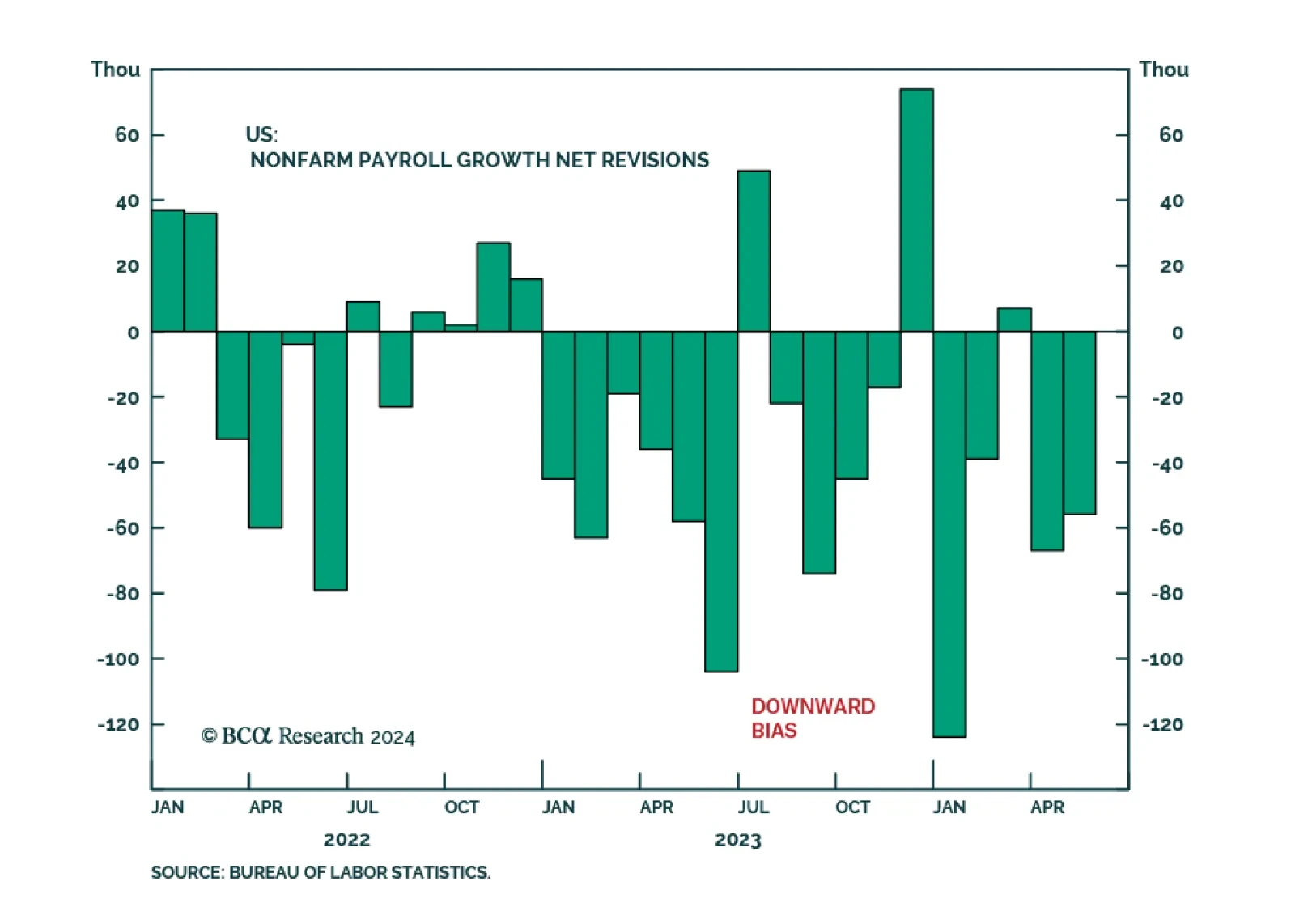

The Bureau of Labor Statistics (BLS) revised down the number of workers on payrolls by 818 thousand over the twelve months period ending March 2024. This largest downward revision since 2009 thus implies that the labor market has…

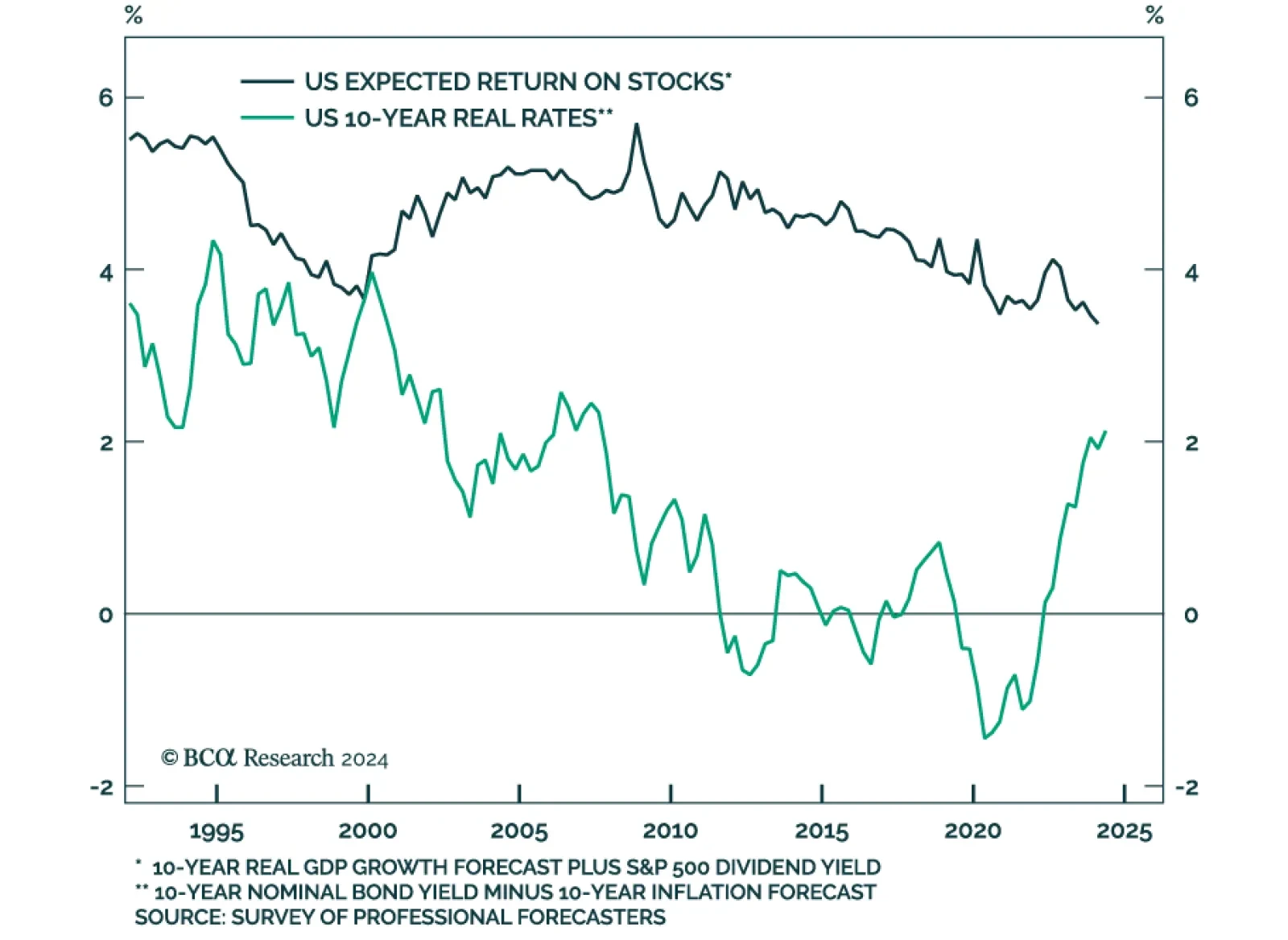

According to BCA Research’s US Investment Strategy and US Bond Strategy services, the drivers of the structural downtrend in real interest rates include: demographic trends (declining fertility rates, longer life…

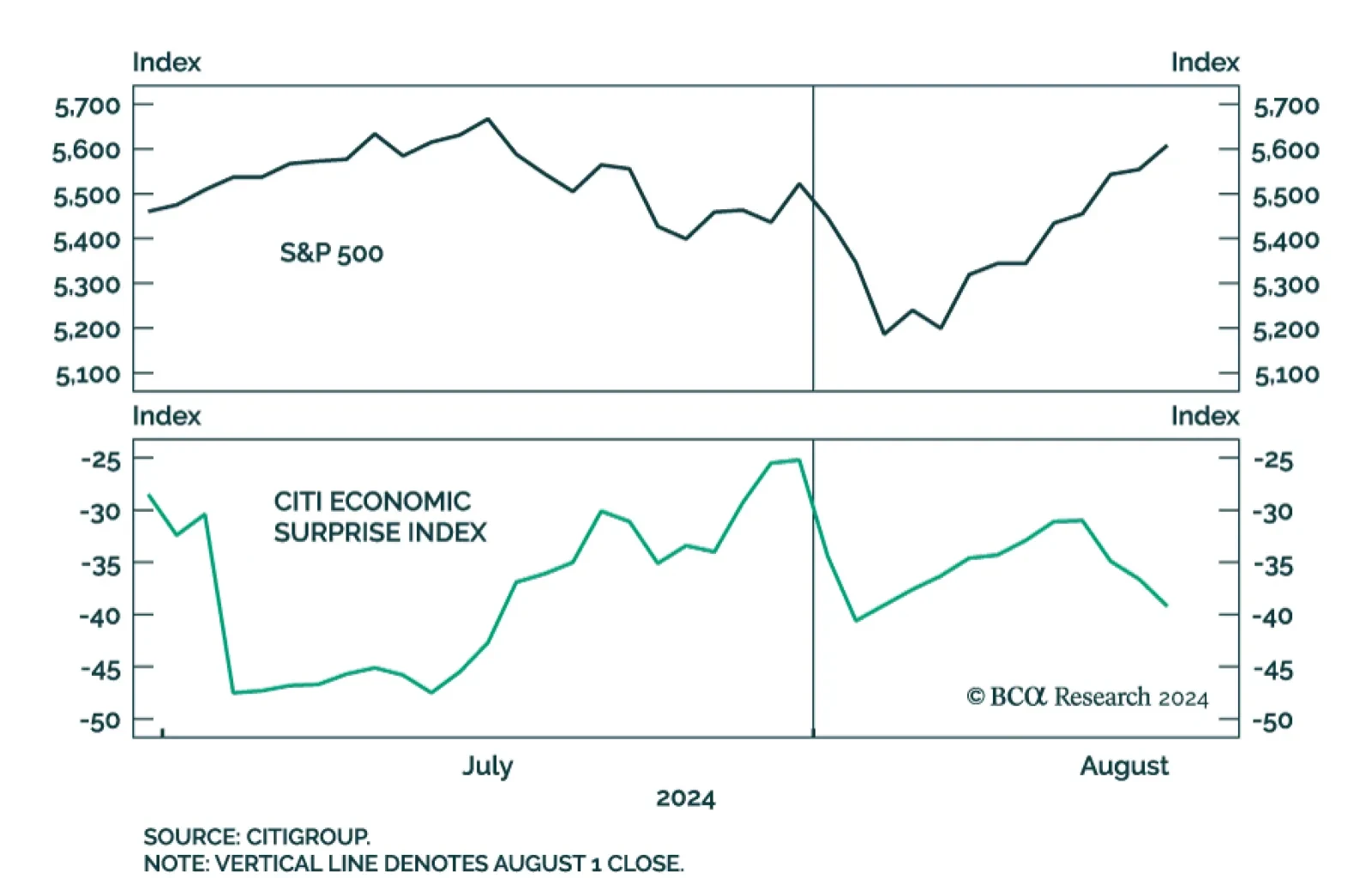

It didn't take long for markets to utterly shrug off the surprise rise in July's unemployment rate. On Tuesday, the S&P 500 closed higher than it was the day before the July Employment Situation report was released…

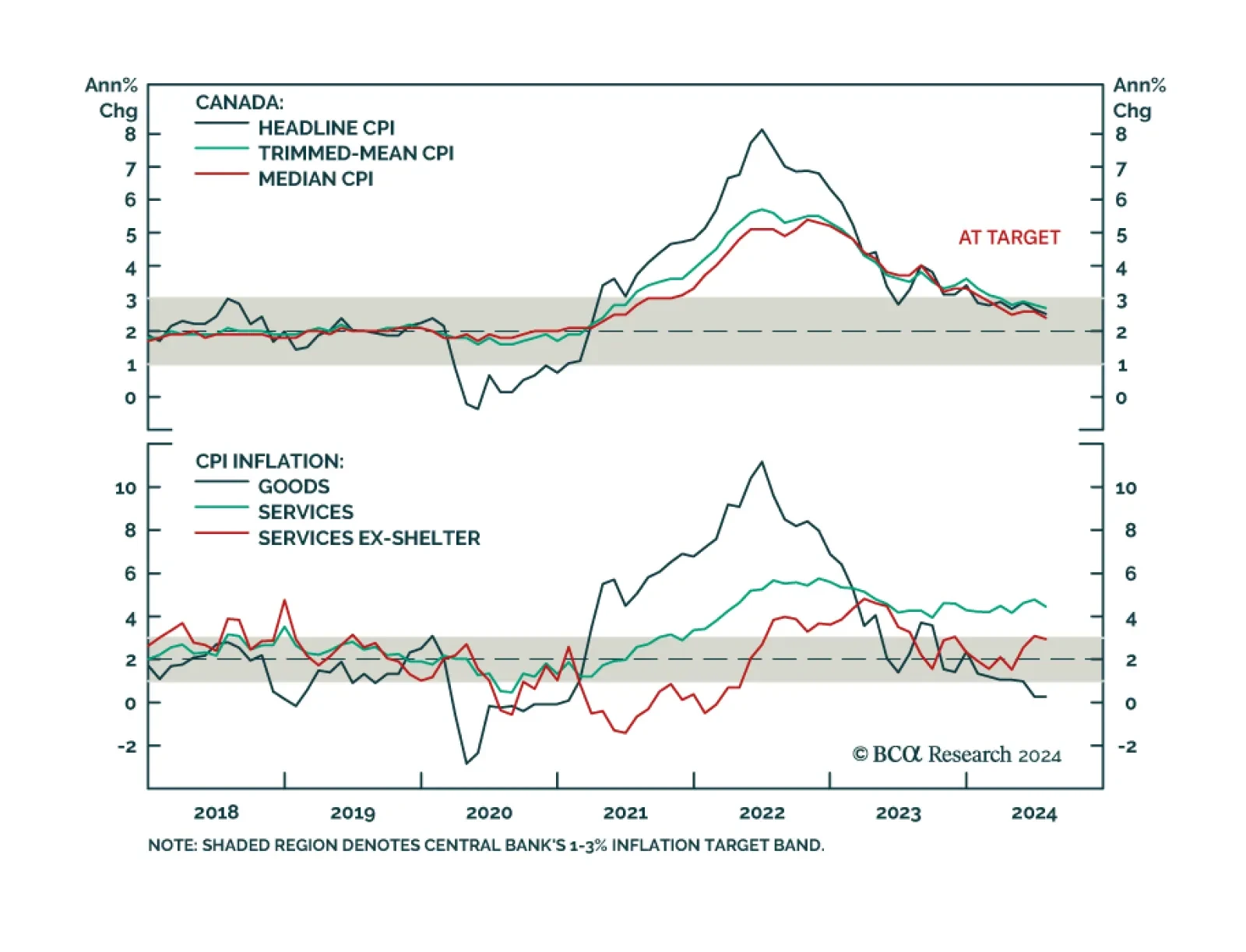

Canadian headline CPI decelerated from 2.7% y/y to 2.5% in July, the slowest pace in over 3 years. Notably, core median and trimmed-mean CPI eased further than expected, to 2.4% and 2.7% y/y respectively, 0.1 ppt below…

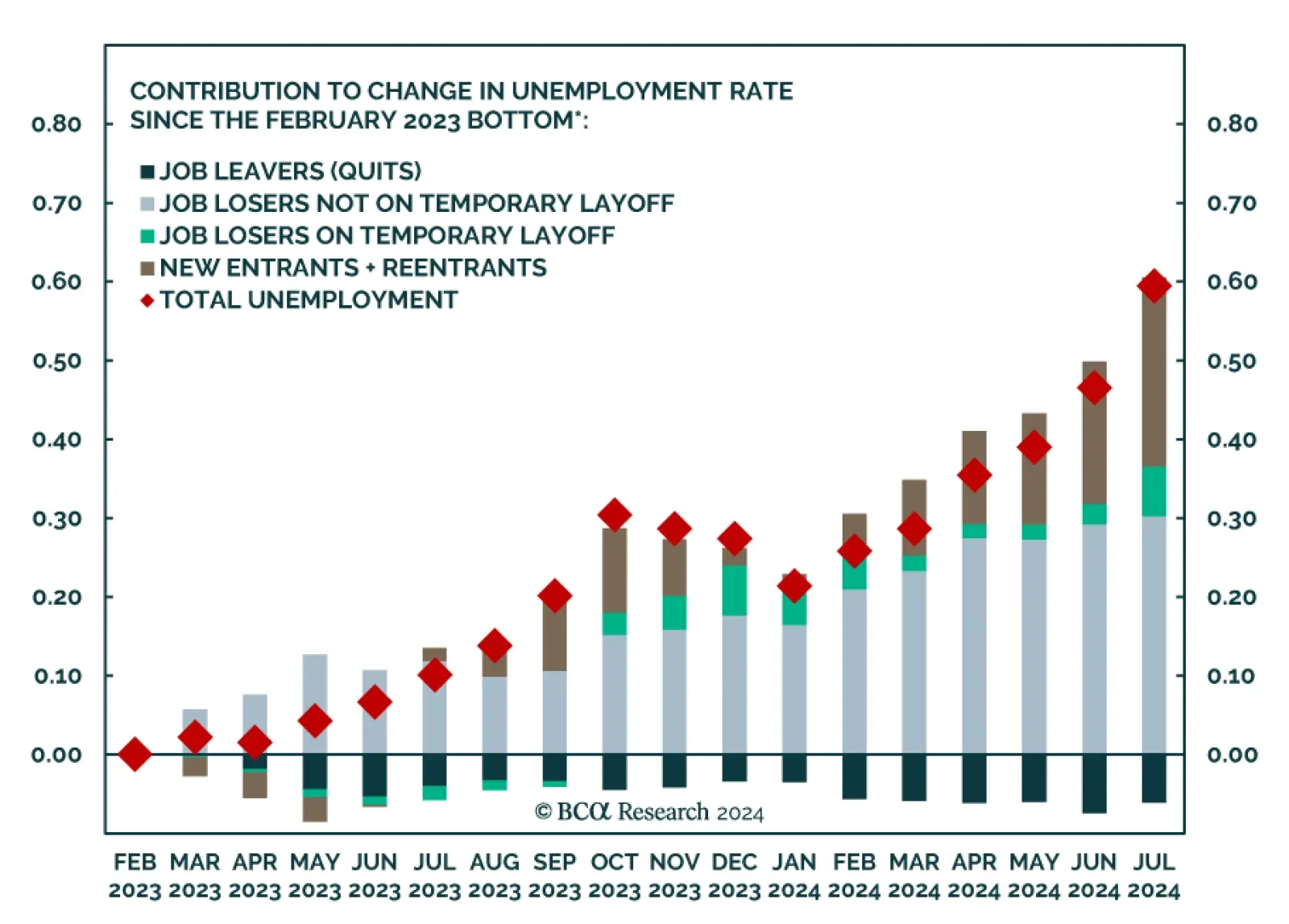

Markets have recouped some of the losses incurred in the aftermath of the July US Employment Situation report. Was the surprise rise in the unemployment rate a false alarm? Supply-side dynamics alone cannot explain the…

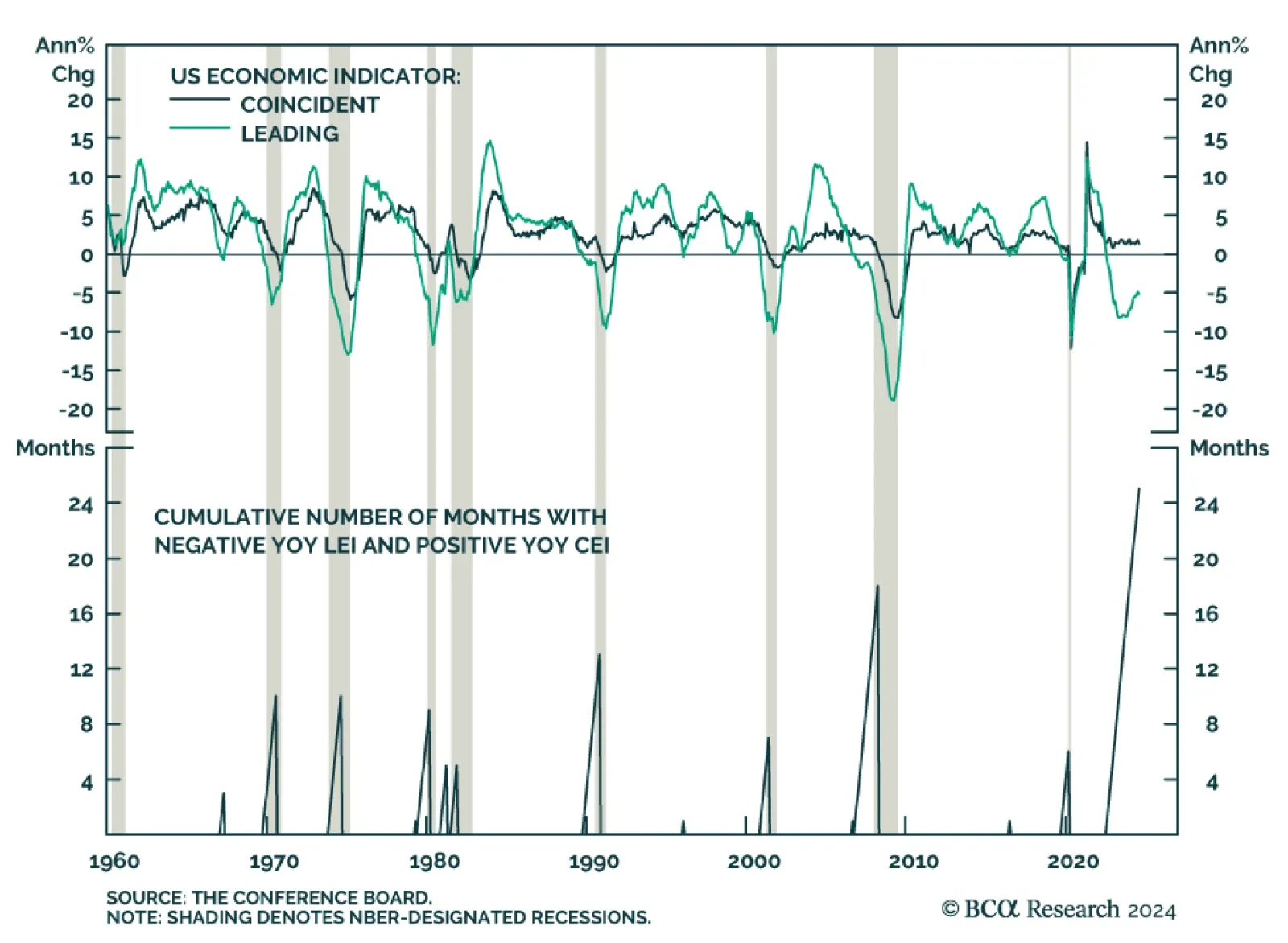

The Conference Board’s US Leading Economic Index (LEI) disappointed in July, contracting 0.6% m/m from a 0.2% decline in June, below expectations of -0.4%. Meanwhile, the Coincident Economic Index (CEI) was flat. Year-on…

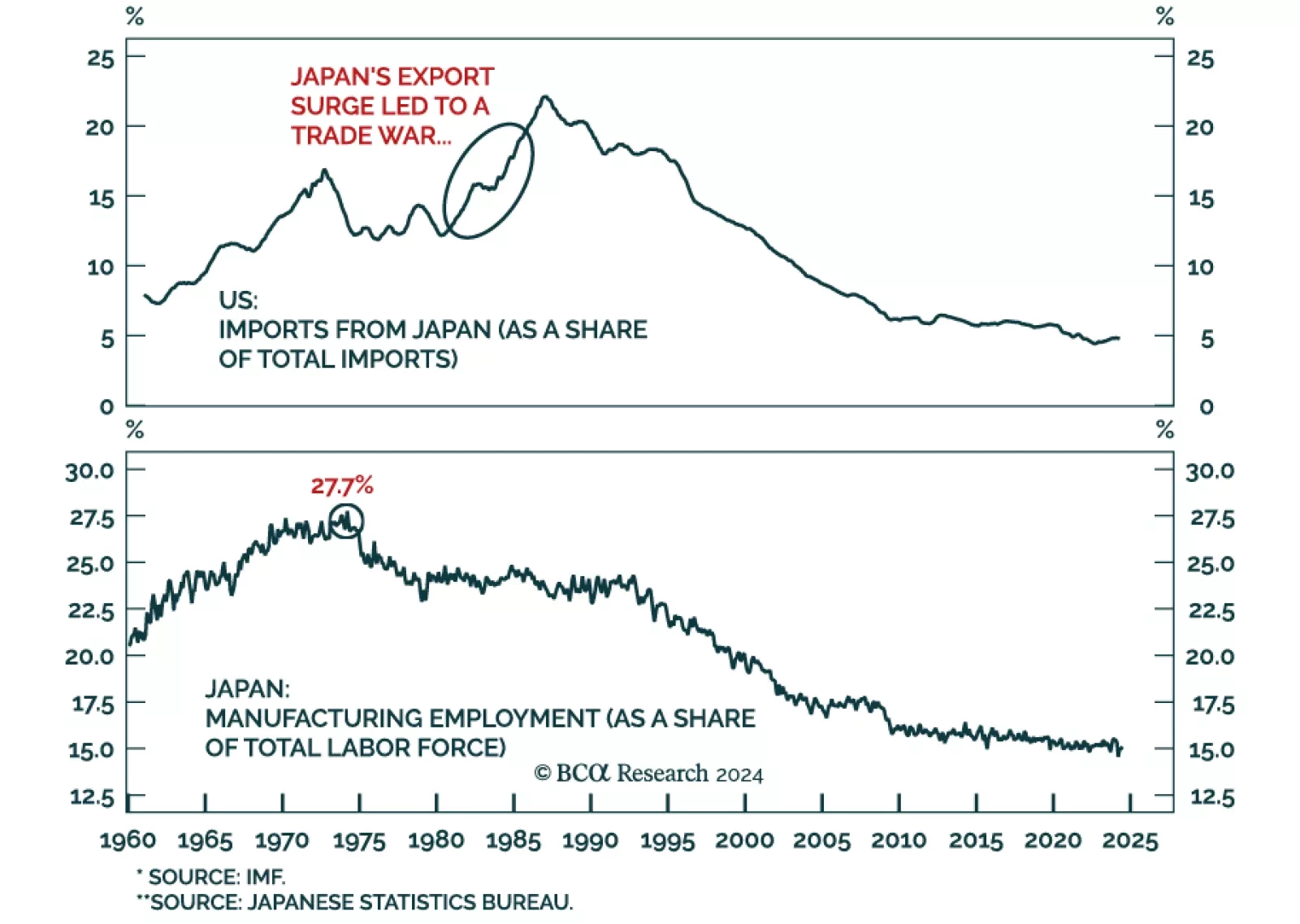

According to BCA Research’s GeoMacro Strategy service, while the idea that Donald Trump would allow China to build factories in the US does not mesh with the contemporary media narrative, it would fit the historical track…

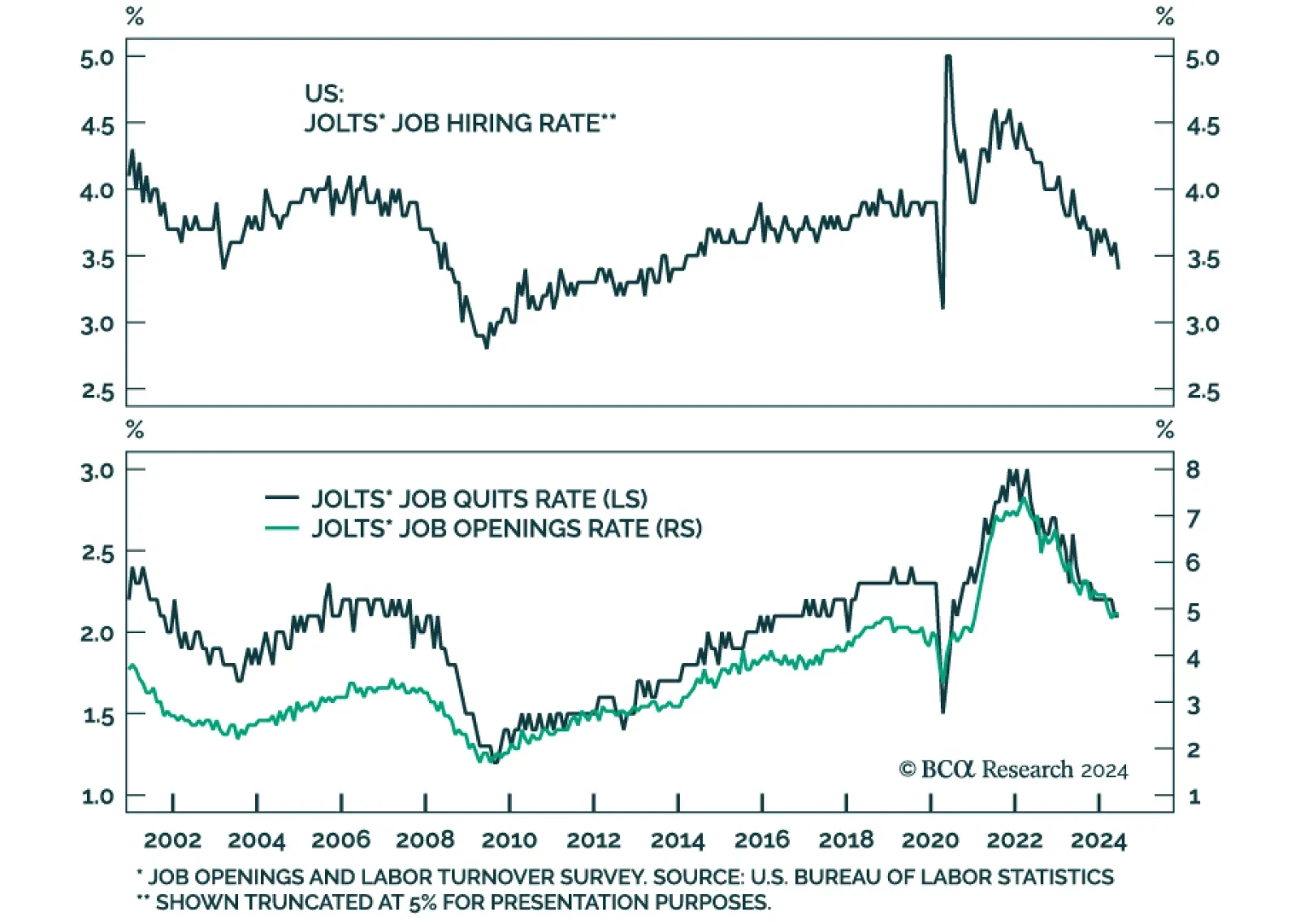

The US unemployment rate has clocked in below 4.5% for 33 consecutive months. However, this historically low rate camouflages nascent cracks in the US labor market. Ahead of recessions, firms usually reduce the pace of hiring…

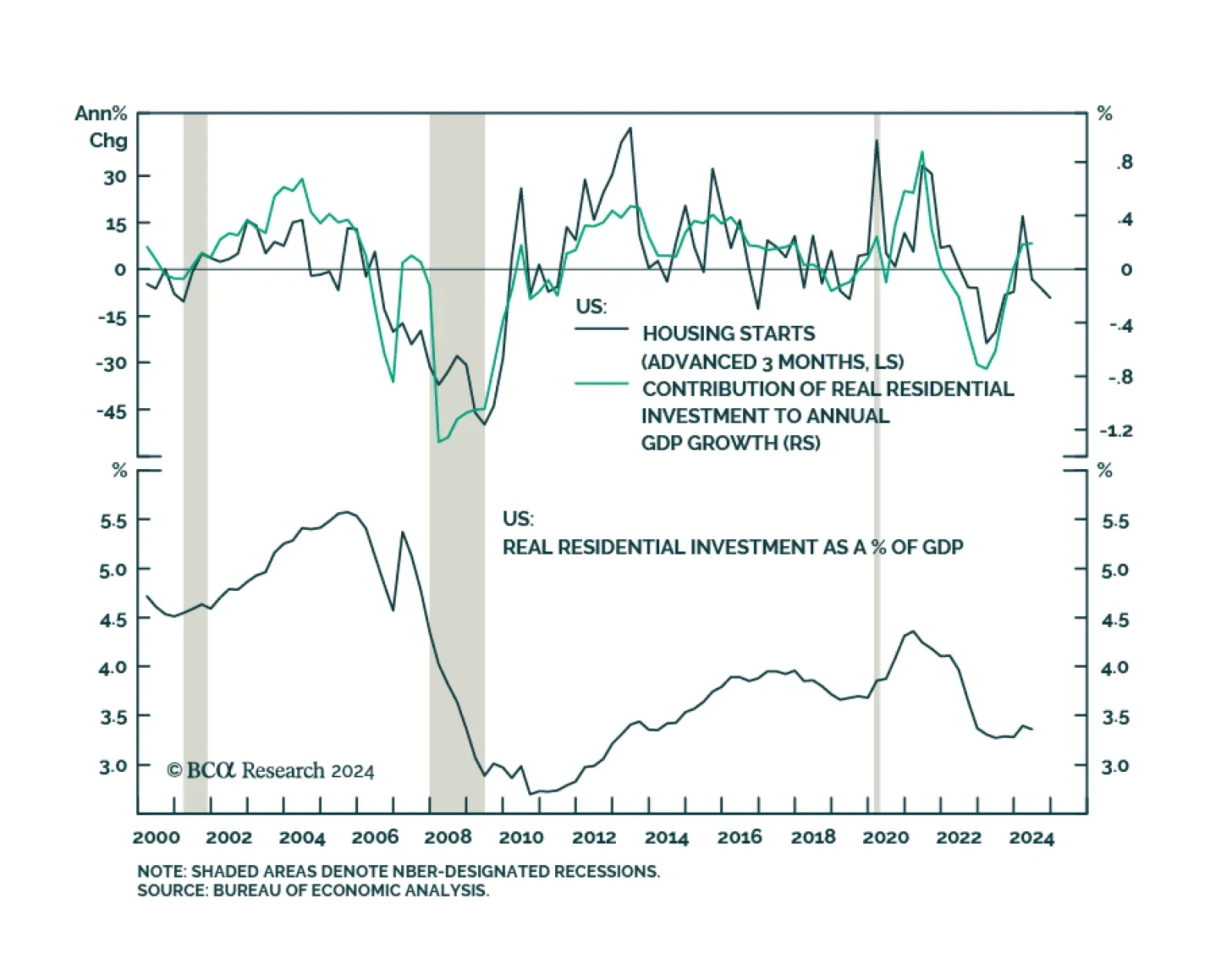

Housing starts and permits both disappointed in July. New construction contracted 6.8% m/m, from a 1.1% expansion in June. Permits, which typically lead housing starts, declined 4.0% m/m in July from 3.9% growth in the previous…

What do the mixed signals sent by the UK economy mean for the Bank of England, and what are the implications for Gilts and the British pound?