In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

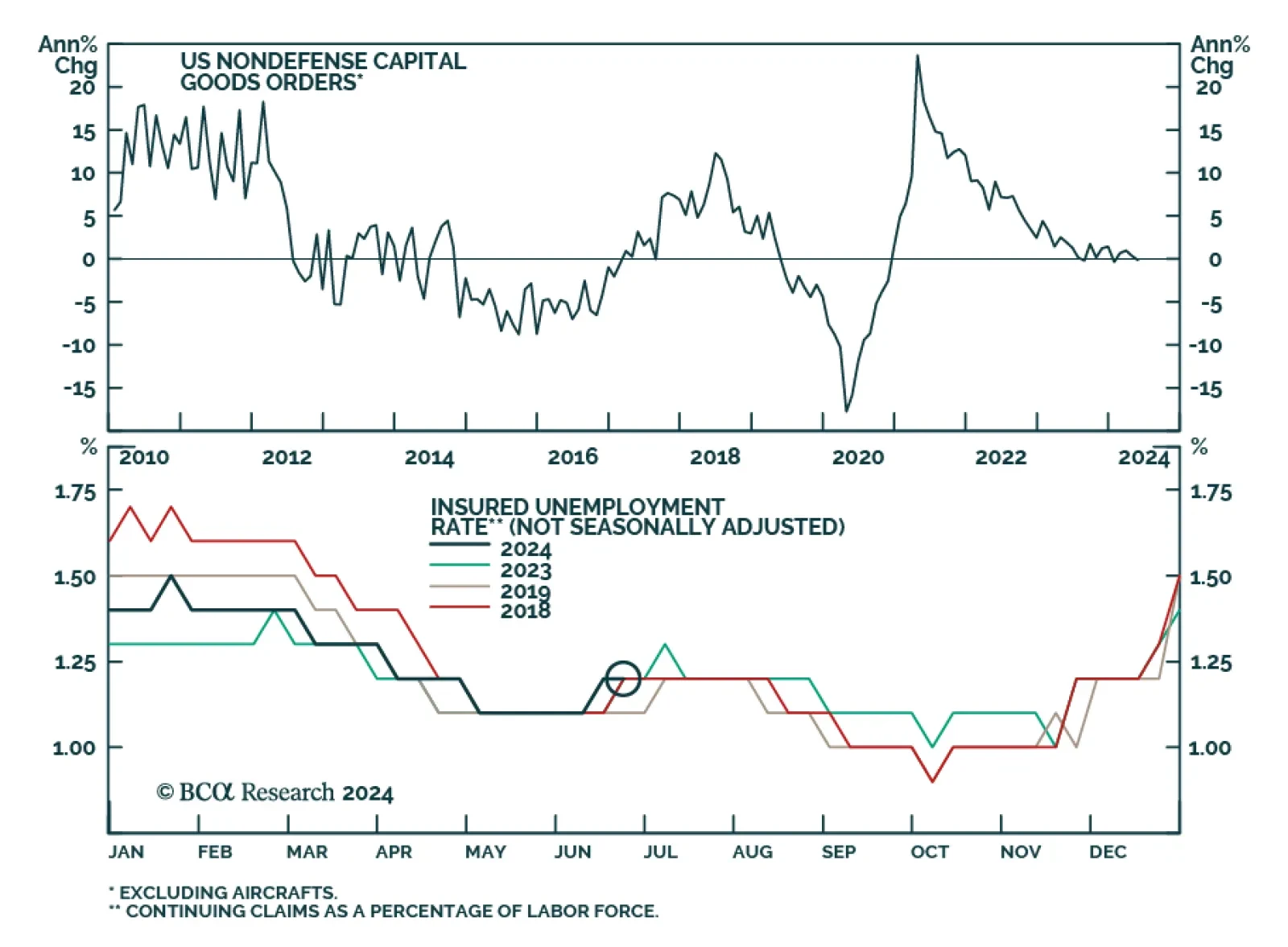

Several pieces of data were released for the US on Thursday. US durable goods orders growth slowed from 0.2% to 0.1% in May, beating expectations of a 0.5% contraction. However other components of the report disappointed…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

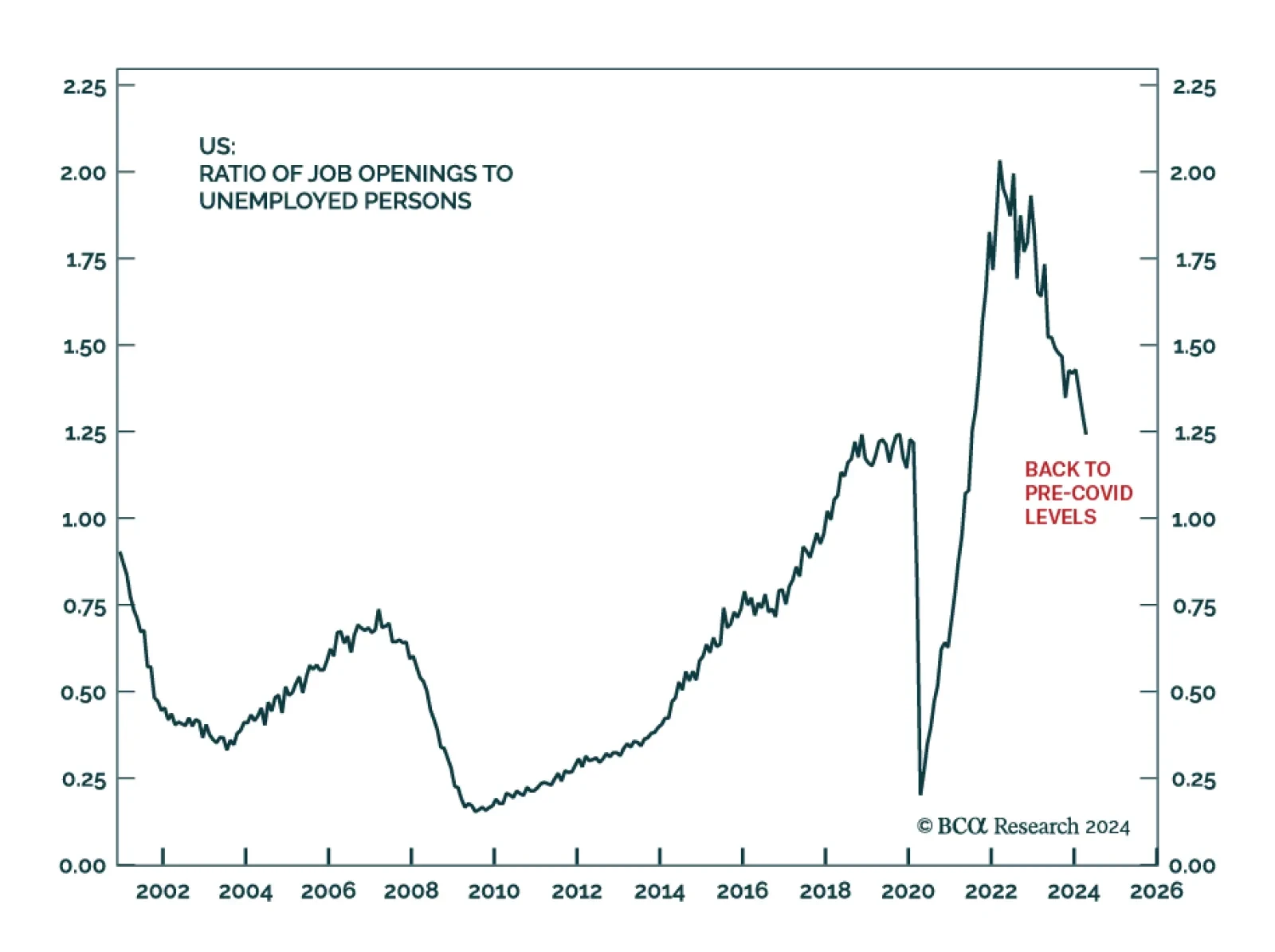

Our Global Investment Strategy team often highlights the job openings-to-unemployed ratio as a gauge of the labor market’s slack. This indicator climbed to over 2 job openings per unemployed person in 2022, as labor…

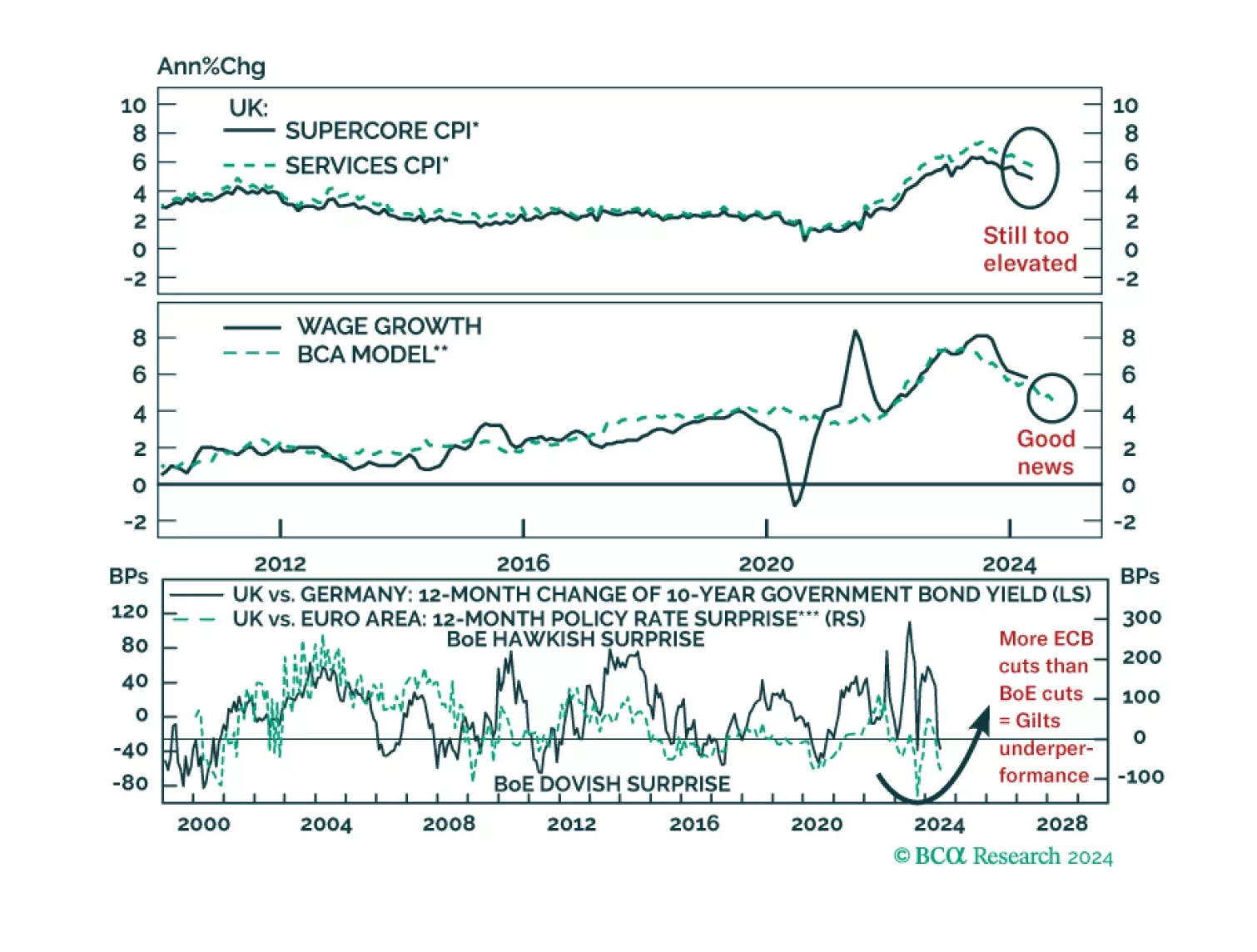

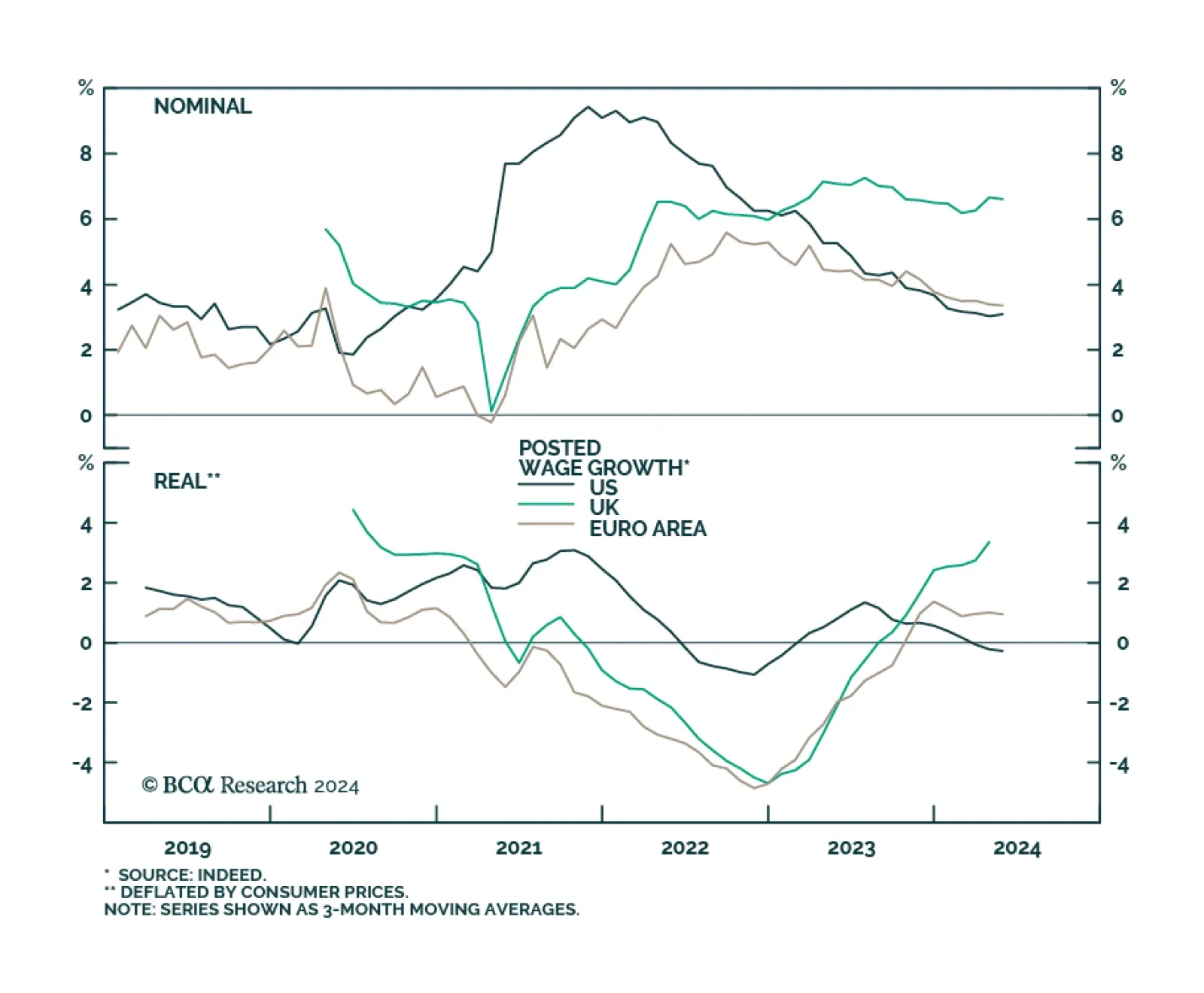

Is the BoE making a mistake moving toward rate cuts before the end of the summer? What would such a move mean for UK asset prices?

Today’s report recaps last week’s webcast and elaborates on its themes, delving into the empirical evidence underpinning our conviction that asset allocators should underweight equities sparingly and fleetingly. We remain tactically…

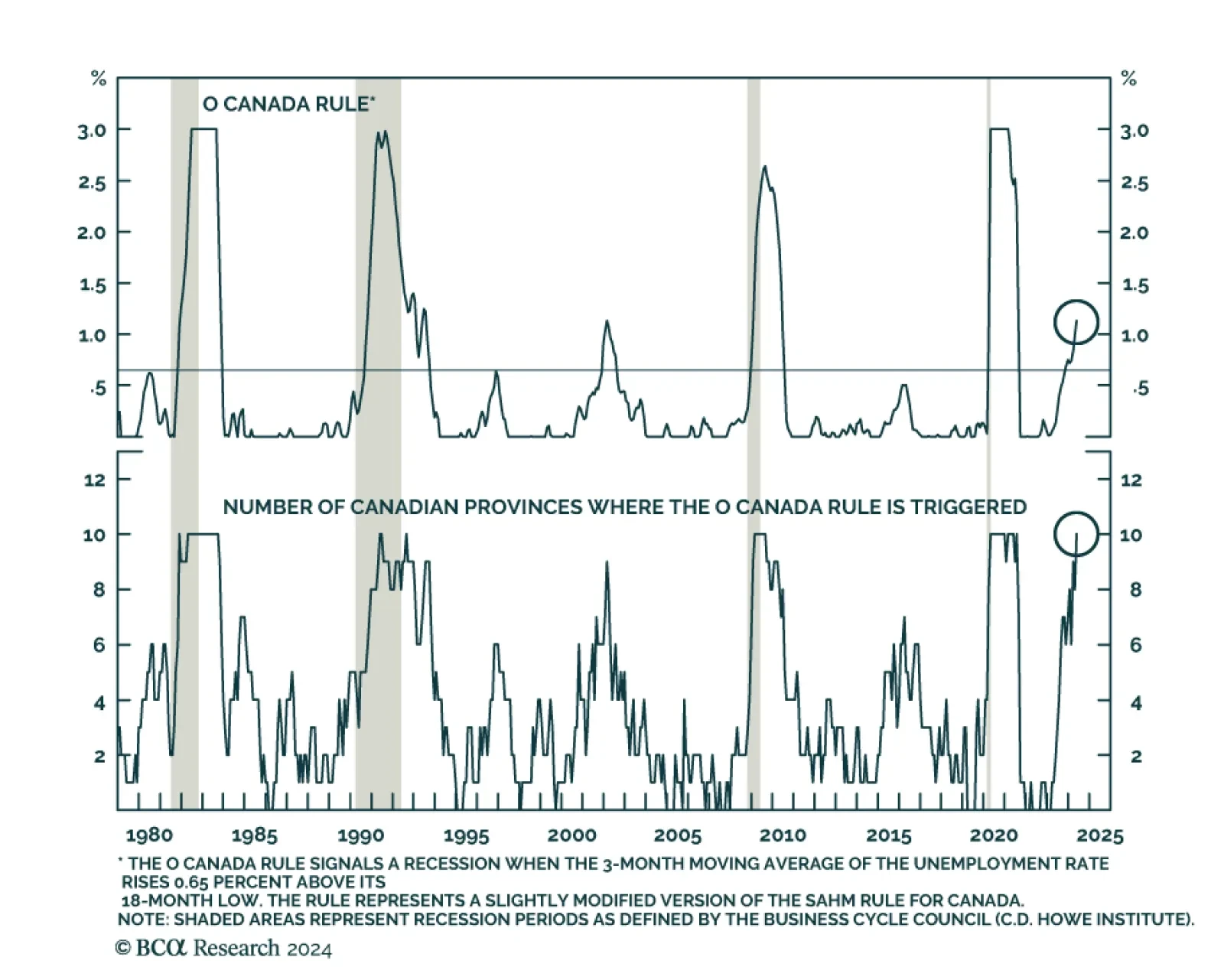

The Bank of Canada (BoC) cut interest rates from 5% to 4.75% in June and another rate cut in July would be warranted. Tight monetary policy is impacting the labor market. The unemployment rate (6.1%) has been on an uptrend…

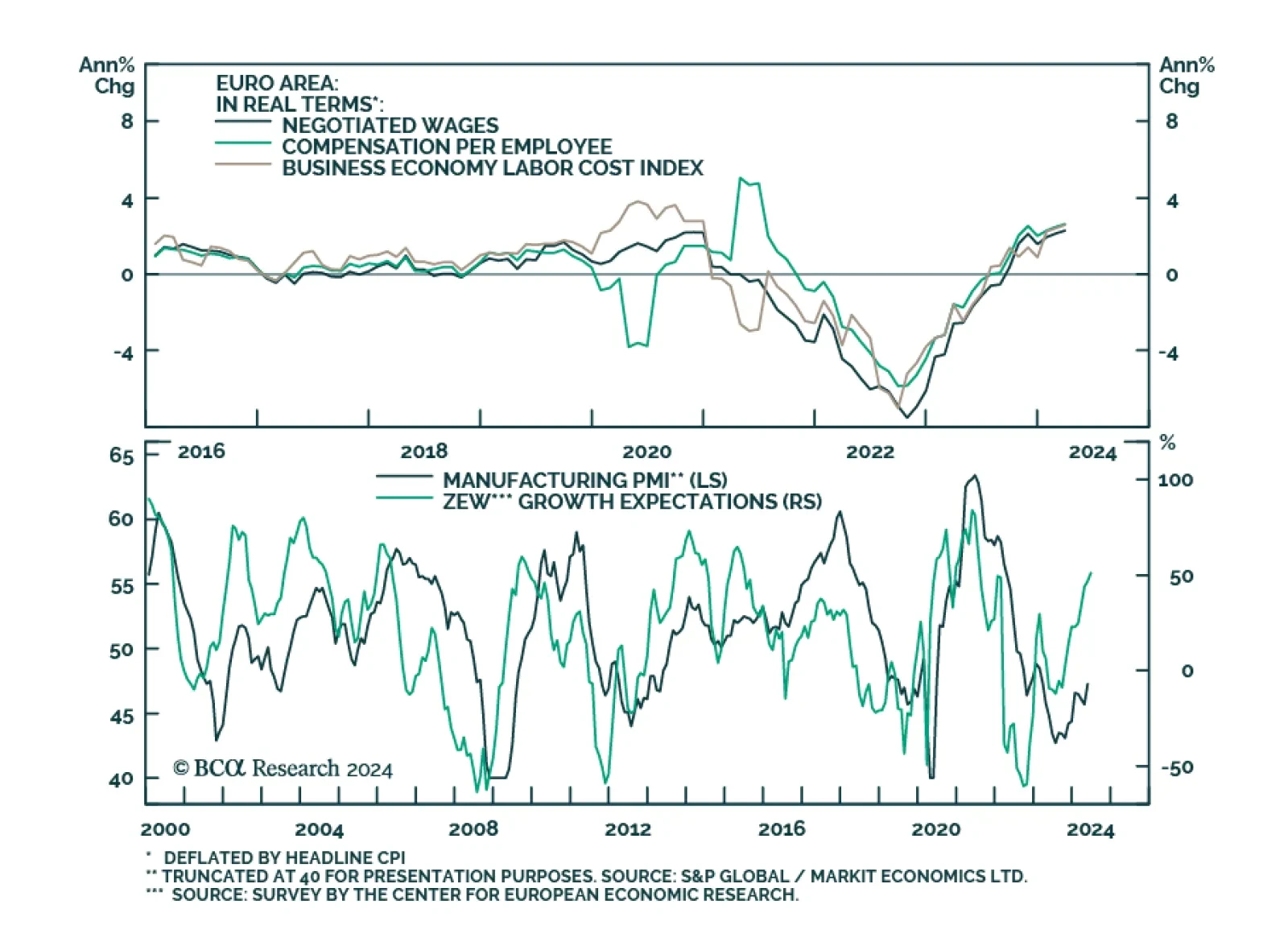

The ECB delivered its first rate cut in June, moderating the degree of restriction rather than pivoting outright to easy monetary policy settings. Indeed, the rate cut was accompanied by an upward revision of inflation and growth…

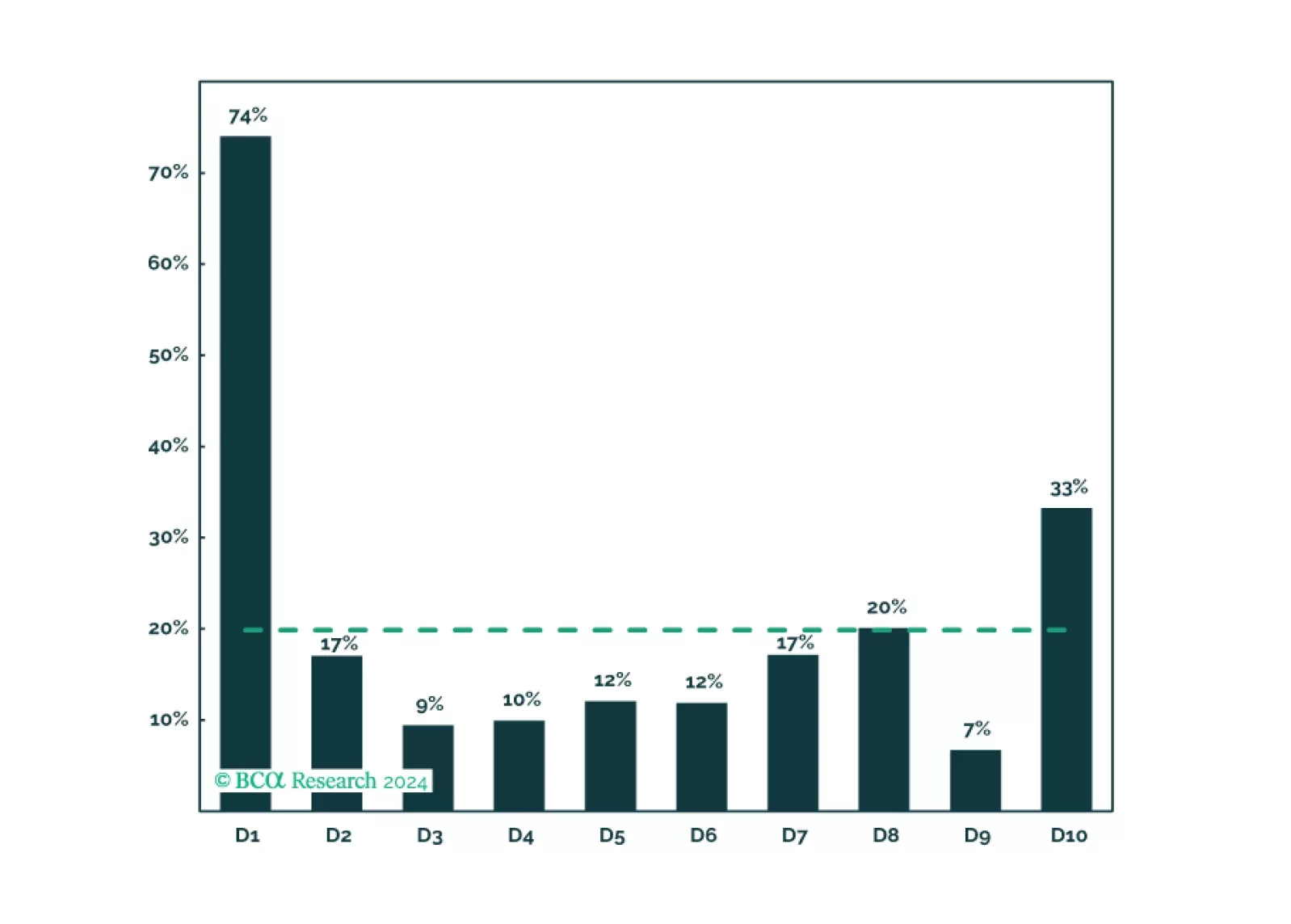

According to BCA Research’s Global Investment Strategy service, aggressive fiscal stimulus and labor market flexibility contributed to the relative strength of the US consumer. However, adverse region-specific effects also…

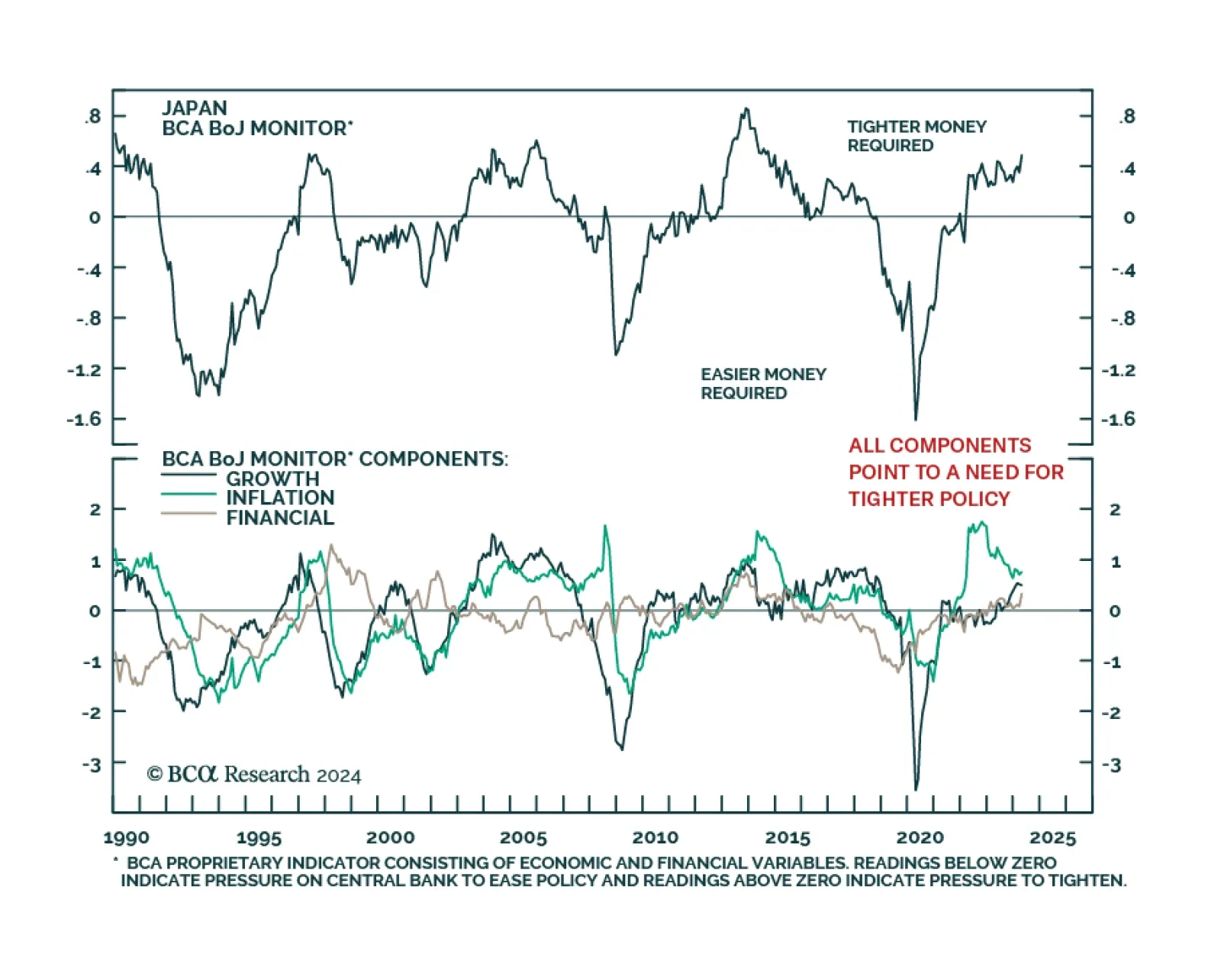

In a largely expected move, the Bank of Japan kept its policy rate unchanged at 0-0.1% in June. It maintained the pace of bond buying at JPY 6tr per month but signaled it would lay out a plan to reduce its balance sheet next…