Our reaction to today’s FOMC meeting and the Treasury’s Quarterly Refunding Announcement.

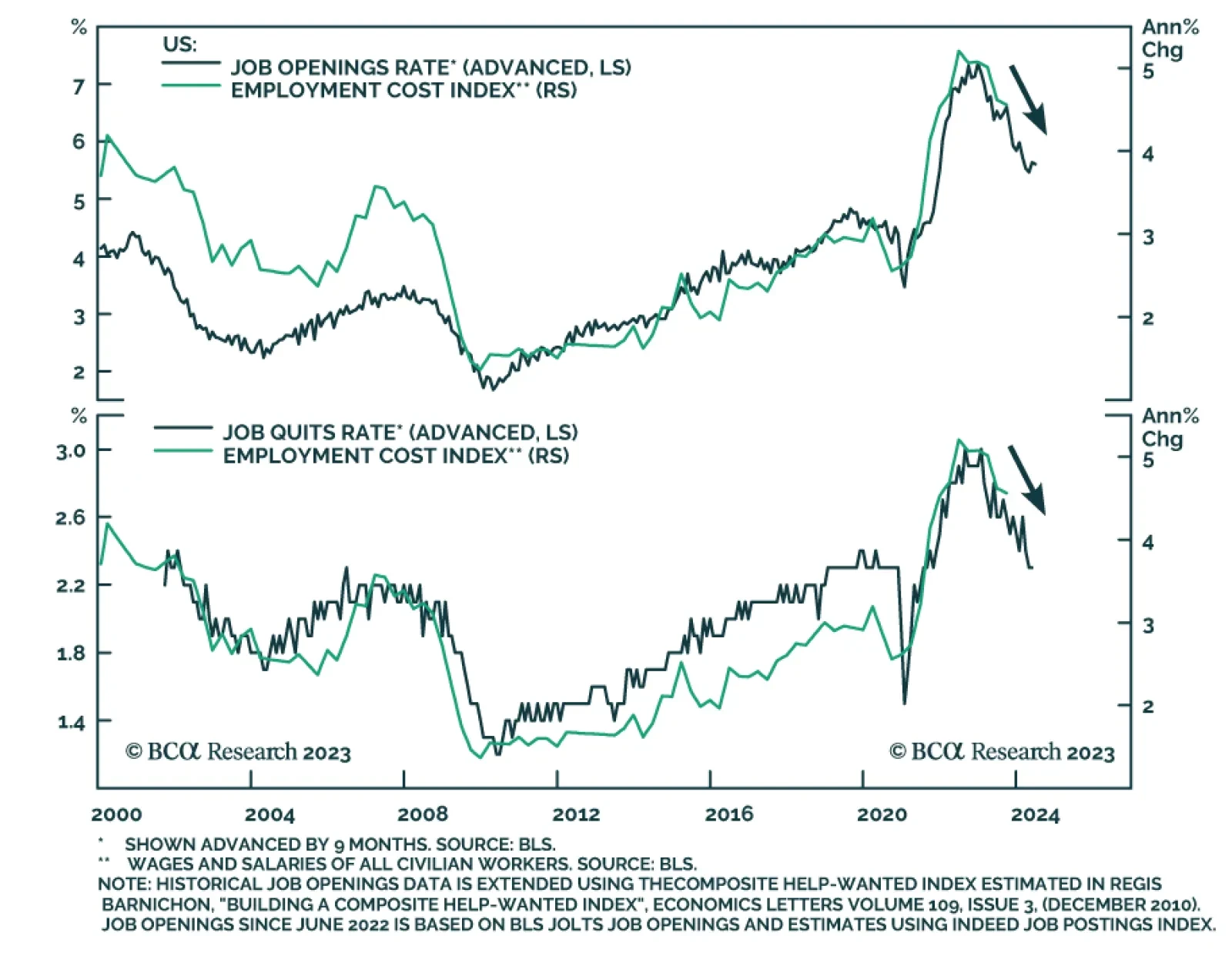

The US Employment Cost Index (ECI) unexpectedly accelerated in Q3, rising by 1.1% q/q versus anticipations the pace of increase would remain unchanged at 1.0% q/q. A pickup in wages and salaries drove the increase. On an annual…

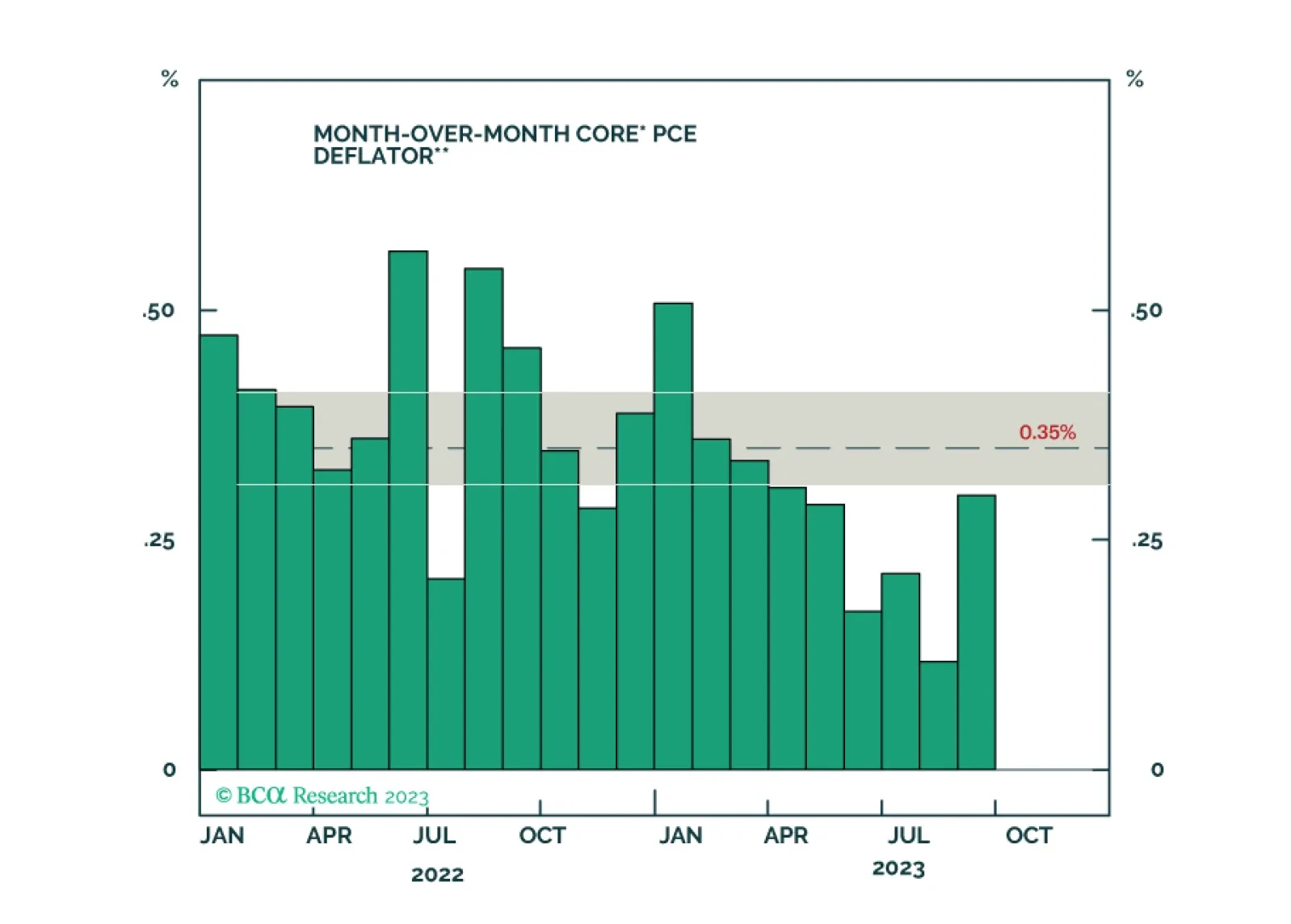

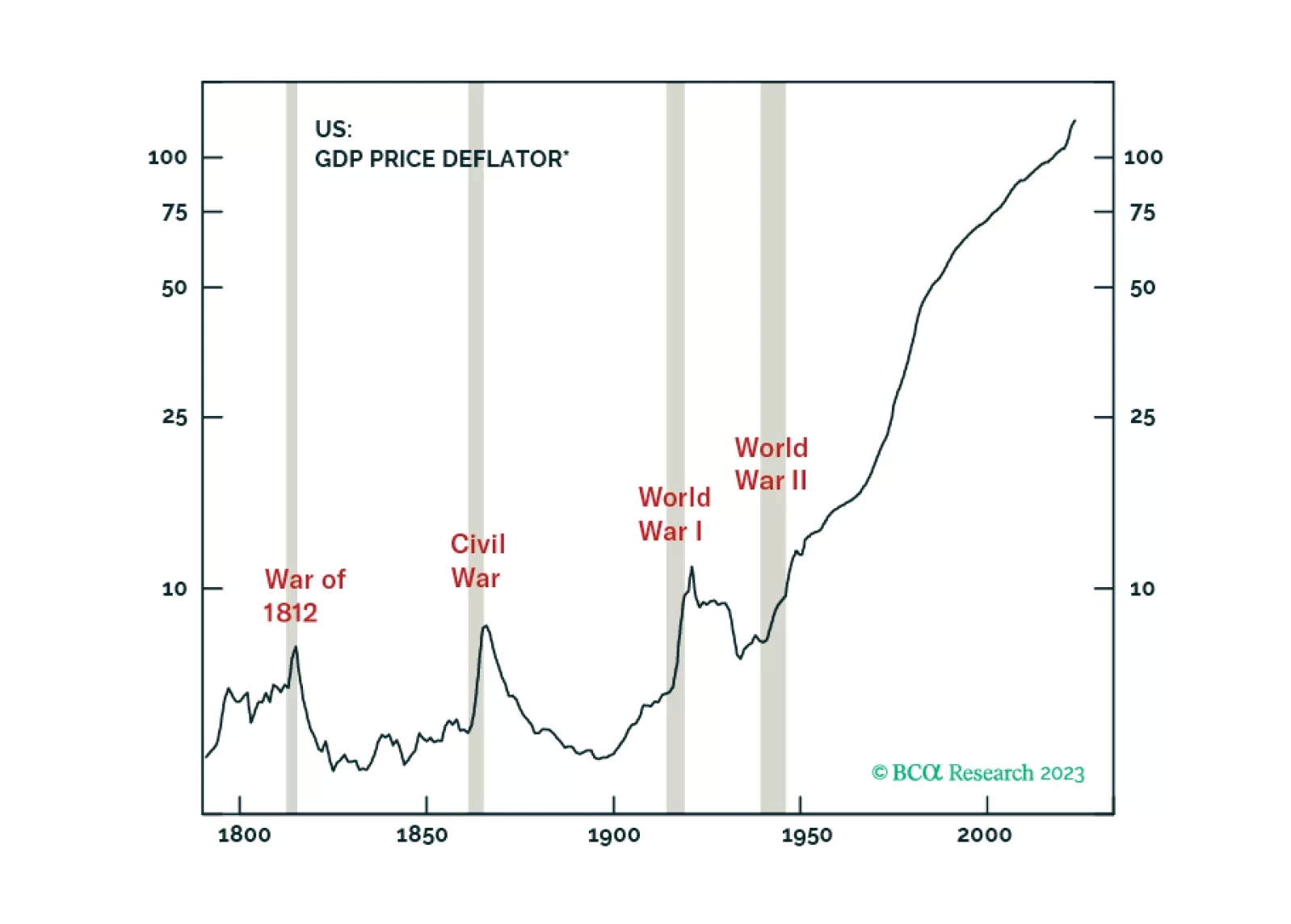

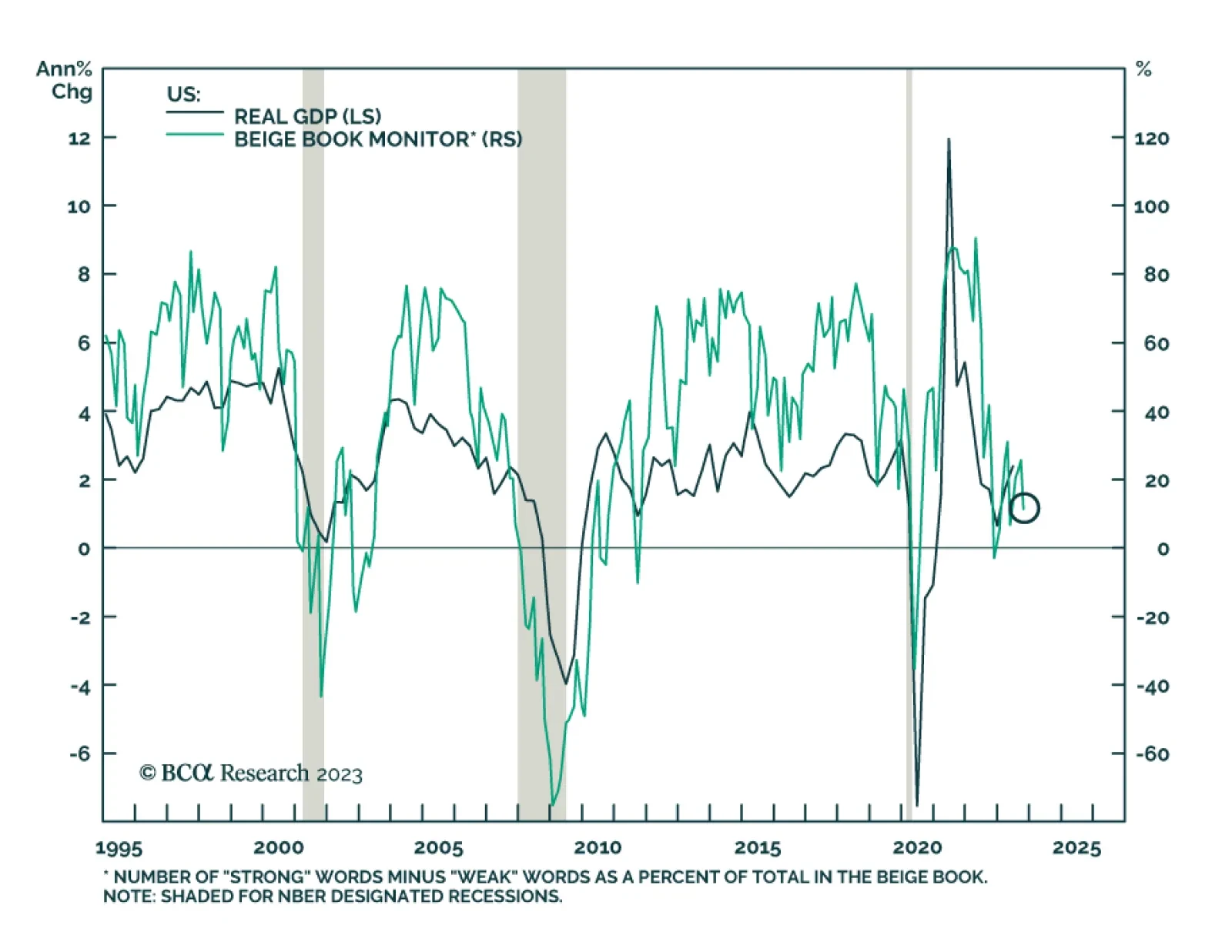

A look at recent data on economic growth, inflation and the labor market, and a discussion of the implications for Fed policy and bond strategy.

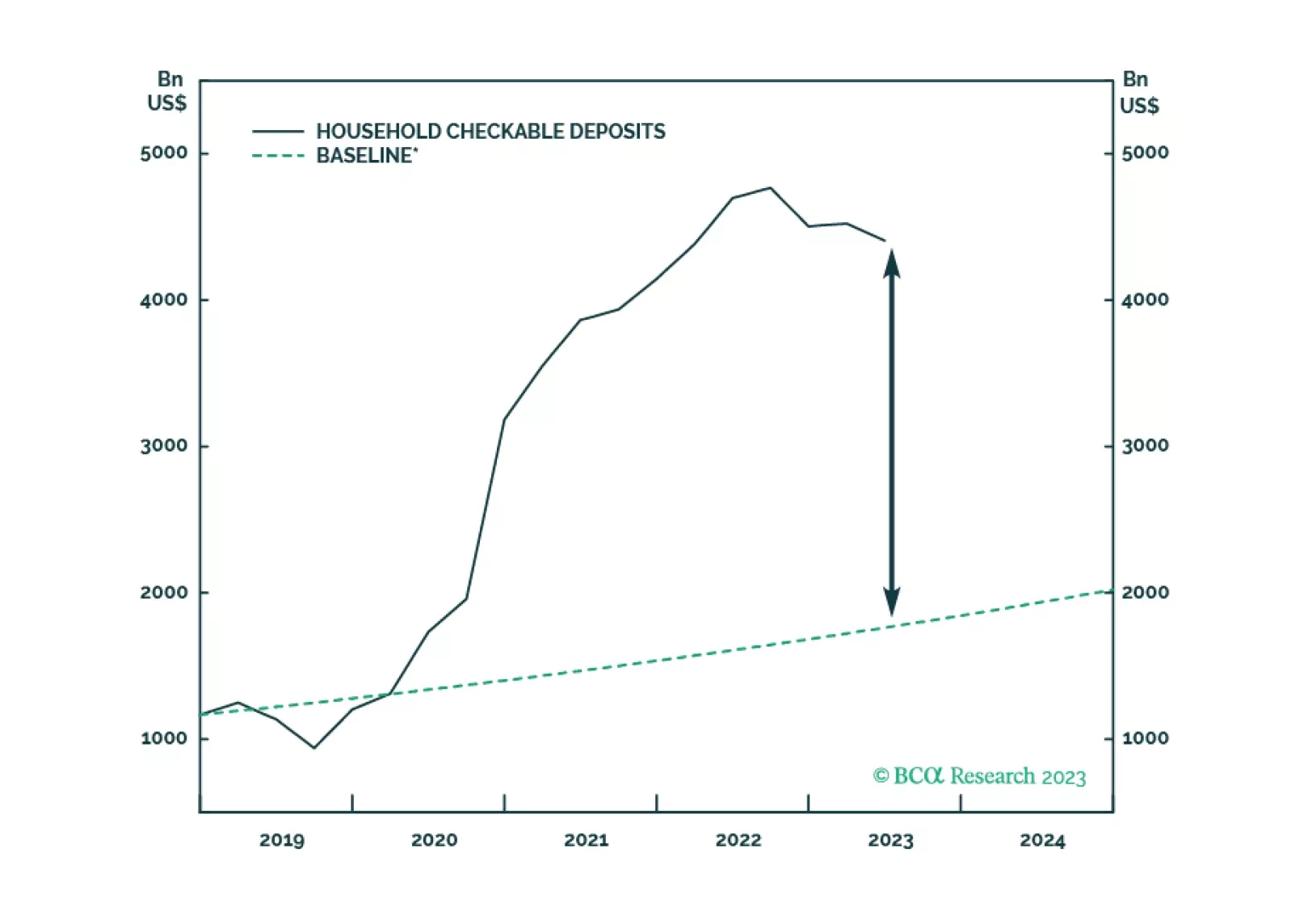

The biggest banks report that consumer credit card delinquencies still have yet to get back to pre-COVID levels and other credit performance indicators, leading and lagging, remain solid. There is still a great deal of cash sloshing…

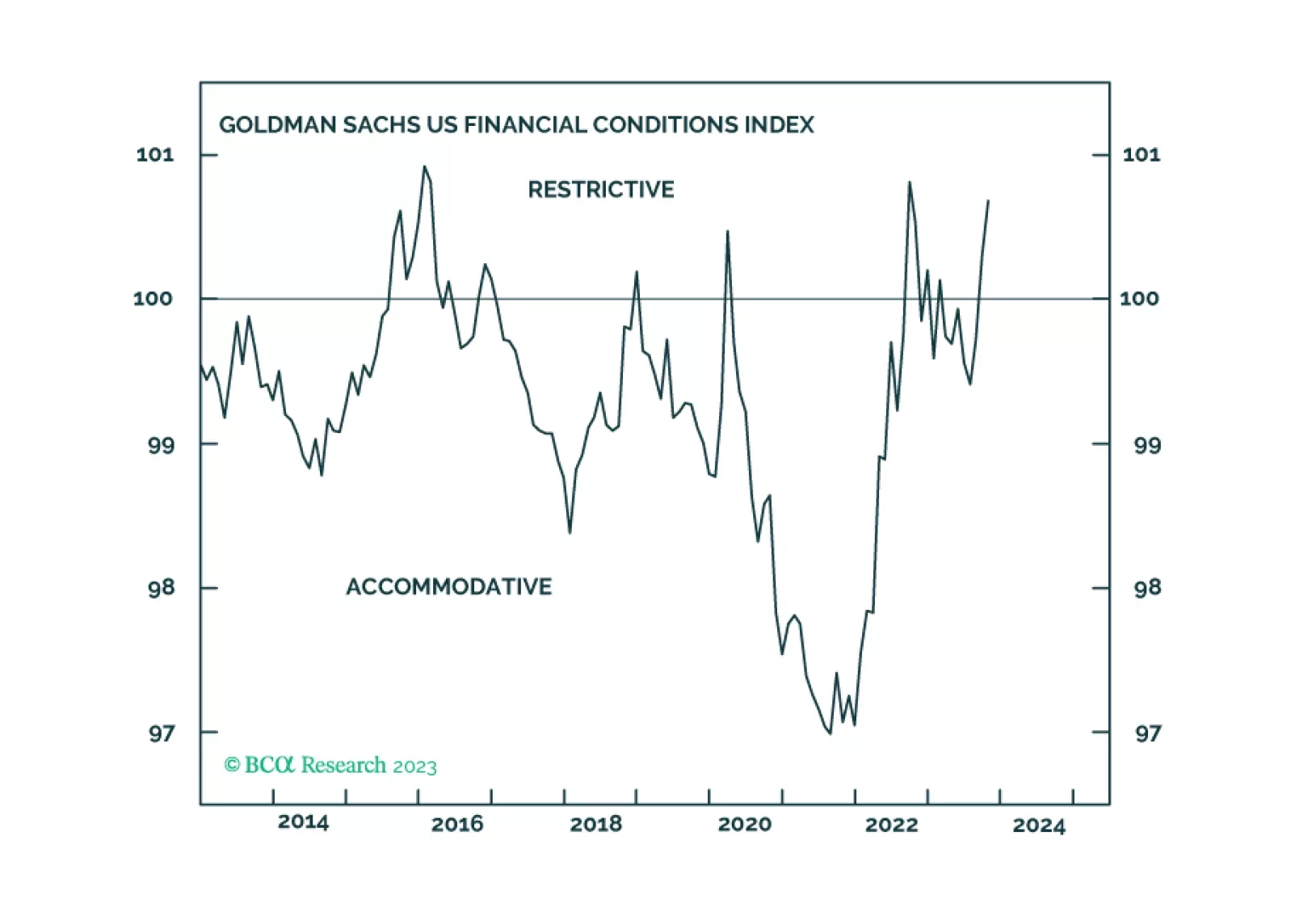

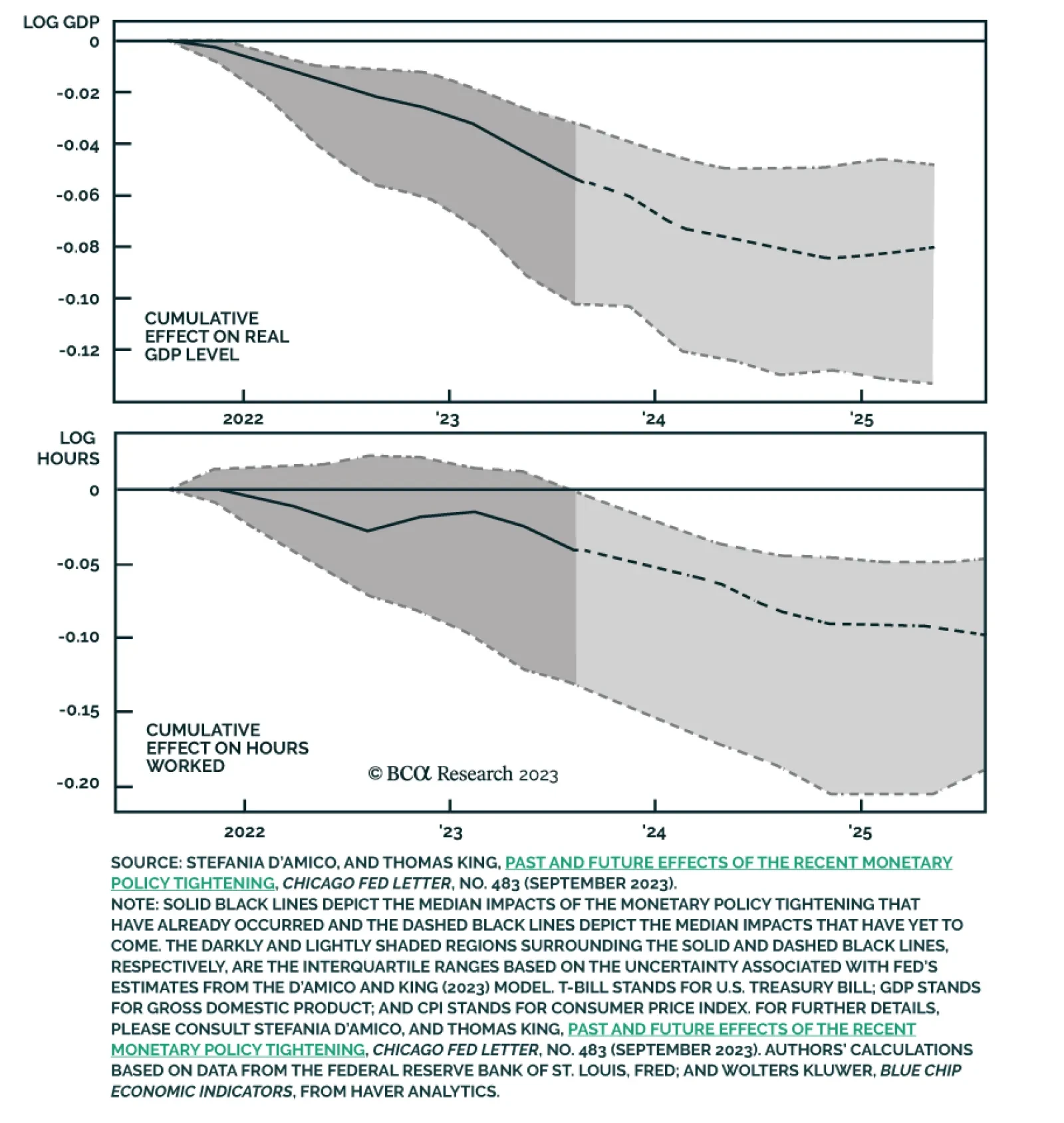

According to BCA Research's Global Investment Strategy service, the global economy will stay buoyant over the next few quarters but will then sour as the lagged effects of higher interest rates and tighter bank lending…

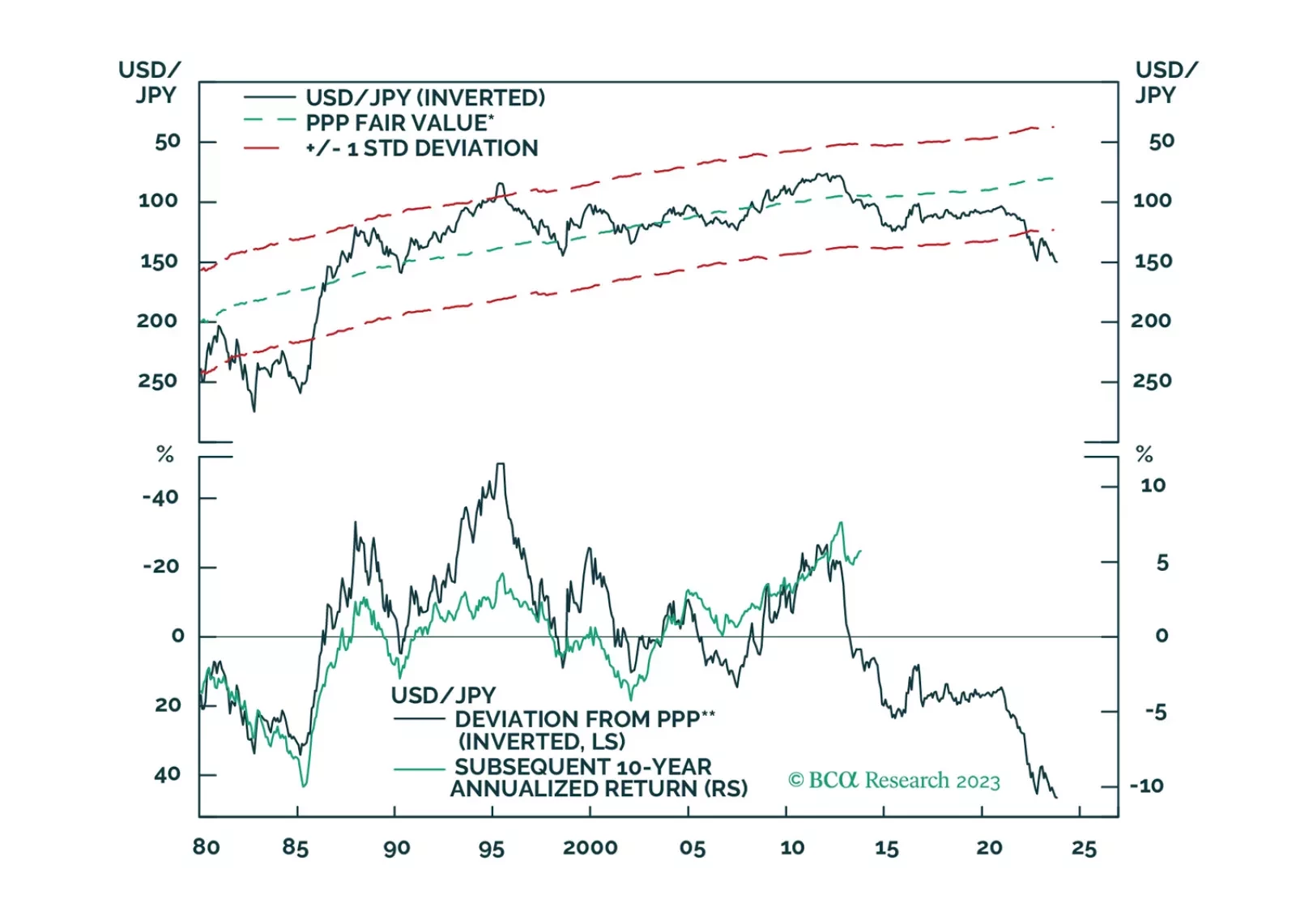

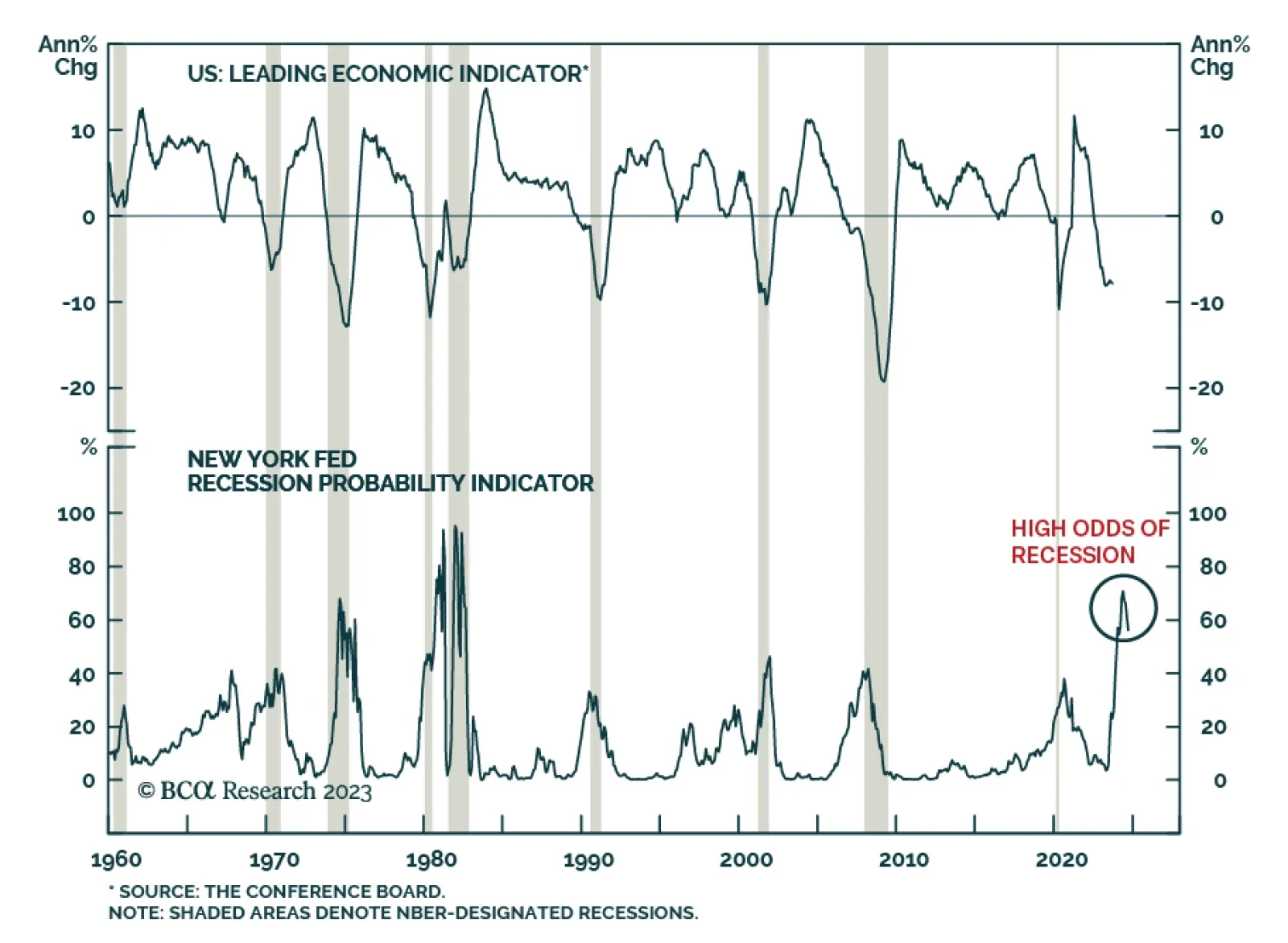

There is a high probability that the global economy will tip into recession in the second half of 2024. A long yen position is an excellent hedge against that risk.

The Conference Board's Leading Economic Index's 0.7% m/m decline in September sent a weaker-than-anticipated signal about the outlook for the US economy. It fell below anticipations that the pace of decline would remain…

Stronger-than-anticipated retail sales and nonfarm payroll employment in September indicate that conditions are still favorable for US consumers. Similarly, the latest reading from the Atlanta Fed's GDPNow model stands at 5.4…