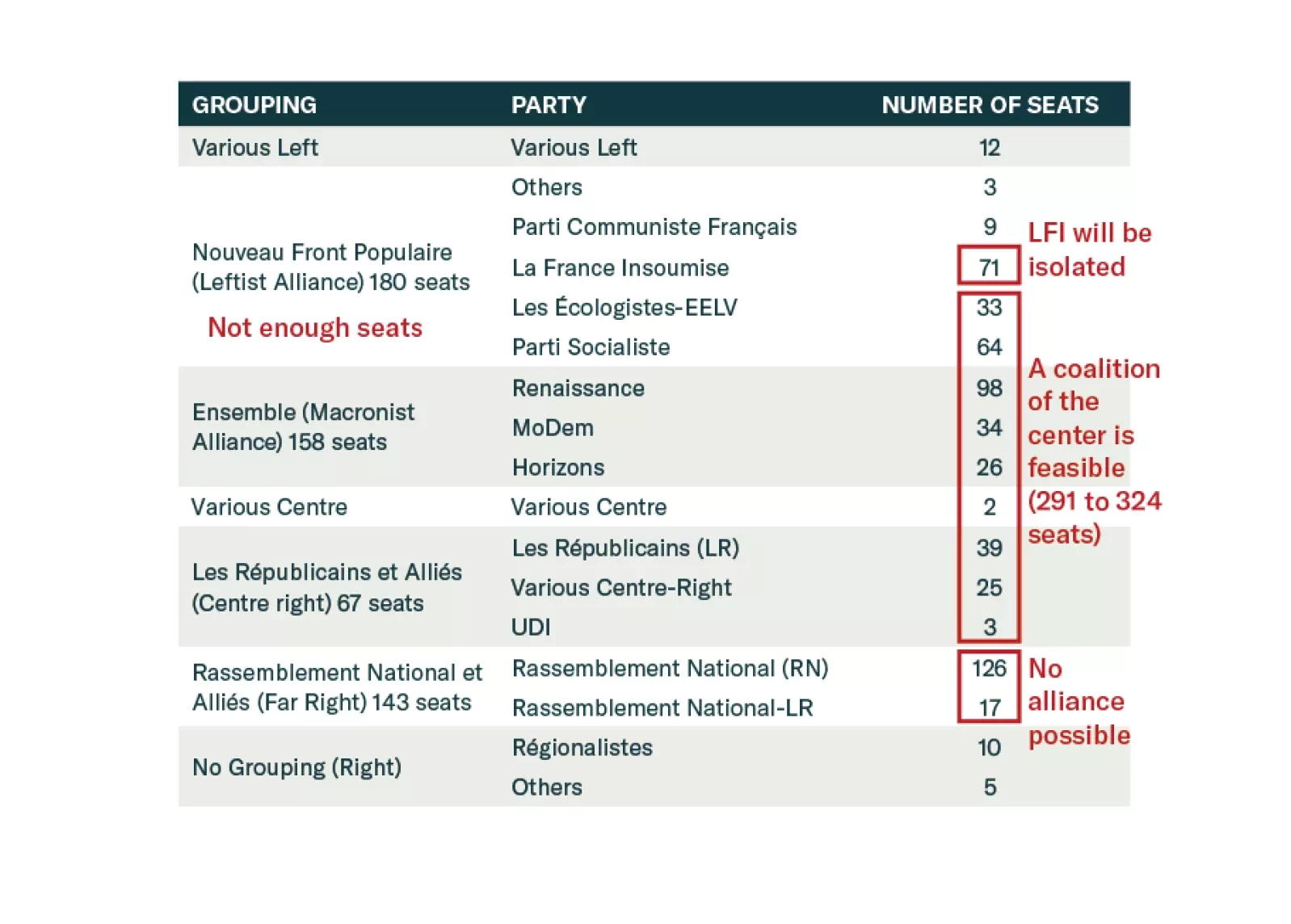

At first glance, France has moved to the far left. However, this coalition is fragile, and Macron’s allies still hold the balance of power. What are the assets that will benefit from this new political setup, and those that will not…

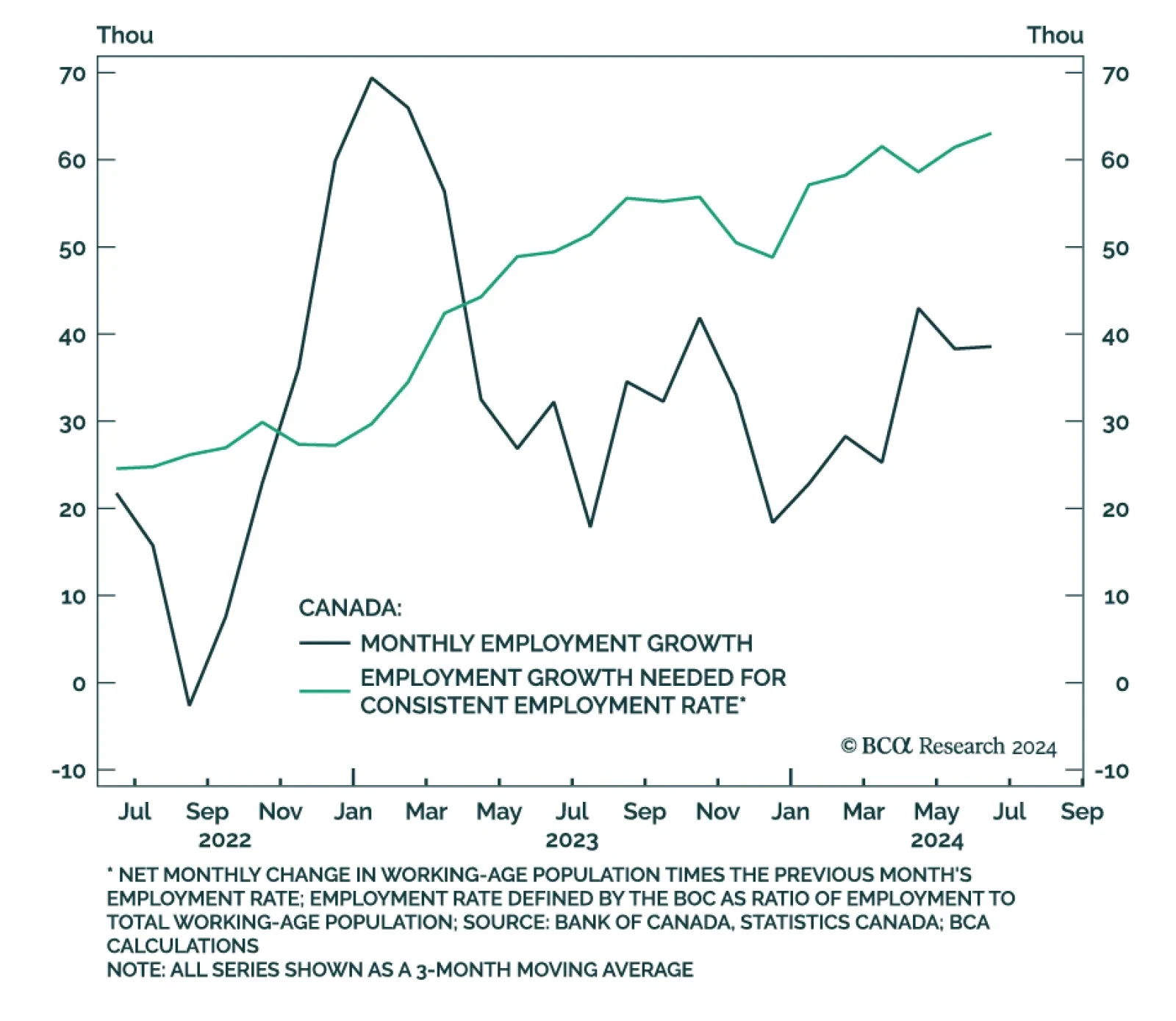

The latest release of the Canadian Labour Force Survey indicated further softening of the labor market in the Great White North. The economy experienced a net loss in total employment, shedding 1,400 jobs compared to market…

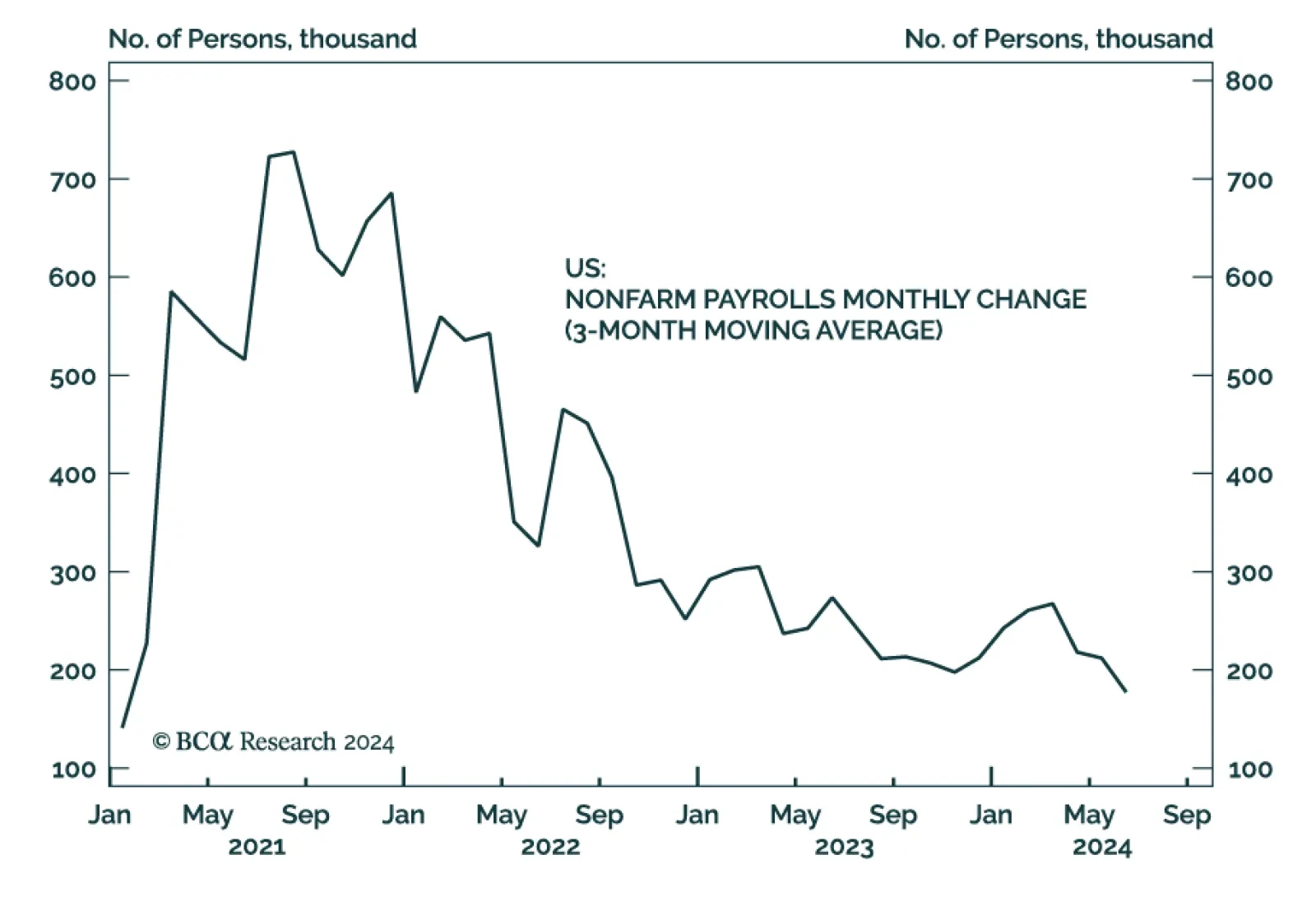

June nonfarm payrolls expanded by 206,000 workers, topping the 190,000 consensus expectation, but downward revisions of 111,000 jobs in April and May pulled the three-month moving average down to 177 thousand, its lowest level…

Our labor market indicators have softened meaningfully during the past month but aren’t yet signaling an imminent recession. That said, the Fed can no longer ignore the labor market with the unemployment rate above 4% and rising.

Does the incipient slowdown in European data herald a soft landing and a goldilocks period for equities? We have our doubts.

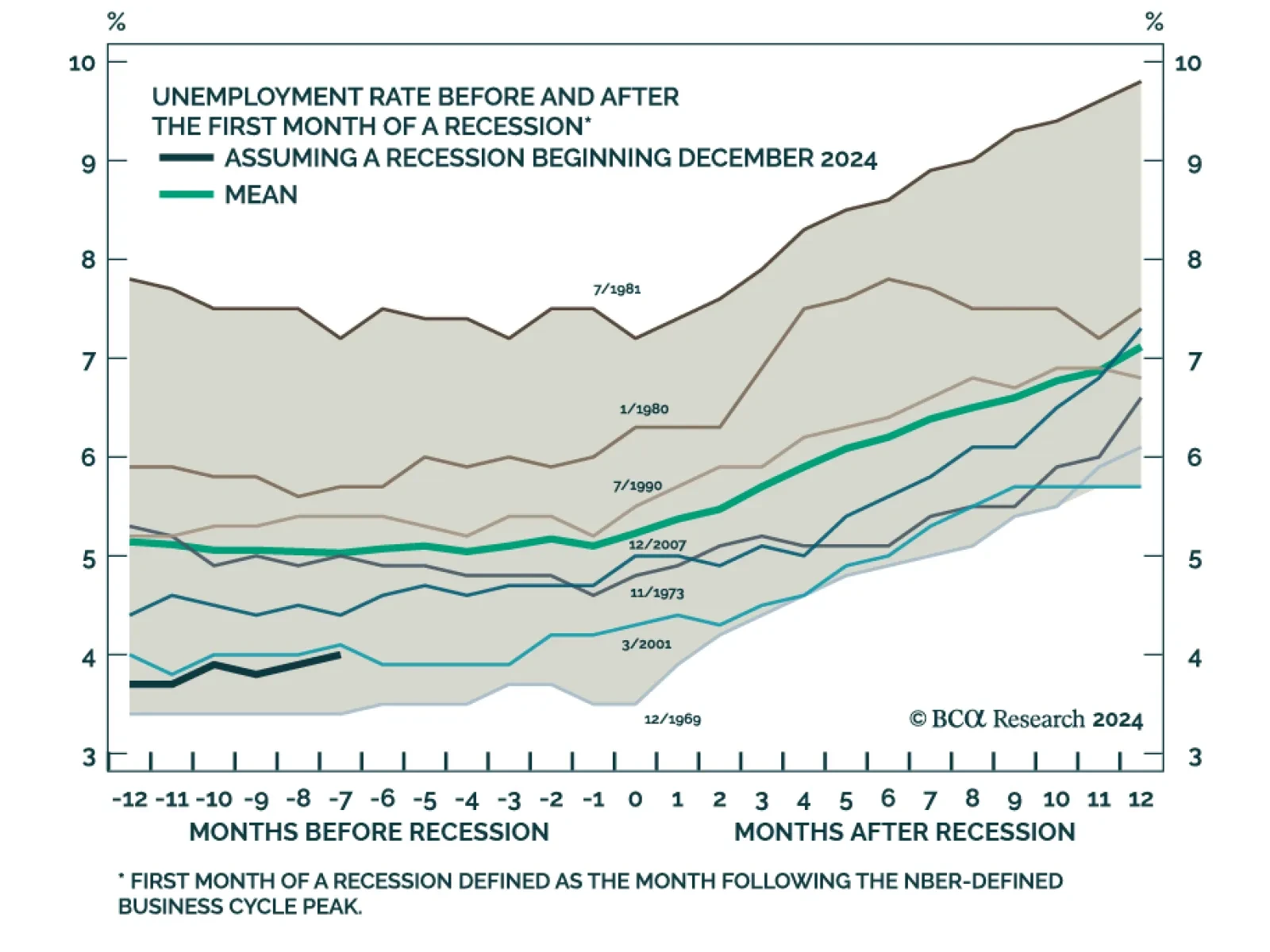

The US unemployment rate stands at just 4.0% today following 27 consecutive sub-4% readings. Does this low unemployment rate guarantee a soft landing in the US economy? Our Global Investment Strategy (GIS) team’s base…

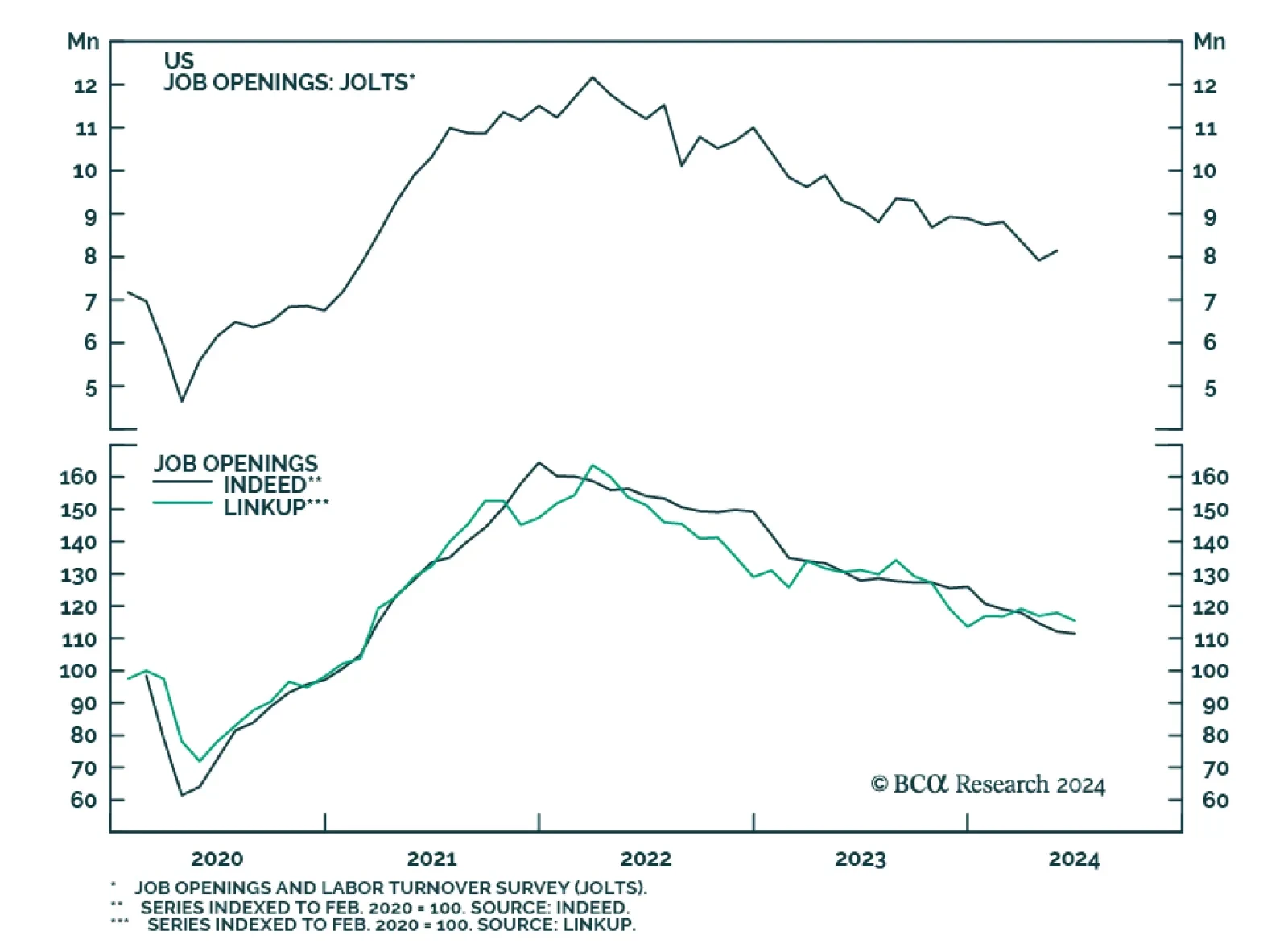

The number of job openings in the US surprised to the upside in May, growing from a downwardly revised 7.9 million to 8.1 million. Not only did the growth in job openings beat expectations of a decline, but the May number even…

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.

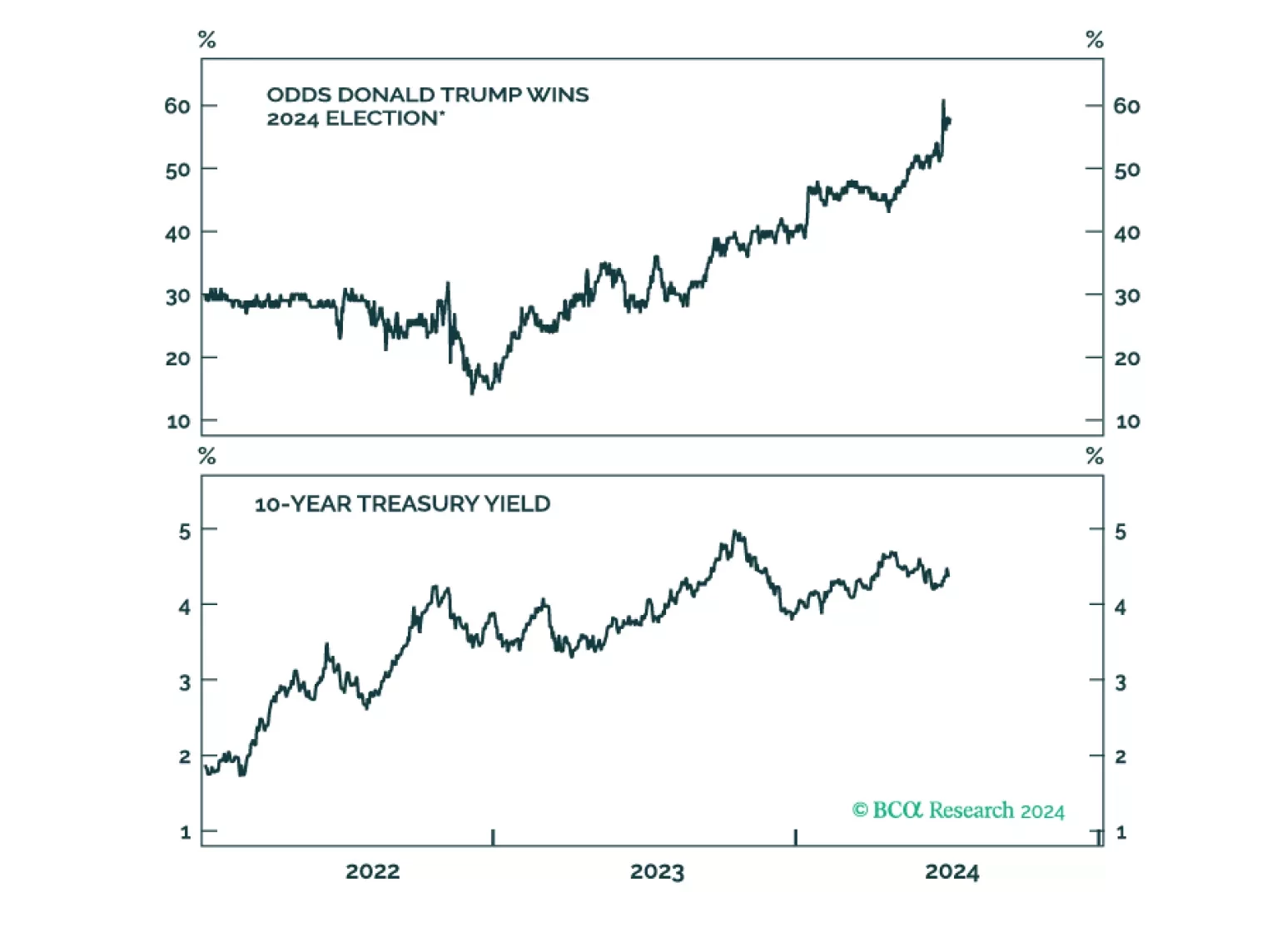

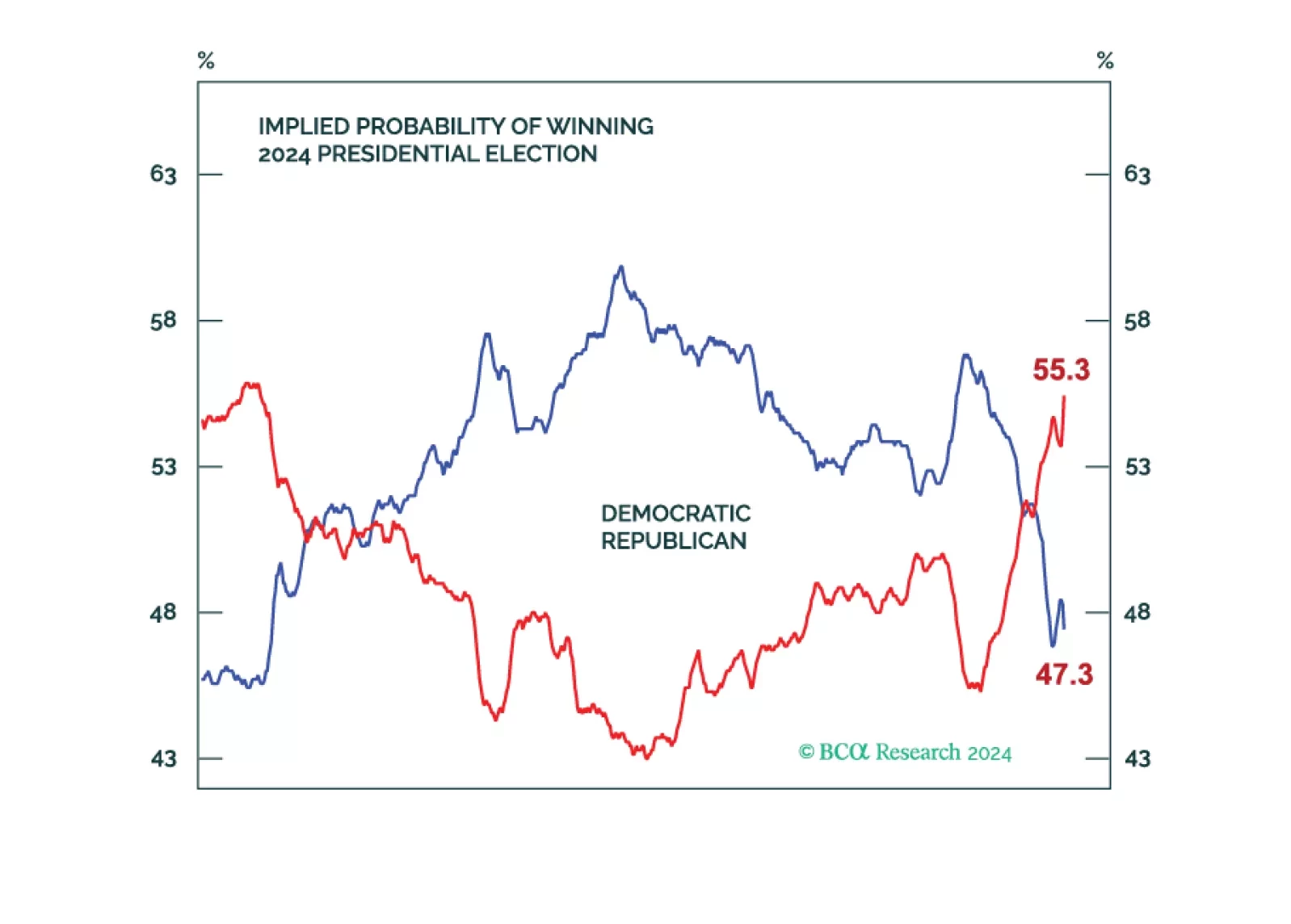

The bond market should sell off and drag stocks down on higher odds of a single-party sweep, policy uncertainty, unorthodox Trump presidency, aggressive tariffs, large tax cuts, large budget deficits, labor shortages, a fired Fed…