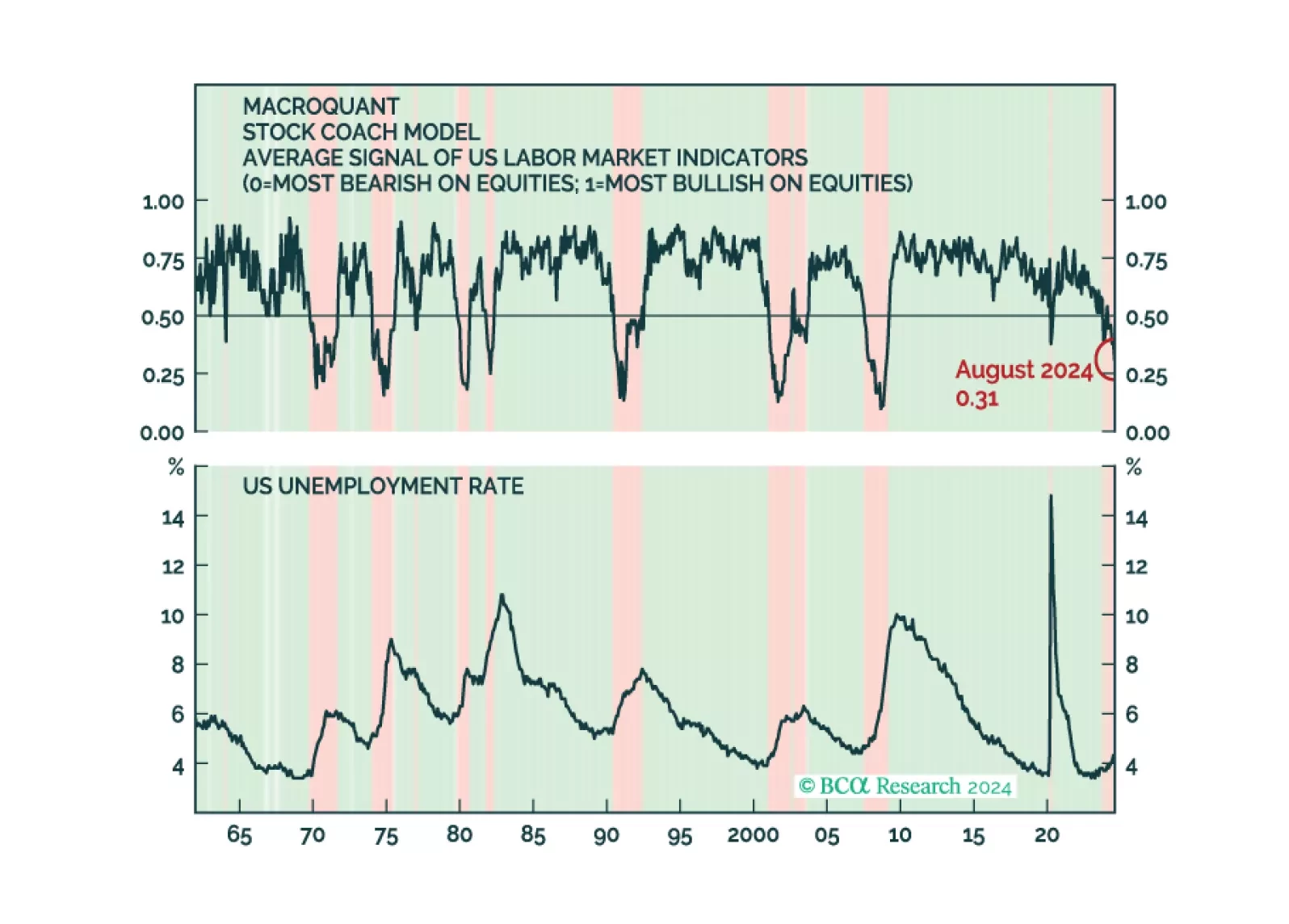

MacroQuant continues to recommend underweighting equities and overweighting bonds. This is consistent with the Global Investment Strategy Team's decision to downgrade global equities to underweight in late June.

After surprising to the upside in July on higher energy costs, Eurozone CPI resumed its deceleration in August. Headline and core CPI declined from 2.6% y/y to 2.2% and from 2.9% to 2.8%, respectively. Energy prices contracted…

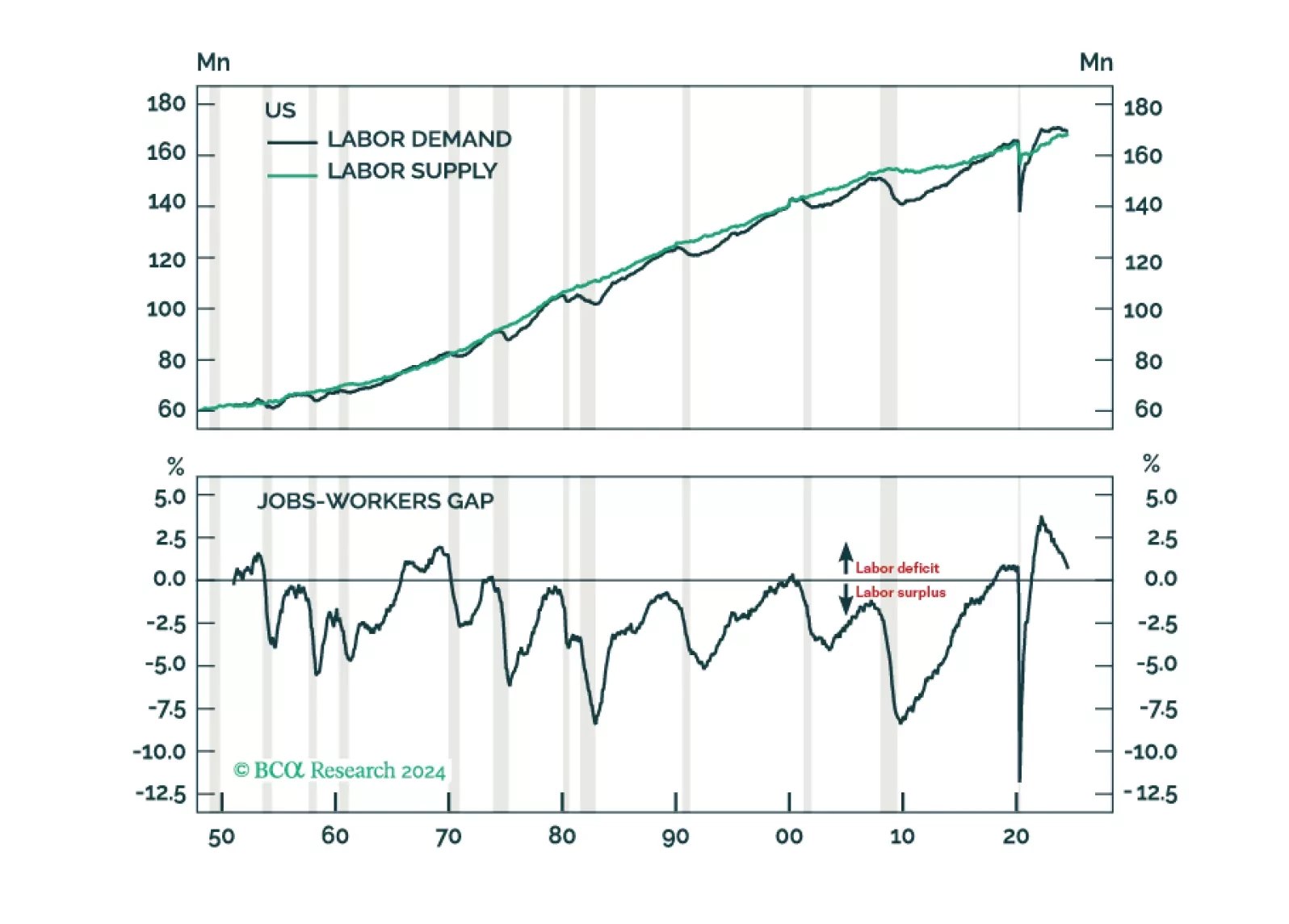

According to BCA Research’s Counterpoint Strategy service, the post-pandemic US economy has inverted from its usual ‘demand-constrained’ state to a highly unusual ‘supply-constrained’ state. This…

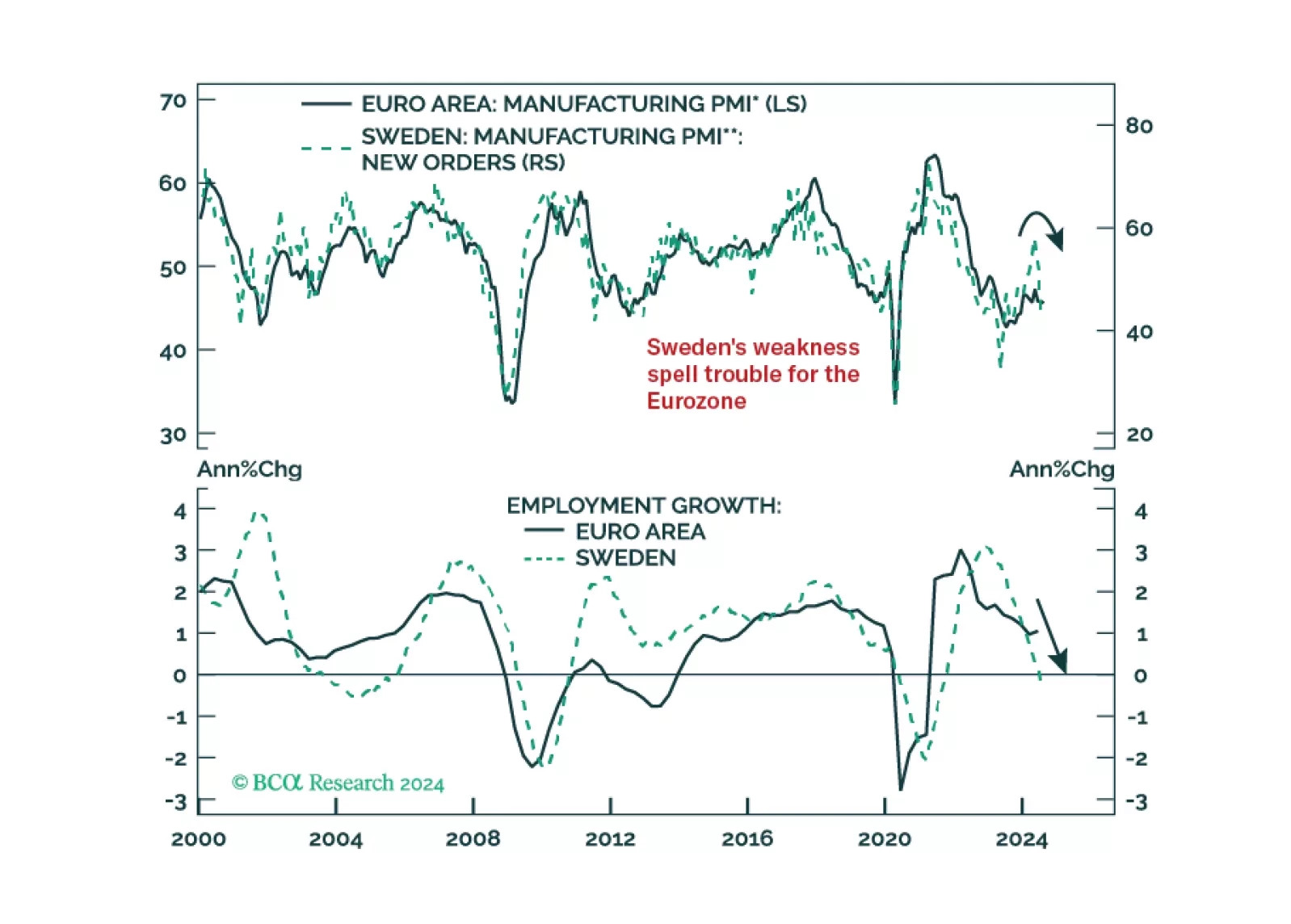

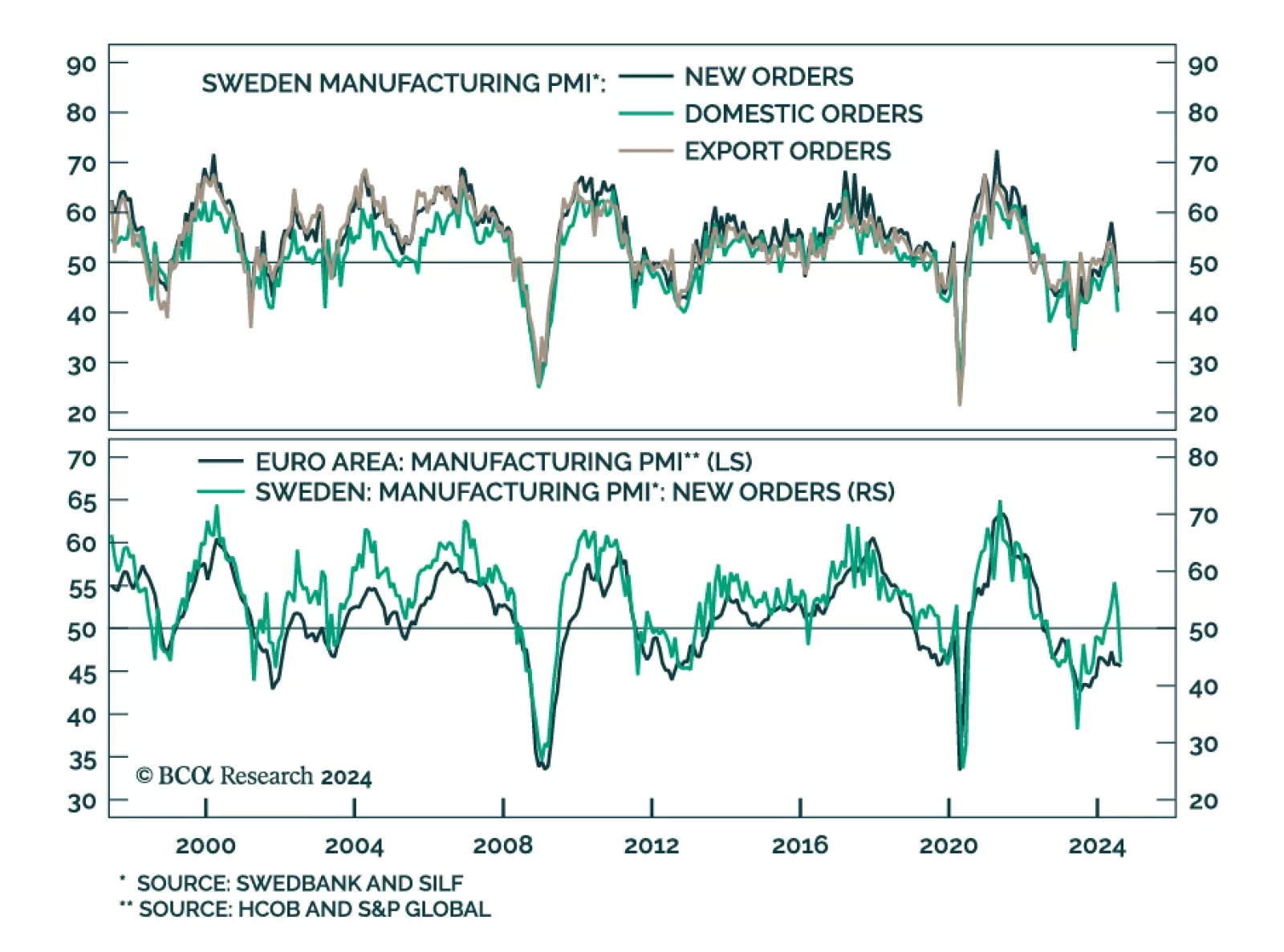

According to BCA Research’s European Investment Strategy service, Sweden, which acts as a bellwether for the global economy, will offer early insight into whether our base-case late 2024/early 2025 recession scenario will…

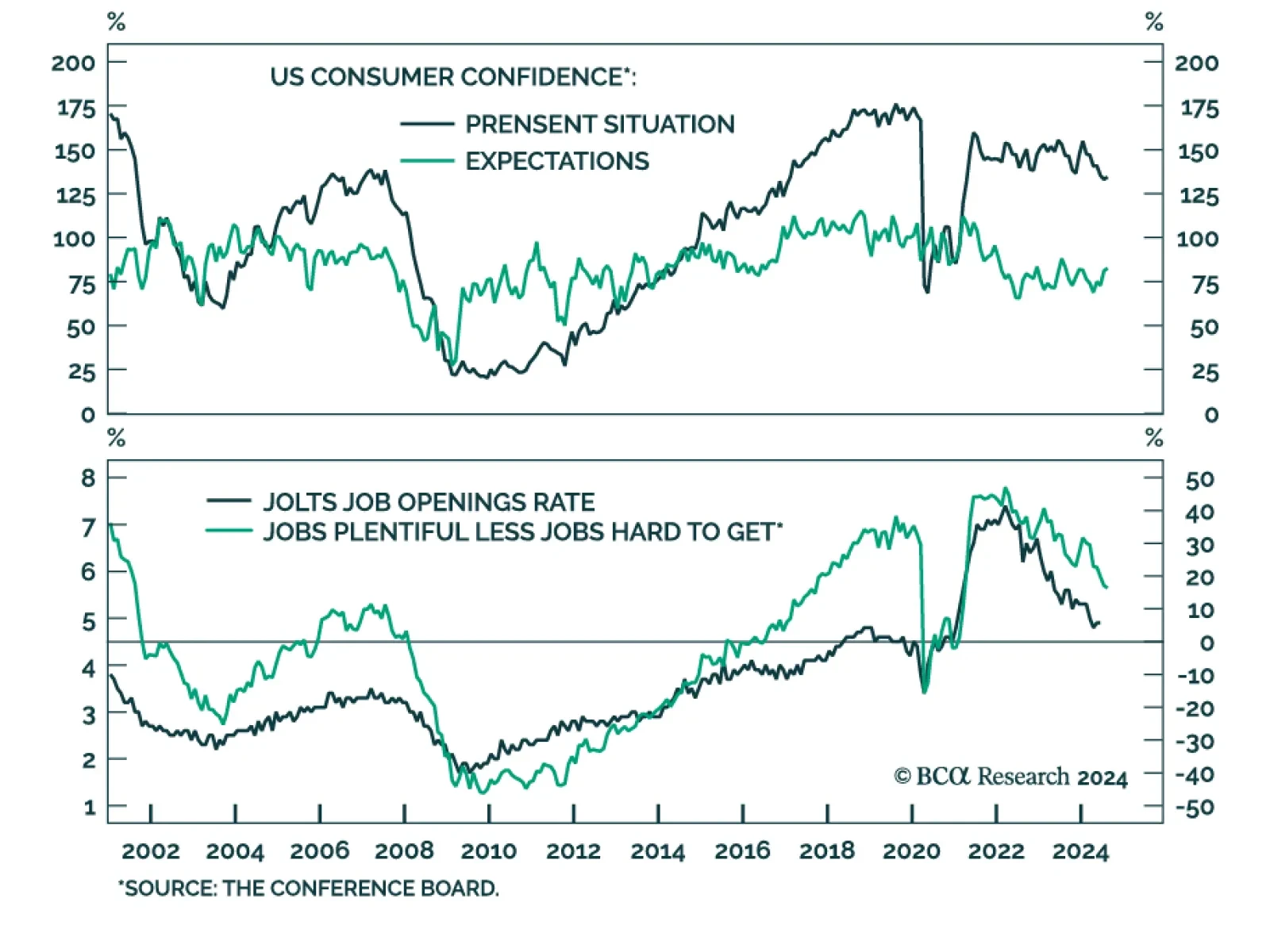

The Conference Board’s Consumer Confidence measure surprised to the upside in August, rising from 100.3 to 103.3, above expectations of 100.7. Consumers’ assessment of present economic conditions climbed 0.8 points to…

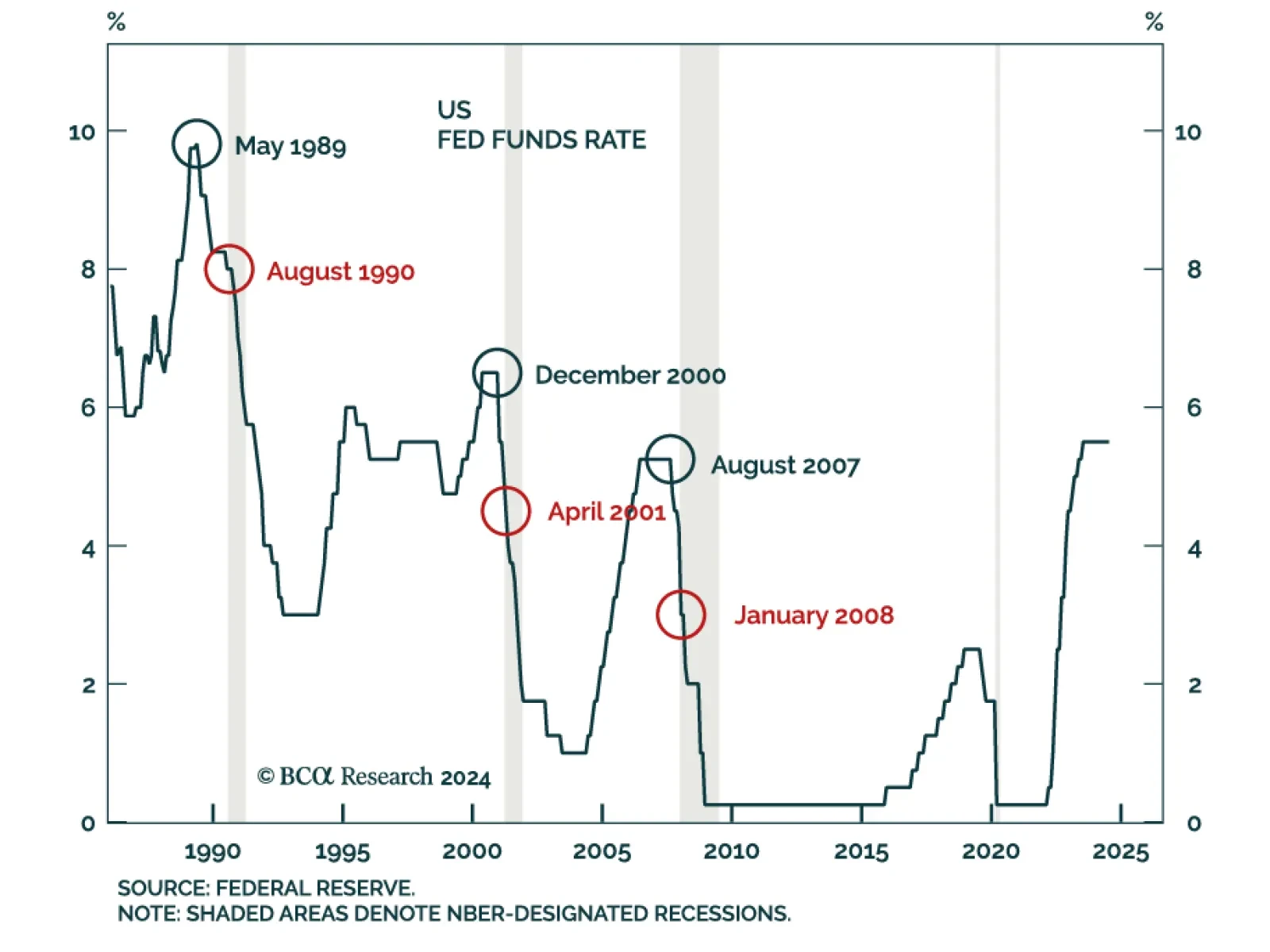

During his Jackson Hole speech, Chair Powell dispelled any remaining doubts about a September rate cut. Still, easing monetary policy is unlikely to result in a soft landing. First, recessions have historically started shortly…

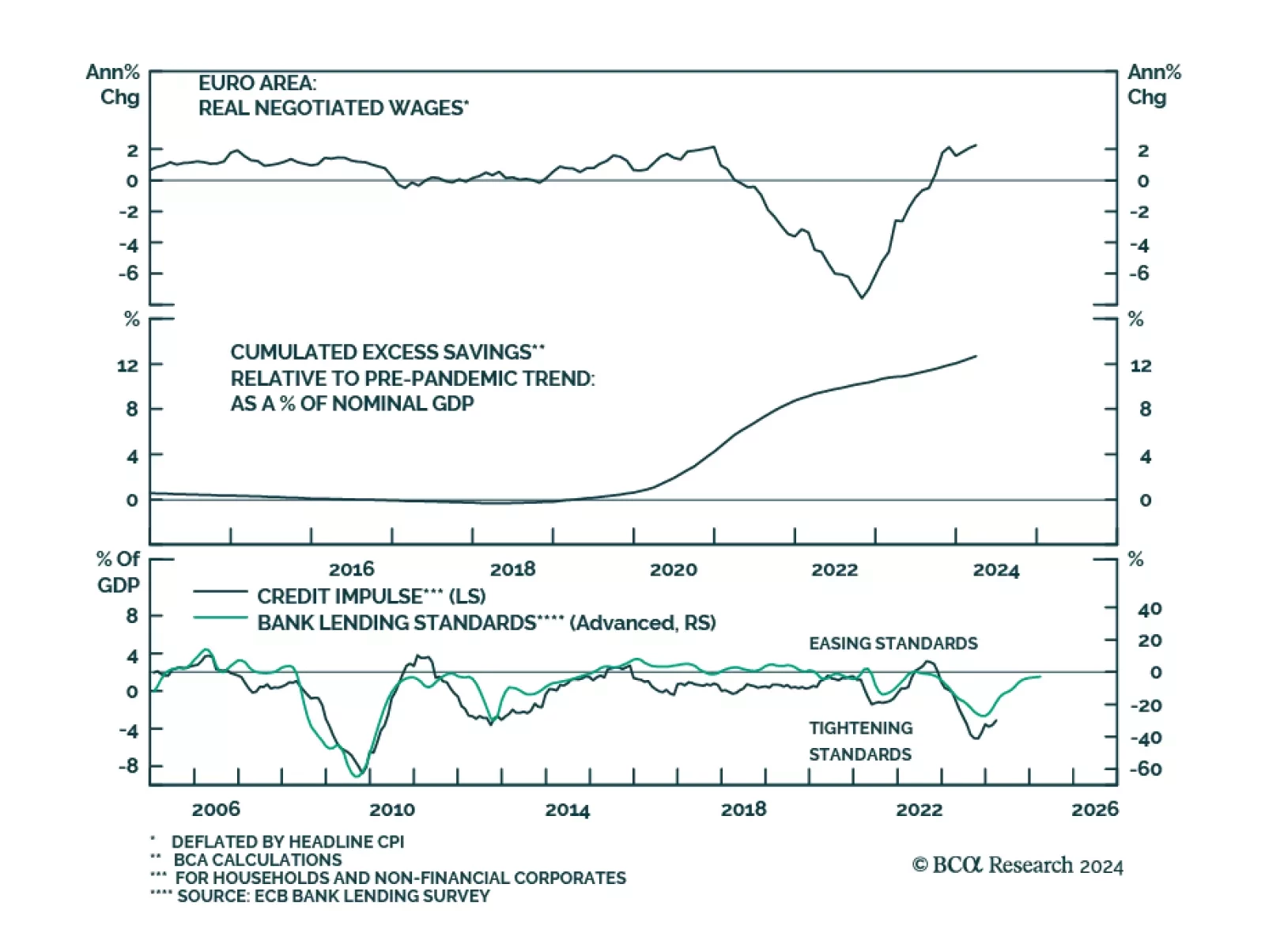

Our negative stance on European growth and assets is not devoid of risks. To gauge whether these risks warrant upgrading our growth outlook, we monitor Sweden closely. So, what is the current message from this Nordic economy?

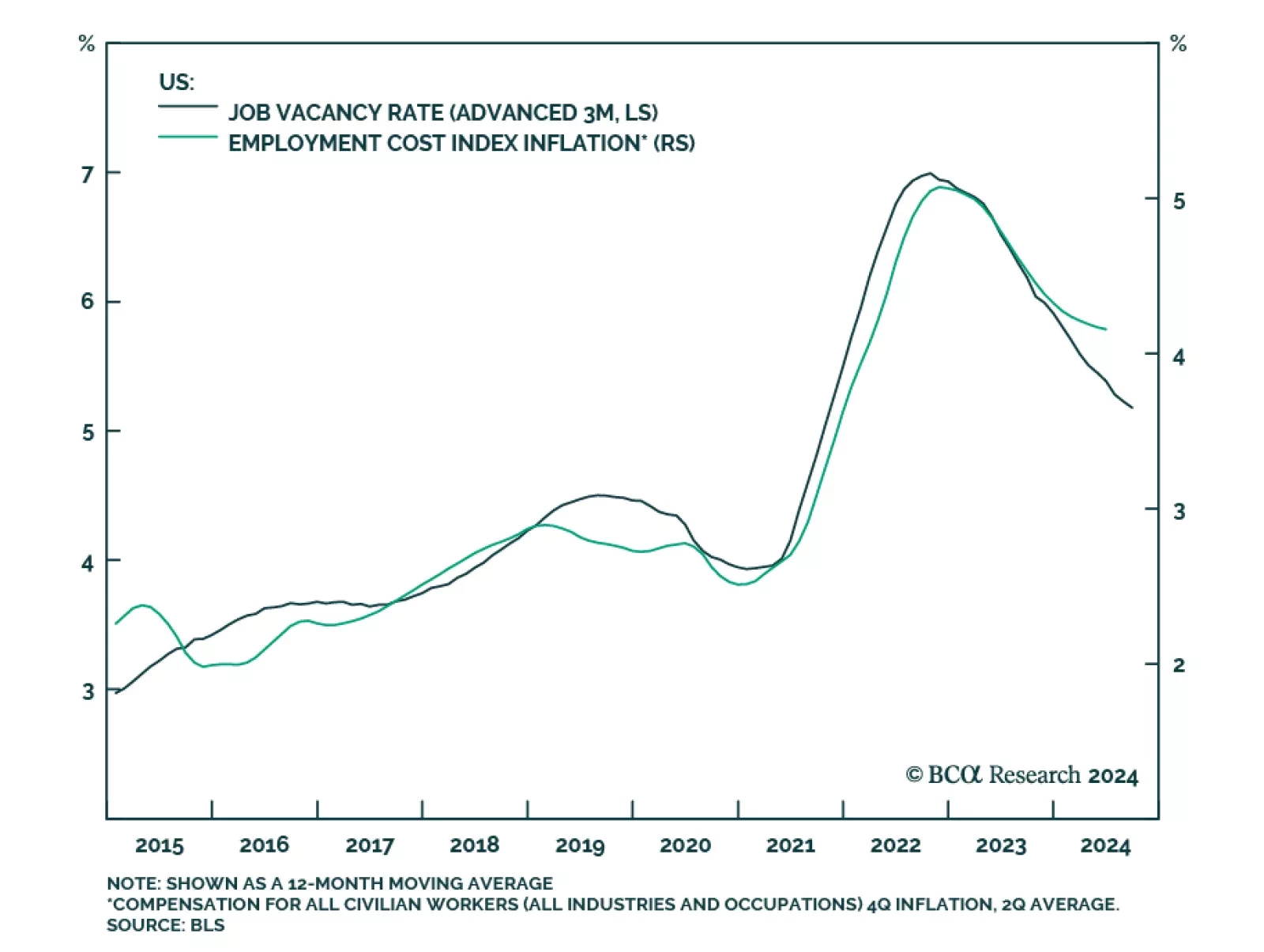

The great US labor market shortage is over. Labor demand will likely fall short of supply by the end of this year, causing unemployment to soar. Neither fiscal nor monetary policy will be able to prevent the coming recession.…

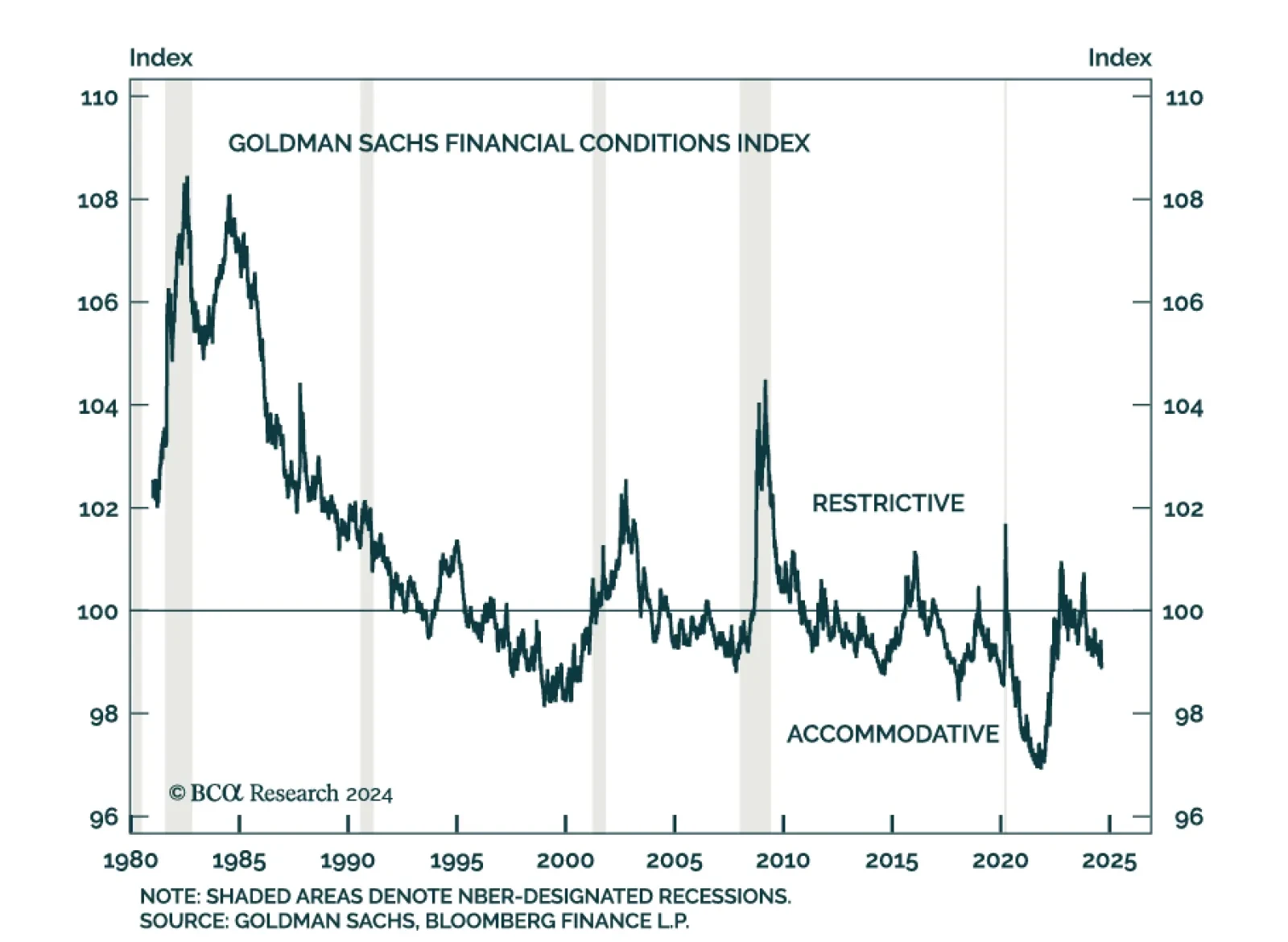

According to Goldman Sachs’ Financial Conditions Index (FCI) financial conditions have become considerably more supportive since the fall of 2023. More recently, the index ticked noticeably lower from 99.4 earlier in August…

We’ve highlighted that continued deterioration in consumer fundamentals will tip the US economy into a recession. Slower compensation growth, tighter lending standards for consumer loans and dwindling excess savings will…