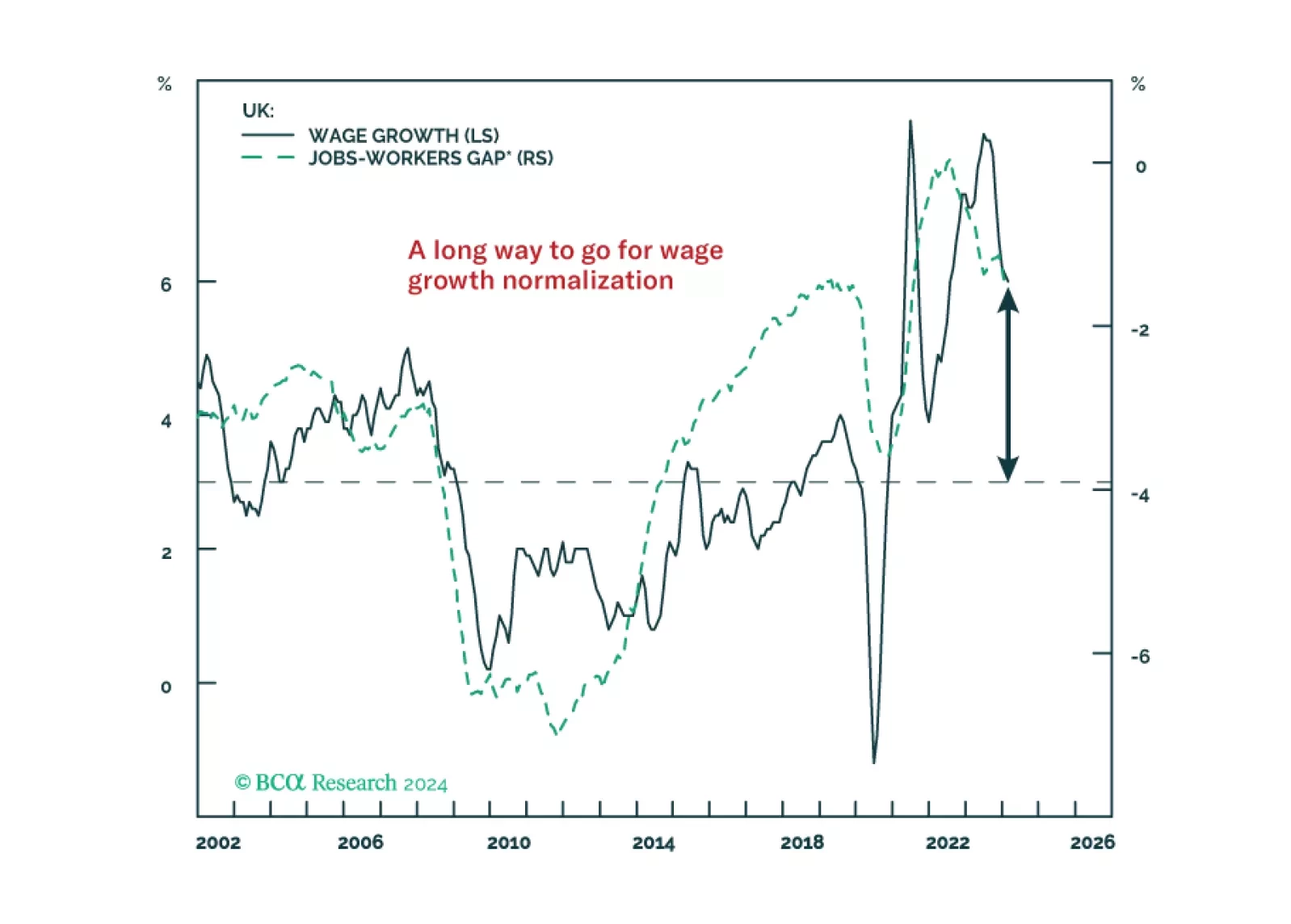

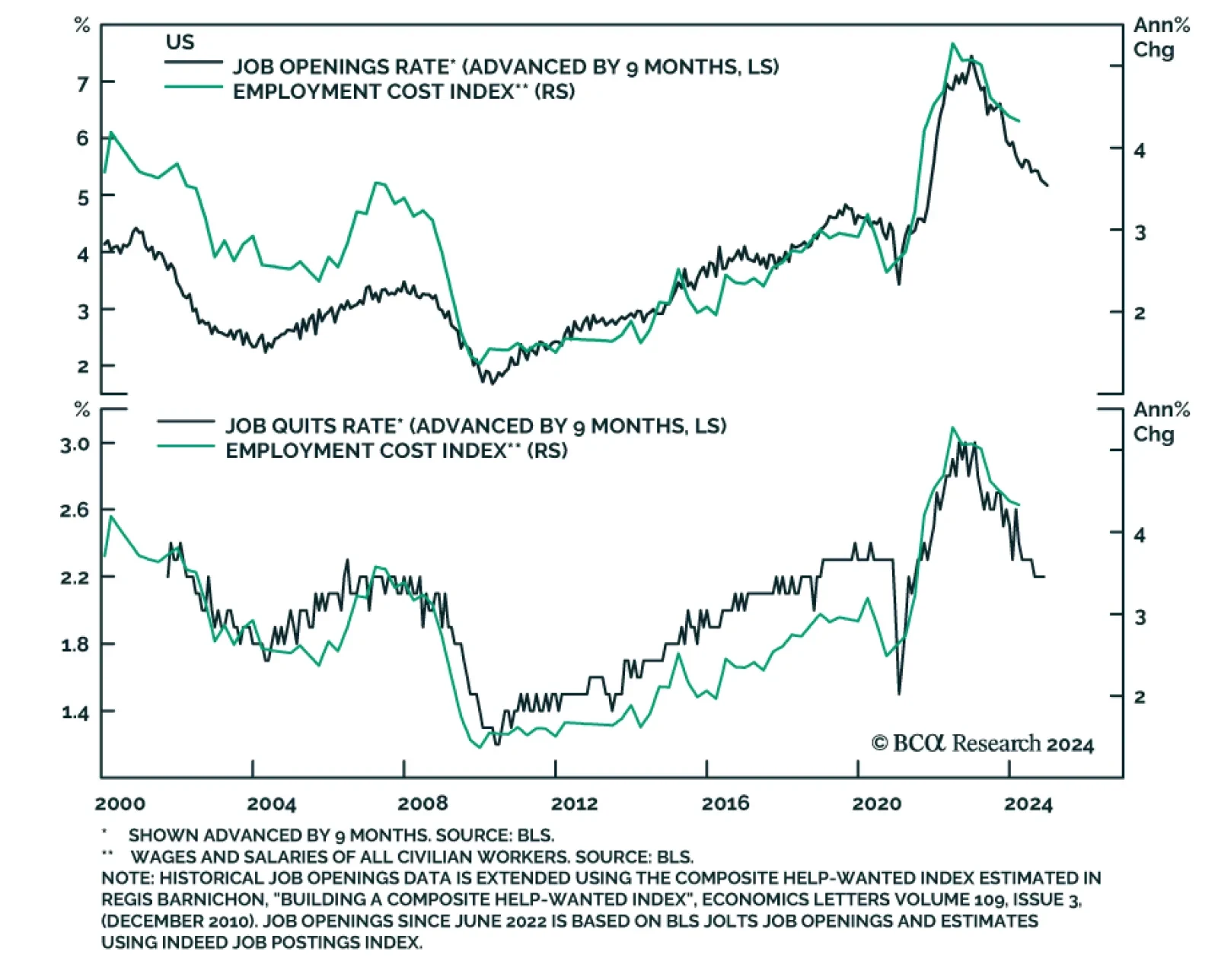

The Q1 US Employment Cost Index (ECI) accelerated at a faster-than-expected 1.2% q/q rate, from 0.9% q/q in Q4. On a year-on-year basis, it rose by 4.2% in Q1 and follows a similar annual increase in the previous quarter. The…

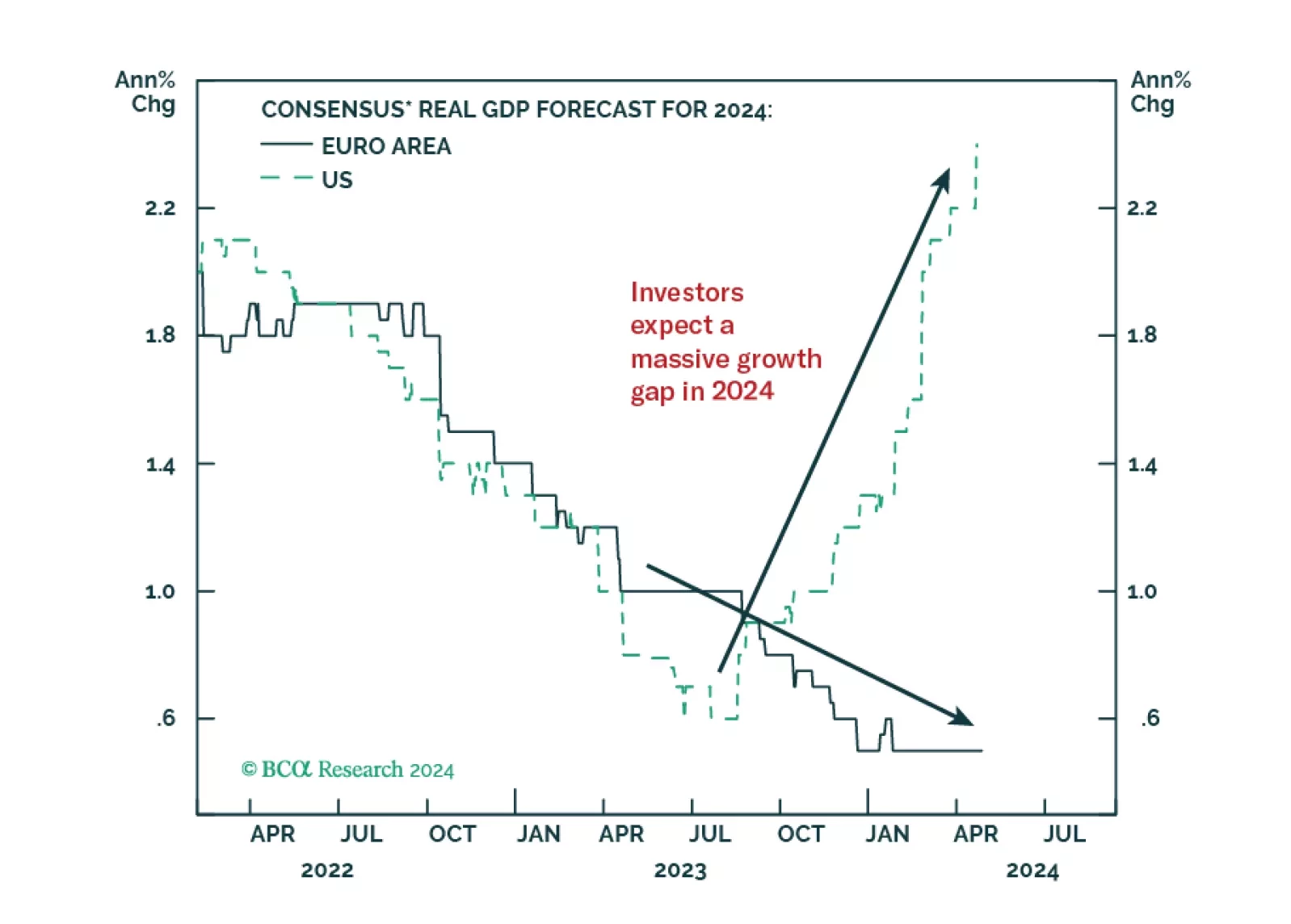

Investors anticipate a record growth gap between the US and the Eurozone in 2024. Does this skewed expectation create market opportunities?

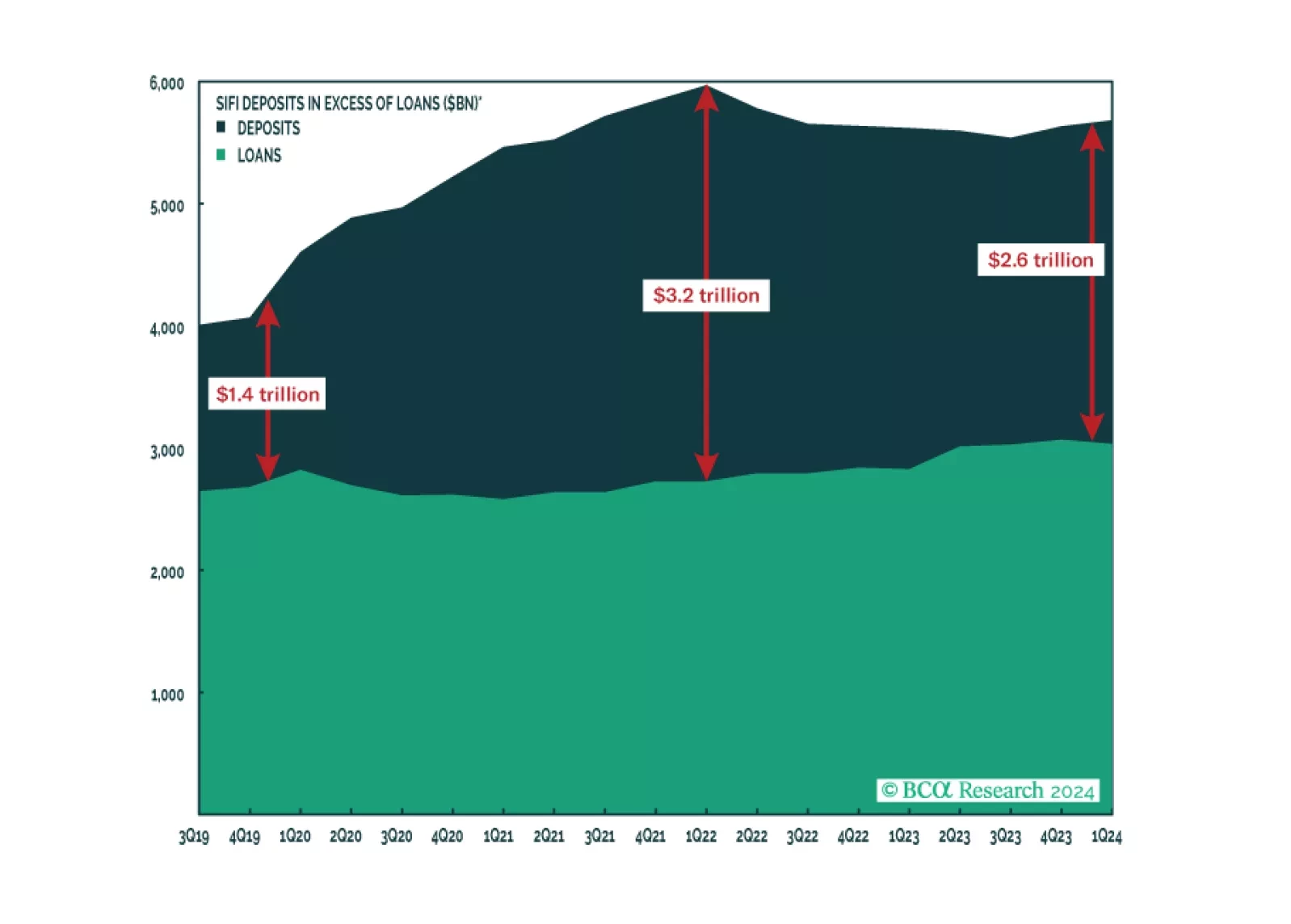

The latest edition of our Big Bank Beige Book suggests the expansion remains intact, though weakness in C’s private-label credit card portfolio could be a harbinger of distress among lower-income consumers. We remain tactically…

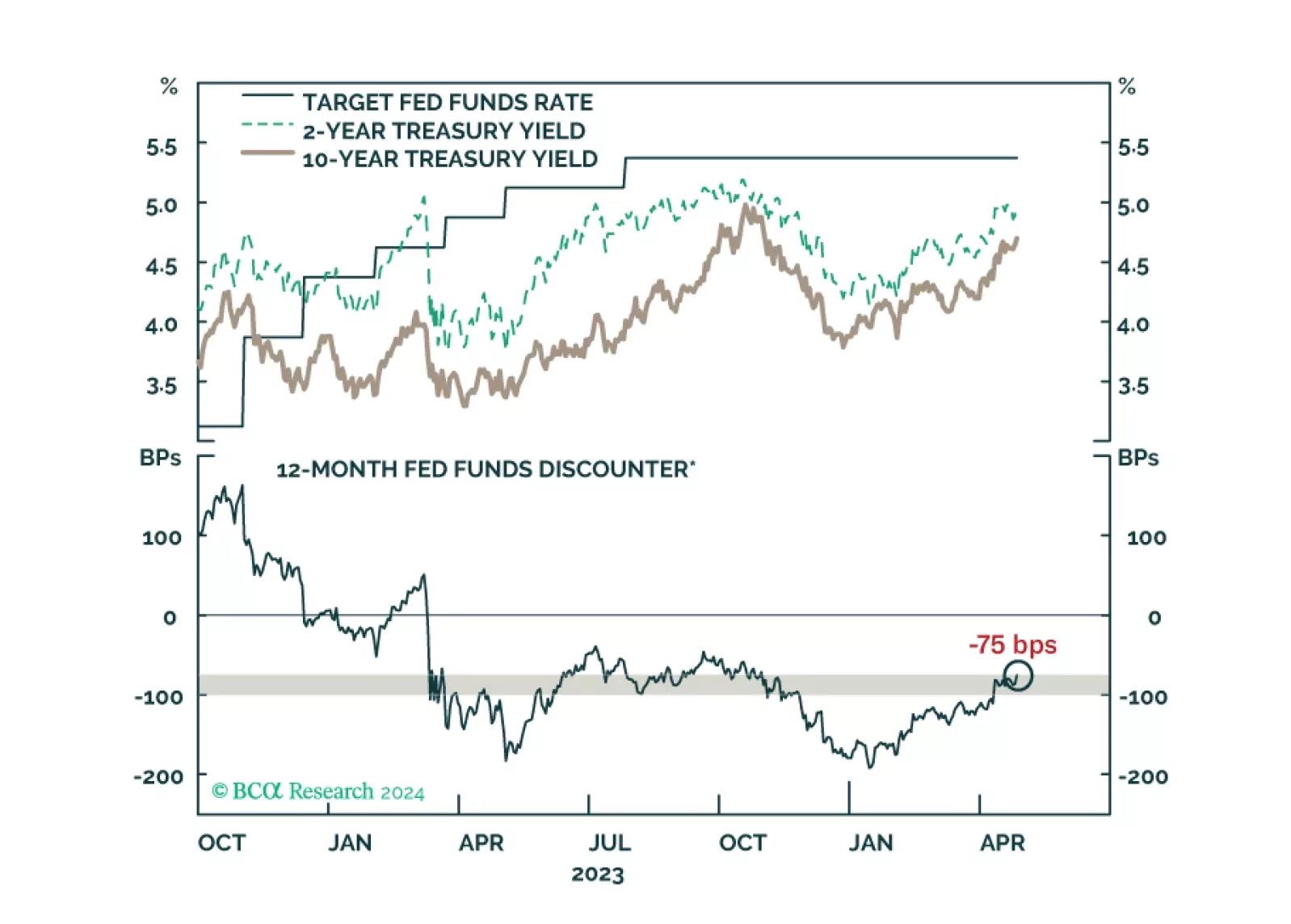

Our latest views on the recent increase in Treasury yields and some key things to watch at next week’s FOMC meeting.

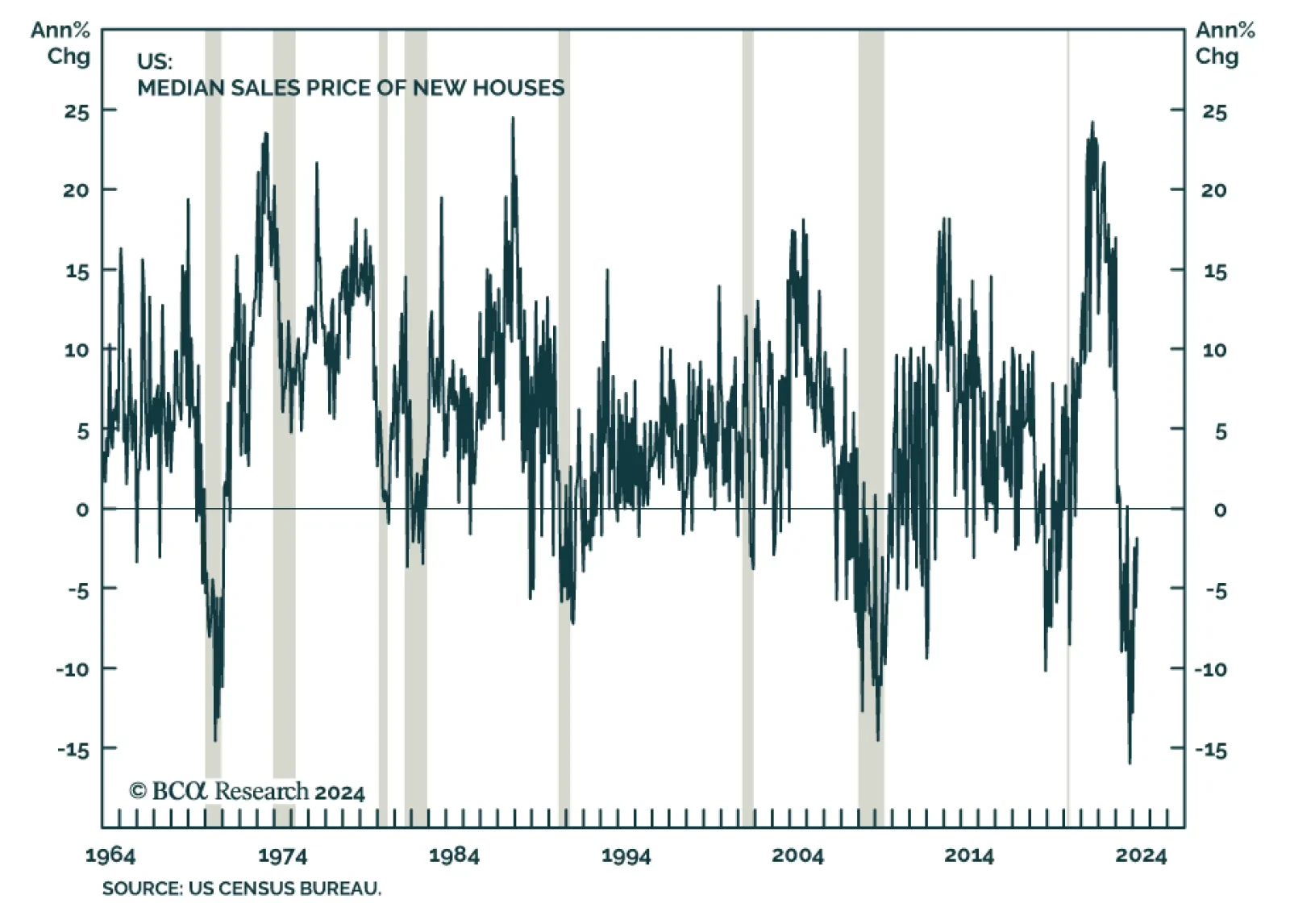

Throughout this cycle, US housing has defied expectations. Overall home prices have never fallen since the pandemic, even as the Fed has conducted its second most aggressive tightening campaign in history. Today, home price…

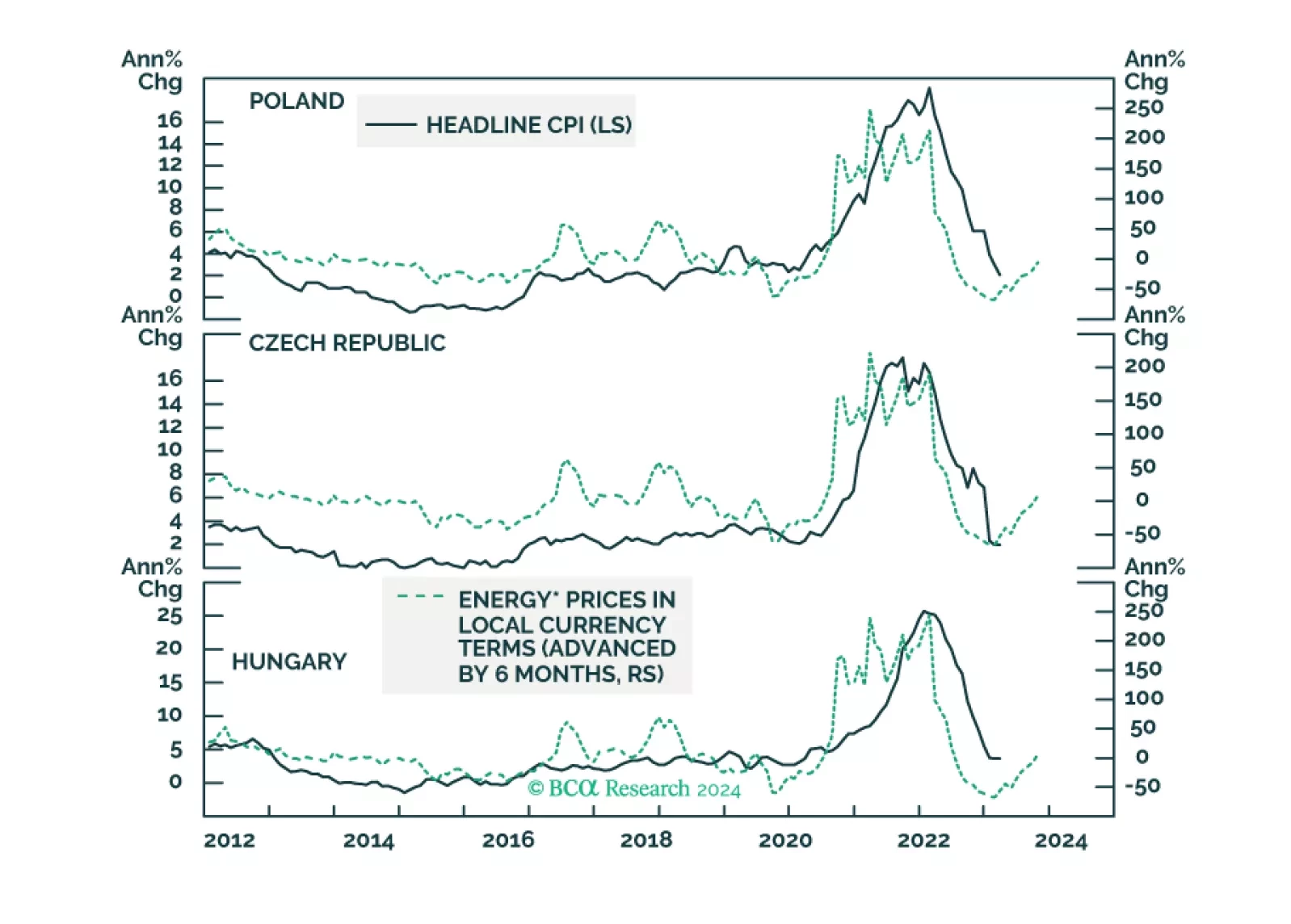

The disinflation process is over in Poland and Hungary. Only the Czech Republic will see its core inflation meet its central bank target this year. The reason is much tighter labor market dynamics in the first two. Investors should…

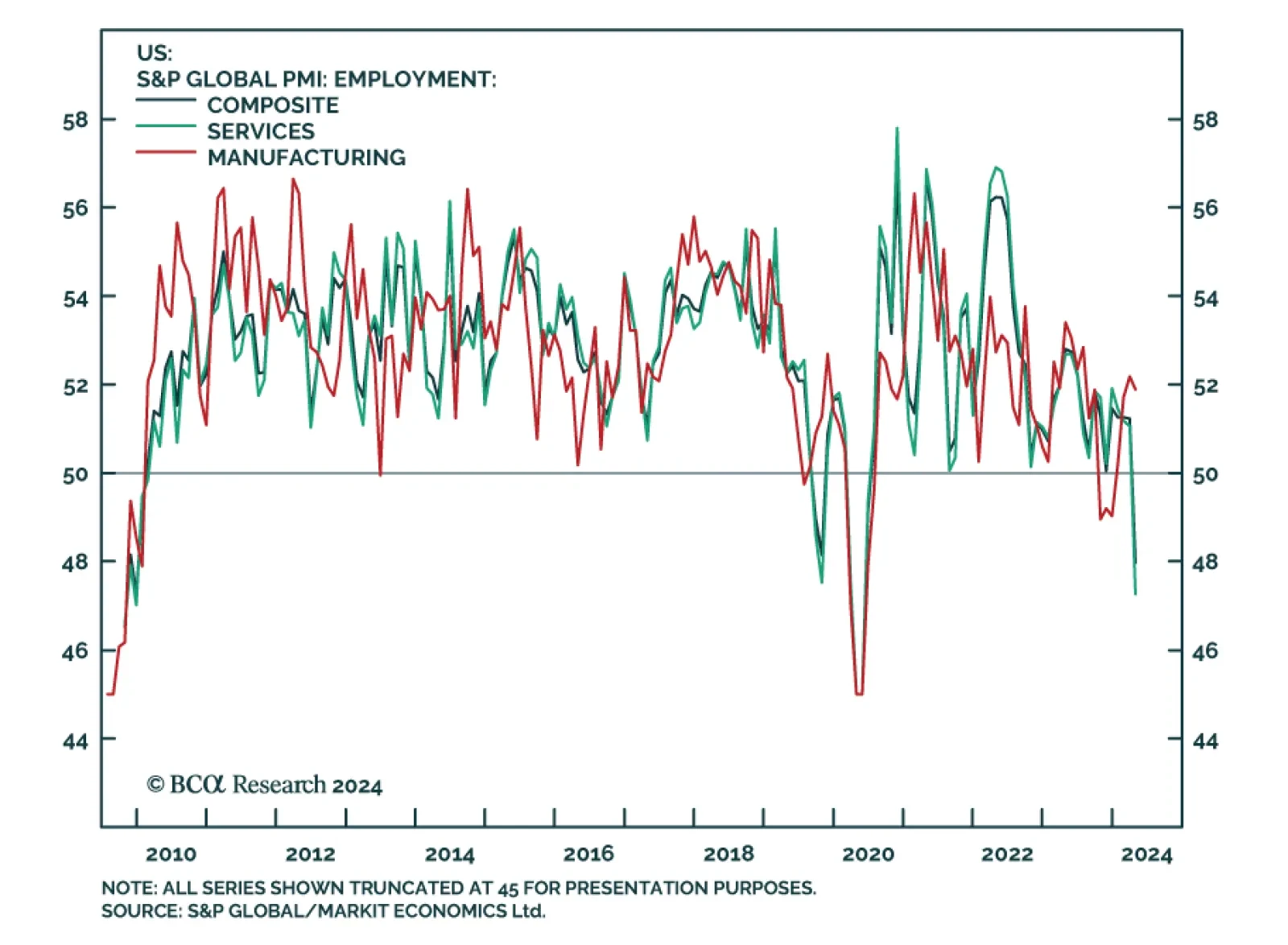

Preliminary S&P PMIs for the US showed the manufacturing index declined to contraction territory of 49.9 from 51.9, falling short of expectations of 52. The services PMI also disappointed coming in at 50.9, versus…

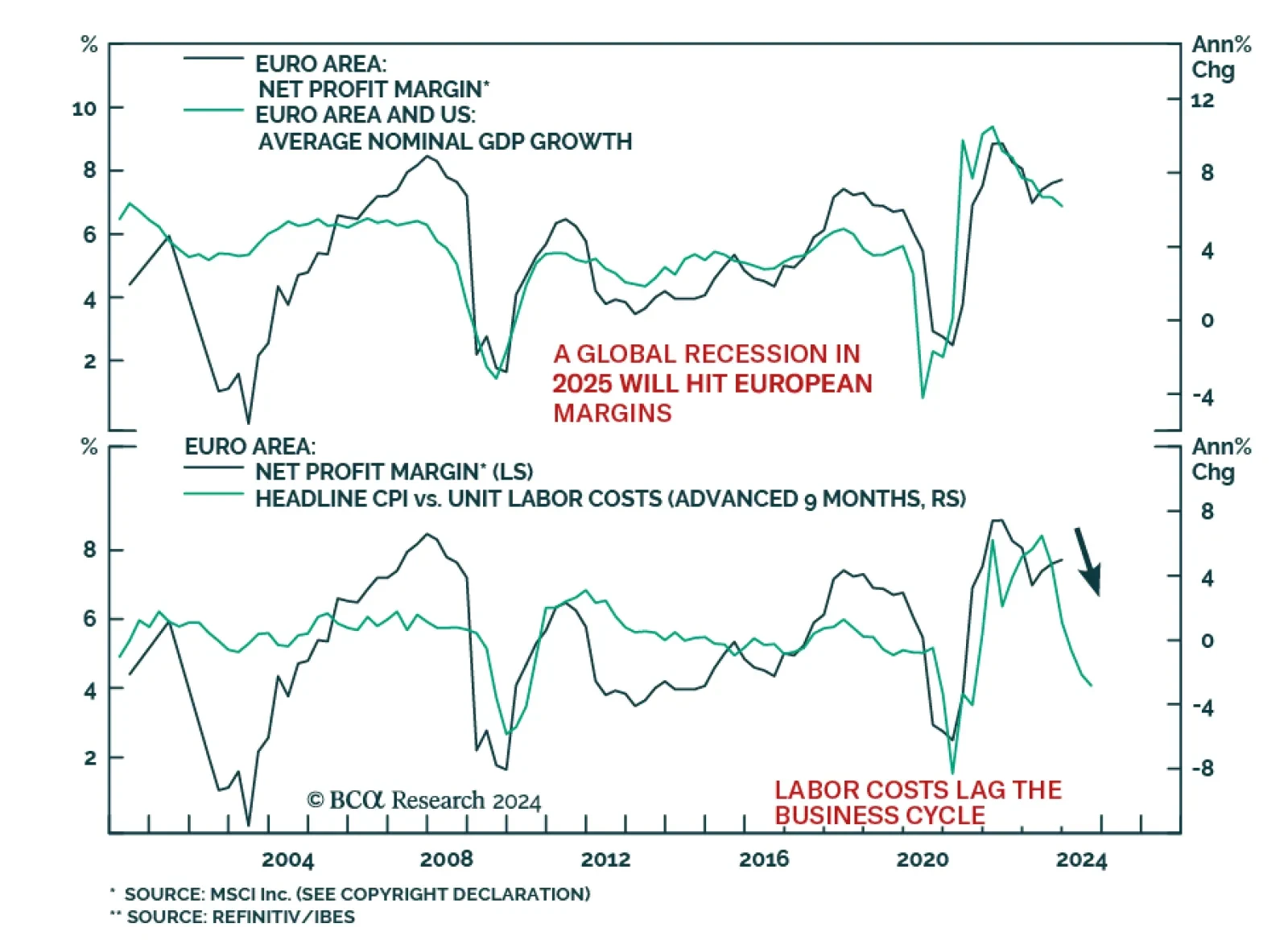

According to BCA Research's European Investment Strategy service, European profit margins have downside because they are both elevated and procyclical. European net margins stand at 7.7% above their long-term average…

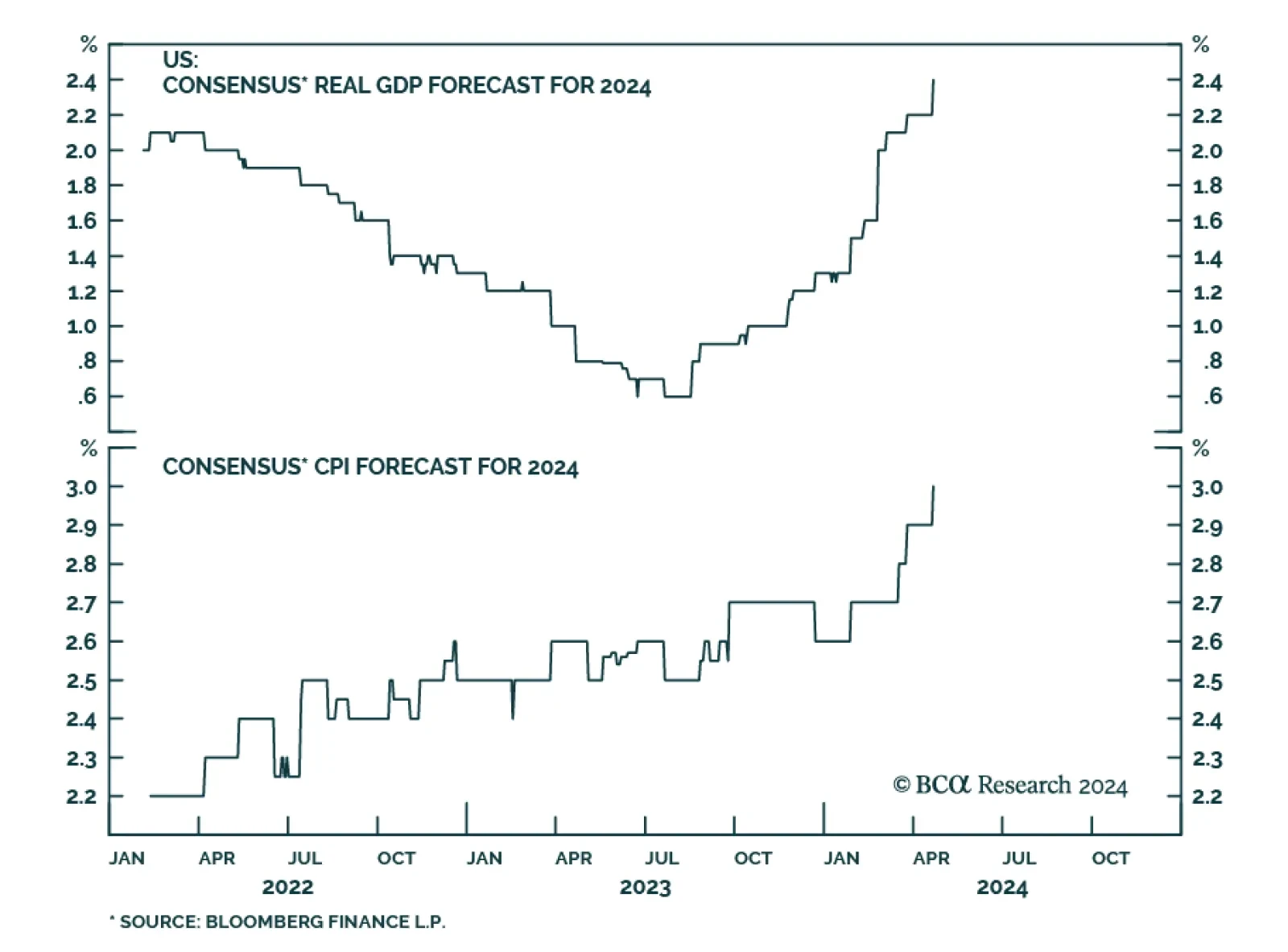

By the end of 2023, the “soft landing” scenario became the dominant narrative in financial markets. Following the regional banking scare in March of last year, market participants slowly came around to the view that…