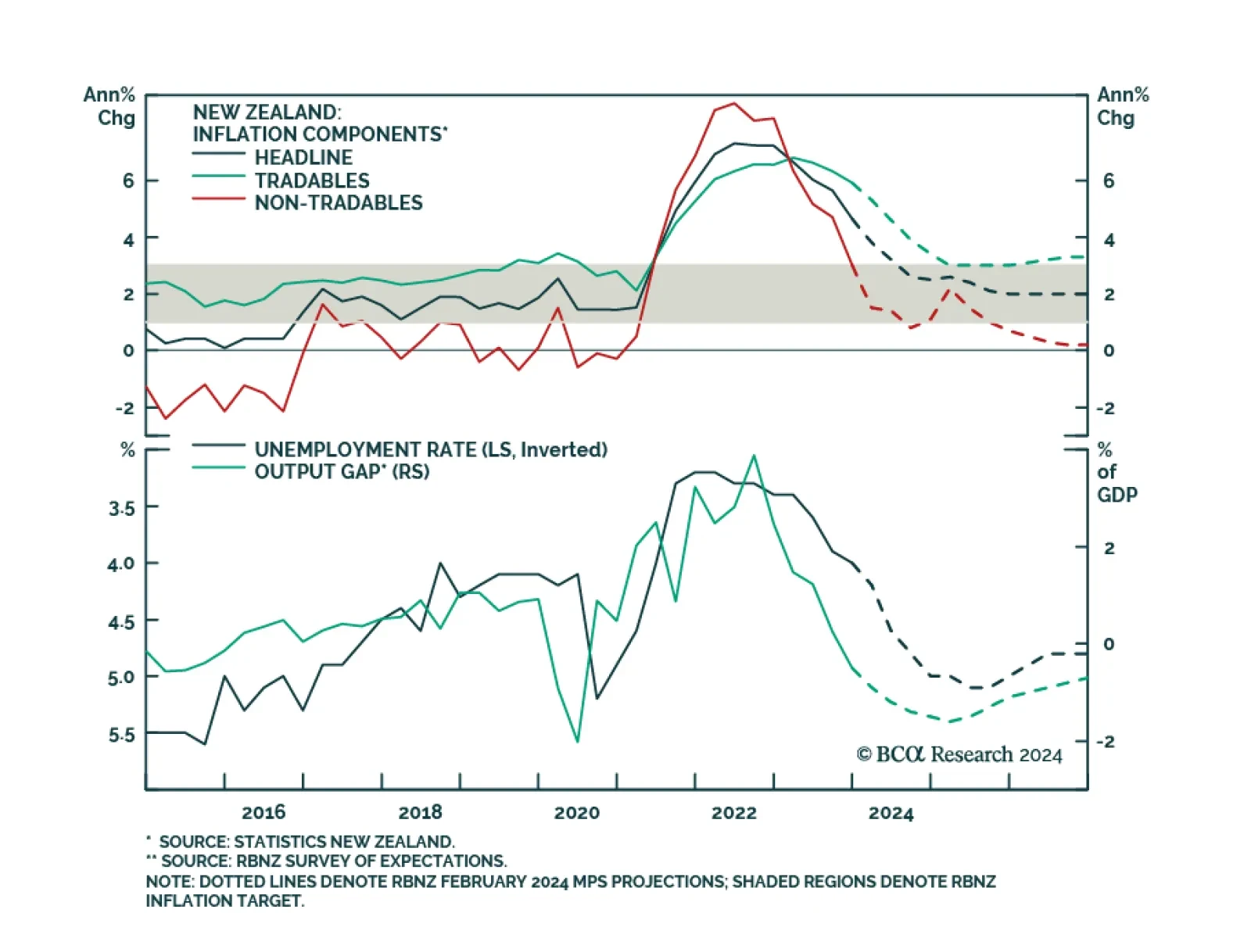

New Zealand government bonds rallied, and the NZD was the worst performing major currency on Wednesday following the Reserve Bank of New Zealand’s (RBNZ) policy announcement. Although the central bank’s decision to…

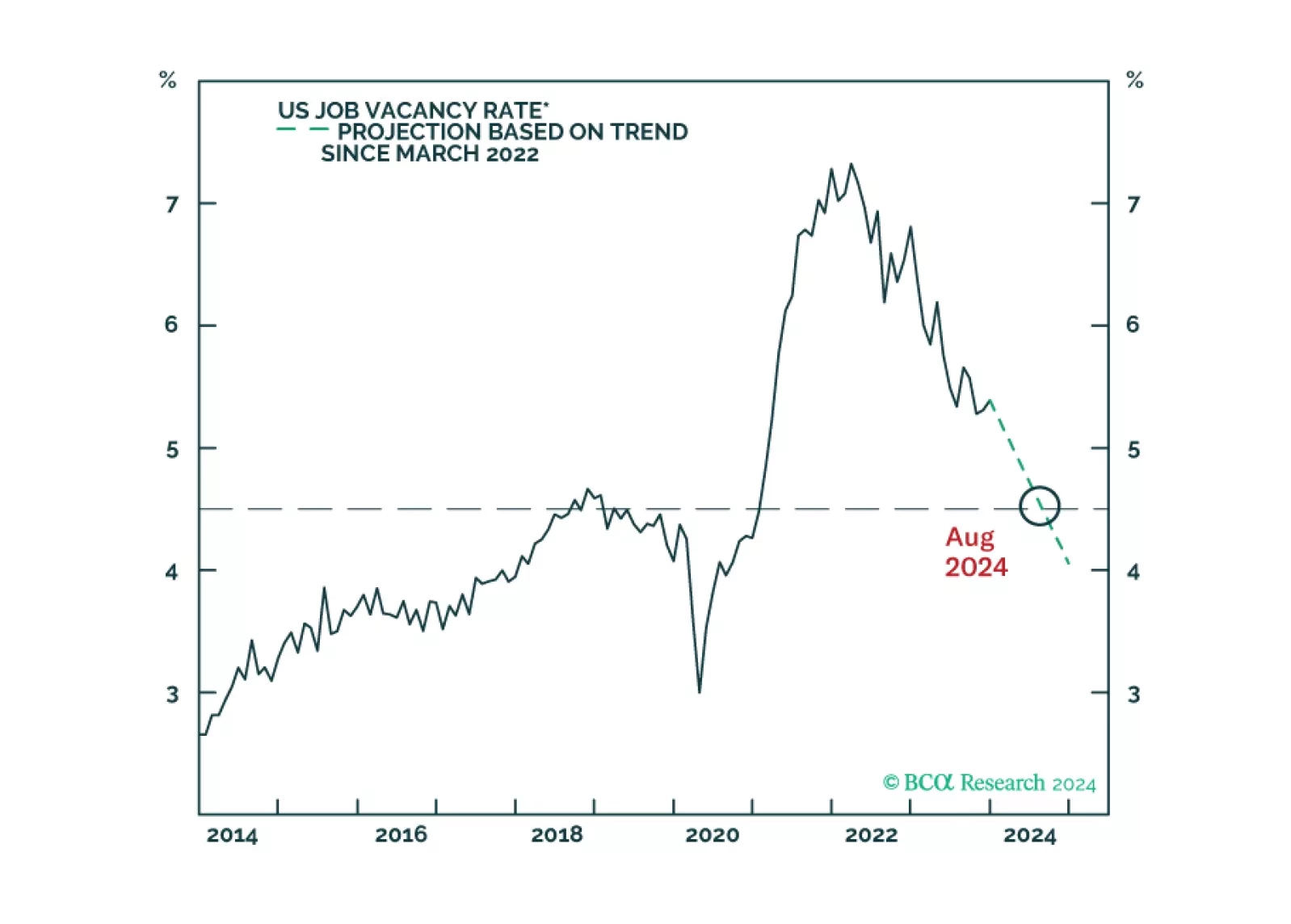

The US ‘immaculate disinflation’ has run its course, given that labour force participation is topping out. This leaves the Fed with a dilemma. Settle for price inflation stabilising at 3 percent, and cut rates early to avoid higher…

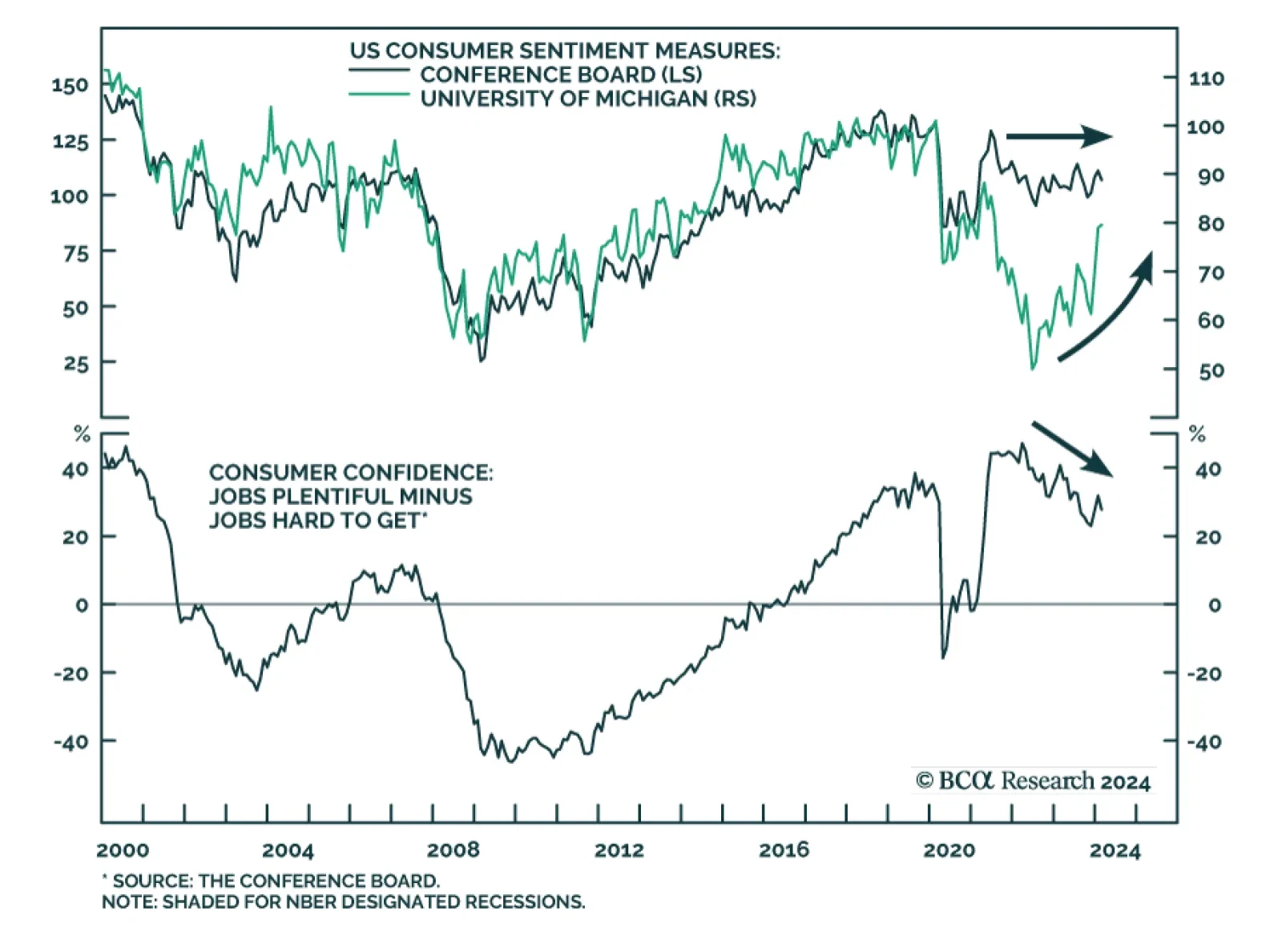

The US Conference Board’s February Consumer Confidence release surprised to the downside. The index decreased to 106.7 from a downwardly revised 110.9, disappointing expectations it would improve to 115.0. Consumers’…

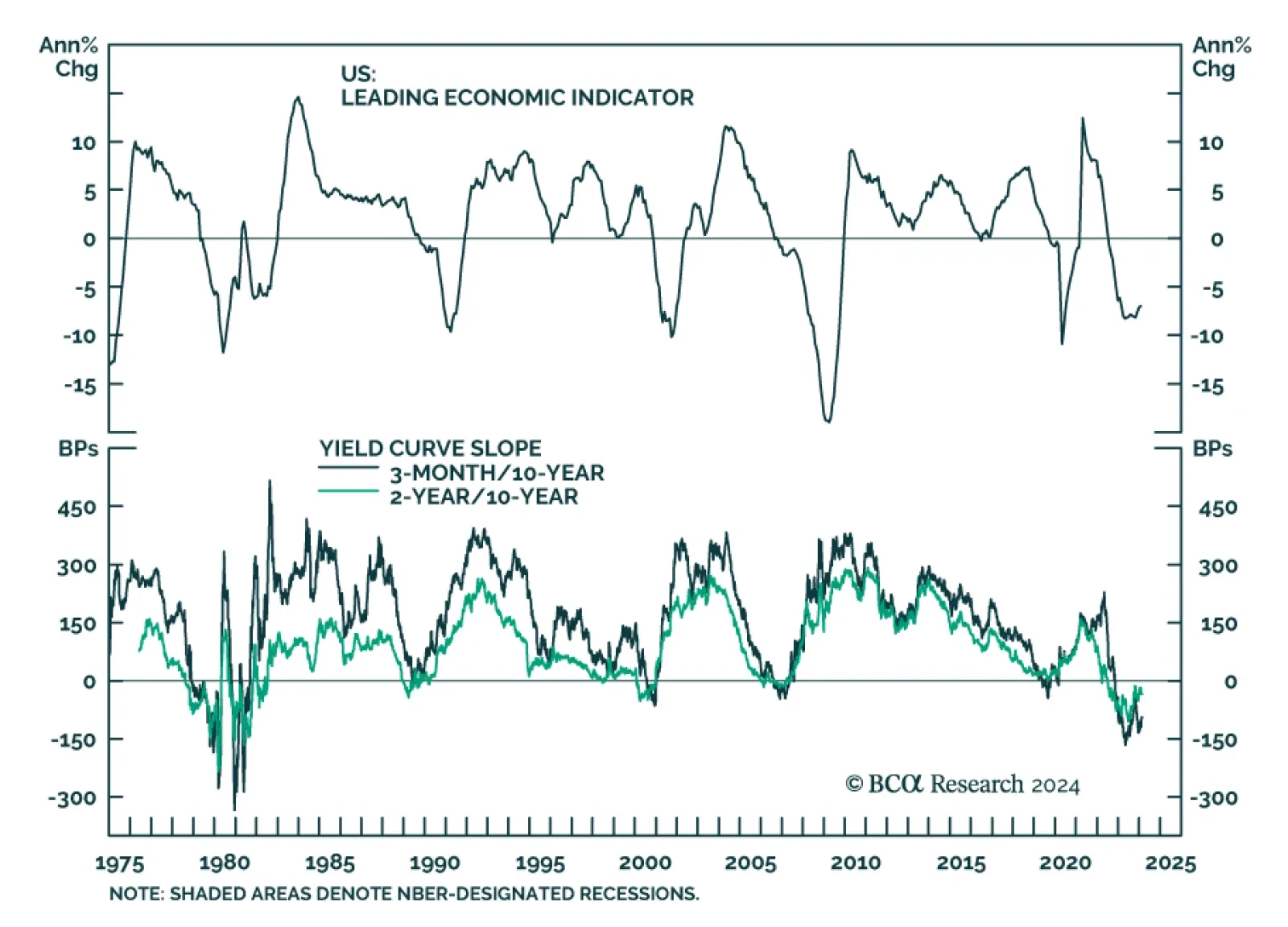

The first in a series of Strategy Insights where we present a checklist for extending duration in each major government bond market. This first entry focuses on the US.

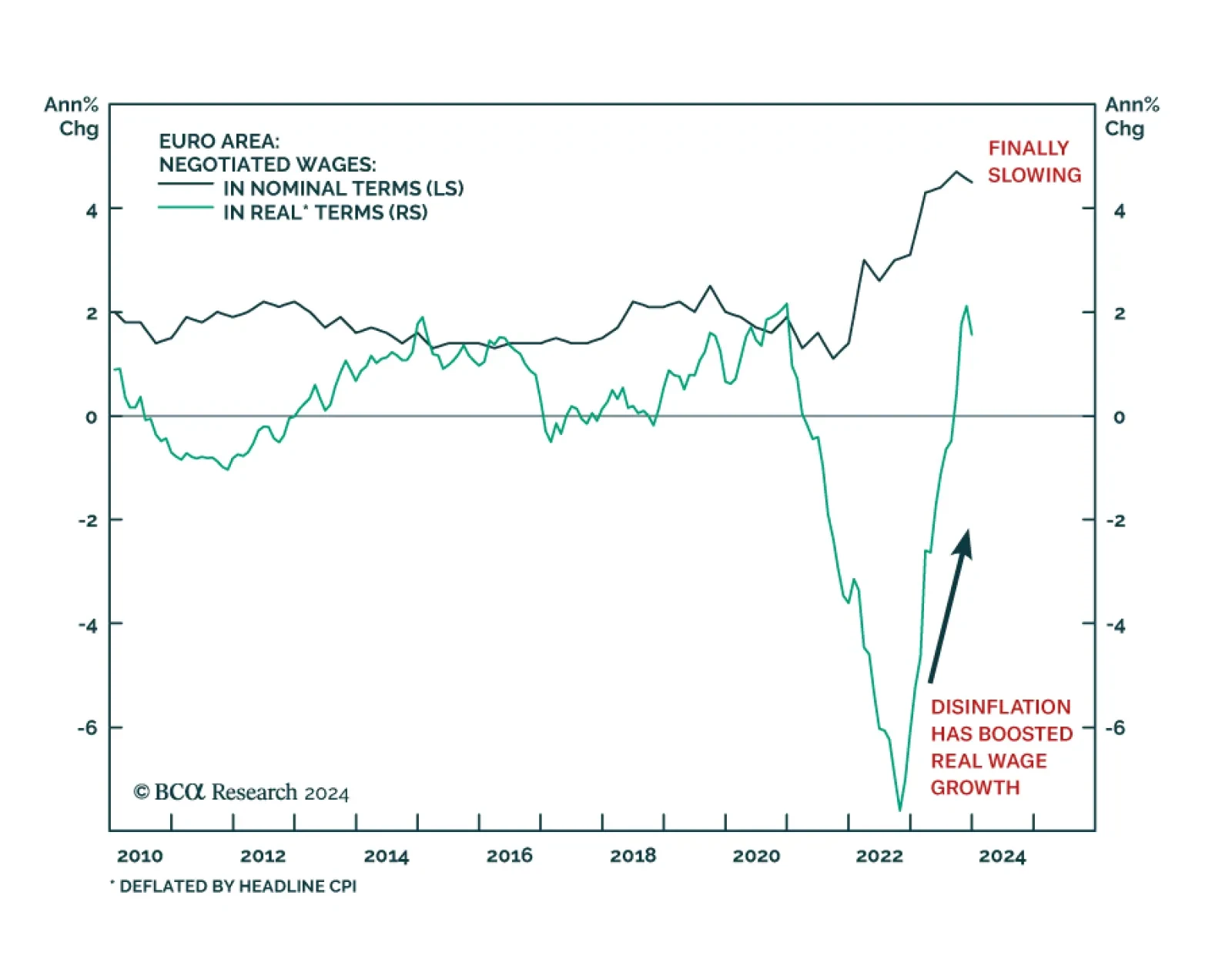

The messaging from the minutes of the ECB’s January meeting was similar to the Fed. Although Governing Council members noted that “for the first time in many meetings, the risks to reaching the inflation target were…

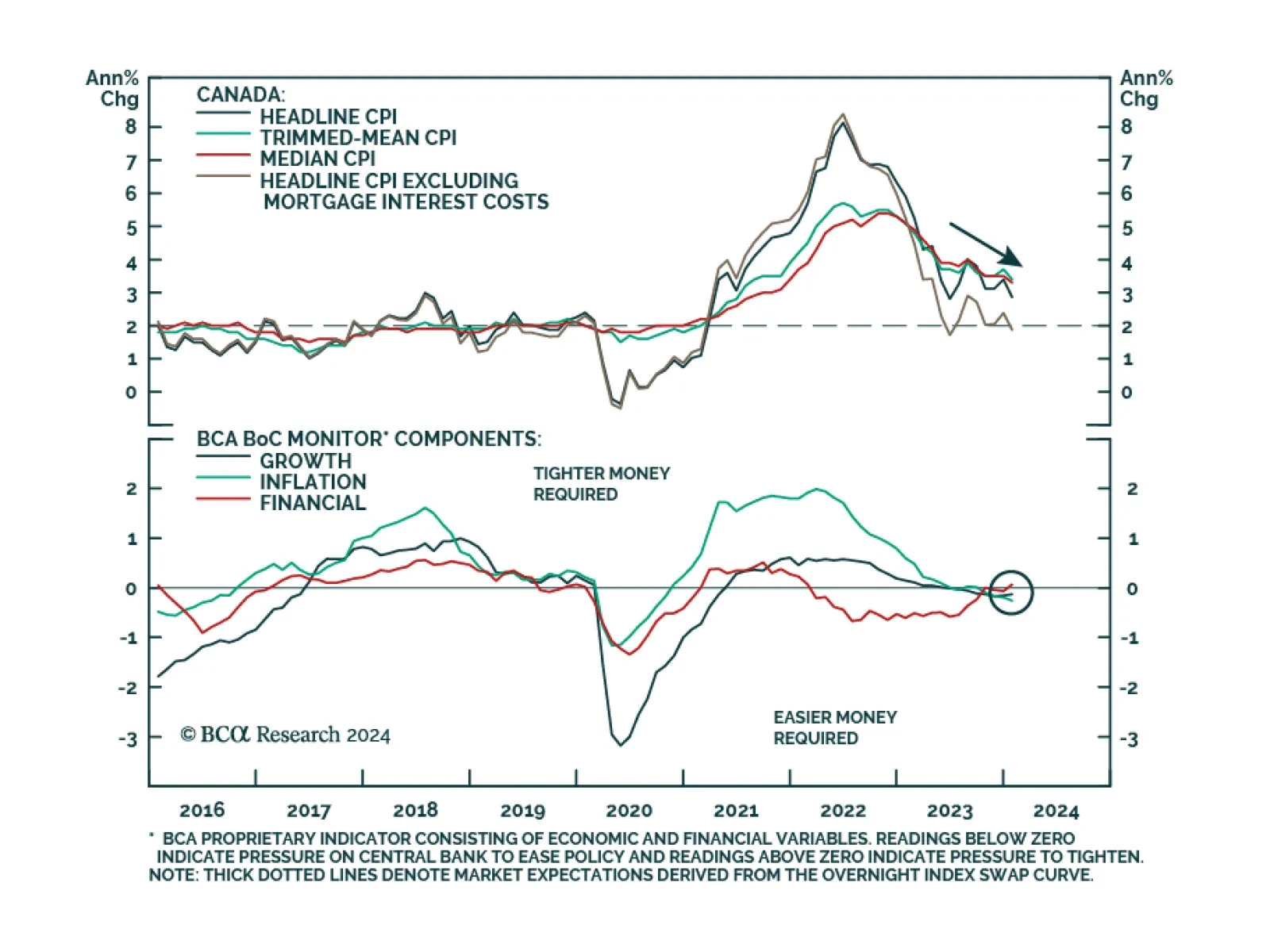

Canada’s January CPI release shows price pressures cooling last month. Headline CPI eased to 2.9%y/y from 3.4%y/y in December, below expectations of 3.3%y/y. Furthermore, month-over-month inflation fell for the first time…

The US Conference Board’s Leading Economic Index (LEI) fell by 0.4% m/m in January, following a 0.1% m/m drop in December – disappointing expectations of a milder decline. This marks the 23rd consecutive monthly…

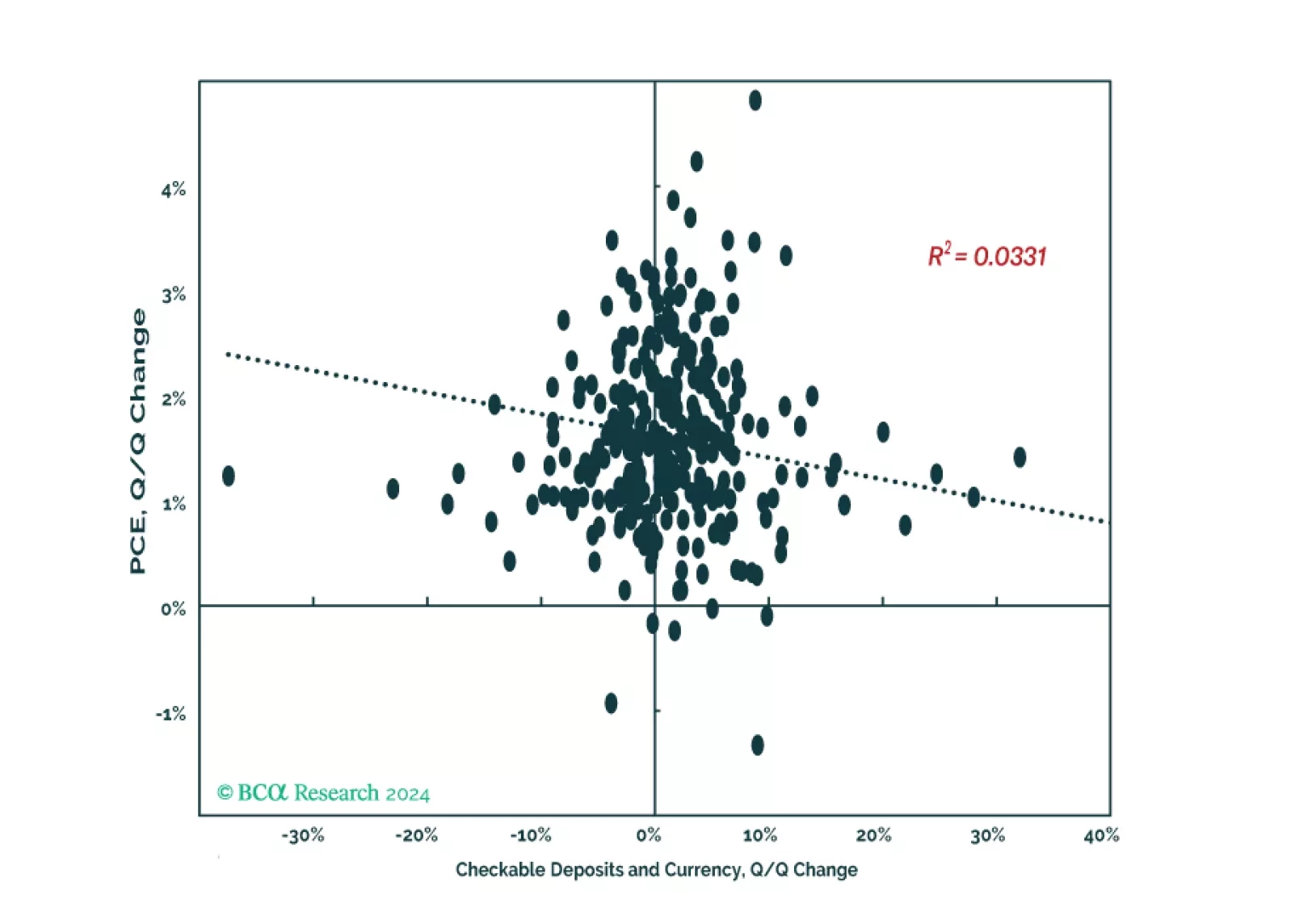

Households have ramped up their cash holdings since the end of 2019, but the absence of an empirical link between cash and consumption leads us to believe that we’ve modestly overestimated the risk of consumer-driven overheating.

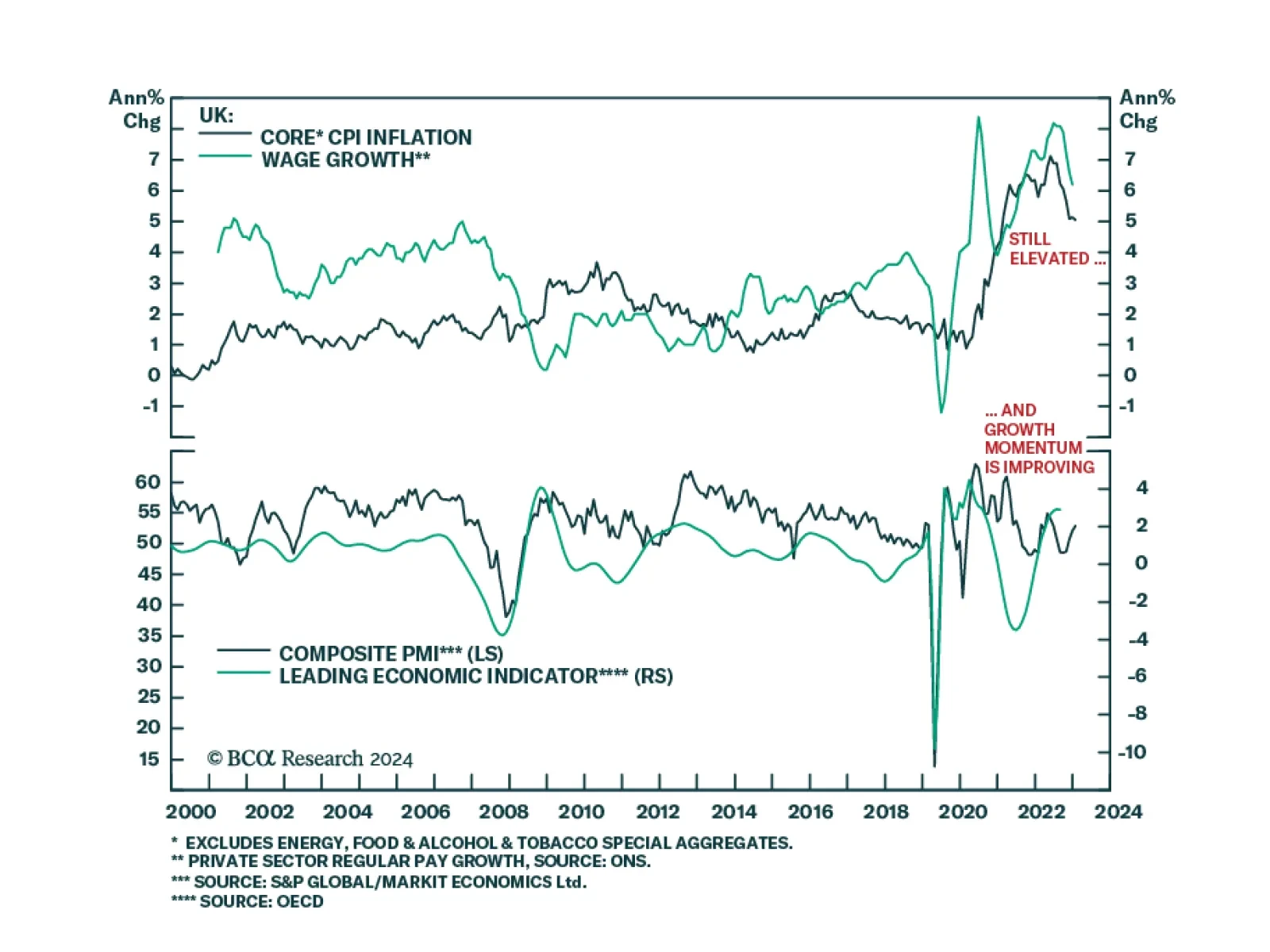

The UK inflation release for January came in slightly softer than anticipated. Both headline and core CPI were unchanged on year-over-year basis at 4.0% and 5.1%, respectively – below expectations of slight accelerations.…