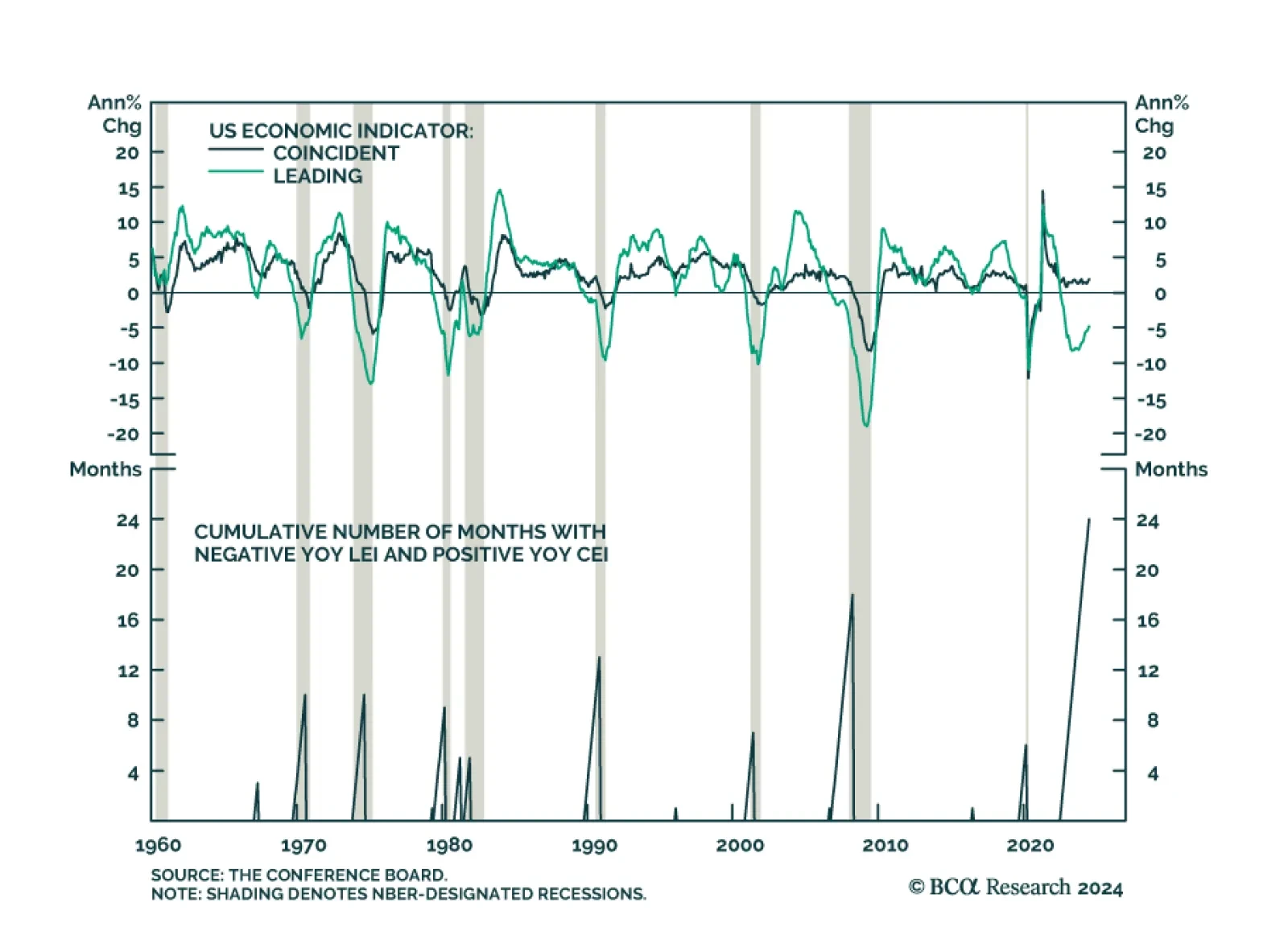

The Conference Board Leading Economic Index (LEI) for the U.S. declined by 0.2% in June from May, marking the smallest decrease in the past three months. Year-over-year, the US LEI remained negative but less so compared to prior…

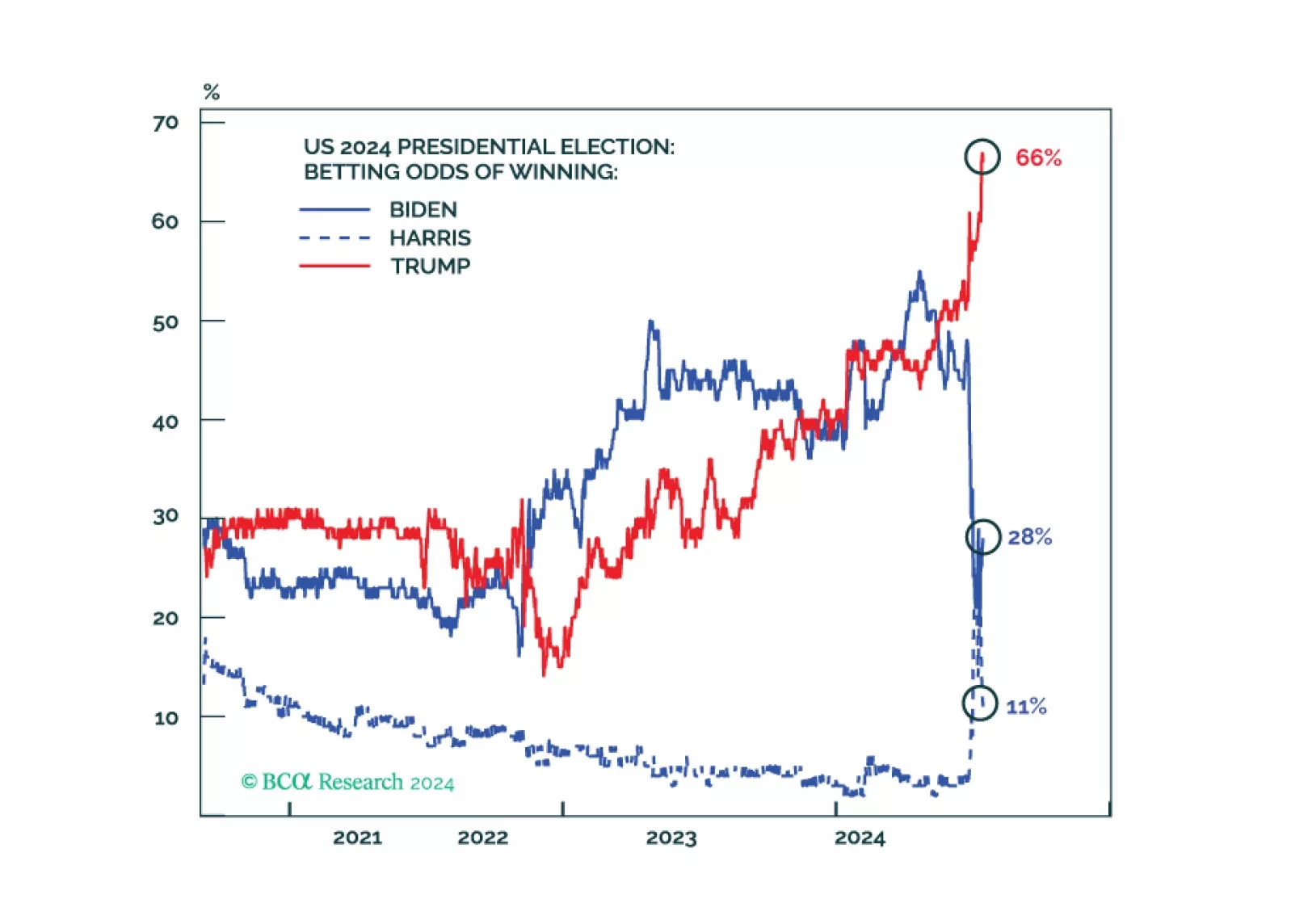

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

Don't buy the dip. The equity bull market is over. The US will enter a recession in late 2024 or in early 2025.

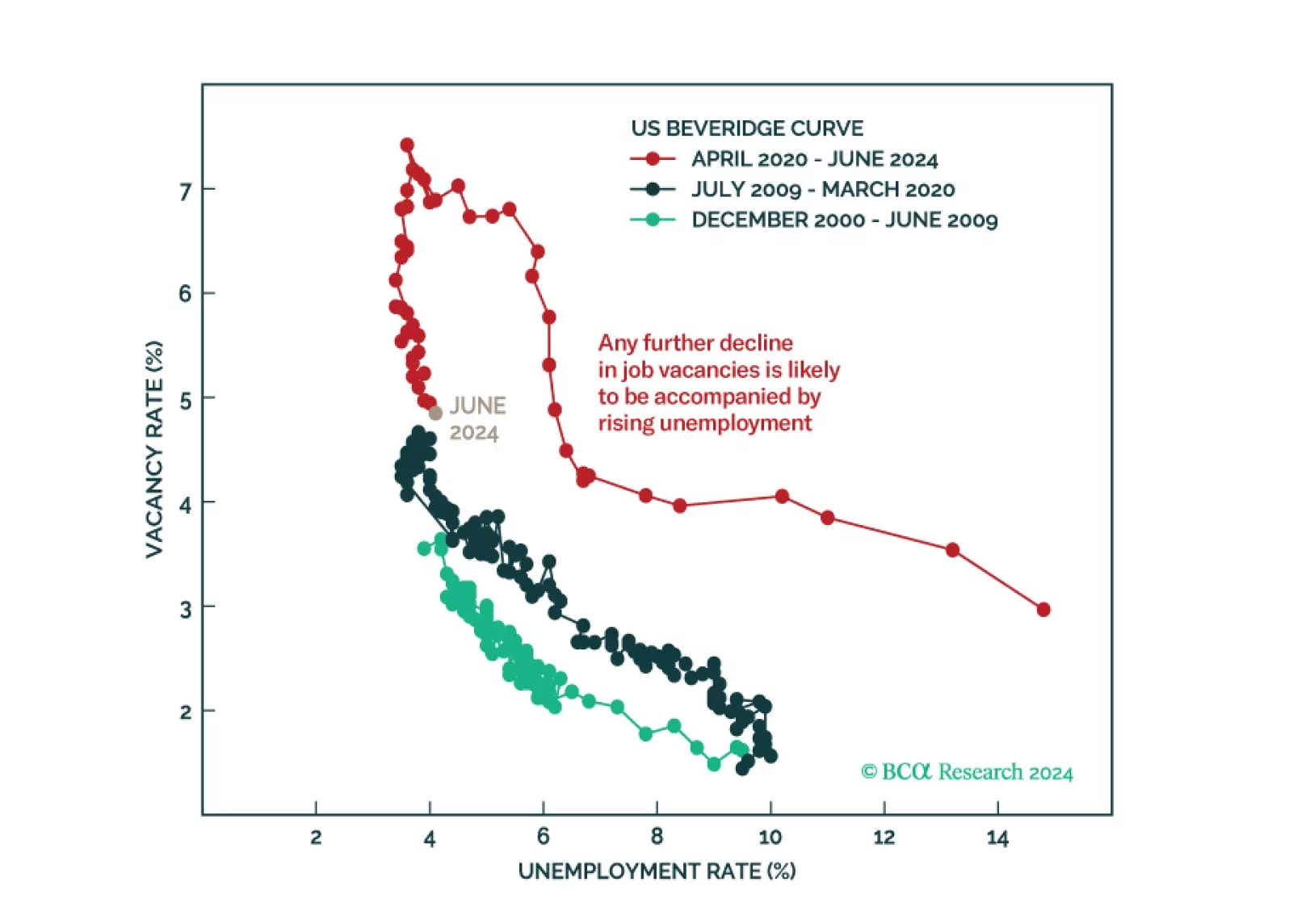

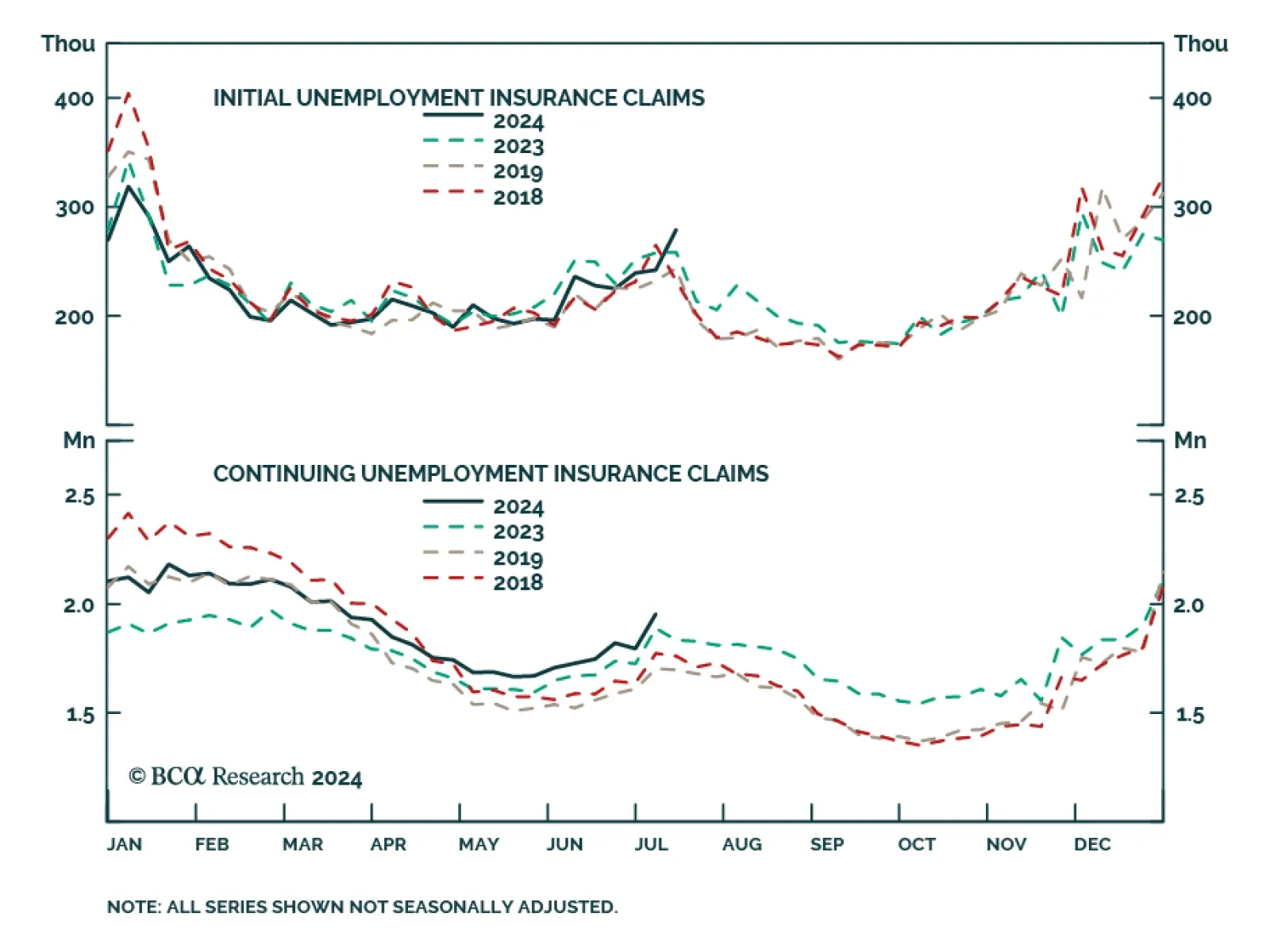

US initial unemployment insurance claims jumped this week and are now running above levels seen at this time of year in 2023, 2019 and 2018. We choose 2023, 2019 and 2018 as our benchmarks because the unemployment rate ran…

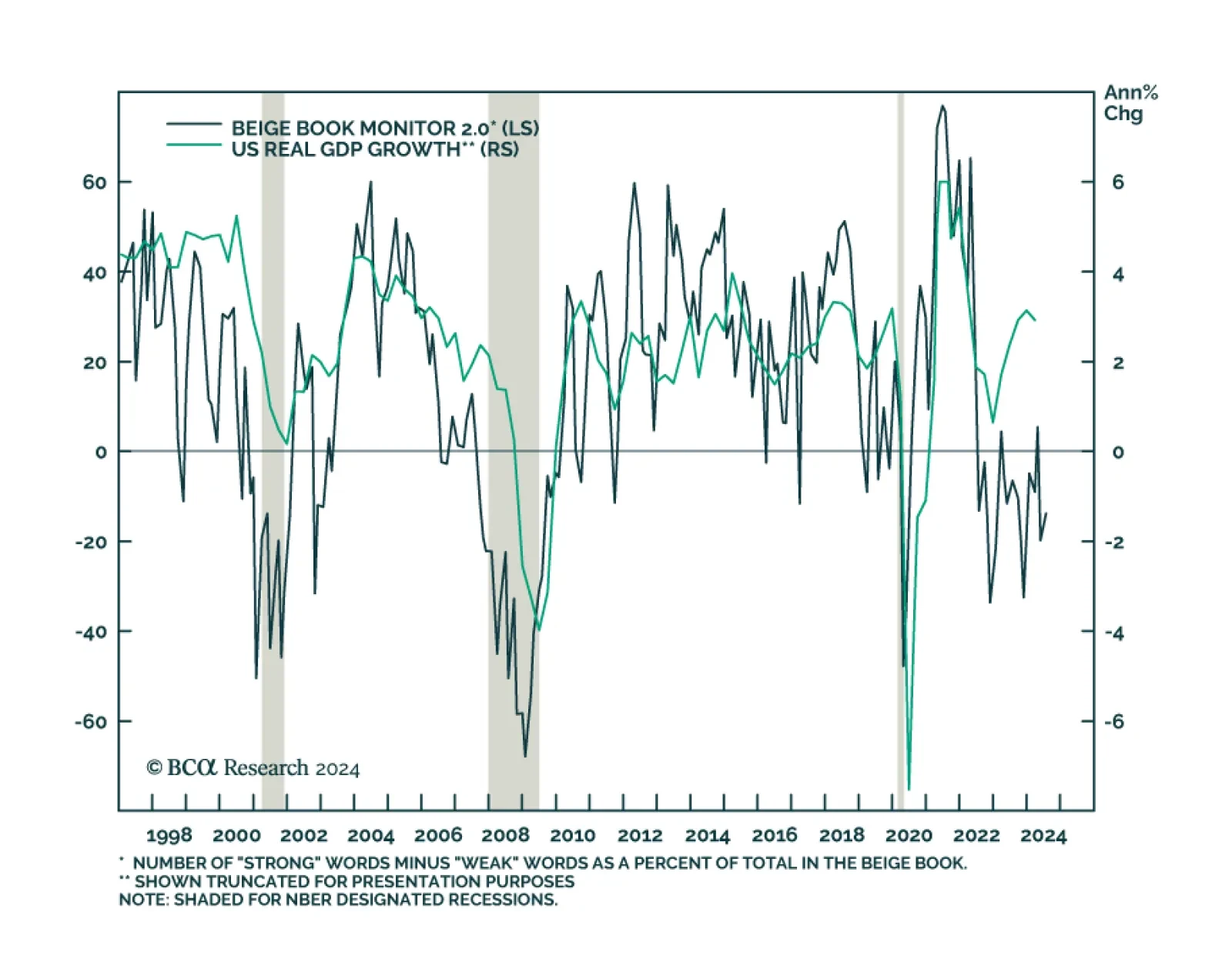

The latest iteration of the Fed’s Beige Book, a compilation of qualitative input sourced from business and other organizational contacts in each of its twelve Districts, was released Wednesday afternoon. The Beige Book…

The real threat to European equities is growth, not political risk. How low will Eurozone earnings fall during the coming recession and how much will equities decline in response?

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.

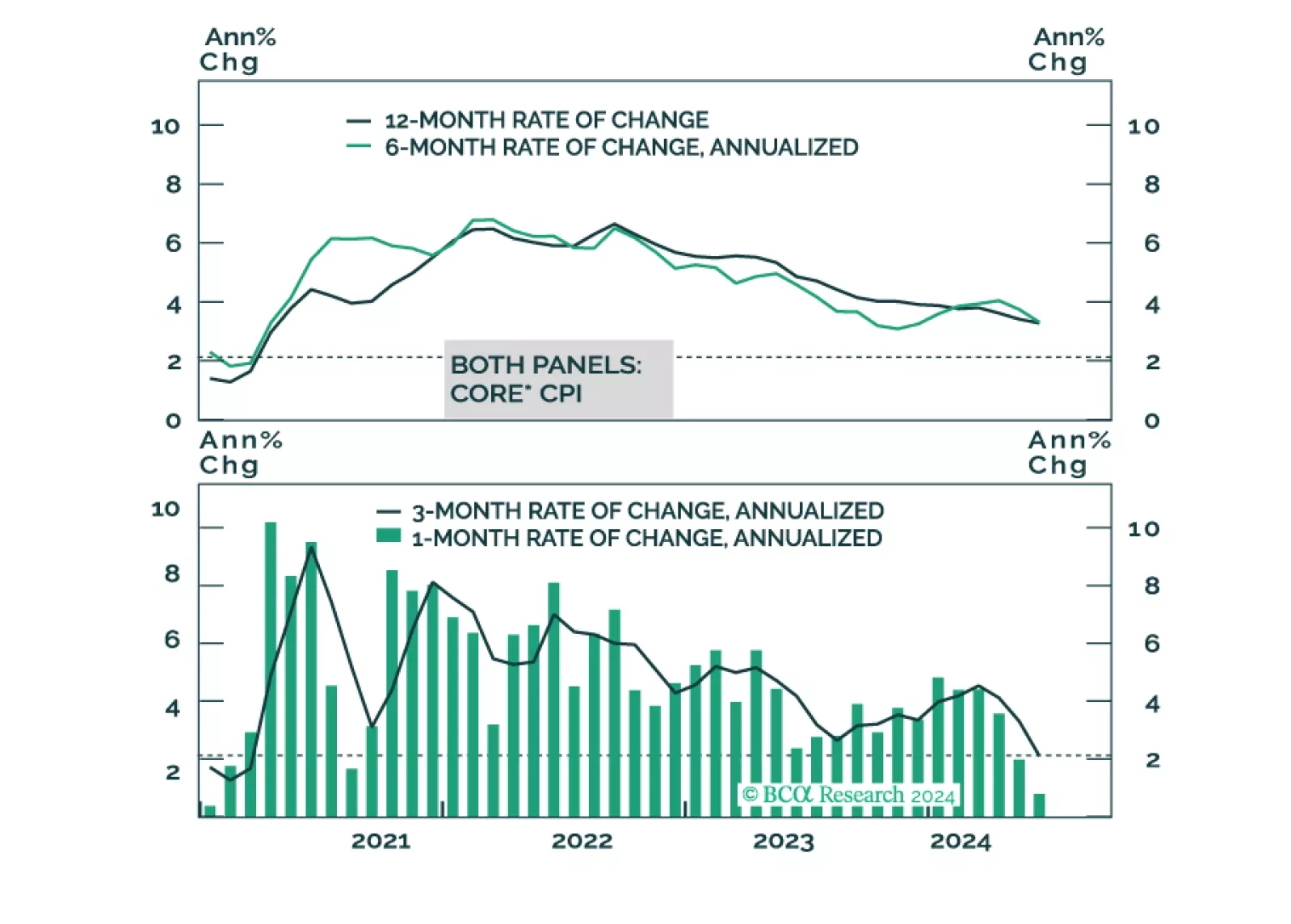

In light of last week’s employment report and this morning’s CPI, it’s time for the Federal Reserve to cut rates.

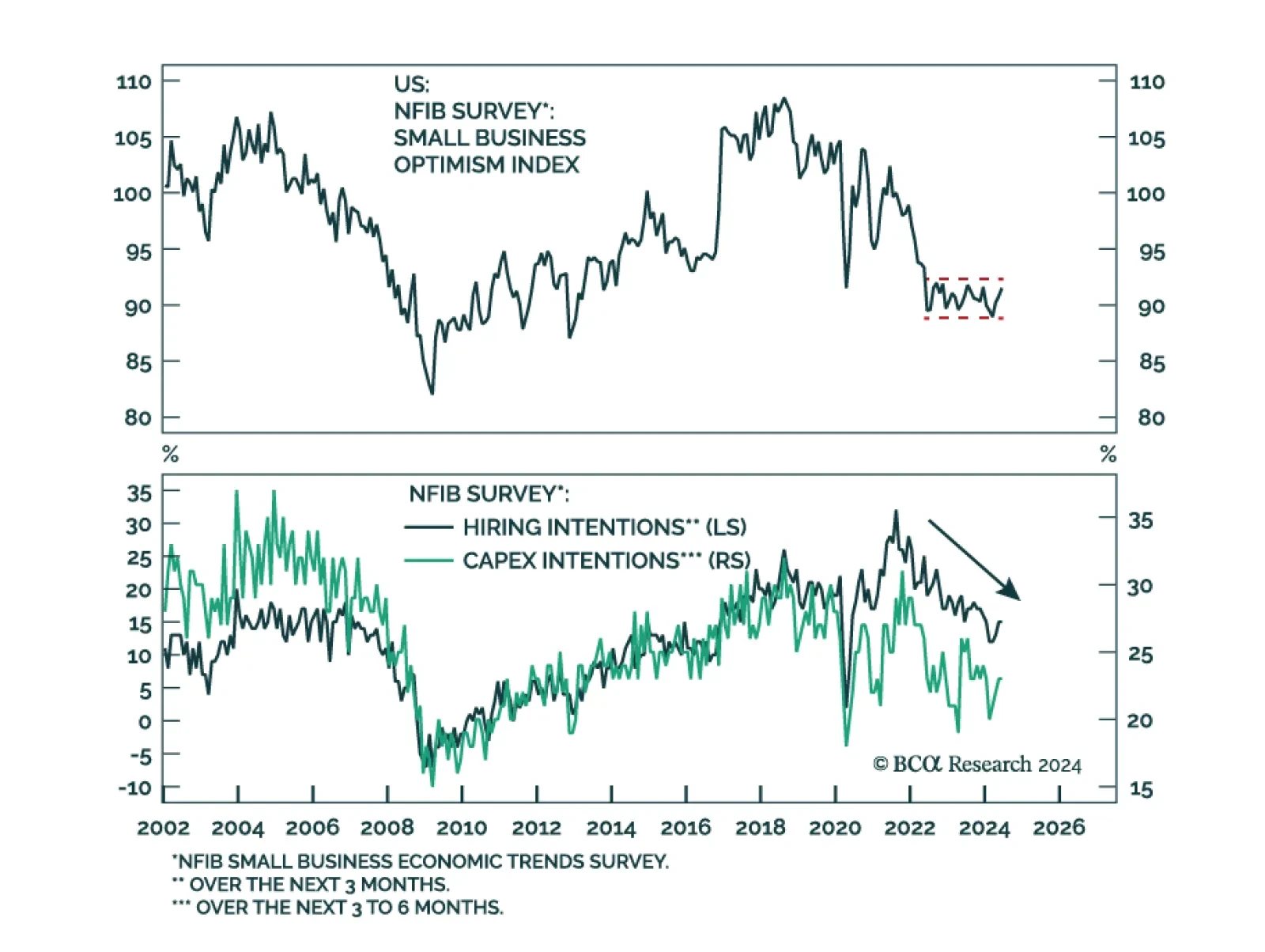

The NFIB Small Business Optimism (SBO) index climbed from 90.5 to 91.5 in June, the highest print this year, topping consensus expectations of a softening to 90.2. On the surface, this appears to be good news. Indeed, small…

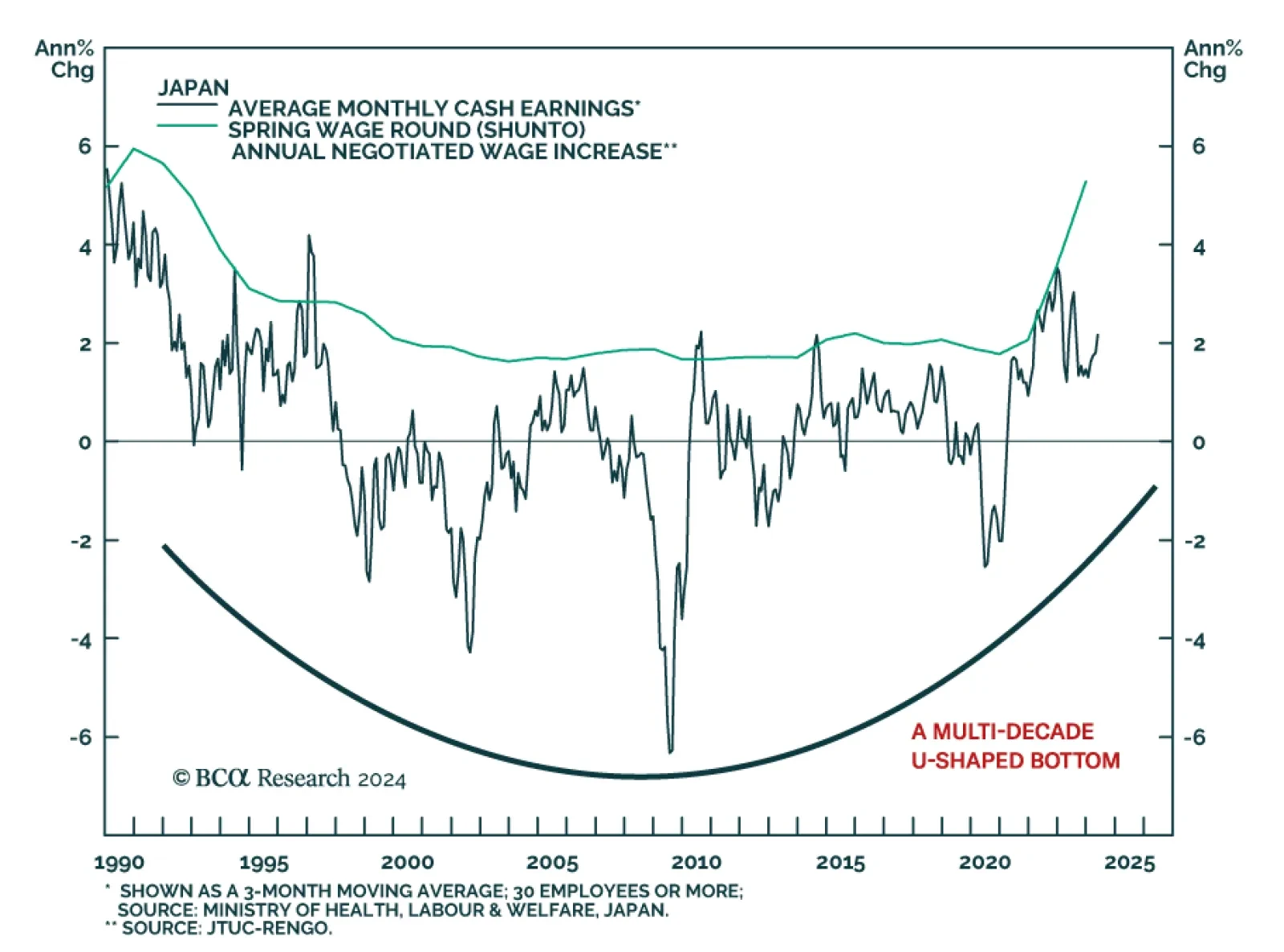

Japanese wage growth fell below expectations in May, expanding by 1.9% y/y versus consensus estimates calling for a 2.1% y/y increase. Although this marks an acceleration from April’s 1.6% y/y, that figure was revised down…