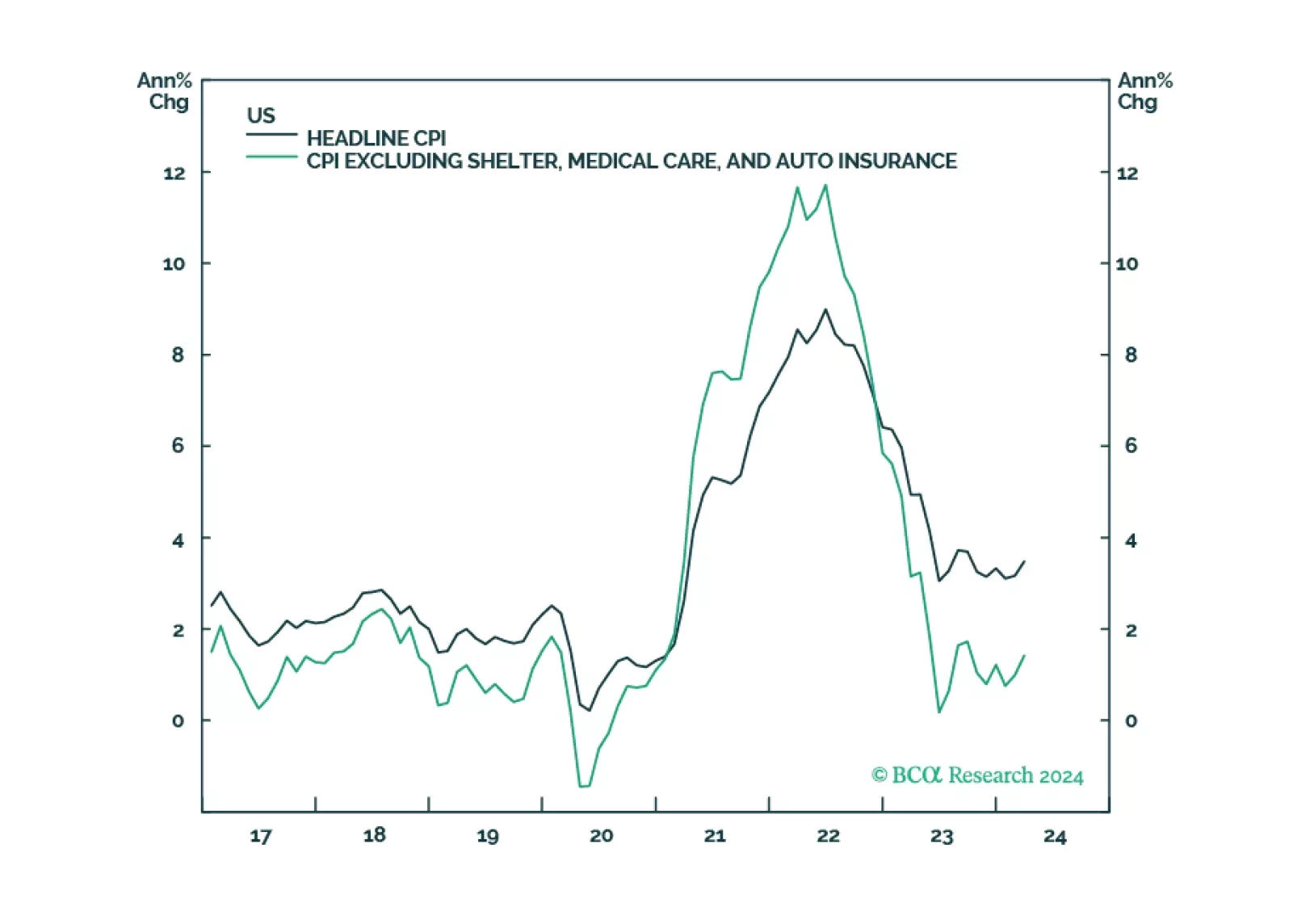

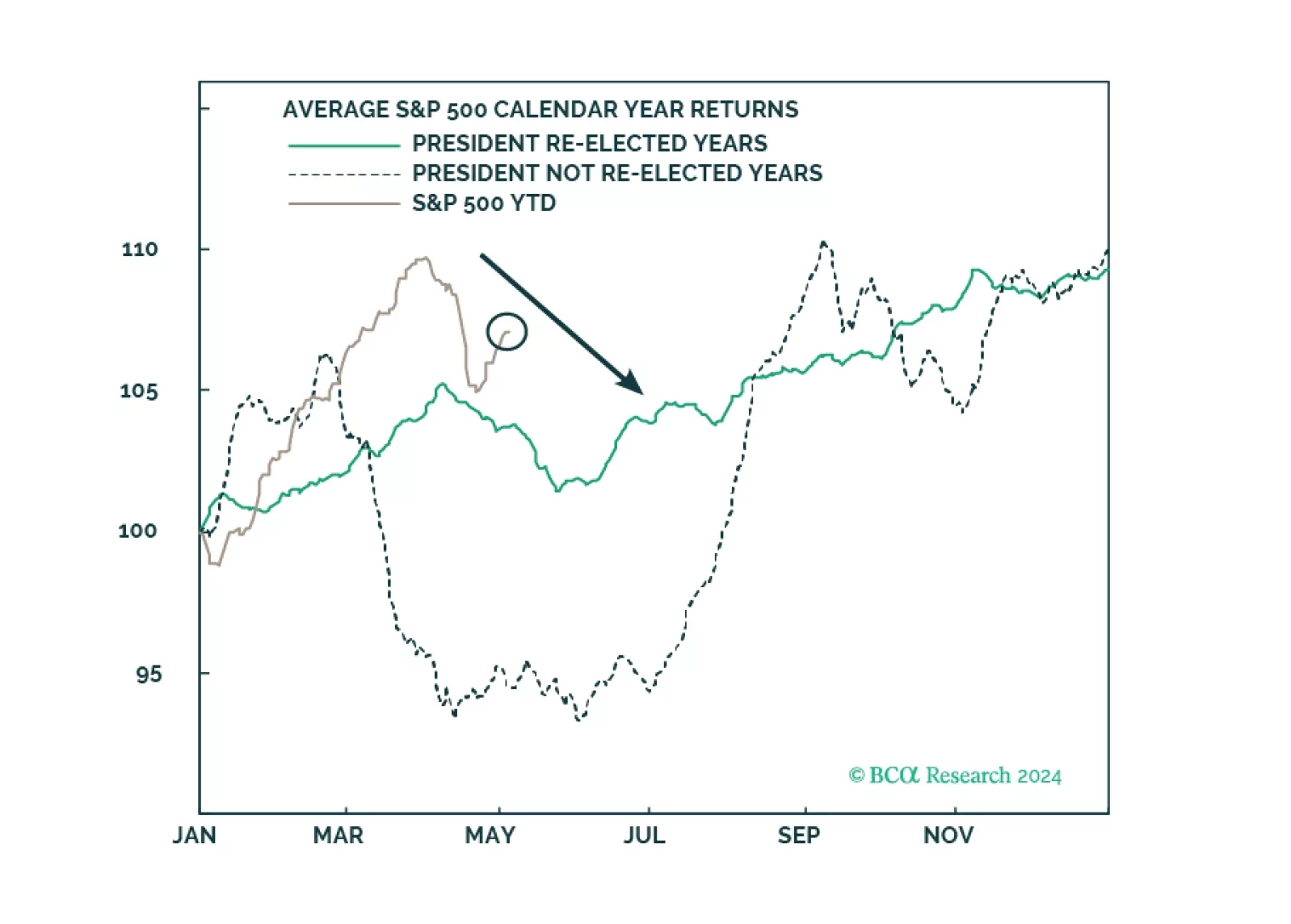

In this week’s report, we defend four out-of-consensus claims. Claim #1: Underlying inflation in the US is not reaccelerating. Claim #2: The US labor market is set to weaken abruptly. Claim #3: The S&P 500 will drop to 3700 in…

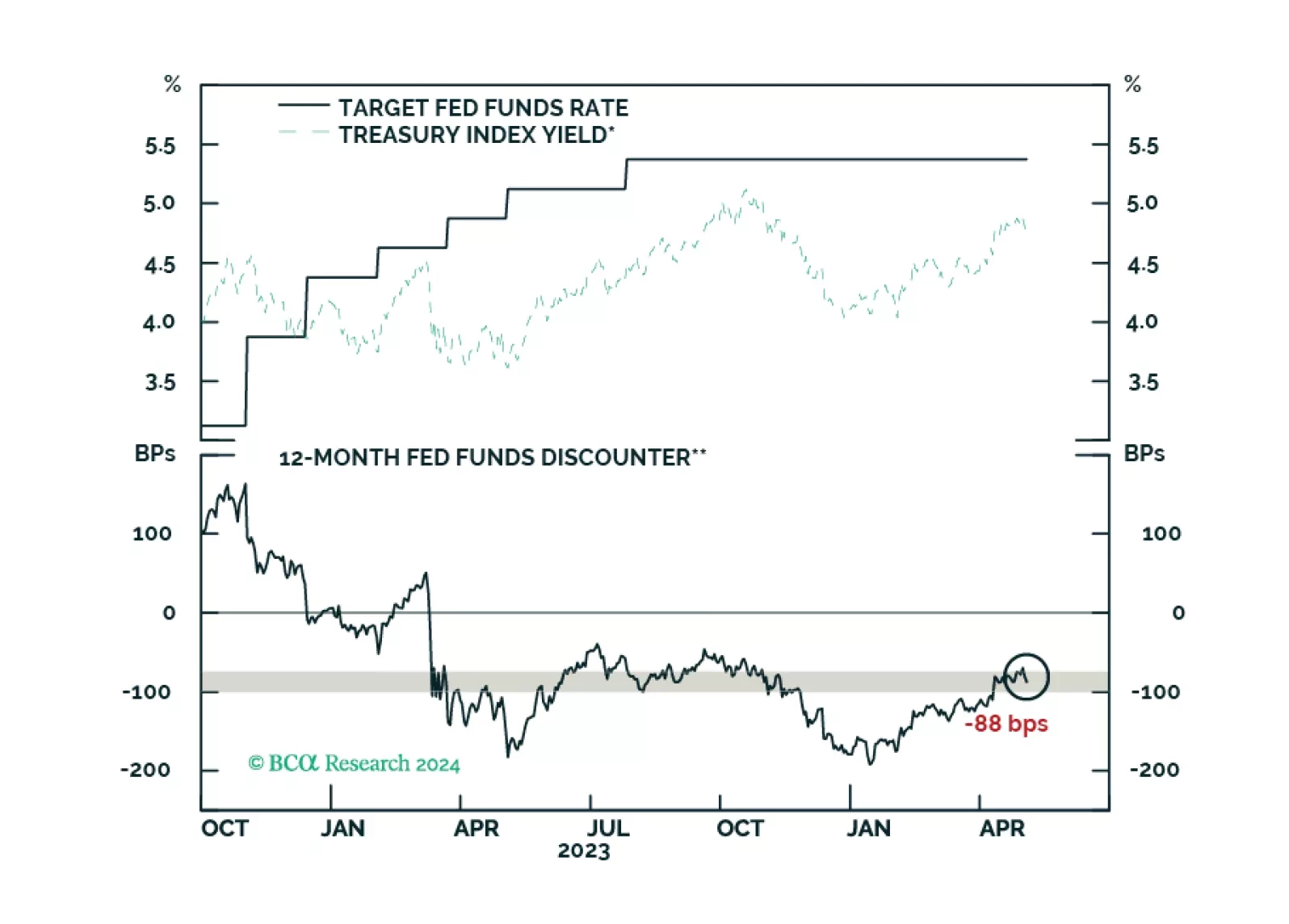

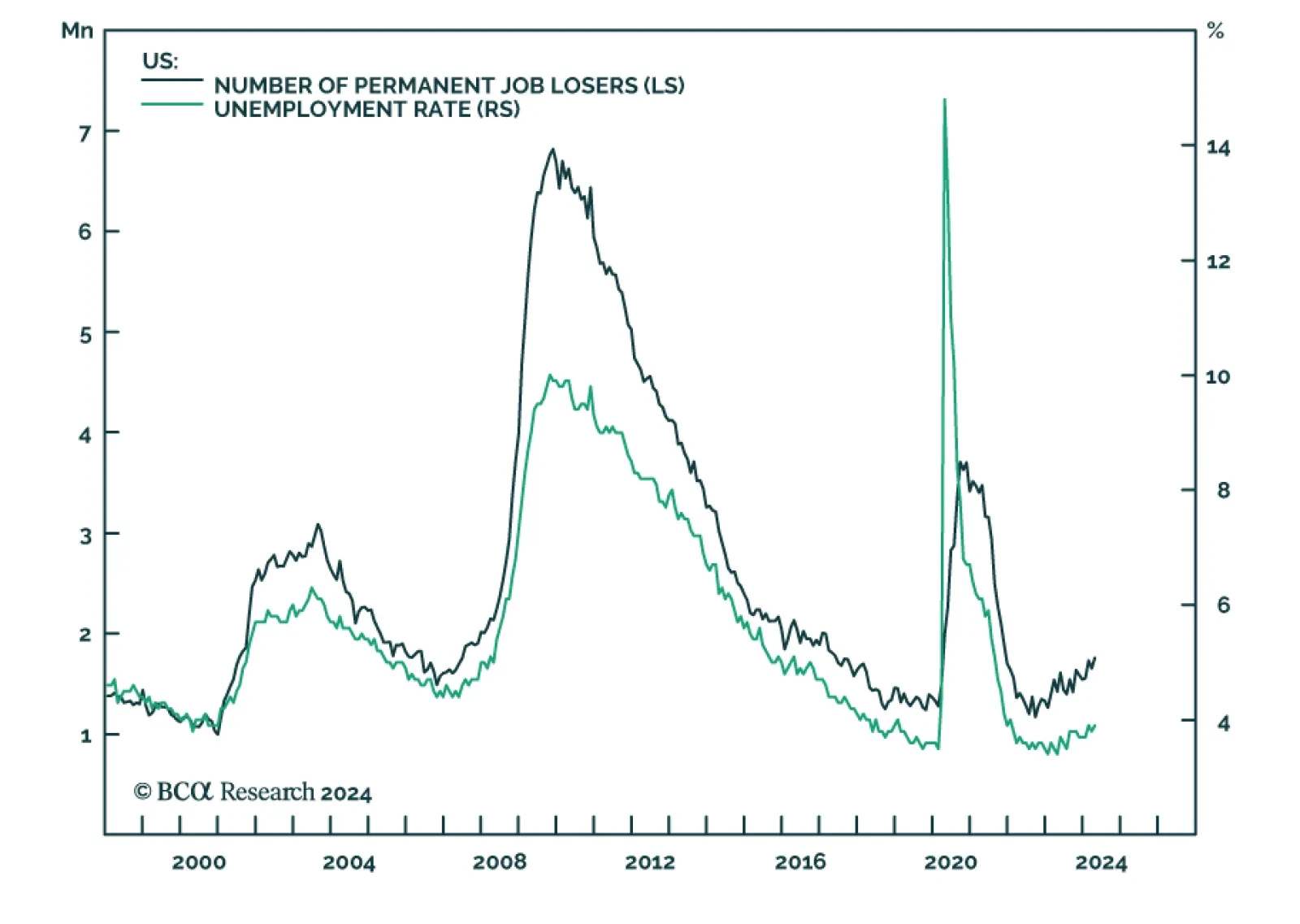

According to BCA Research’s US Bond Strategy service, while US economic data clearly show that labor demand has slowed from its peak two years ago, it isn’t yet clear whether this slowing represents a re-normalization…

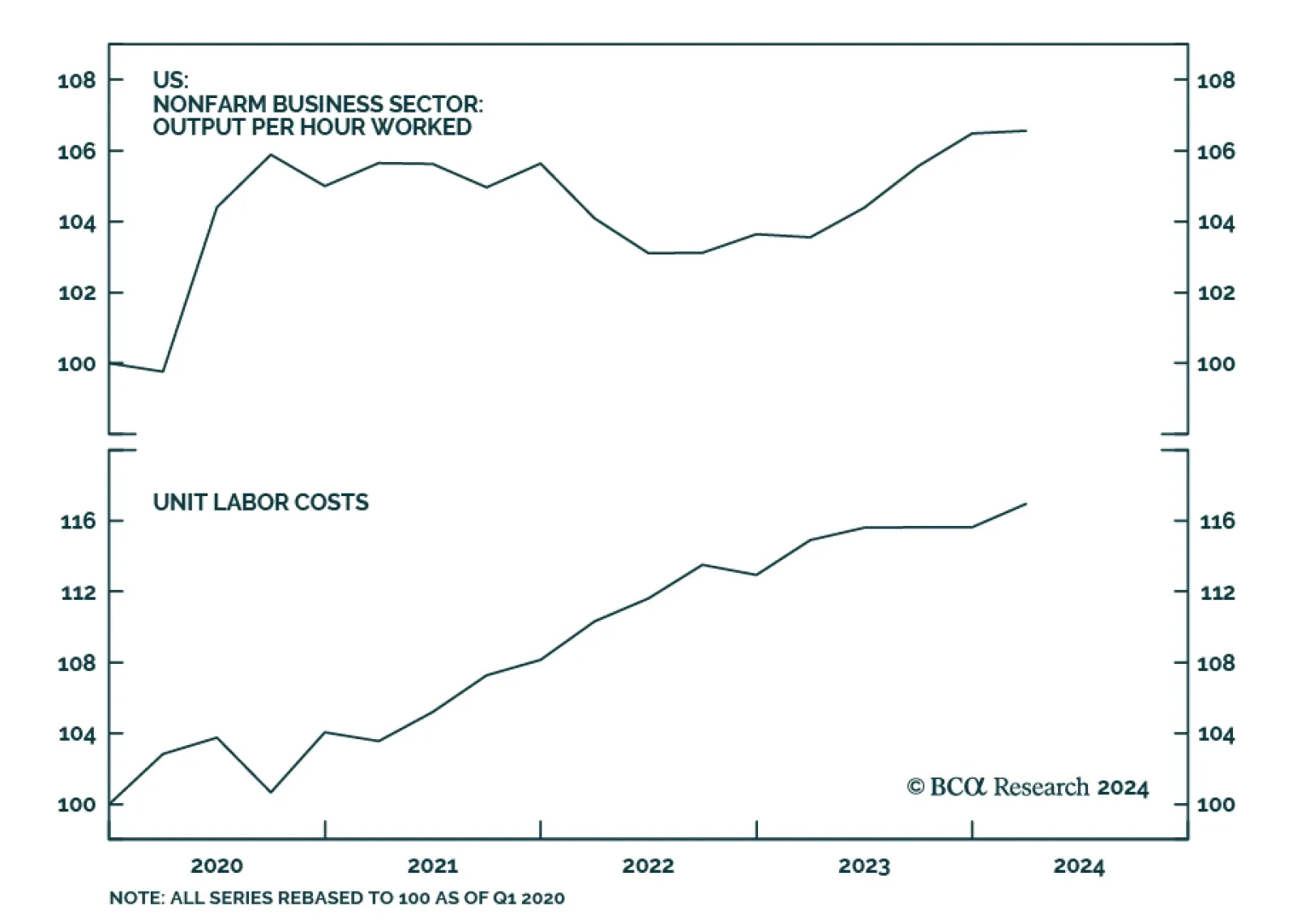

Average hourly earnings growth slowed to 0.2% m/m in April from 0.3% m/m in March and came in below expectations. On a year-on-year basis, they decelerated from 4.1% to 3.9%, the lowest since June 2021 and below expectations of 4…

Some thoughts on this morning’s employment report and recent trends in US economic data.

Investors should prepare for economic data to weaken even as policy uncertainty and geopolitical risk skyrocket ahead of the US election.

The preliminary nonfarm labor productivity estimate increased by an annualized 0.3% in Q1, below both the previous quarter’s 3.5% rate and expectations of 0.5%. Meanwhile unit labor costs increased by 4.7% annualized in Q1…

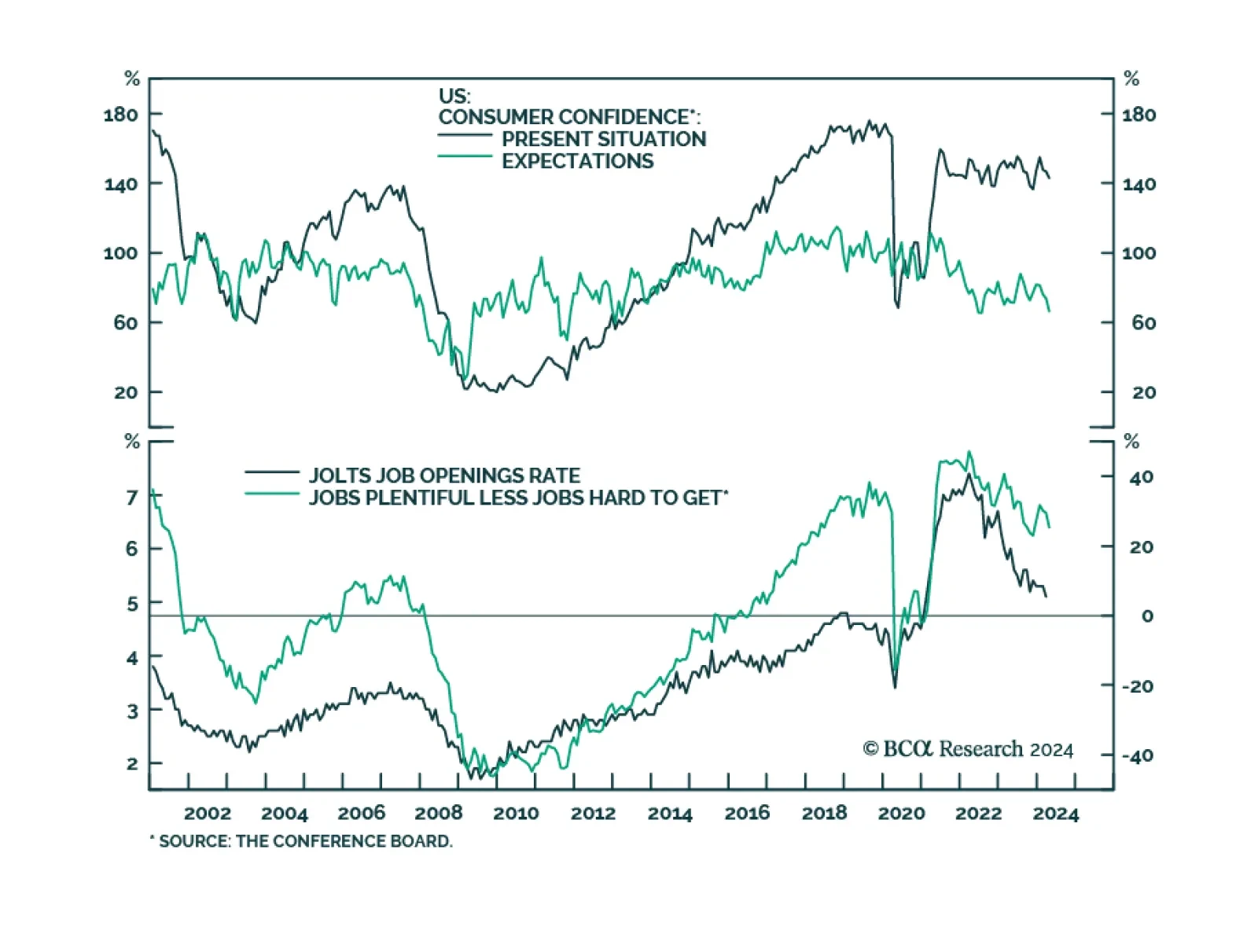

The Conference Board’s gauge of consumer confidence largely disappointed in April. 3.9- and 7.6-point decreases in the Present Situation and Expectations subcomponents, respectively, drove the overall index to a 22-month…

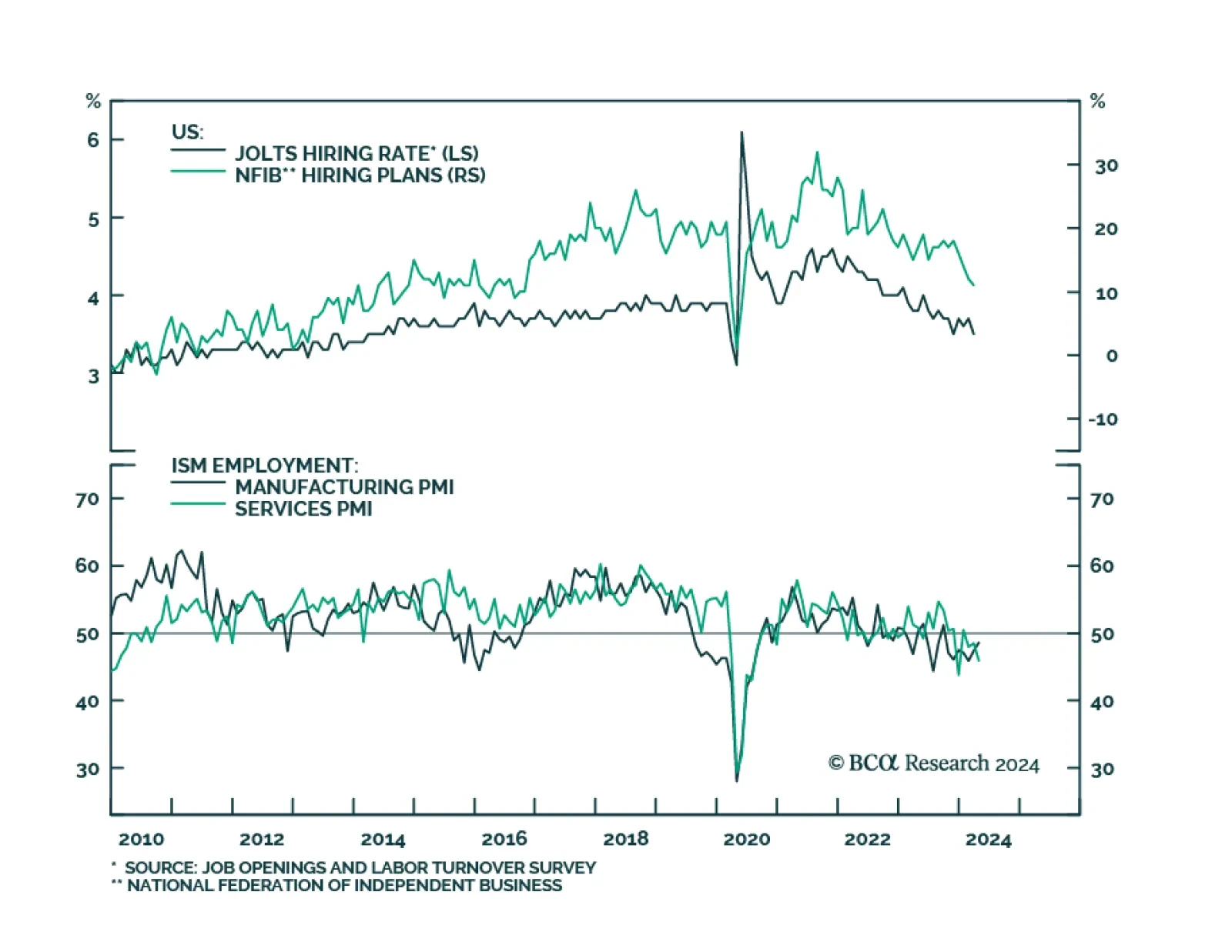

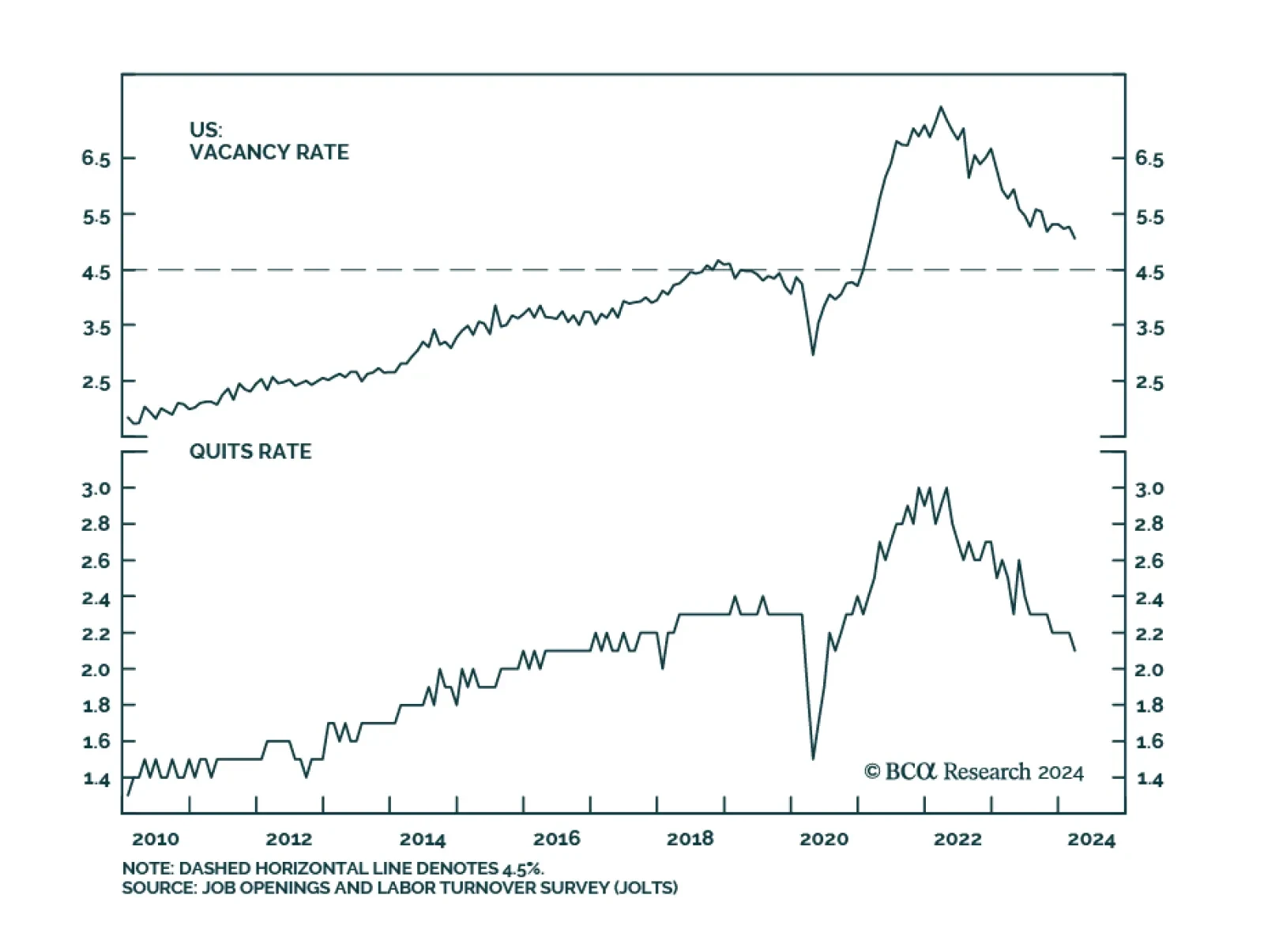

The details of the JOLTS report showed a labor market that continued to cool in March. The number of US job openings decreased to 8.488 million in March, from 8.813 million in February, and below expectations of 8.680 million…

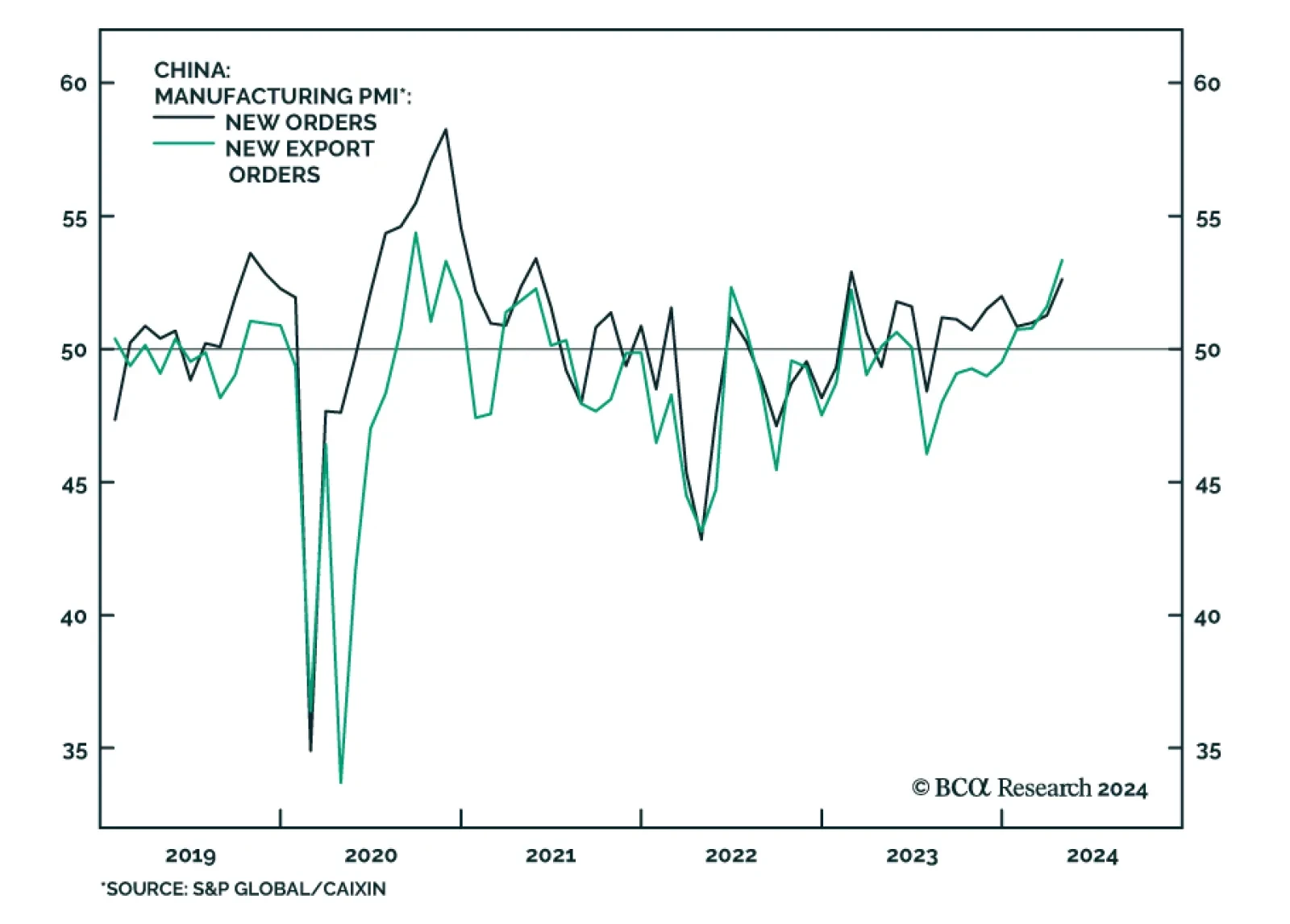

The Chinese NBS non-manufacturing PMI came in at 51.2, below the previous month’s number of 53 and below expectations of 52.2. Moreover, the NBS manufacturing PMI also decreased to (a better-than-expected) 50.4 in April…