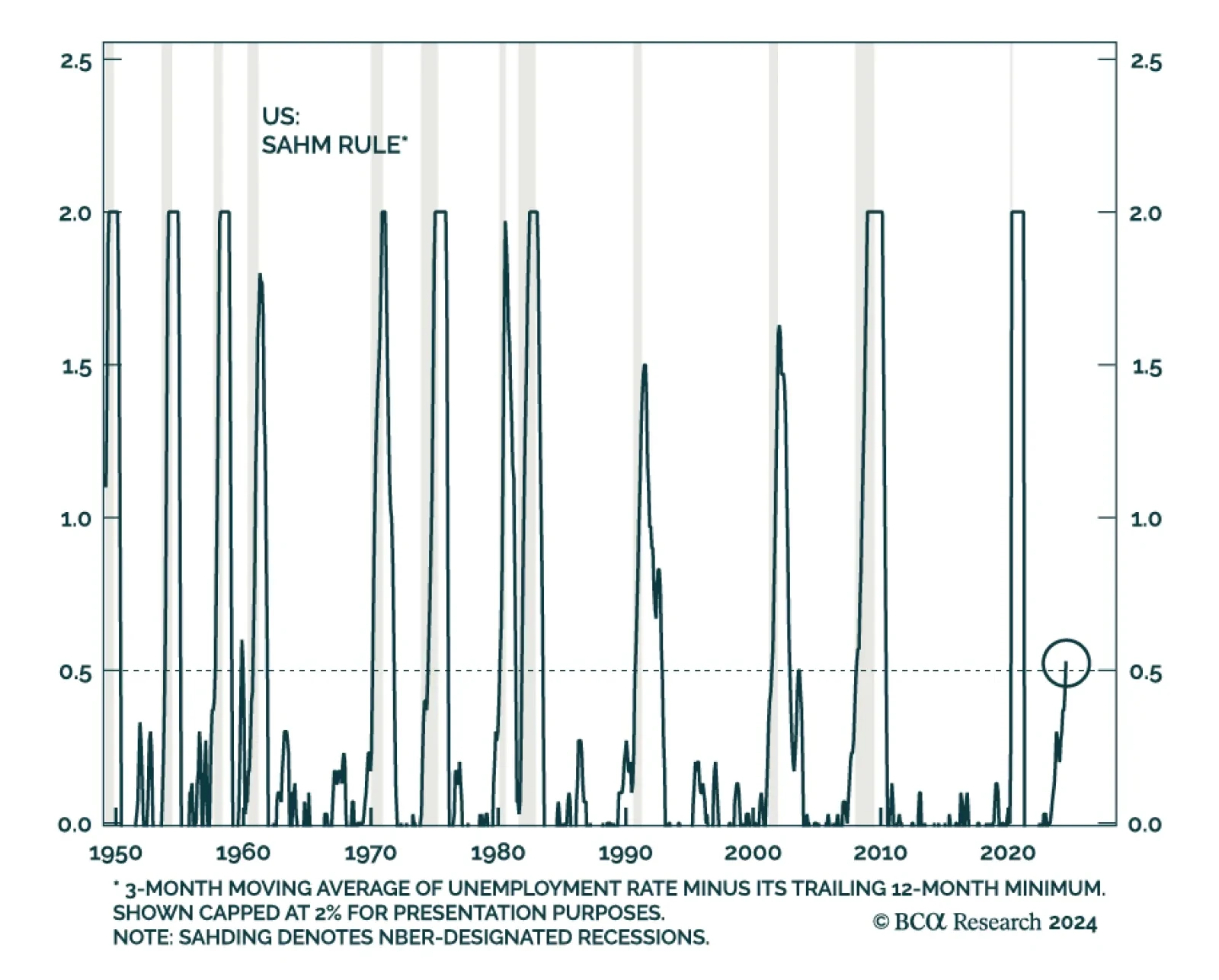

The Sahm Rule – a widely watched real-time recession indicator – signals the early stages of a recession when the 3-month moving average of the unemployment rate rises at least half a percentage point above its past…

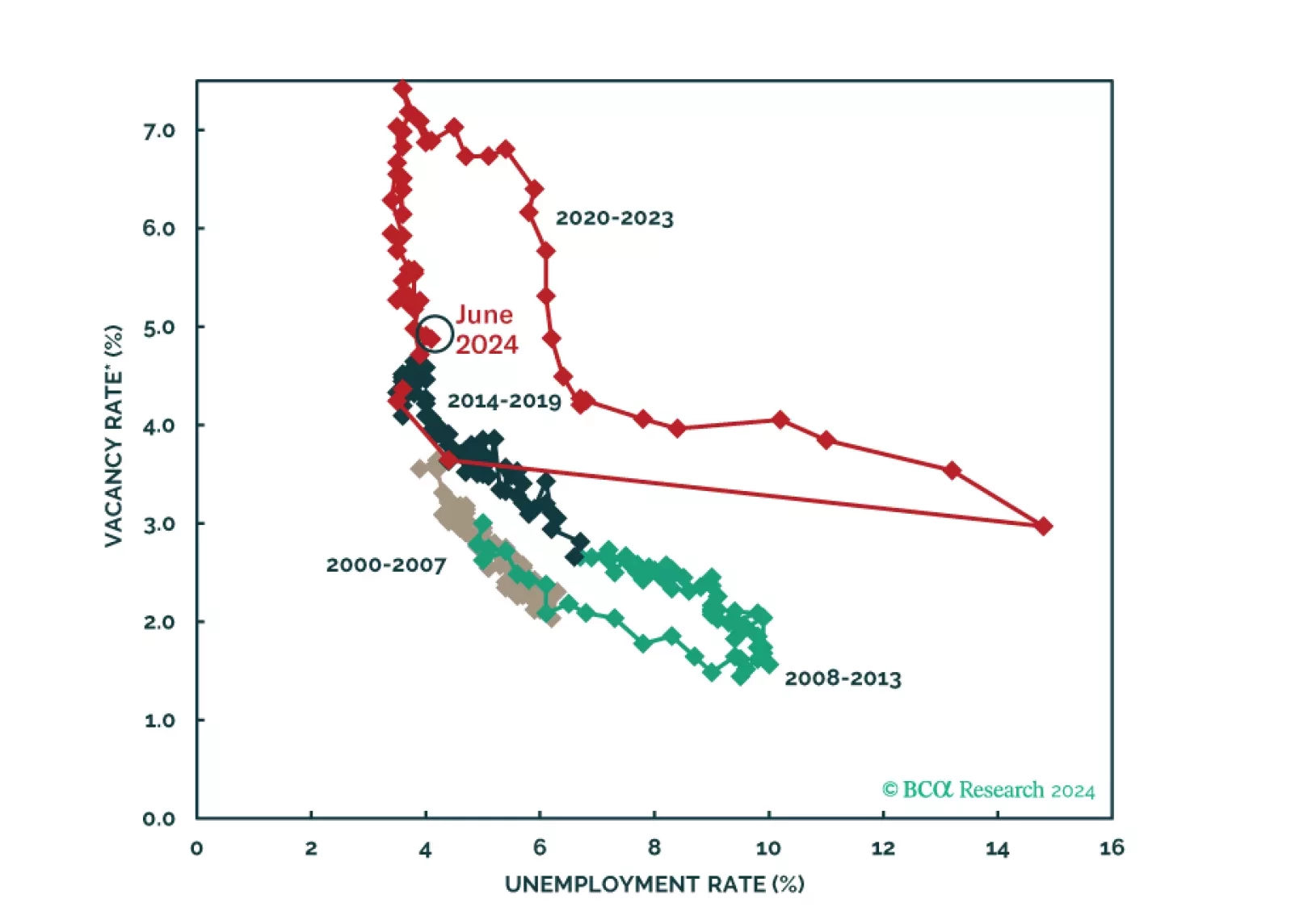

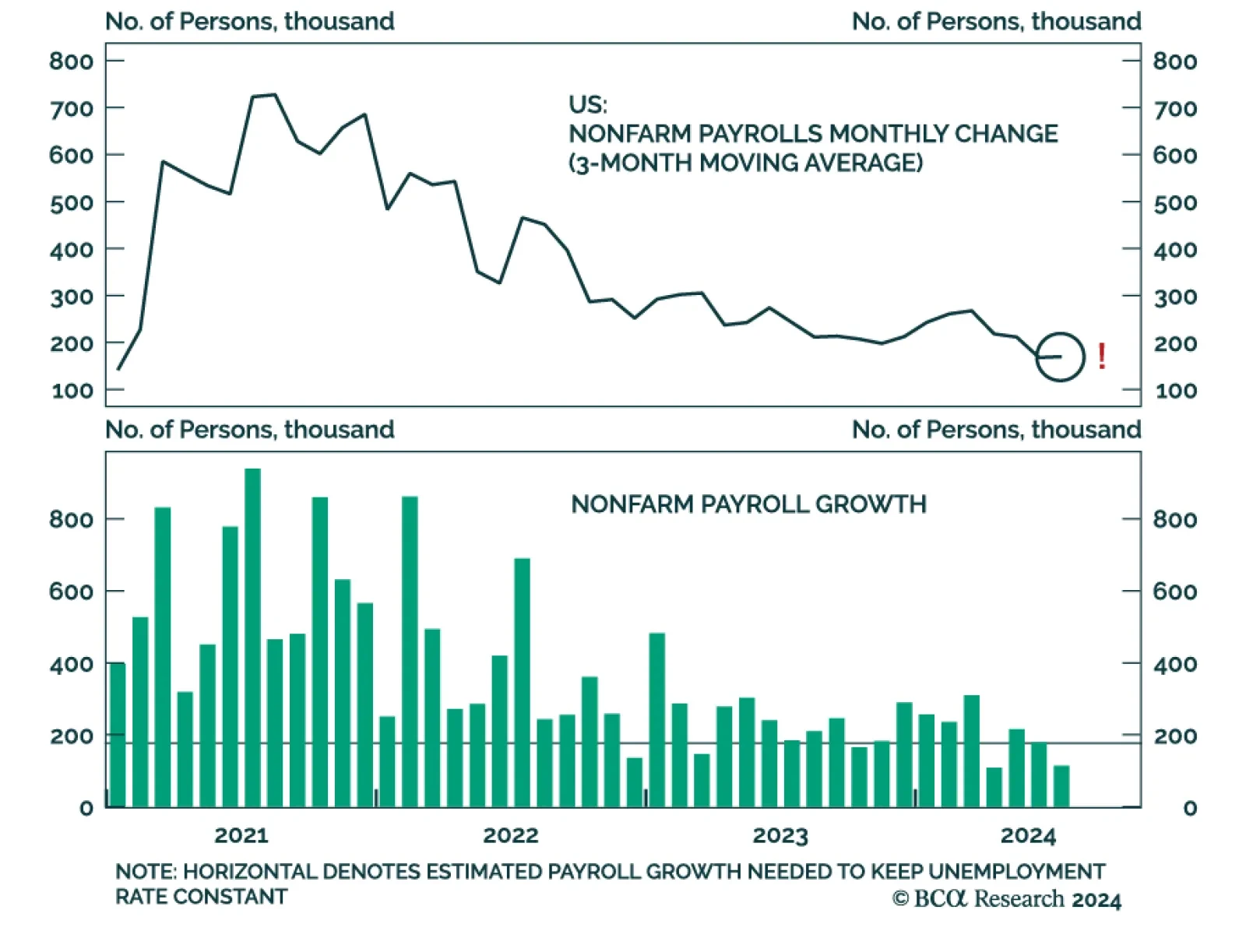

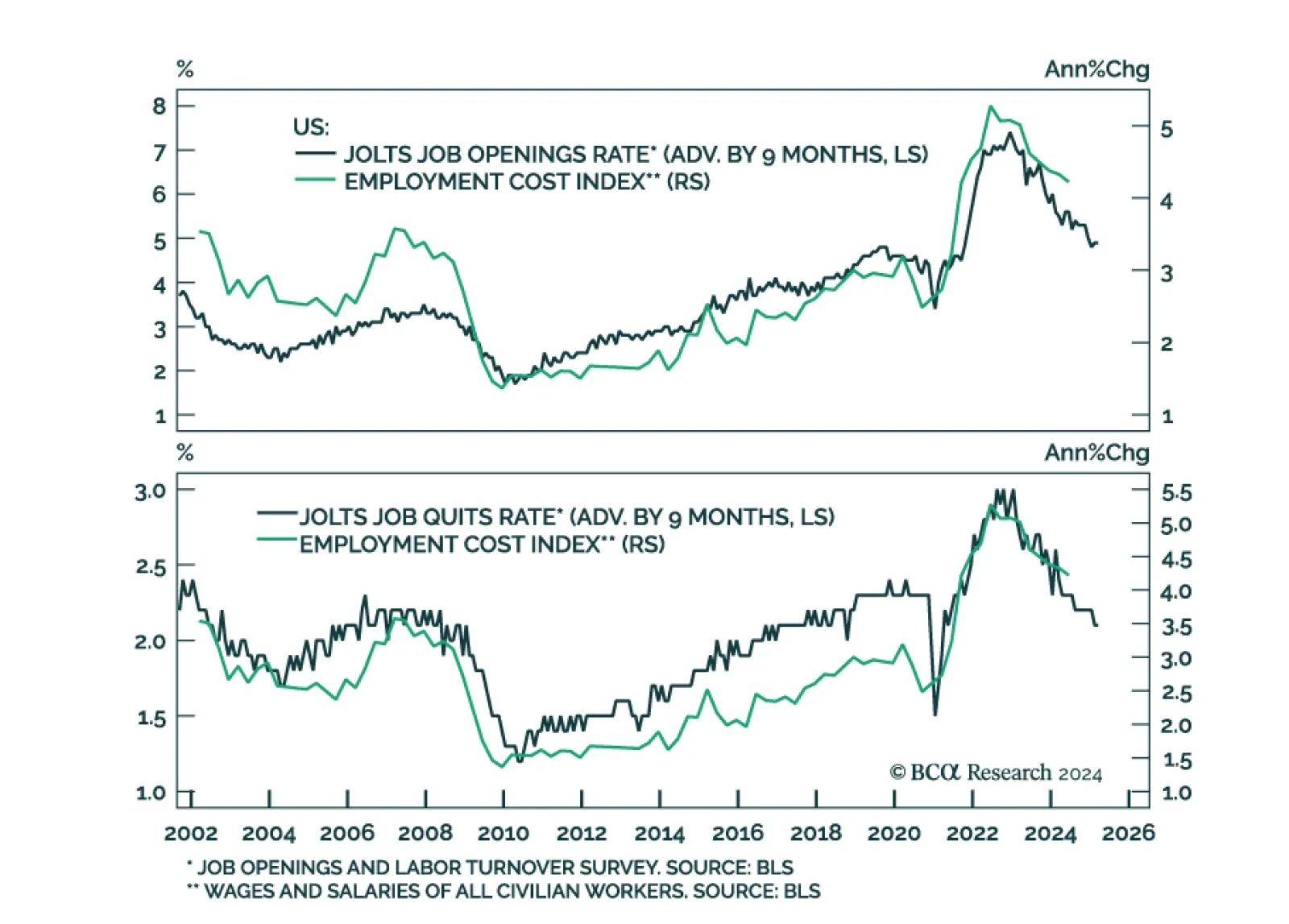

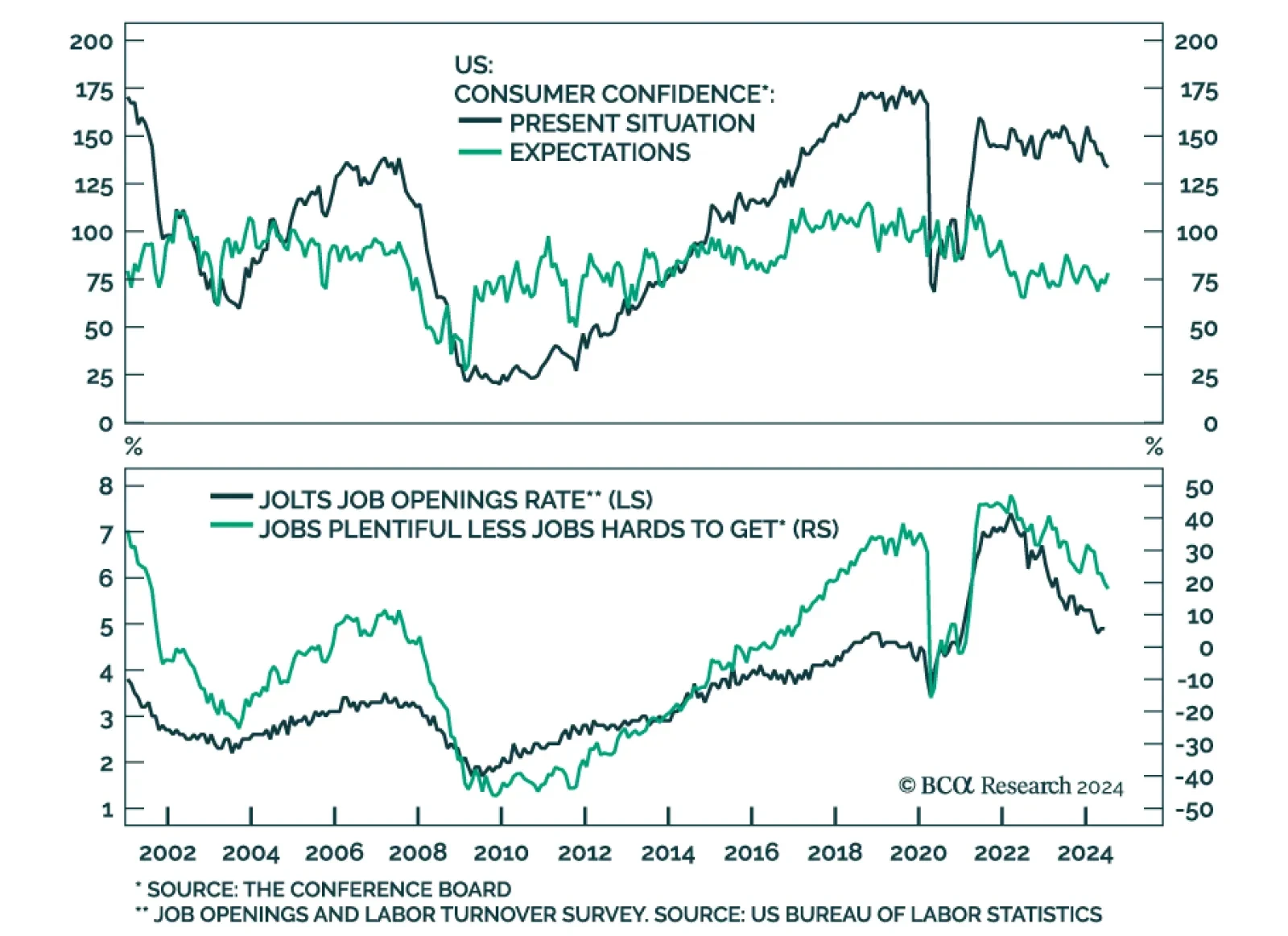

July nonfarm payrolls expanded by 114 thousand workers, a sharp slowdown from June’s downwardly revised 179 thousand, and significantly disappointing expectations of 175 thousand. The unemployment rate unexpectedly edged…

According to BCA Research’s Global Asset Allocation service, there are clear signs that growth is weakening. BCA’s Global Nowcast has been slowing for three months. Behind this slowdown is the fact that the US…

The market is pricing in a soft landing, but we see growing signs that the global economy is faltering. Investors should be defensively positioned.

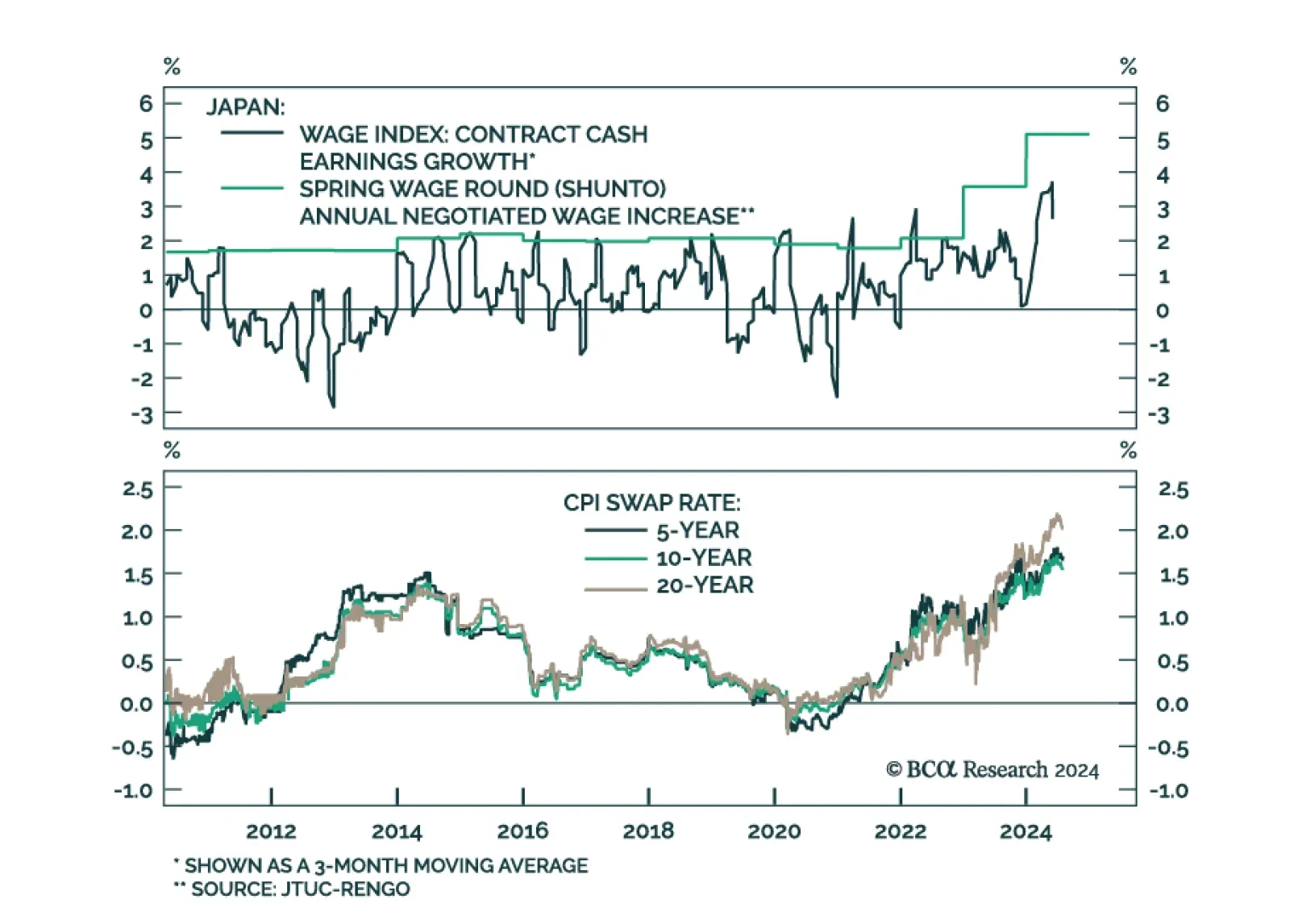

The Bank of Japan hiked its policy rate by 15 bps from 0.10% to 0.25% on Wednesday, and announced further quantitative tightening, reducing its pace of monthly bond buying from JPY 6 trillion to JPY 3 trillion. While the central…

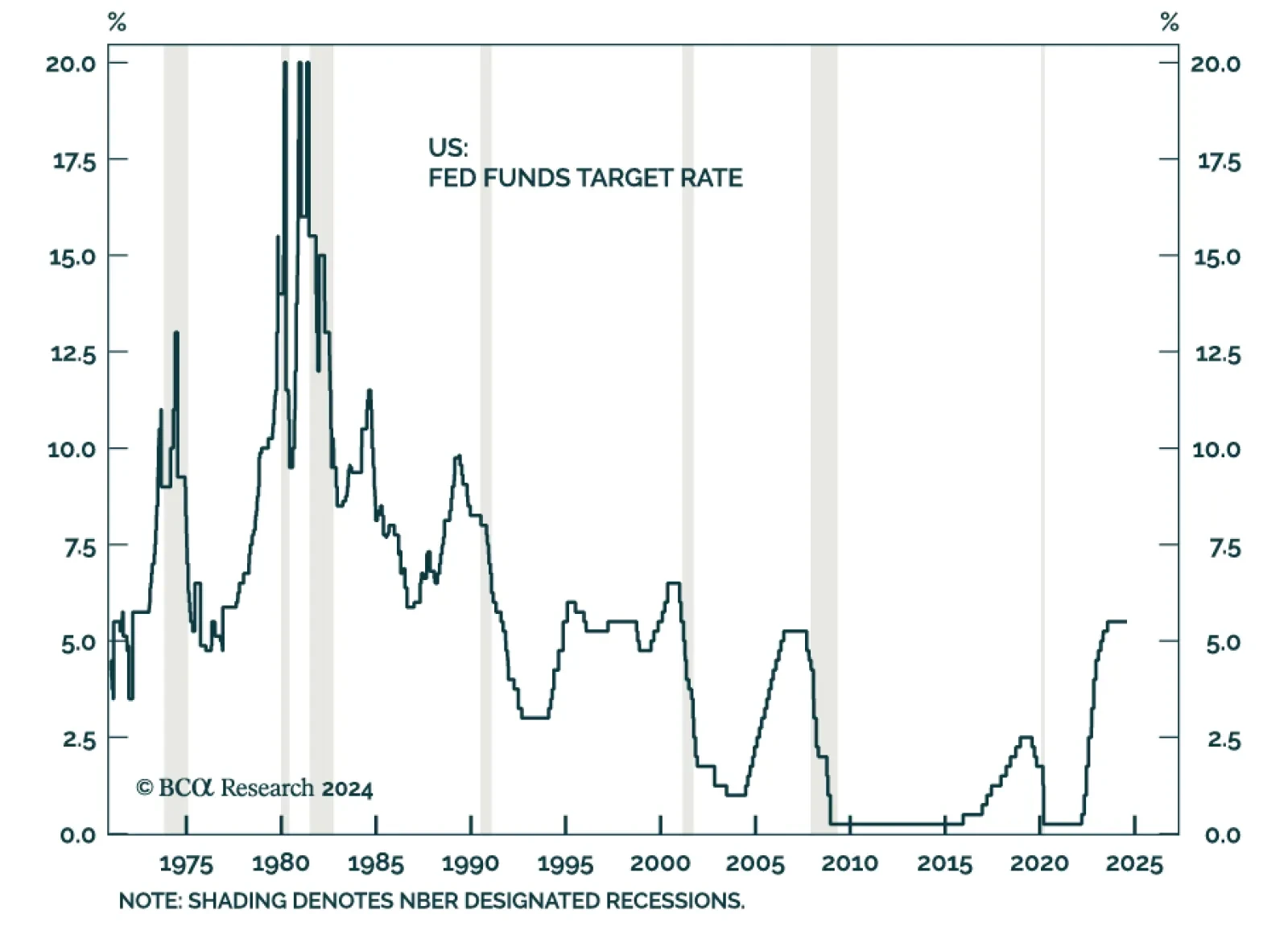

FOMC members unanimously voted in favor of keeping rates on hold in July but signaled that a September cut is on the table. Inflationary pressures have indeed continued to ease over the past several months. Notably, the…

The Fed kept rates steady today, but teed up an initial rate cut in September while putting more emphasis on the employment side of its dual mandate.

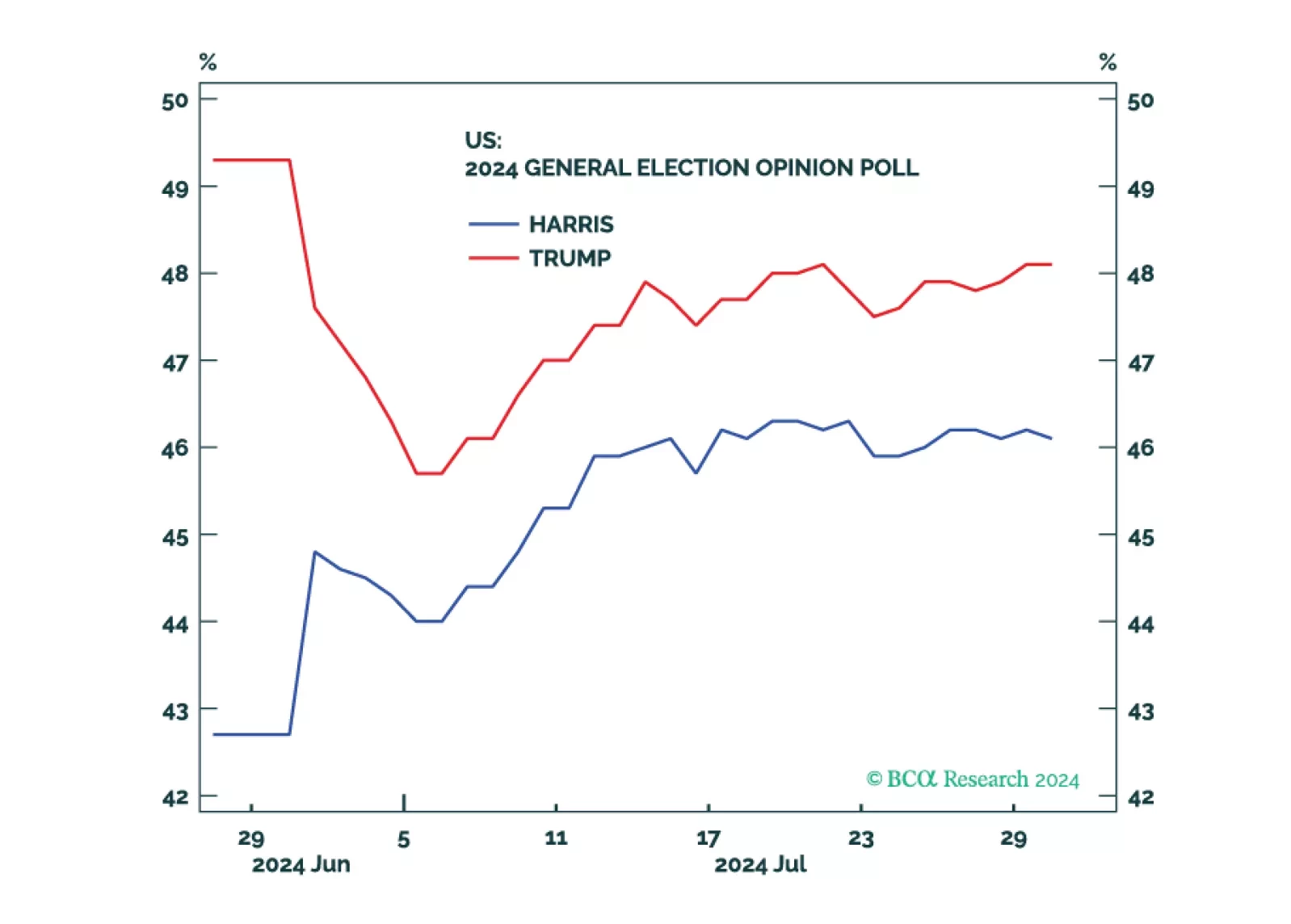

Republicans are favored but the election is still competitive. Equities, corporate credit, and cyclical sectors will fall until policy uncertainty is reduced.

The Conference Board measure of consumer confidence surprised to the upside, rising from 97.8 to 100.3 in July. Respondents’ more optimistic economic outlook drove the overall increase, offsetting a bleaker view of current…

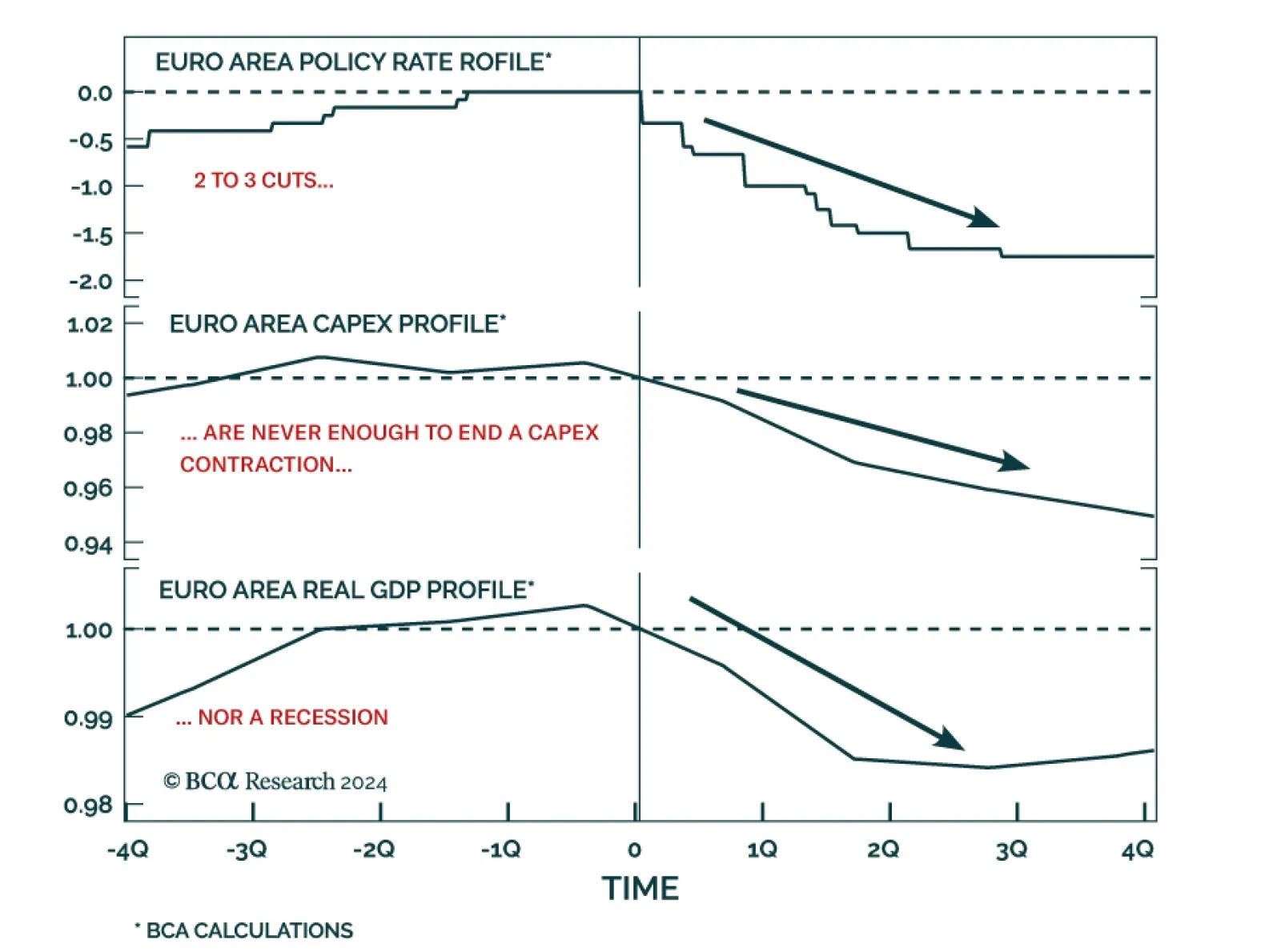

Eurozone GDP surprised to the upside in Q2, growing by 0.3% q/q annualized against expectations of 0.2%. Stronger-than-expected expansions in France (0.3% q/q vs 0.2%) and Spain (0.8% q/q vs 0.5%), as well as steady growth in…