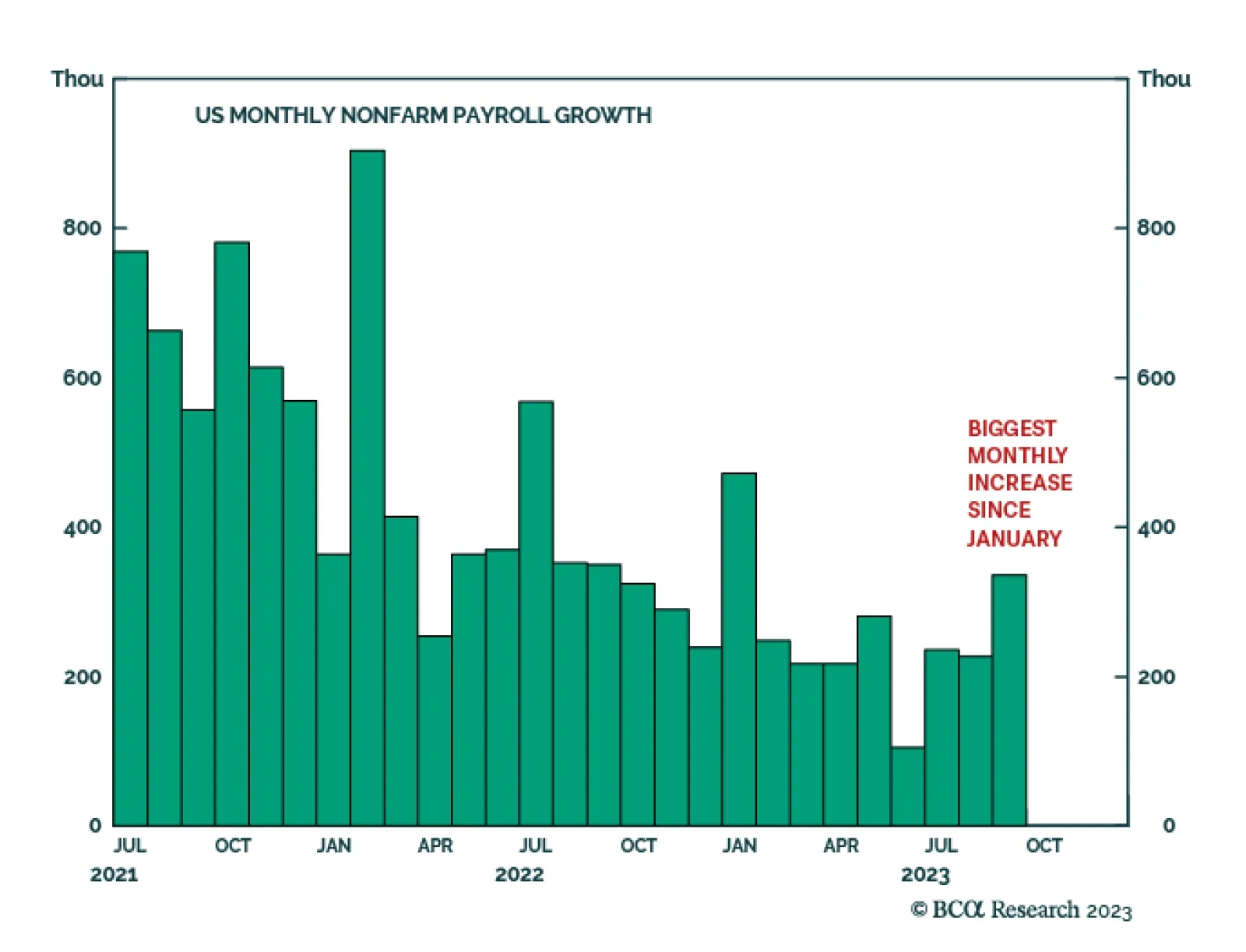

The US Nonfarm Payroll report delivered a strong positive surprise about employment growth in September. Job gains accelerated from 187 thousand to 336 thousand – significantly above expectations of a slight decline to 170…

An update to our US bond strategy following this morning’s employment report.

The Fed’s ‘Sahm rule’ real-time recession indicator signals a US recession when the three-month moving average of the unemployment rate rises by 0.50 percent from its low during the previous 12 months. But…

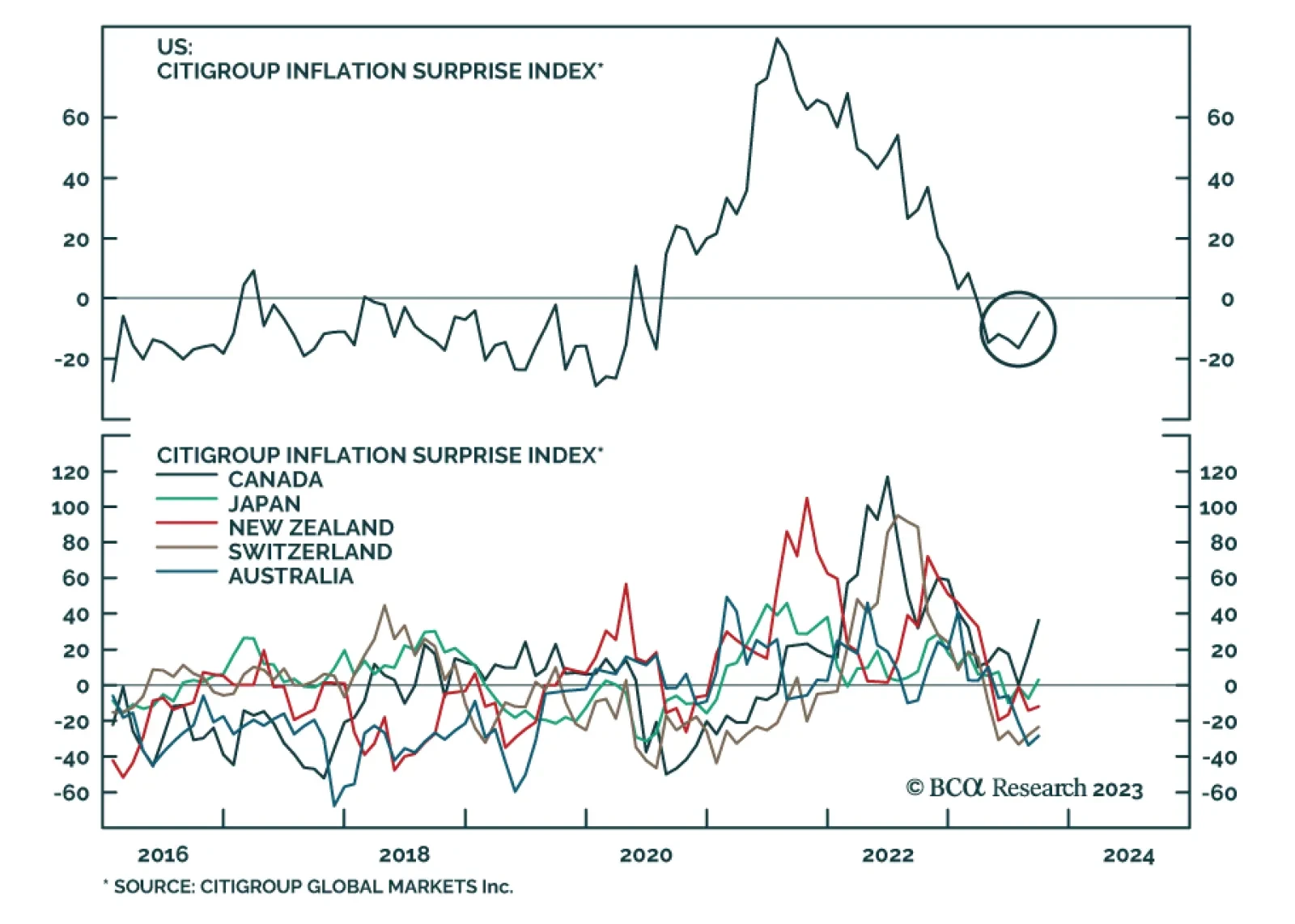

The Citi US Inflation Surprise Index has risen over the past two months after having bottomed at a three-year low in July. The good news is that the level of the index remains negative after having first fallen below zero in…

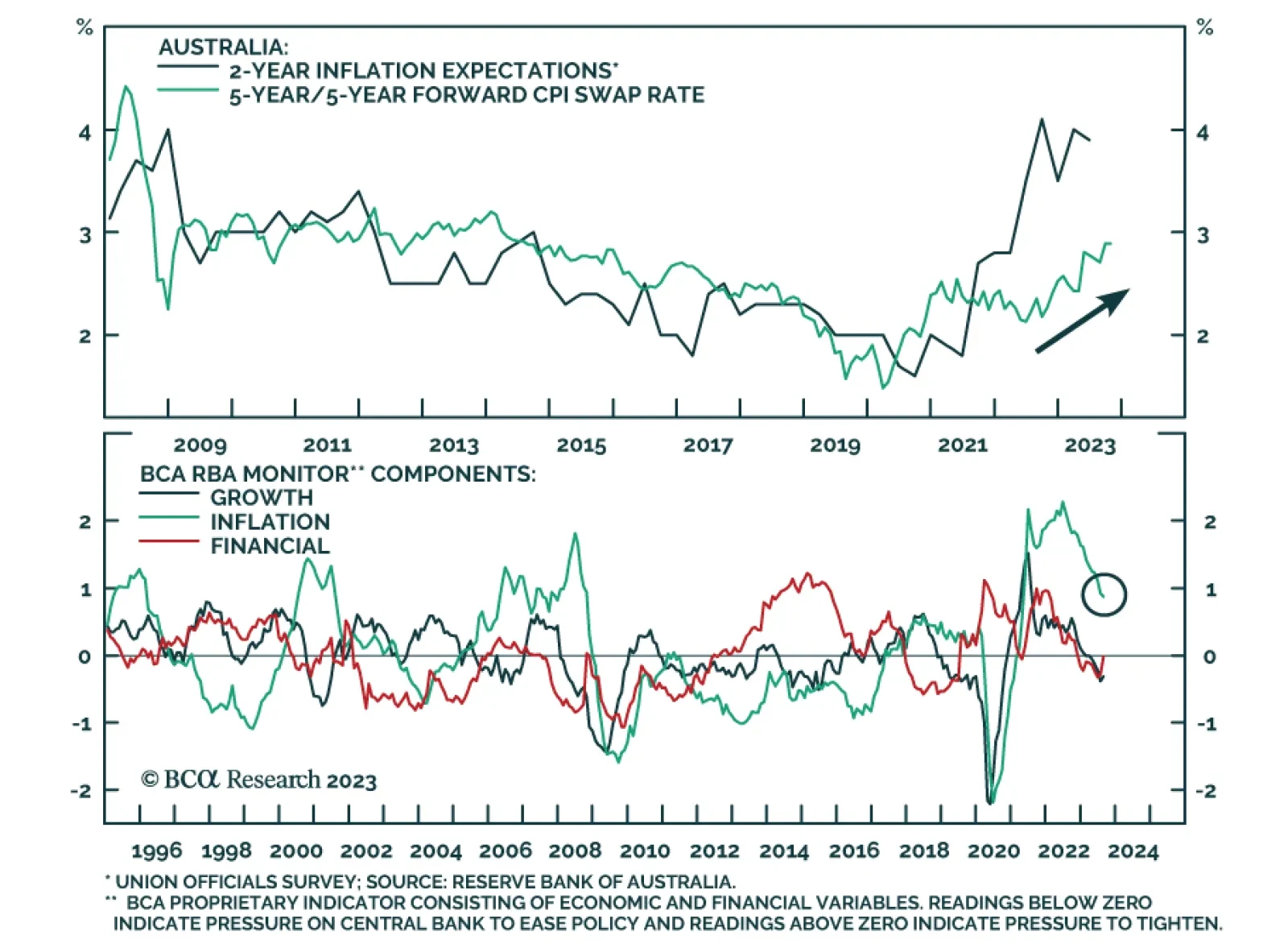

The Australian dollar was among the worst performing major currencies on Tuesday after the Reserve Bank of Australia held the cash rate at 4.1% for the fourth consecutive month. In her post meeting statement, newly appointed…

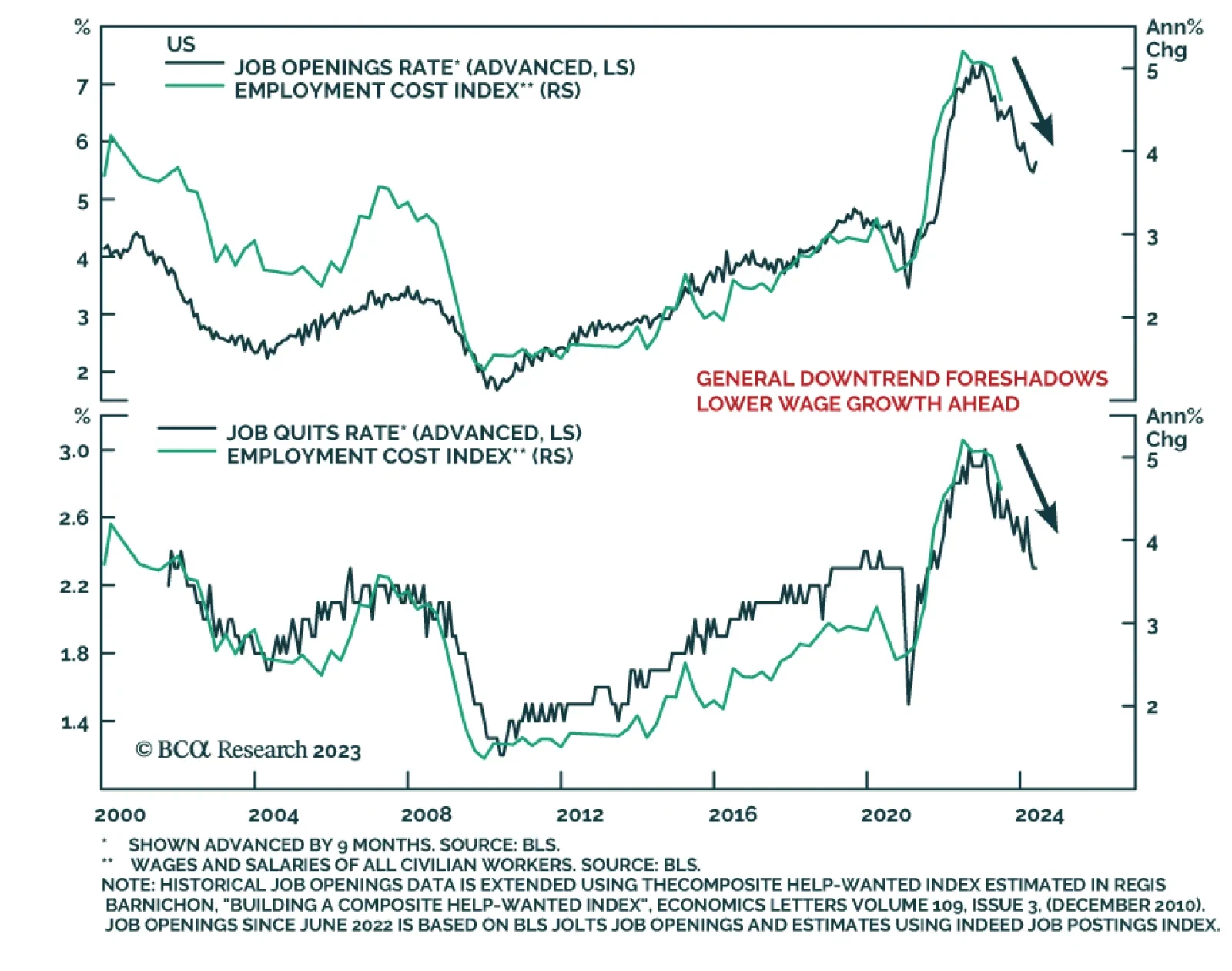

The US JOLTS report sent a chill through financial markets on Tuesday. The bigger-than-expected number of job openings in August fueled investors’ concern that the Fed will be forced to maintain a hawkish stance for longer…

Aggressive monetary tightening has always led to recession, although the timing is uncertain. The effects of high interest rates are starting to be felt. Investors should stay risk off and buy government bonds as a safe haven…

In Section I, we note that the recent surge in long-maturity government bond yields is symptomatic of a sharp reduction in market expectations for a soft-landing economic outcome. This underscores that the US and other developed…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

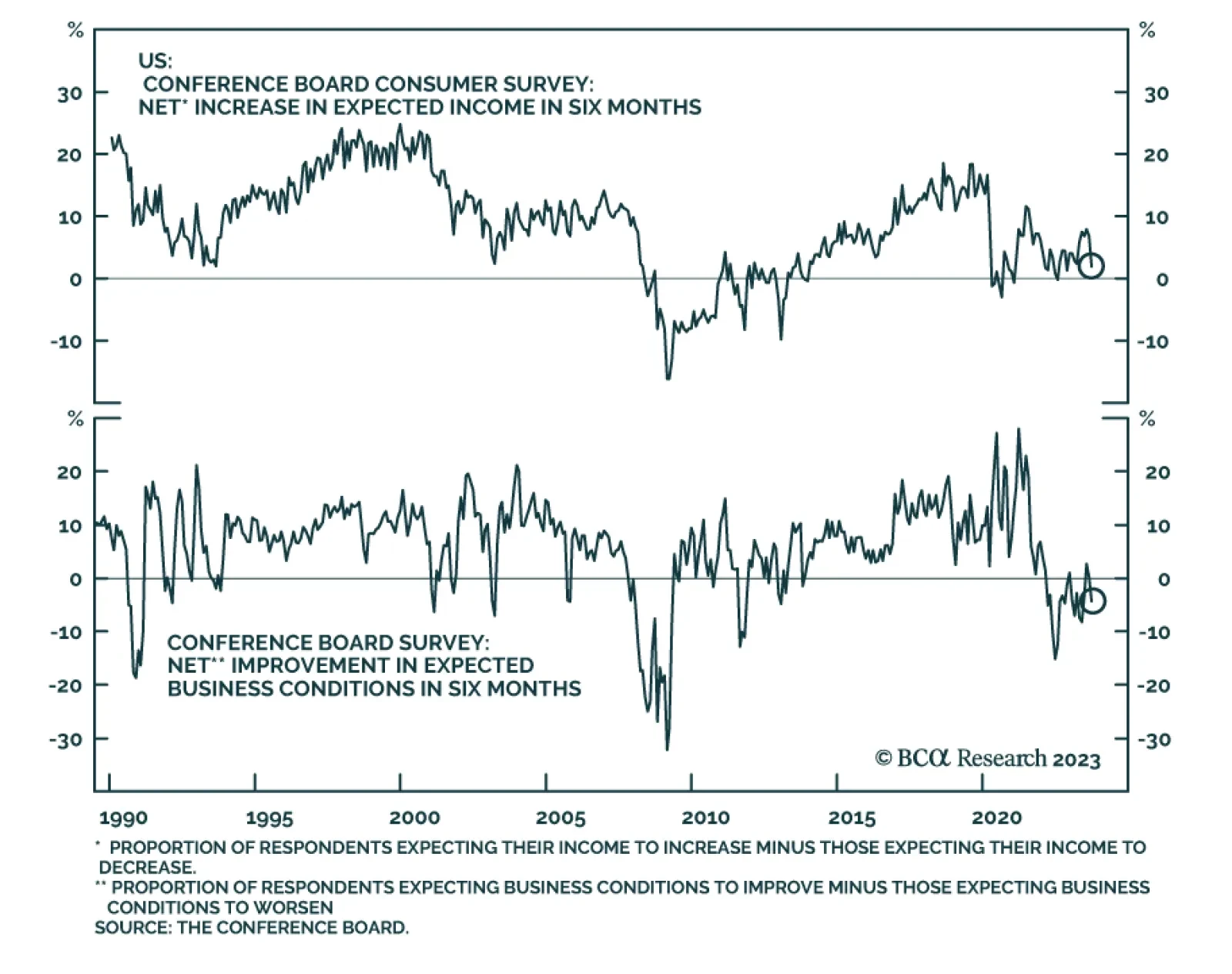

The Conference Board’s Consumer Survey results delivered a negative signal about the US consumption outlook on Tuesday. Although the present situation component inched up marginally in September, a 9.6-point drop in the…