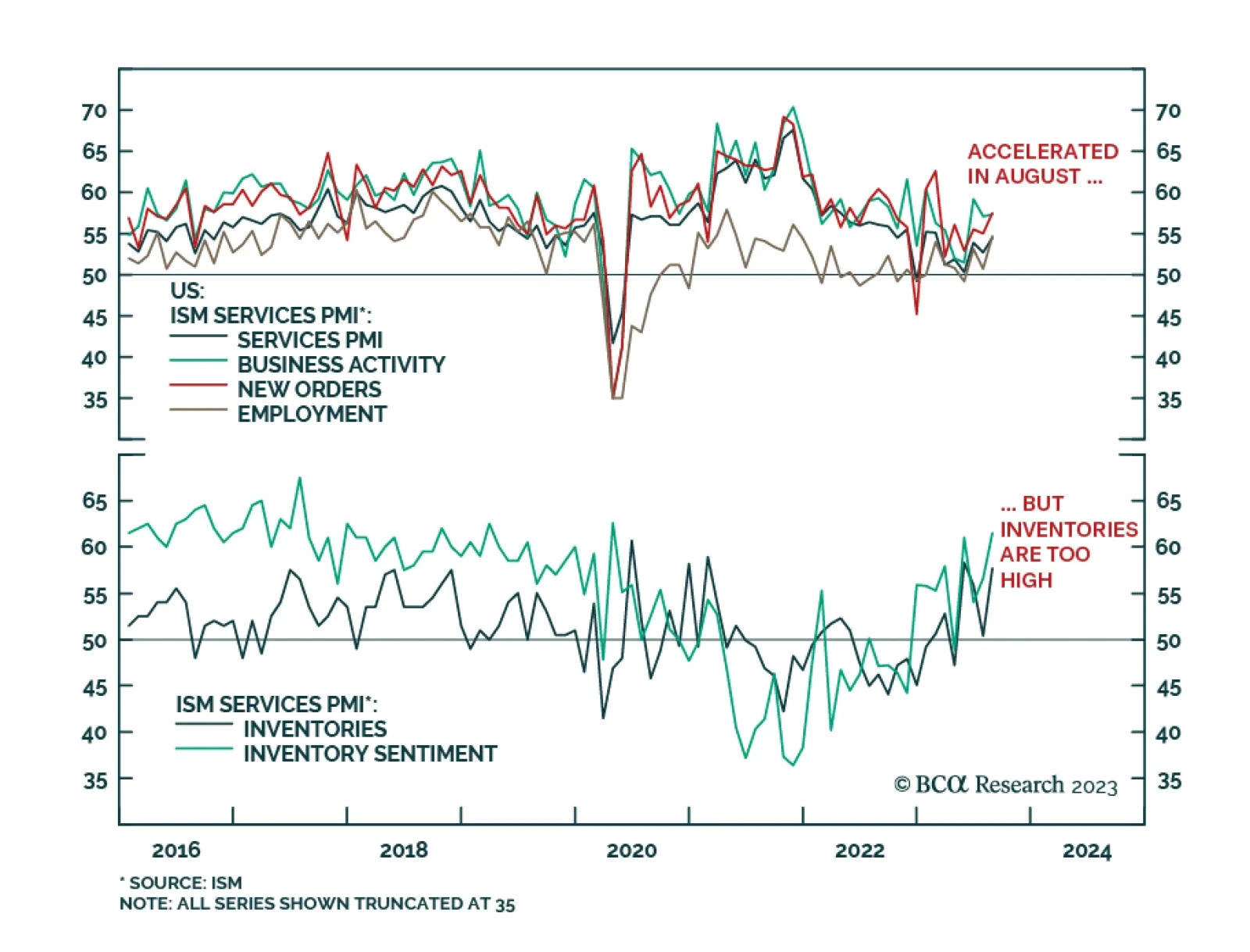

The US ISM delivered a positive signal about service sector activity in August. The headline index unexpectedly jumped by 1.8 points to a six-month high of 54.5, surprising expectations of a 0.2-point decline to 52.5. Importantly…

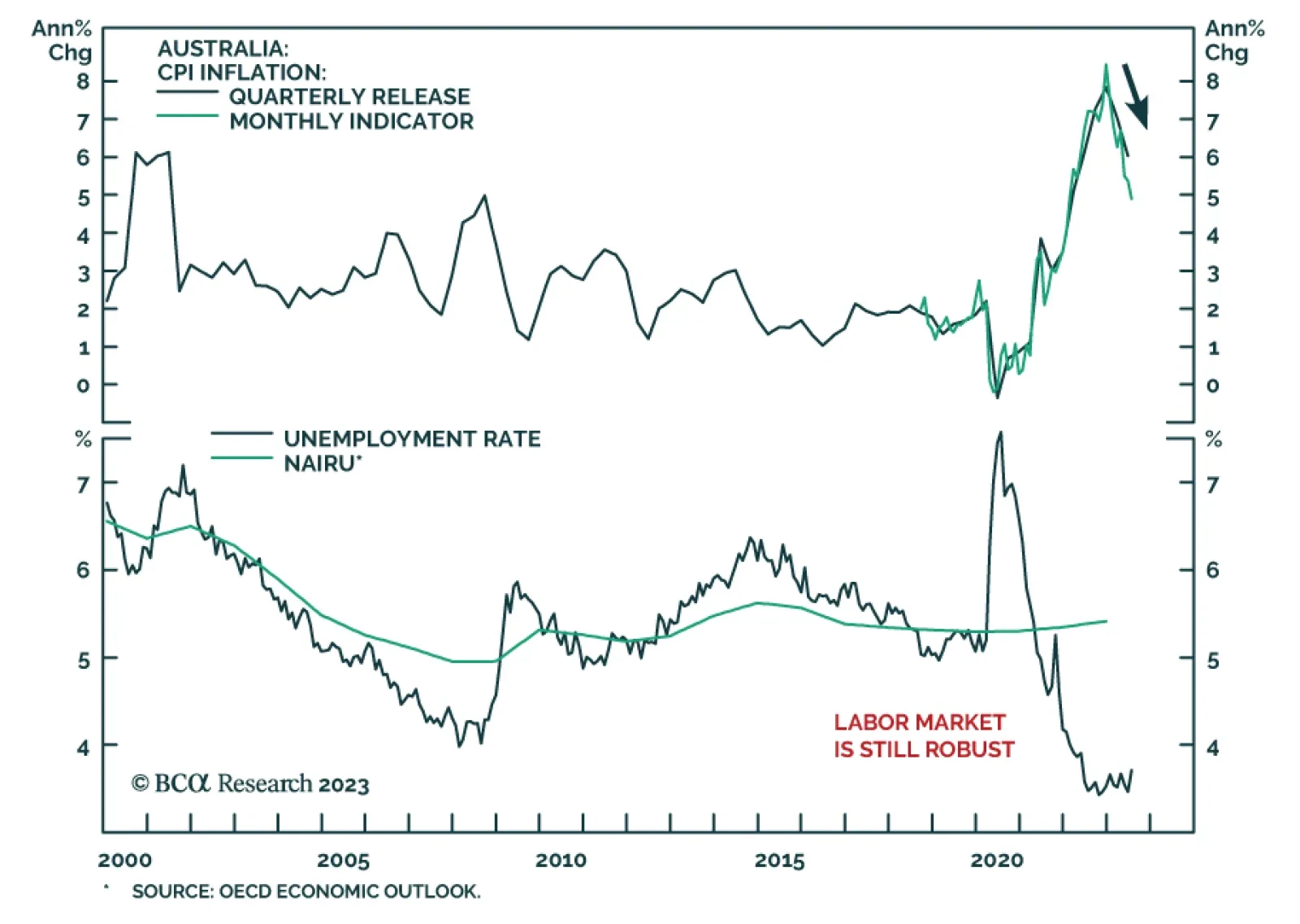

The AUD was the worst performing currency on Tuesday after the Reserve Bank of Australia kept its cash rate target unchanged at 4.1% for the third consecutive month. In particular, outgoing Governor Philip Lowe underscored that…