Core Europe’s industrial sector will relapse in the coming months due to US tariffs and a strong euro. Investors can play the imminent deflationary shock by being long Central European bonds. They should, however, hedge the…

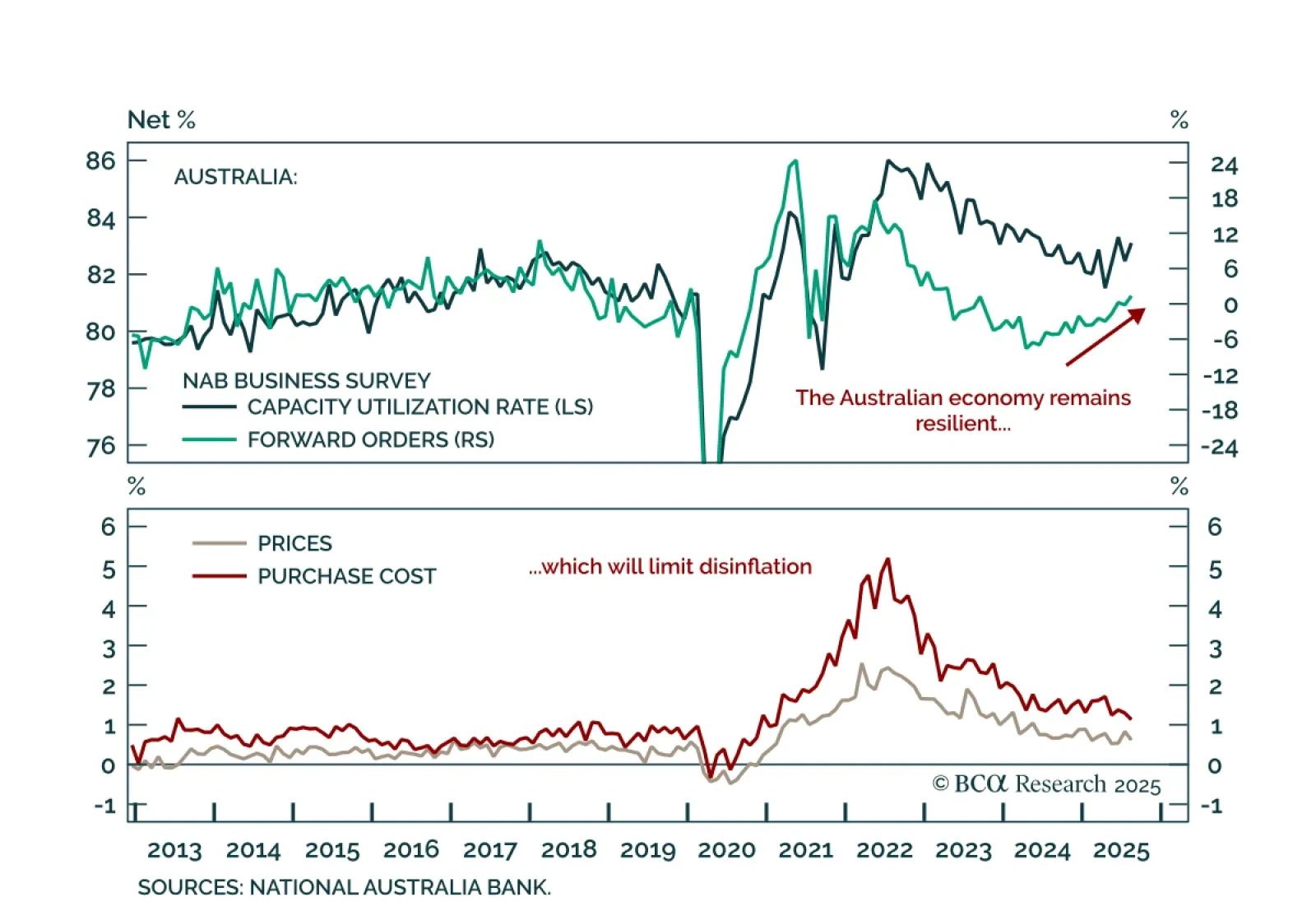

Australia’s NAB survey shows underlying resilience, reinforcing our underweight on ACGBs and the case for AUD flatteners vs. CAD steepeners. The August survey was mixed, with current conditions improving to 7 from 5, while business…

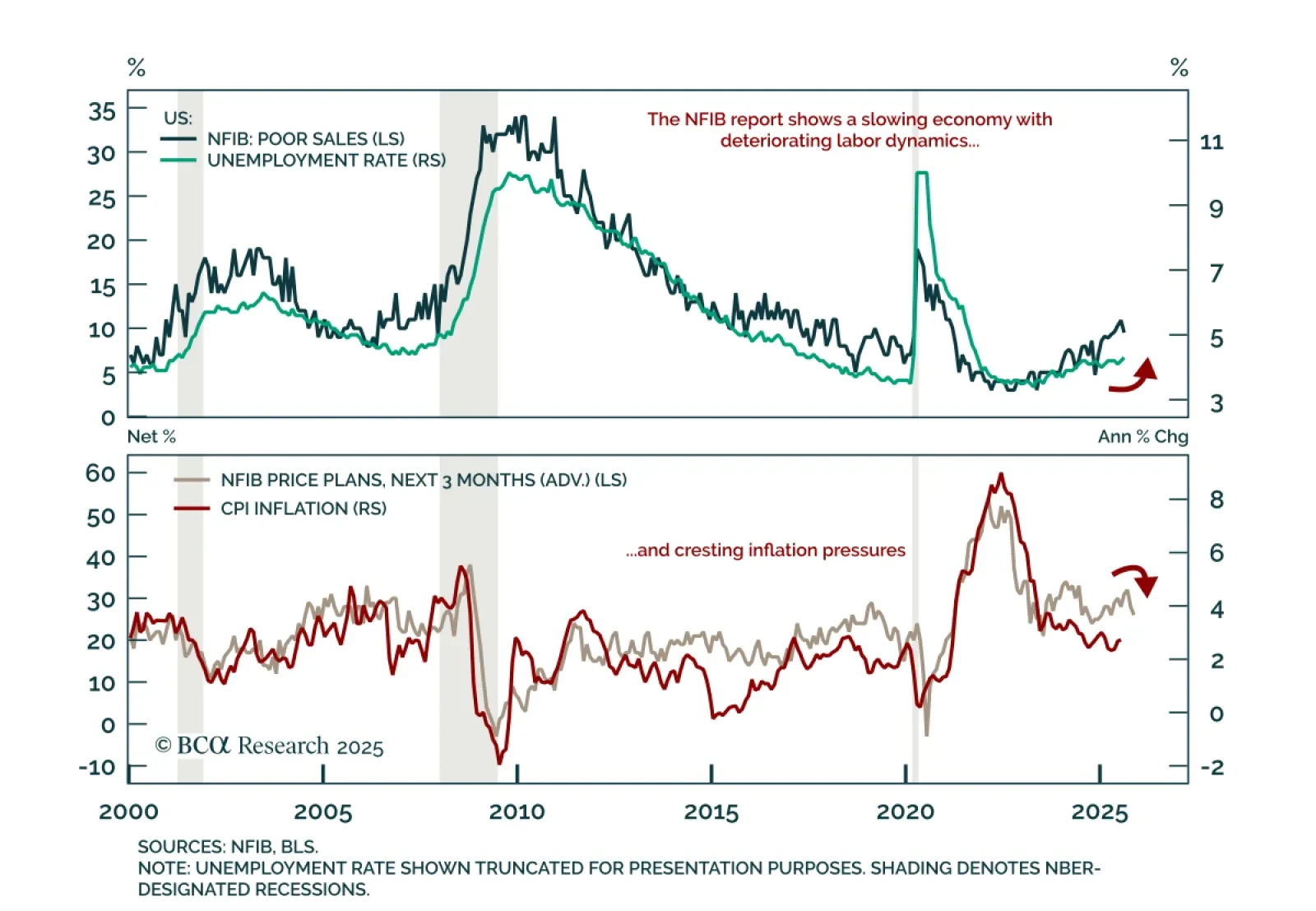

The August NFIB survey shows a fragile US economy with disinflationary signals and weak employment, supporting our defensive stance. The Small Business Optimism Index rose to 100.8 from 100.3, a six-month high, though still below…

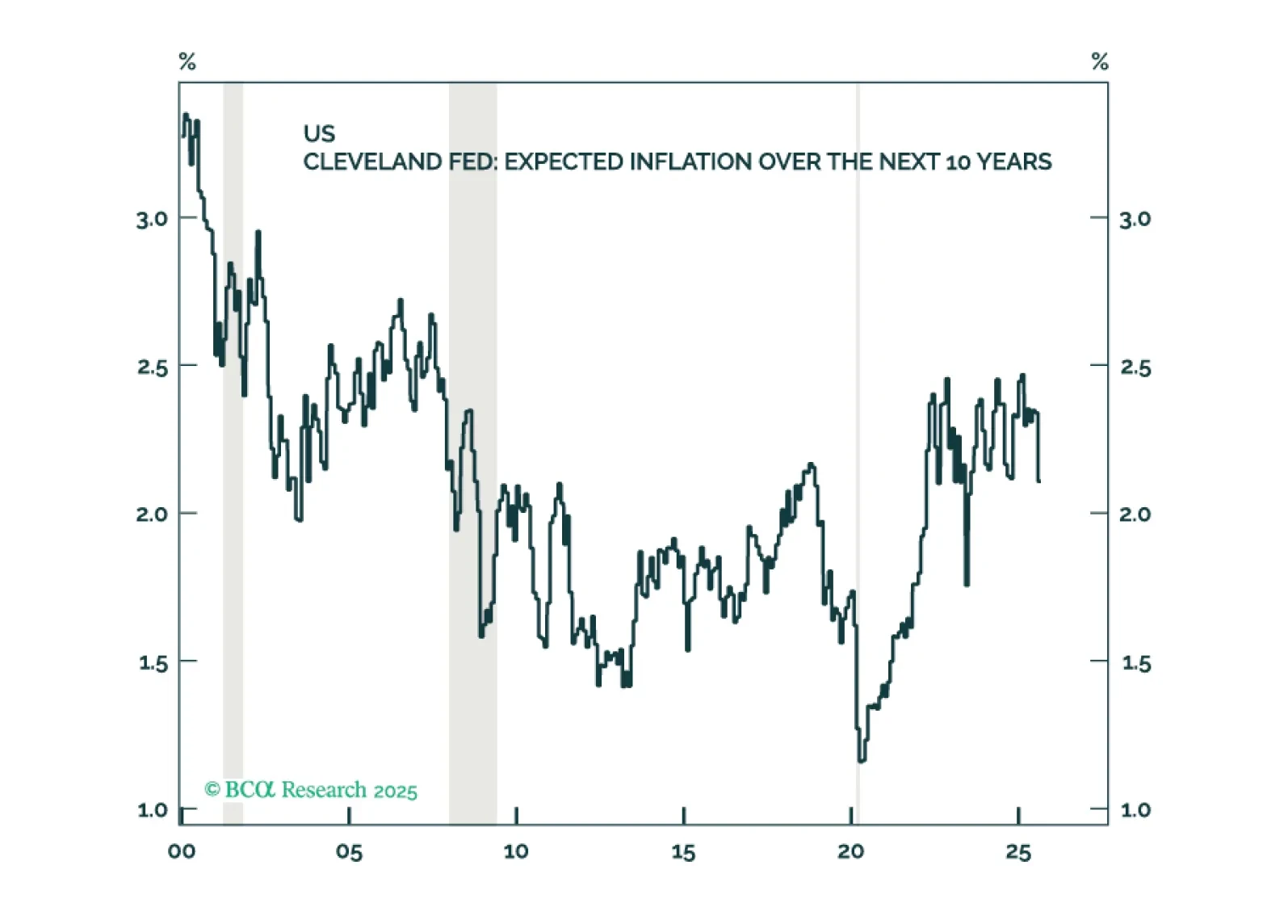

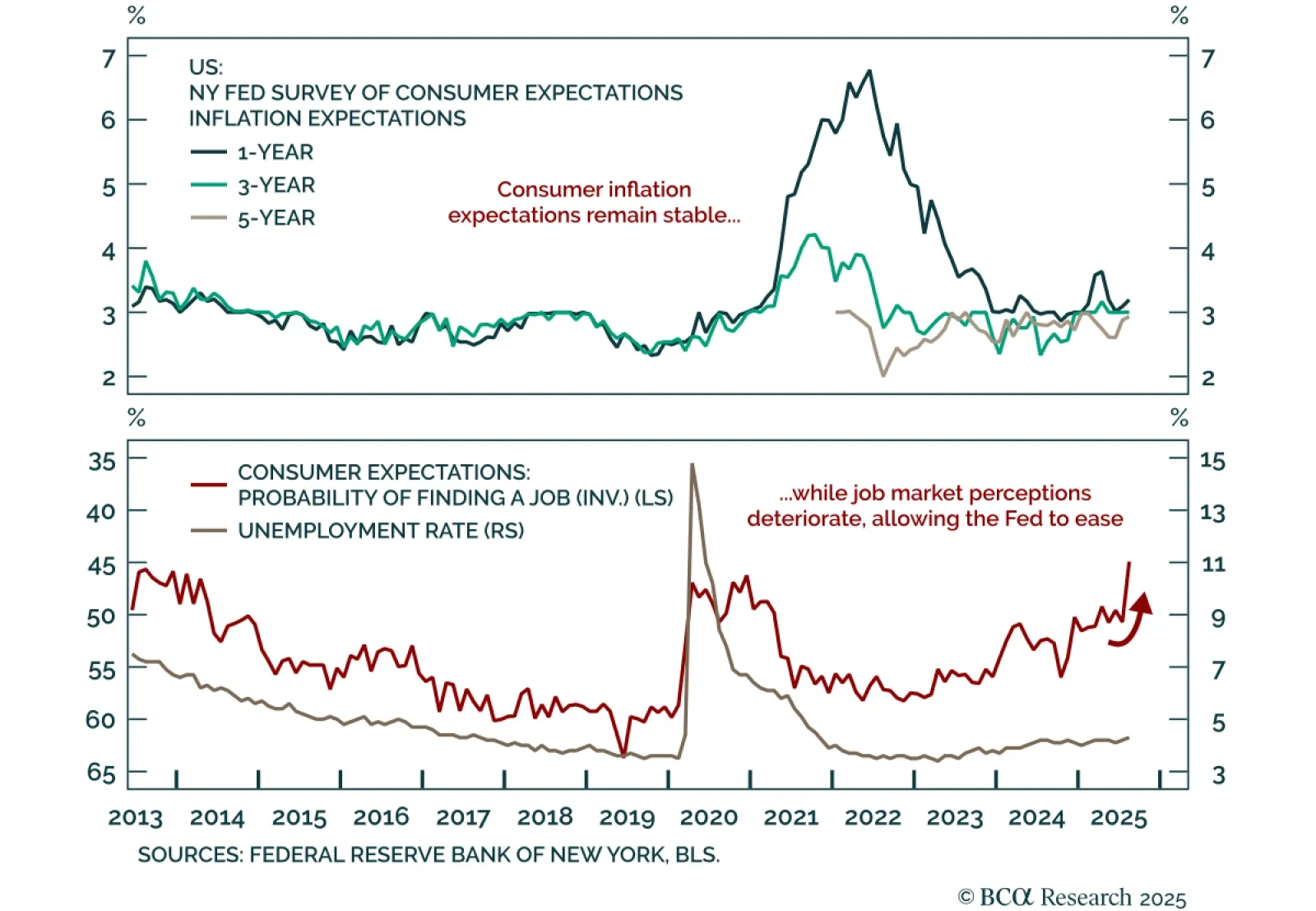

Stable long-term inflation expectations and weak labor perceptions support a defensive stance. The NY Fed Survey of Consumer Expectations showed 1-year inflation expectations ticking up to 3.2% in August, while the 3-year (3.0…

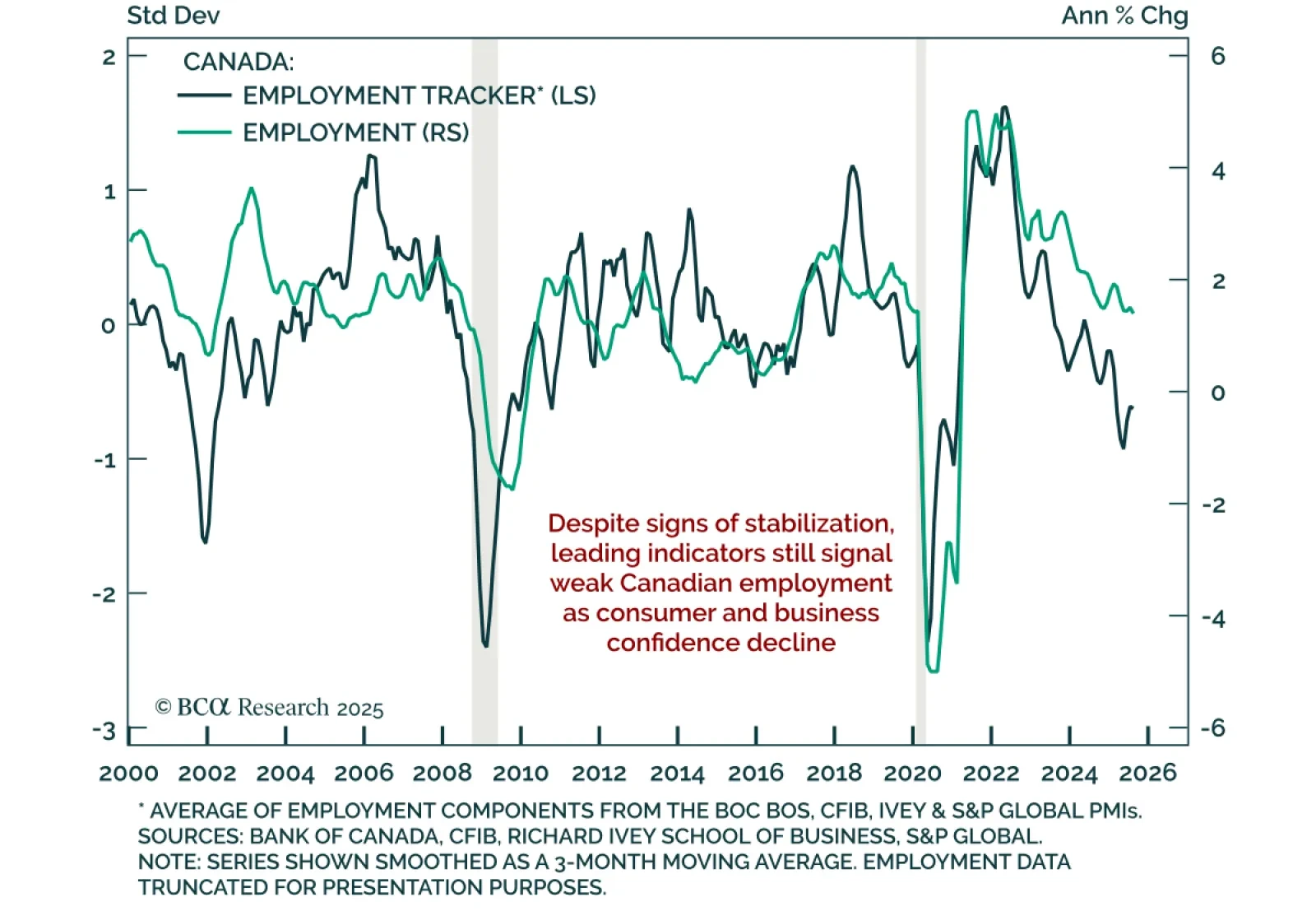

Canada’s August jobs report confirms the economy remains weak, supporting Canadian bonds and CAD steepeners. Employment fell by 66k, driven by declines in both part-time (-60k) and full-time (-6k) positions, against expectations…

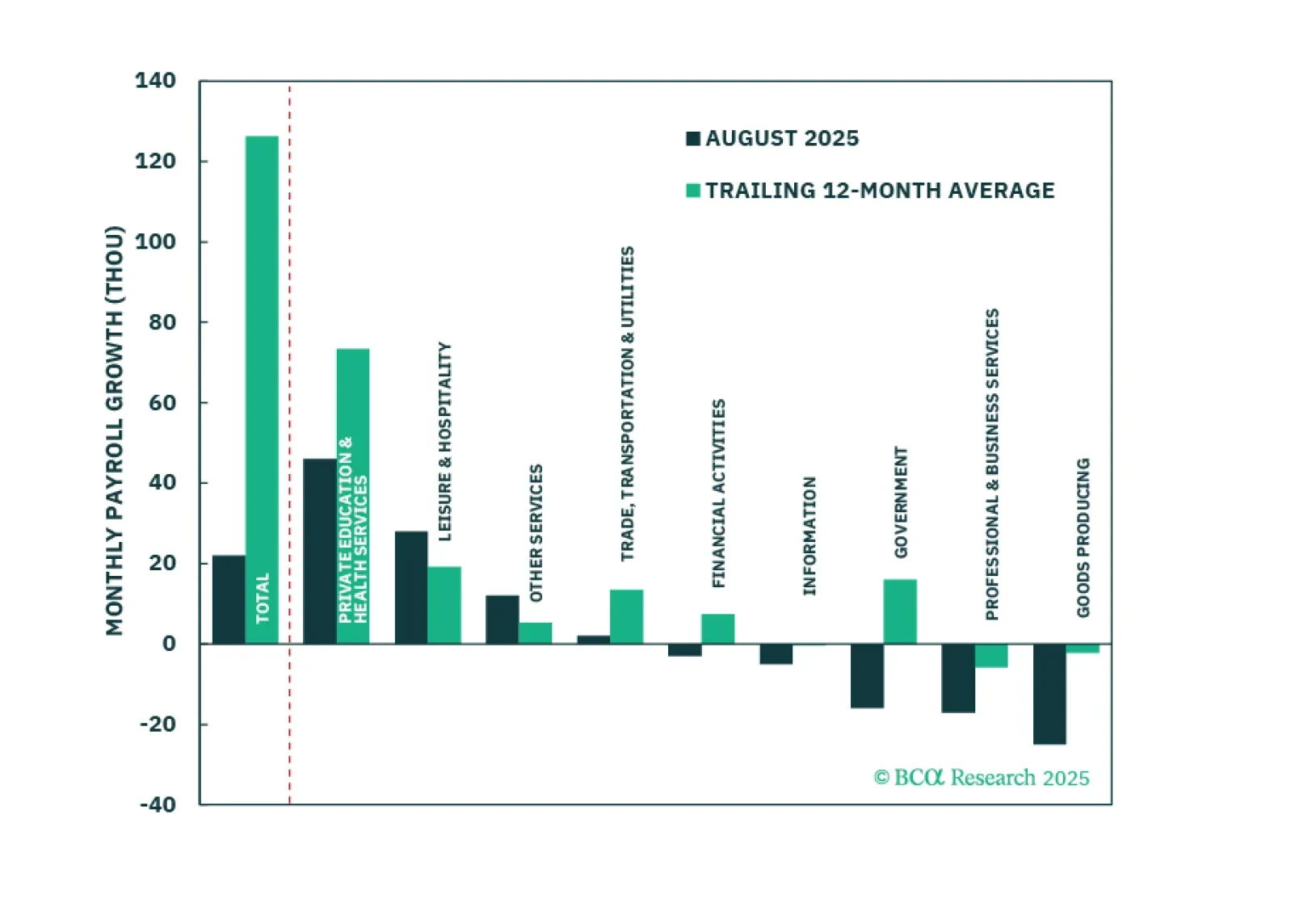

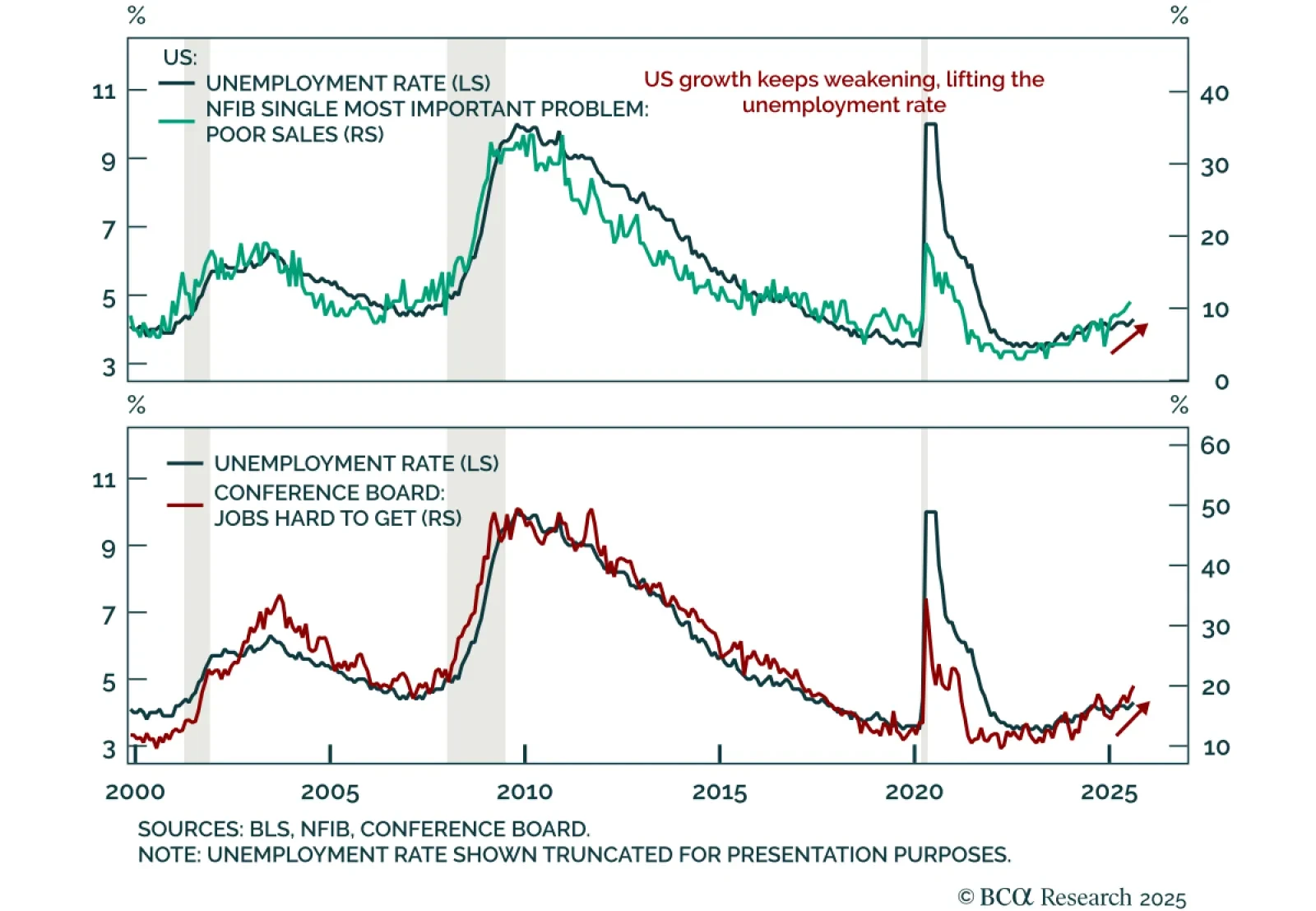

The August US employment report confirmed a significant labor market deceleration, keeping us modestly defensive. Nonfarm payrolls rose just 22k after 79k in July, while net revisions subtracted 21k from prior months. The 3-…

The August employment report showed a modest increase in labor market slack, enough to cement a 25-basis-point rate cut this month.

Inflation expectations in the US remain reasonably well anchored and there are few signs of a brewing wage-price spiral. Thus, the near-term risks to growth outweigh the risks of higher inflation. Looking beyond the next year or two…

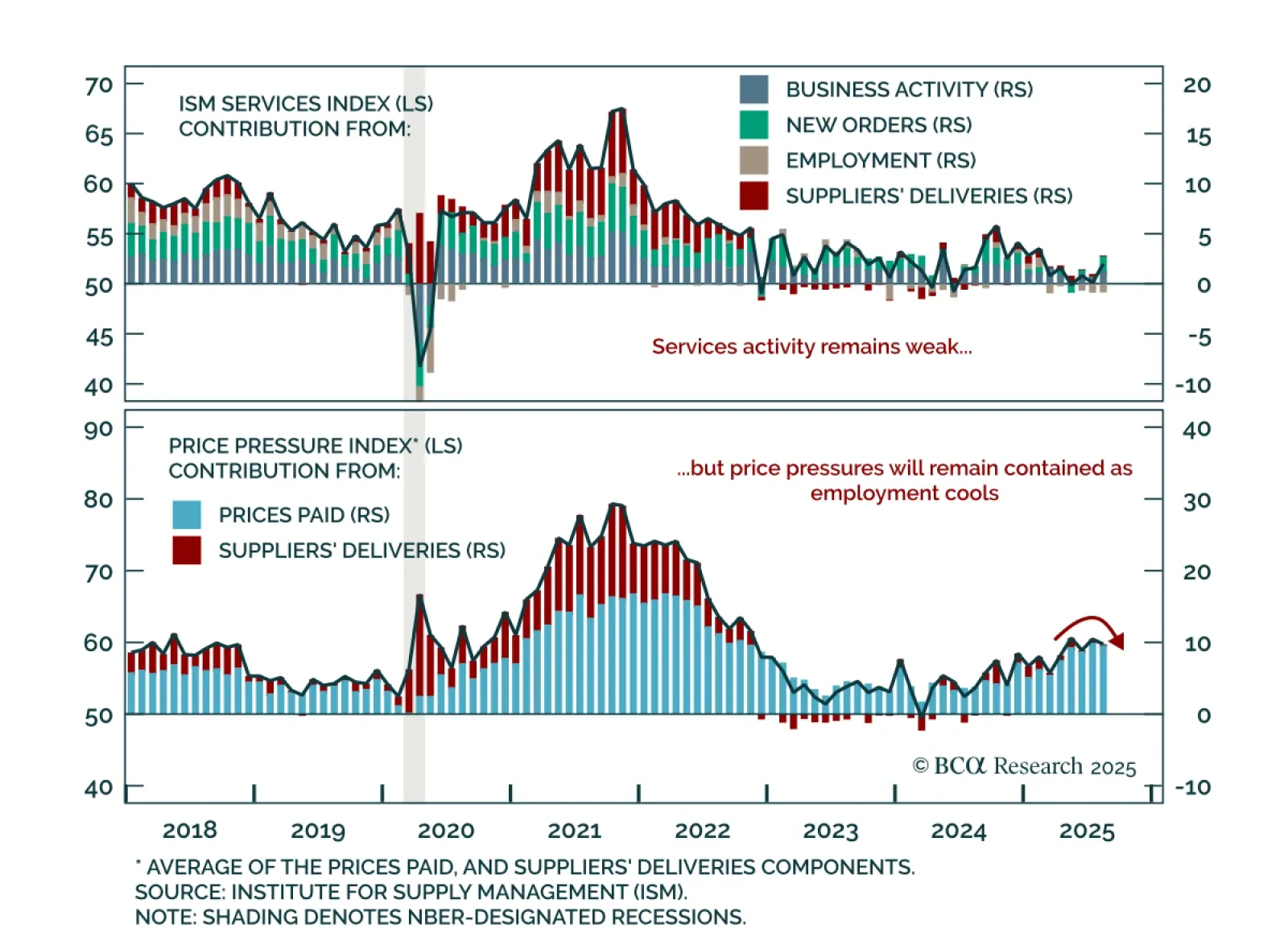

August ISM Services beat expectations, but employment weakness highlights fragile momentum. The index rose to 52.0 from 50.1, driven by business activity and new orders. However, the employment component stayed in contraction at 46.5…

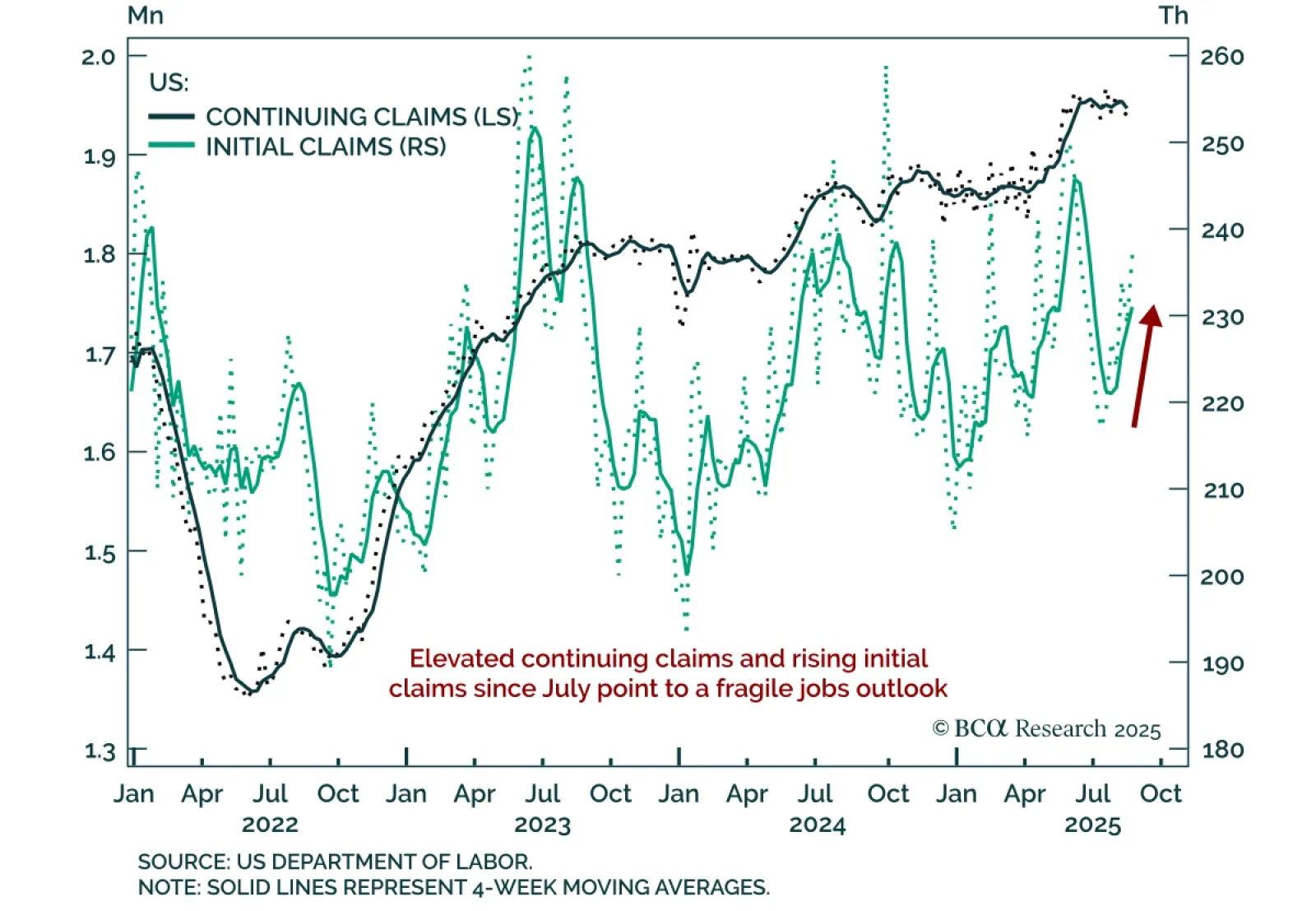

US jobless claims rose to 237k, the highest since July, underscoring fragile labor momentum. While still below the recent 250k peak, claims have been rising steadily since early July, suggesting the labor market weakness seen in…