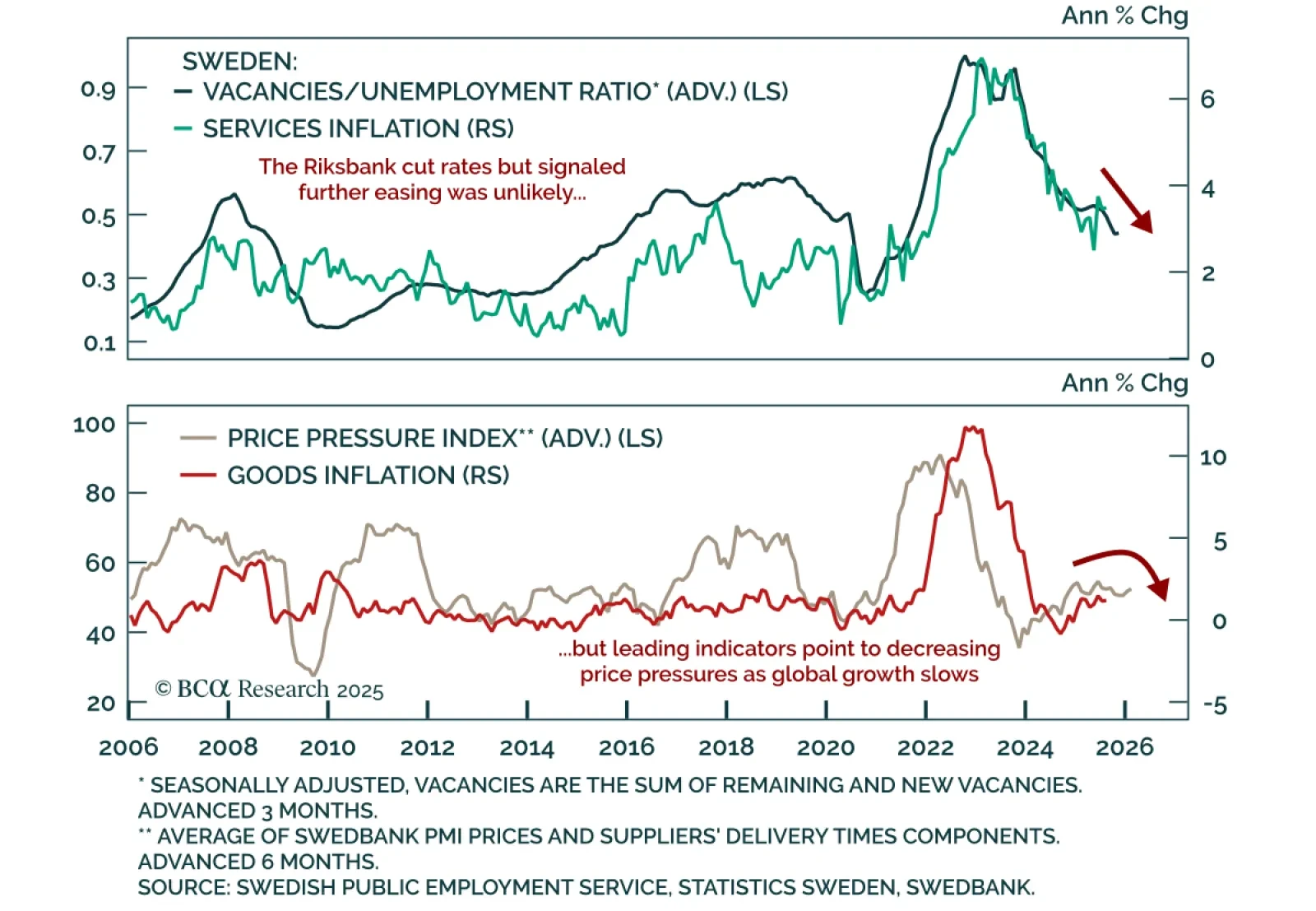

The Riksbank surprised with a 25 bps cut to 1.75%, signaling no further easing for now but keeping the door open to additional cuts as growth weakens. The move came despite recent inflation prints above the central bank’s forecasts.…

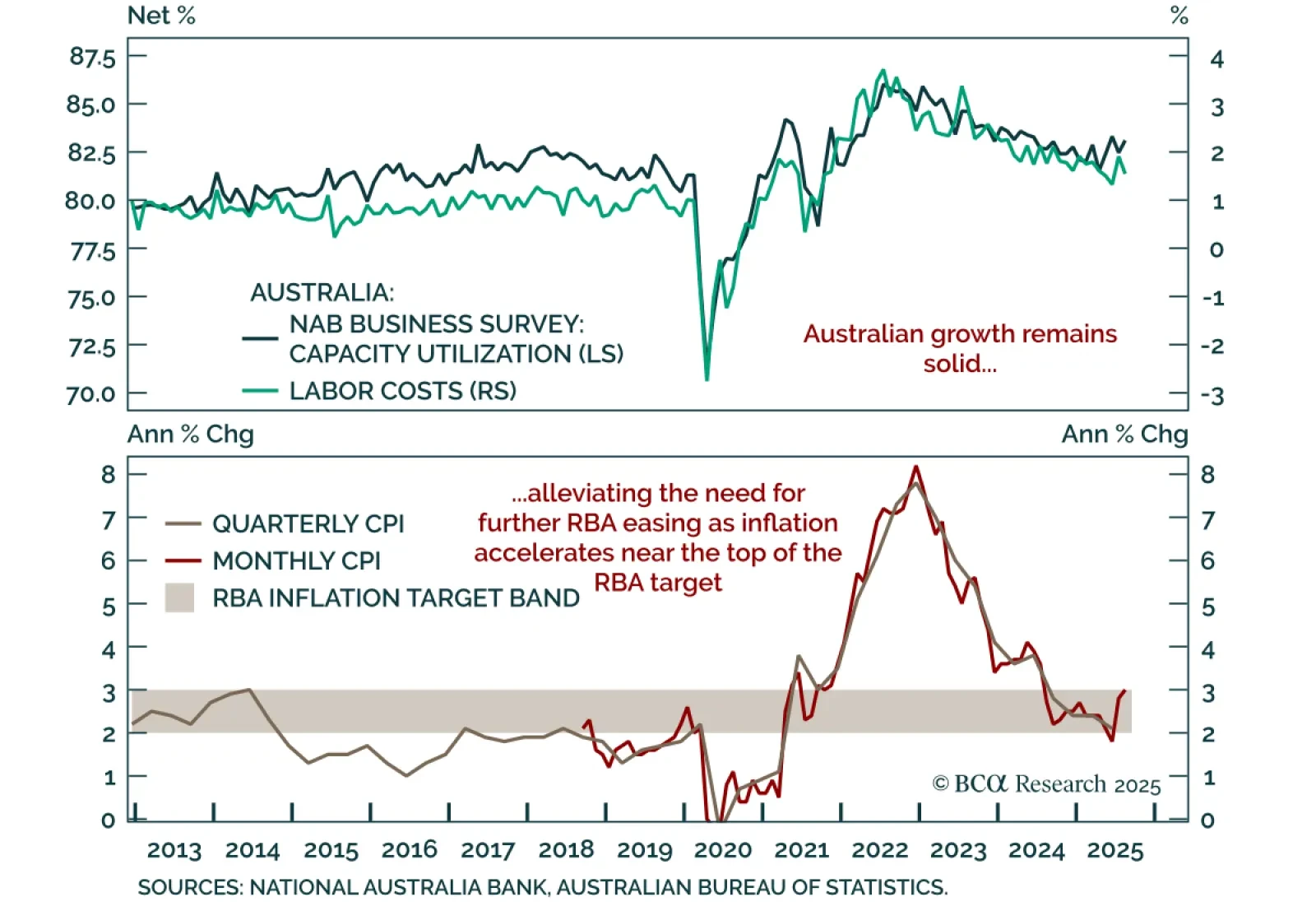

Australian inflation surprised higher in August, validating the RBA’s cautious stance and supporting an underweight on ACGBs. Headline CPI rose to 3.0% y/y from 2.8%, the highest in a year and at the top of the RBA’s 2-3% target…

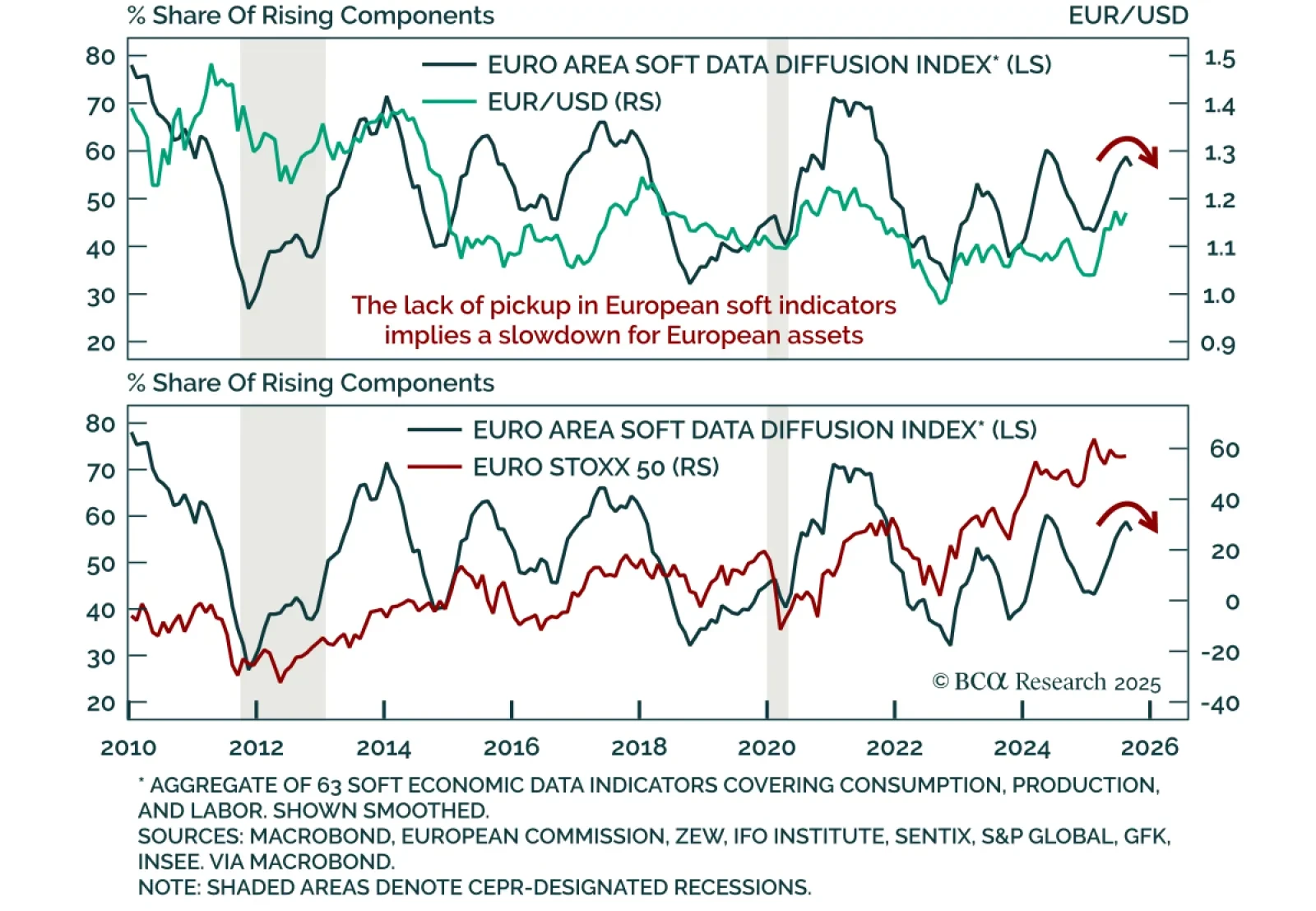

European sentiment indicators weakened again in August and September, reinforcing tactical US outperformance. While the September flash consumer confidence print beat expectations, it is still sluggish. Surveys such as Sentix and ZEW…

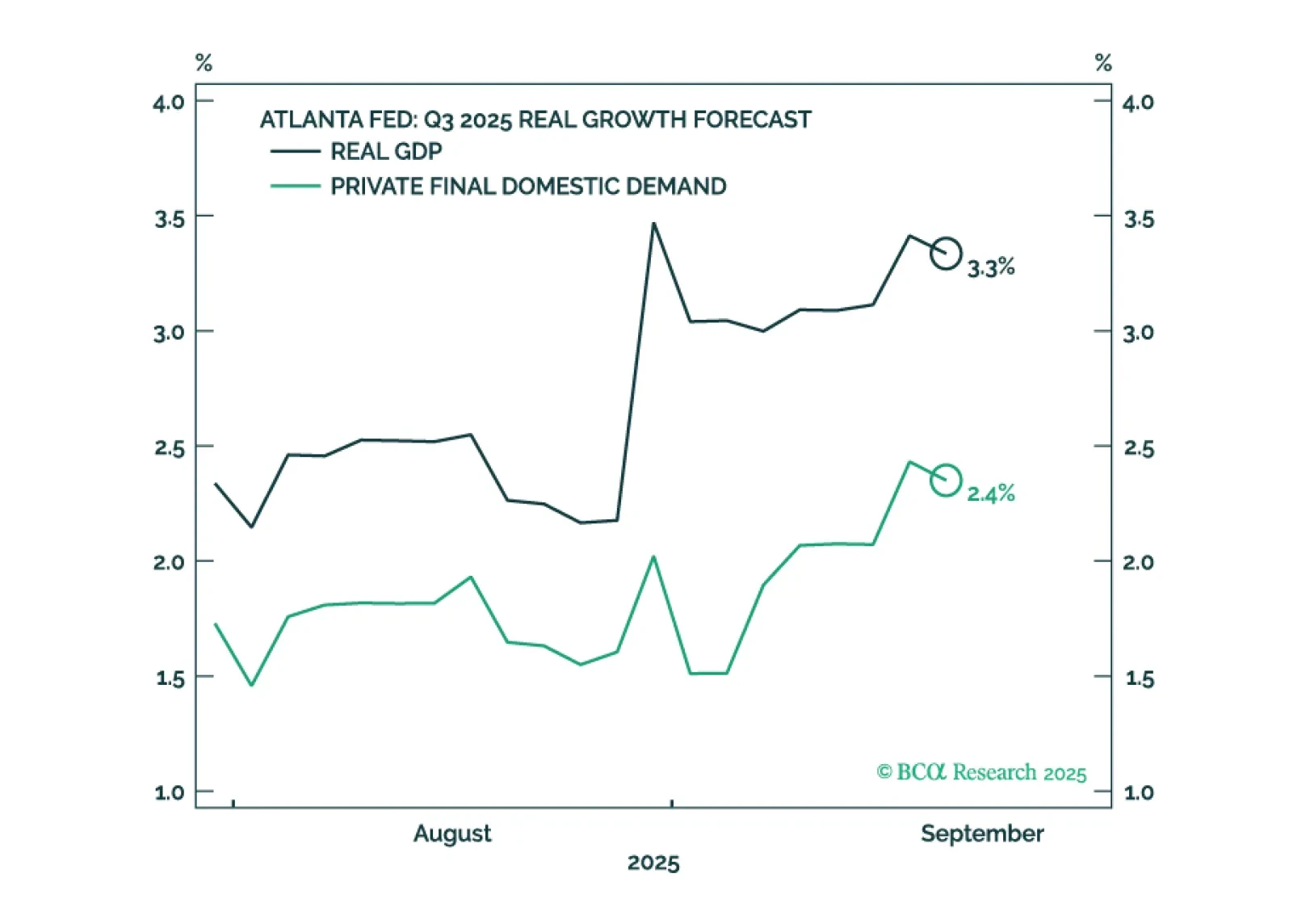

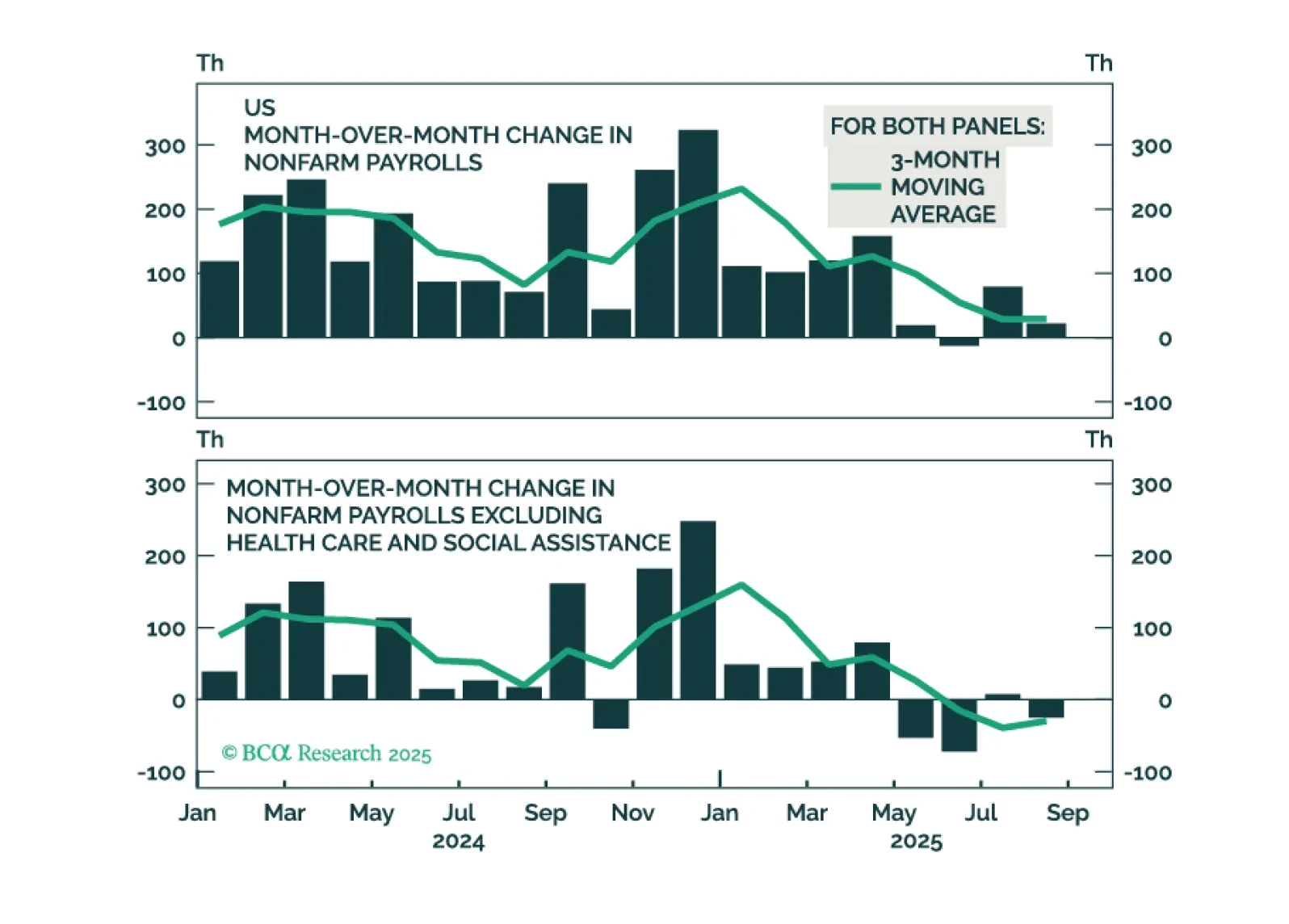

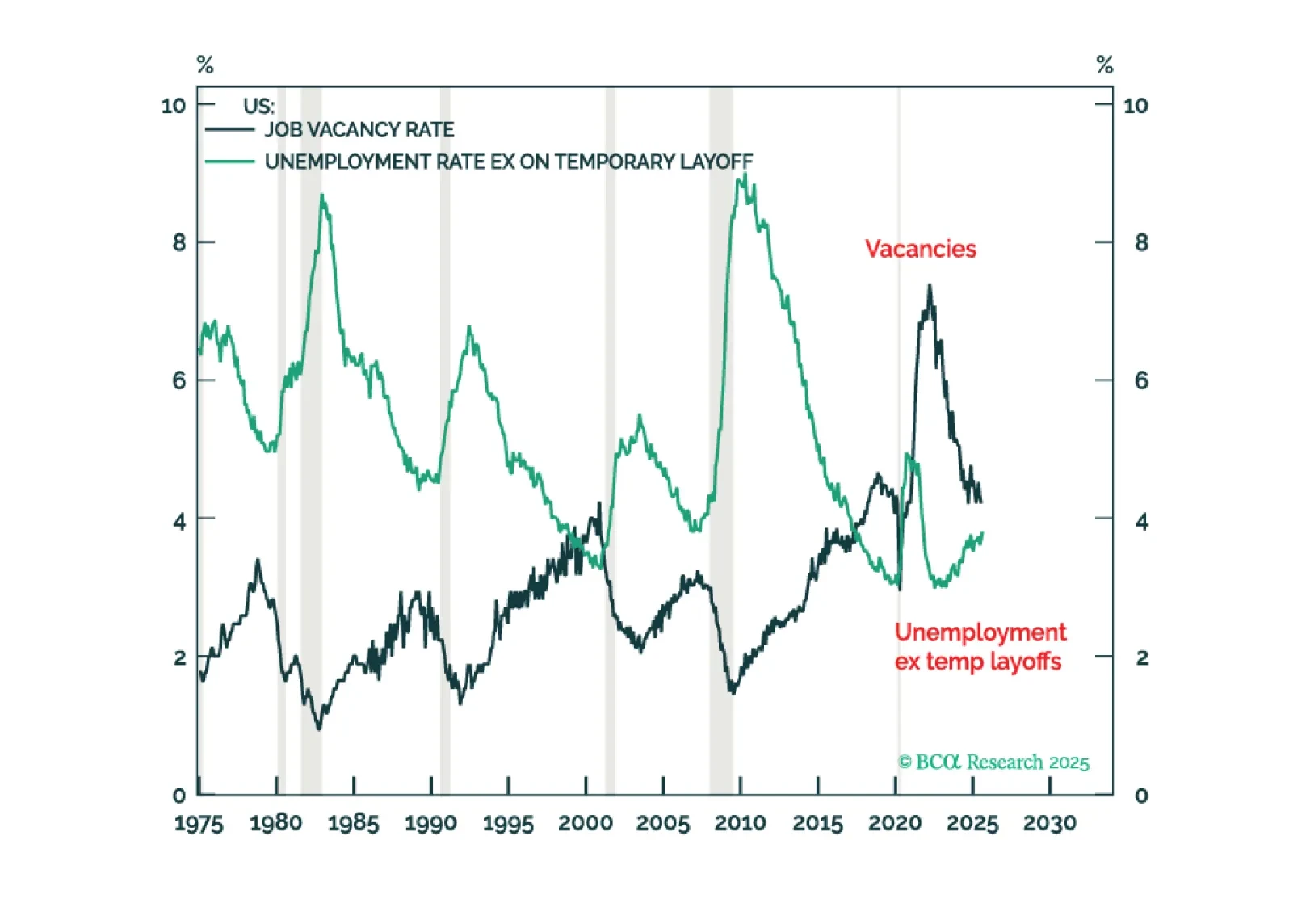

US GDP growth appears to have accelerated even as employment growth has faltered. We will make a final decision in early October when we publish our next Strategy Outlook, but most likely, we will cut our 12-month US recession…

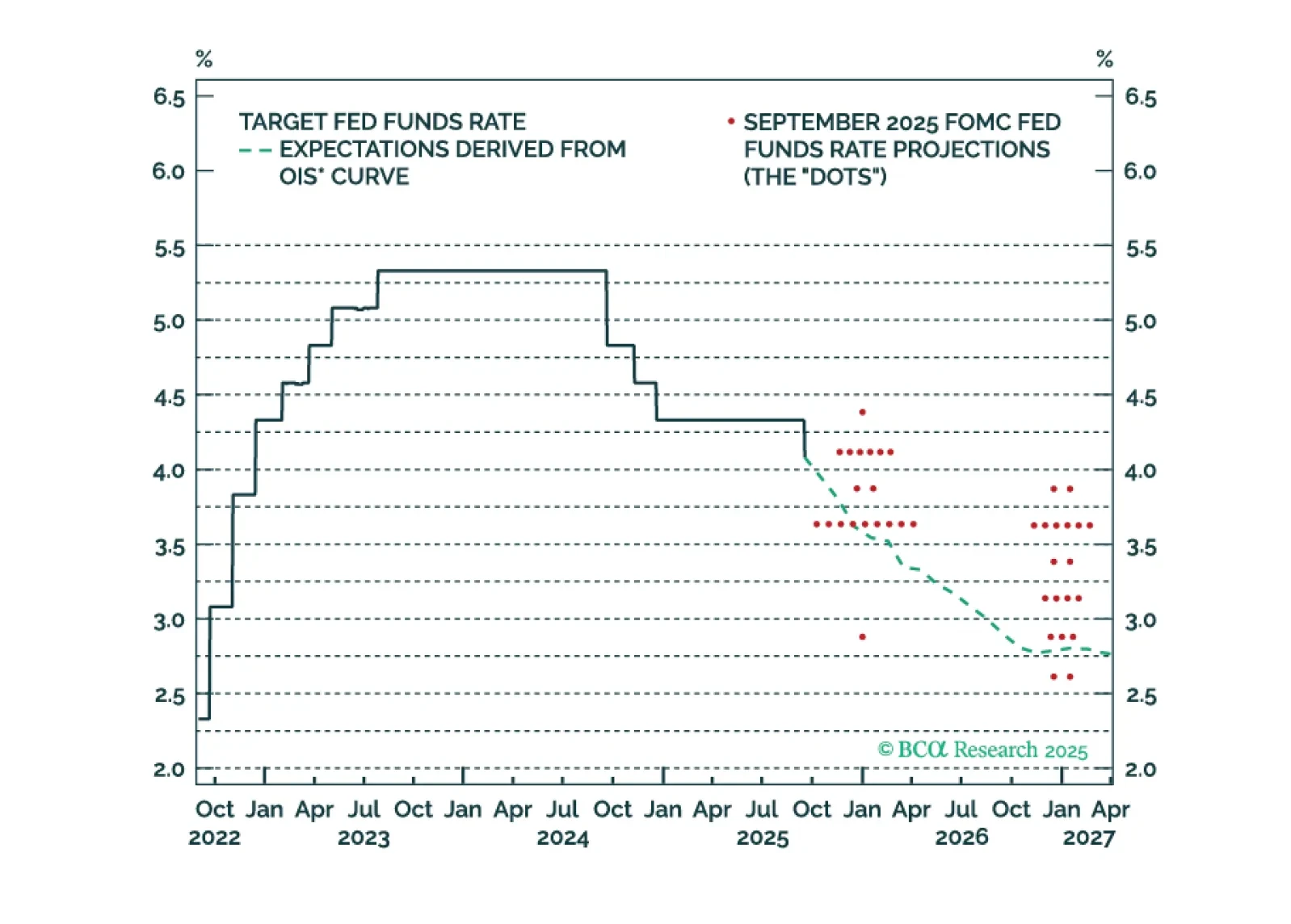

Median Fed unemployment rate projections are overly optimistic. The Fed will end up cutting more in 2026 than it currently anticipates.

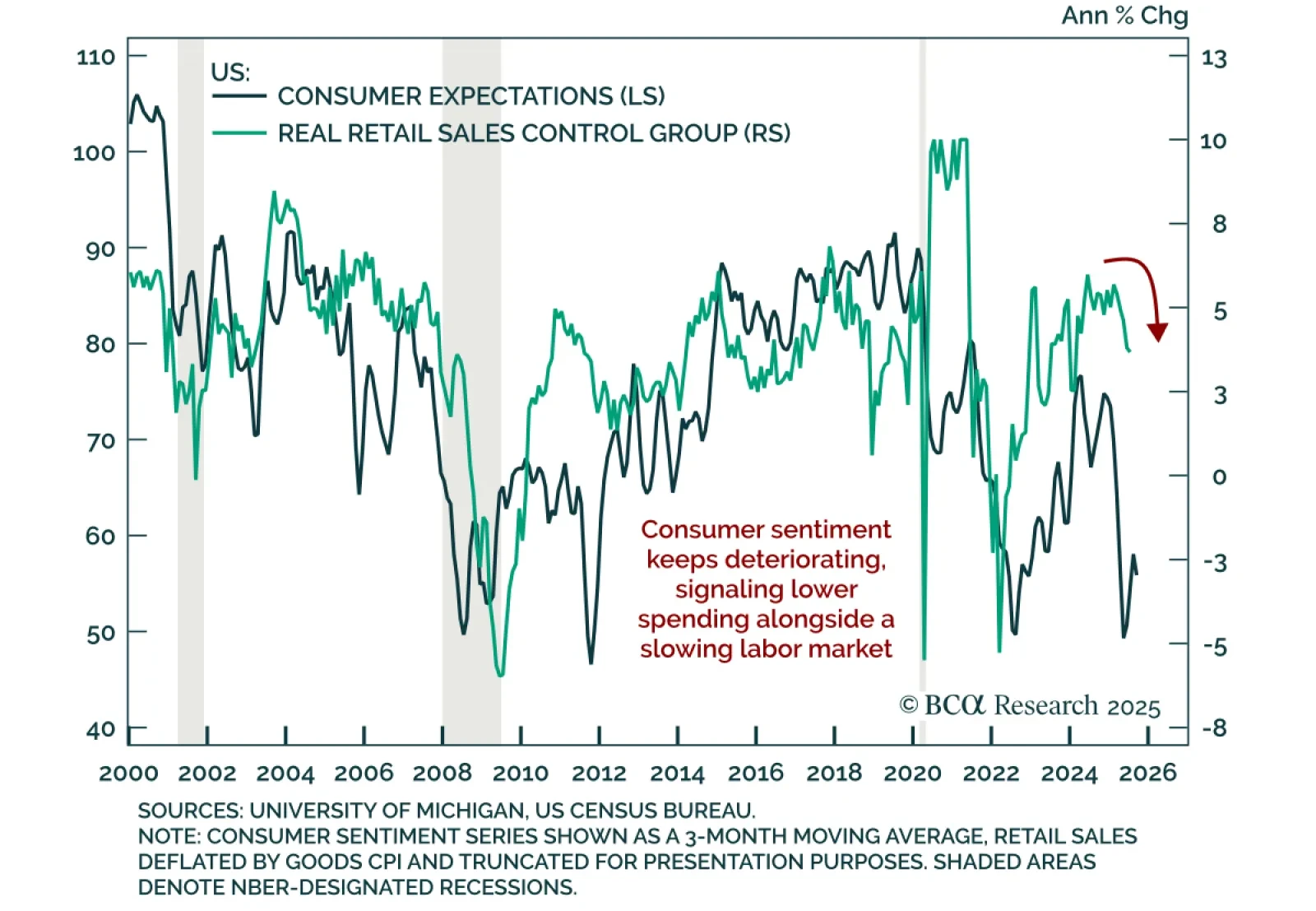

US consumer sentiment deteriorated in September, reinforcing signs of slowing consumption and supporting a defensive stance. The preliminary University of Michigan Consumer Sentiment Index dropped more than expected to 55.4 from 58.2…

While it is impossible to know exactly when global equities will peak, there are now enough vulnerabilities to justify keeping one’s finger near the eject button.

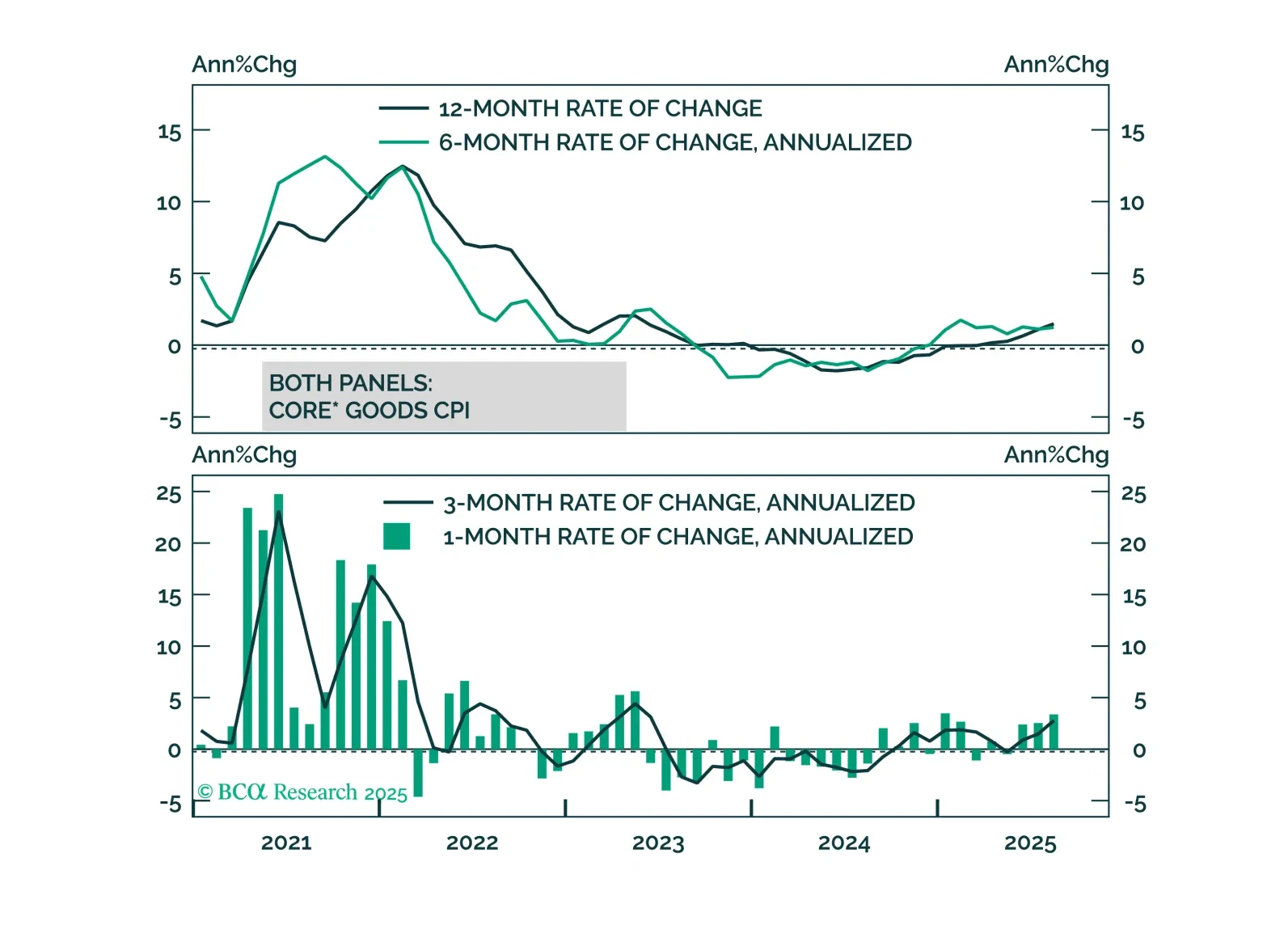

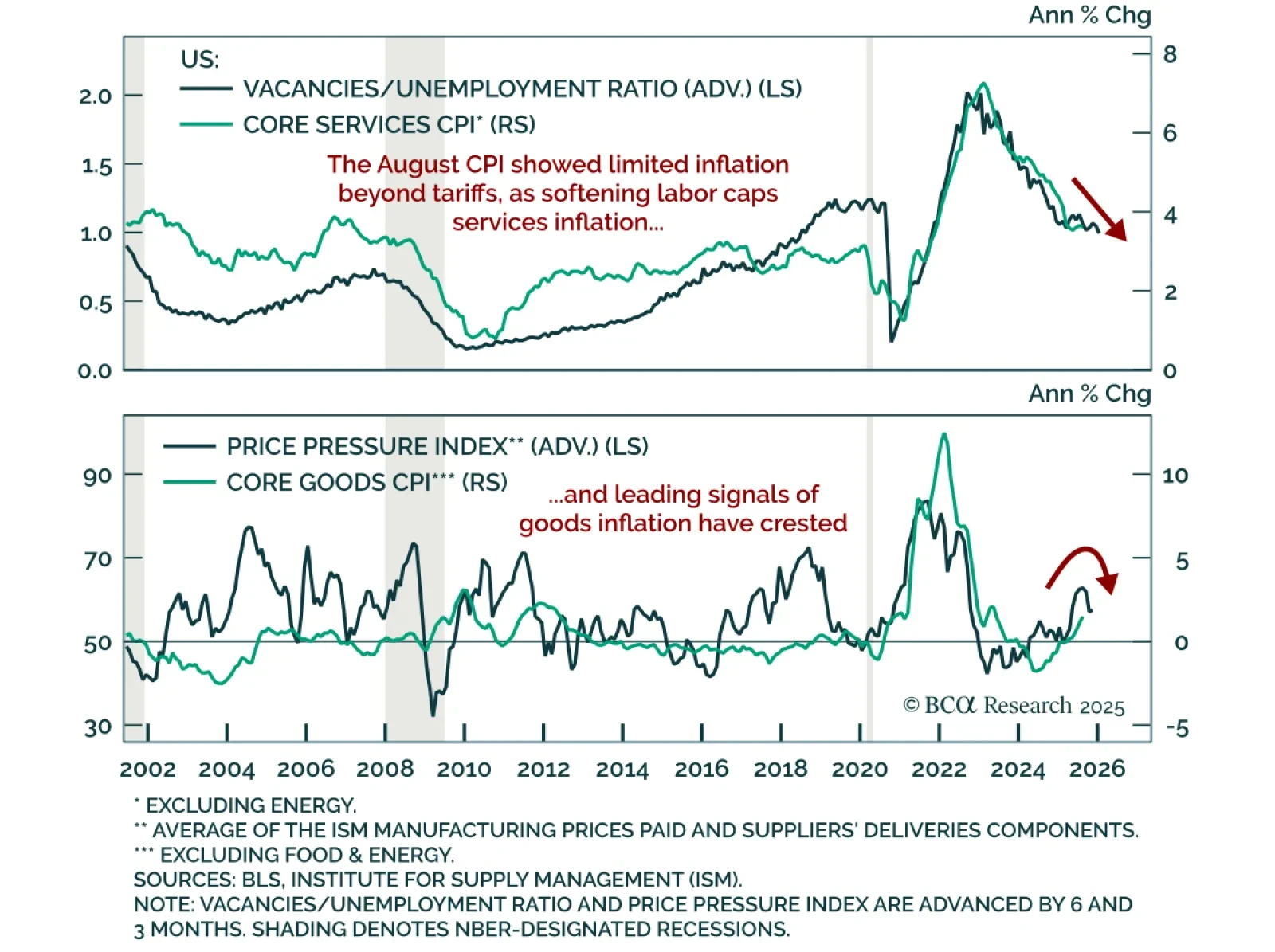

August US CPI was in line with expectations, reinforcing the case for Fed easing and a long-duration stance. Headline CPI rose 0.4% m/m (2.9% y/y), while core held at 0.3% m/m (3.1% y/y). Core goods inflation ticked up to 1.5% y/y…

High US inflation is being driven by tariffs, not domestic inflationary pressure. This argues for Fed easing and a bull-steepening of the Treasury curve.

For the next few months at least, inflation risk trumps recession risk for both US markets and world markets. This because, correctly gauged, the US jobs market is still supply-constrained with ‘jobs looking for a worker’ exceeding ‘…