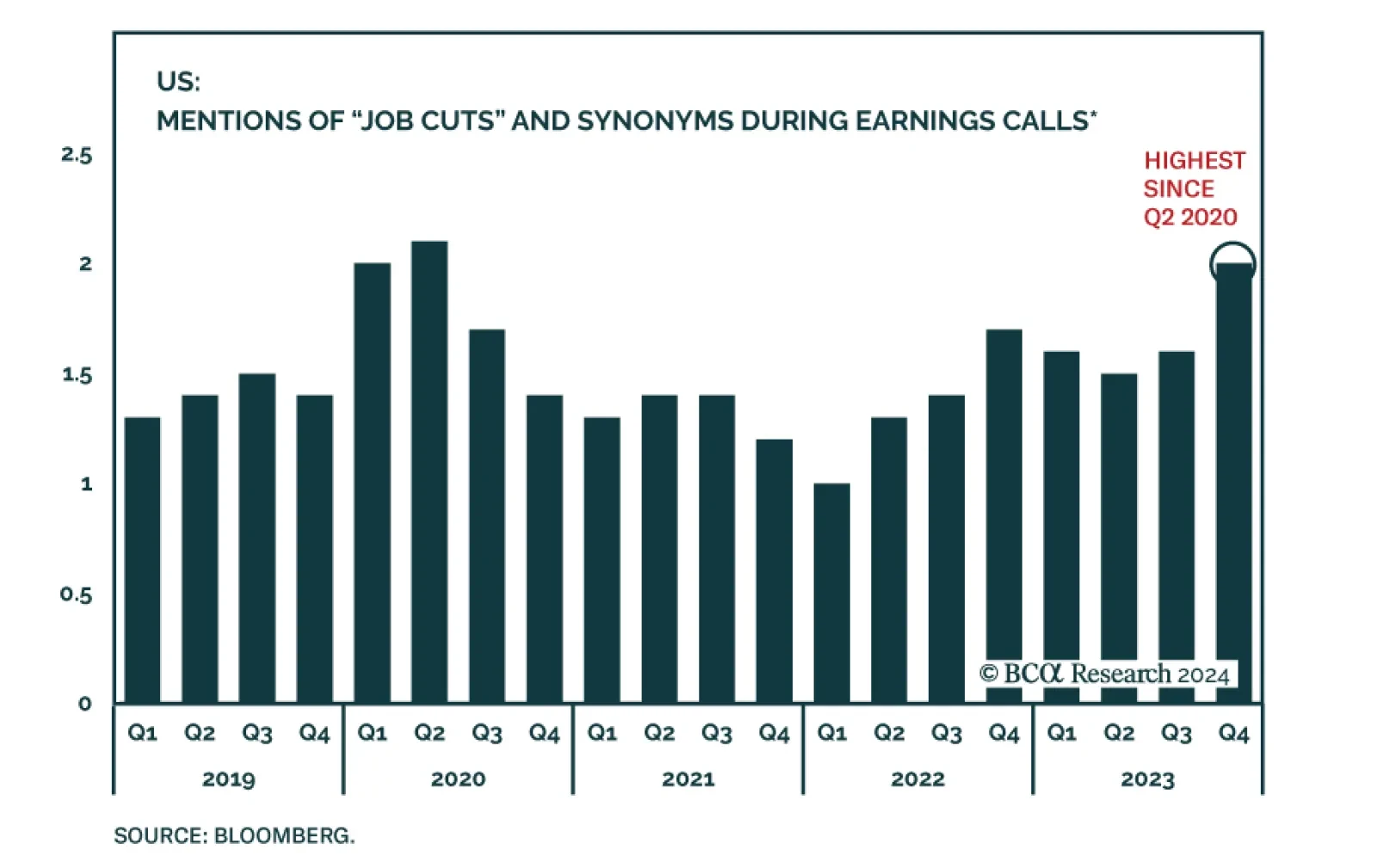

BCA Research’s Global Investment Strategy service’s revised forecast is centered on a recession starting in late 2024 or early 2025. The strong pace of US growth has continued into early 2024. Preliminary estimates…

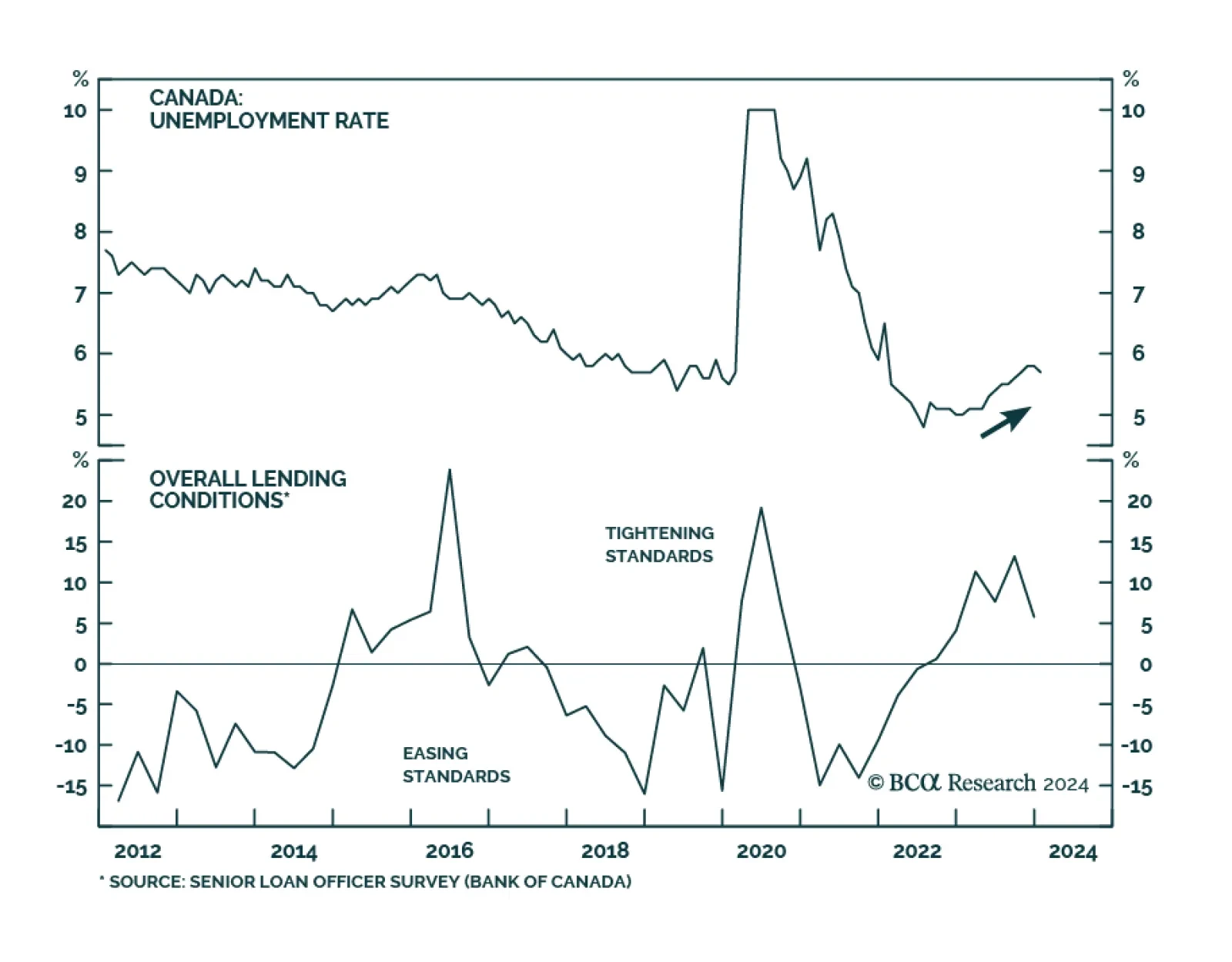

The latest Canadian data suggest that although demand is cooling down, the Canadian economy is not in freefall. The unemployment rate fell for the first time since December 2022, declining by 0.1 percentage points to 5.7%,…

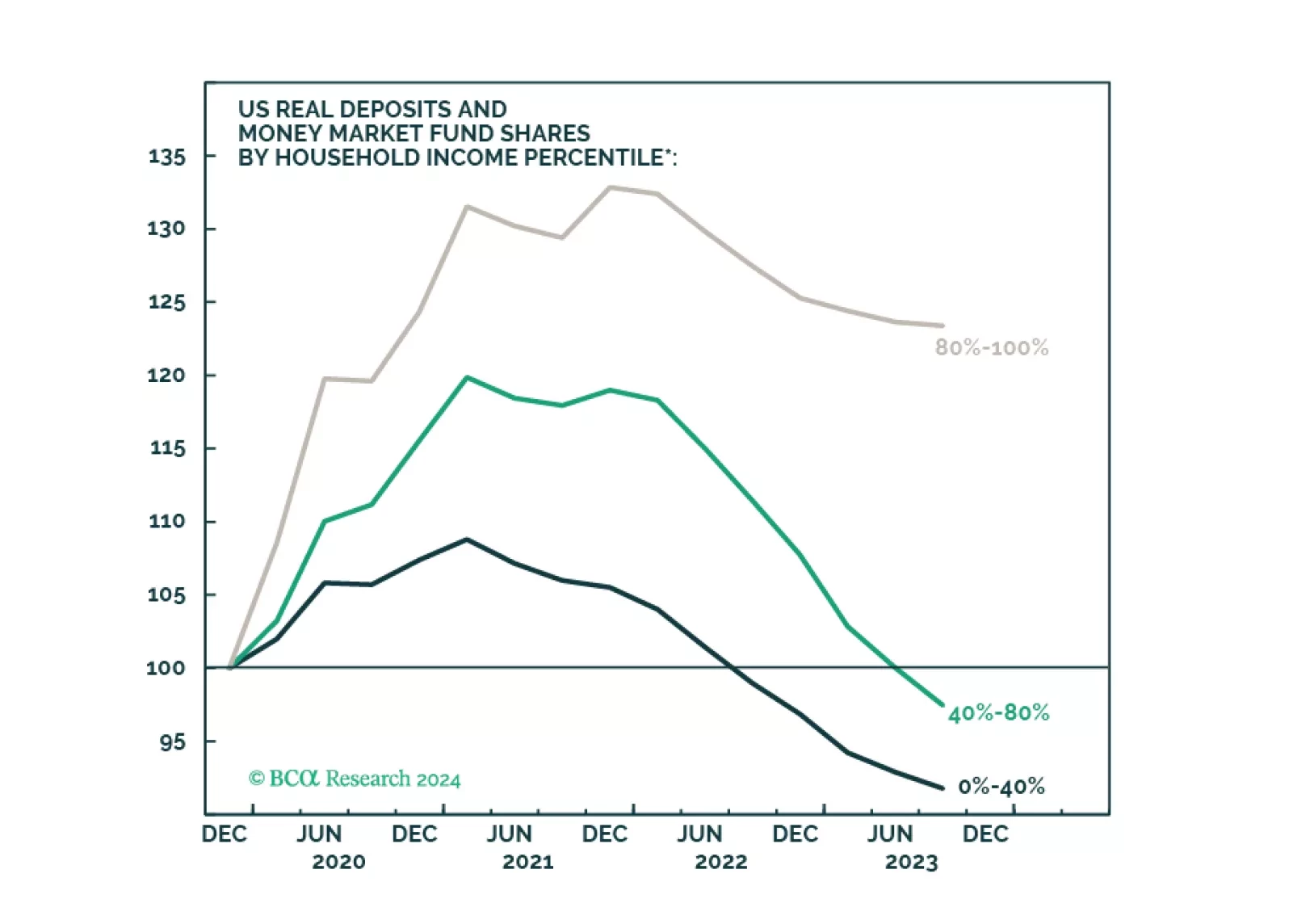

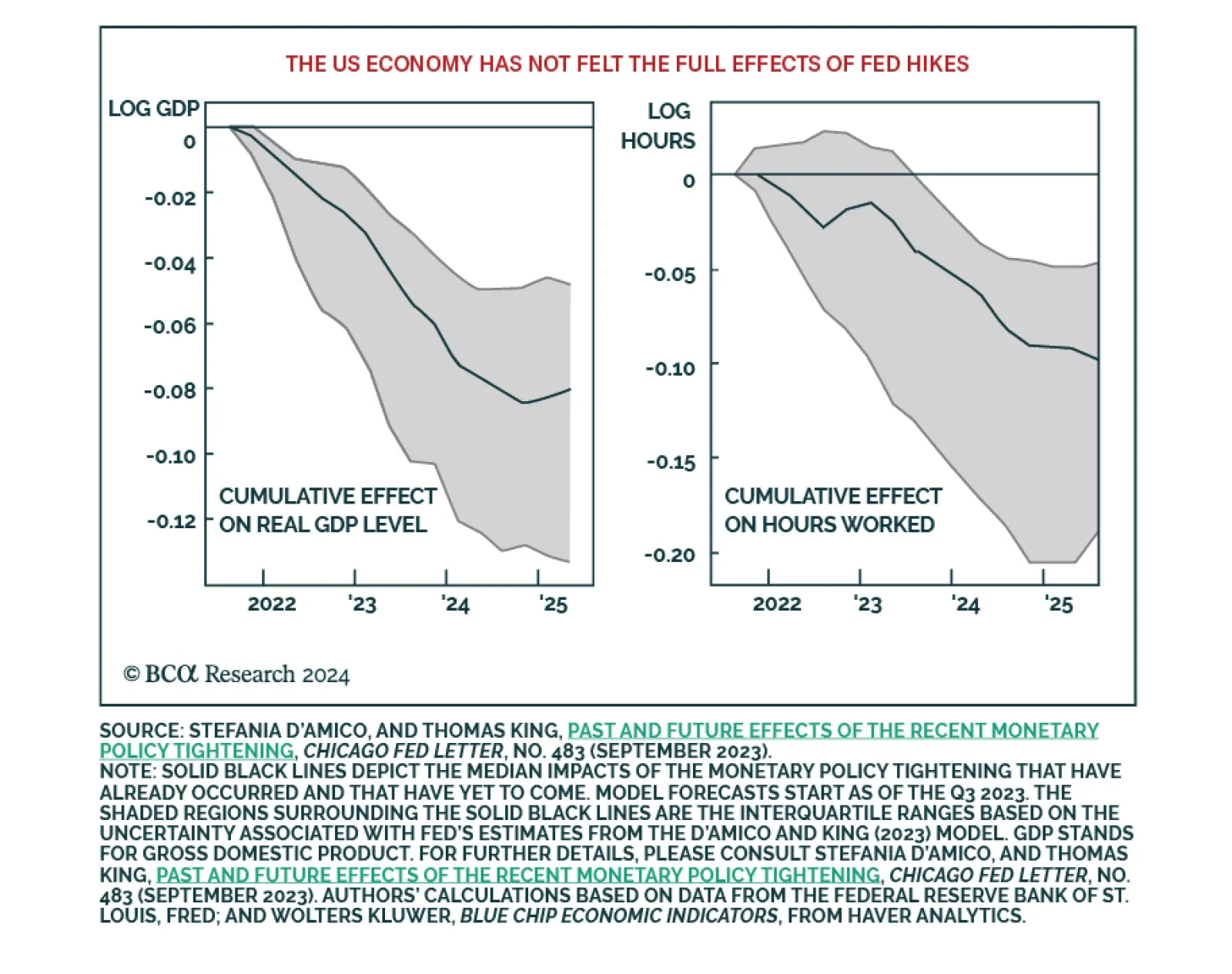

Easier financial conditions, rising home prices, rebounding consumer sentiment, and a stabilization in manufacturing activity all augur well for near-term US growth prospects. An unsustainably low savings rate is a key risk to the US…

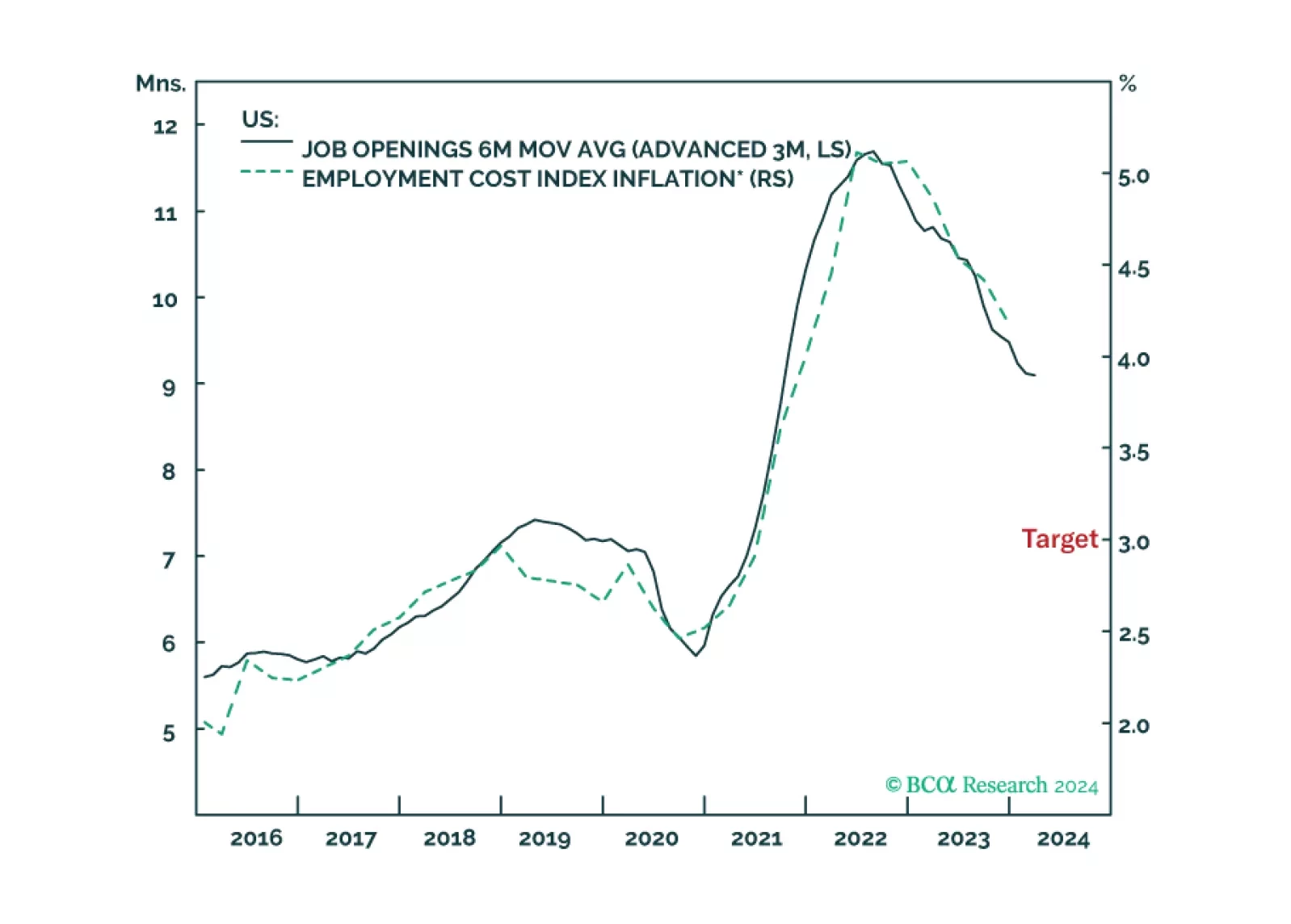

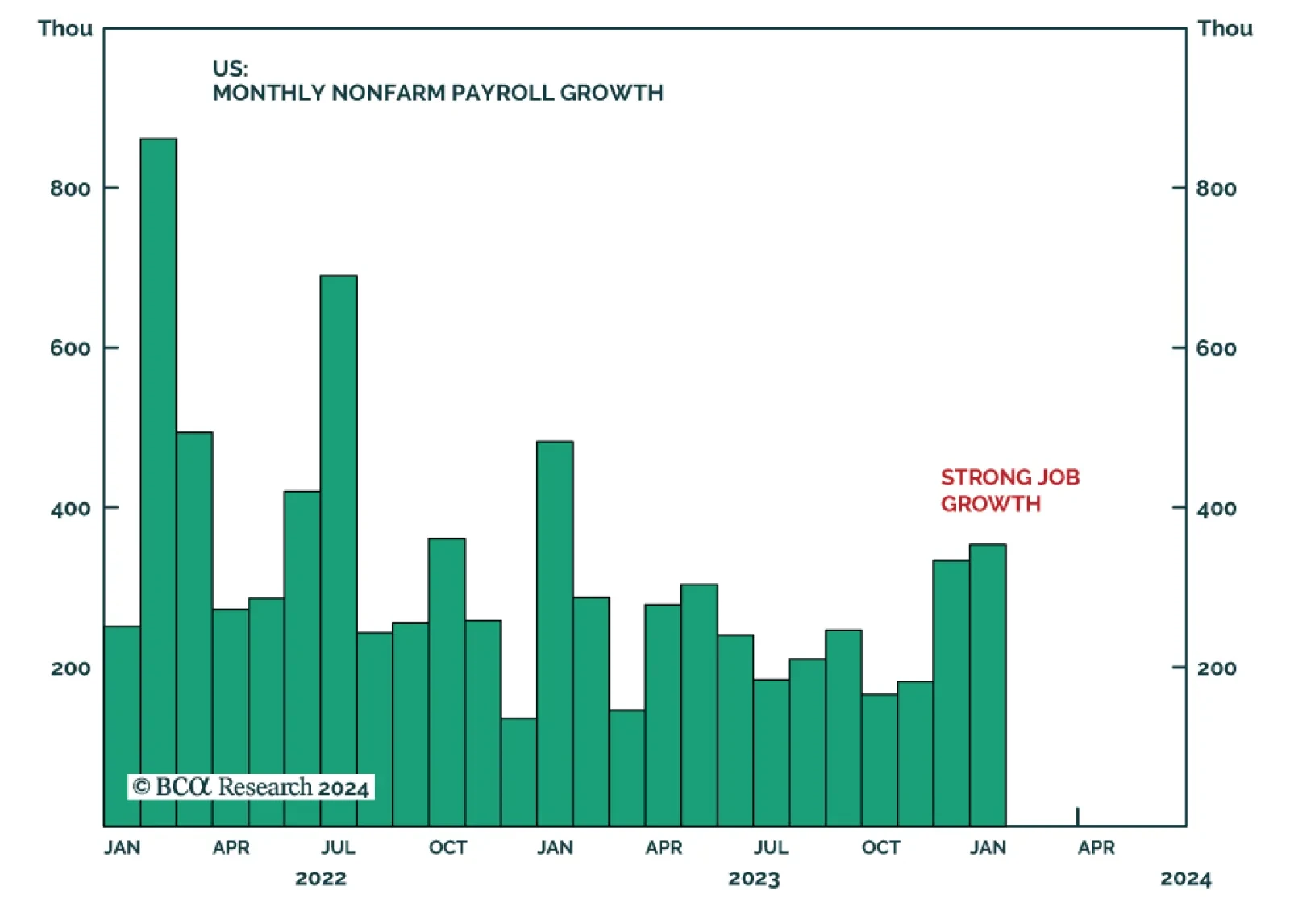

Last Friday’s blockbuster US employment report is among the recent data releases that have focused investors’ attention on the possibility that resilient economic conditions will reduce the magnitude of Fed easing…

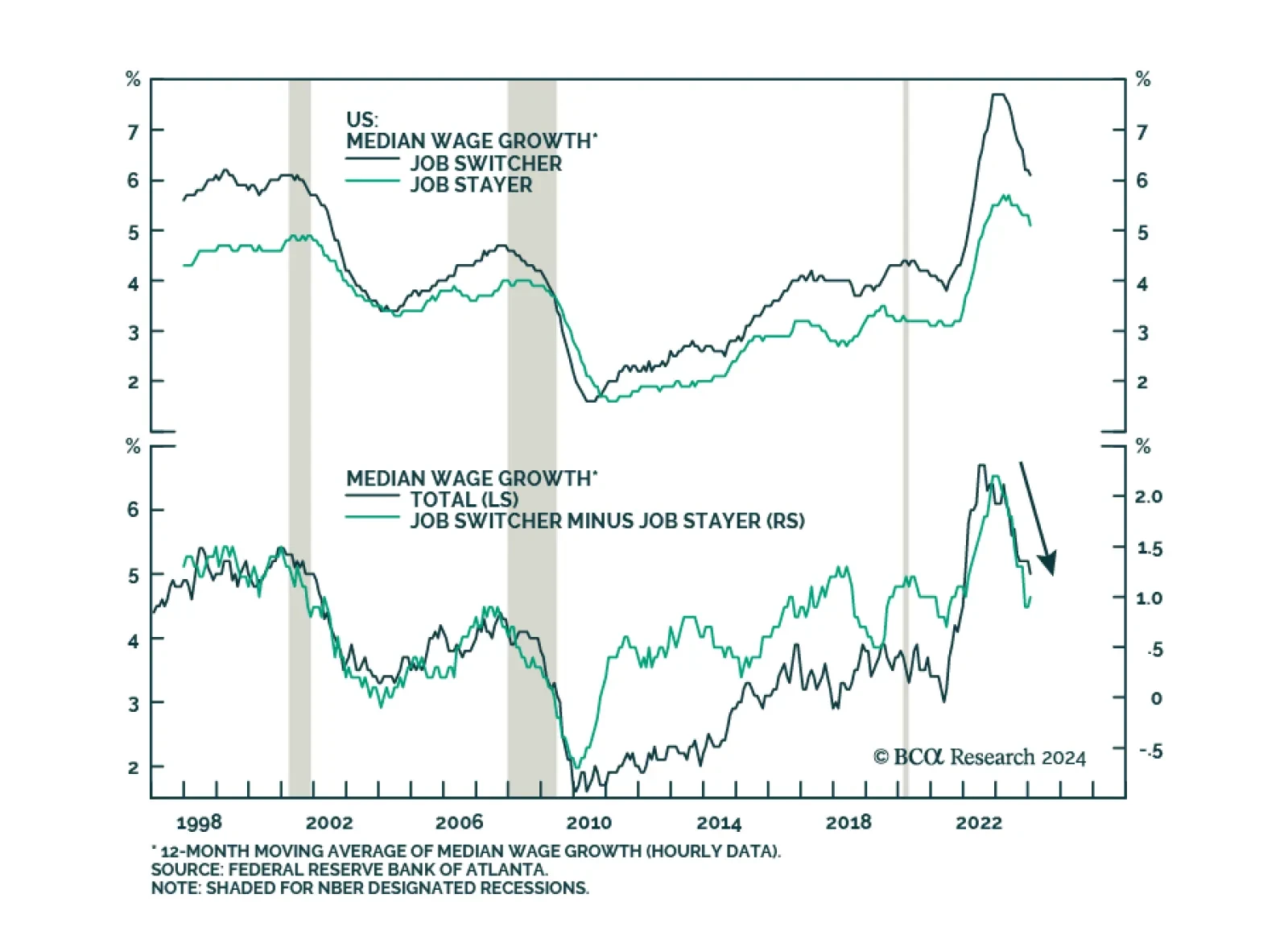

After having surged in the second half of 2021 and early 2022, the Atlanta Fed’s Wage Growth Tracker peaked in mid-2022 and has since been on a general downtrend. The latest reading of 5.0% in January is a continuation of…

The disinflation to date has been benign because it has come almost entirely from improving supply. But the supply-side tailwind has exhausted, so the last mile of the journey to 2 percent inflation will be the hardest, especially in…

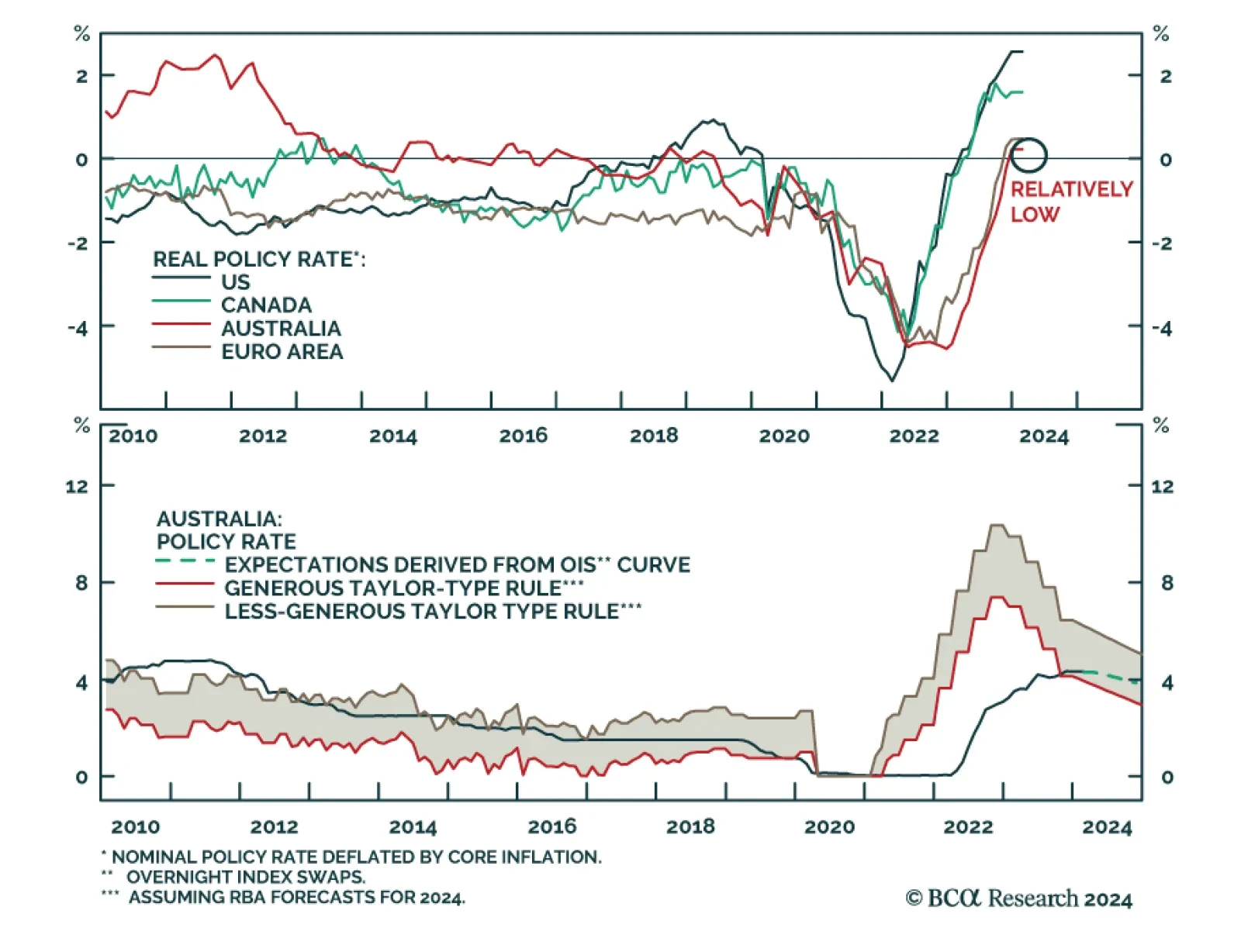

As expected, the Reserve Bank of Australia kept the policy rate unchanged at 4.35% on Tuesday. The updated economic forecasts show a downward revision to the growth outlook for this year versus the previous round of…

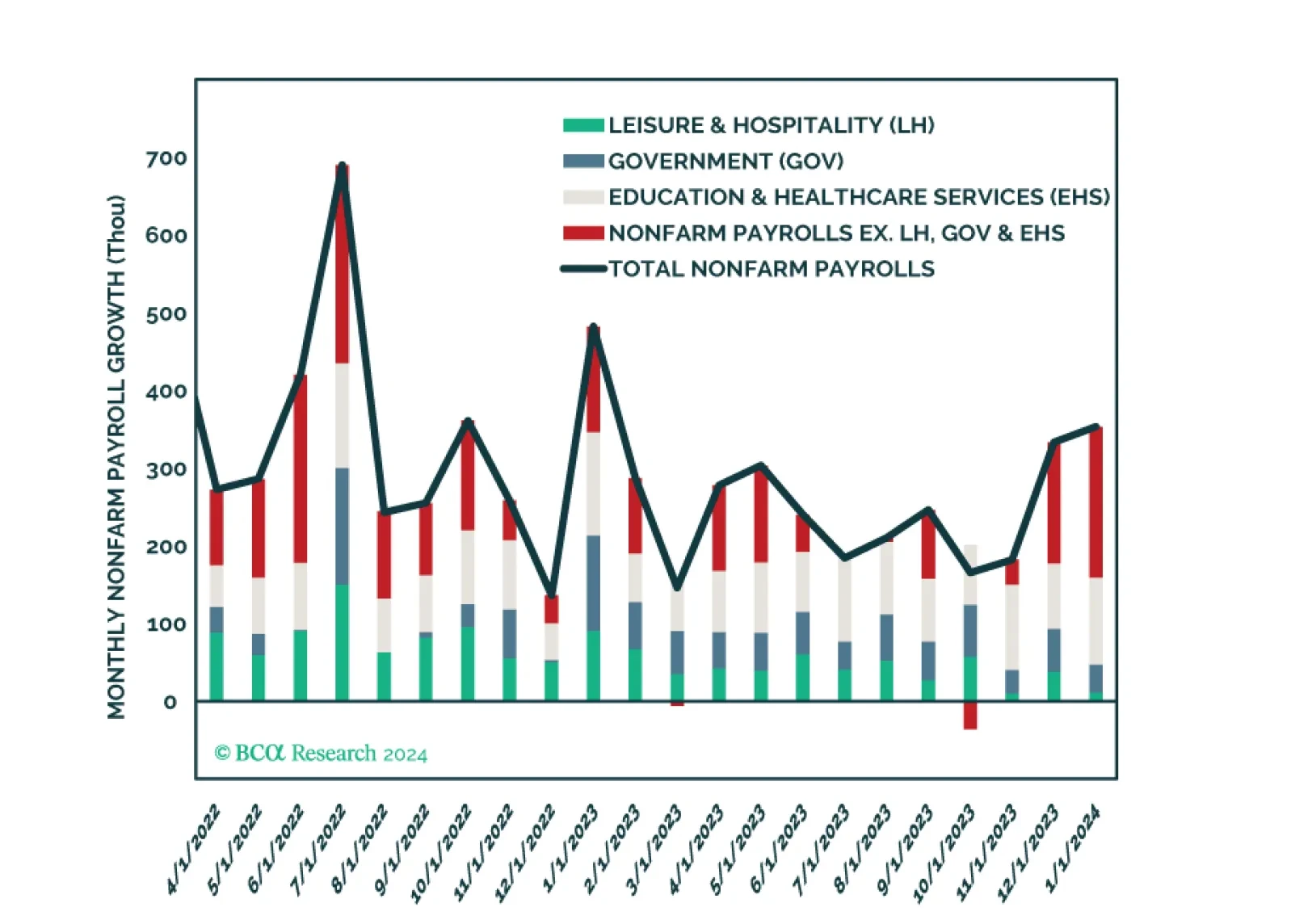

The US Employment report came in well above consensus expectations on Friday, delivering a strong positive signal on labor market conditions in January. The 353 thousand increase in nonfarm payroll employment beat expectations of…

Our thoughts on bond positioning following this morning’s employment data.

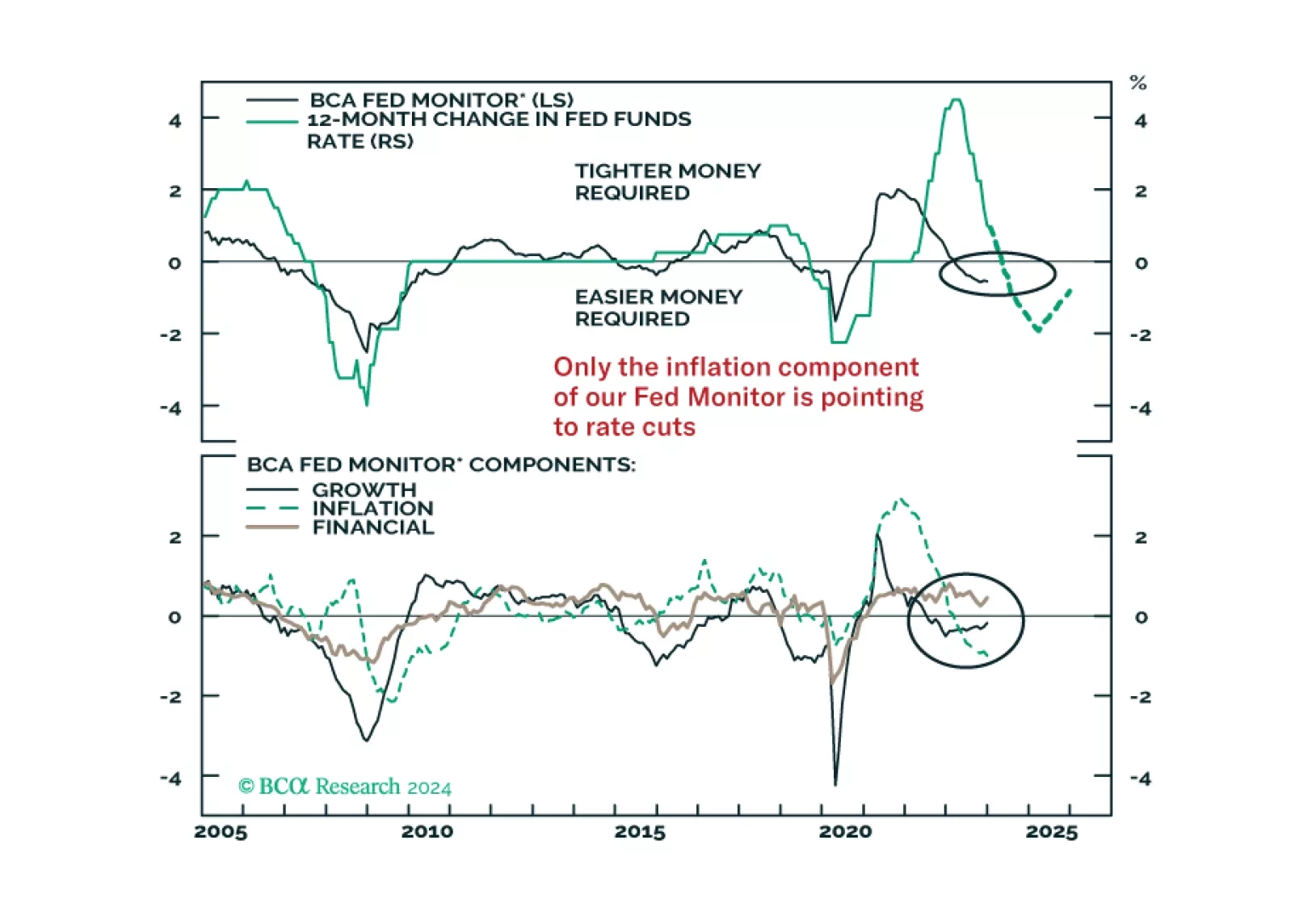

In this Insight, we share our thoughts on yesterday’s FOMC meeting and the Fed’s likely next moves, with implications for US bond strategy.