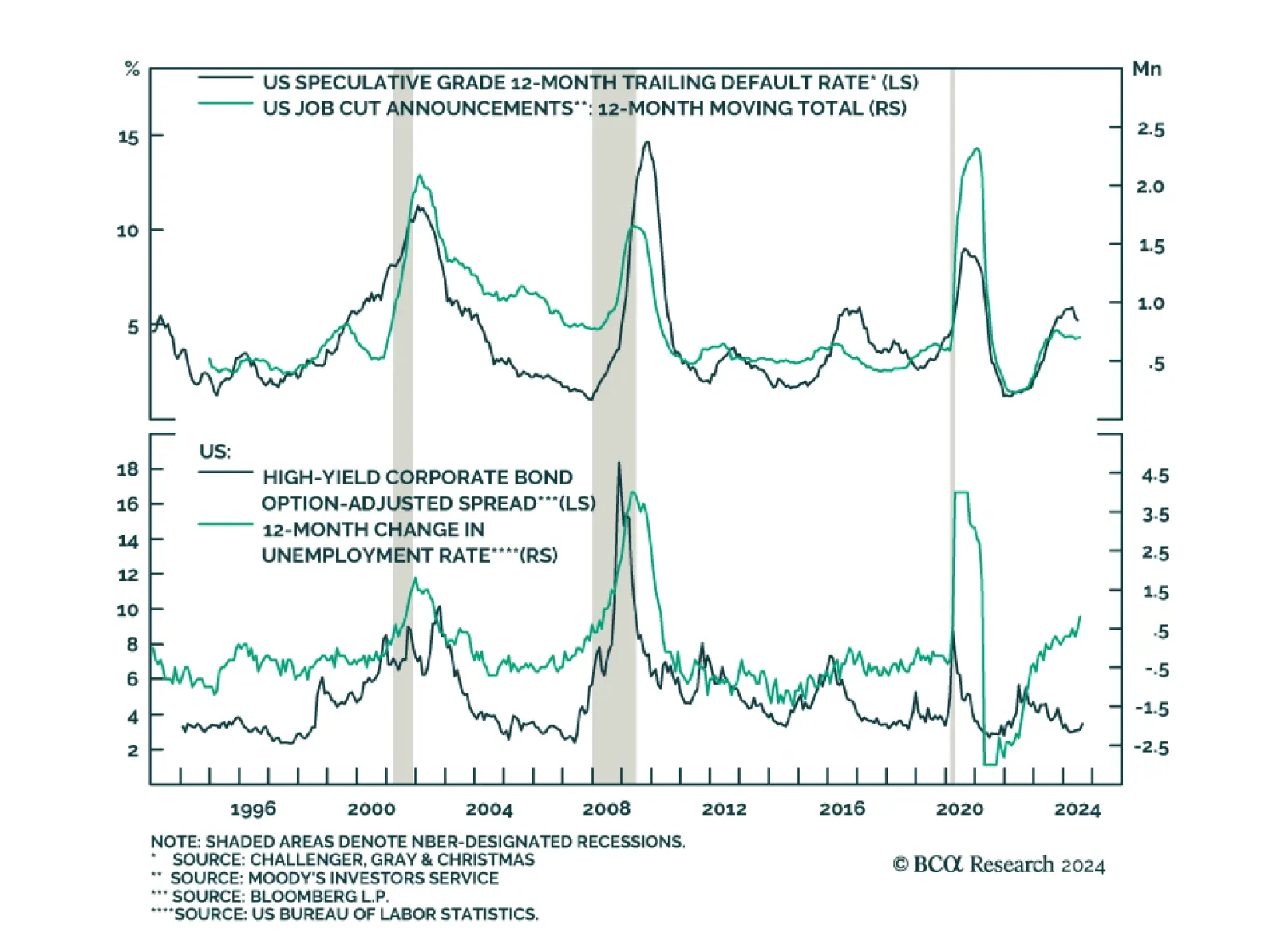

Consistent with the risk-on environment that has dominated markets so far this year, high yield bonds have returned 4.9% YTD on a total return basis, outperforming both Treasuries (2.9%) and investment grade (3.1%).…

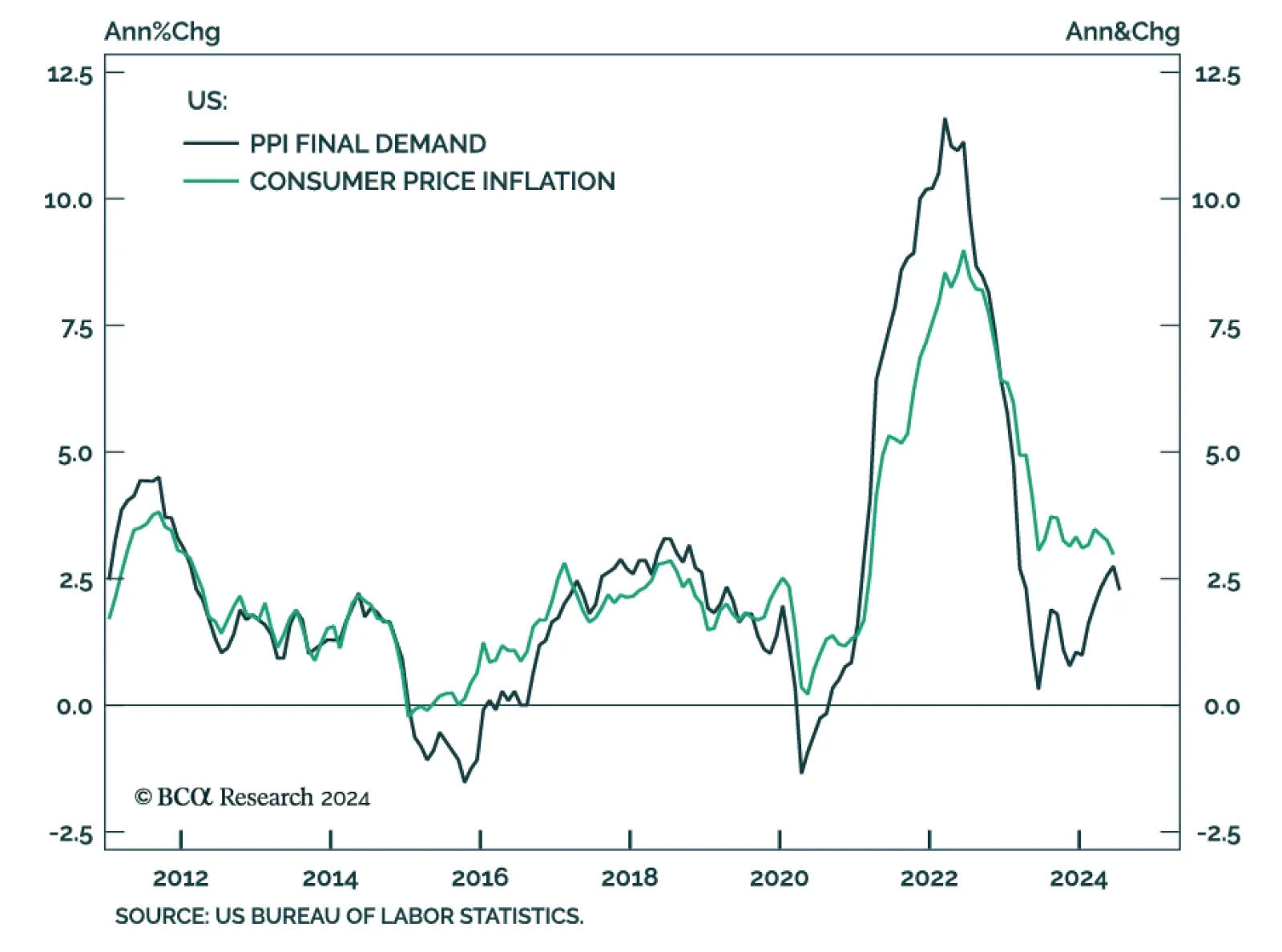

US producer prices rose by a softer-than-expected 0.1% m/m in July, from 0.2% in June. The core measure remained unchanged, the tamest reading in four months. Notably, the index for final demand services fell 0.2% m/m. Our US…

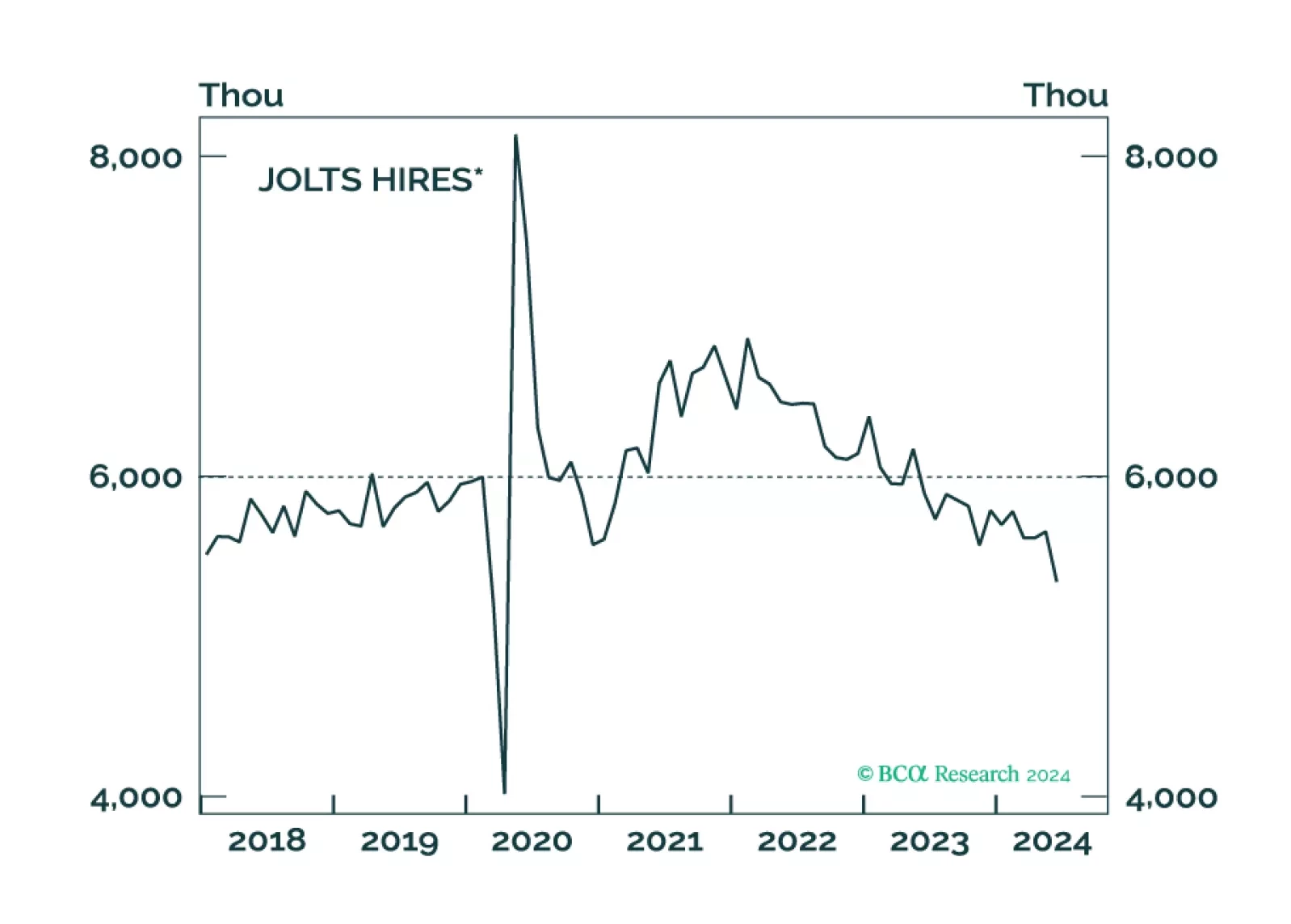

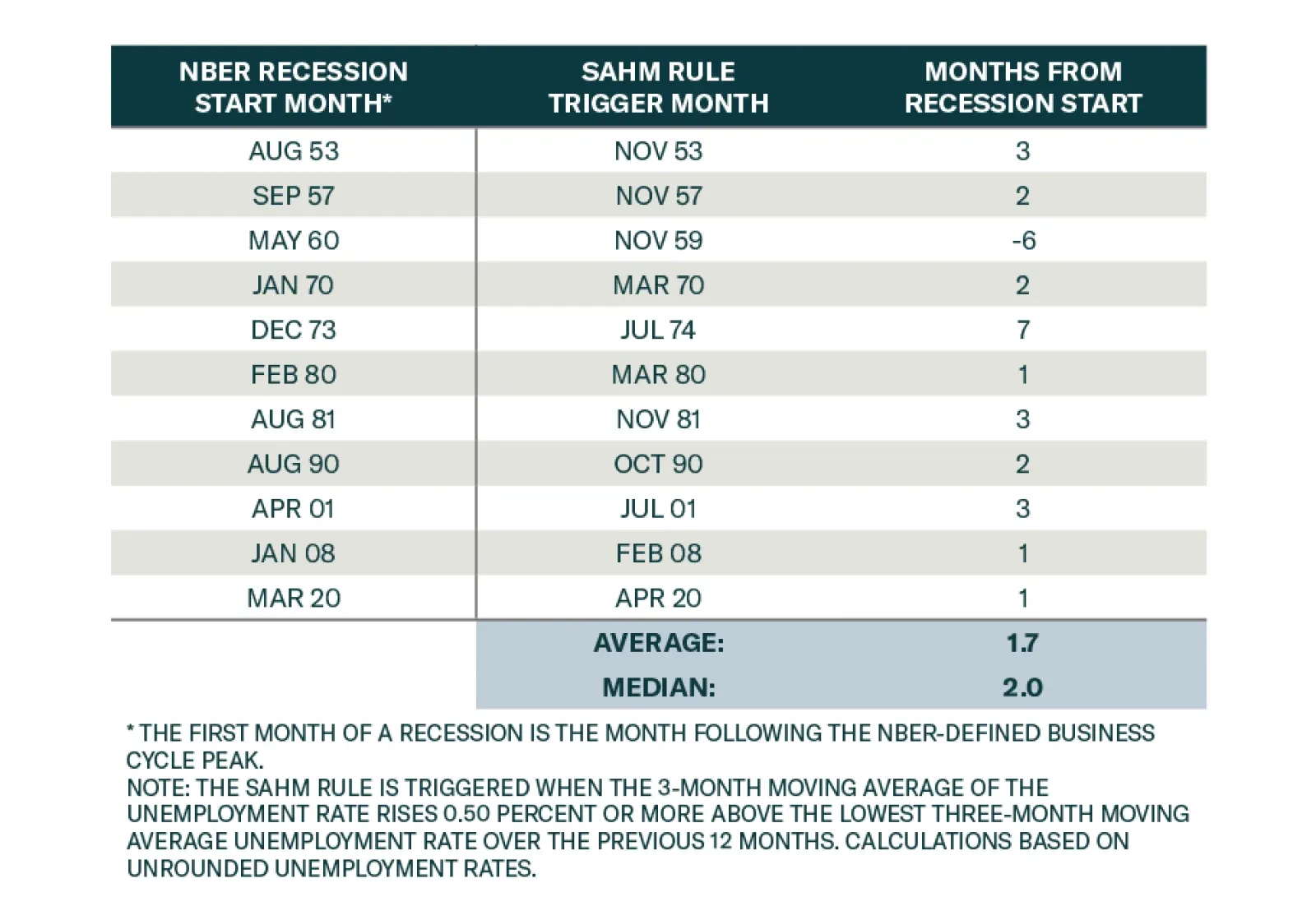

Market and economic observers have devoted a lot of attention to the Sahm Rule following July’s employment report, and whether or not it has been triggered. BCA’s analysis has highlighted that the overall direction of…

Over the past few weeks, global equities have been hit by rising scepticism over the bullish AI narrative and increasing concerns over global growth. Stocks should stabilize in the near term, but the medium-term direction is to the…

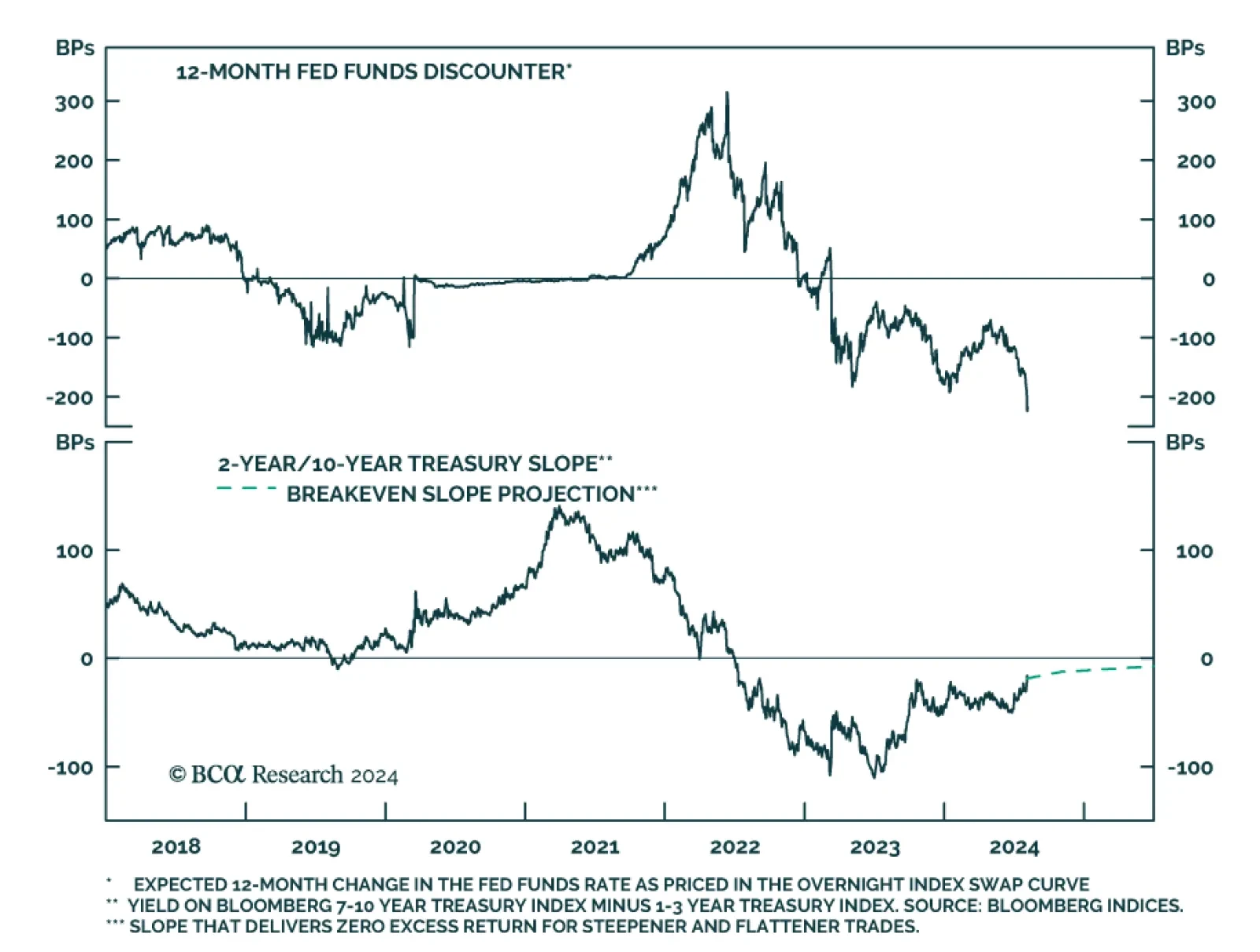

According to BCA Research’s US Bond Strategy service, Friday’s employment report caused financial markets to price-in some recession risk for the first time in months. The Treasury curve bull-steepened in July, a move…

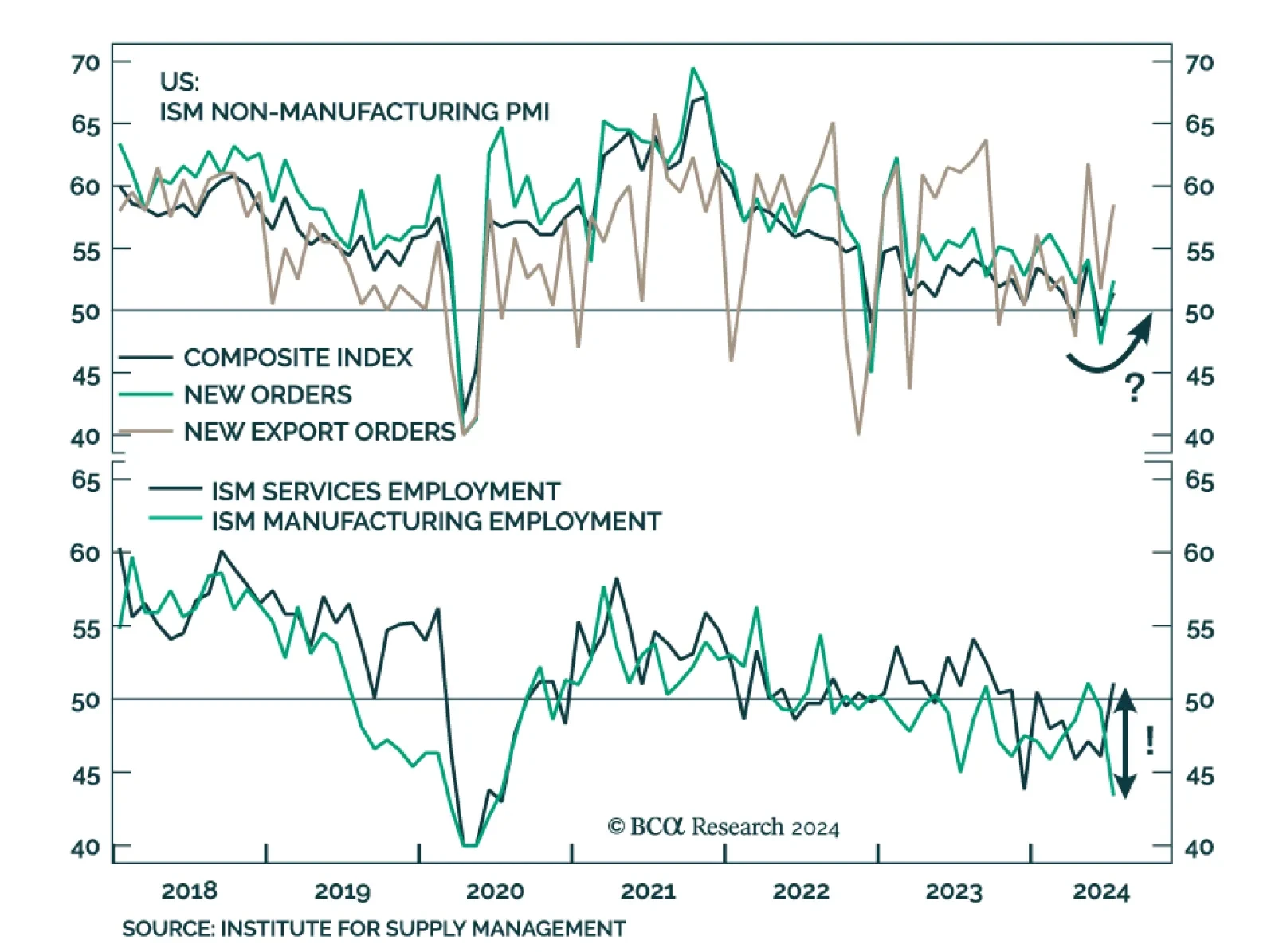

The ISM services PMI surprised positively in July. The headline index expanded 2.6 ppts to 51.4, reversing May’s fastest pace of contraction in four years. Notably, the business activity subcomponent increased 4.9 ppts…

Our Portfolio Allocation Summary for August 2024.

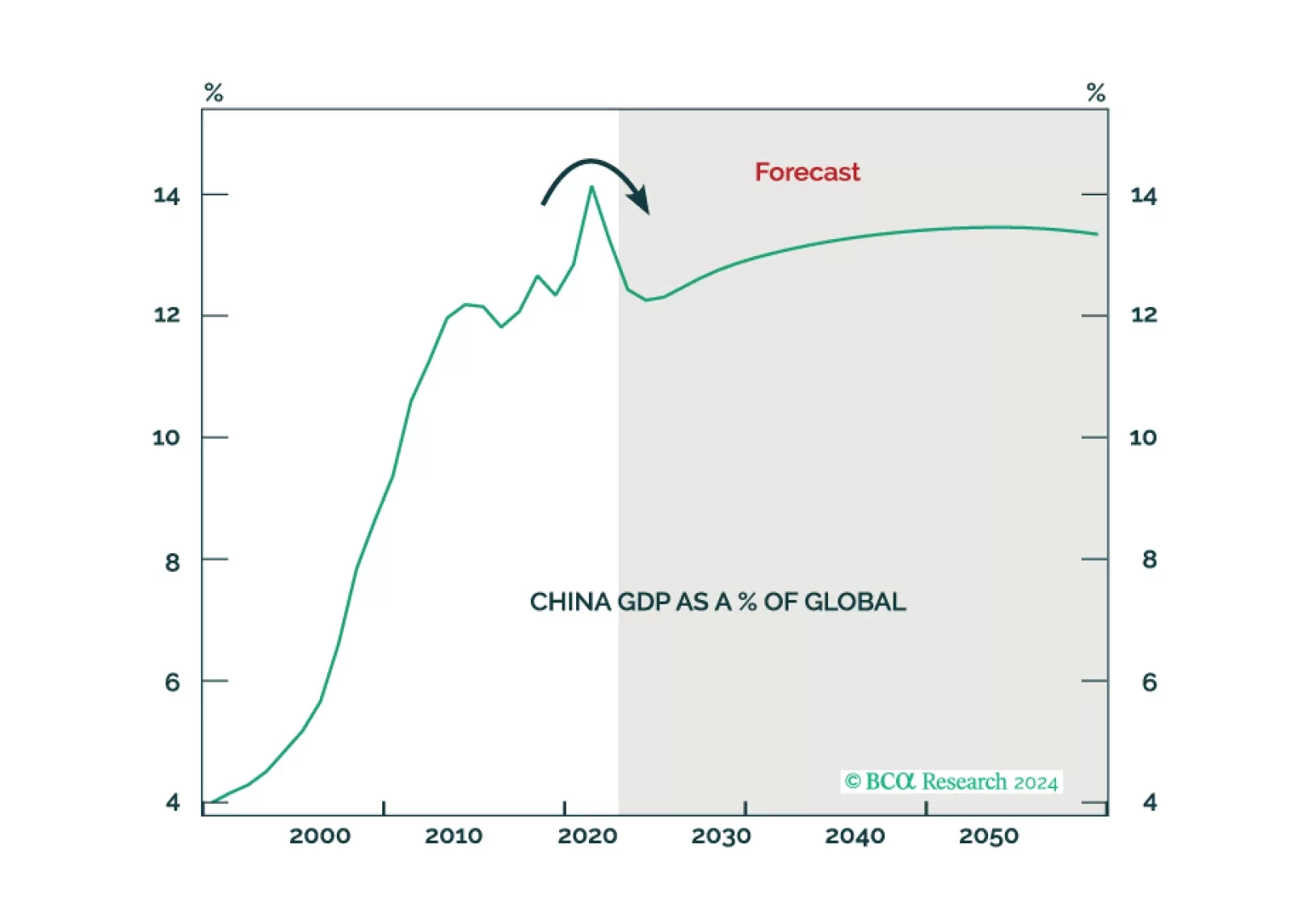

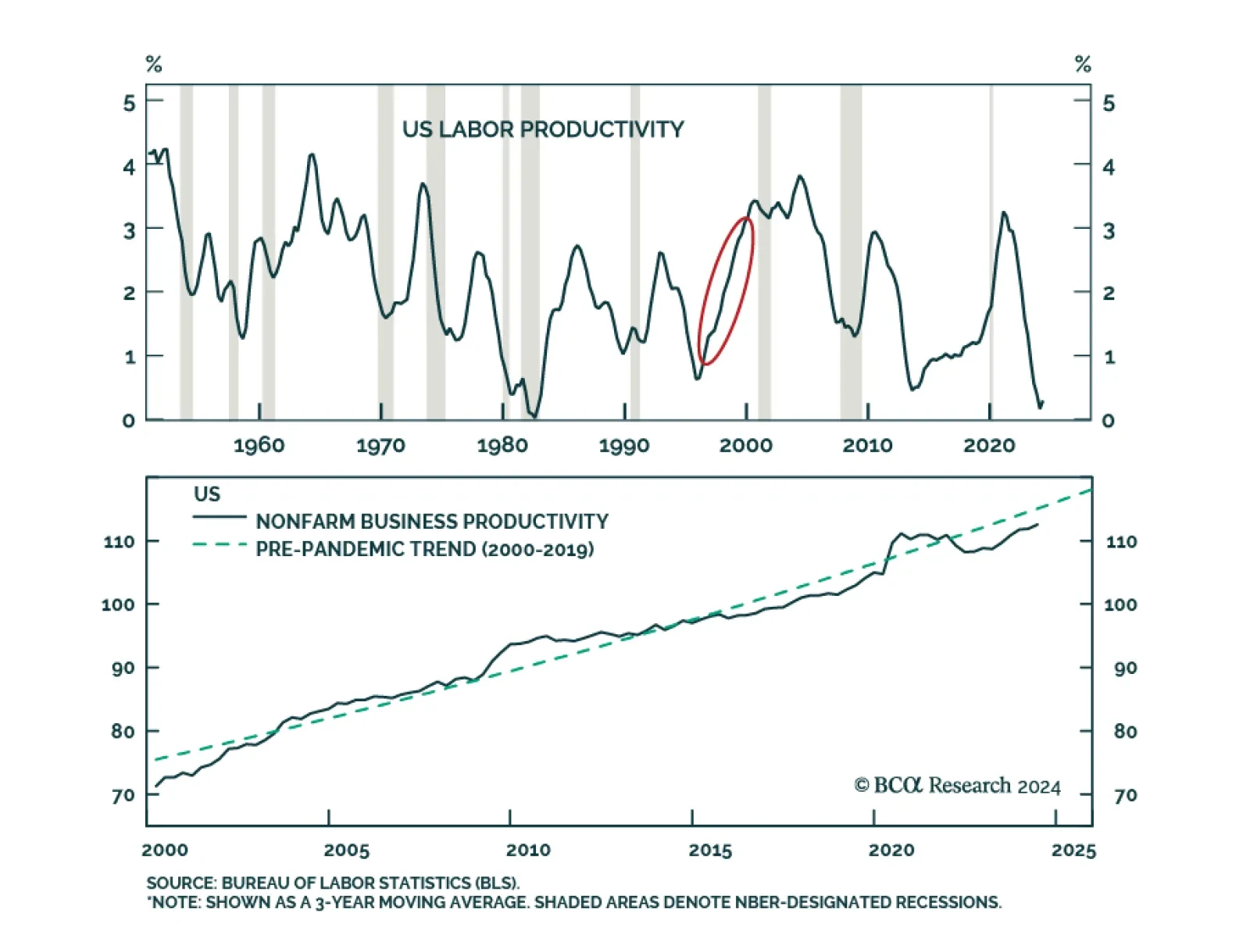

We have previously highlighted that an upside surprise in China’s fiscal stimulus as well as an AI-triggered jump in US productivity could potentially prolong the expansion, and constitute two key risks to our recession…