BCA Research's Global Investment Strategy service assigns 25% odds of the recession starting in 2025 or later. Our colleagues continue to think that the US will succumb to a recession in 2024, probably in the second…

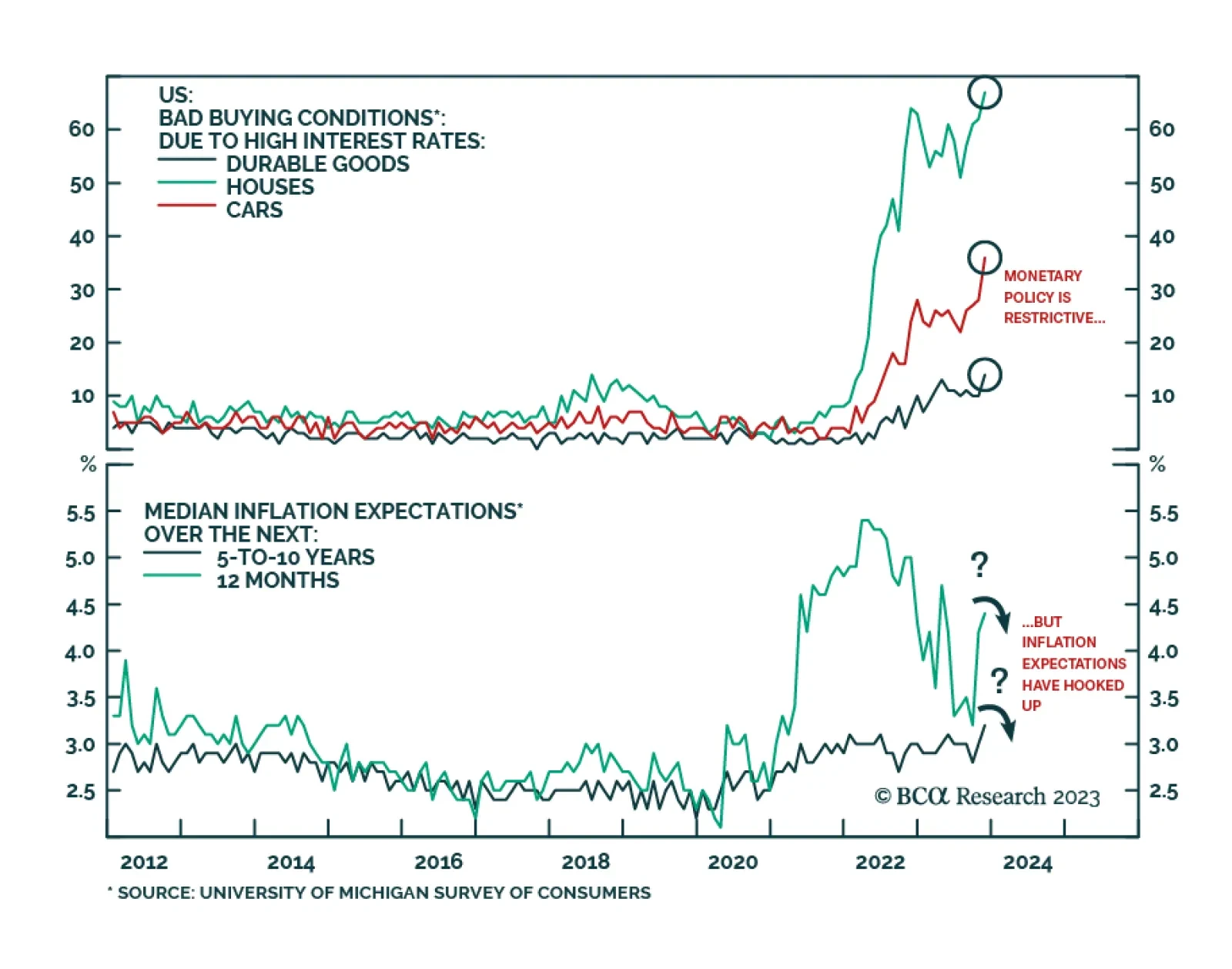

The preliminary release for the University of Michigan’s Consumer Survey sent a pessimistic signal about consumer sentiment on Friday. The headline index fell from 63.8 to 60.4 in November, below expectations of a marginal…

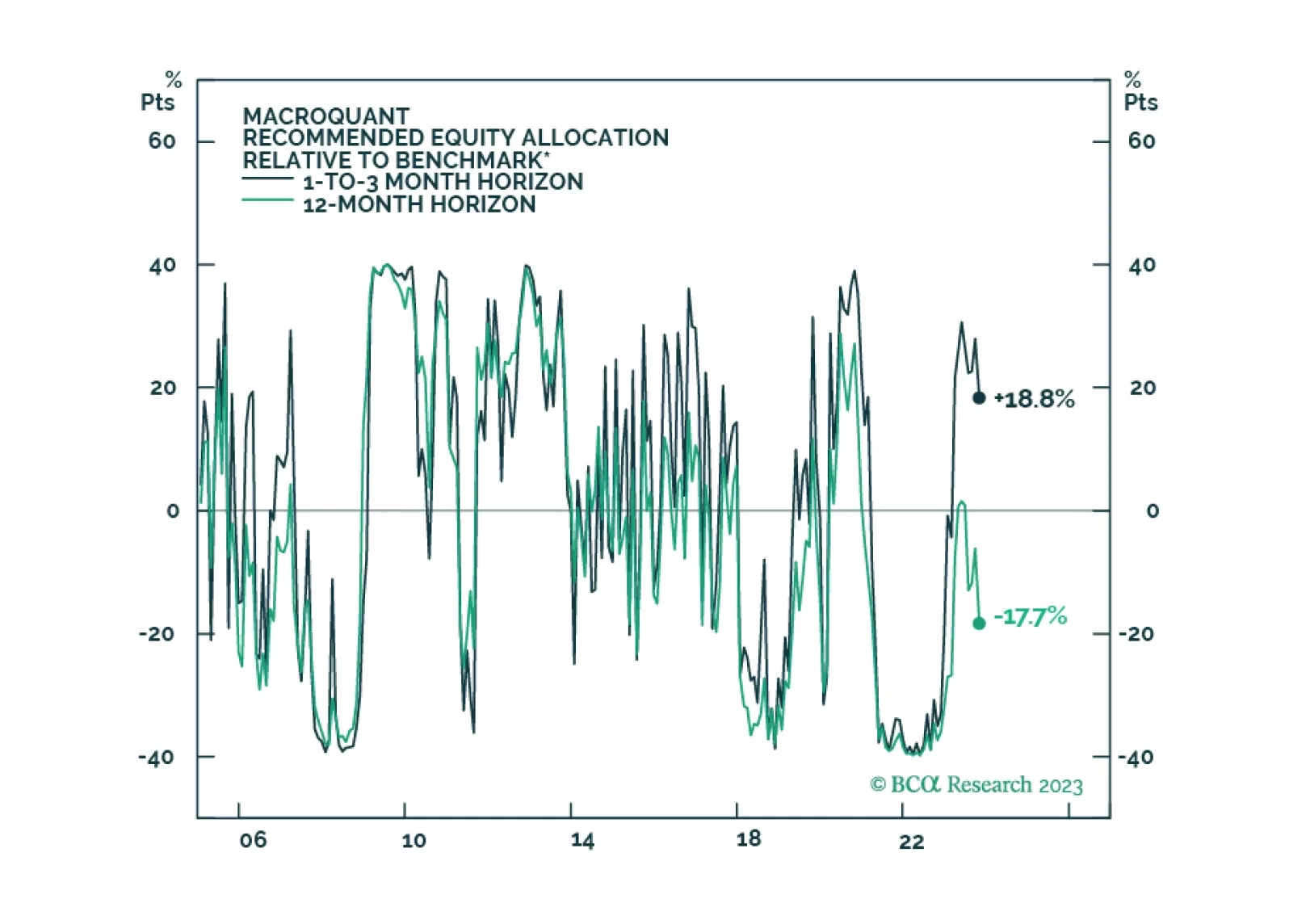

Labor markets are softening in most developed economies, as is usually the case in the lead-up to recessions. Our base case is that the global recession will begin in the second half of 2024, but we will be monitoring our MacroQuant…

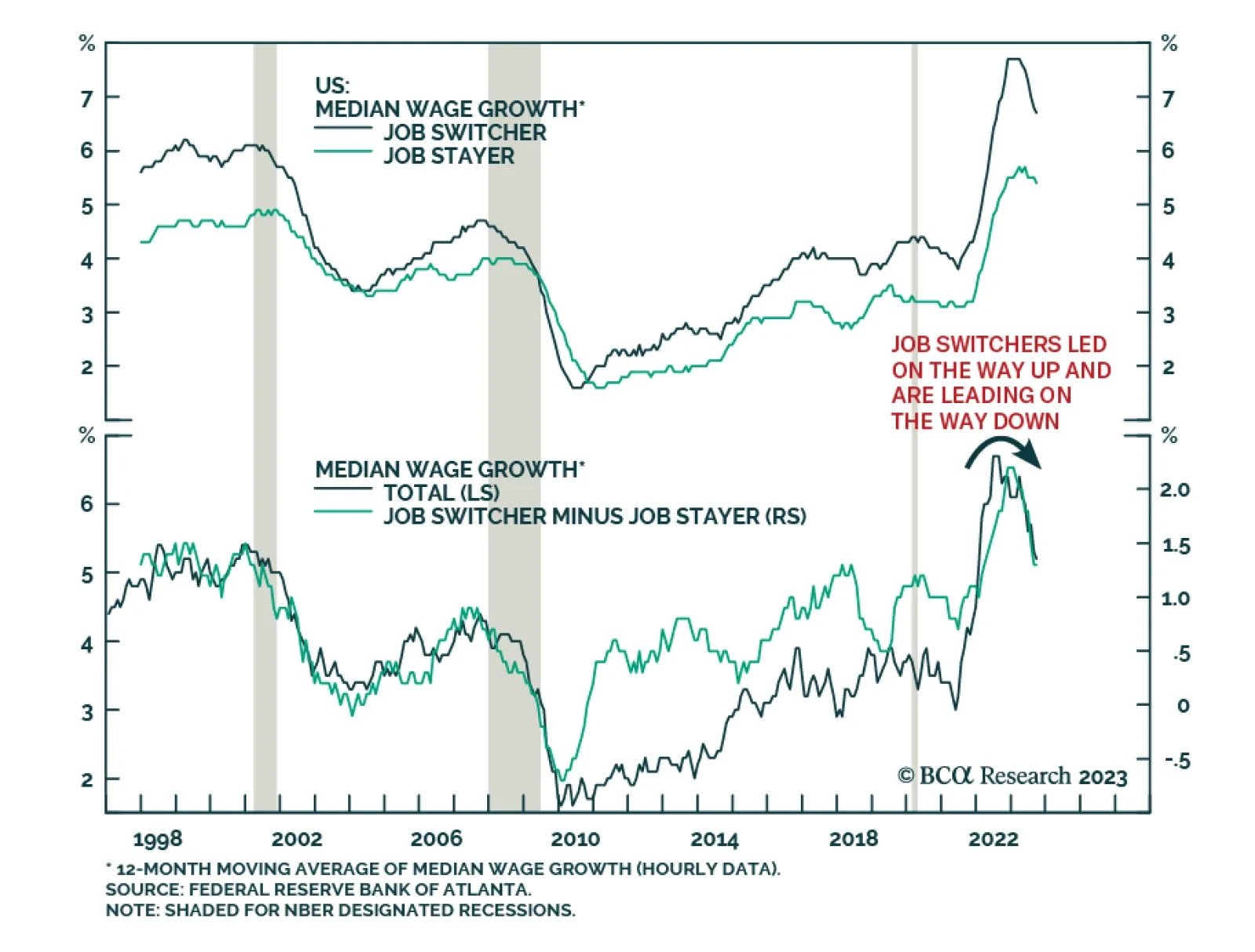

After surging in H2 2021/H1 2022, the Atlanta Fed's Wage Growth Tracker has been on a general downtrend for over a year. The latest reading of 5.2% in October – albeit unchanged from September – is considerably…

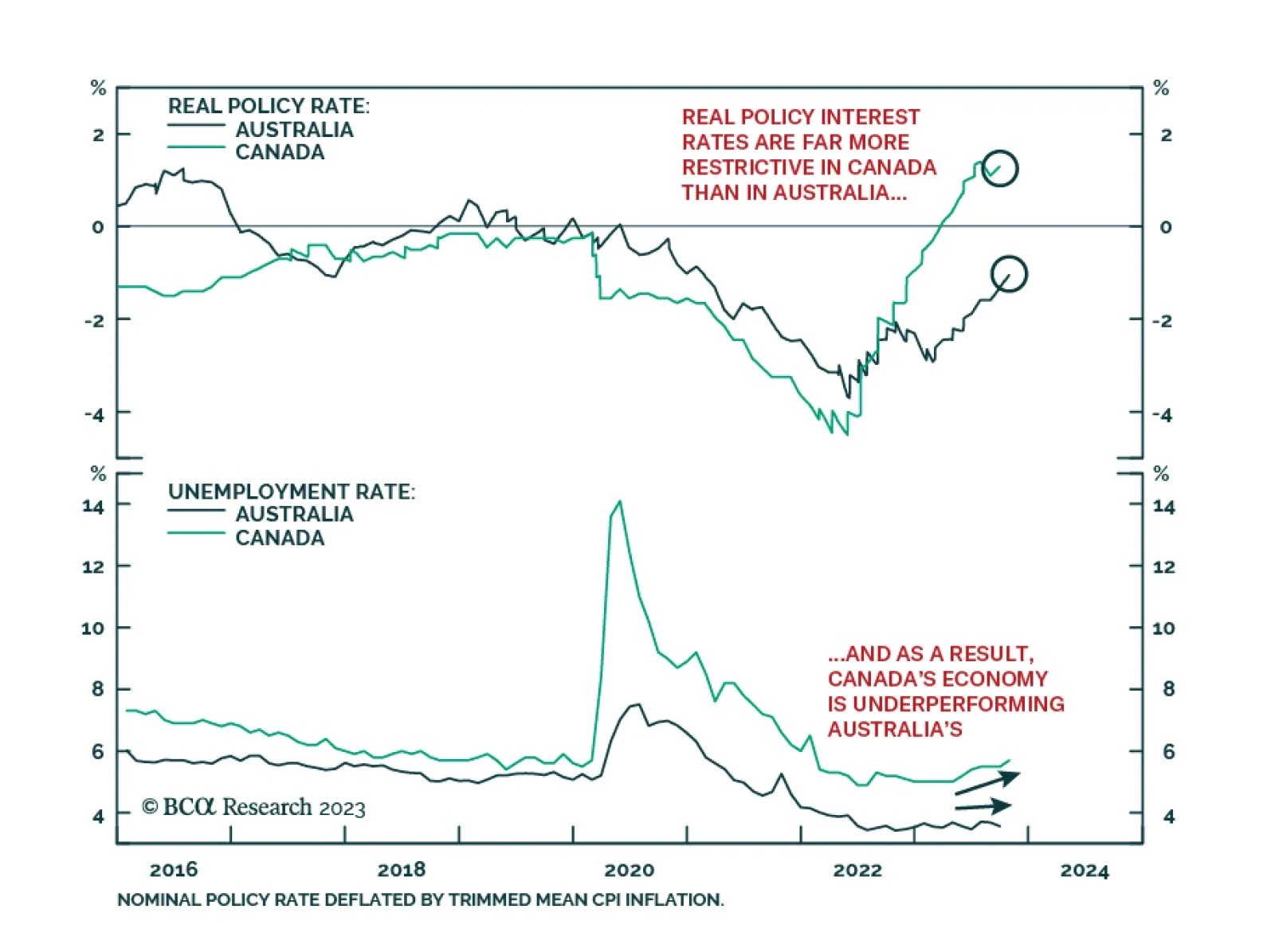

The economies of Canada and Australia share many similarities. Both nations are major commodity exporters, but with overvalued housing markets and highly indebted consumers. Lately, however, a notable gap has appeared…

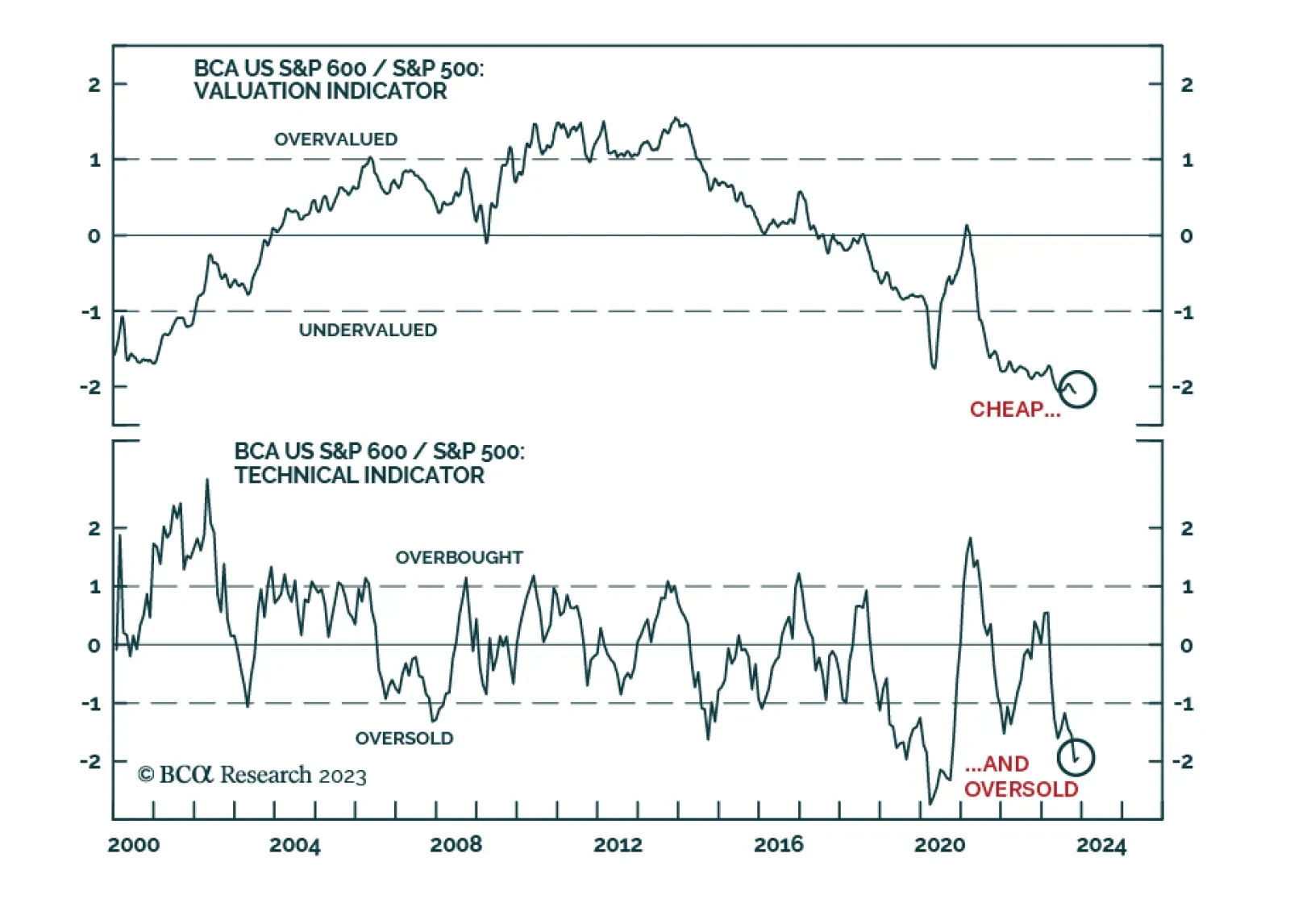

US small-cap stocks have underperformed significantly this year. While the S&P 500 price index is up 14.0% year-to-date, the S&P 600 has lost 2.5%. However, this underperformance has not been a straight line down. Small…

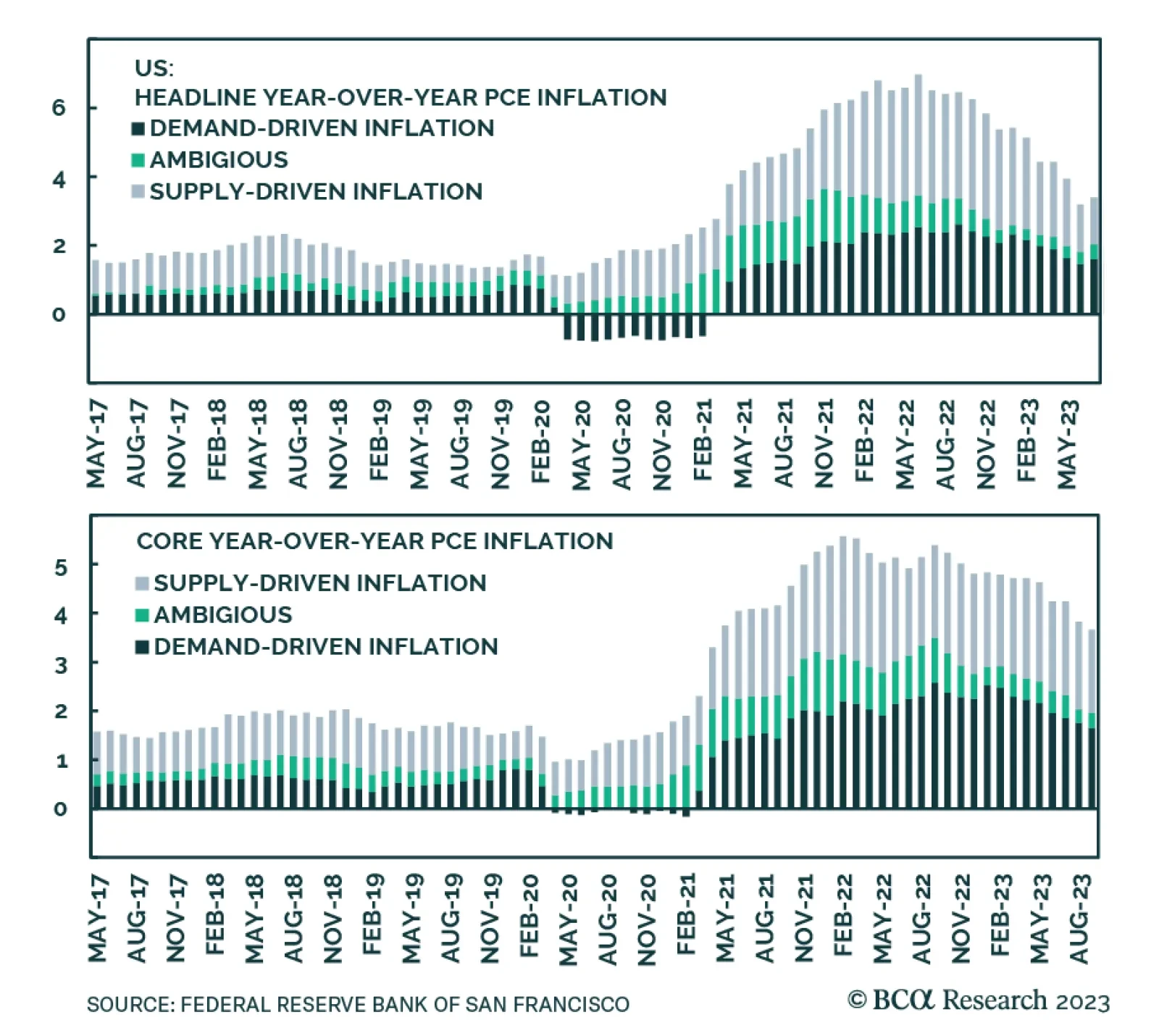

The US disinflationary trend remains intact. The core PCE deflator continued its downtrend in September, falling to 3.7% y/y from a peak of 5.6% in February 2022. Alternative measures of underlying price pressures such as the…

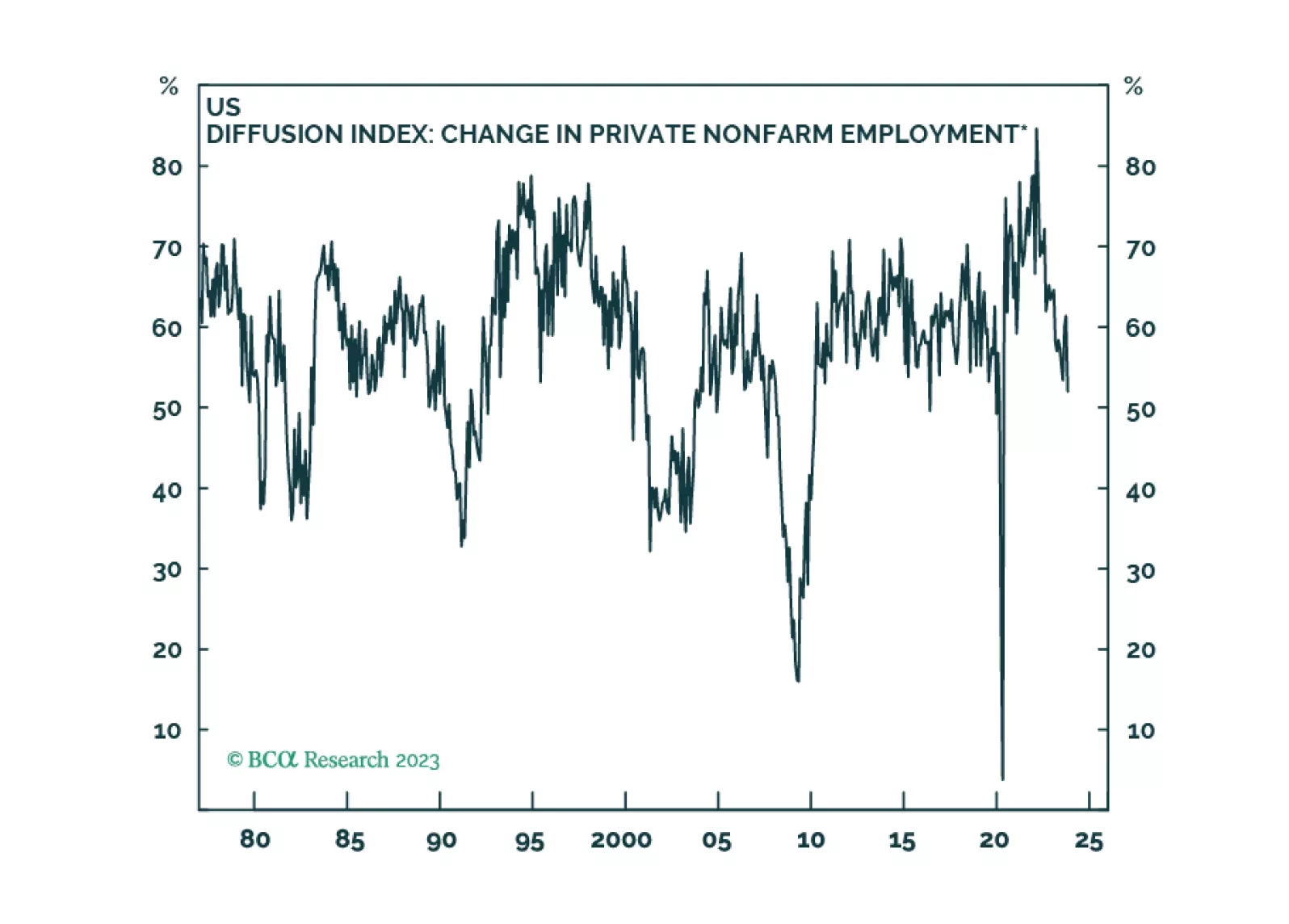

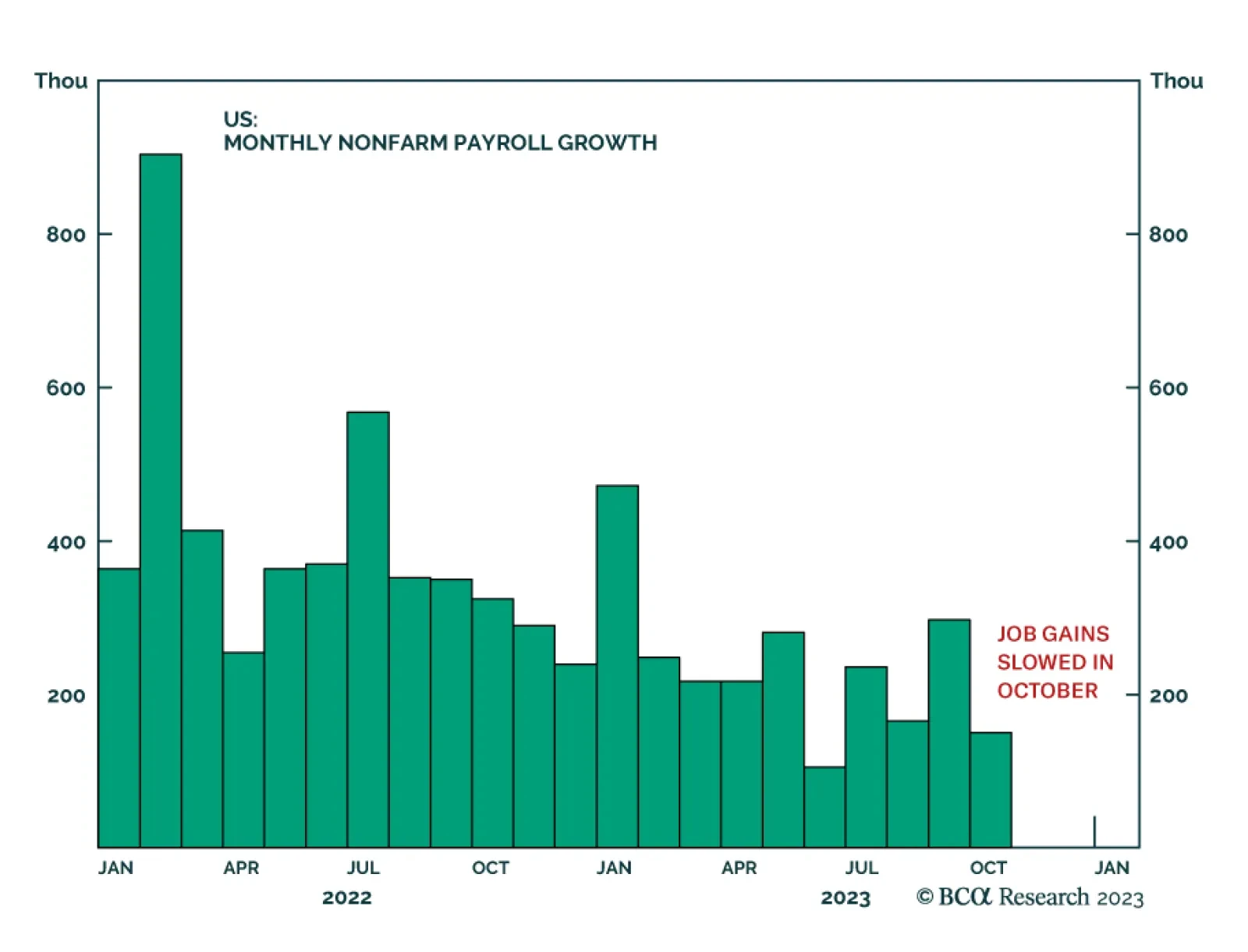

The US Nonfarm Payroll report indicates that labor market conditions cooled in October. The 150 thousand increase in payroll employment fell below expectations of 180 thousand and marks a slowdown from the 297 thousand increase…

We are approaching another phase transition from boom to bust. Stocks should rally into year-end, but investors should look to reduce equity exposure early next year while increasing bond exposure.