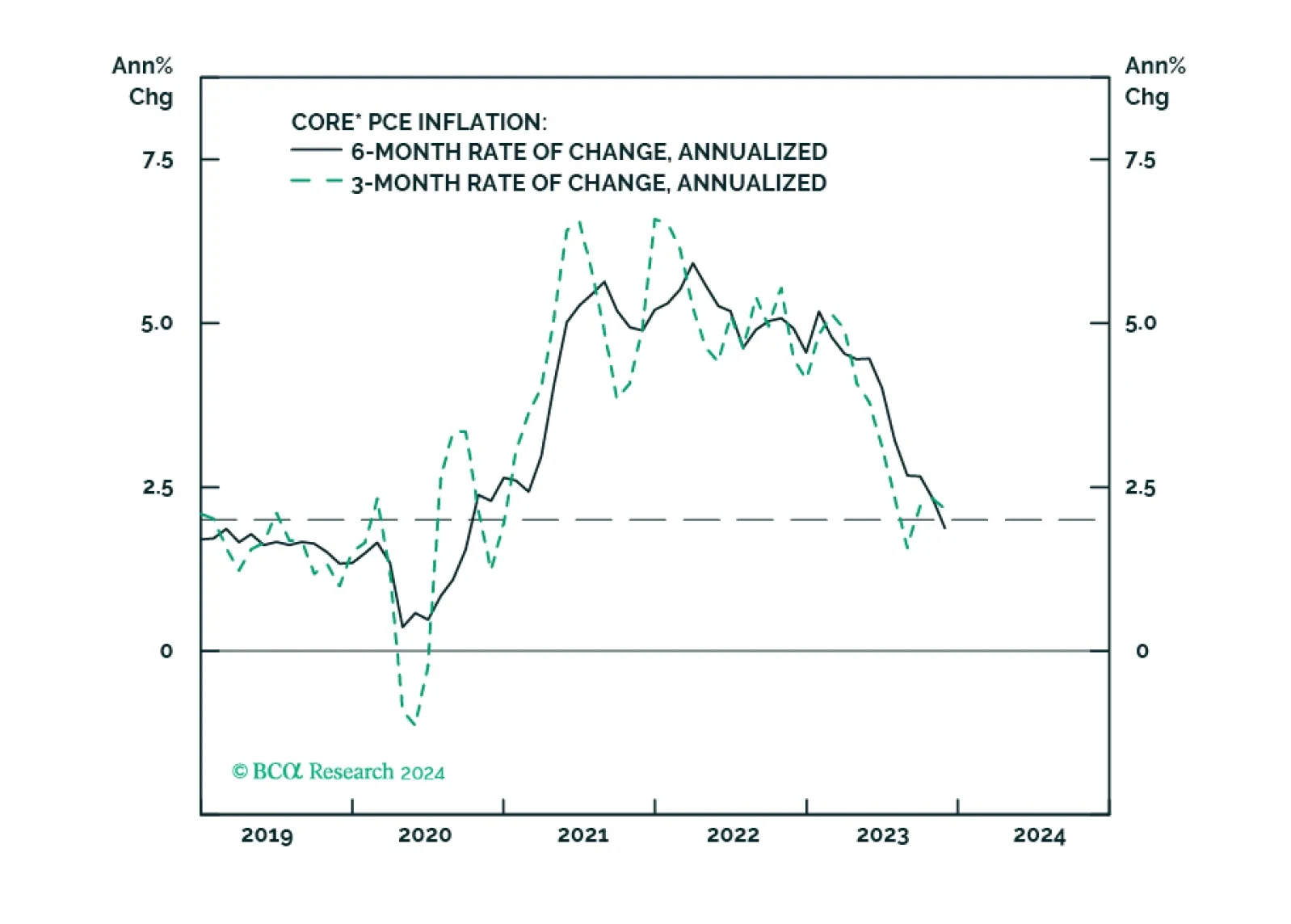

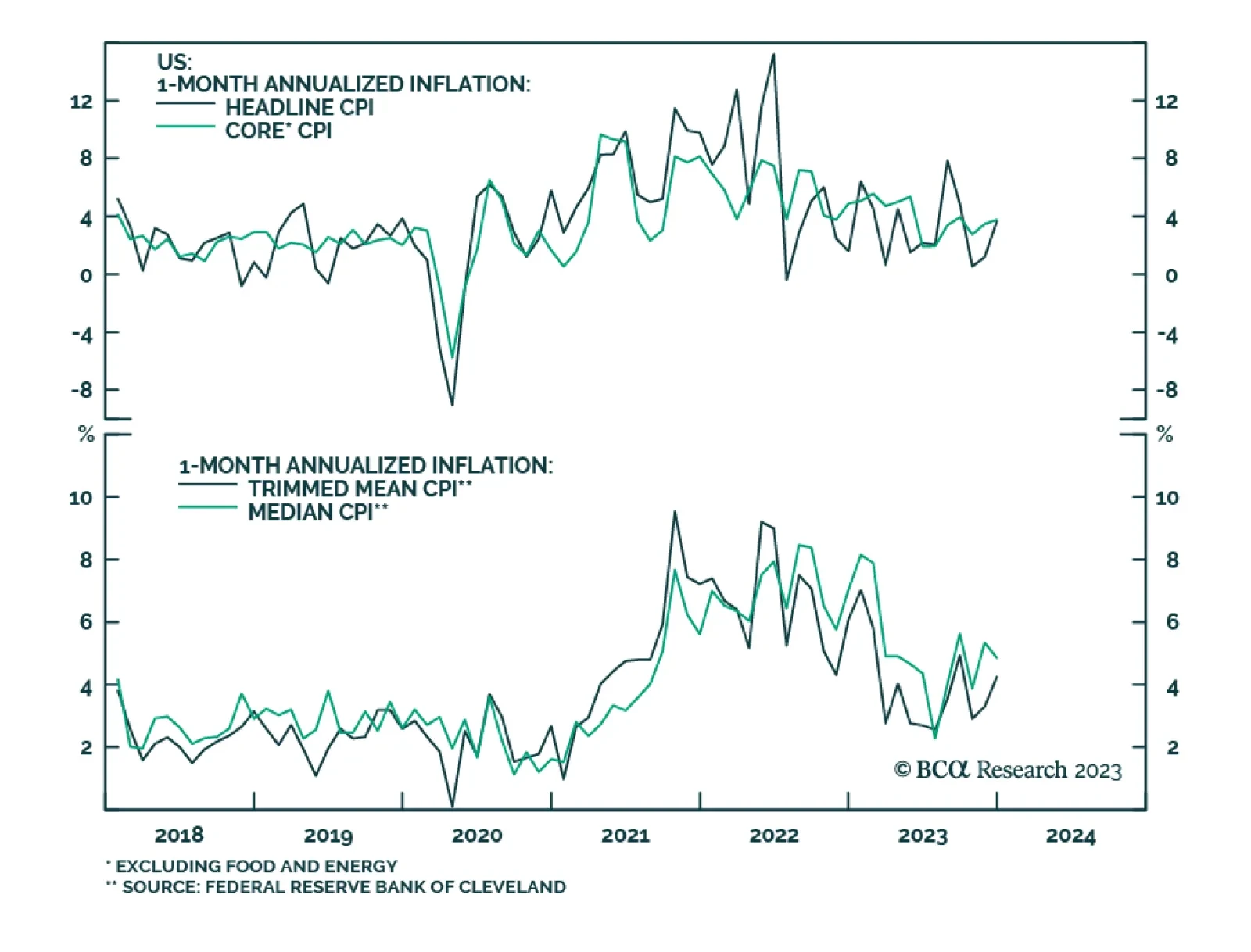

Low inflation argues for the Fed to move relatively quickly toward rate cuts. Continued above-trend GDP growth poses a risk to this view, but leading indicators point to slower growth in the coming quarters.

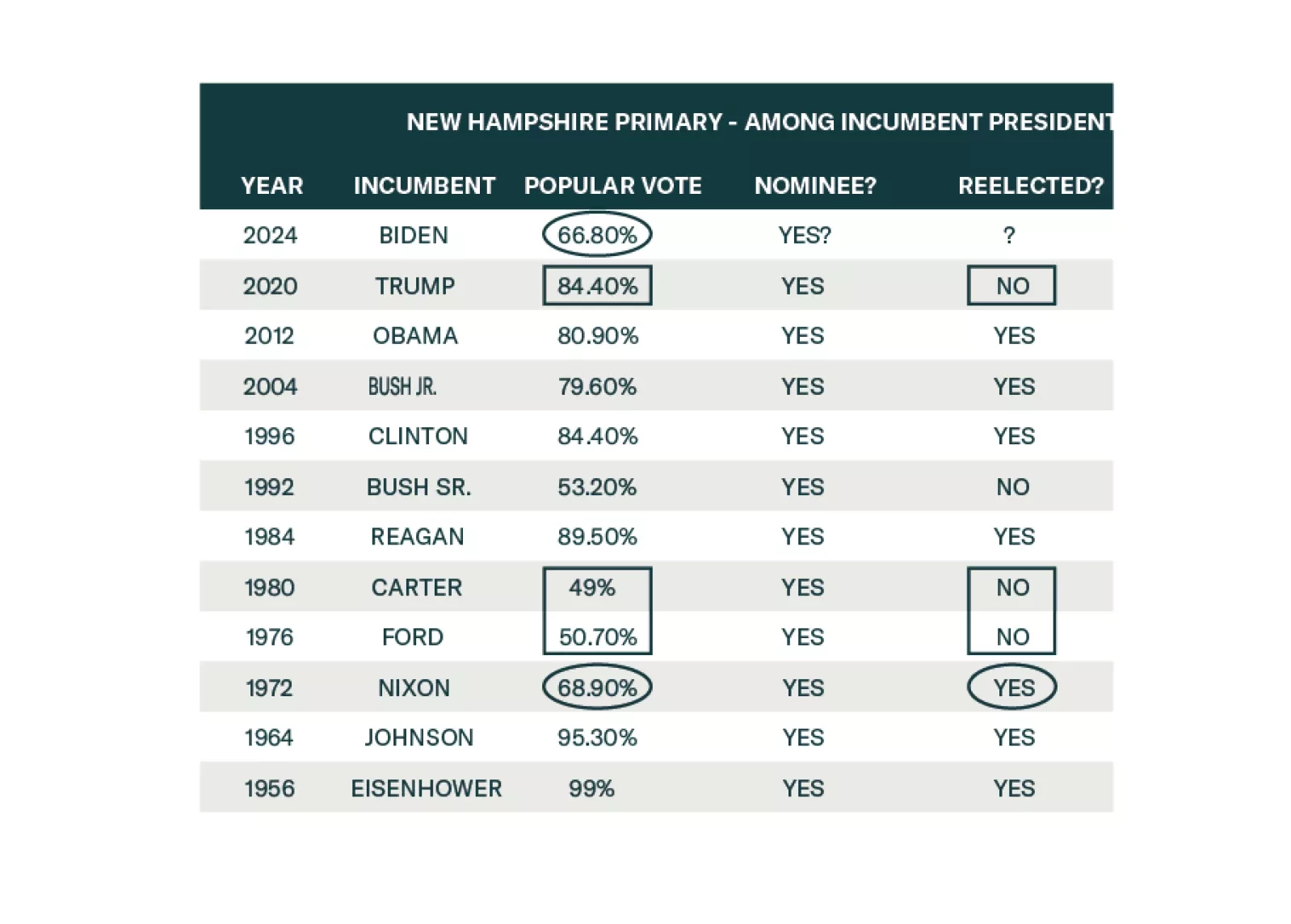

The US primary election is effectively over. The Biden-Trump rematch – our base case since 2022 – is all but set in stone. Only a health issue or freak incident could change that now.

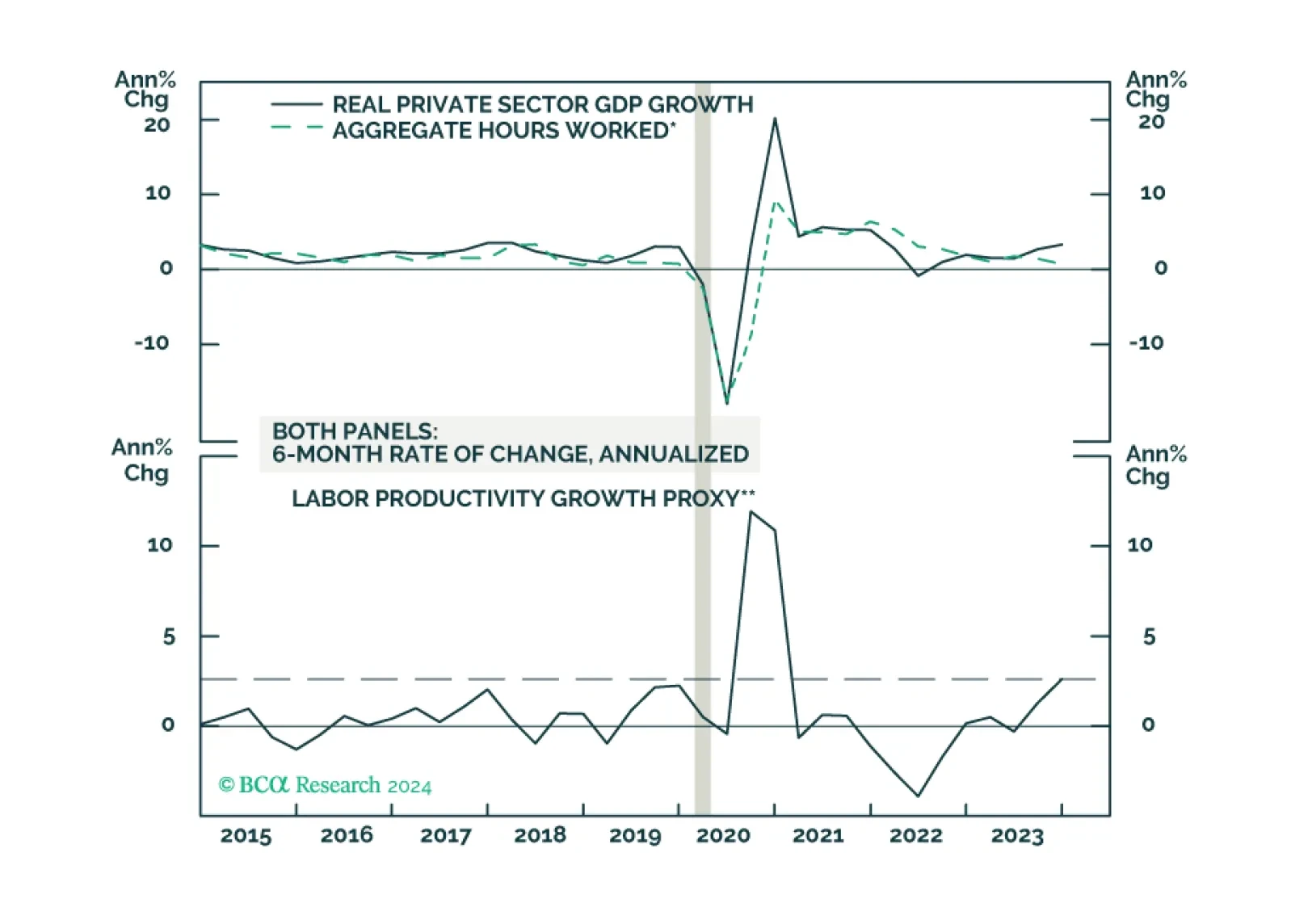

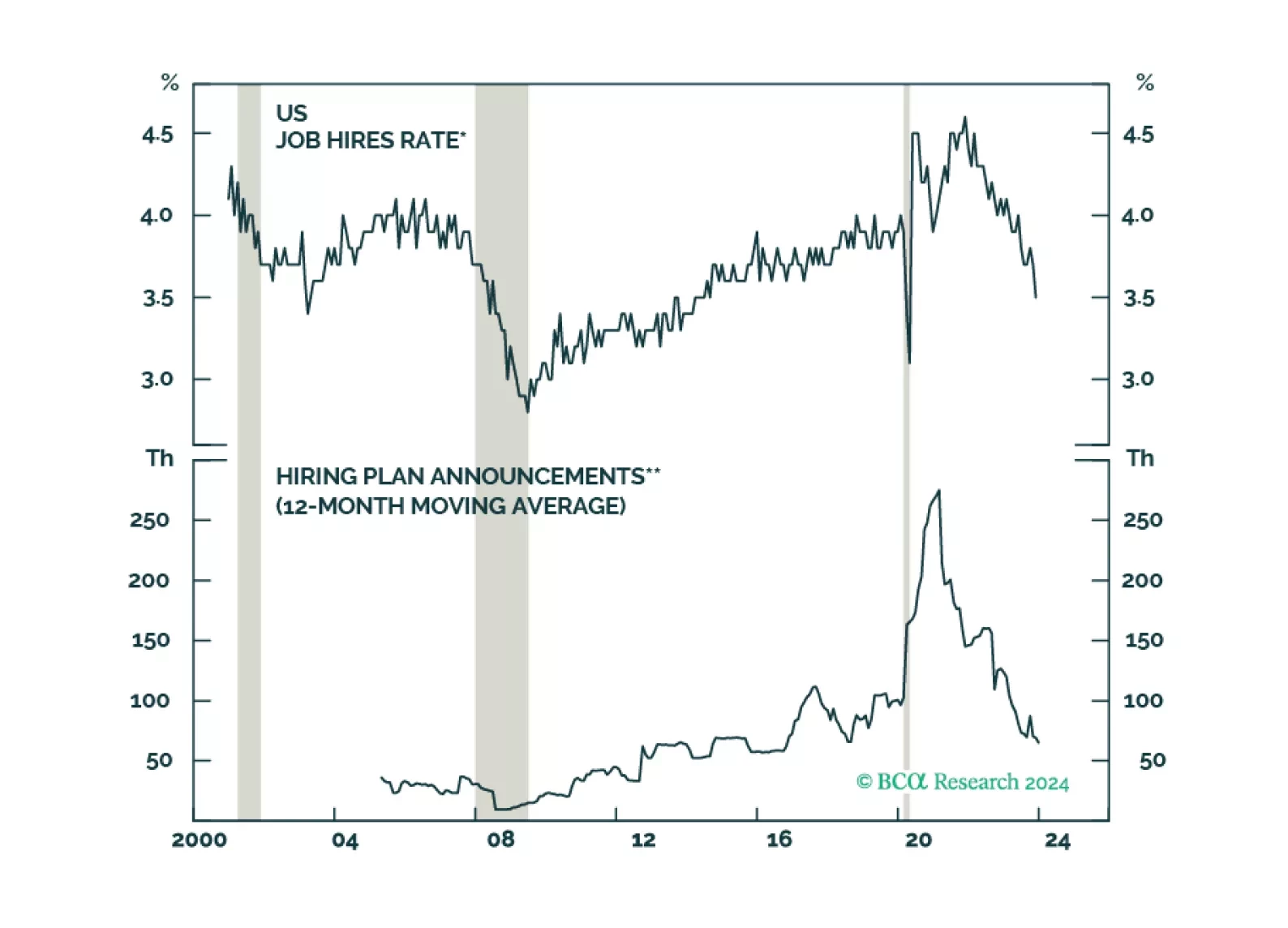

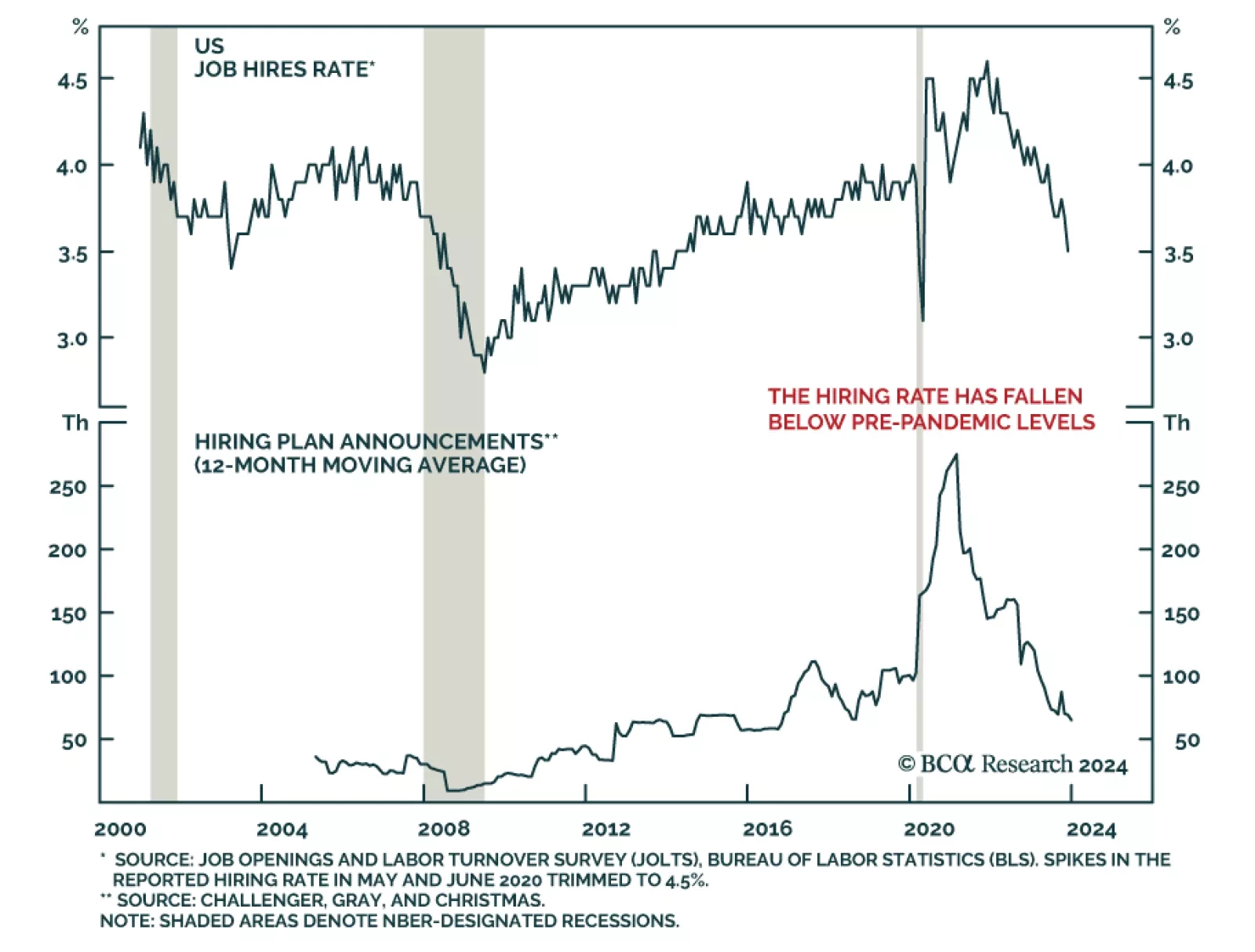

According to BCA Research’s Global Investment Strategy service, labor demand can fall even in a full-employment economy. Investors often focus on the unemployment rate as a gauge of how strong the labor market is. The…

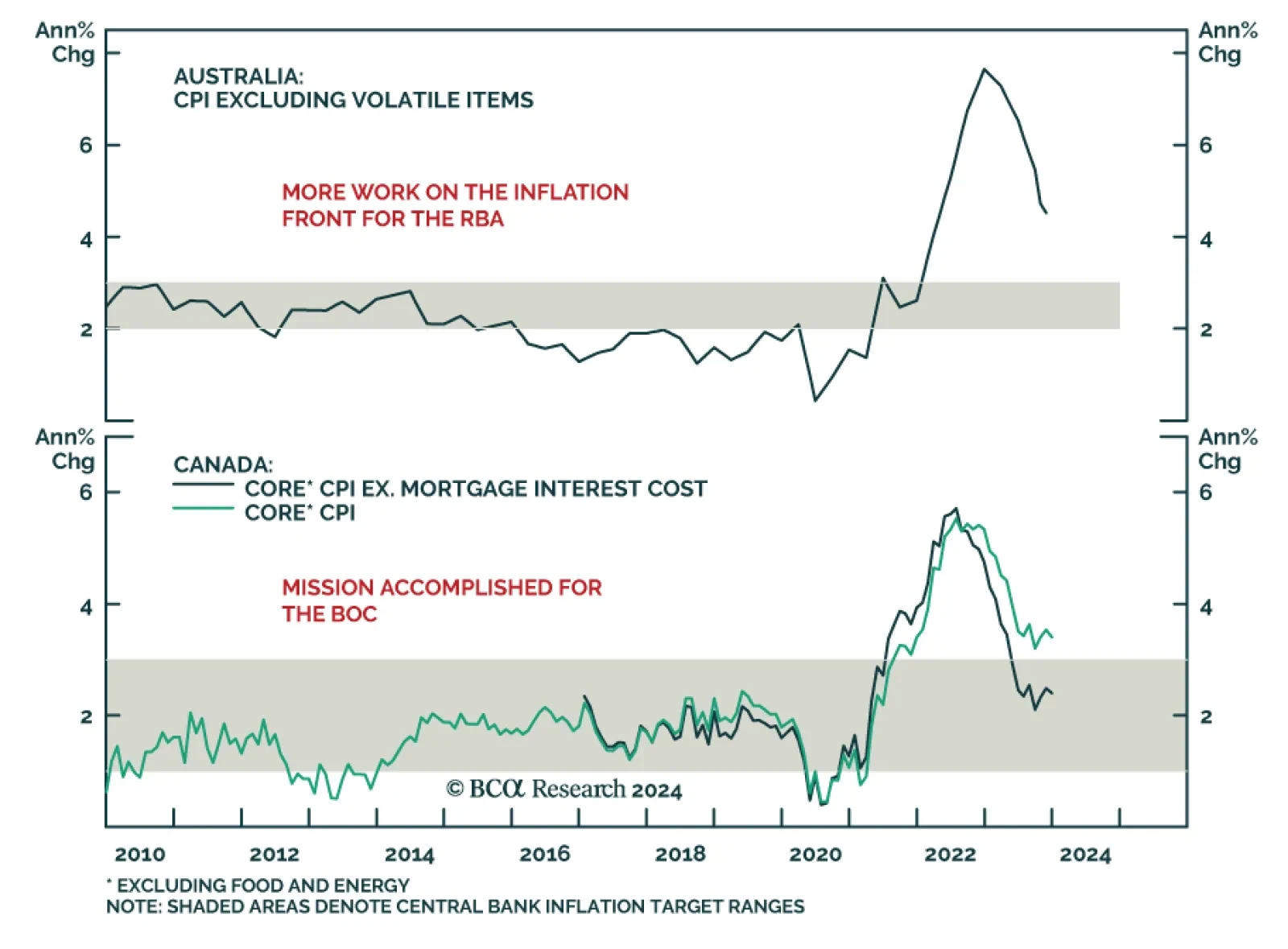

Ahead of today’s Bank of Canada (BoC) meeting and the Reserve Bank of Australia (RBA) meeting on February 6th, our Global Fixed Income Strategists compared the monetary policy outlooks for both central banks. In Canada,…

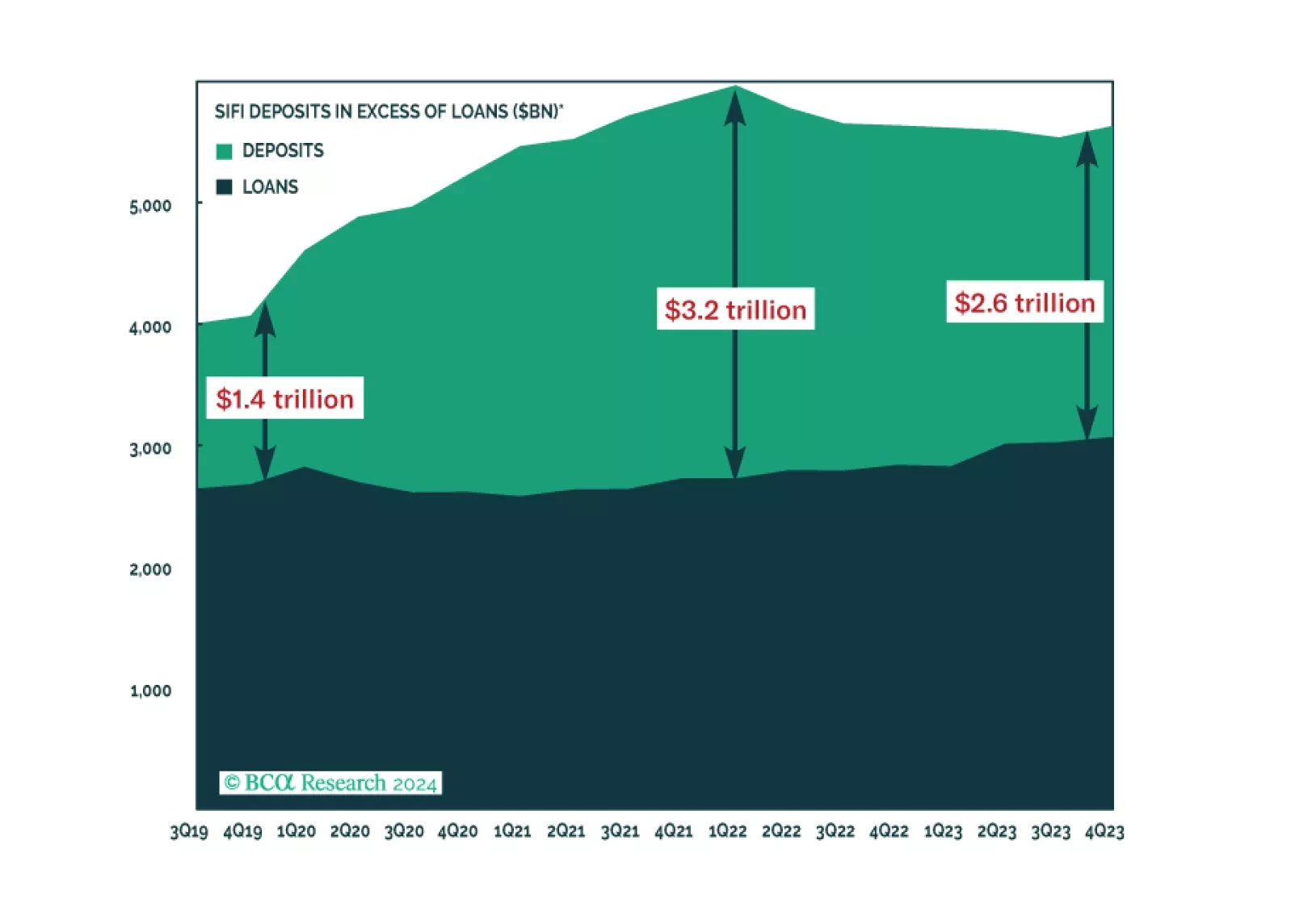

The SIFI banks expressed confidence in their credit outlook for 2024 and expect that credit losses will crest soon, given the reserves they’ve already set aside. Their implicit embrace of the soft-landing narrative suggests to us…

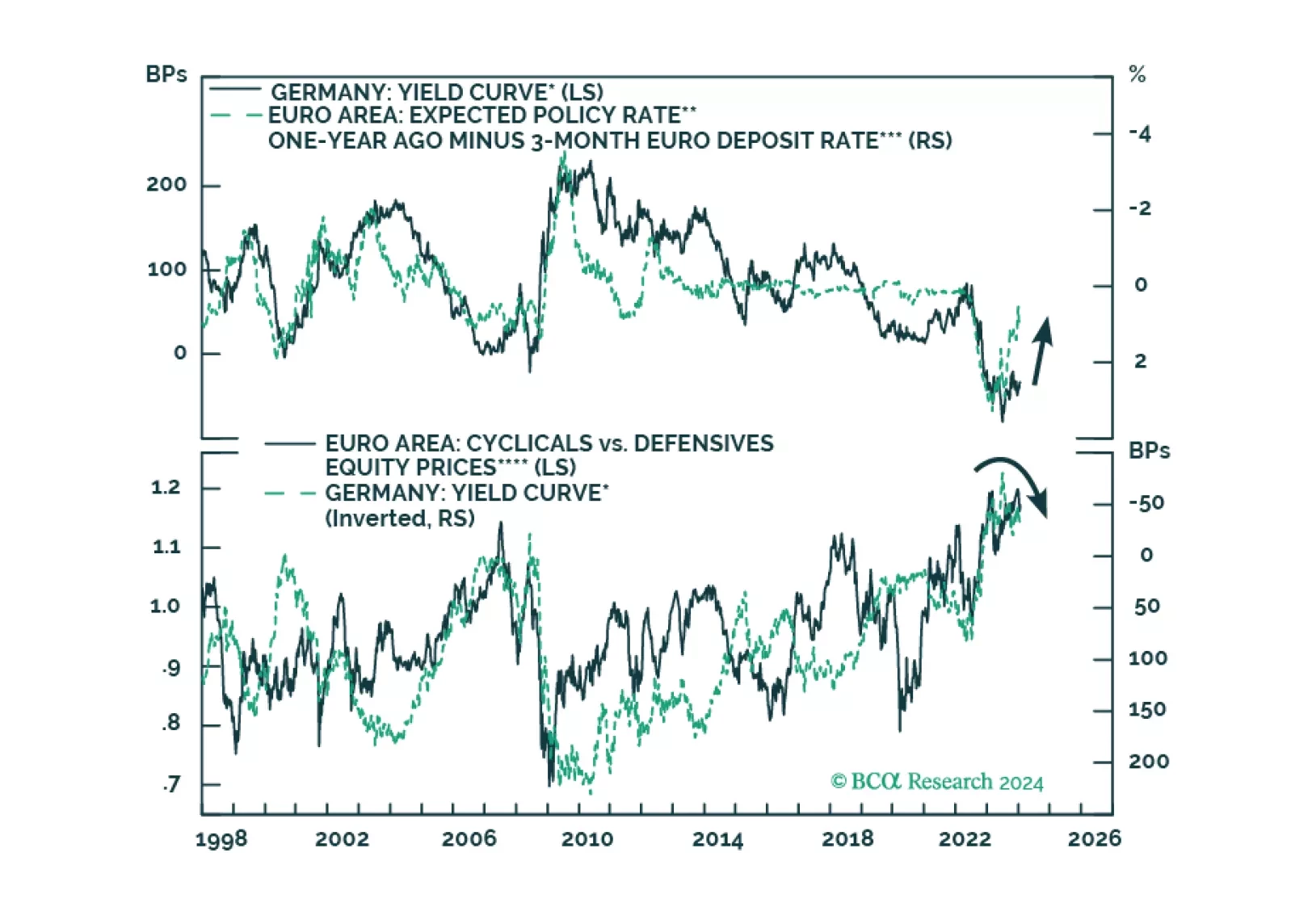

The ECB will begin cutting rates in June, what does this start date imply for the yield curve and European cyclicals?

Investors have taken comfort in the fact that unemployment has remained low in the major economies. But underneath the surface, there are clear signs that labor demand is weakening. The clock keeps ticking towards our H2 2024…

An update to our outlooks for the Fed’s interest rate and balance sheet policies following this week’s remarks from Fed Governor Waller.

US CPI inflation for December came in slightly hotter than anticipated. Headline inflation accelerated from 0.1% to 0.3% on a month-over-month basis and rose from 3.1% to 3.4% on a year-over-year basis. Both the monthly and…

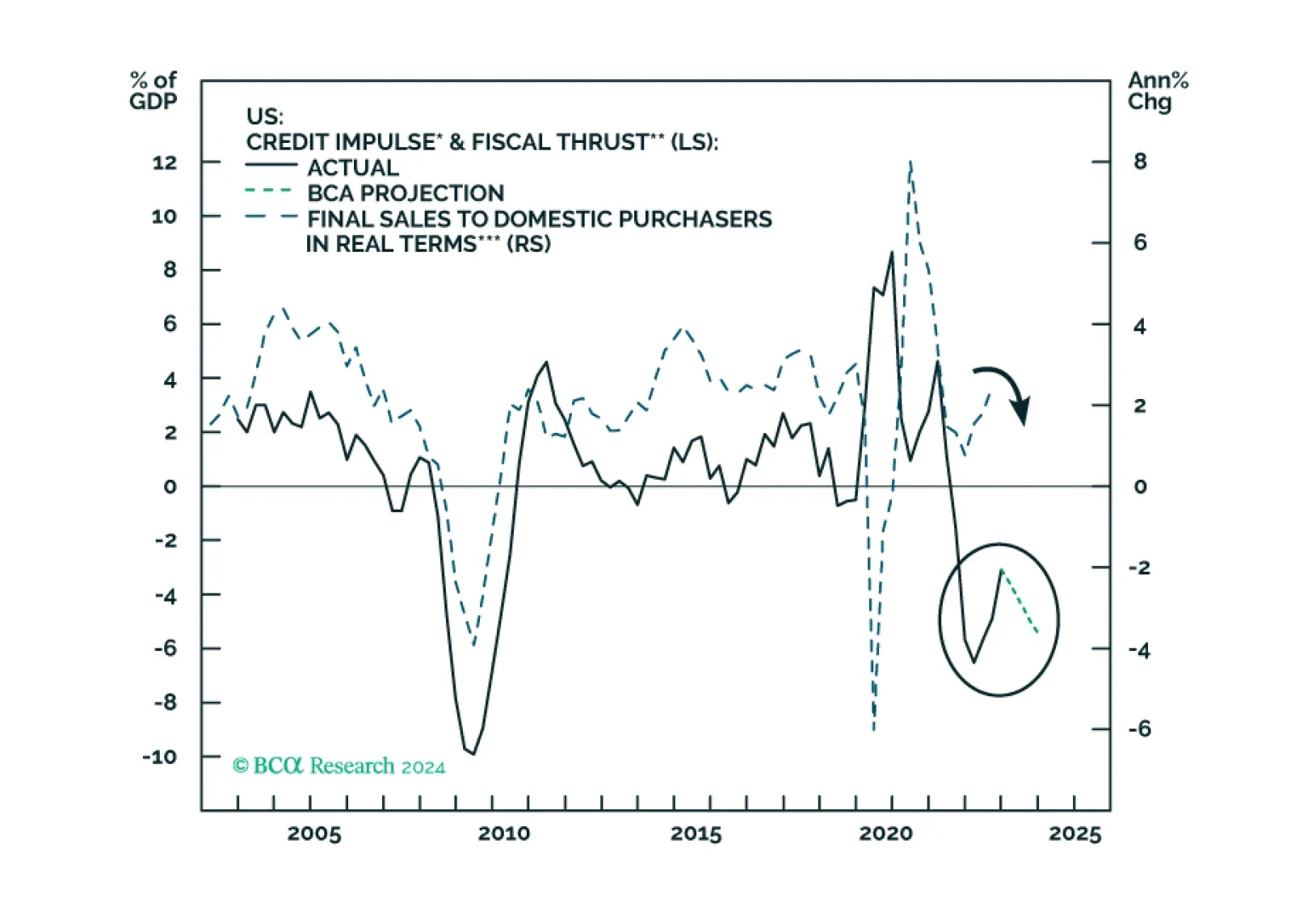

The combined US credit impulse and fiscal thrust indicator will likely relapse in 2024, heralding growth weakness. Stalling US sales volume and falling inflation, combined with sticky labor costs, will herald a non-trivial profit…