We update the indicators in our duration checklist following this morning’s employment report.

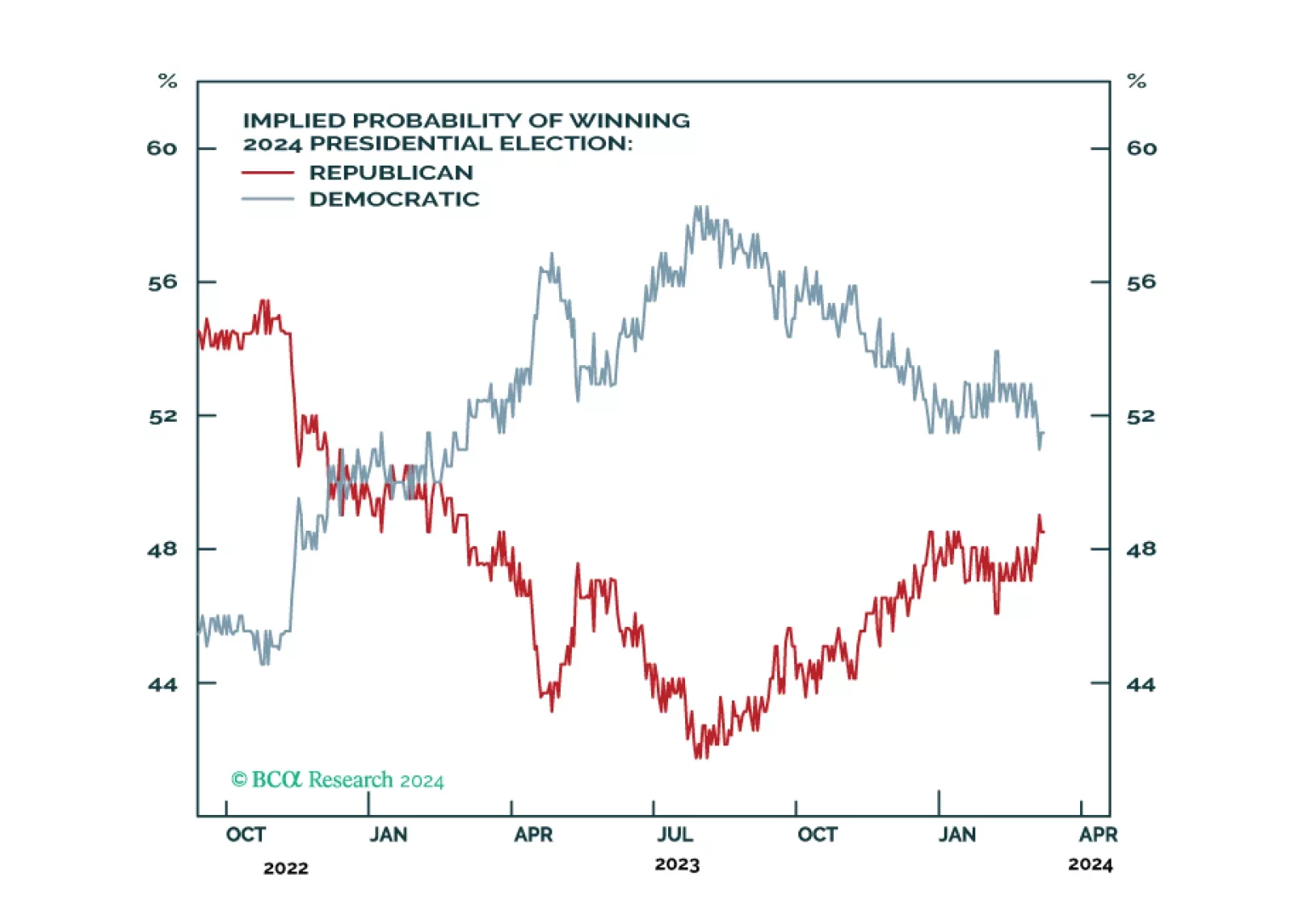

Democrats are still slightly favored for reelection as the incumbent party is presiding over a growing economy. However, Biden’s strong showing in the primary election is not lifting his popular approval yet, and that is a worrying…

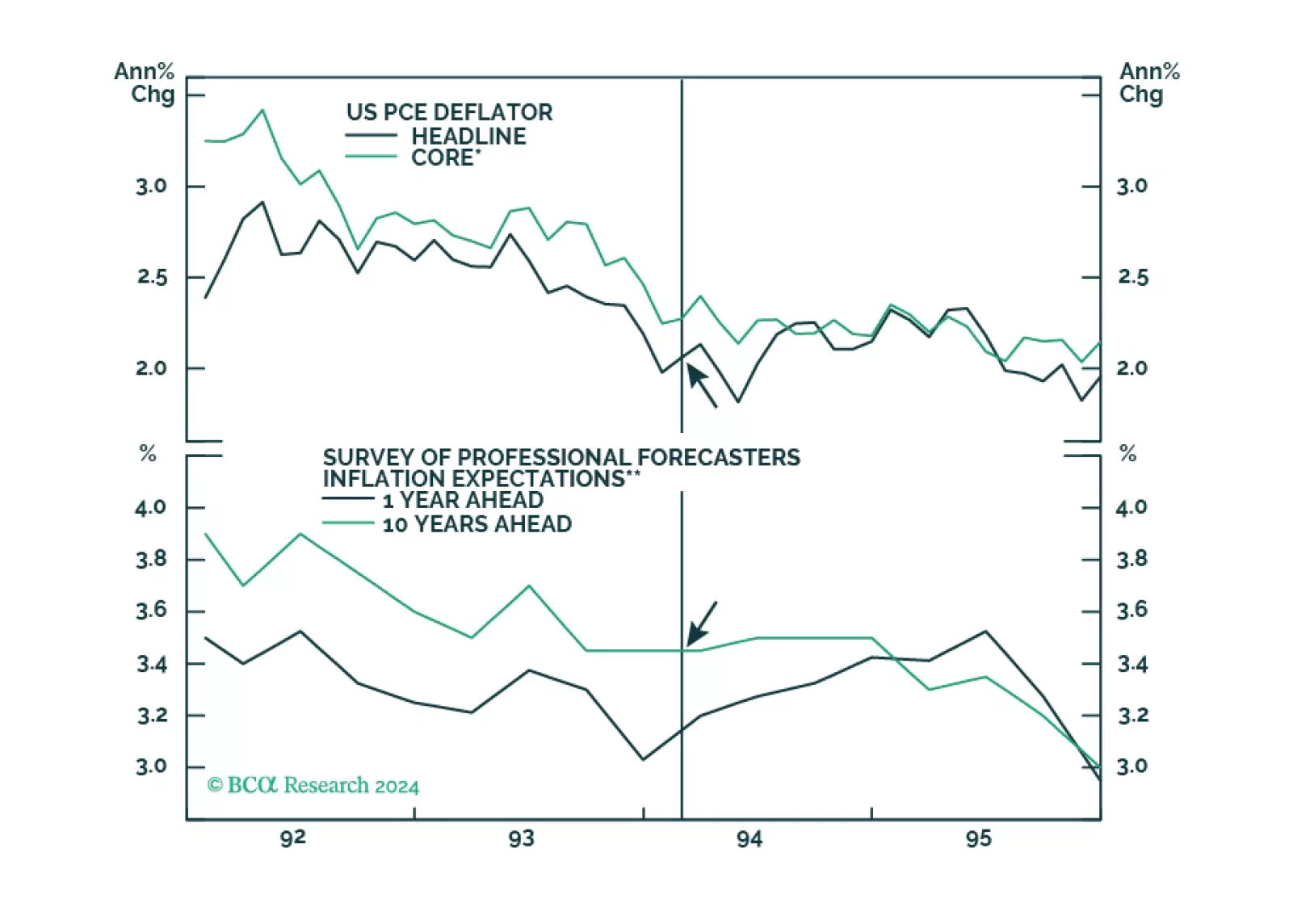

Many investors have cited the 1994 tightening cycle as an example of how the Fed managed to raise rates without triggering a recession. However, the unemployment rate was 6.5% in early 1994, which meant that inflation was less of a…

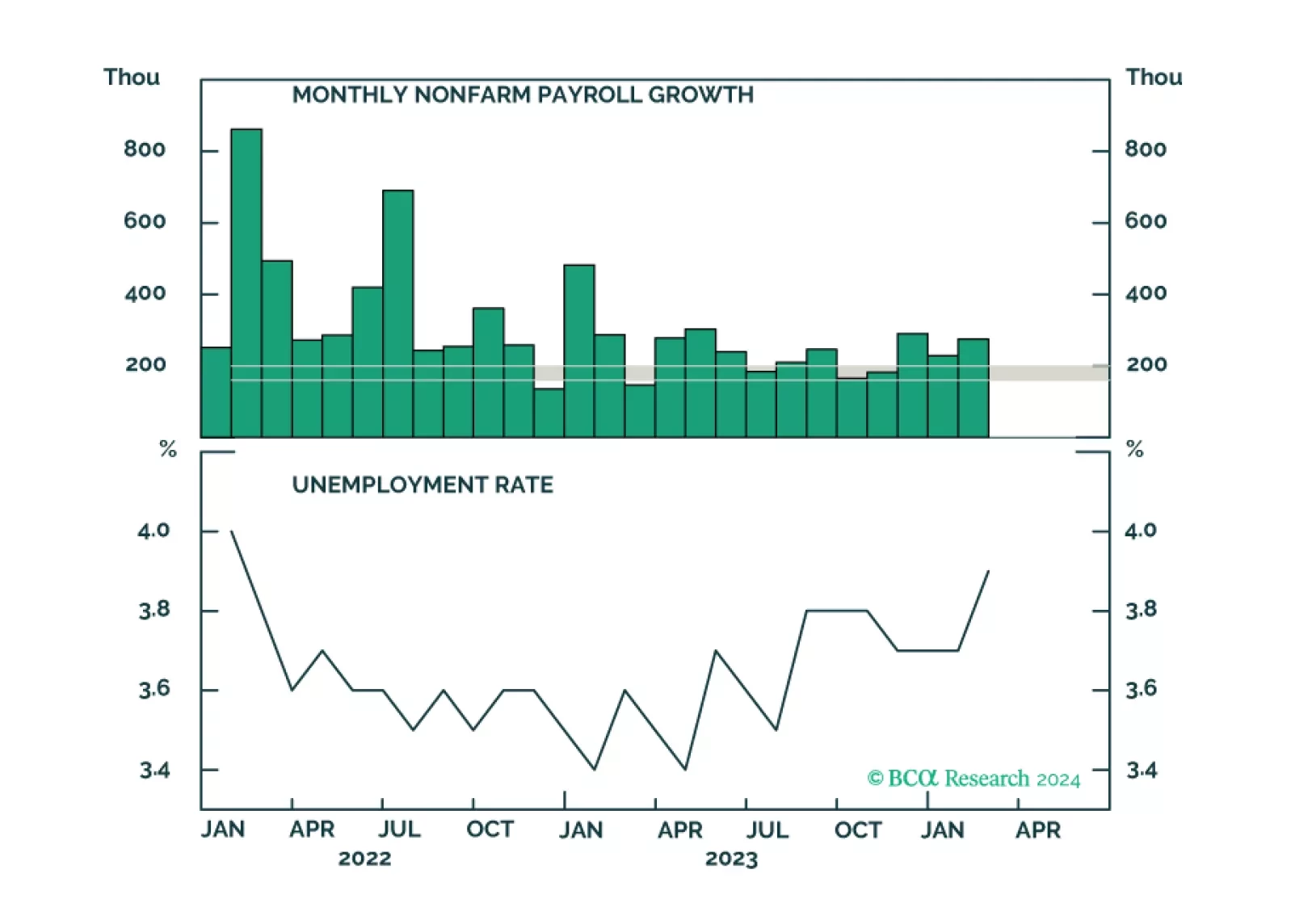

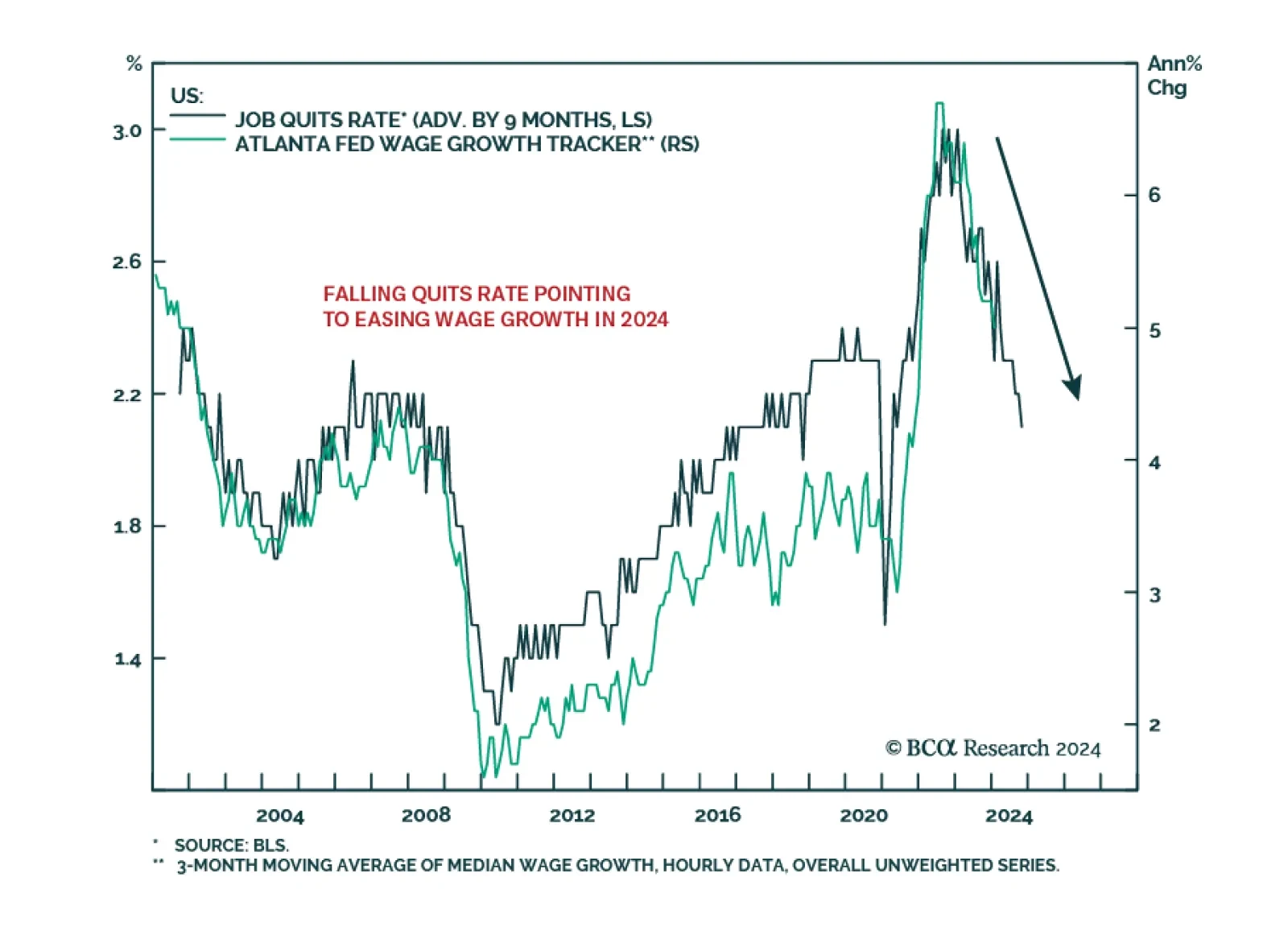

The US January JOLTS data released yesterday was in line with expectations, with job openings clocking in at 8.86 million versus a downwardly-revised 8.89 million in December. Importantly, US job openings are likely to continue…

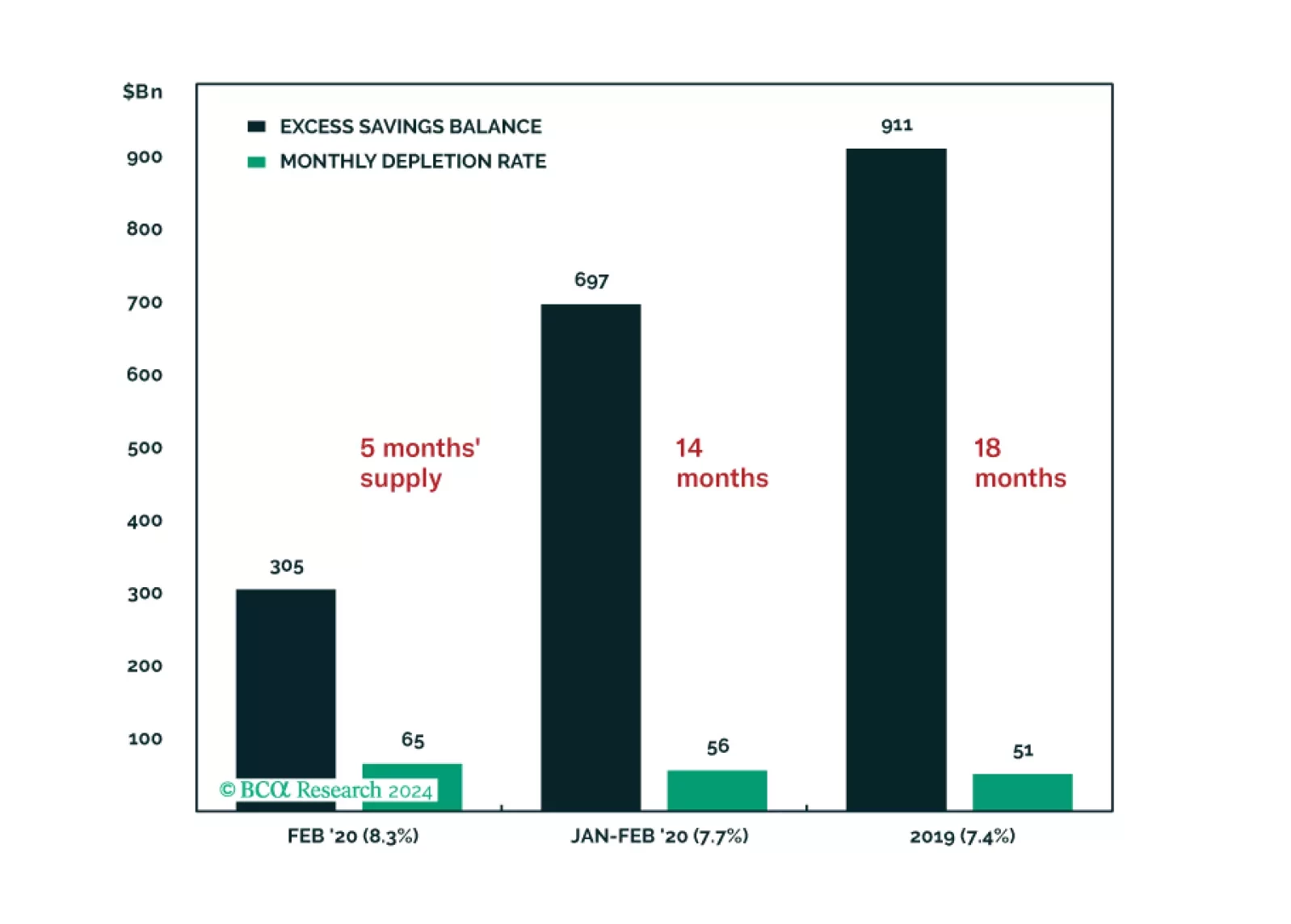

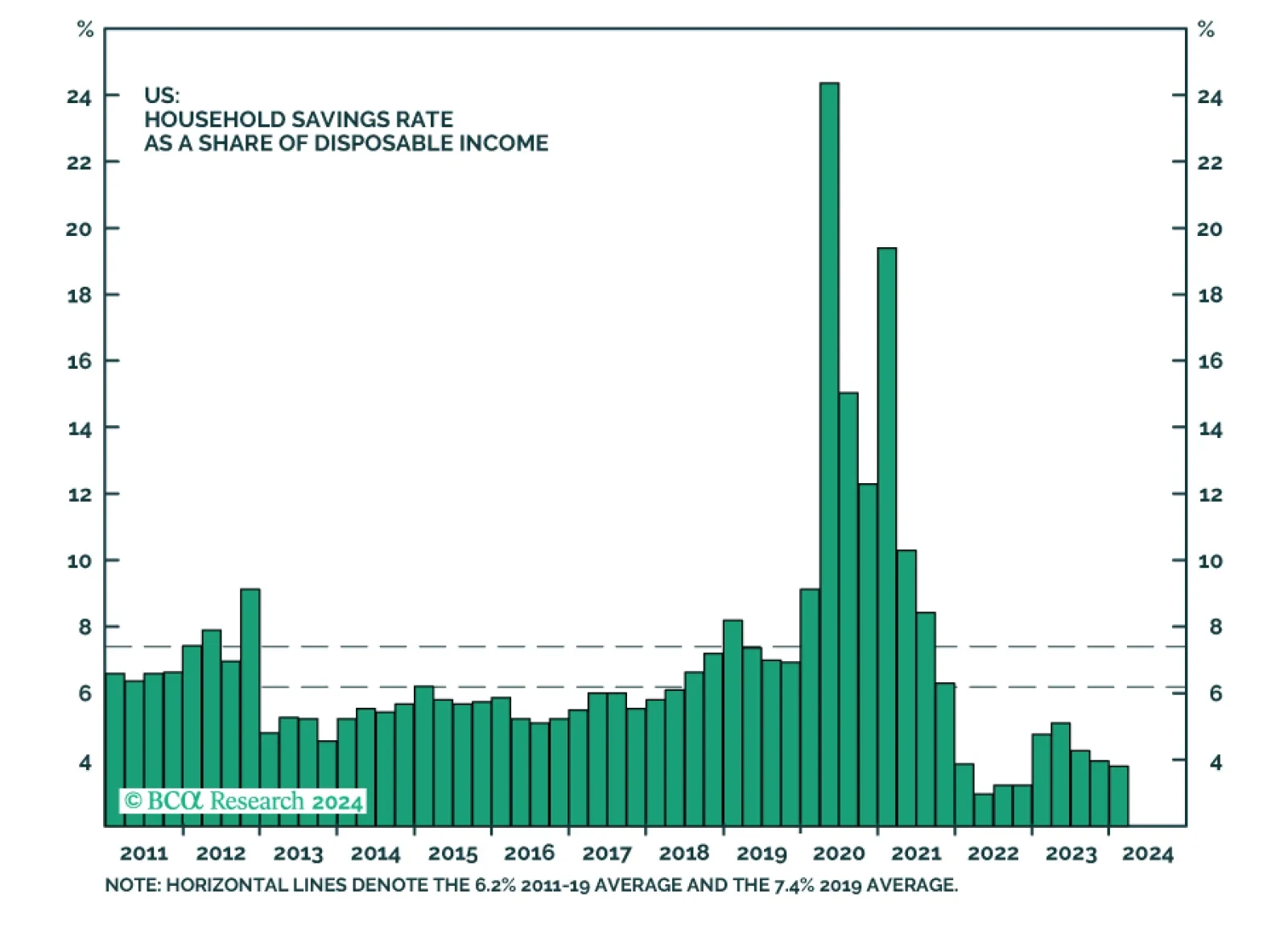

Our US Investment Strategy service examines the state of consumer finances in the context of their view that a recession will materialize this year with a double-digit peak-to-trough decline in S&P 500 earnings expectations…

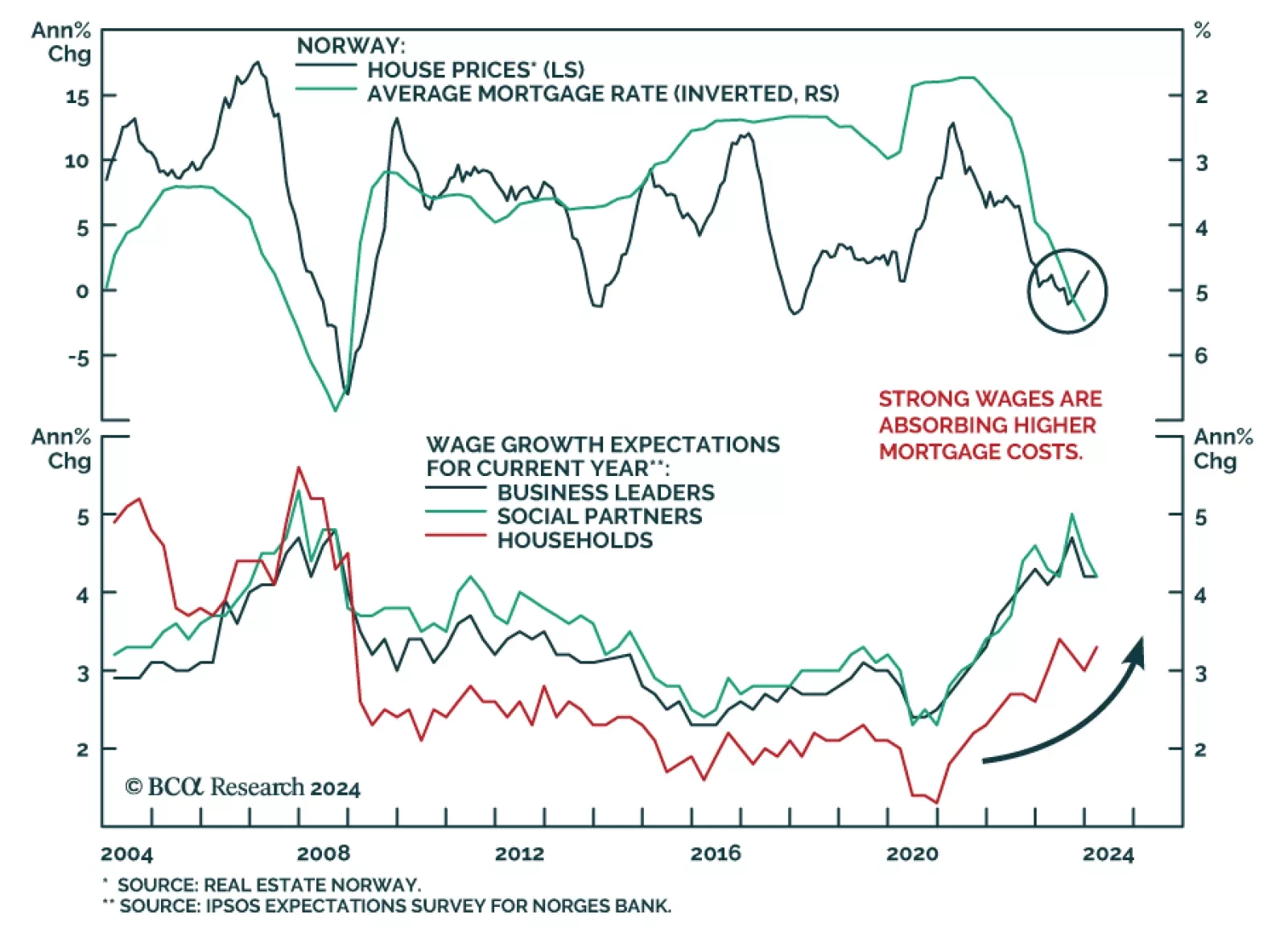

Data out of Norway is becoming increasingly positive, and there is a strong investment case to be made for the country, with bullish implications for both equities and the currency: Retail sales remain robust and are…

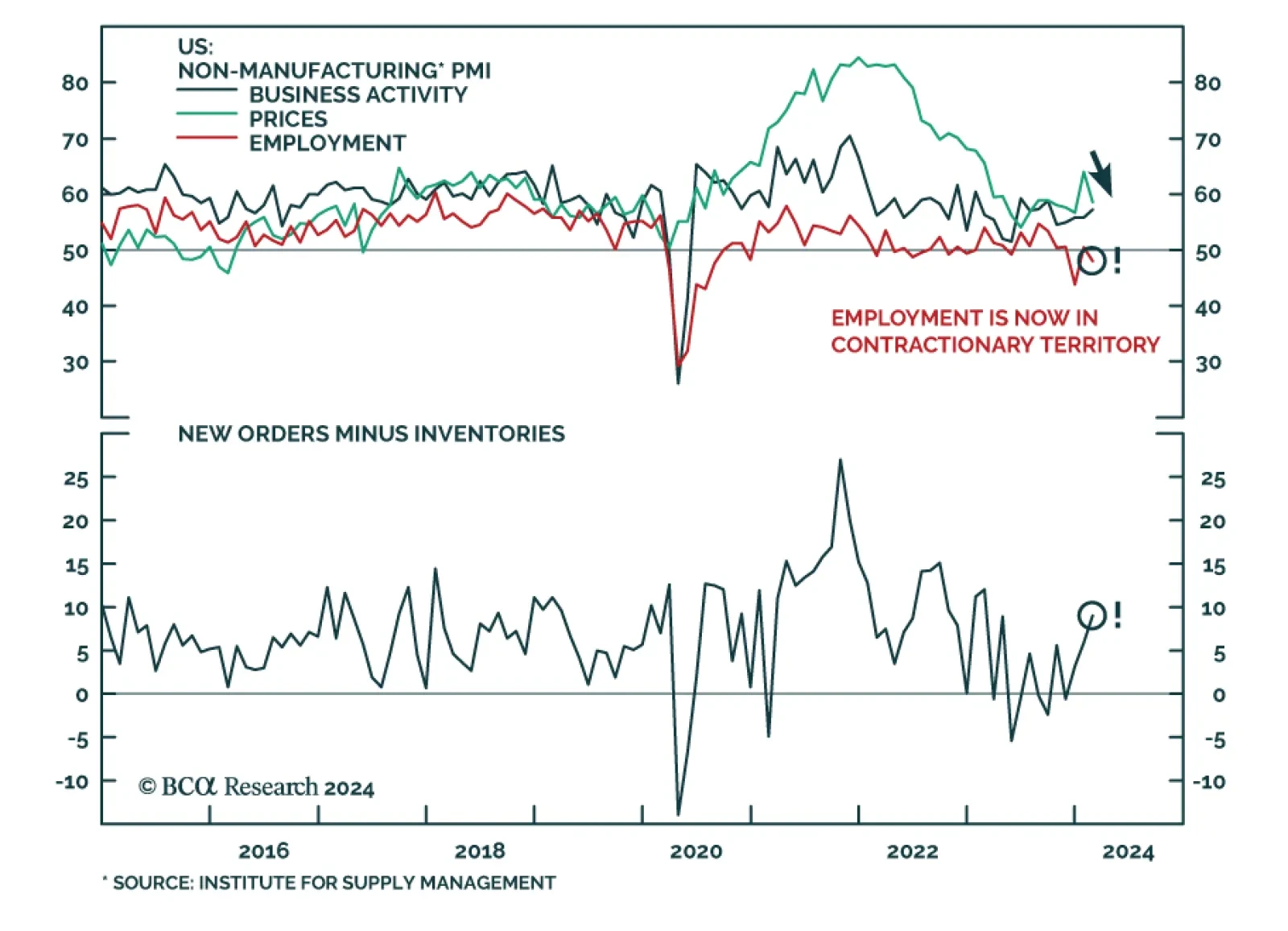

The US ISM Services PMI declined slightly to 52.6 in February, just below expectations of 53. Overall, the service sector continues to expand, however, the recent ISM suggests that growth is slowing down. In fact, most of the…

We feel as good about spurning the soft-landing narrative today as we did about spurning the recession narrative a year ago, but we are not giving into complacency. This week’s report looks at two key ways that we may be getting it…

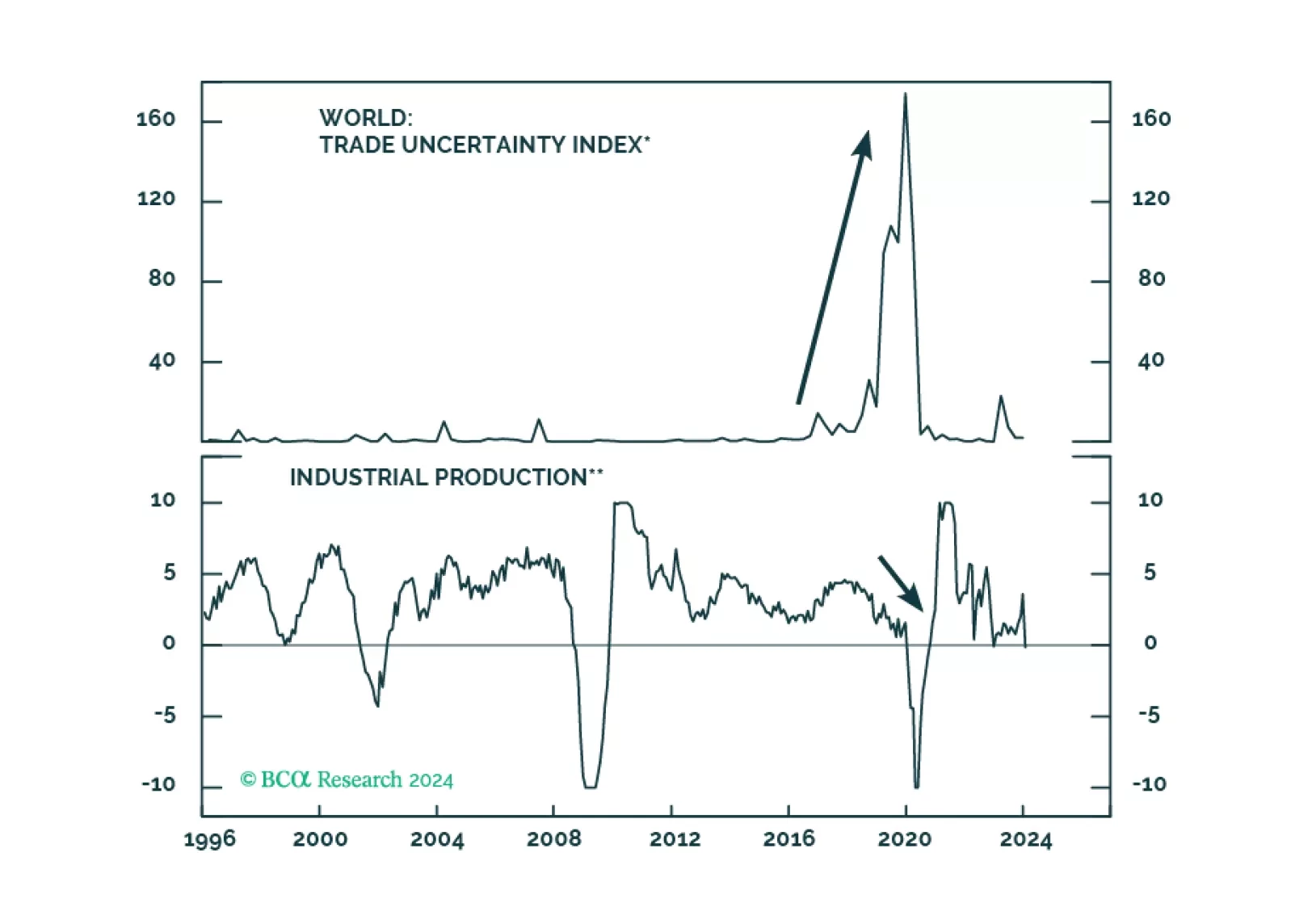

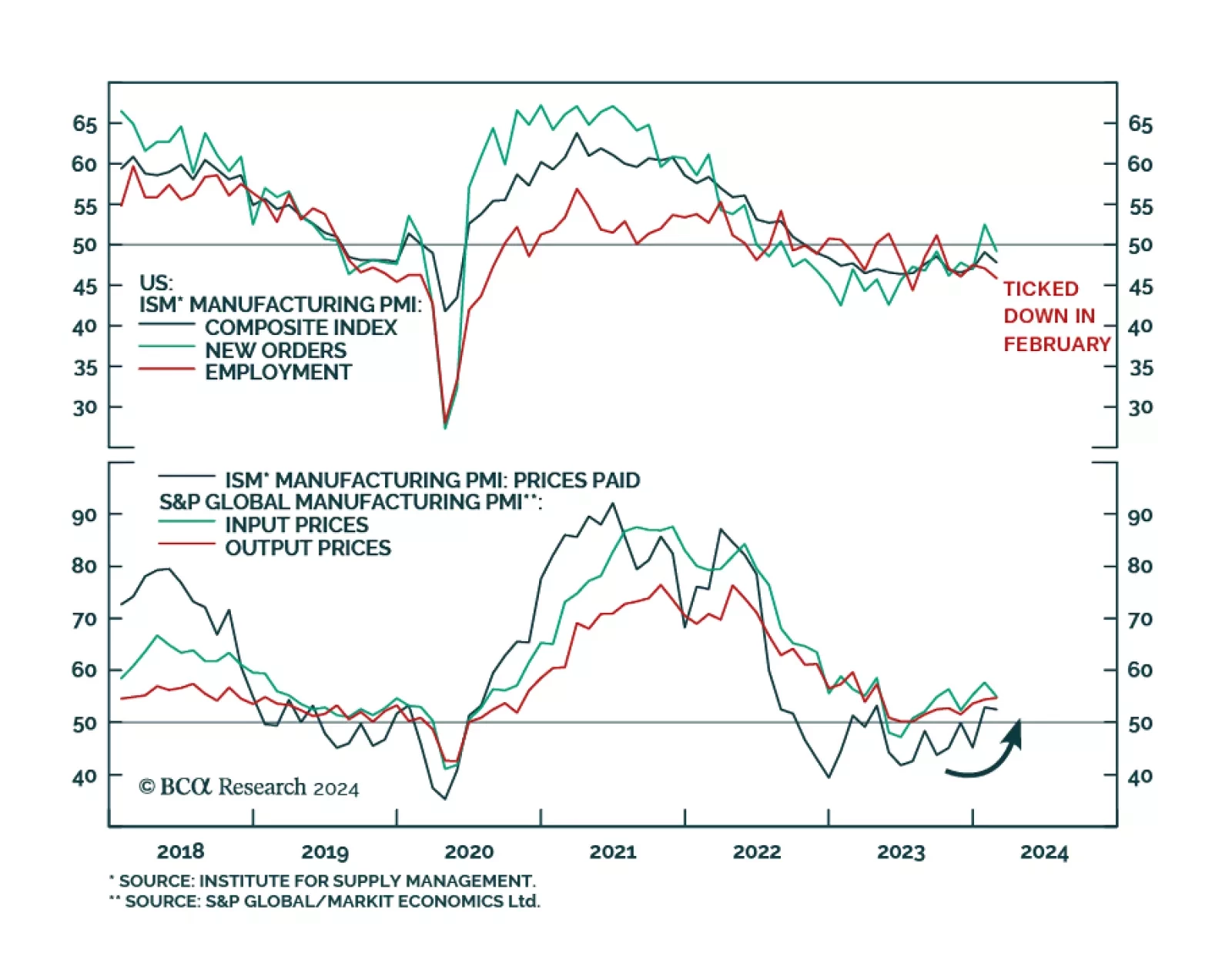

The US ISM manufacturing PMI release for February disappointed consensus expectations. The headline index relapsed to 47.8 after climbing to a 15-month high of 49.1 in January, falling below expectations of a continued slowdown…