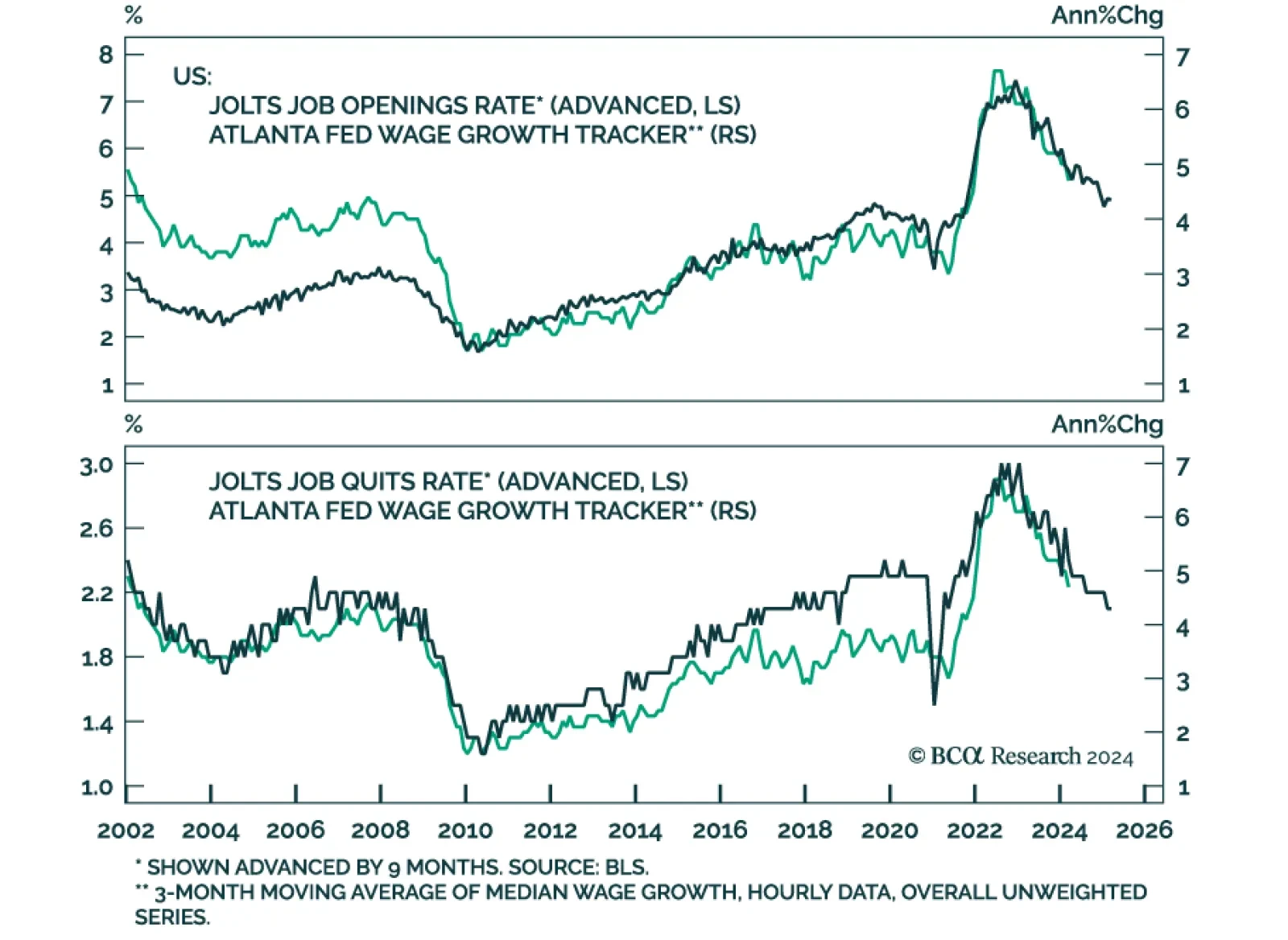

US job openings grew by 8.18 million in June, exceeding expectations of 8 million, but below May’s 8.23 million openings. The pro-cyclical manufacturing sector accounted for the largest drag, withdrawing 100 thousand…

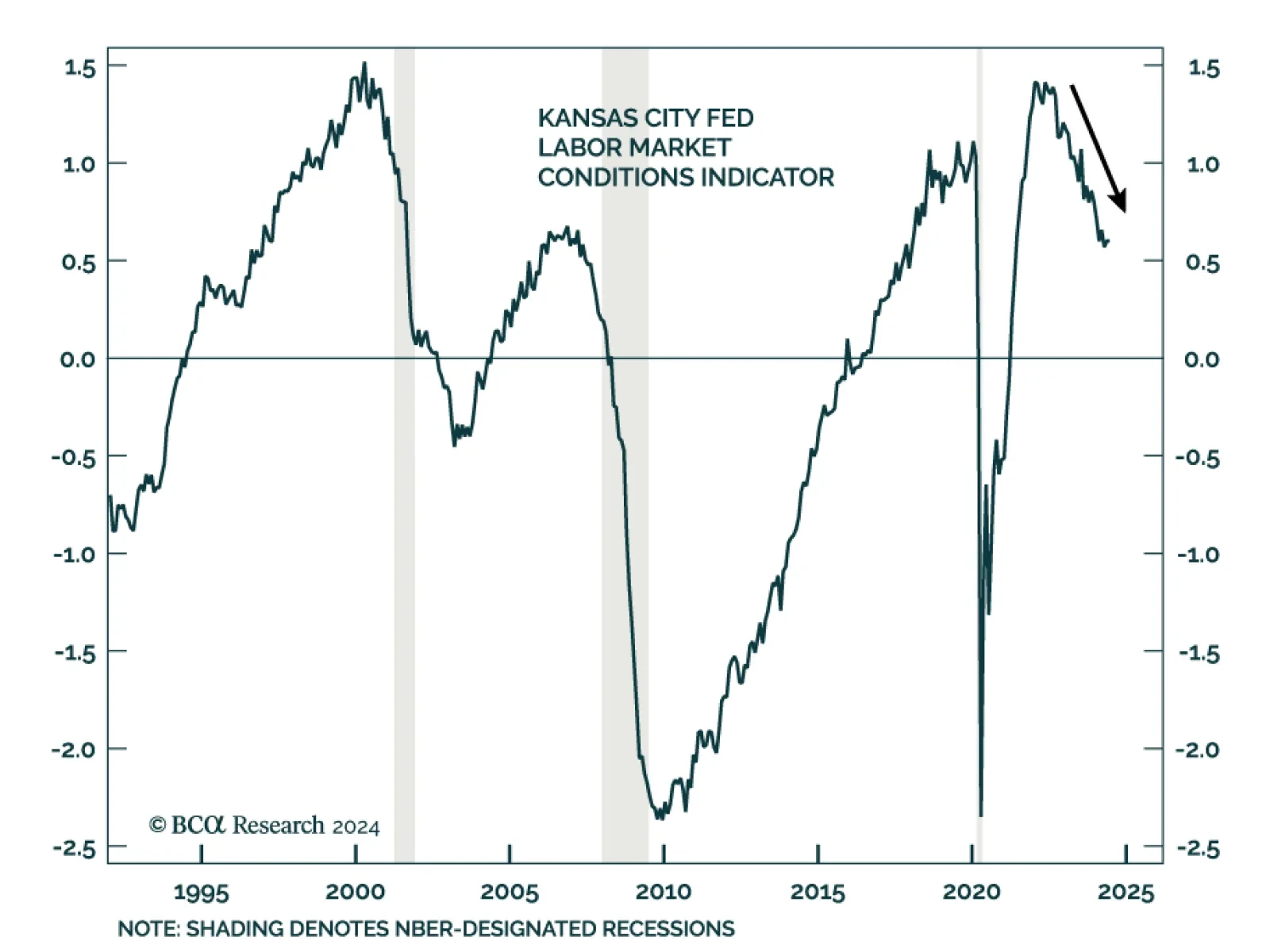

The Kansas City Labor Market Conditions Indicator (LMCI) is a broad measure of labor market trends incorporating 24 national labor market variables. It has been on a steady downtrend since 2022, though at 0.6, it remains slightly…

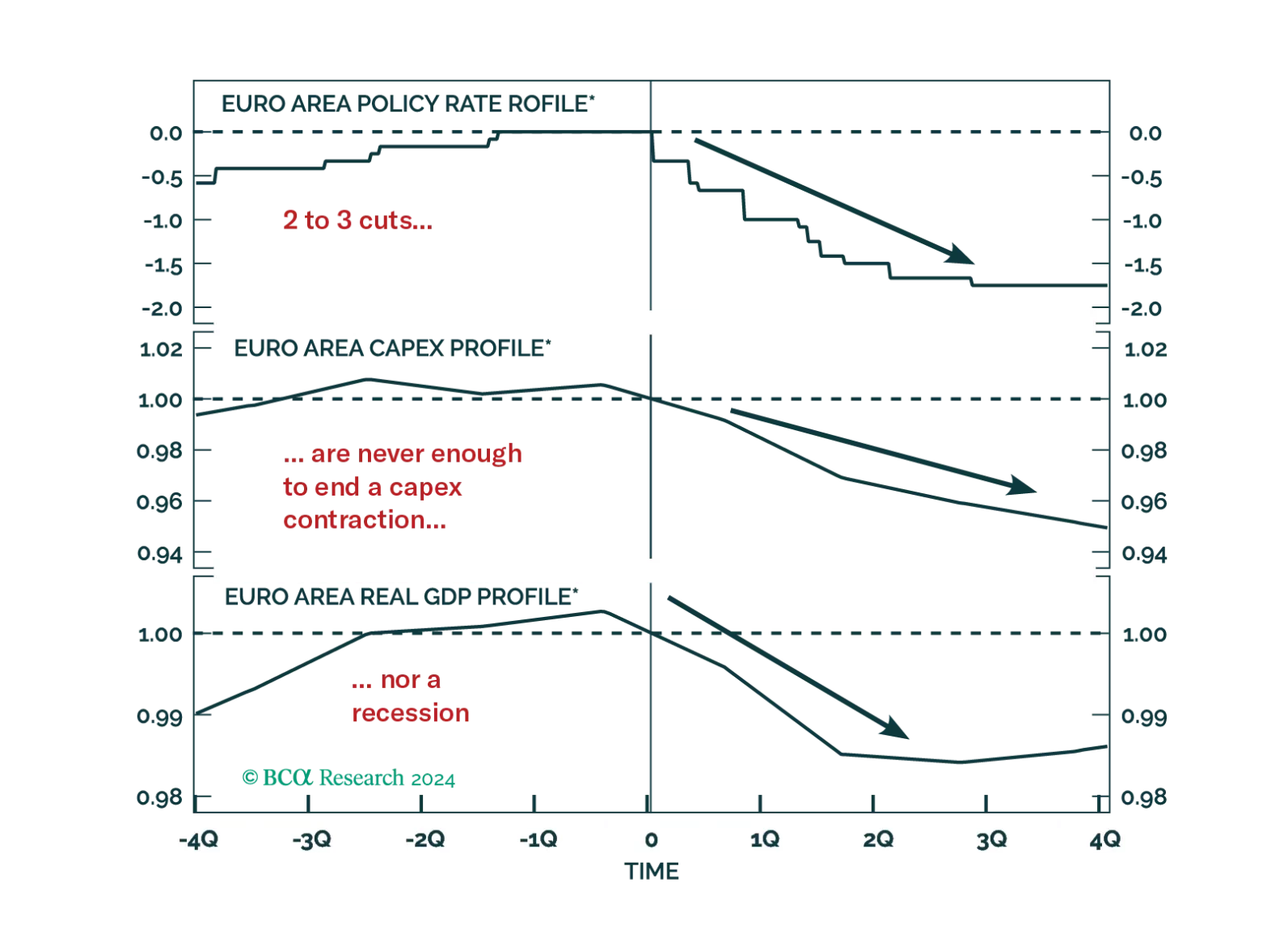

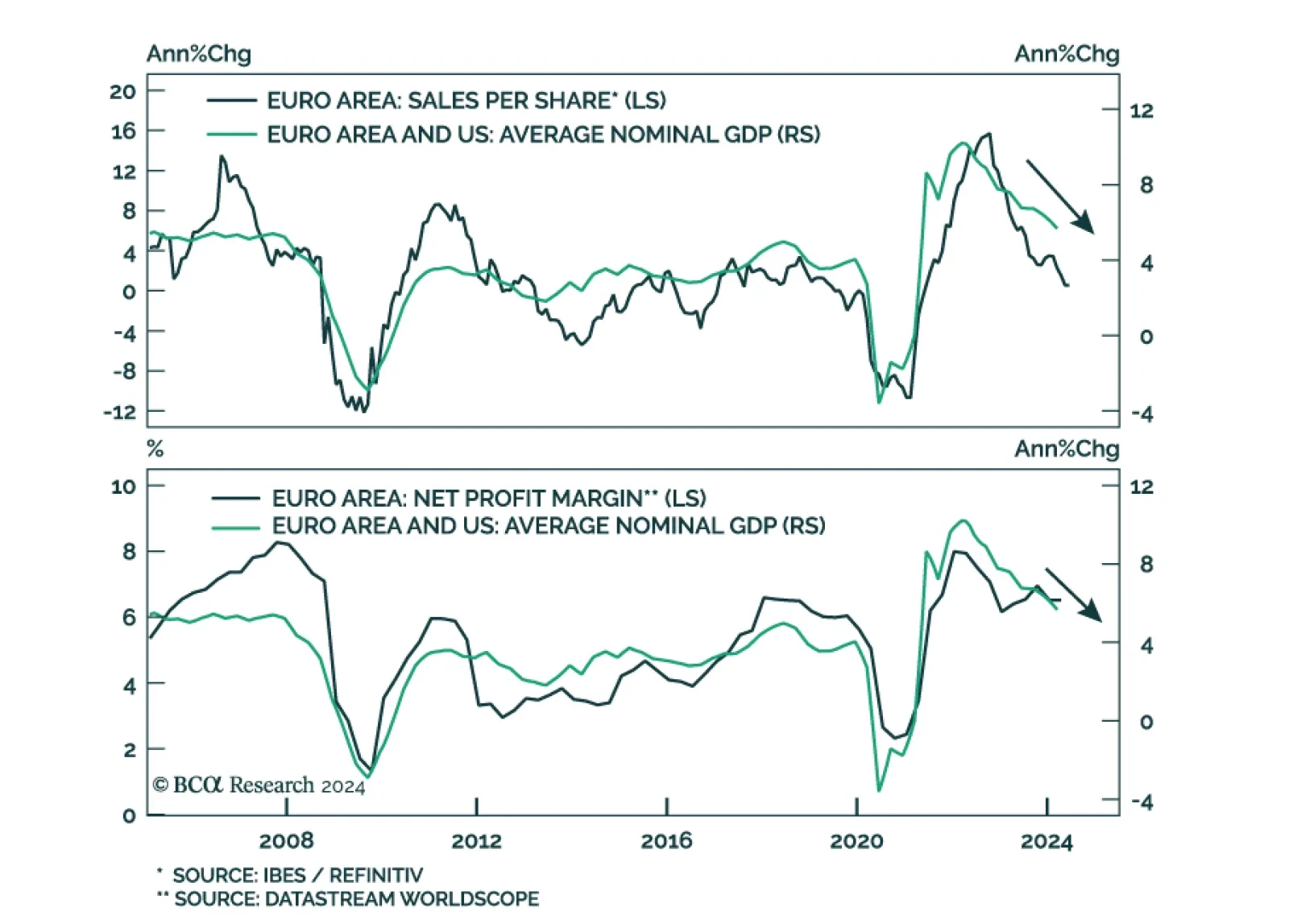

Investors hope that the ECB rate cuts priced into the curve will be sufficient to achieve a soft landing in Europe. History argues against this view, but will this time be different?

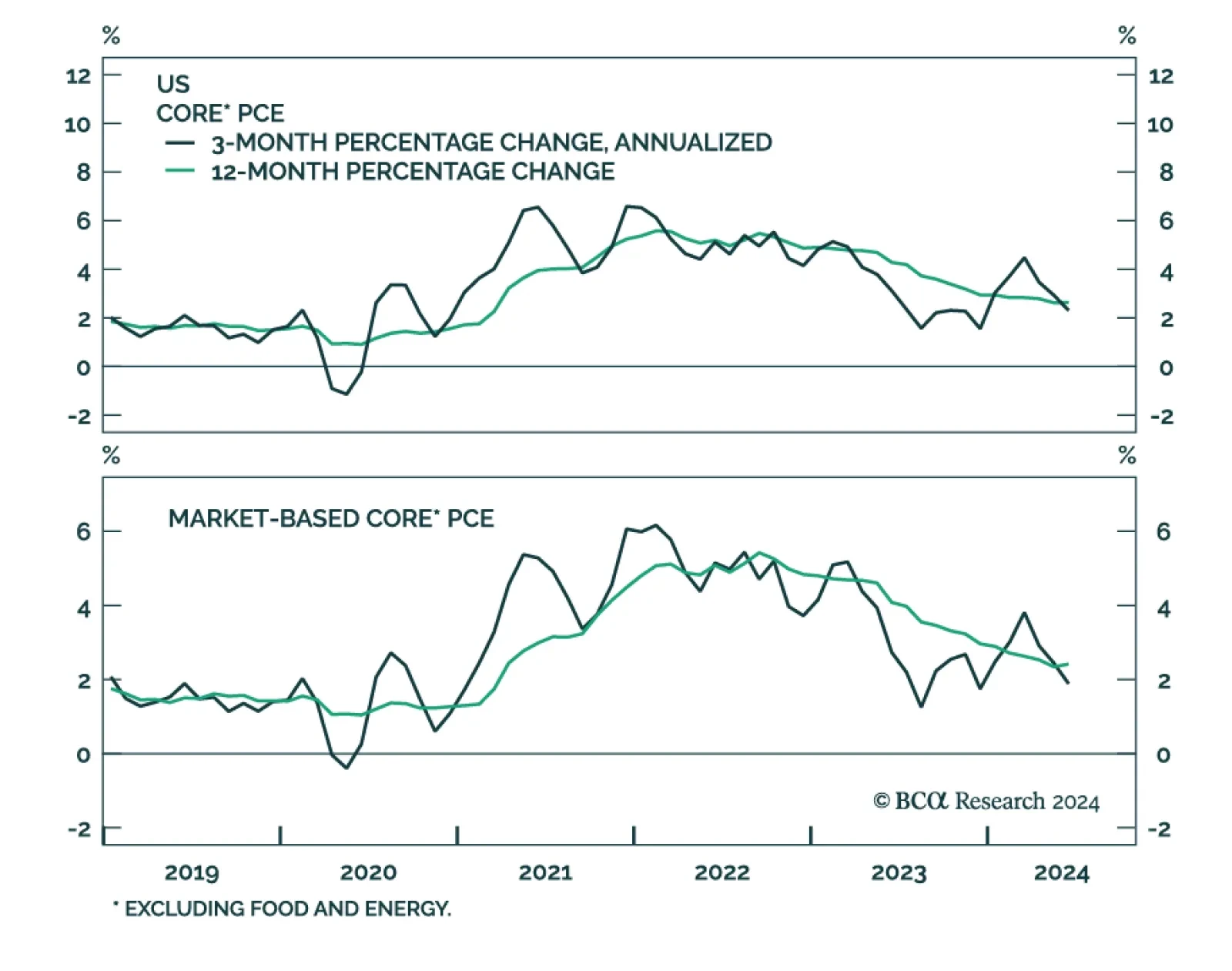

US nominal personal income growth and real personal spending decelerated at a faster-than-expected pace in June, both moderating to 0.2% m/m from 0.4% in May. Core PCE – the Fed’s favored inflation gauge –…

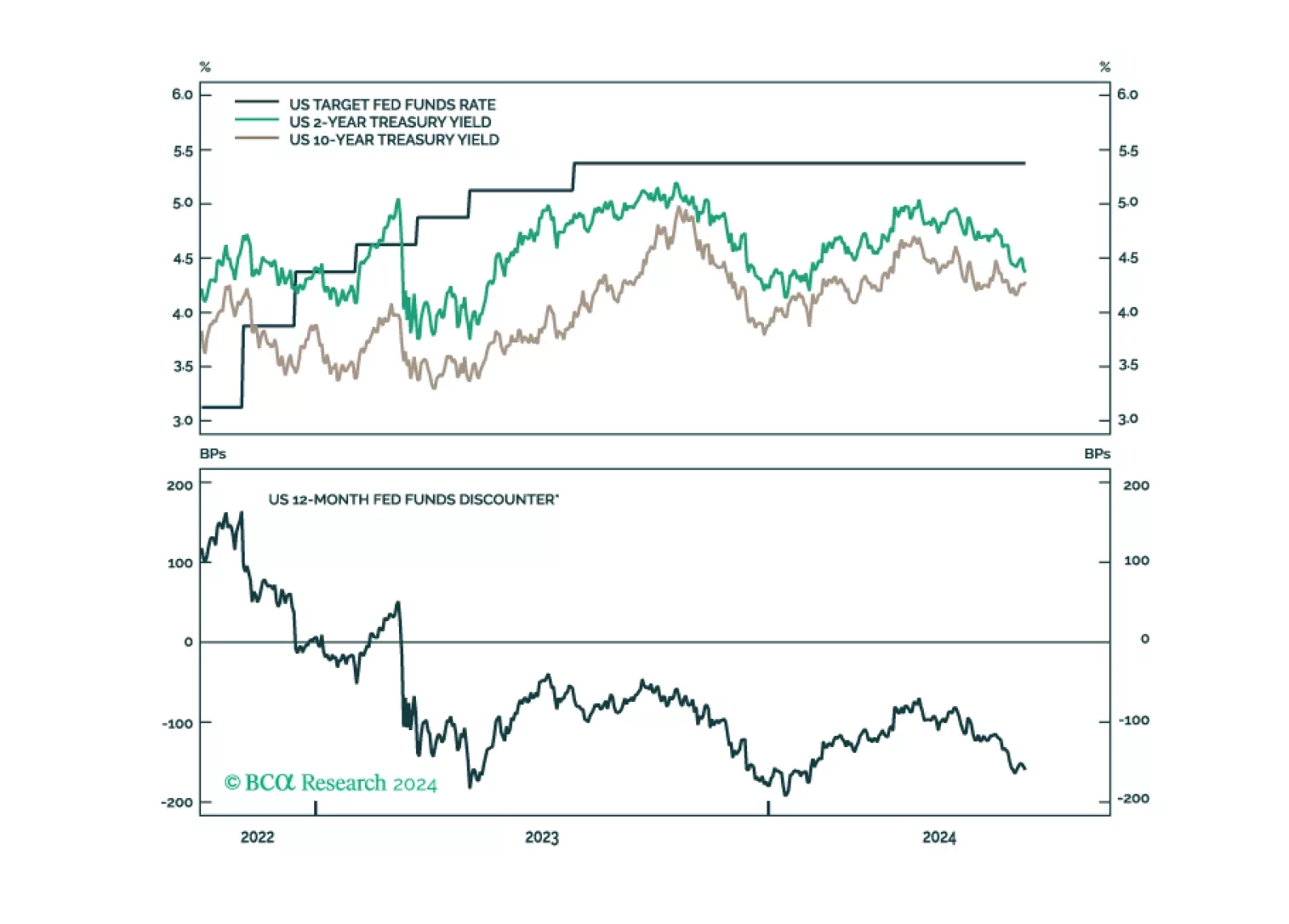

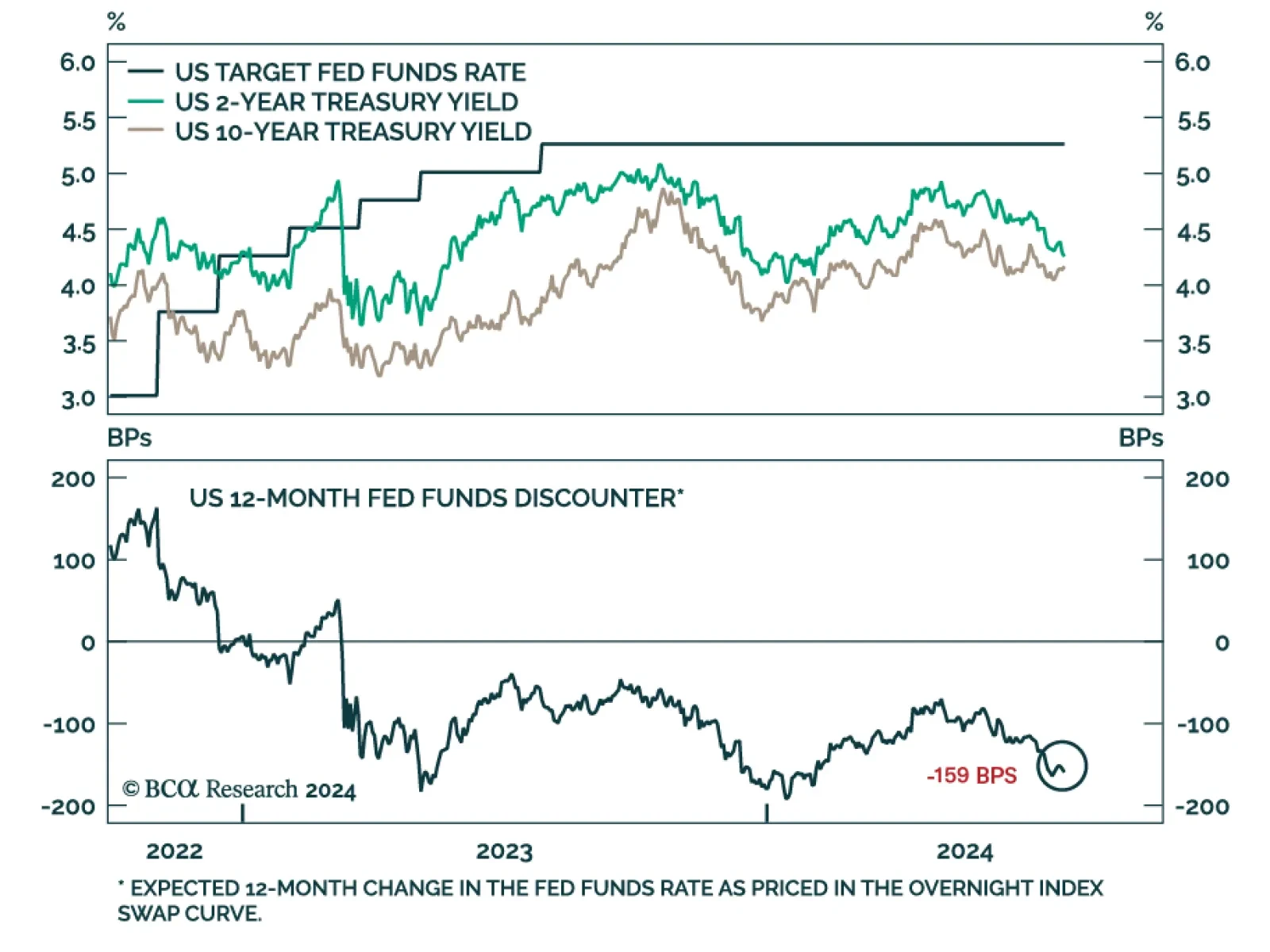

According to BCA Research’s US Bond Strategy service, it is time to increase portfolio duration from “at benchmark” to “above benchmark” on a 6-12 month horizon. Since February, our colleagues…

After this morning’s jobless claims number, we have now seen enough deterioration in our preferred labor market indicators to increase portfolio duration from “at benchmark” to “above benchmark”.

We assign high odds that the US will tip into a recession by year-end or early 2025. Given it has been the largest driver of global demand in this cycle, a US recession will morph into a global downturn. The procyclical…

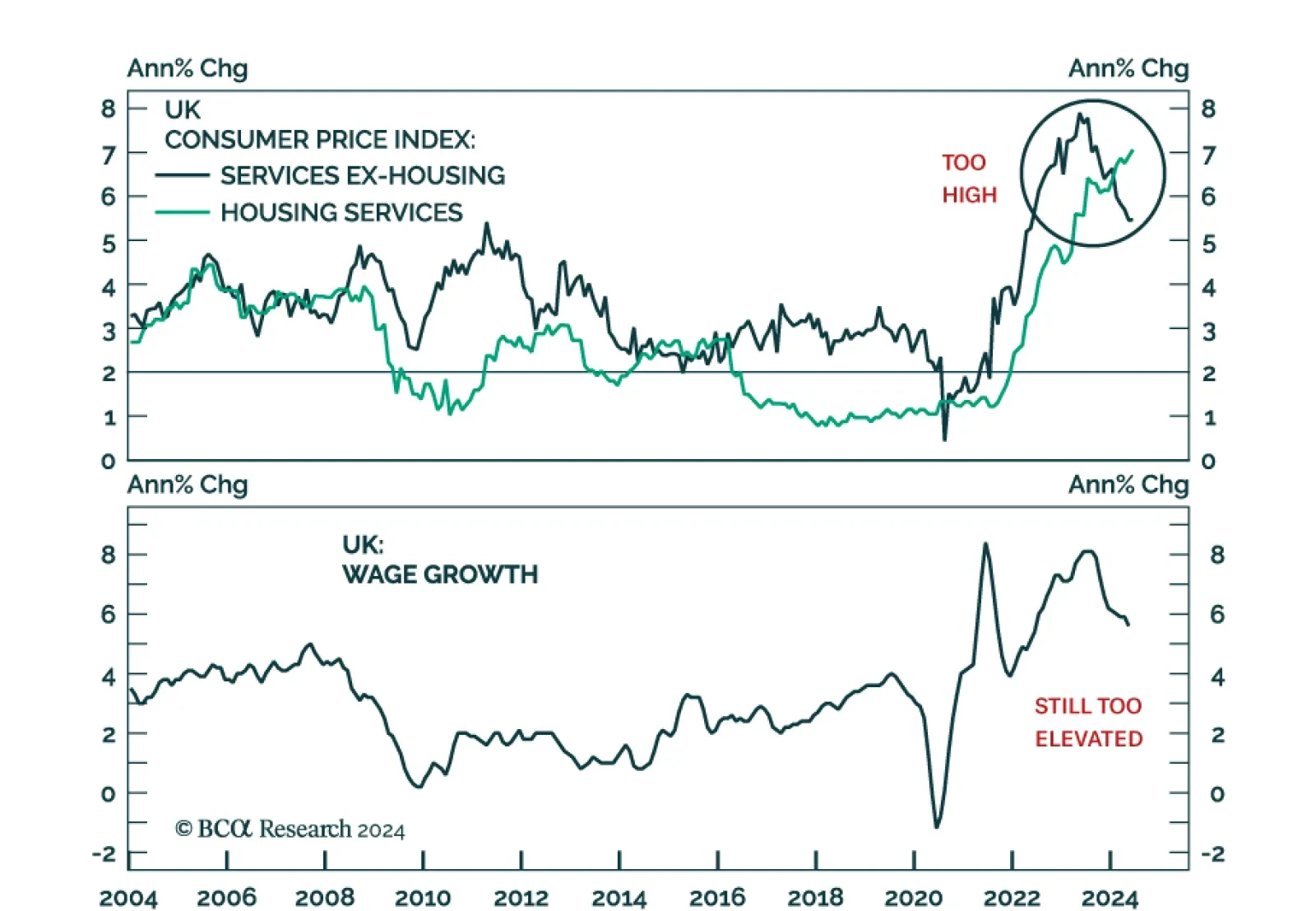

UK’s CPI growth stands right on the Bank of England’s (BoE) 2% target. However, services inflation remains sticky, growing at a constant 5.7% y/y in June. Moreover, the deceleration in wage growth remains insufficient…

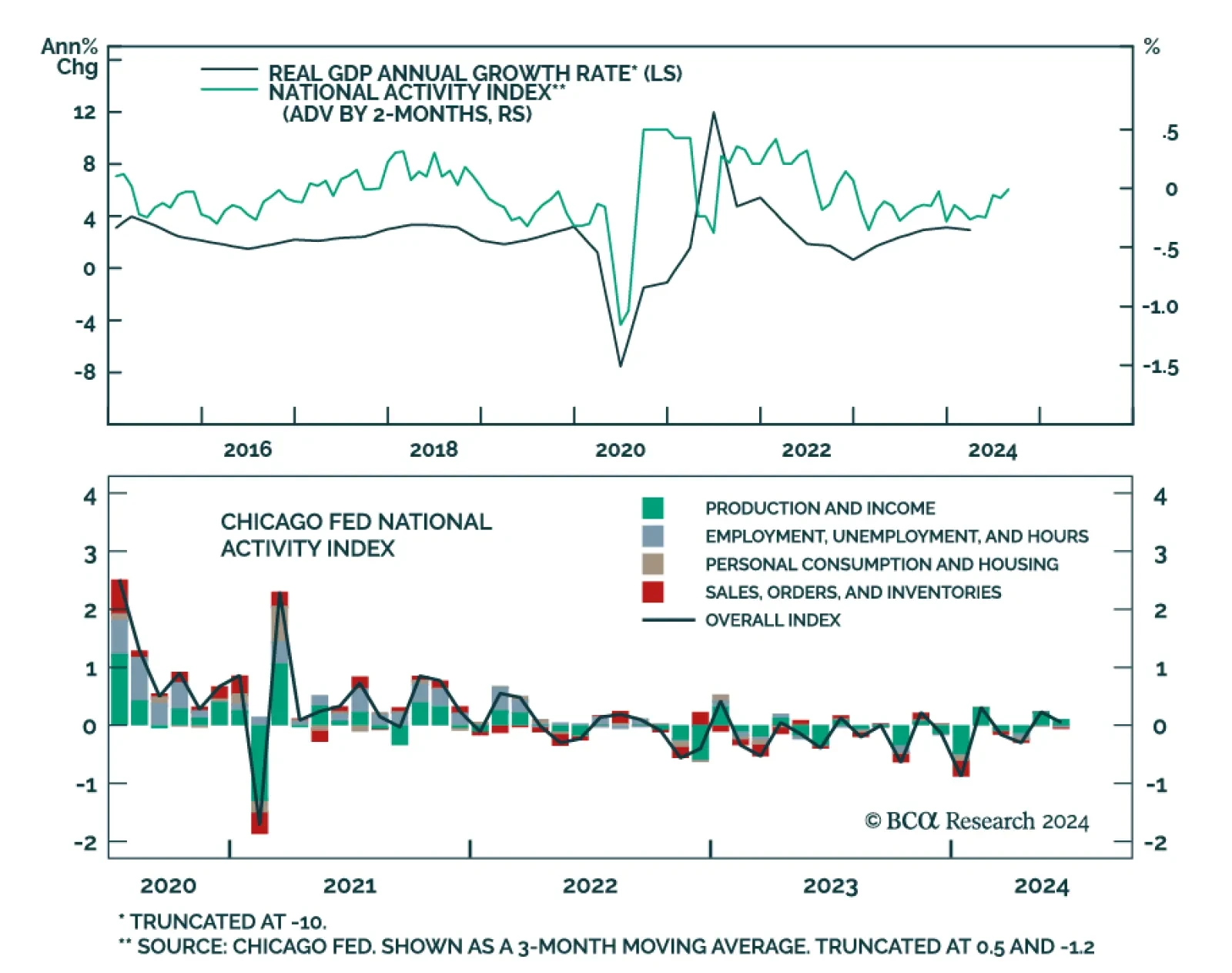

The Chicago Fed National Activity Index (CFNAI) – a summary statistic of US economic data releases – decreased to 0.05 from 0.23, suggesting that the US economy cooled in June. Although the headline index surpassed…

As Trump’s victory odds rise, the underperformance of European equities deepens. How negative would a global trade war be for European assets?