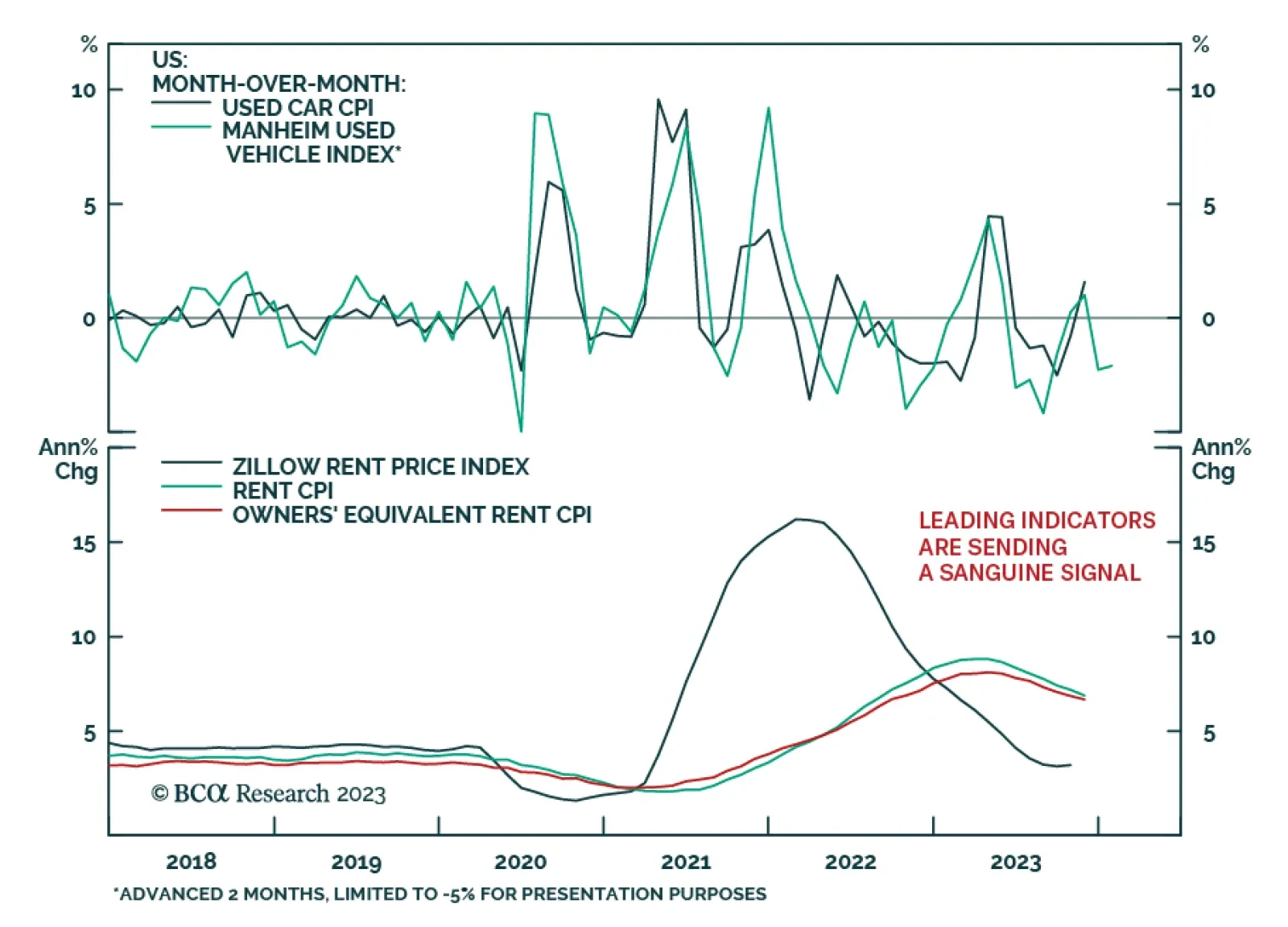

The November US CPI release came in broadly in line with consensus expectations on Tuesday. On an annual basis, headline CPI inflation eased from 3.2% y/y to 3.1% y/y while core inflation was unchanged at 4.0% y/y. On a monthly…

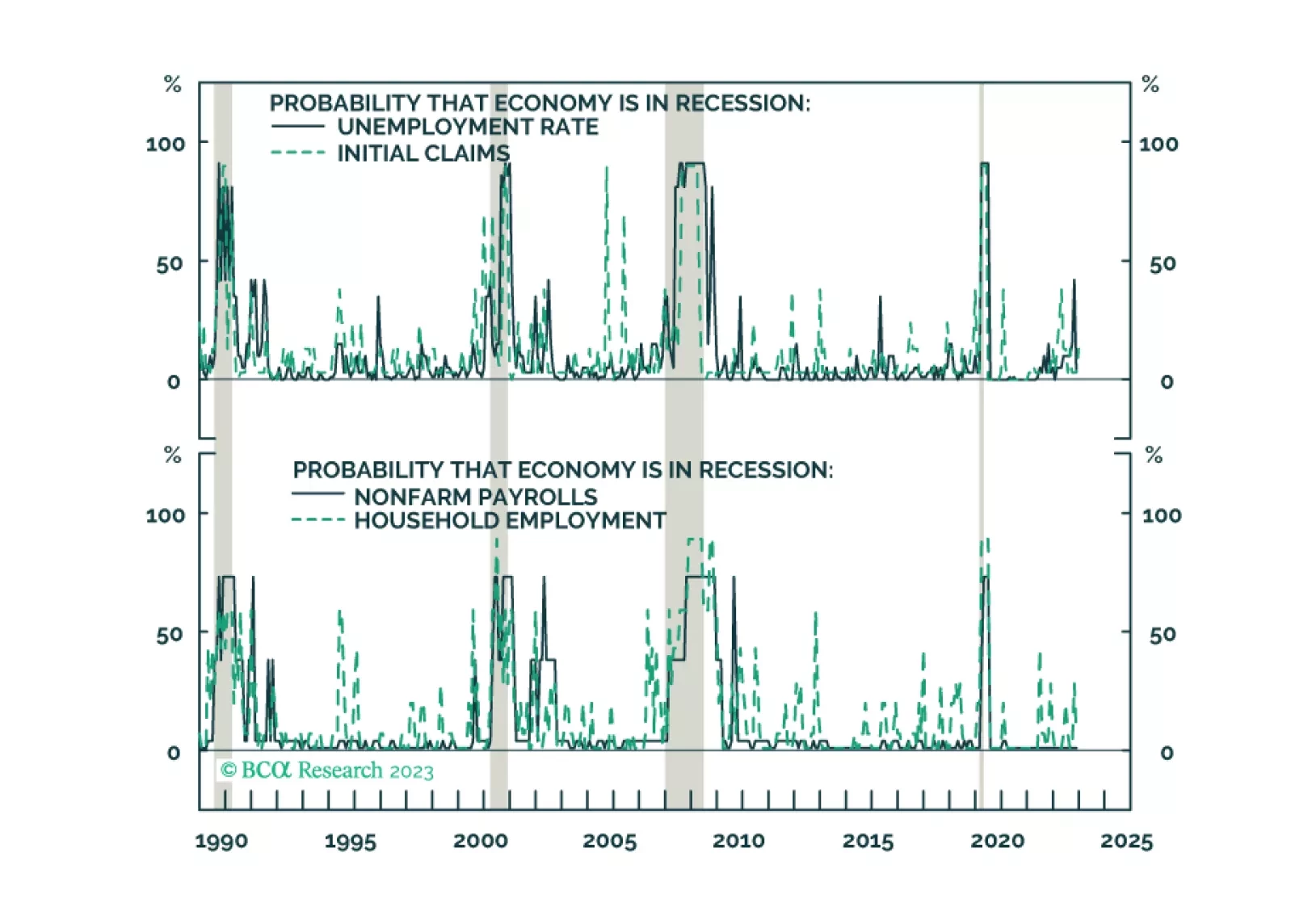

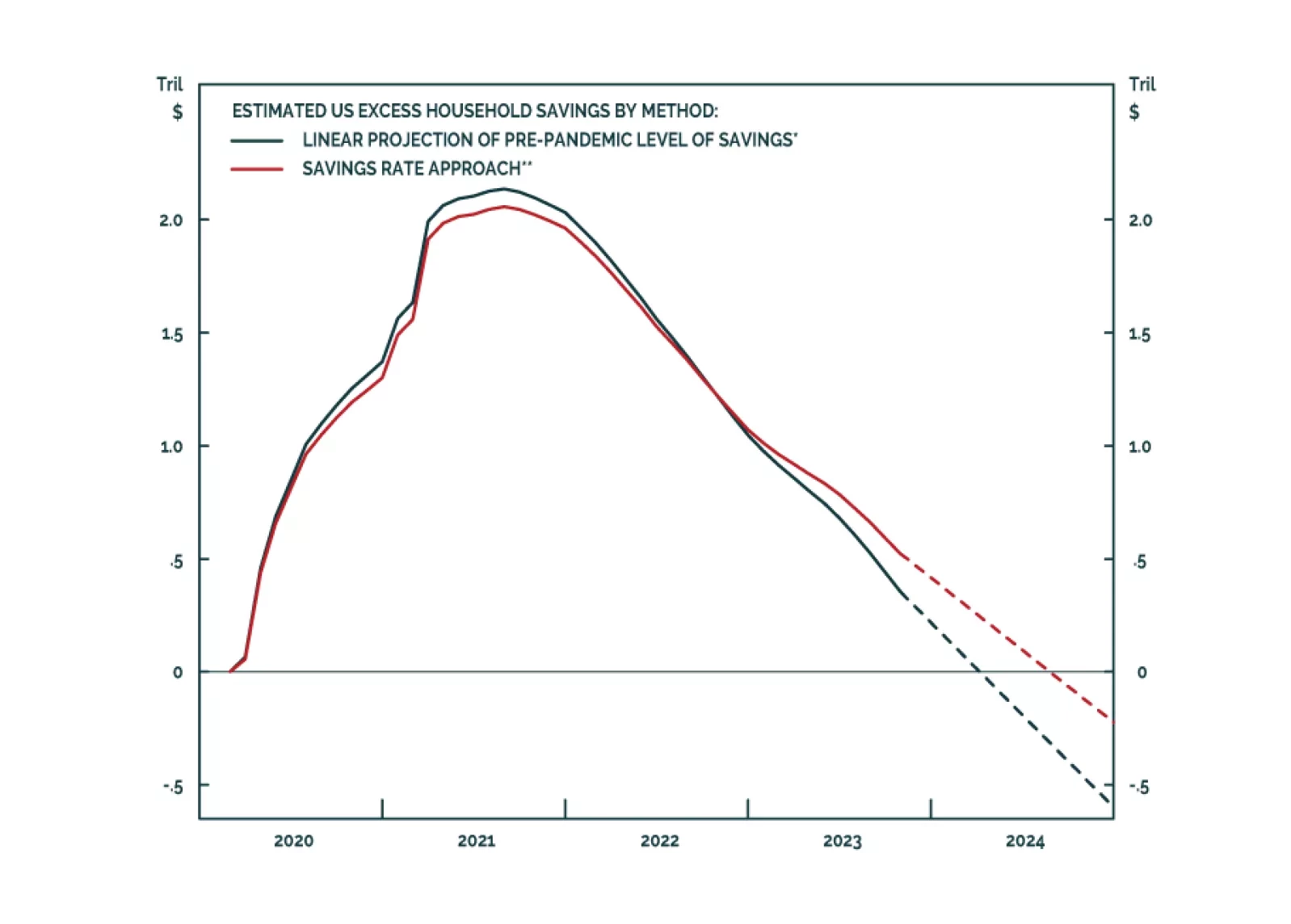

Global Investment Strategy predicted the surge of inflation in 2021/22 and the immaculate disinflation of 2023. Now their unique framework is predicting a recession in the second half of 2024.

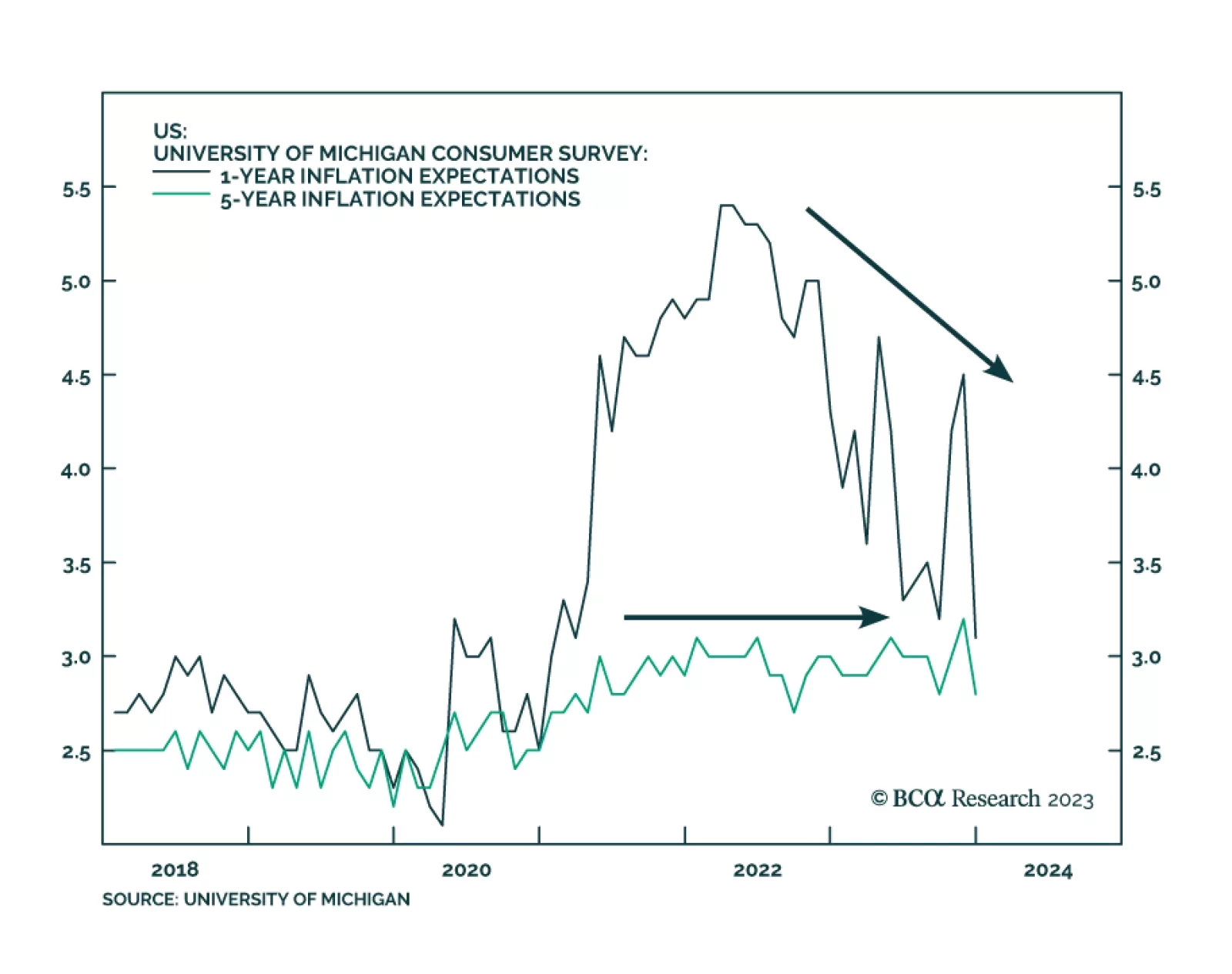

The University of Michigan’s Consumer Survey sent an optimistic signal about the attitude of the US consumer on Friday, handily beating consensus estimates across the board. The preliminary headline index came in at 69.4,…

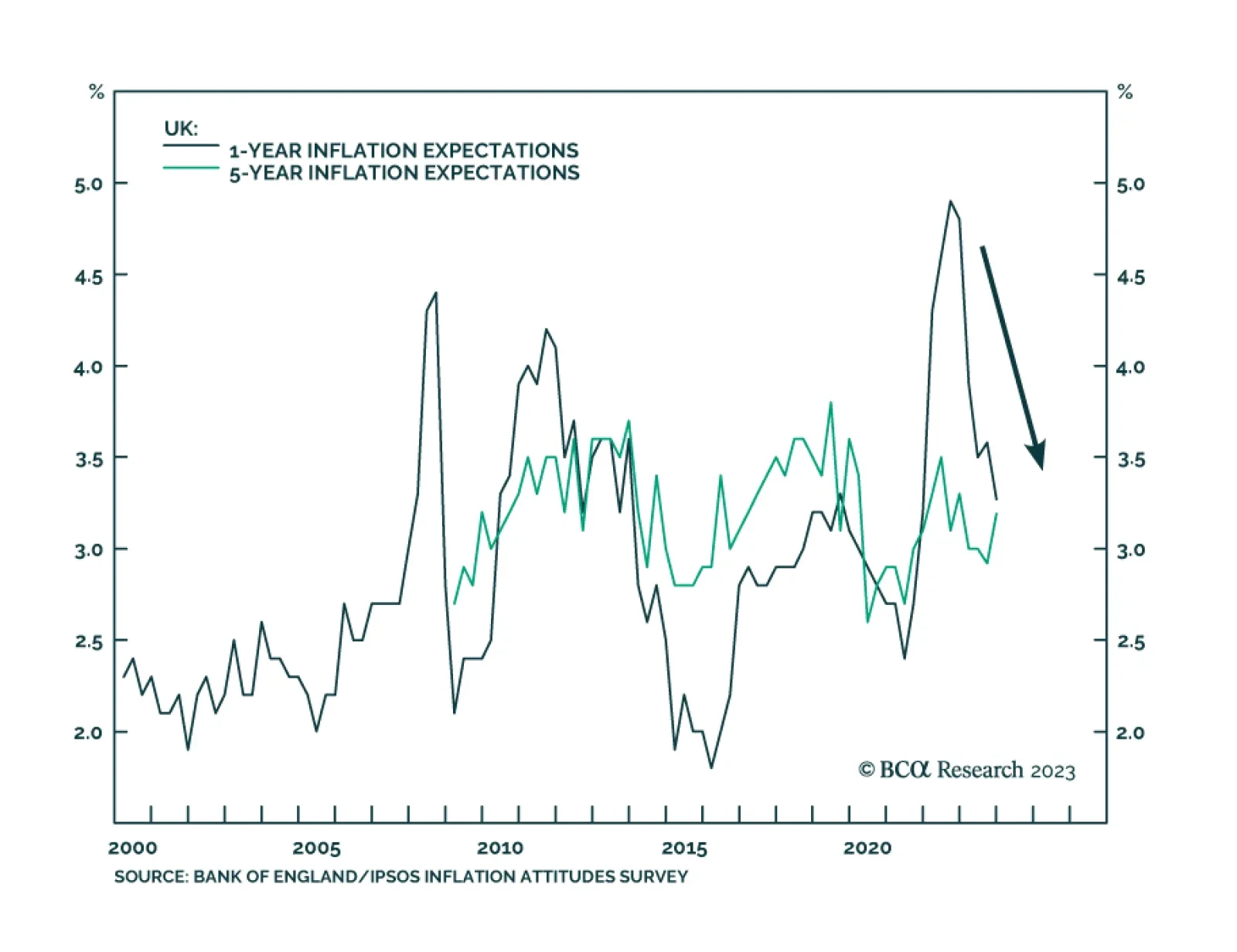

The latest Bank of England/Ipsos quarterly Inflation Attitudes Survey shows the public revised down its near-term inflation outlook. Respondents now believe inflation will fall to 3.3% in the year ahead – down from 3.6% in…

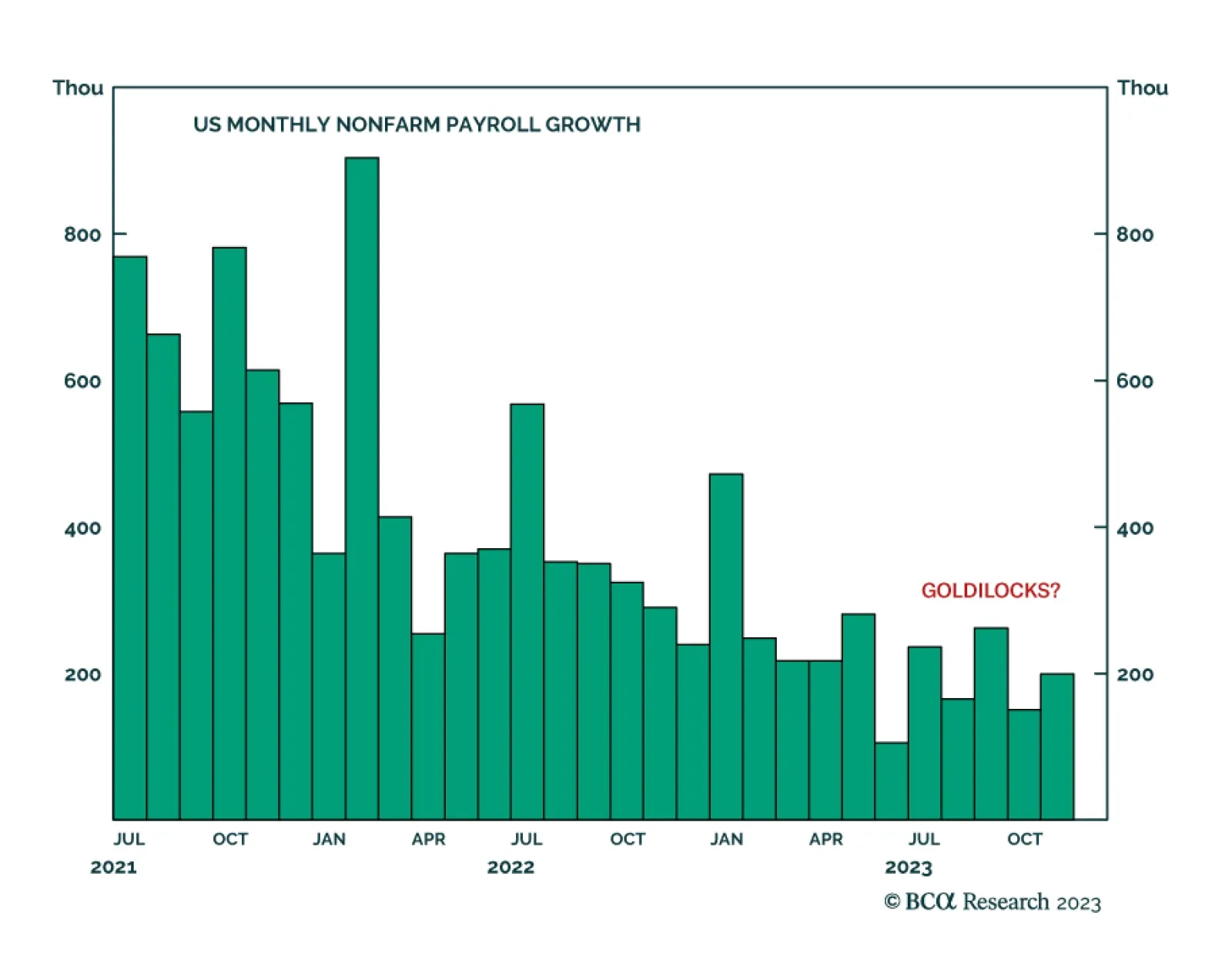

The US employment report delivered a positive surprise on Friday. Nonfarm payroll growth accelerated from 150 thousand to 199 thousand in November, beating expectations of 185 thousand. Importantly, the favorable result was…

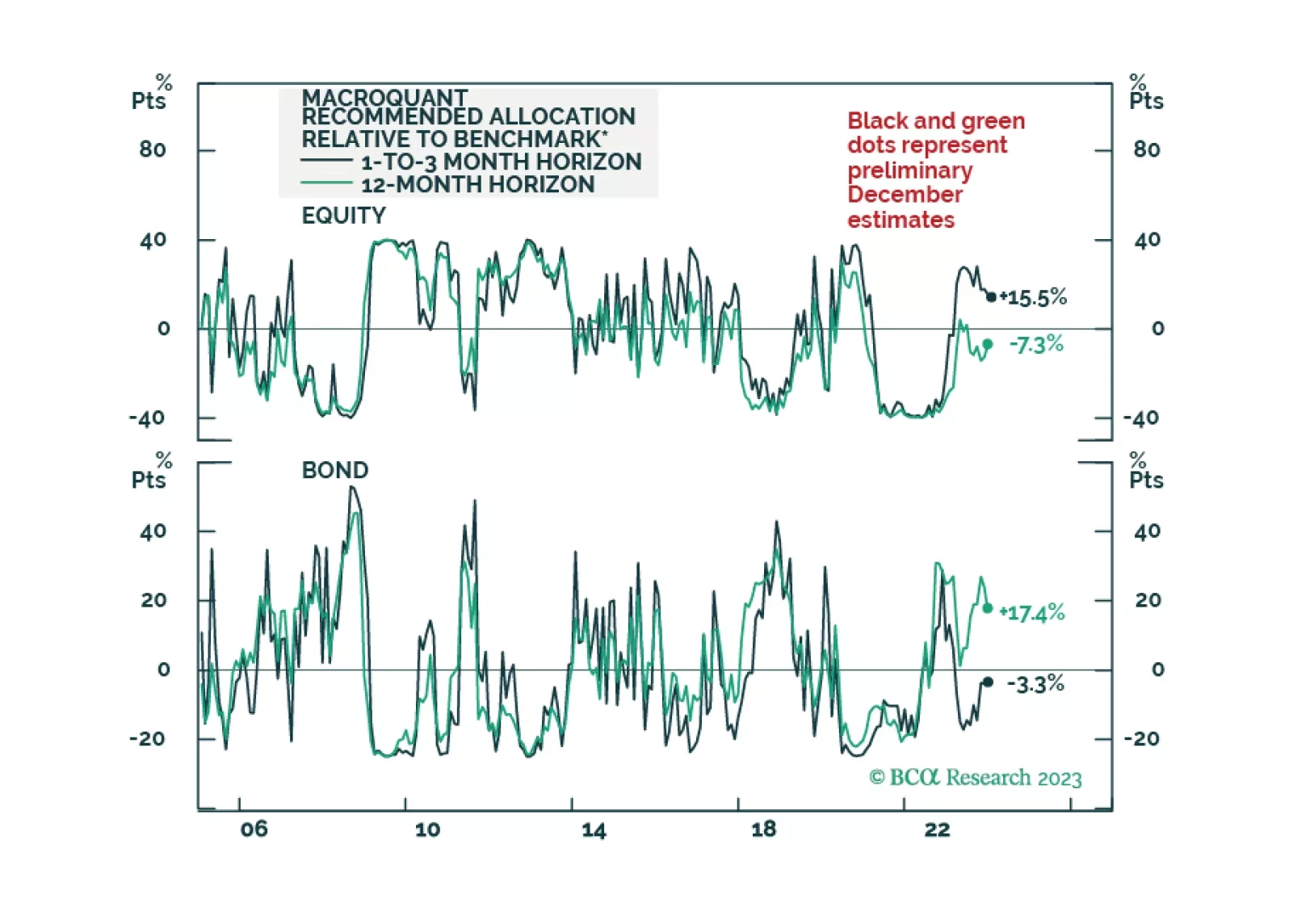

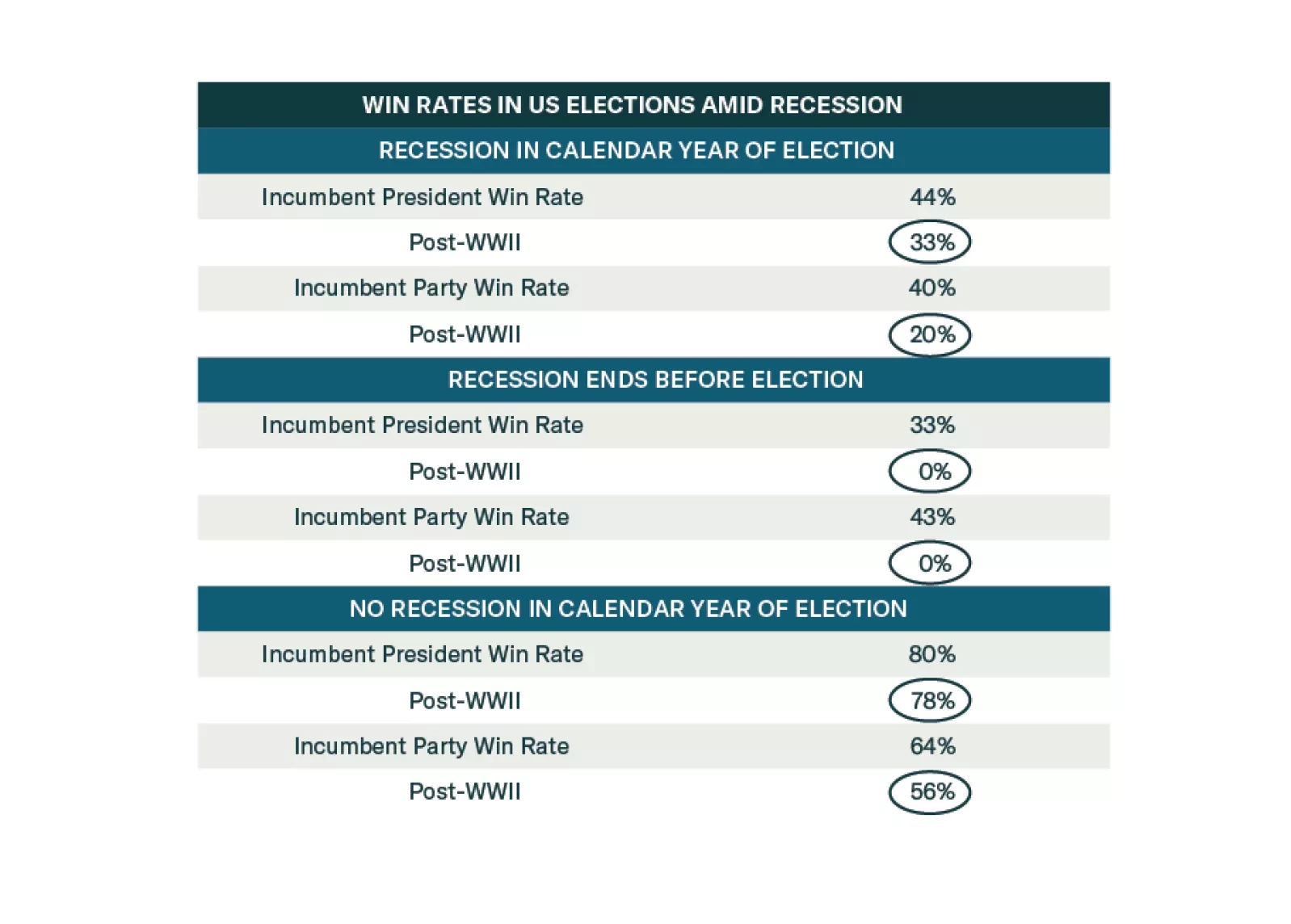

Democrats are favored to win the election until recession materializes. But recession risks are high. Investors should adopt a defensive and conservative strategy in 2024 amid extreme US policy uncertainty.

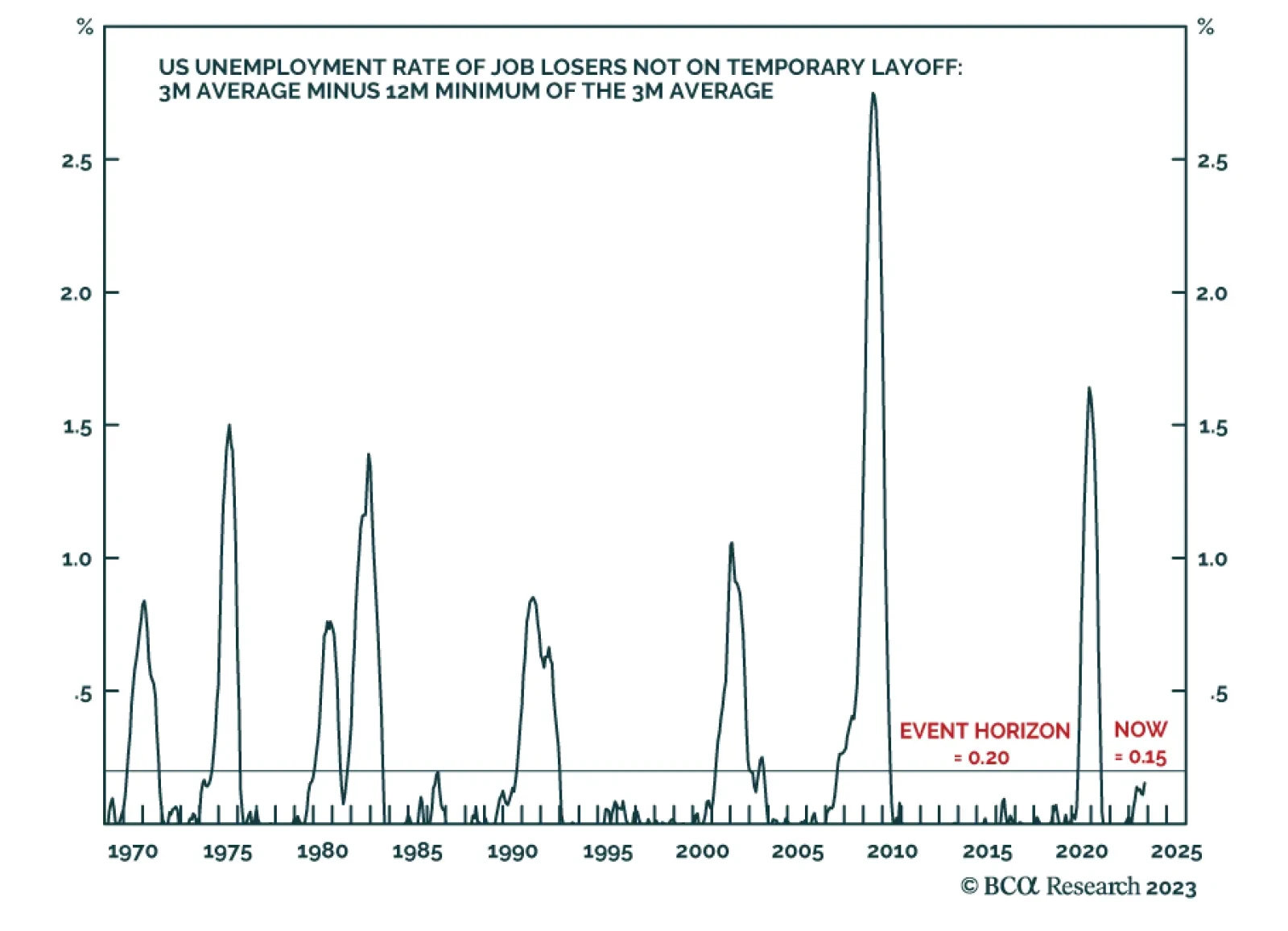

The ‘Joshi rule’ real-time recession indicator signals the start of a US recession when the three-month moving average of the unemployment rate of ‘job losers not on temporary layoff’ rises by 0.20 percent…

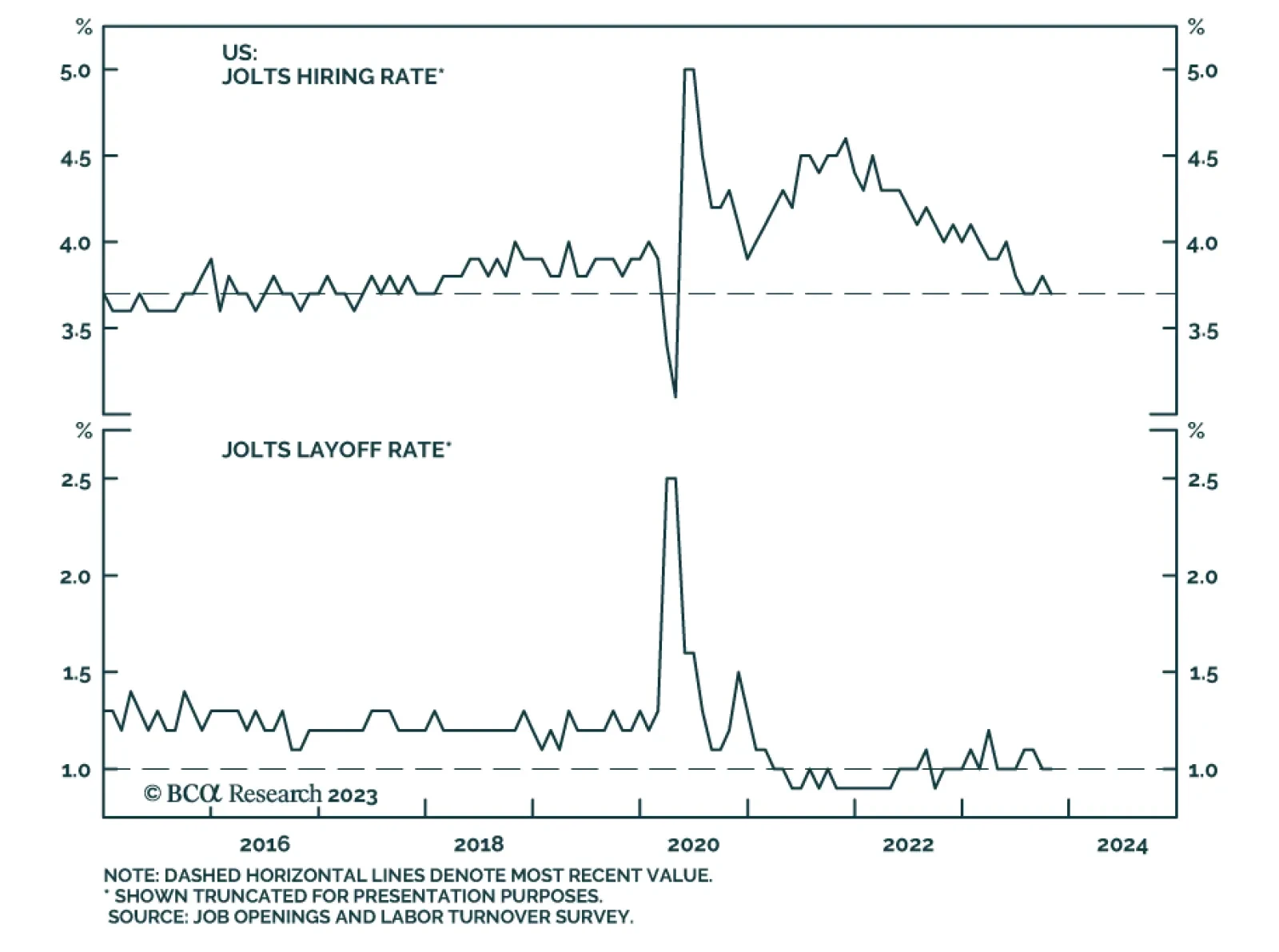

The number of US job openings fell sharply in October according to the JOLTS survey, from 9.4 million to 8.7 million. At 8.7 million, job openings are still above the 7.1 million average seen in the two years prior to the…