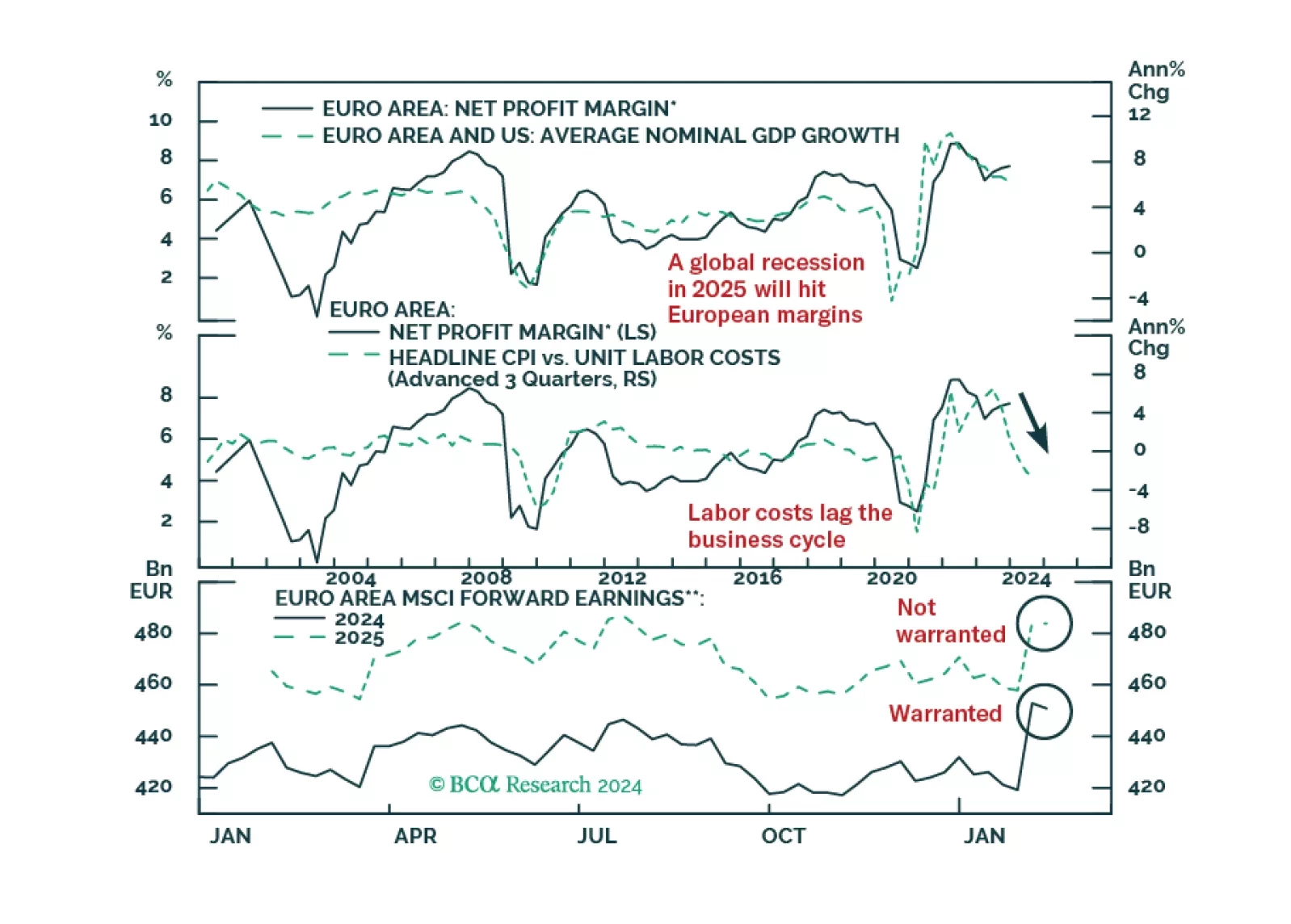

European profits margins are elevated. Will a mild recession be enough to bring them down?

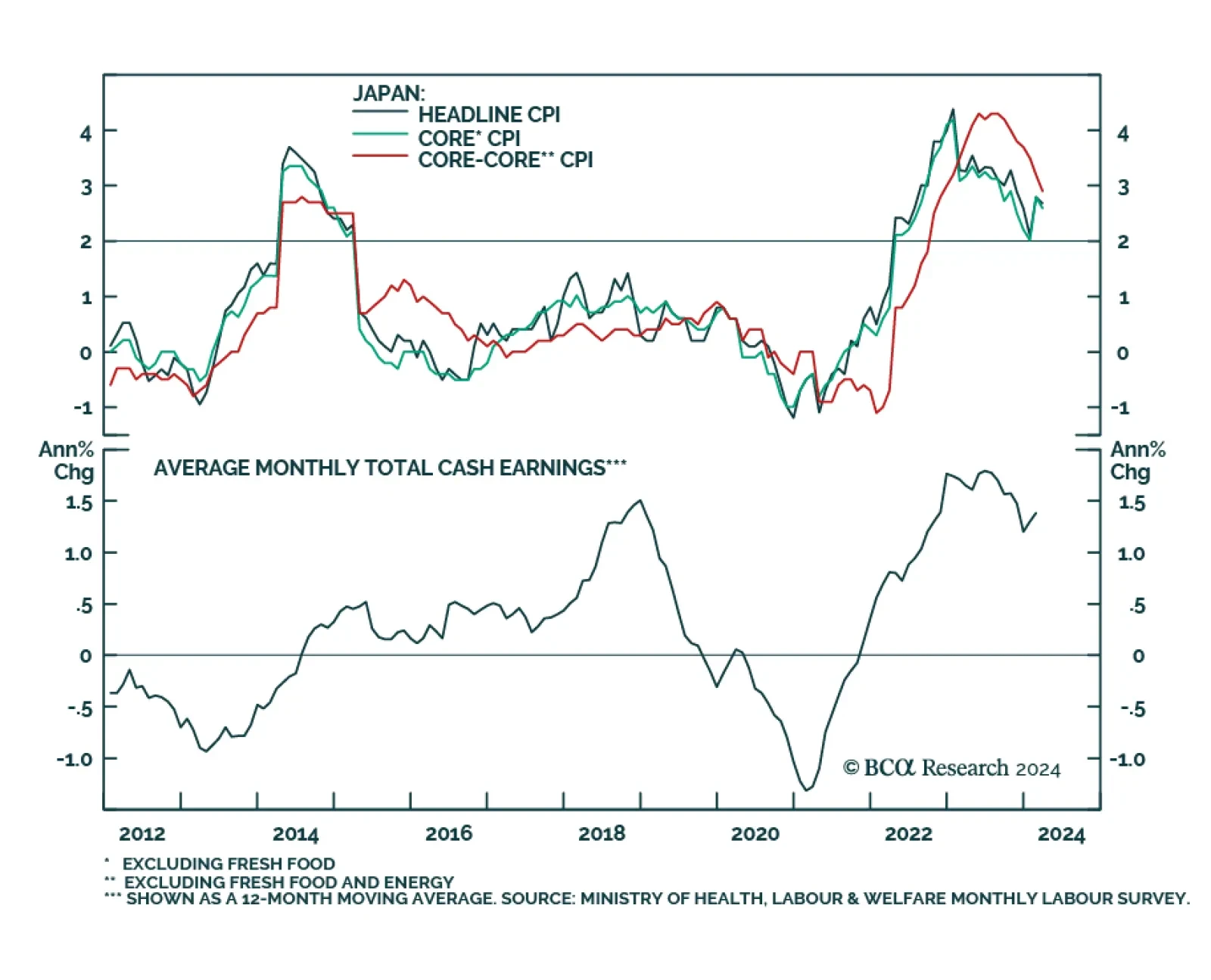

Japan’s national CPI inflation unexpectedly cooled in March, falling to 2.7% y/y versus consensus estimates it would remain at 2.8% y/y. Notably, measures of underlying inflation such as core CPI (ex-fresh food) and “…

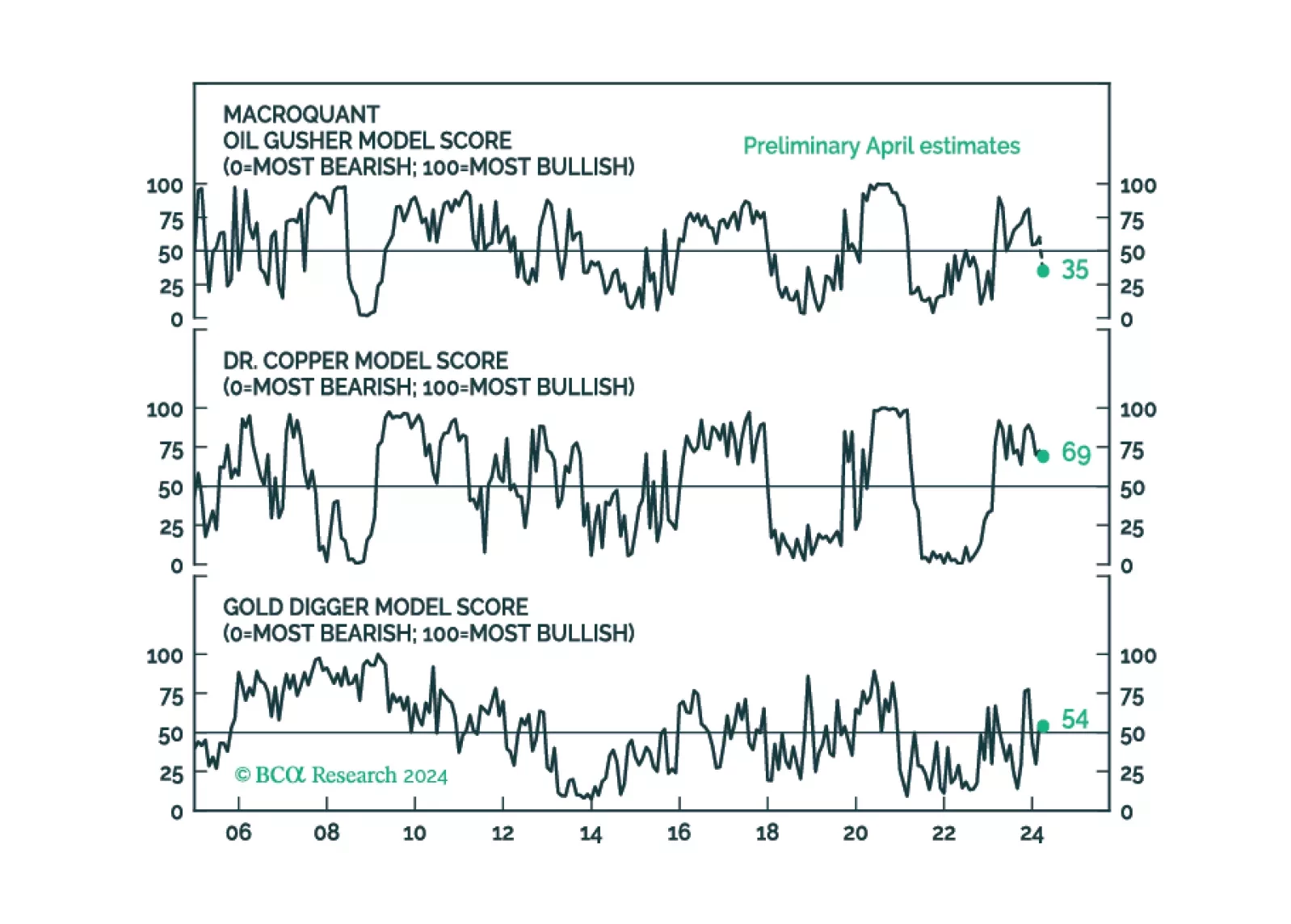

This year’s rise in commodity prices represents a blow-off rally rather than the start of a durable bull market. The global economy is heading for a recession. Stocks, commodities, and other risk assets are vulnerable.

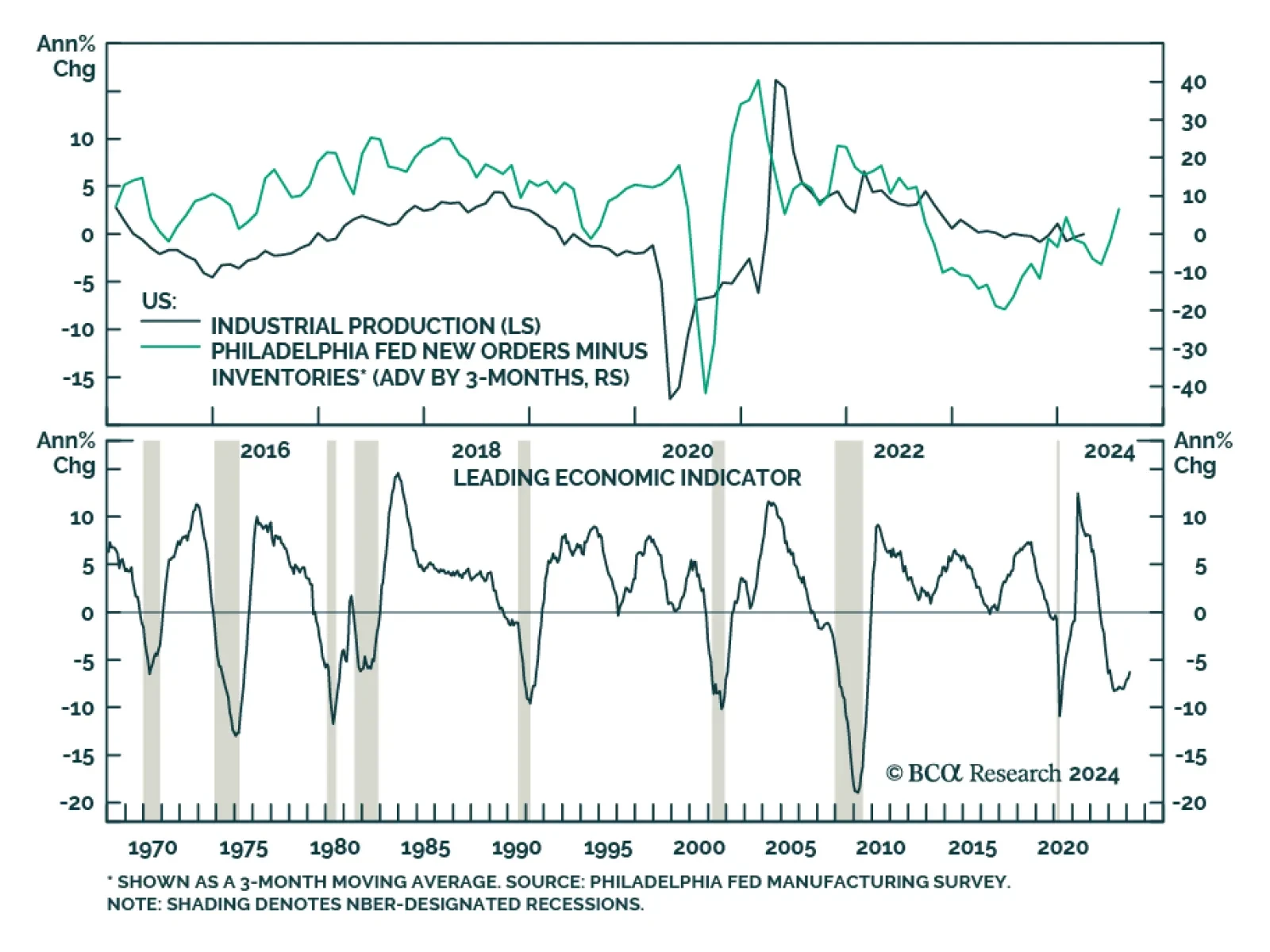

The headline Philadelphia Fed manufacturing survey for April delivered a positive surprise on Thursday, increasing from 3.2 to a twelve-month high of 15.5 and beating expectations it would soften to 2.0. Measures of demand…

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

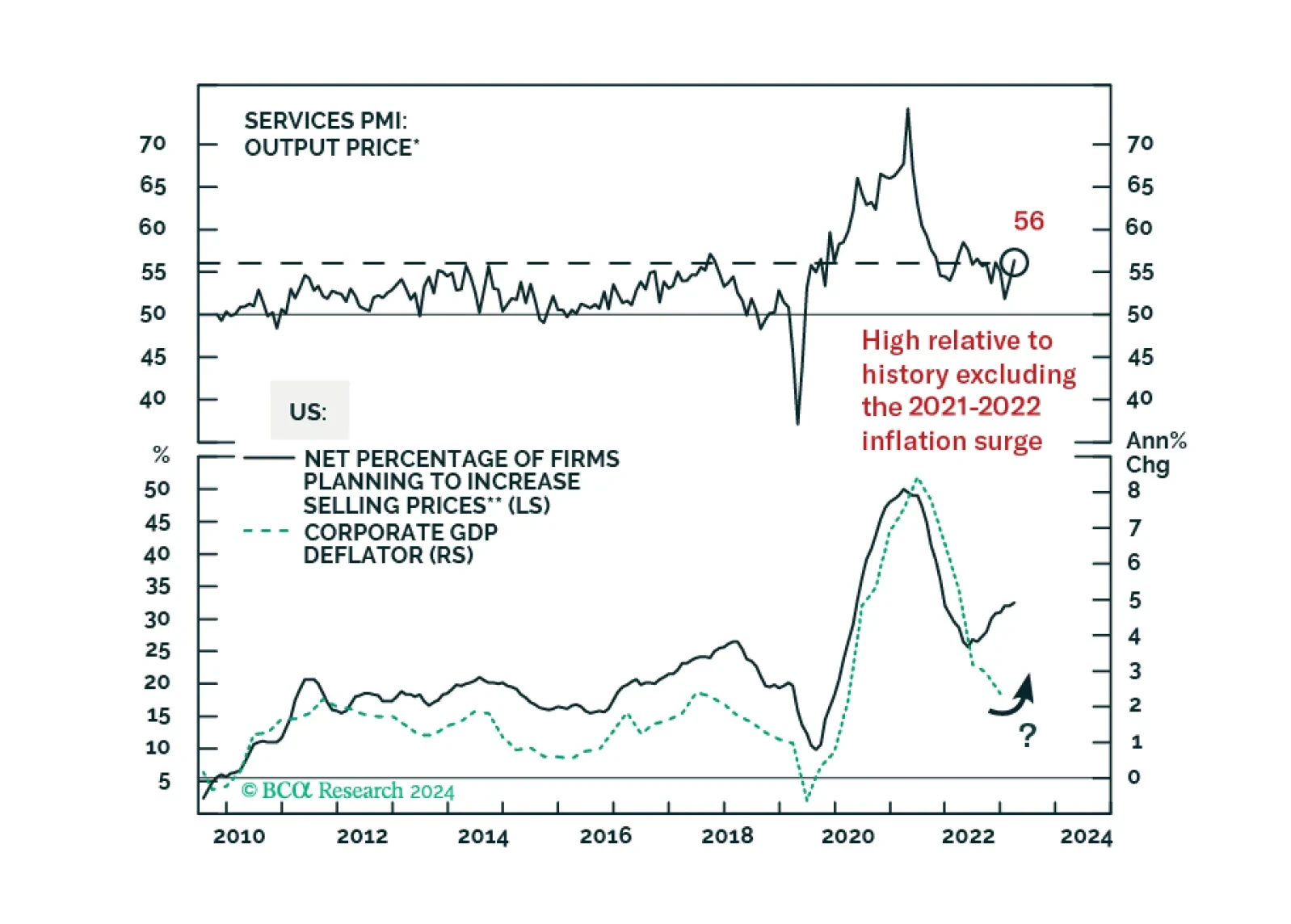

In the short run, global risk assets are vulnerable due to rising oil prices and bond yields. Cyclically, a global economic downturn will weigh on global risk assets.

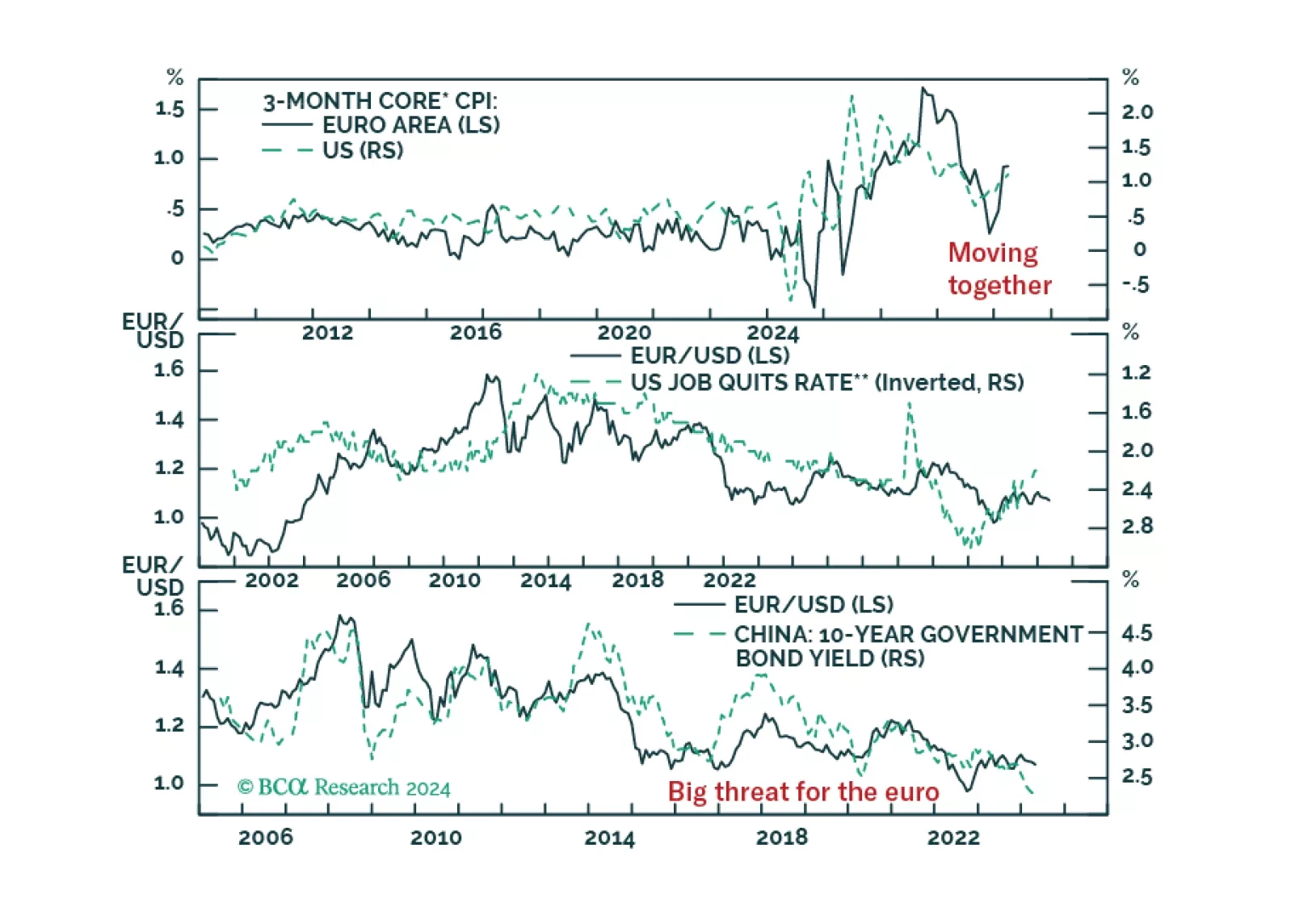

EUR/USD collapsed in the wake of last week’s hotter-than-expected US CPI report. Is this pessimism warranted and will the euro’s trading range that has prevailed since 2023 breakdown?

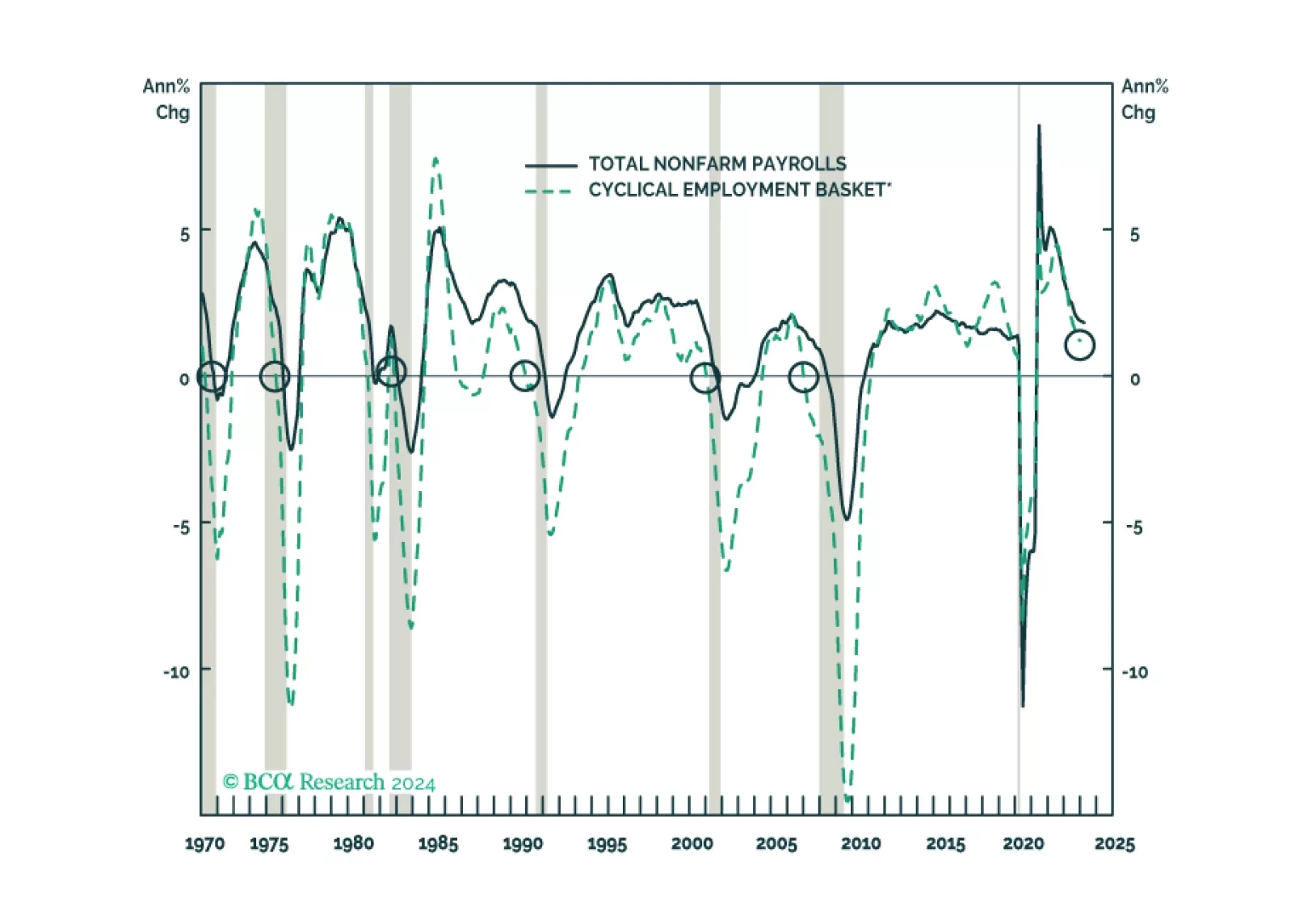

We look beneath headline data to assess the state of the labor market in cyclical goods-producing industries that have previously led overall nonfarm payrolls and in the services segments that have recently been leading the charge.…

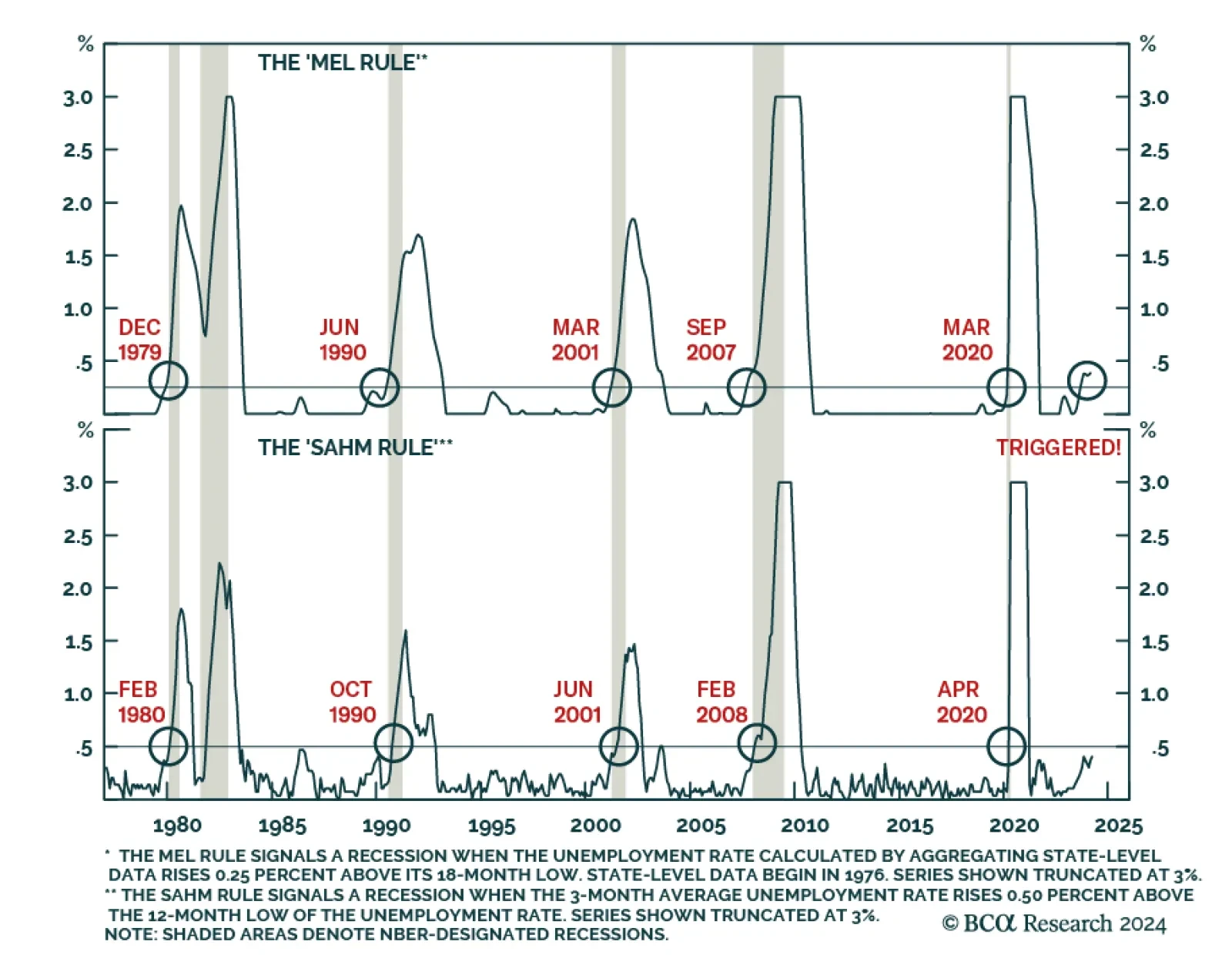

According to BCA Research’s Global Investment Strategy service, a comprehensive review of leading US labor market indicators reveals that most are now flashing red. This includes the “Mel rule,” a refinement of…

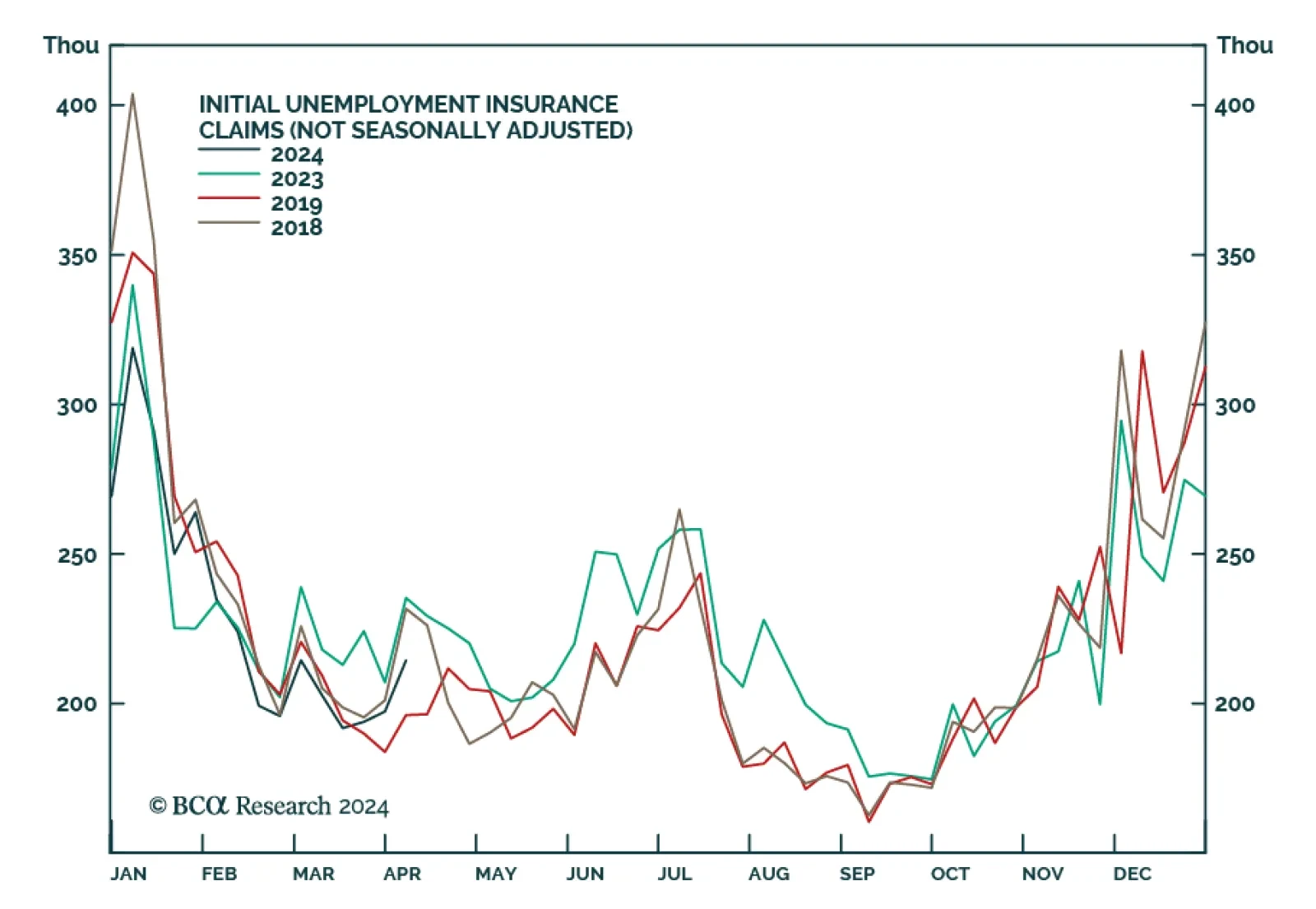

US Initial jobless claims declined from 222 thousand to 211 thousand in the week ending April 5, below expectations of a less pronounced decrease to 215 thousand. On a seasonally unadjusted basis, the number increased to 214…