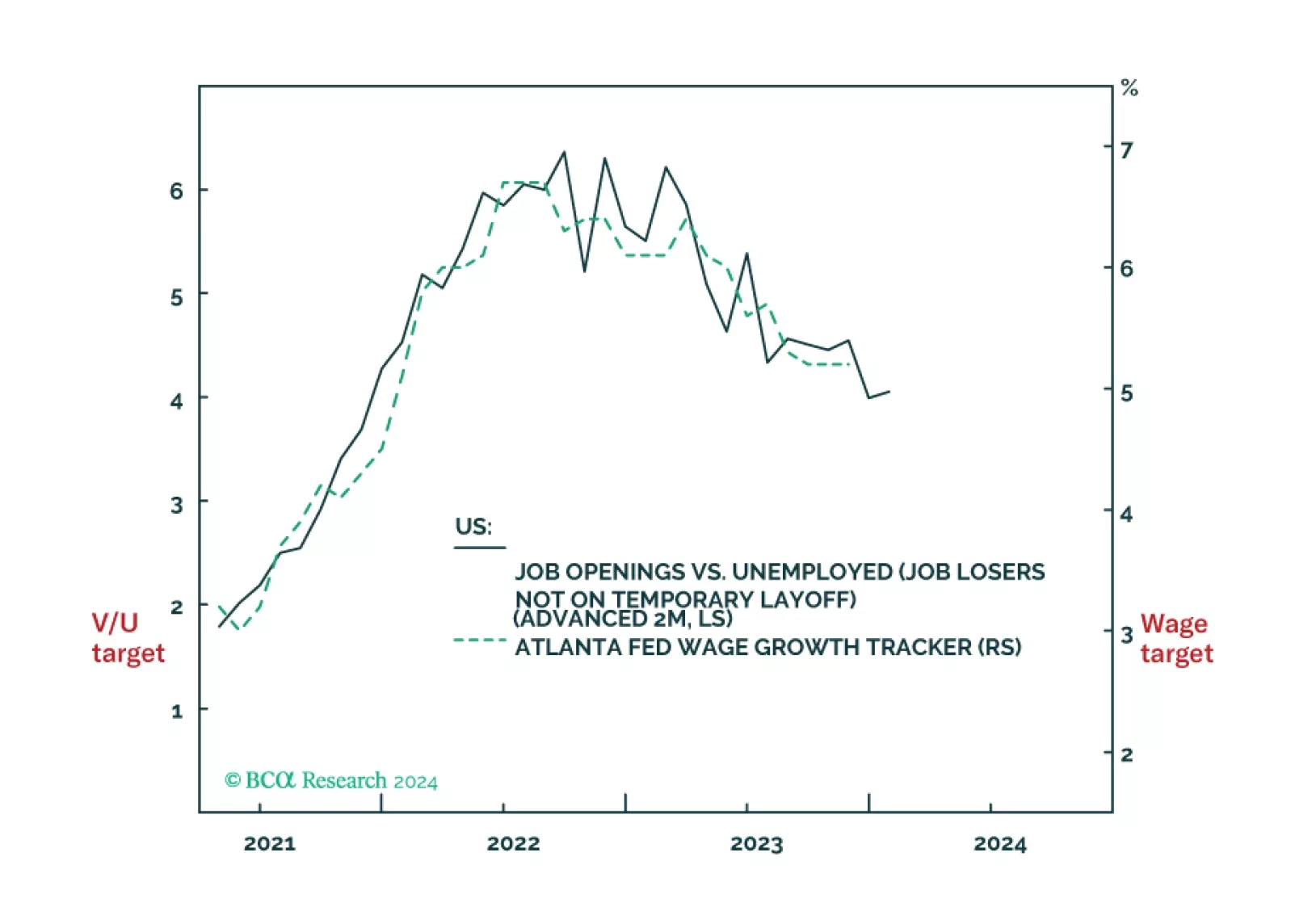

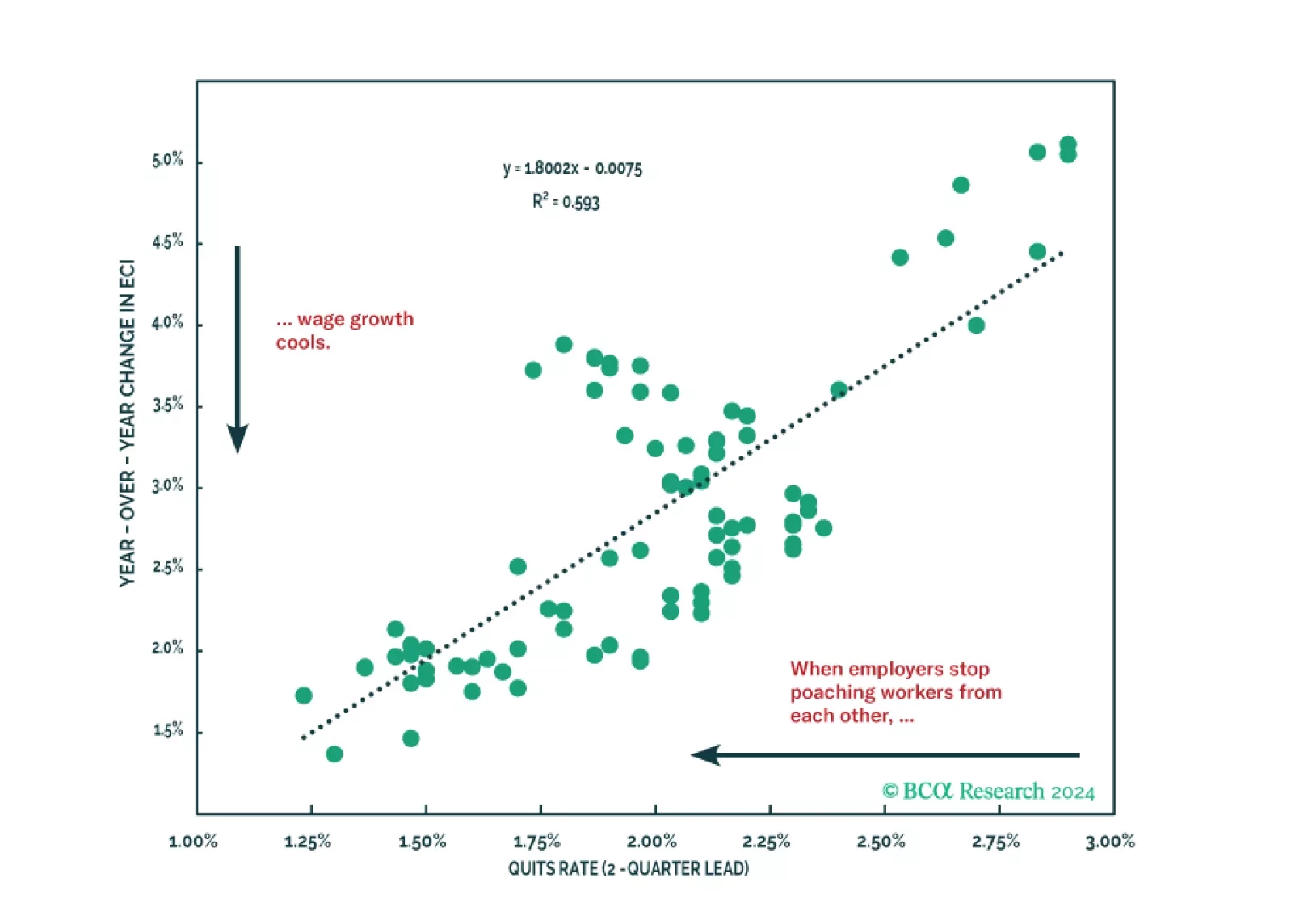

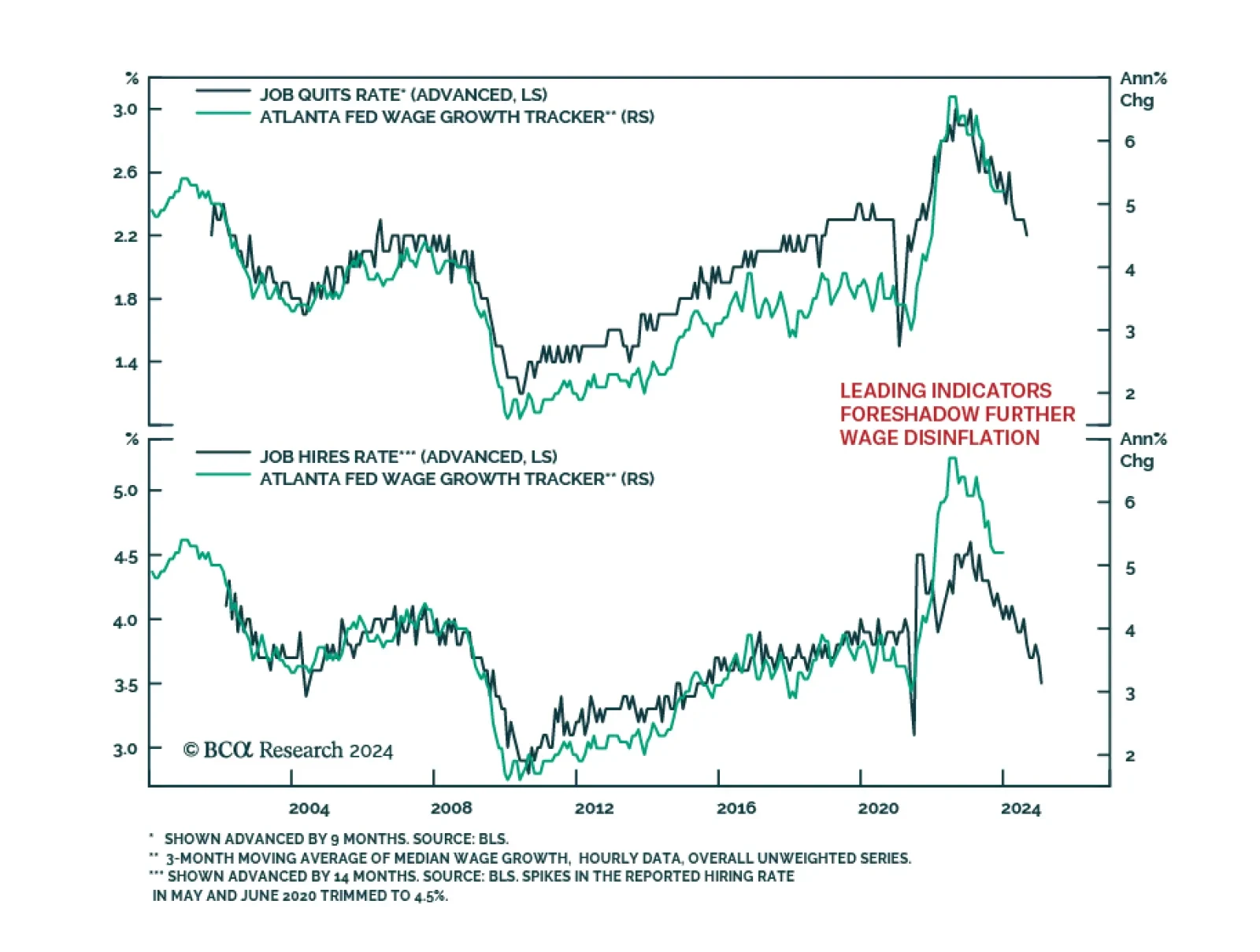

The Atlanta Fed’s US Wage Growth Tracker stalled at 5.2% in December, unchanged from November. Notably, after falling from a peak of 7.1% in June 2022, this indicator has stabilized at still-elevated levels in recent months…

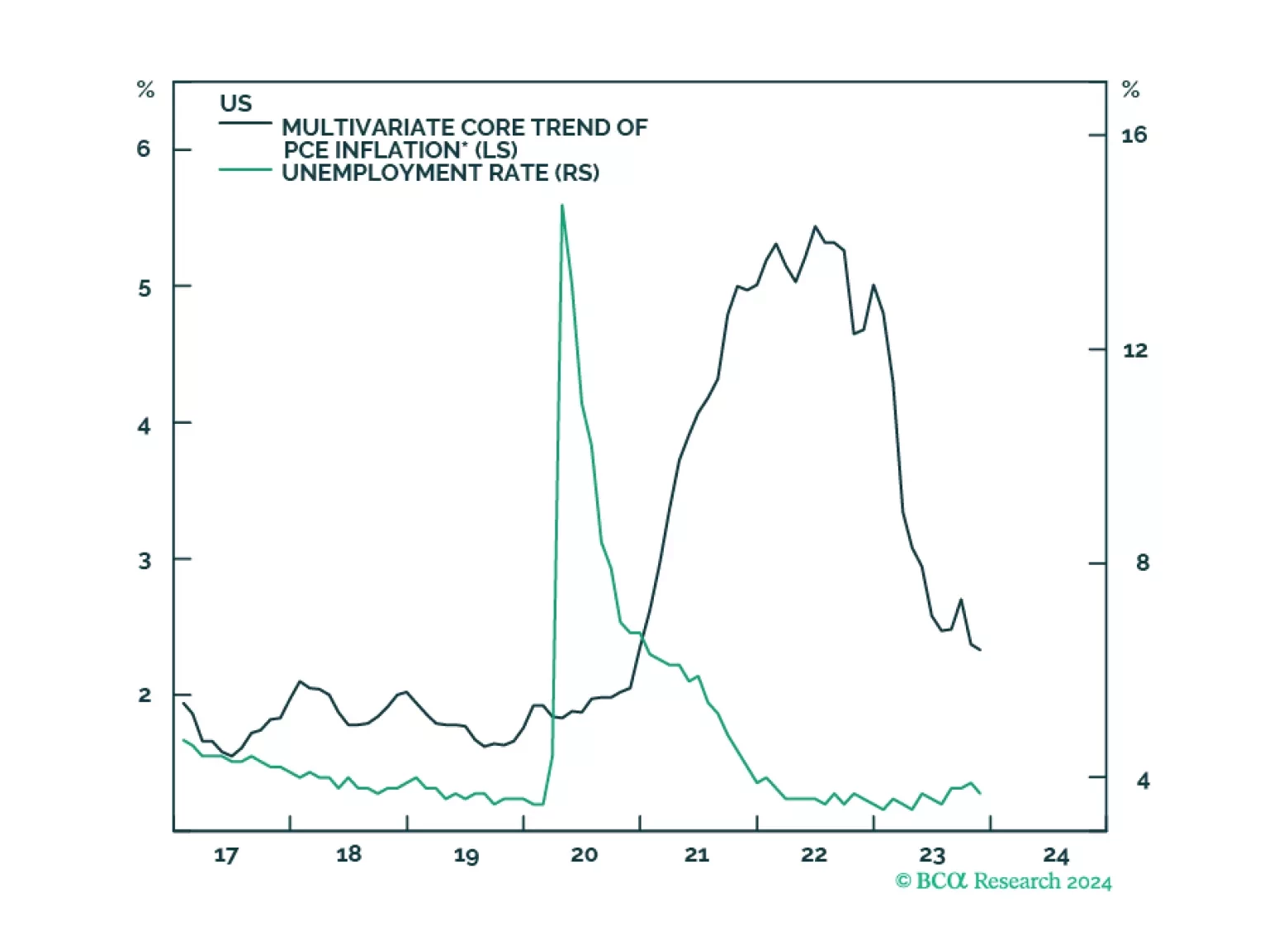

The Fed faces a dilemma. Cut rates early to avoid a recession, but at the risk of not slaying wage inflation. Or, not cut rates early to ensure that wage inflation is slayed, but at the risk of a downturn. Faced with such a dilemma,…

BCA Research’s US Bond Strategy service recommends investors keep portfolio duration close to benchmark for now. They will increase rate exposure as the labor market downturn worsens. Treasury yields are up slightly to…

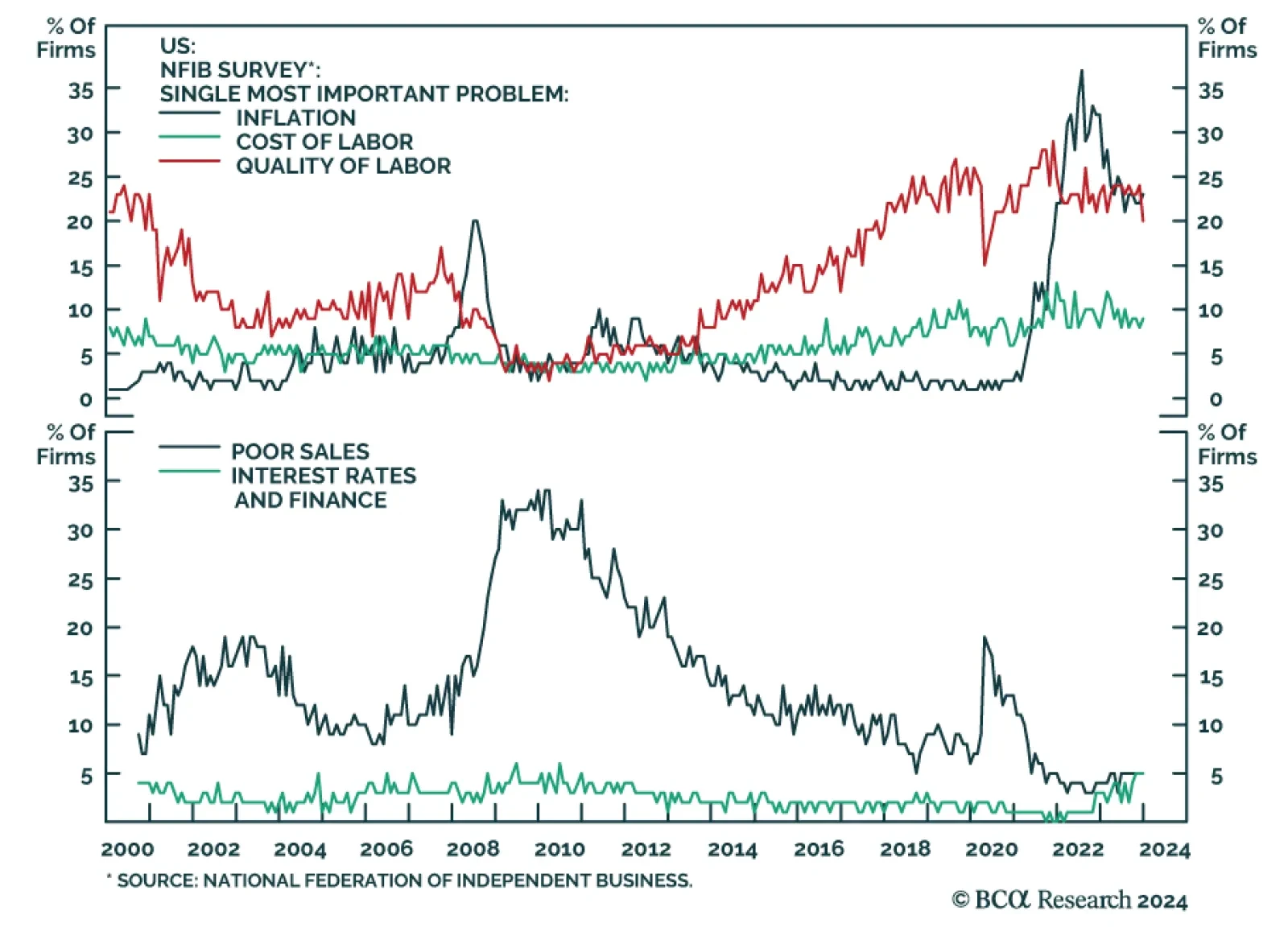

The NFIB Small Business Optimism Index delivered a slight positive surprise on Tuesday. The index rose 1.3 points to a five-month high of 91.9 in December and beat consensus expectations of 91.0. However, the contents of the…

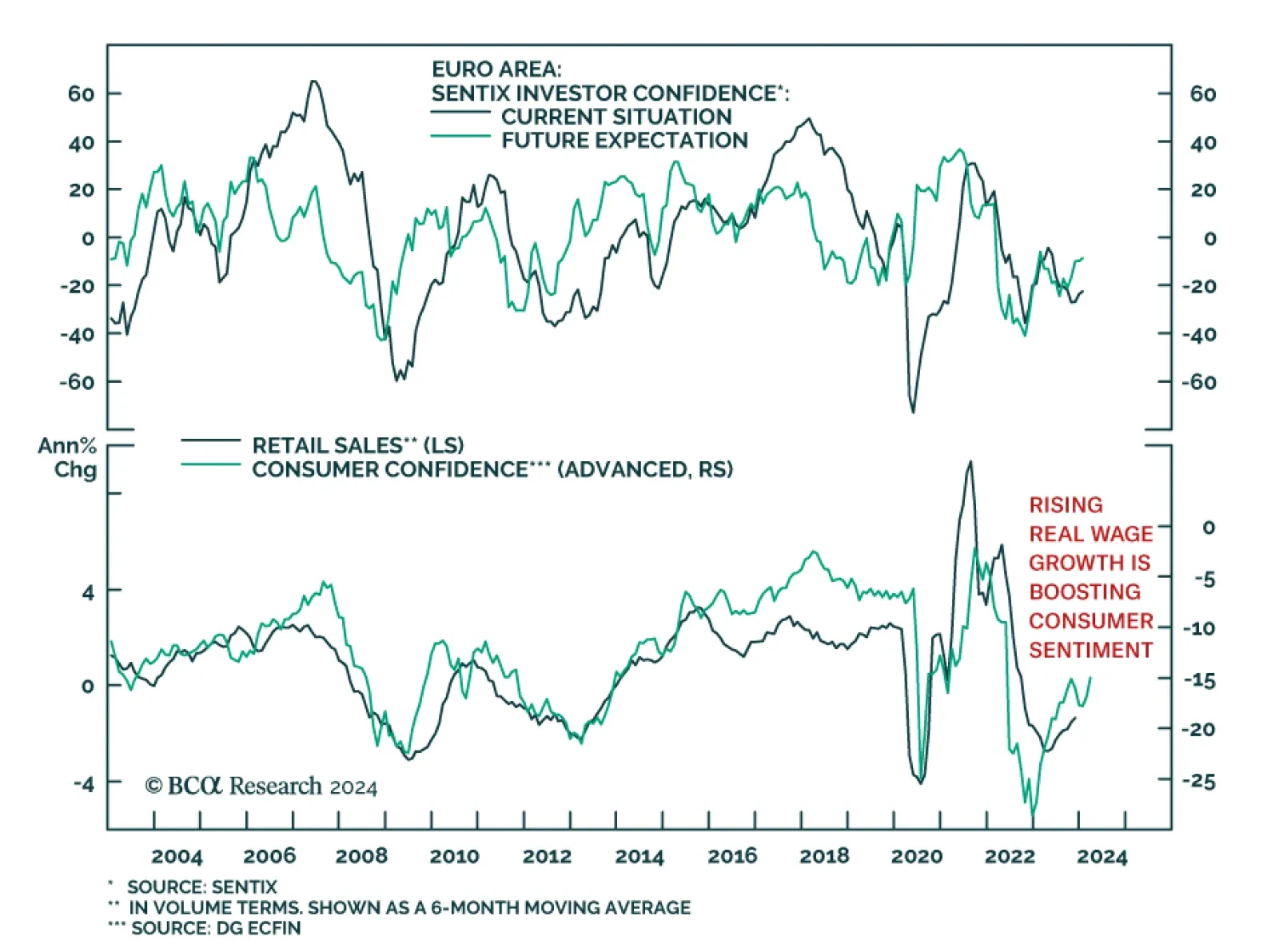

Optimism among investors and economic agents continues to improve in the Eurozone. The Sentix Economic Index for the Eurozone rose from -16.8 to -15.8 in January – in line with consensus expectations and marking the third…

Our Portfolio Allocation Summary for January 2024.

Despite the blah opening to the year, we do not think stocks have reached an inflection point. We expect that incoming data will continue to flatter the soft-landing narrative for another couple of months, helping the S&P 500 to…

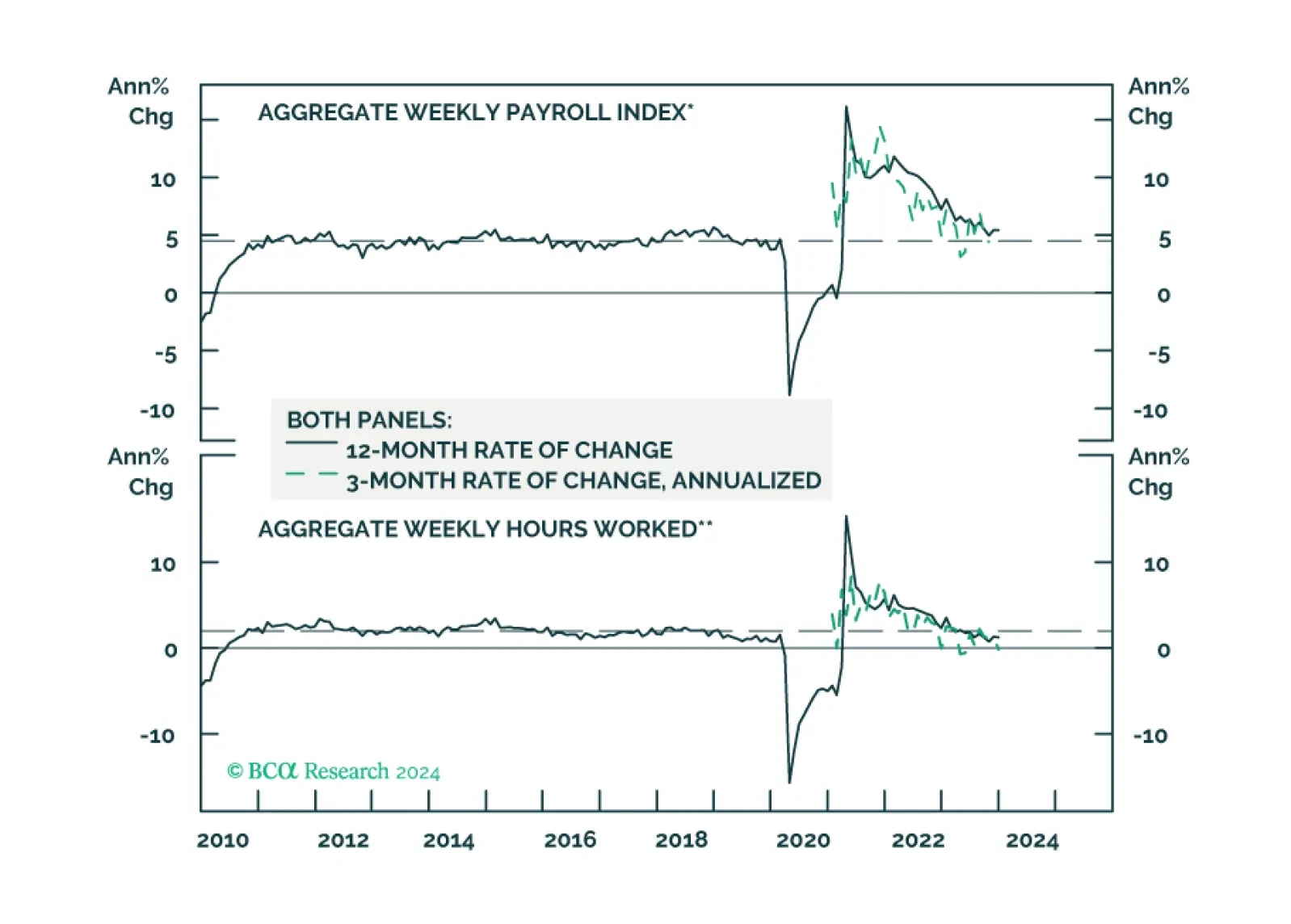

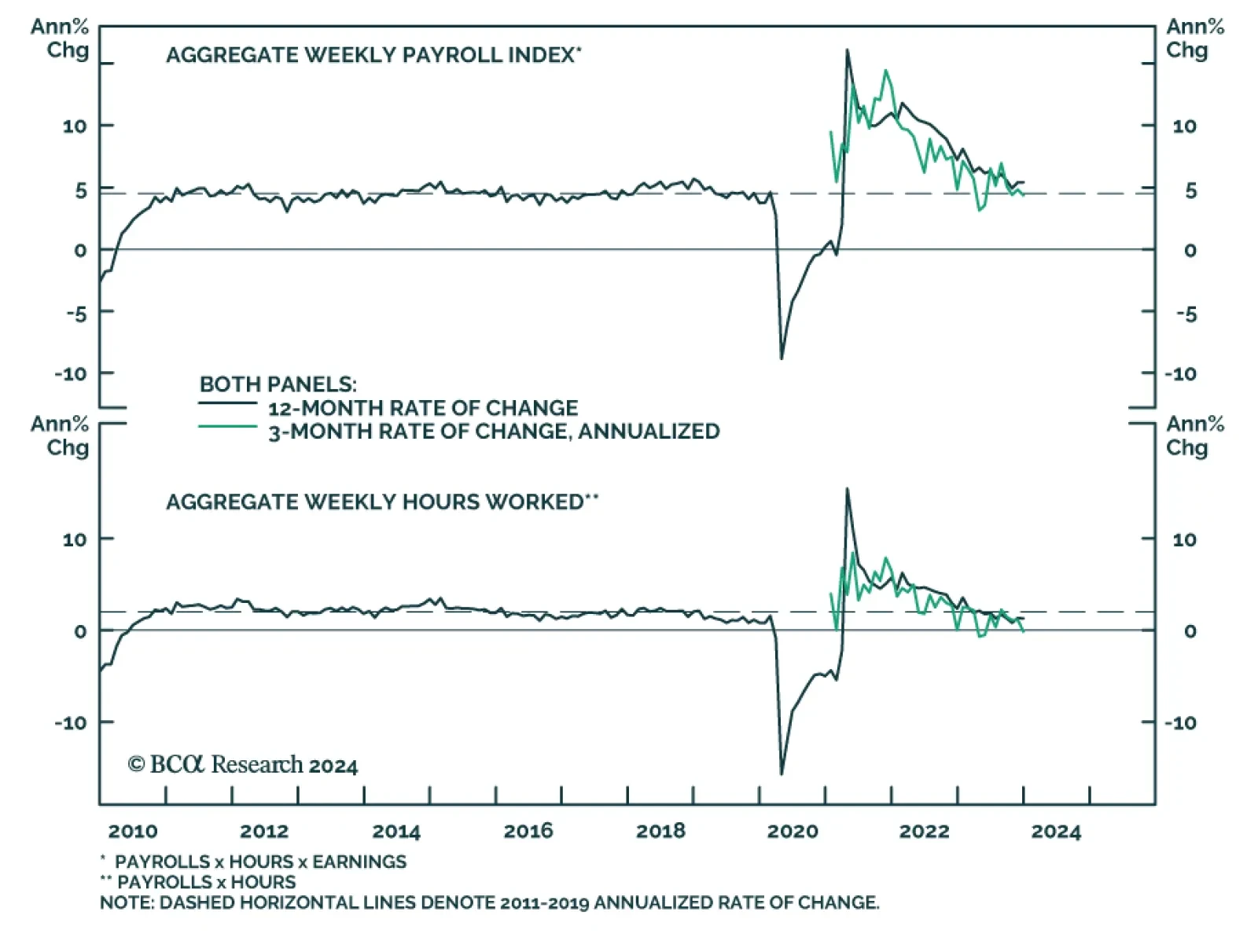

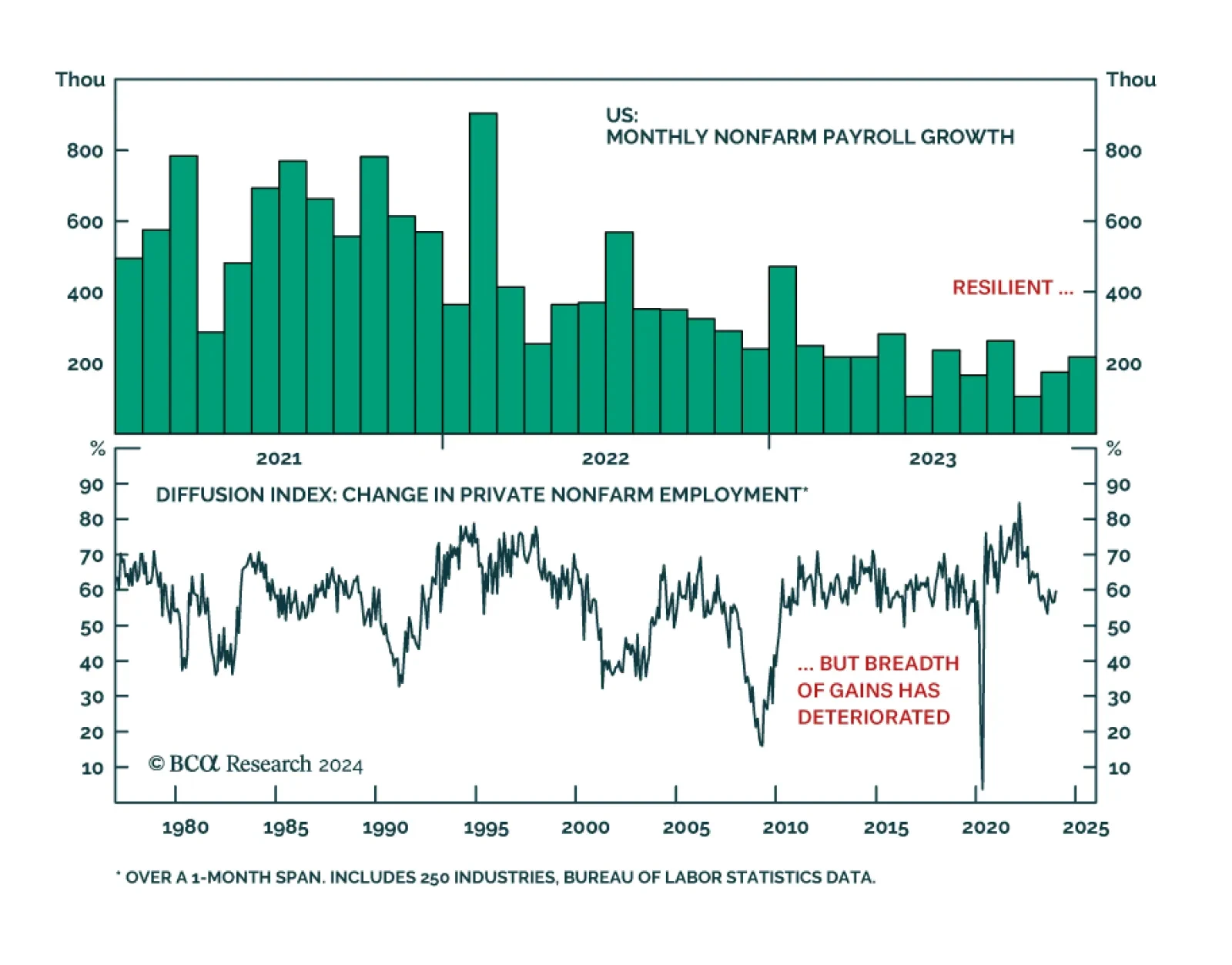

At first blush, the US establishment survey delivered a positive surprise on Friday. The increase in US nonfarm payroll employment jumped from 173 thousand to 216 thousand in December – beating expectations of 175 thousand…

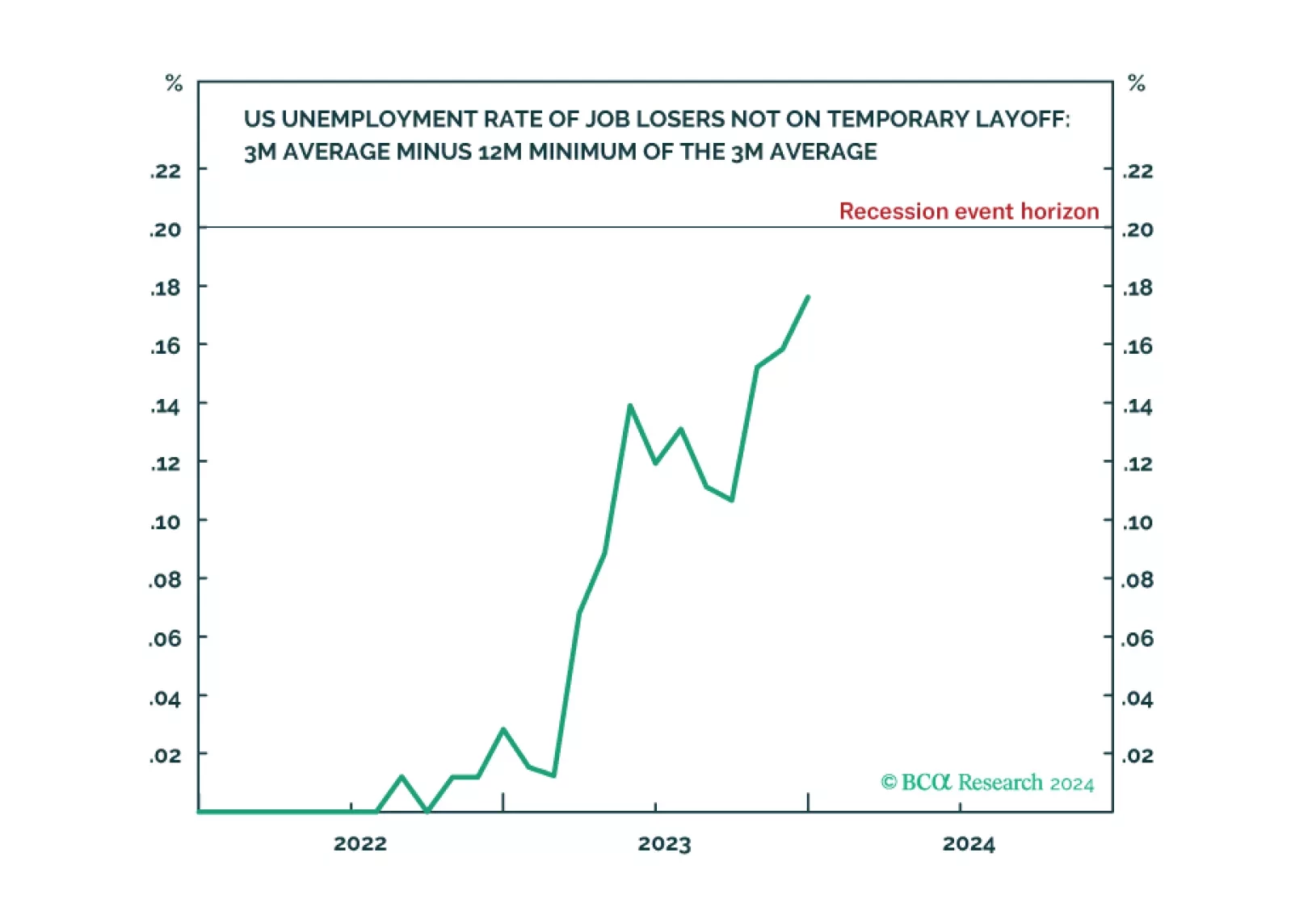

Following today’s US jobs data release, the Joshi rule real-time US recession indicator inched up to 0.18 and is now just a whisker from its recession event-horizon of 0.20.

A soft landing can be achieved but not maintained. We are cutting our tactical recommendation on stocks from overweight to neutral and scaling back our long-duration stance.