The US economy remains on a path towards a recession, most likely starting in late 2024 or early 2025. For now, investors should maintain a benchmark allocation to equities, but employ a barbell strategy of overweighting defensives…

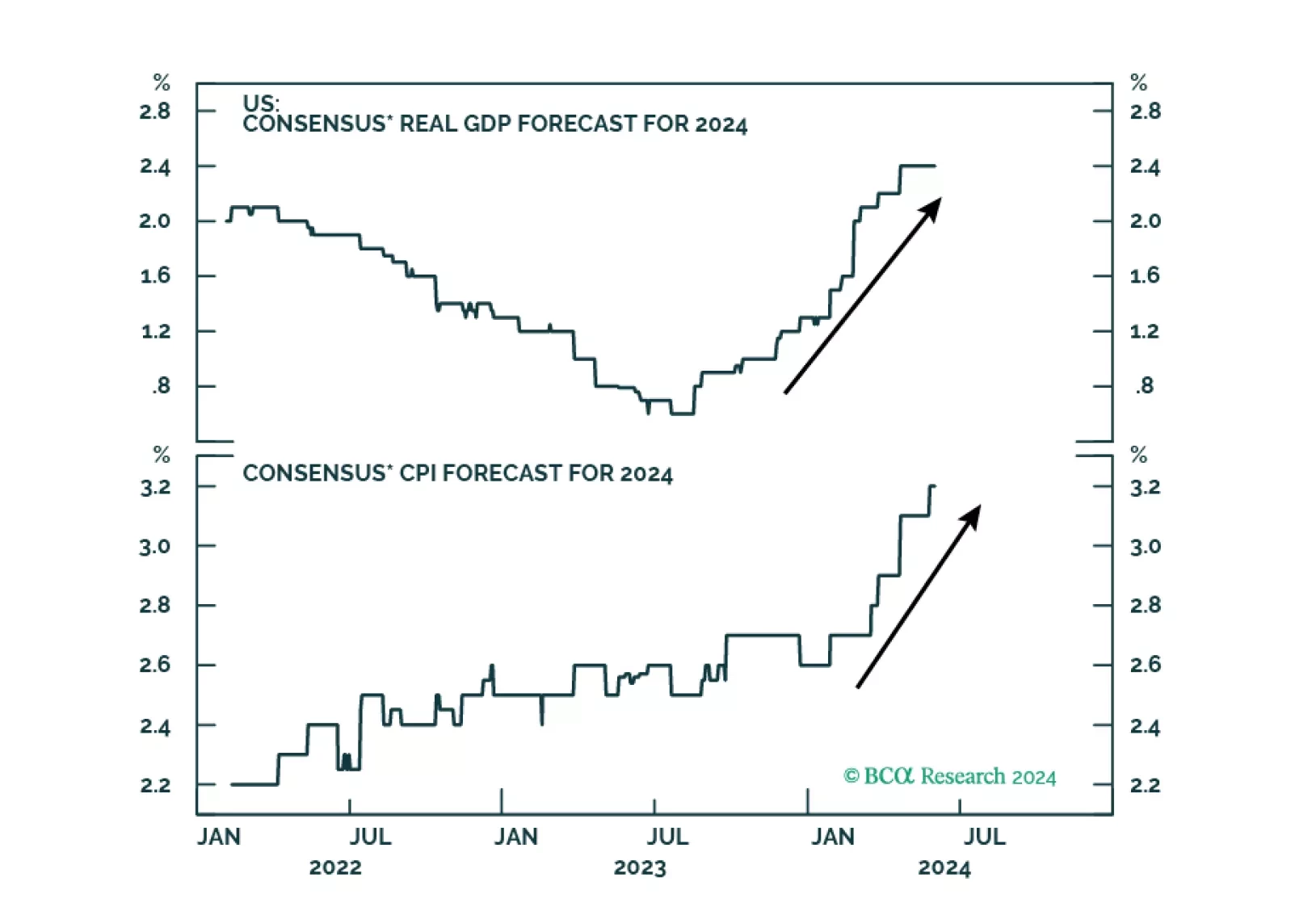

According to BCA Research’s Global Asset Allocation service, the economy has been in the “Overheating” phase of the cycle for a while, with signs of slowing growth but also stubbornly high inflation. The most…

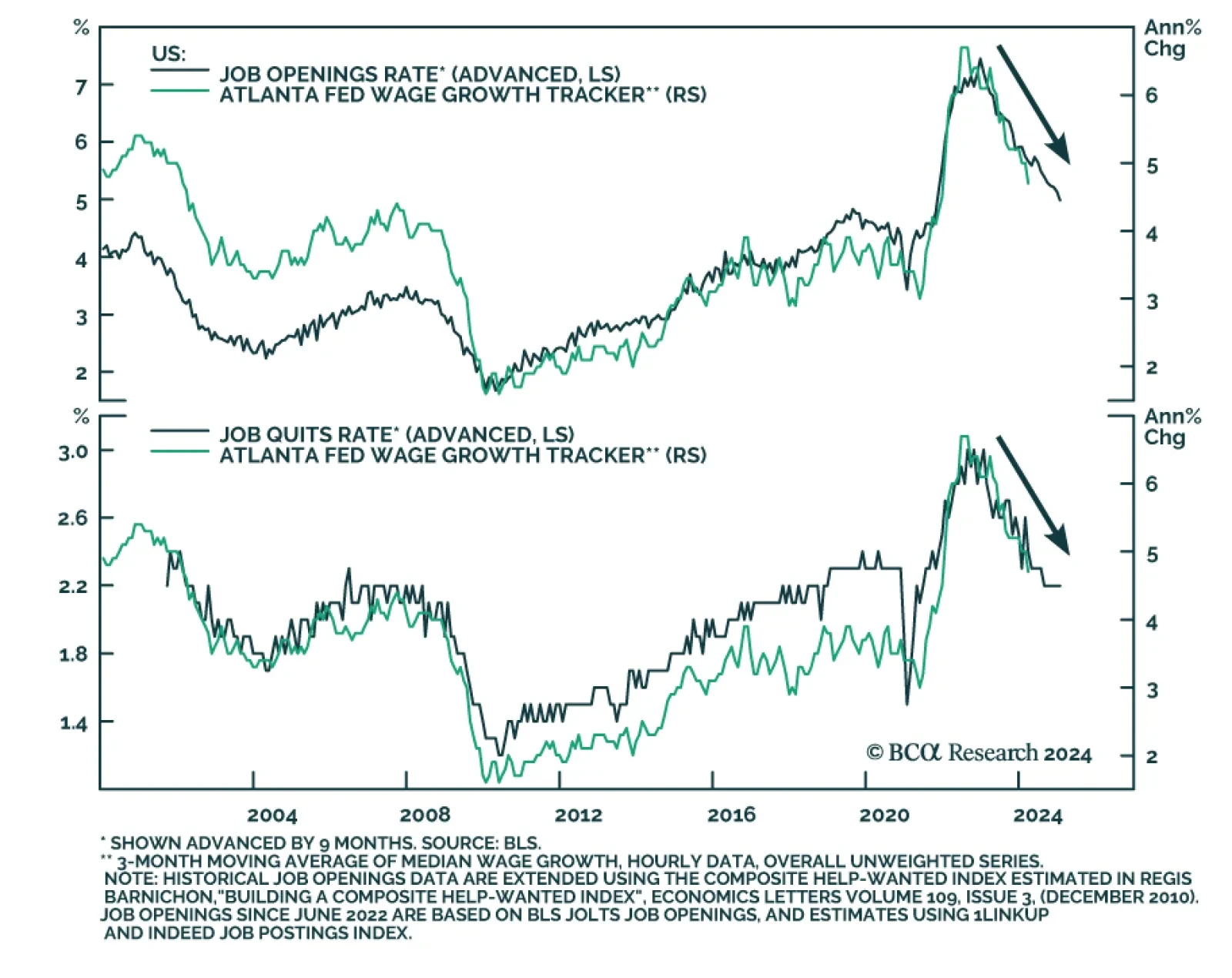

US job openings softened from 8.5 million in March to 8.1 million in April, below expectations of 8.4 million, and the lowest level in three years. Healthcare and social assistance, as well as leisure and hospitality, drove the…

The US economy is in the “Overheating” phase, so stronger growth brings higher inflation. Tight monetary policy means recession is still likely over the next 12 months. Stay defensive.

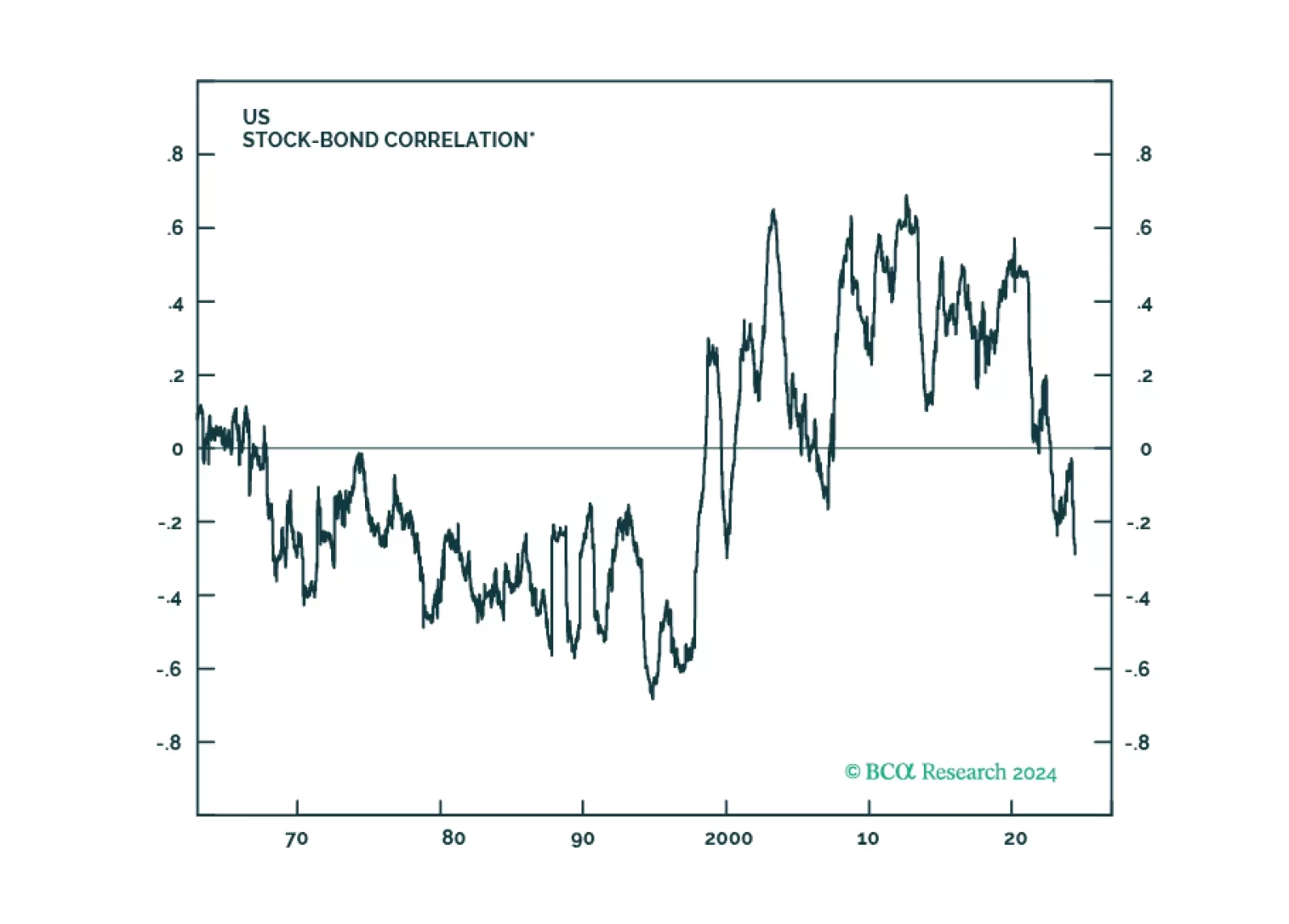

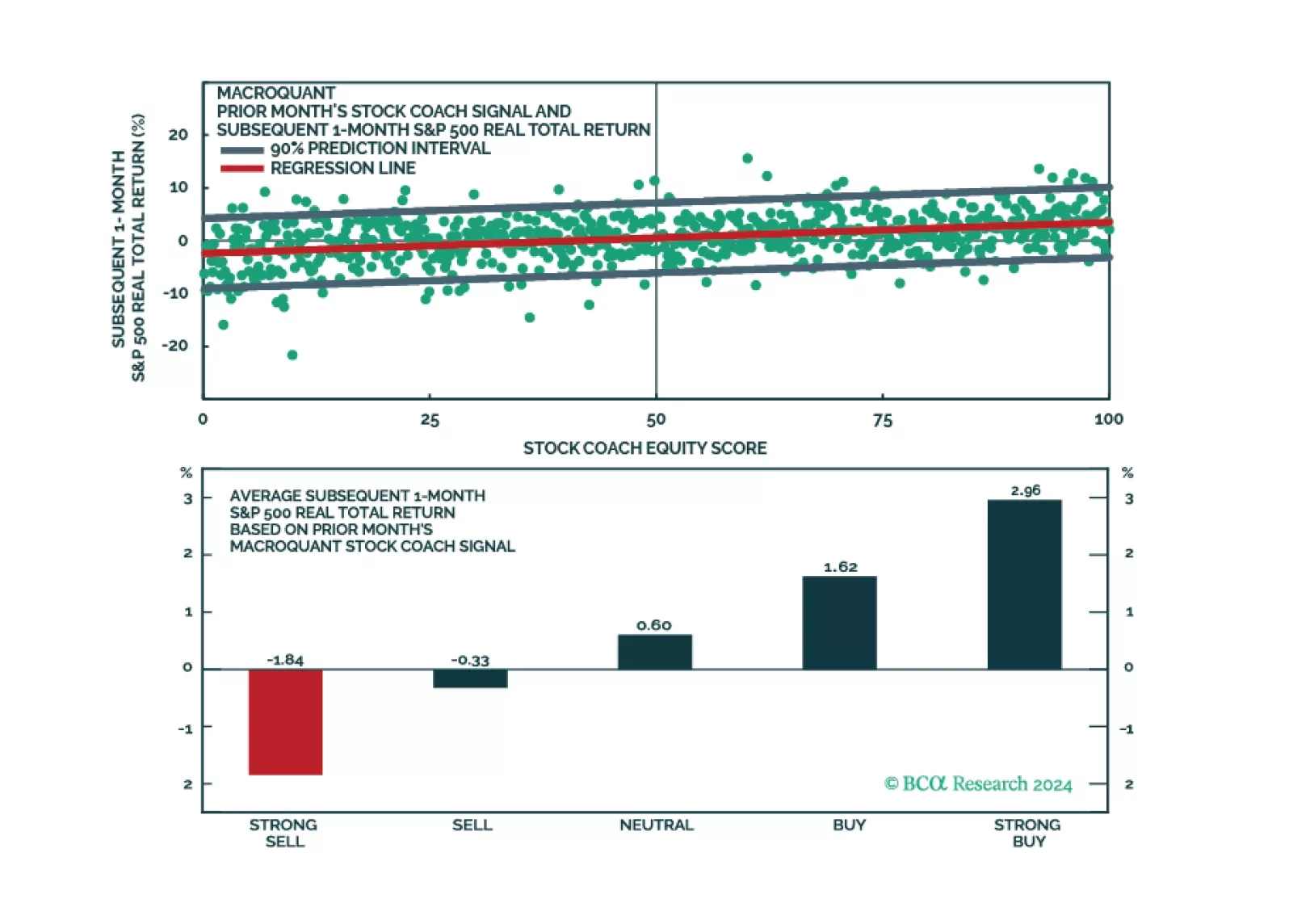

MacroQuant sees significant downside risks to stocks over a 1-to-3 month horizon and suggests increasing allocation to long-term bonds. The model favours defensive equity sectors but is also hedging its bets by overweighting…

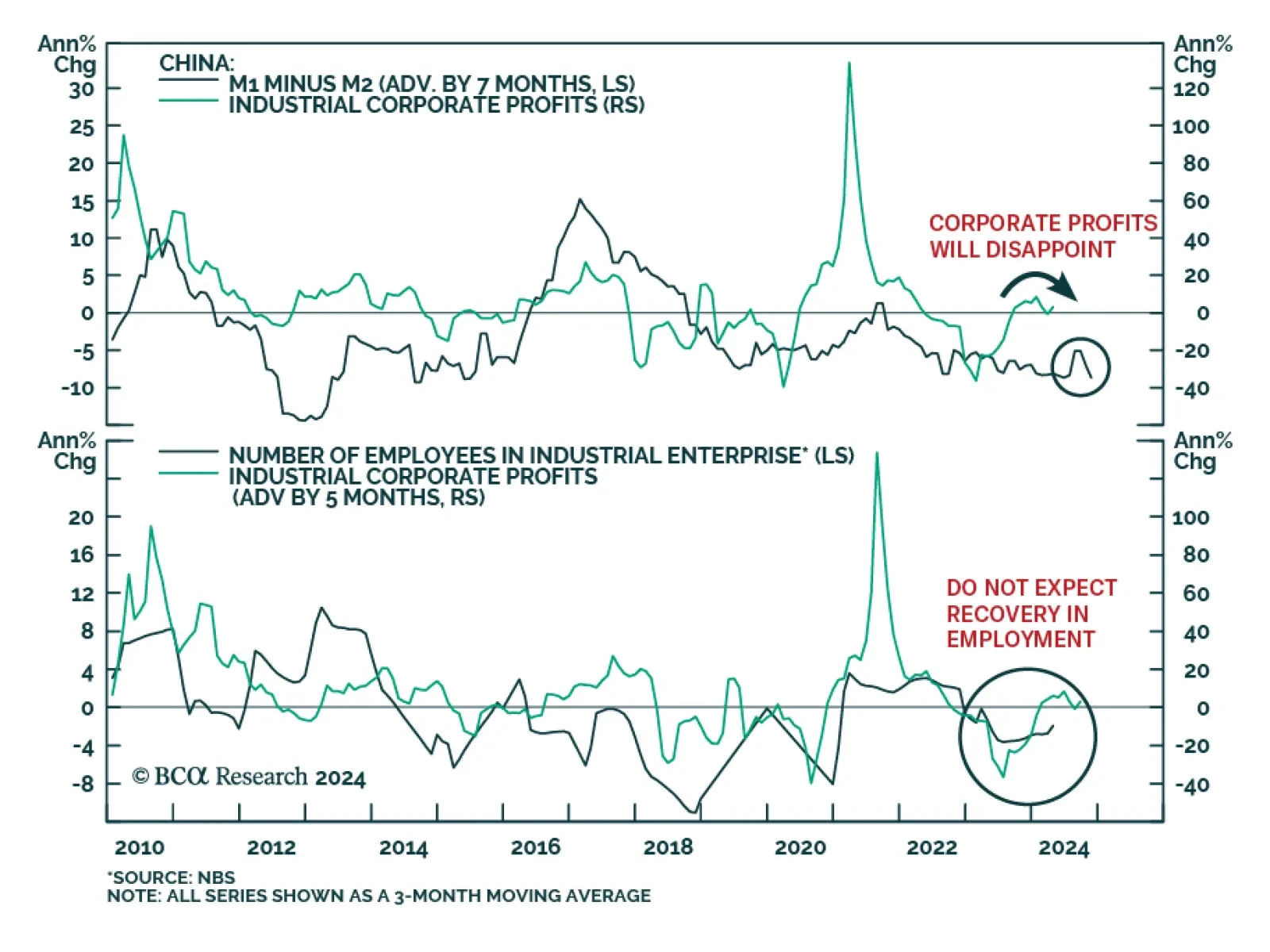

As in many other countries, China’s cyclical consumption growth is primarily driven by labor market conditions, income, and borrowing. BCA Research’s China Investment Strategy service maintains the view that these…

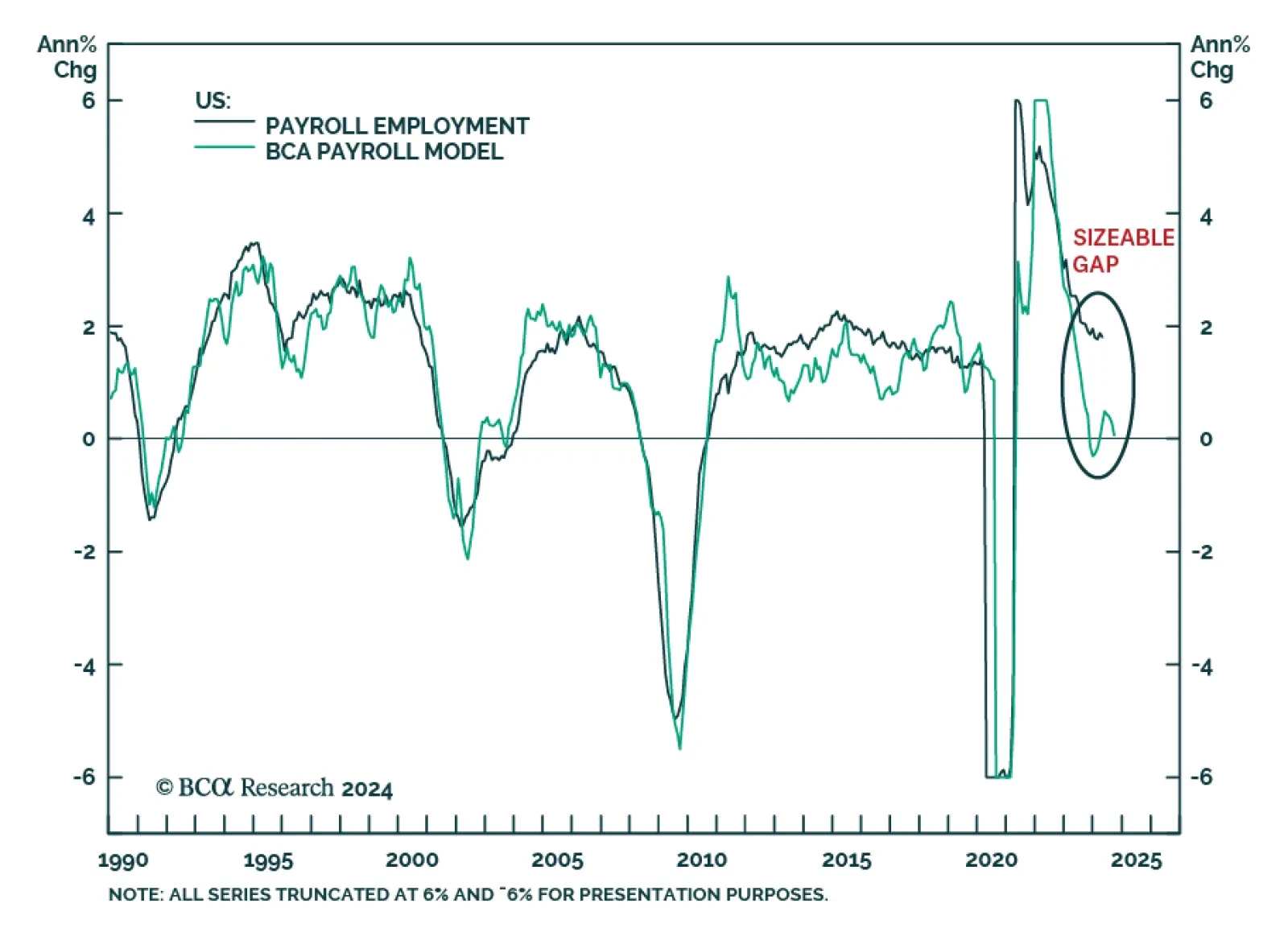

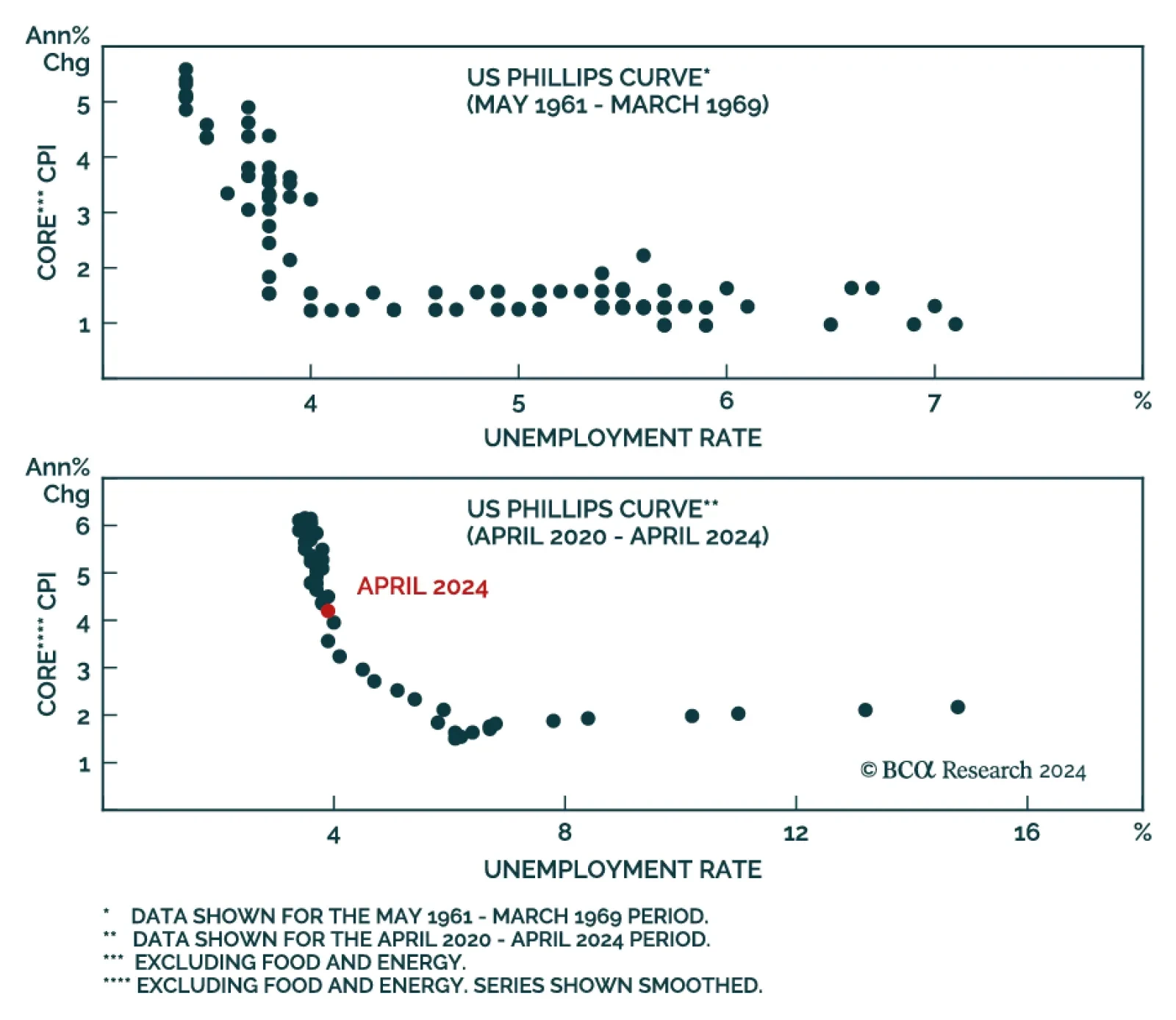

At BCA Research, fundamentals drive our analysis and we use indicators and quantitative metrics as guides to inform our views further. It is our fundamental assessment of the US labor market that underpins our view that softer…

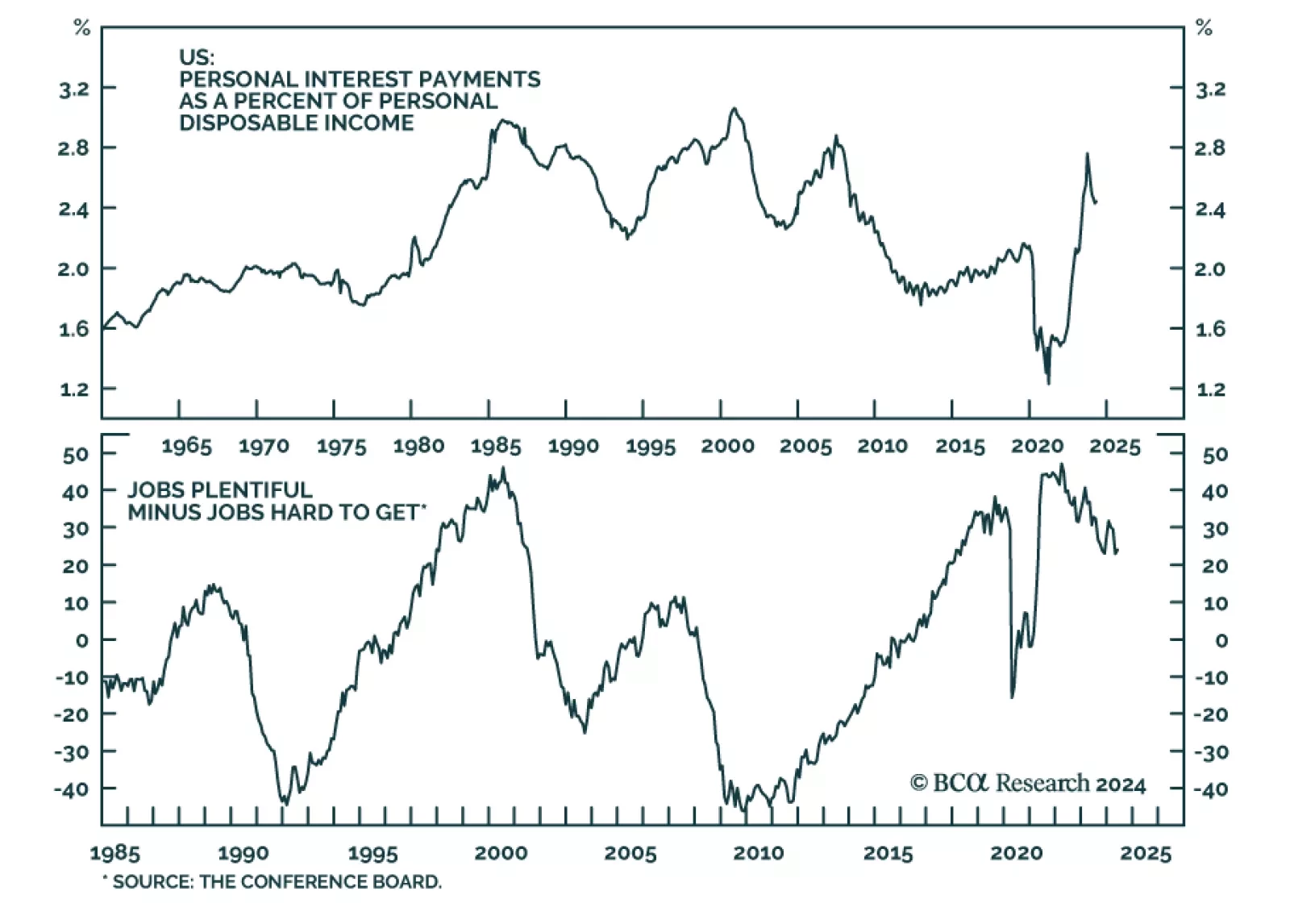

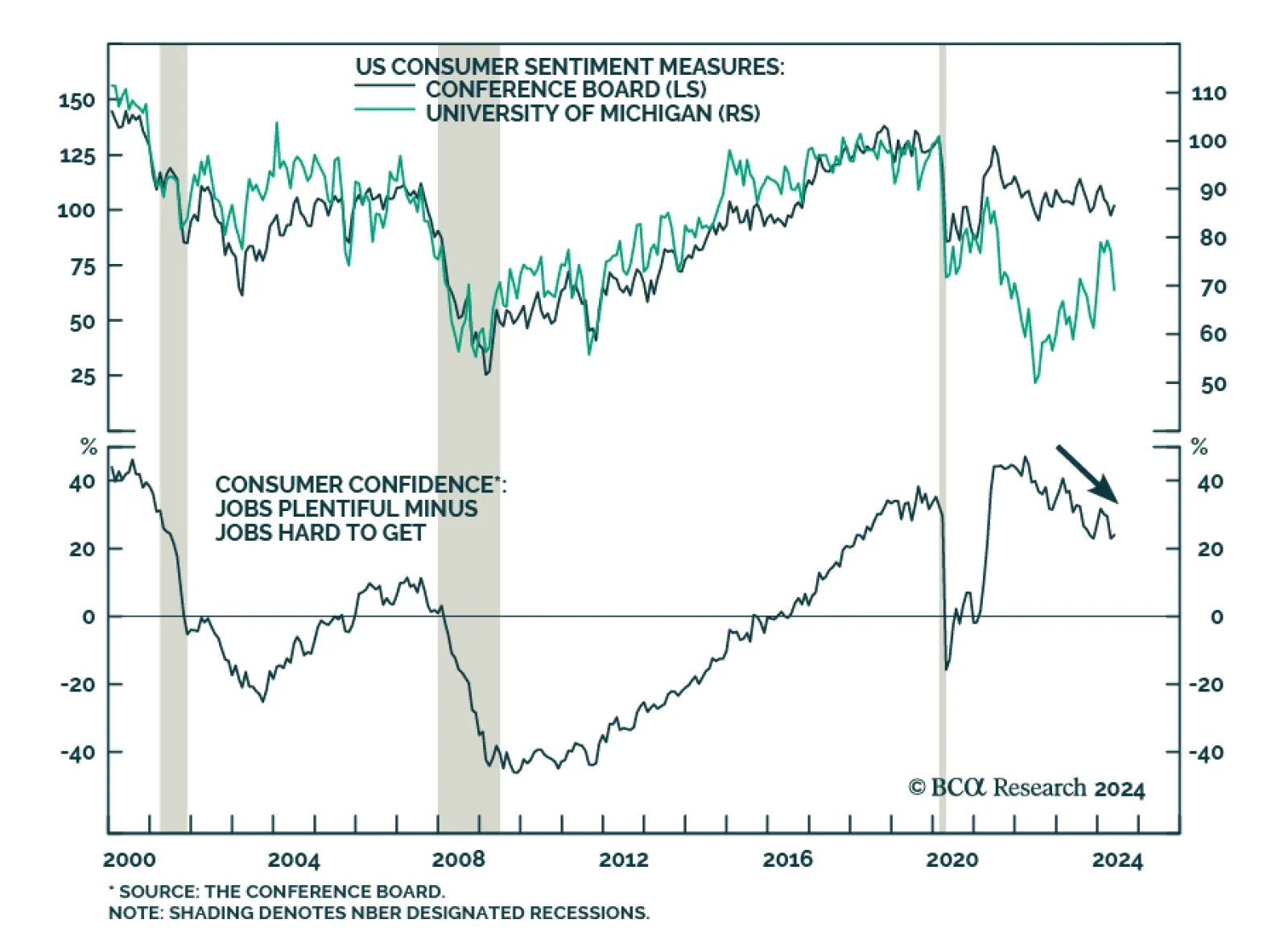

The Conference Board’s measure of consumer confidence surprised to the upside on Tuesday. The headline index improved to 102 from 97.5, upending expectations of a continued moderation to 96. The rebound follows 3…

According to BCA Research’s Global Investment Strategy service, there is only a narrow path to a soft landing. Our colleagues estimate a mere 20% chance that the US will avoid a recession before the end of 2025. The US…