Global consumer spending is likely to slow over the coming quarters, culminating in a major economic downturn in late 2024 or early 2025. Investors should maintain benchmark exposure to equities for now but look to turn more…

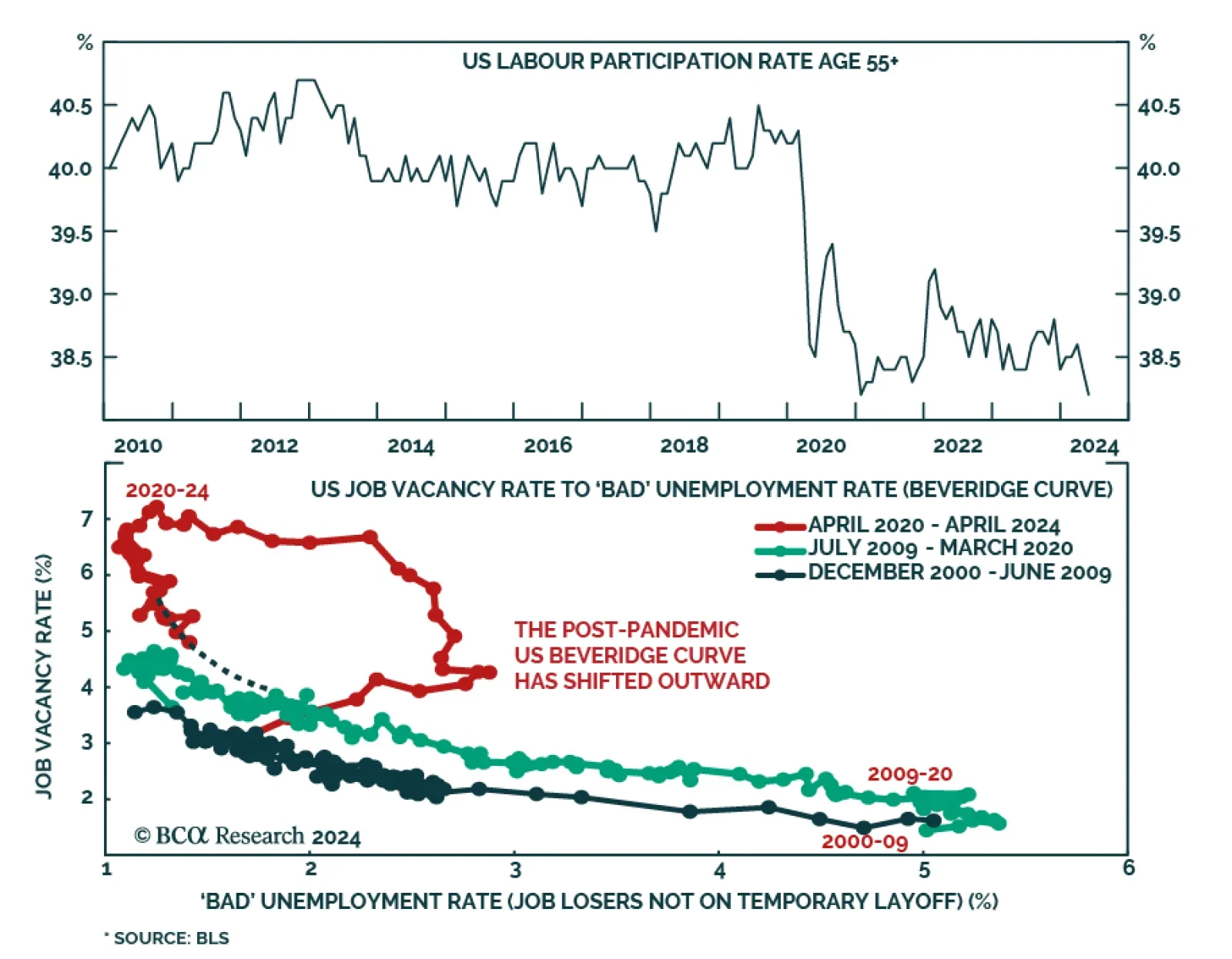

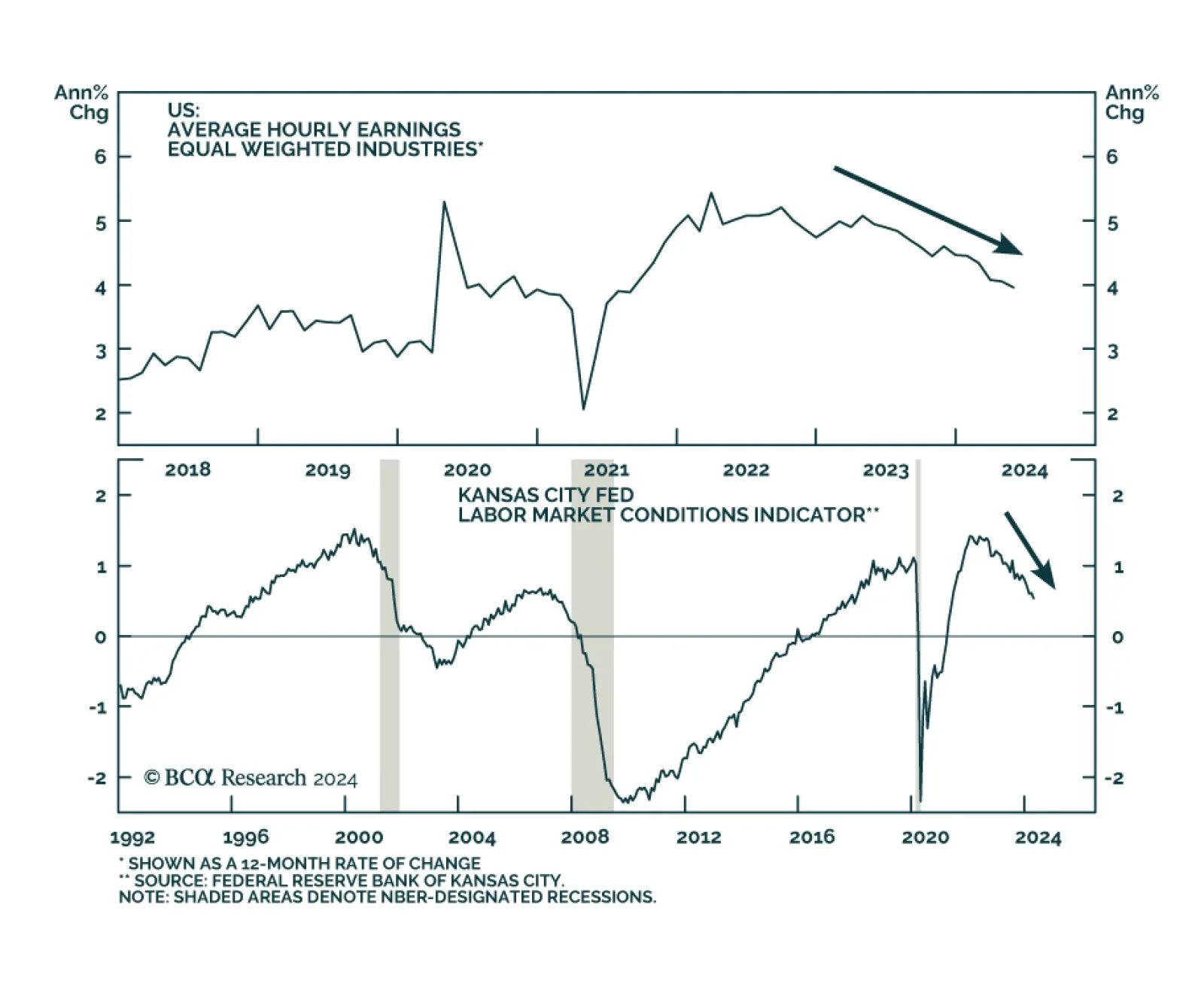

According to BCA Research’s Counterpoint service, job losers not on temporary layoff (‘bad’ unemployment) will need to rise further for the Fed to reach its 2 percent inflation target. Although prime-age…

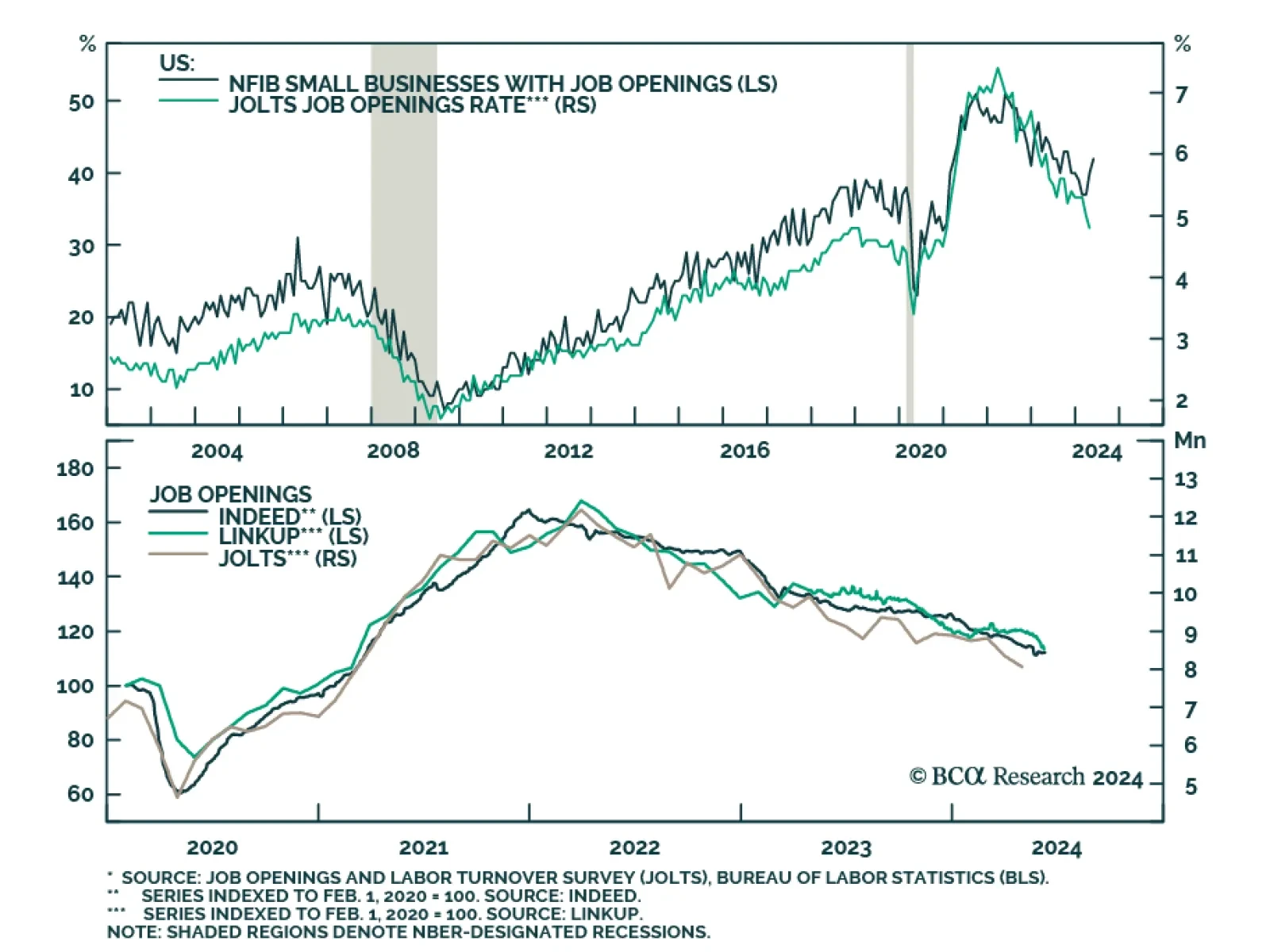

The NFIB Small Business survey surprised to the upside in May, suggesting improved optimism among small business owners. Most notably, an increasing share of respondents is planning on hiring workers, and the jobs opening…

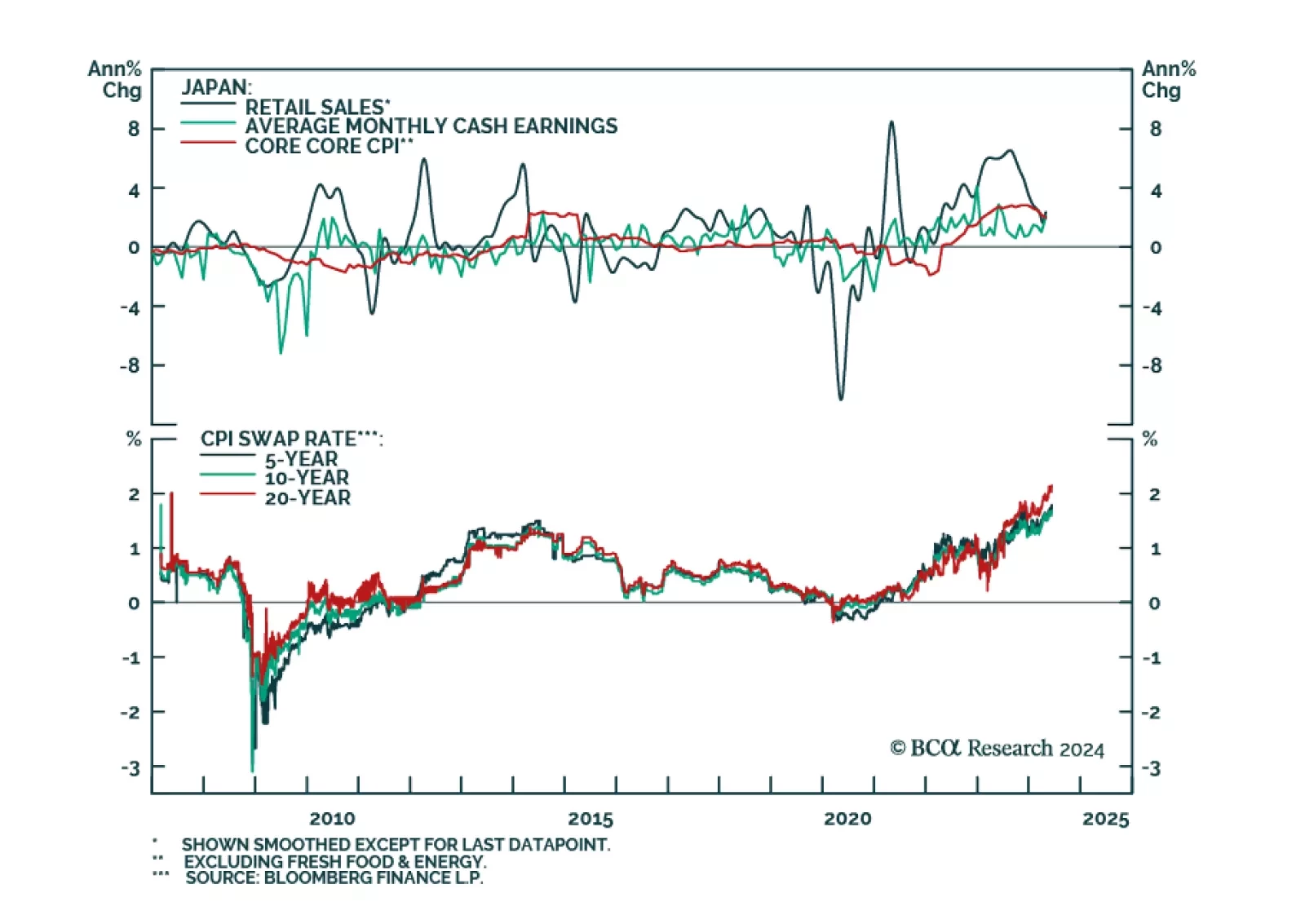

The Bank of Japan exited negative interest rate policy in March, but subsequent softer-than-expected CPI inflation prints have complicated its path towards tightening. The central bank is widely expected to stay put when it meets…

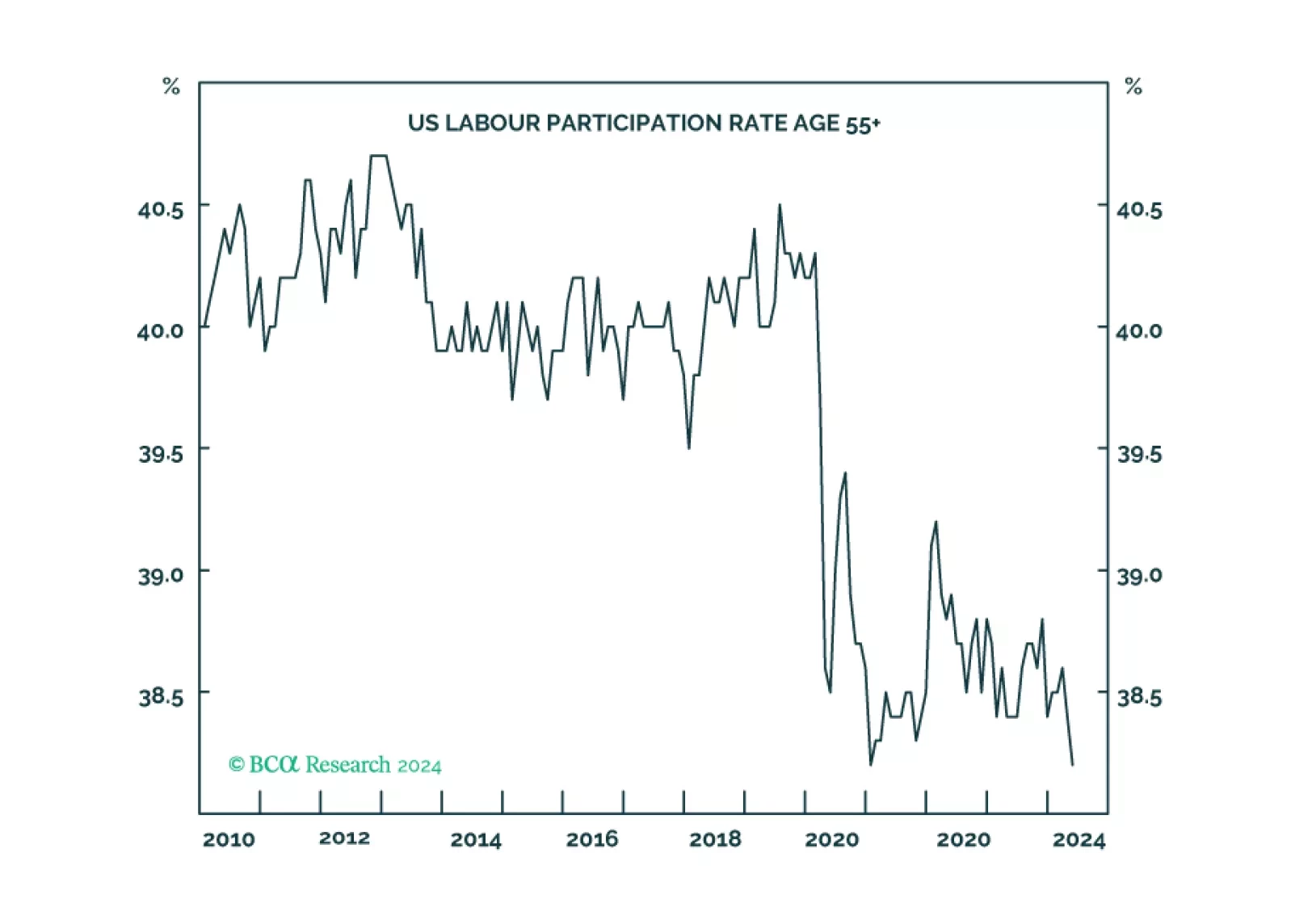

1 in 17 older Americans workers have gone missing either through ‘excess retirements’ or ‘excess mortality’. The consequent dislocation of the labour market means that the Fed’s work is not yet done. We go through some investment…

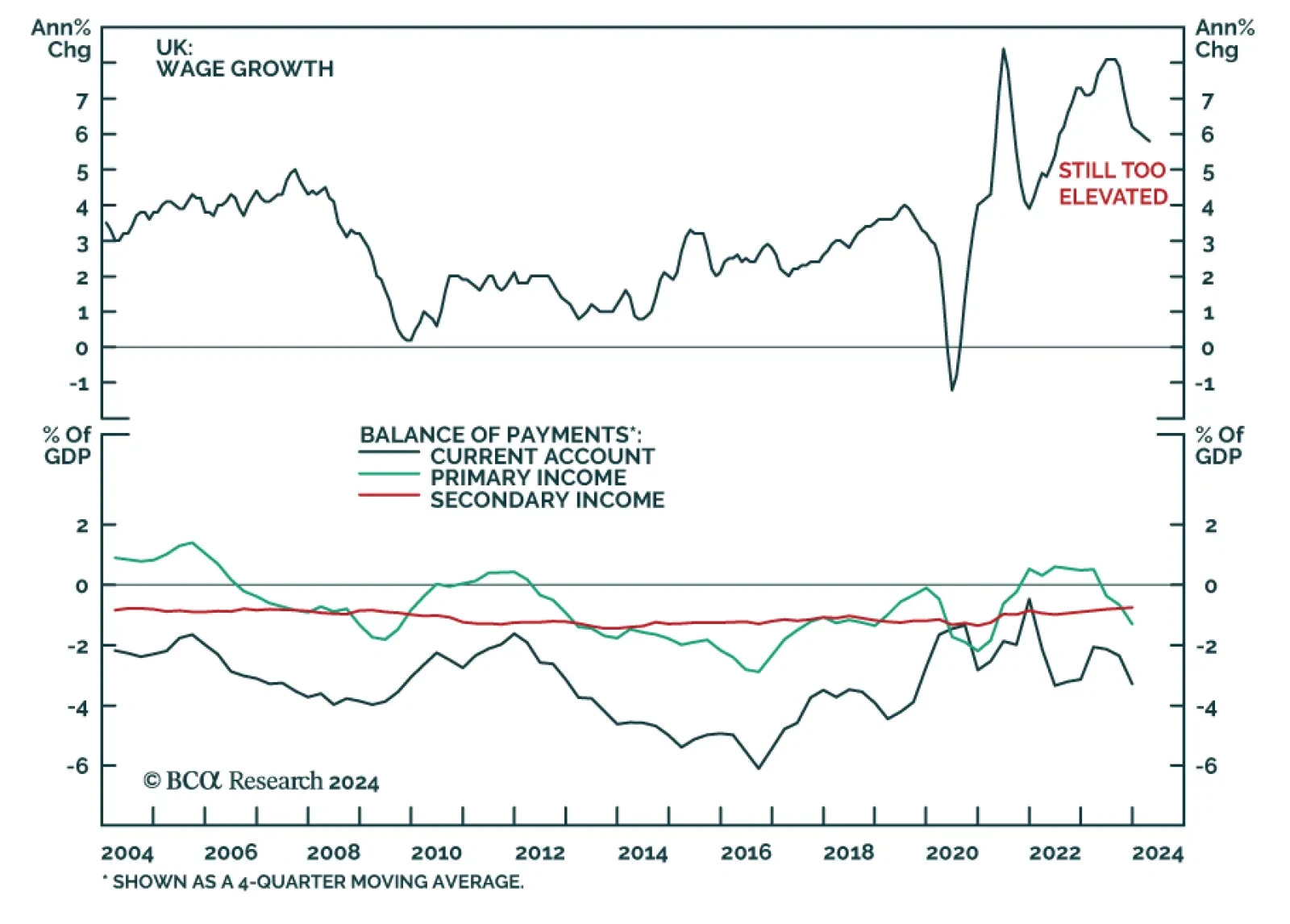

The UK unemployment rate surprised to the upside in the 3-month period ending in April, ticking up to 4.4% against expectations it would remain stable at March’s originally reported 4.3%. Concurrently, wage growth remains…

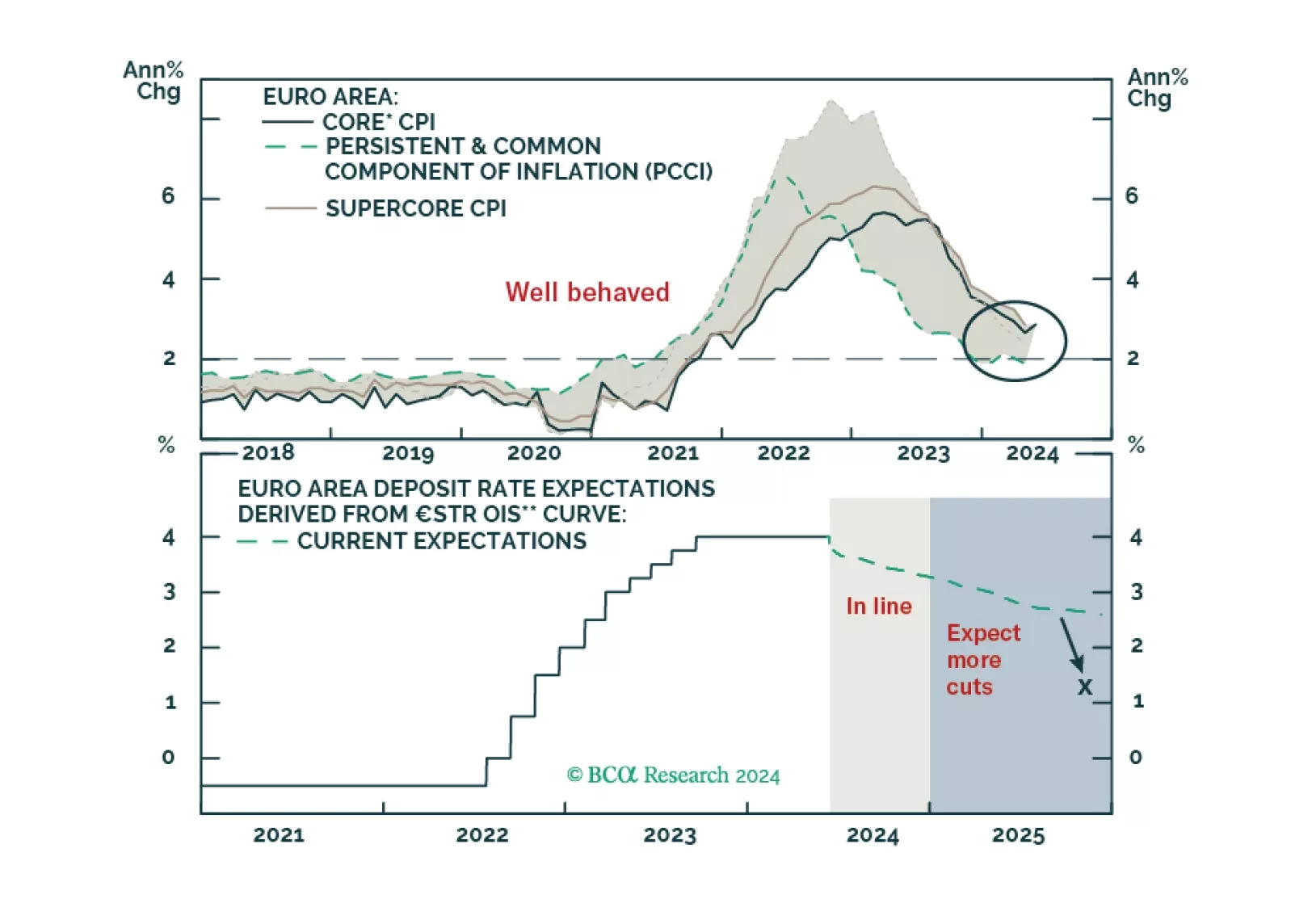

The ECB is now firmly in easing mode, even if it refuses to pre-commit to a specific rate path. What does this data dependency mean for the euro and European yields?

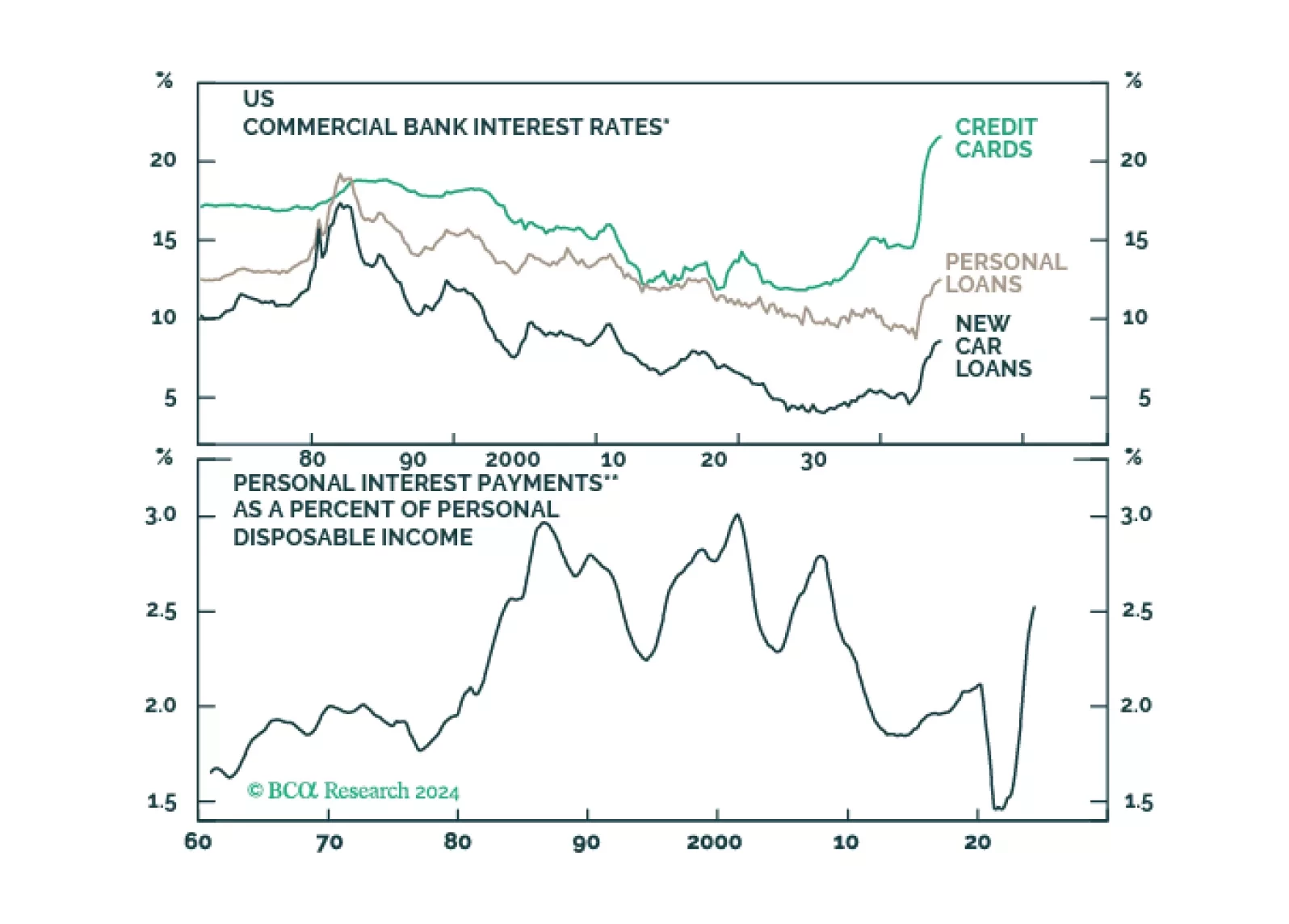

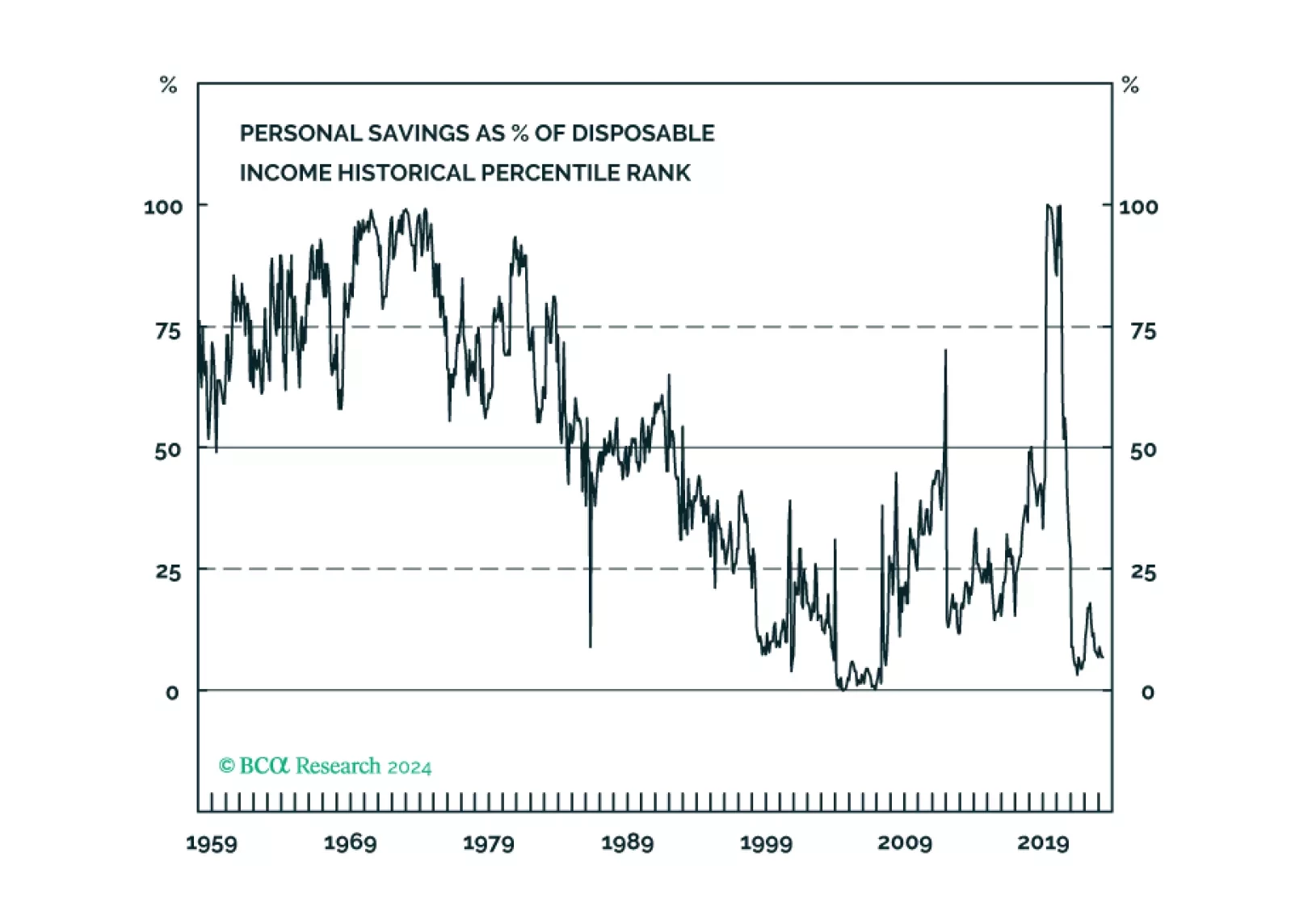

Although the comprehensive economic surprise indexes continued weakening in May, the metrics in our equity downgrade checklist haven’t softened enough to check more boxes now. While we continue to expect the US economy will enter a…

US nonfarm payrolls grew by 272 thousand in May, accelerating from 165 thousand in April, and swamping expectations of 180 thousand. Average hourly earnings increased by 4.1% y/y from an upwardly revised 4.0%. However, the…

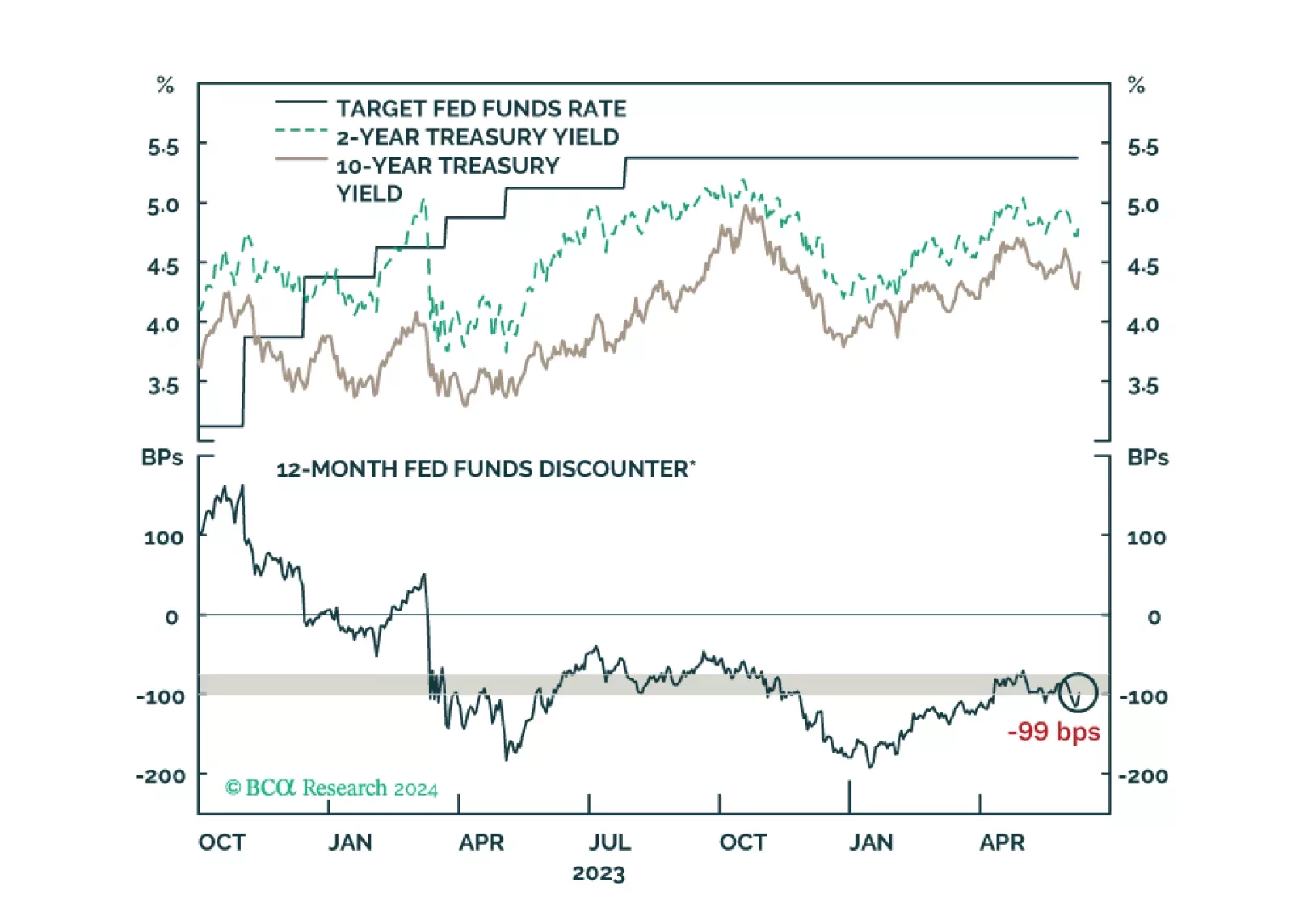

US Treasury yields bounced after this morning’s employment report. We offer our updated views about how long the recent trading range will hold.