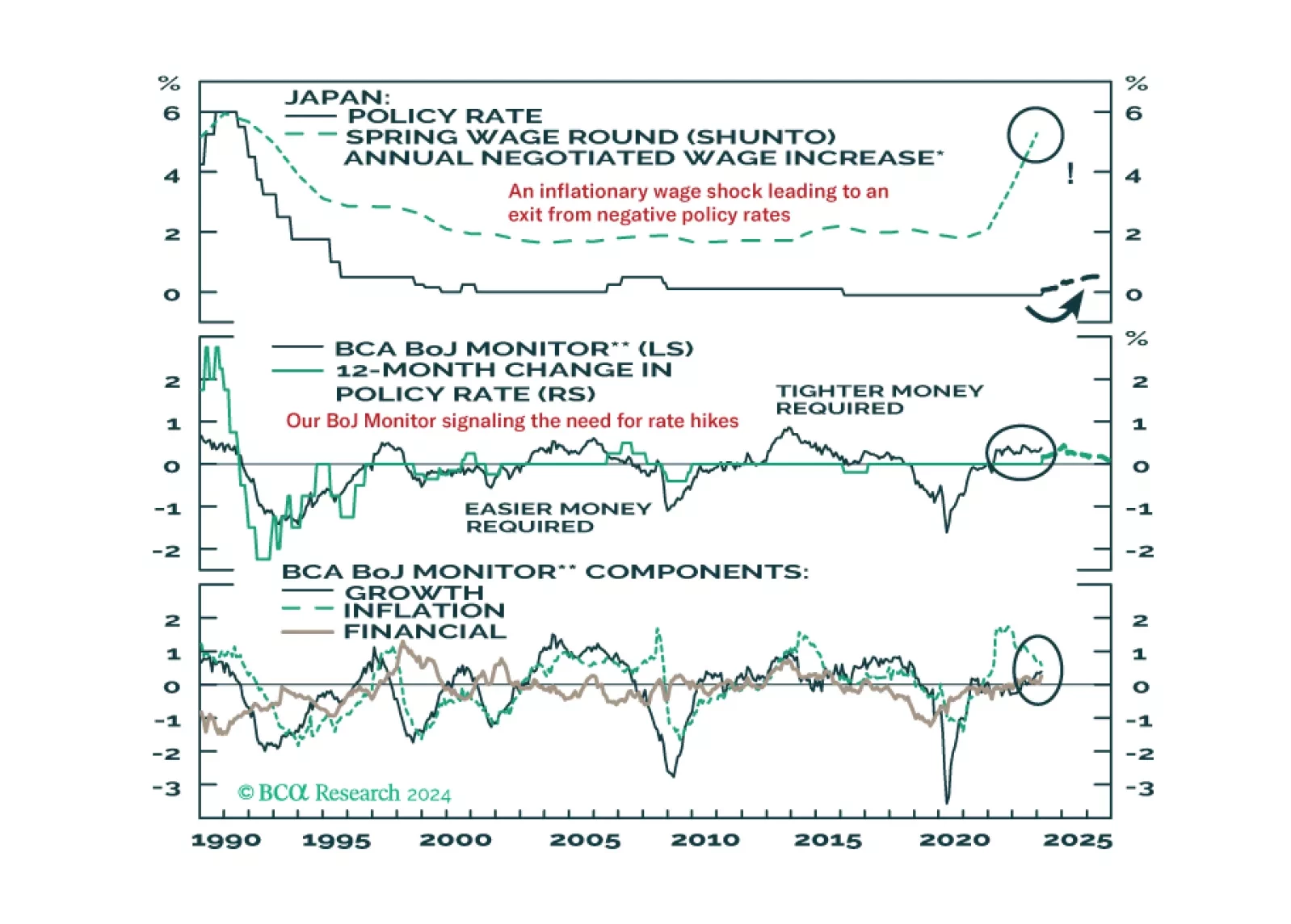

The Bank of Japan delivered a historic policy adjustment this week, ending both negative interest rates and Yield Curve Control. In this Insight, BCA’s global fixed income and currency strategists discuss the immediate implications…

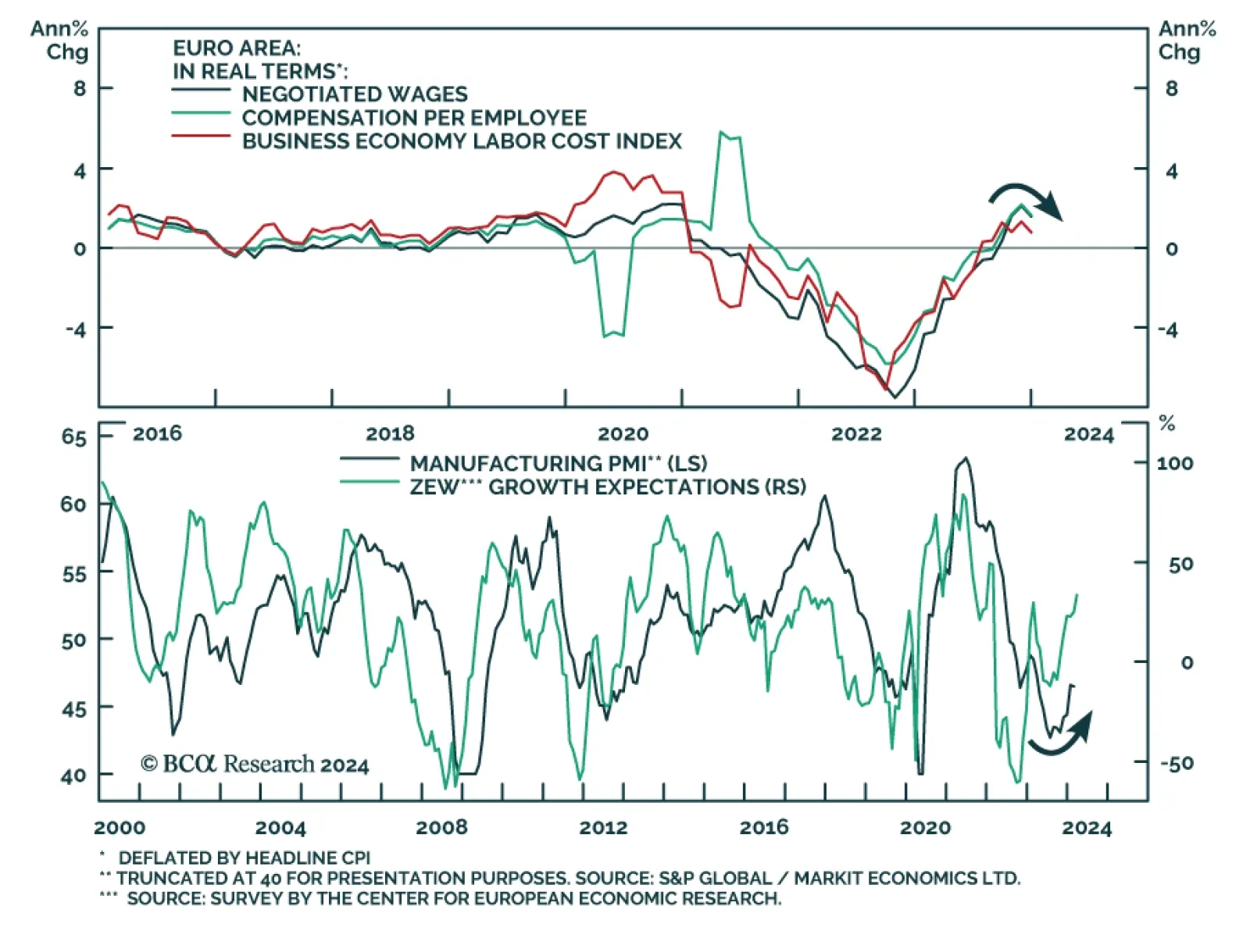

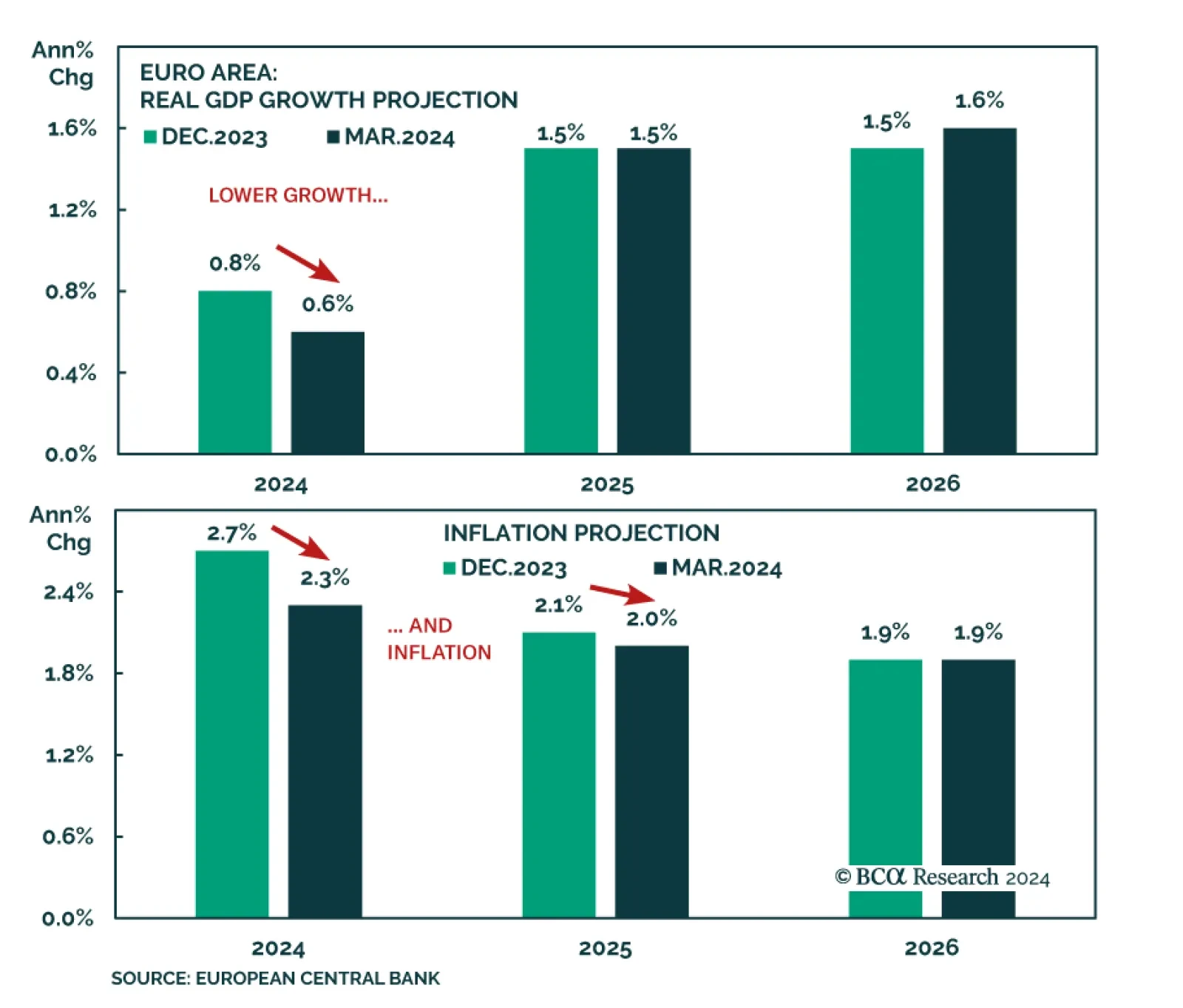

Various indicators of Eurozone wage growth have cooled off in recent months. Notably, the labor costs index eased sharply from a downwardly revised 5.2% y/y to 3.4% y/y in 2023Q4 – the slowest pace of increase since…

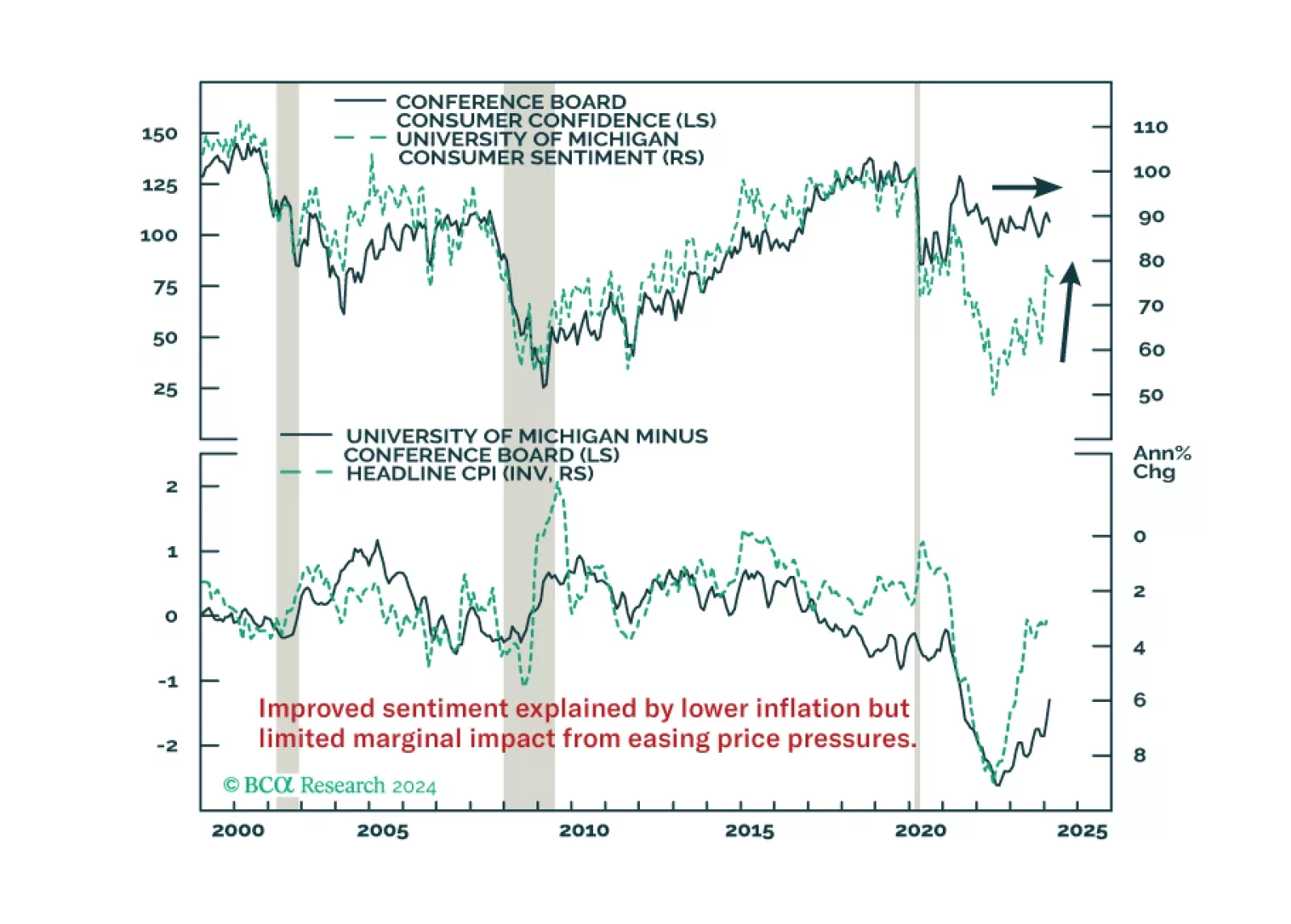

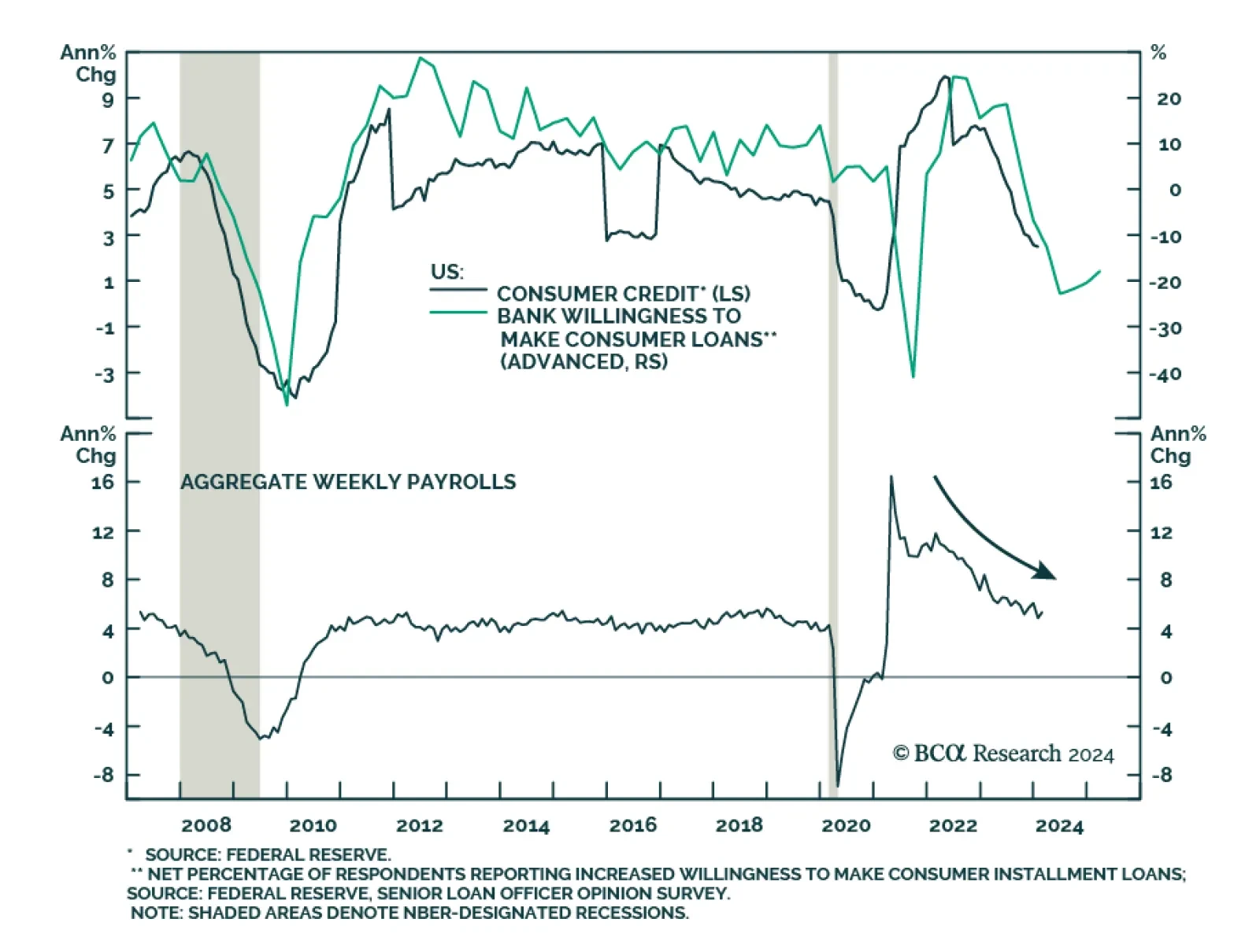

Improved consumer morale will not compensate for the fading tailwinds to consumption. Neither will the wealth effects from higher stocks and home prices.

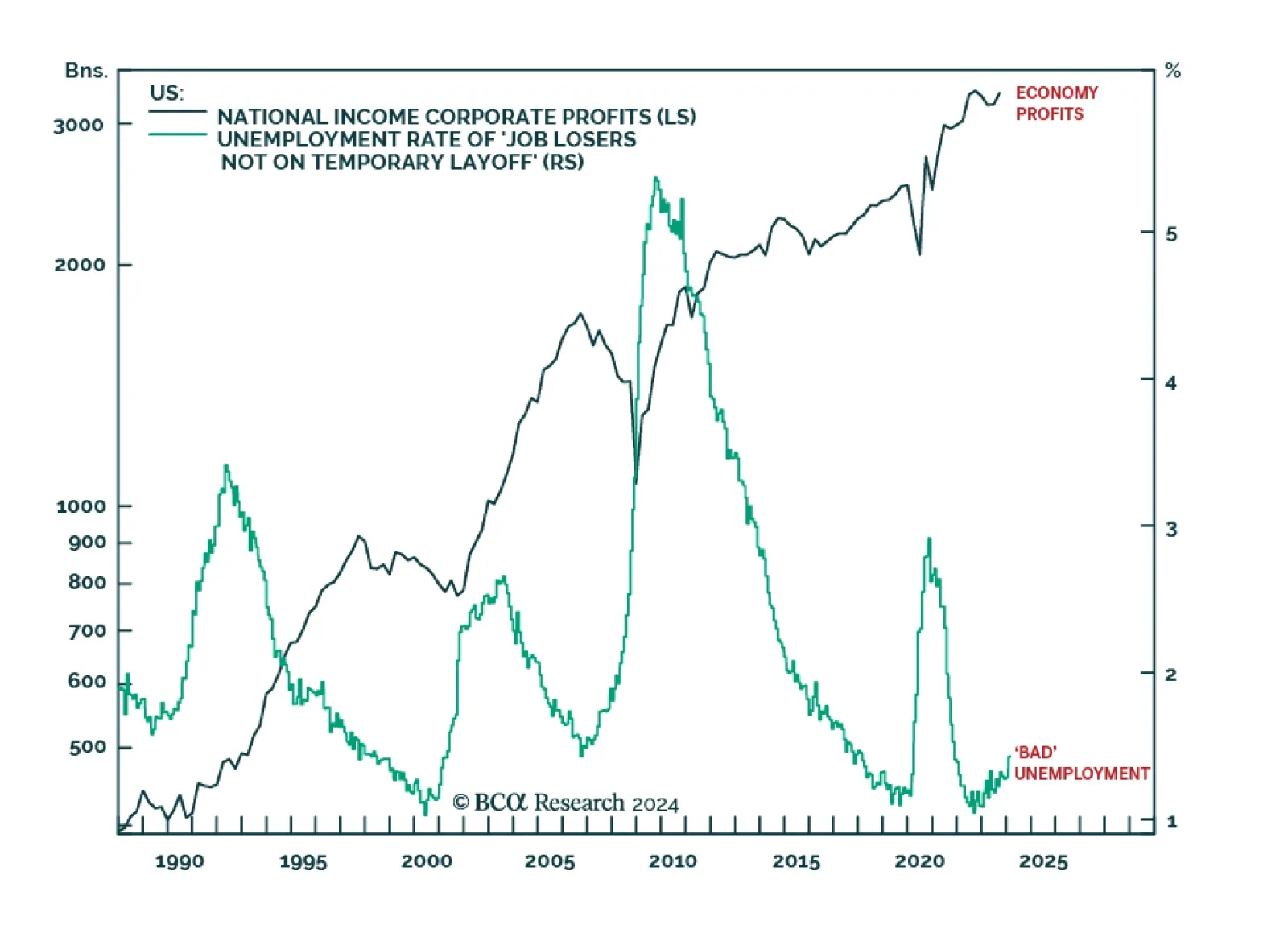

According to BCA Research’s Counterpoint service, ‘bad unemployment’ is on the rise in the US, despite resilient growth. There are two ways that you can become unemployed. Either by losing your job. Or by…

There is a general consensus among BCA Research strategists that a US recession is highly likely over the next two years. While last month our Global Investment strategists reduced the probability that a recession will…

According to BCA Research’s European Investment Strategy service, last week’s ECB meeting confirmed their long-held view that the most likely date for the first ECB rate cut would be June. The ECB continues to…

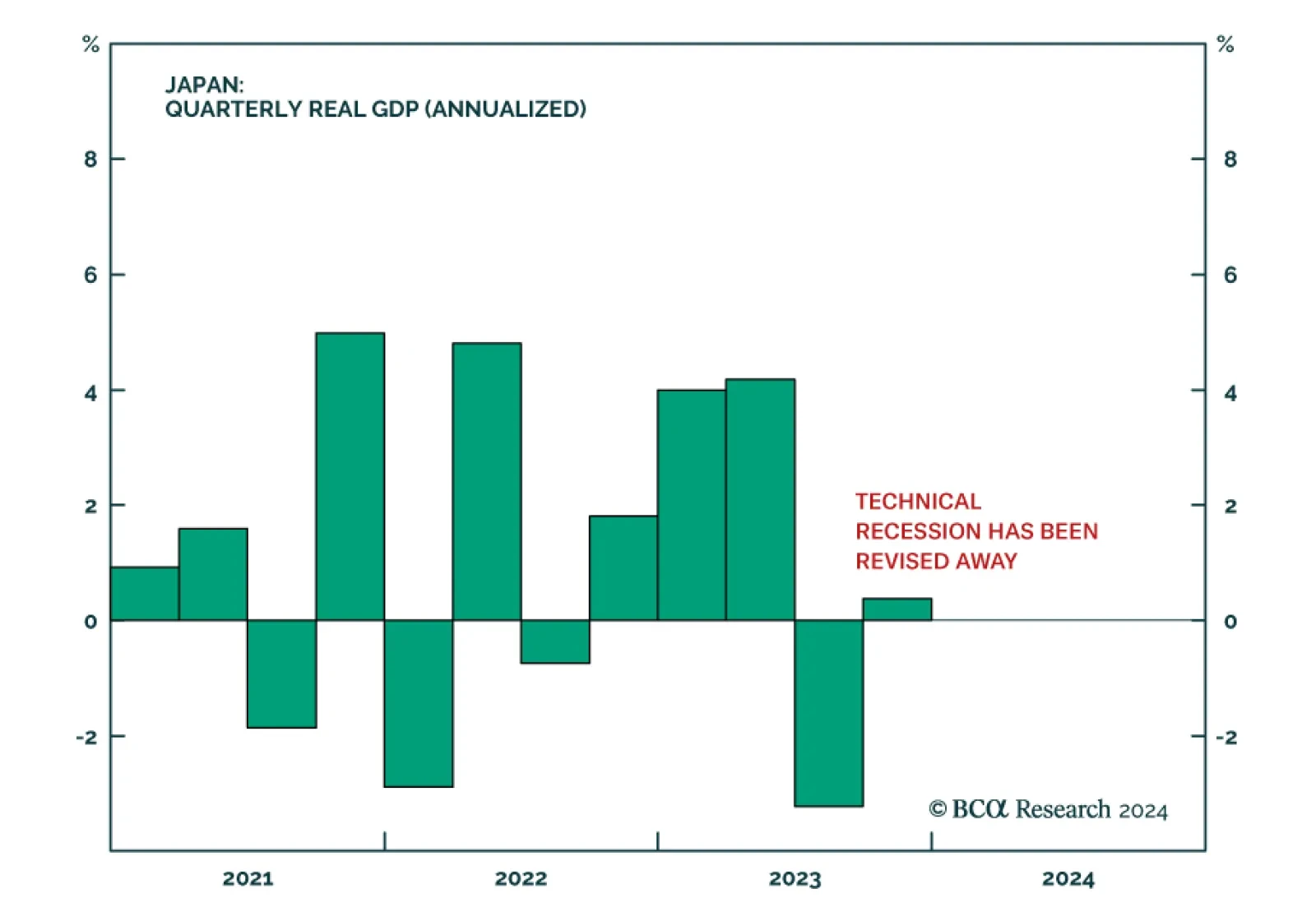

Japanese equities and government bonds sold off on Monday and the yen strengthened following the release of the revised Q4 GDP report showing the economy expanded by an annualized 0.4% q/q in Q4 2023 versus earlier estimates of a…

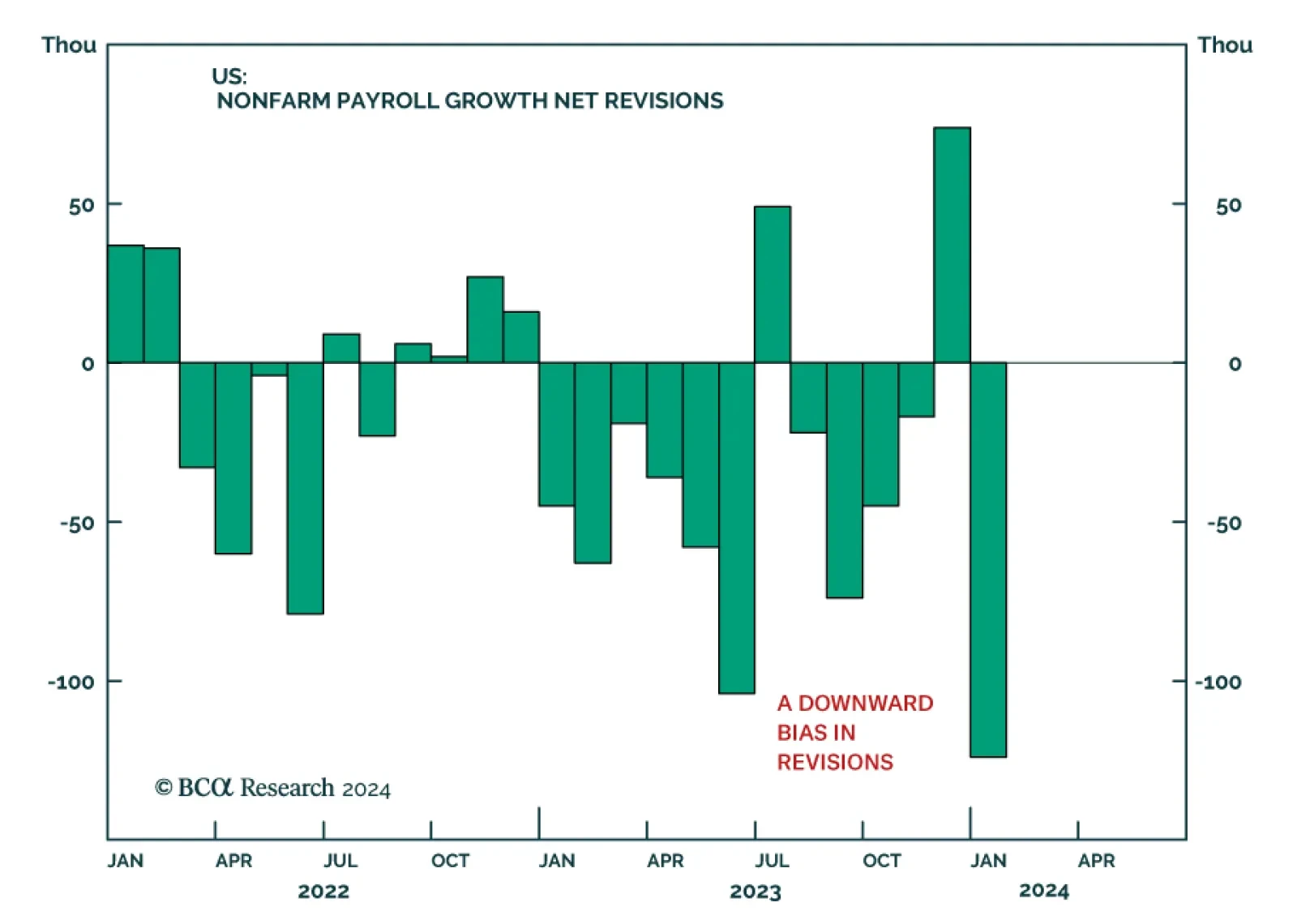

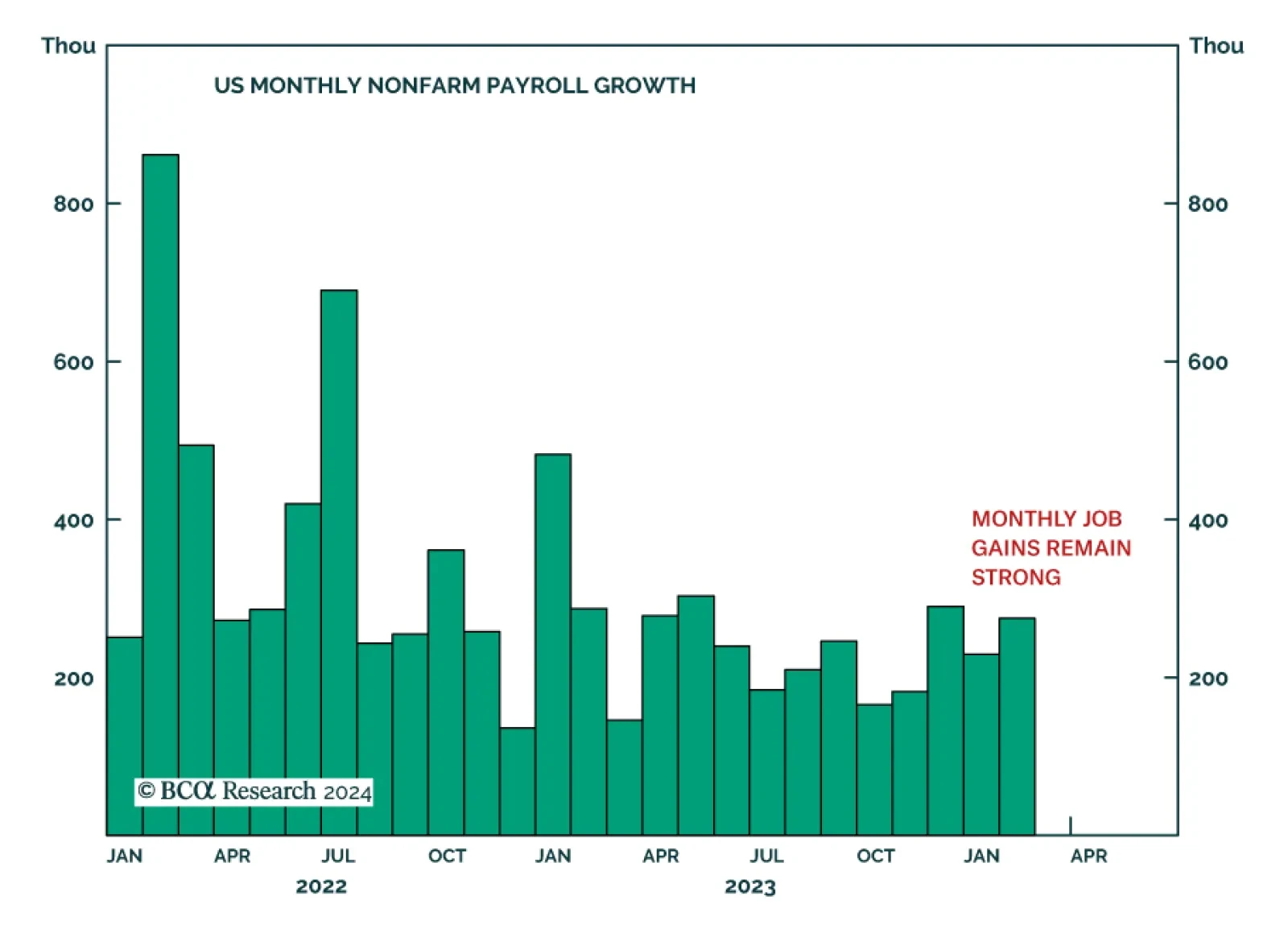

For the past year, relatively large downward revisions have been key features of the monthly US nonfarm payrolls reports. Friday’s release was no exception. Although it showed the magnitude of job gains beat expectations in…

The US employment situation report sent a mixed signal on Friday. While total nonfarm payrolls rose by 275 thousand jobs in February, exceeding the 200 thousand expected, the previous two months’ numbers were revised lower…

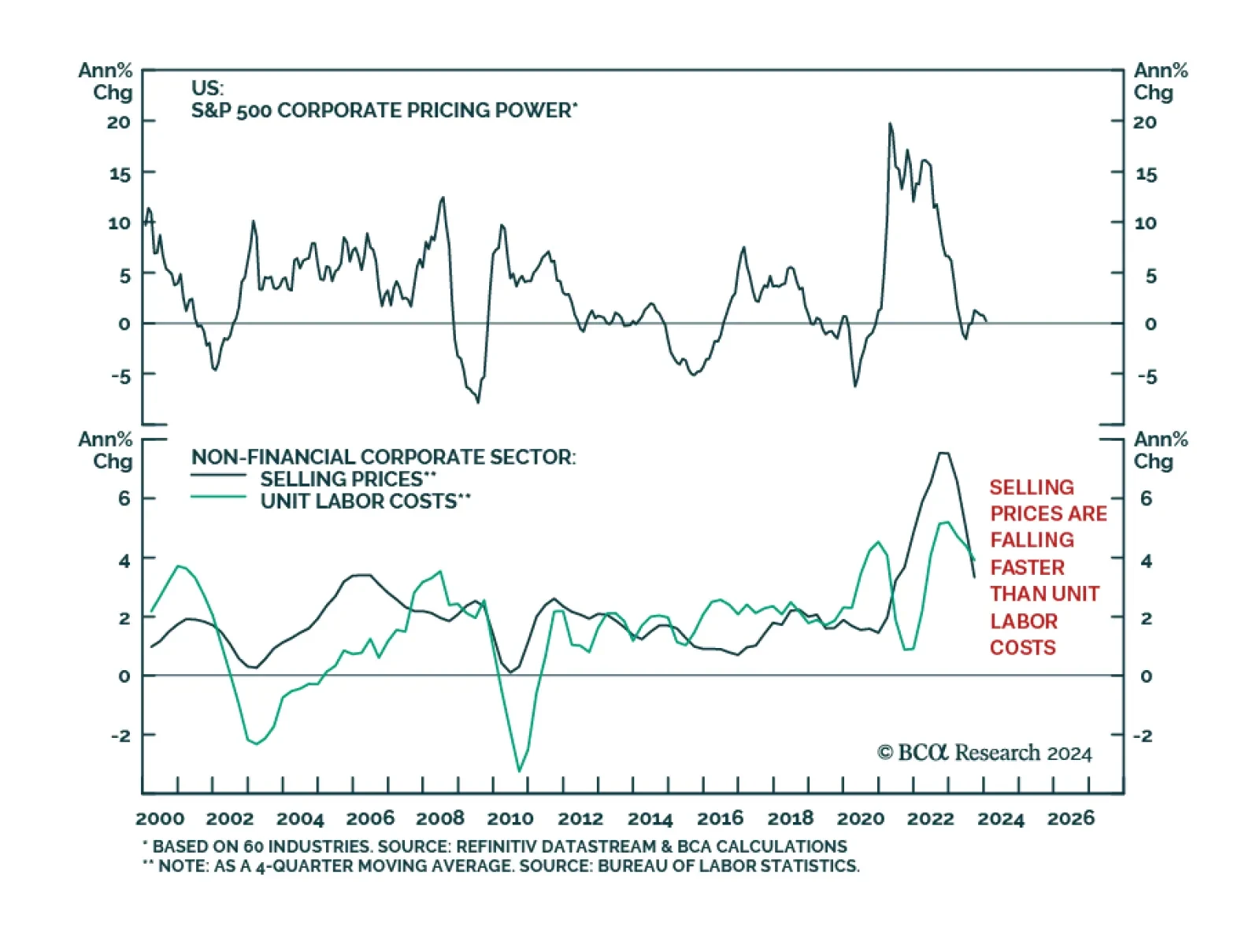

According to Factset, analysts are forecasting S&P 500 earnings and revenues to grow by 11.0% y/y and 5.0% y/y respectively in 2024 (an acceleration from 0.9% and 2.8% in 2023). Information technology and communications…