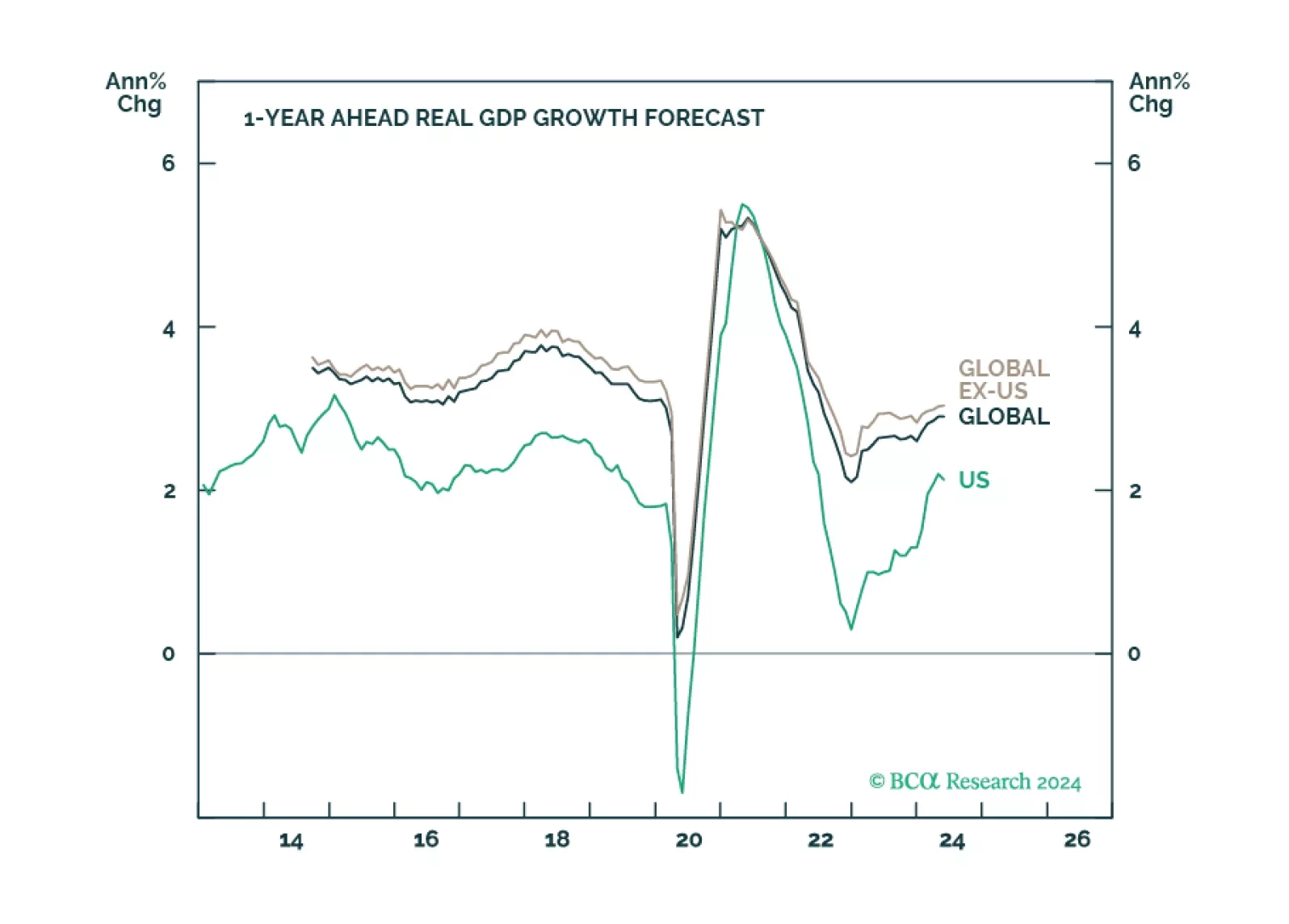

Looking at economic activity, global monetary policy seems restrictive, however, the behavior of financial markets tells a different story. What gives?

The signs of an approaching recession are starting to emerge. We will turn tactically defensive once they all fall into place.

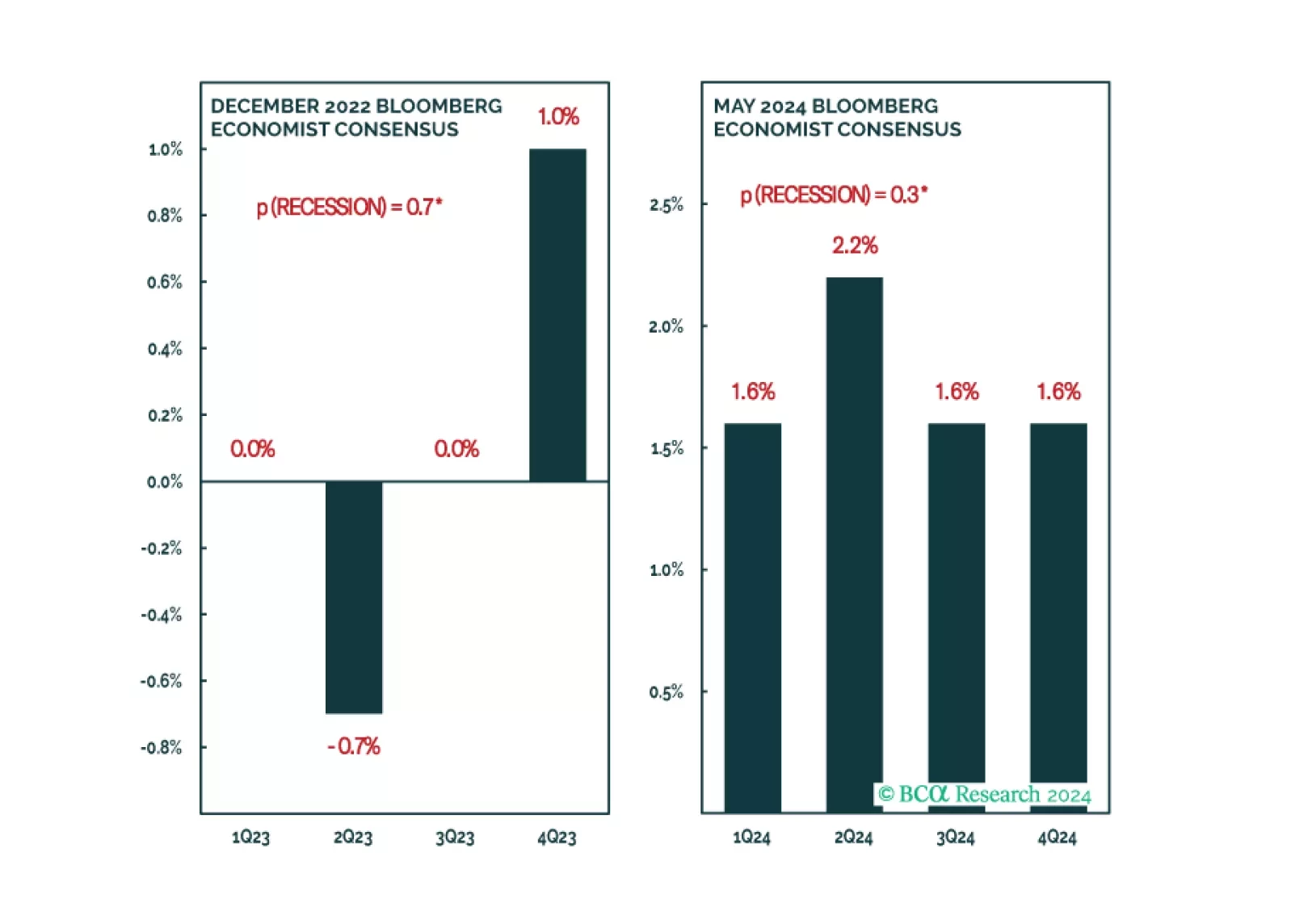

There is a path to a soft landing, but it is a narrow one. We estimate that there is only a 20% chance that the US will avoid a recession before the end of 2025. We are currently neutral on global equities, but expect to downgrade…

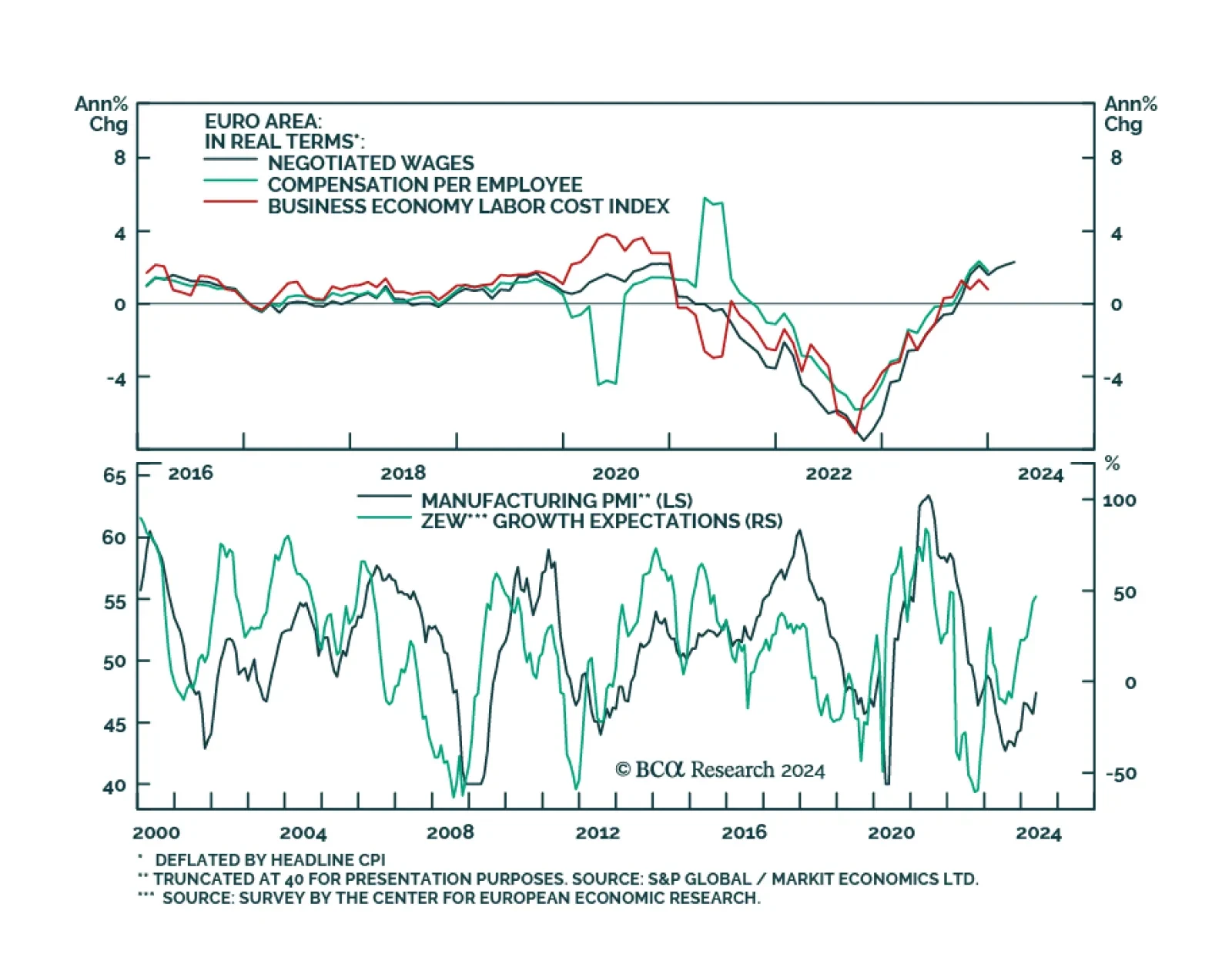

Negotiated wages rose 4.7% y/y in Q1, from 4.5% y/y in Q4 in the Eurozone. Meanwhile, preliminary estimates for the Eurozone Composite PMI surprised to the upside in May. Although wage growth is the main driver of services…

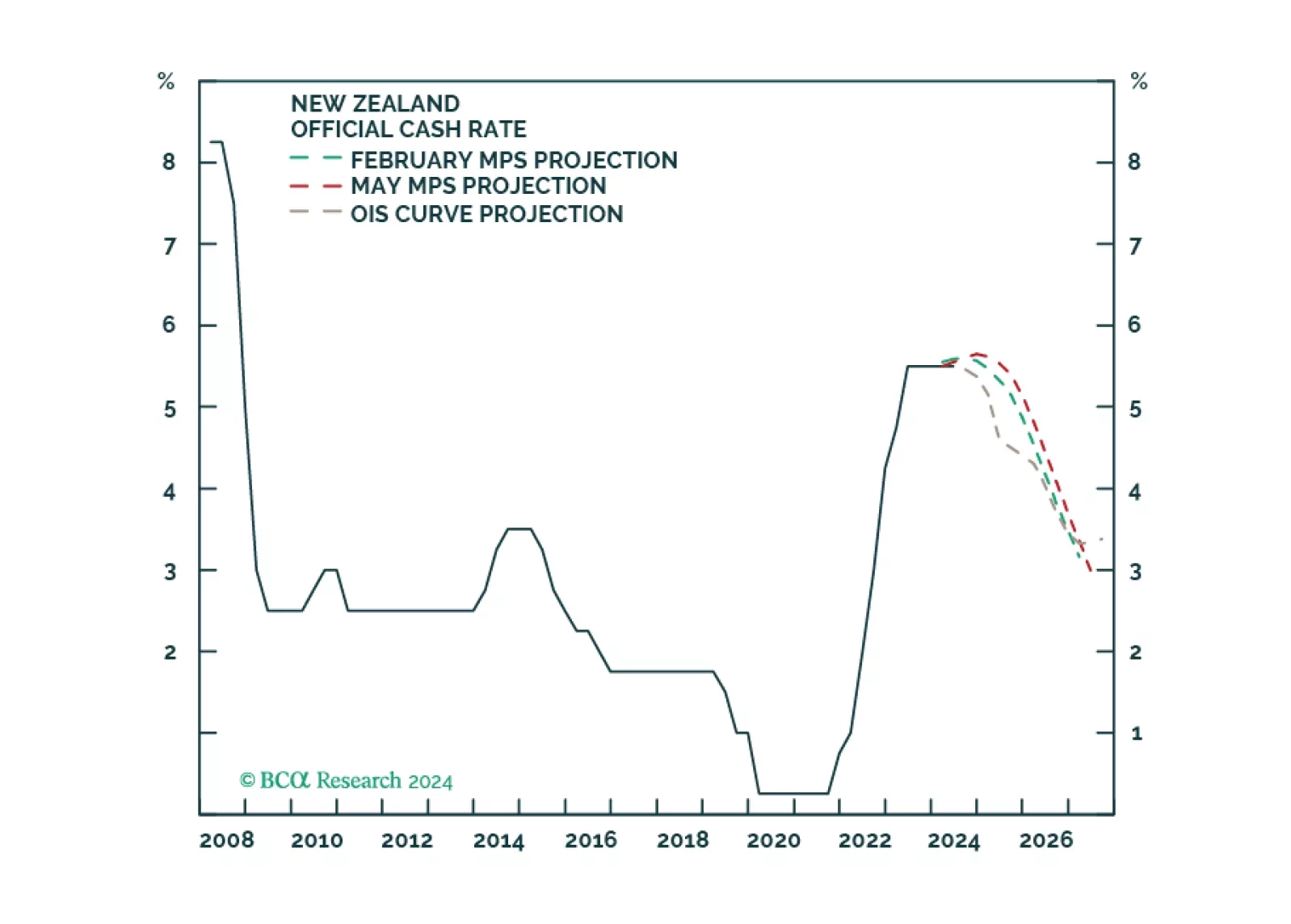

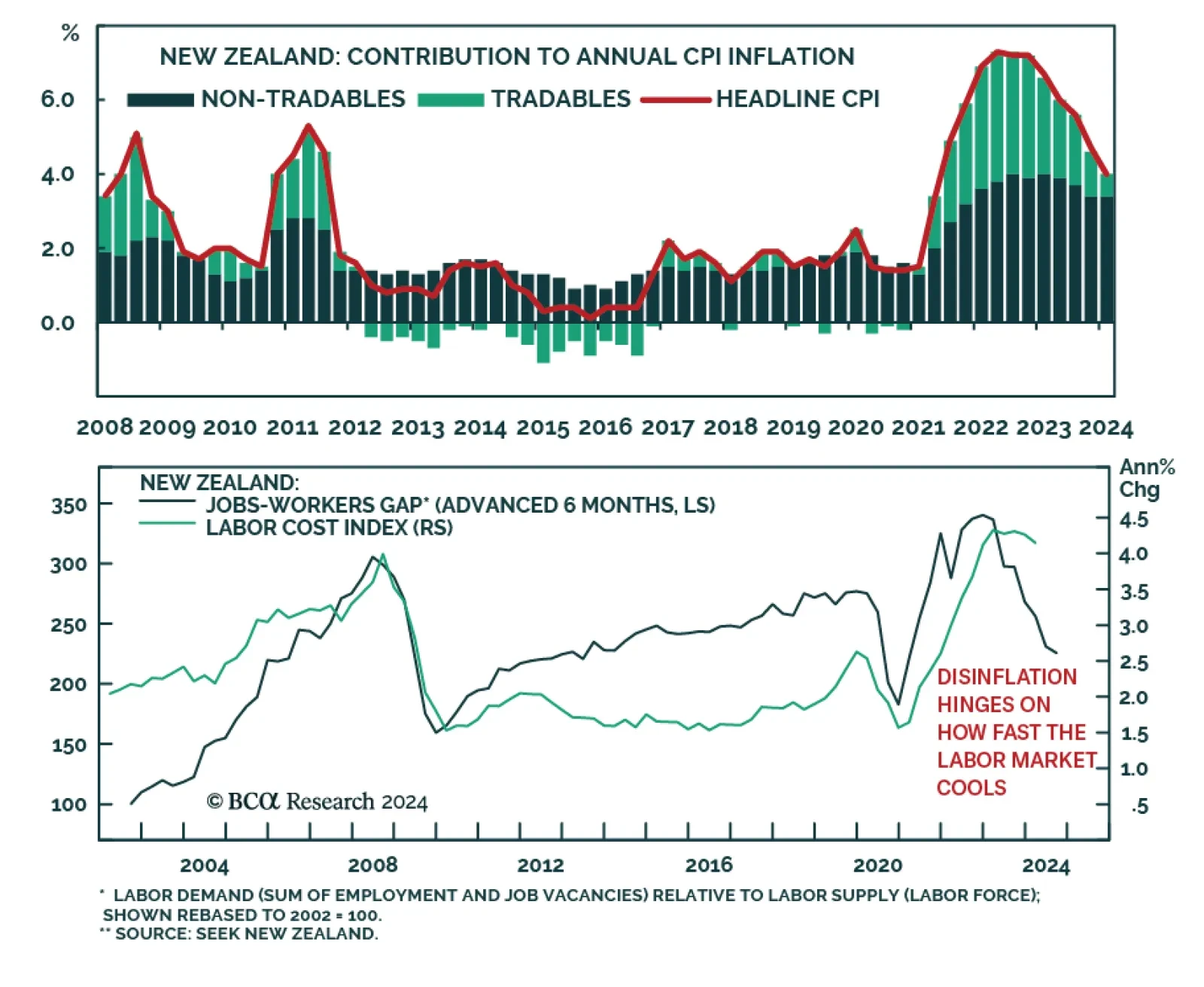

The Reserve Bank of New Zealand (RBNZ) kept interest rates on hold at this week’s monetary policy meeting, in line with expectations. However, there were three new notes from its monetary policy statement that will likely…

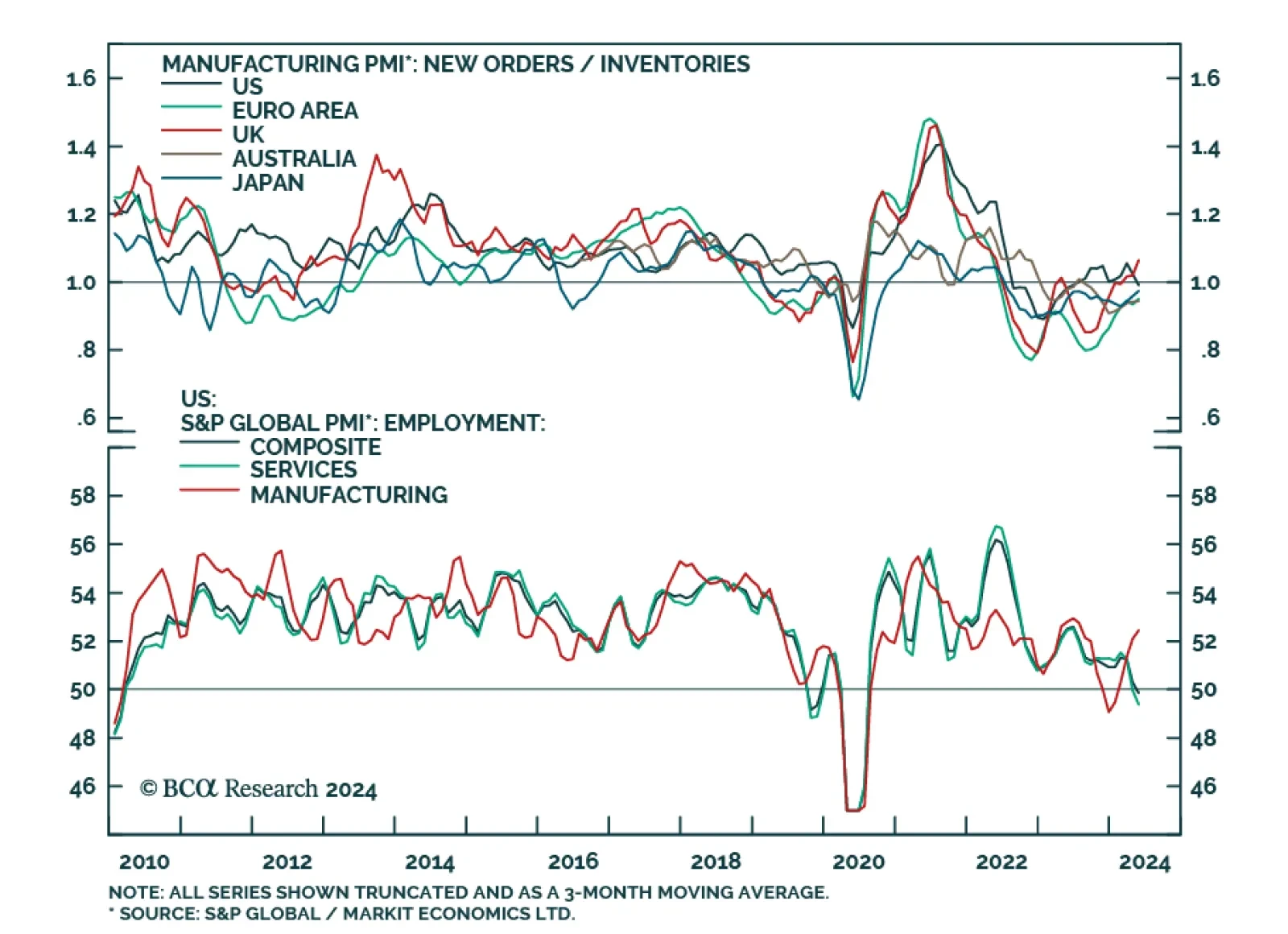

Preliminary estimates suggest that manufacturing activity generally improved across DM economies in May. Manufacturing PMIs for the US, the Eurozone, Japan and the UK all improved from their April levels. Notably,…

In this Insight, we revisit our "higher for longer" theme for the Reserve Bank of New Zealand, in light of the latest central bank meeting. In conclusion, we are inching towards a more dovish RBNZ ahead. Ergo, we recommend some fixed…

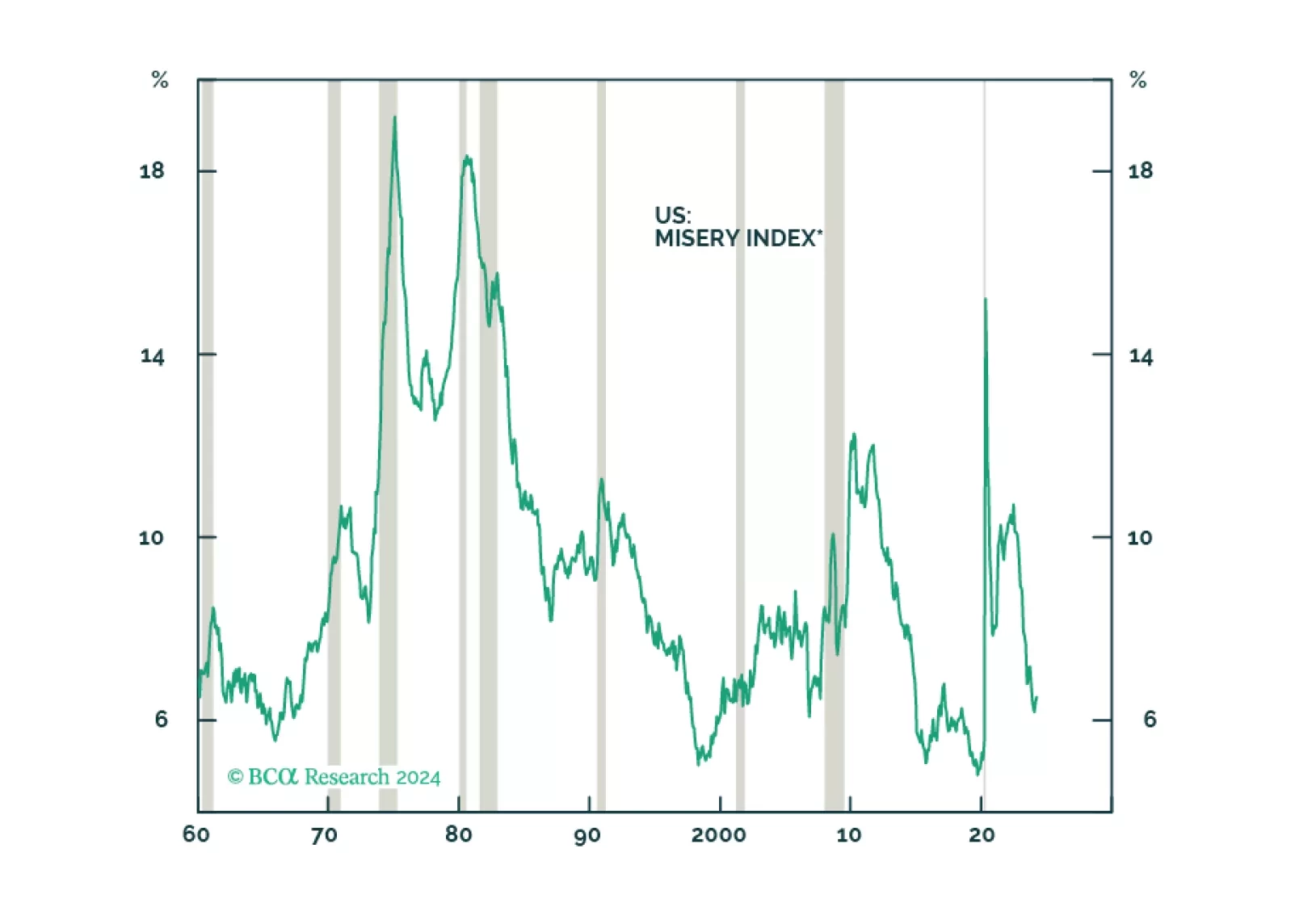

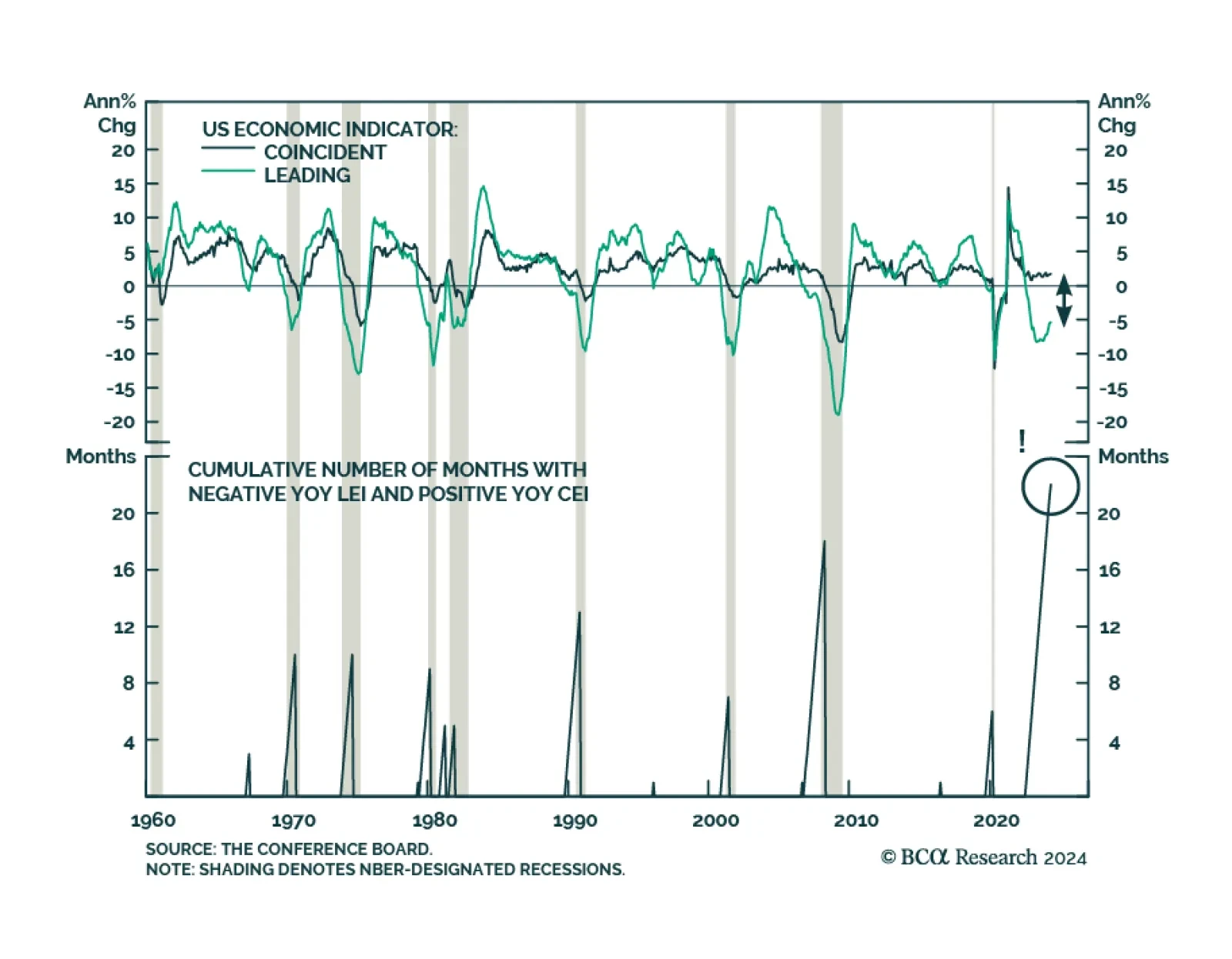

The Conference Board US Leading Economic Index (LEI) declined by a larger-than-expected 0.6% m/m in April from 0.3% m/m. Deteriorating consumer sentiment and manufacturing new orders led the overall decline. Contractions in…

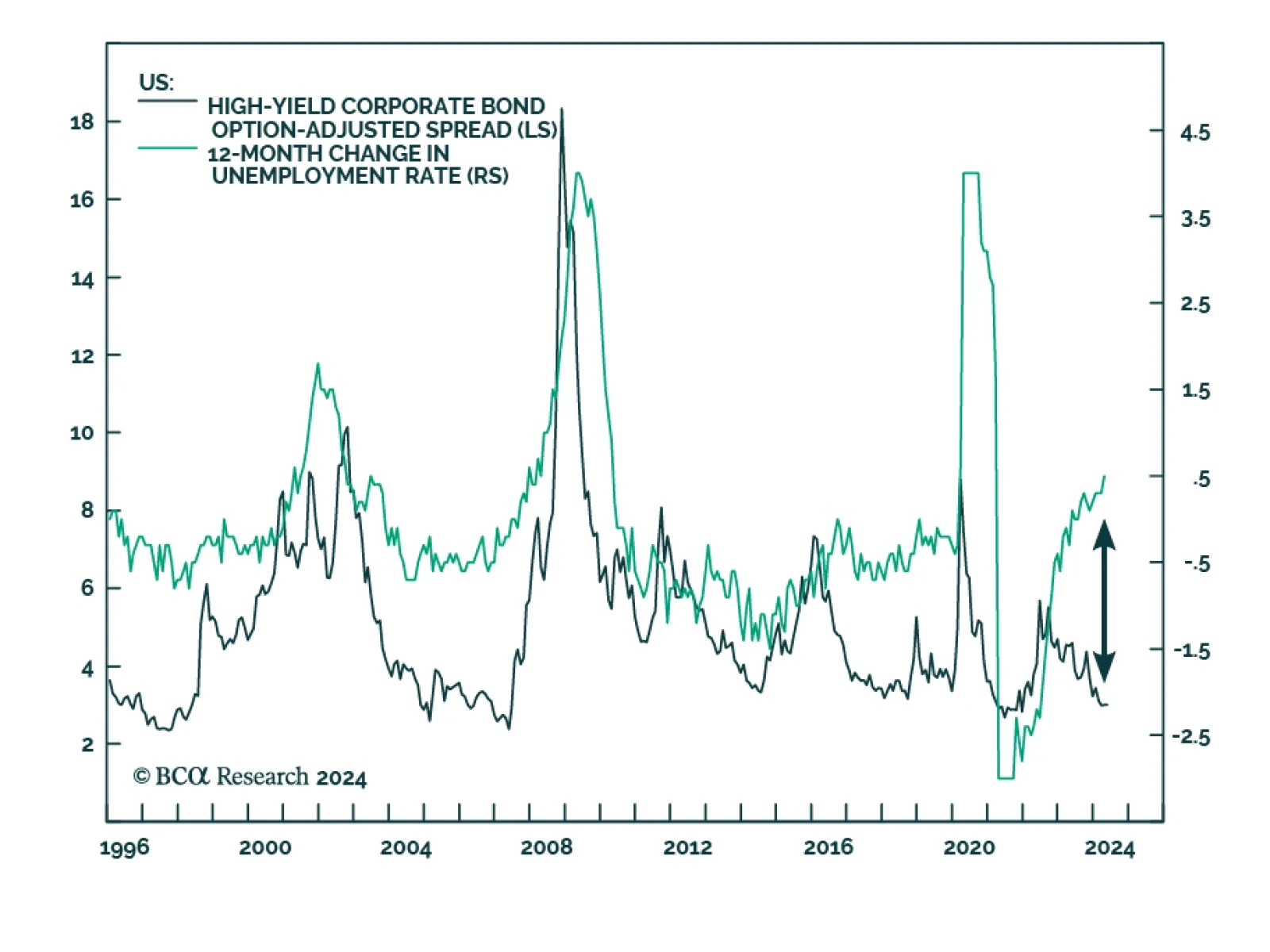

Credit spreads continue to price in a Goldilocks scenario. US investment grade and high-yield OAS have tightened 41 and 137 bps from their October peaks, resulting in handsome outperformance by both sectors relative to duration-…

The stock market will suffer a setback from the weakening labor market and a rebound in US and global policy uncertainty.