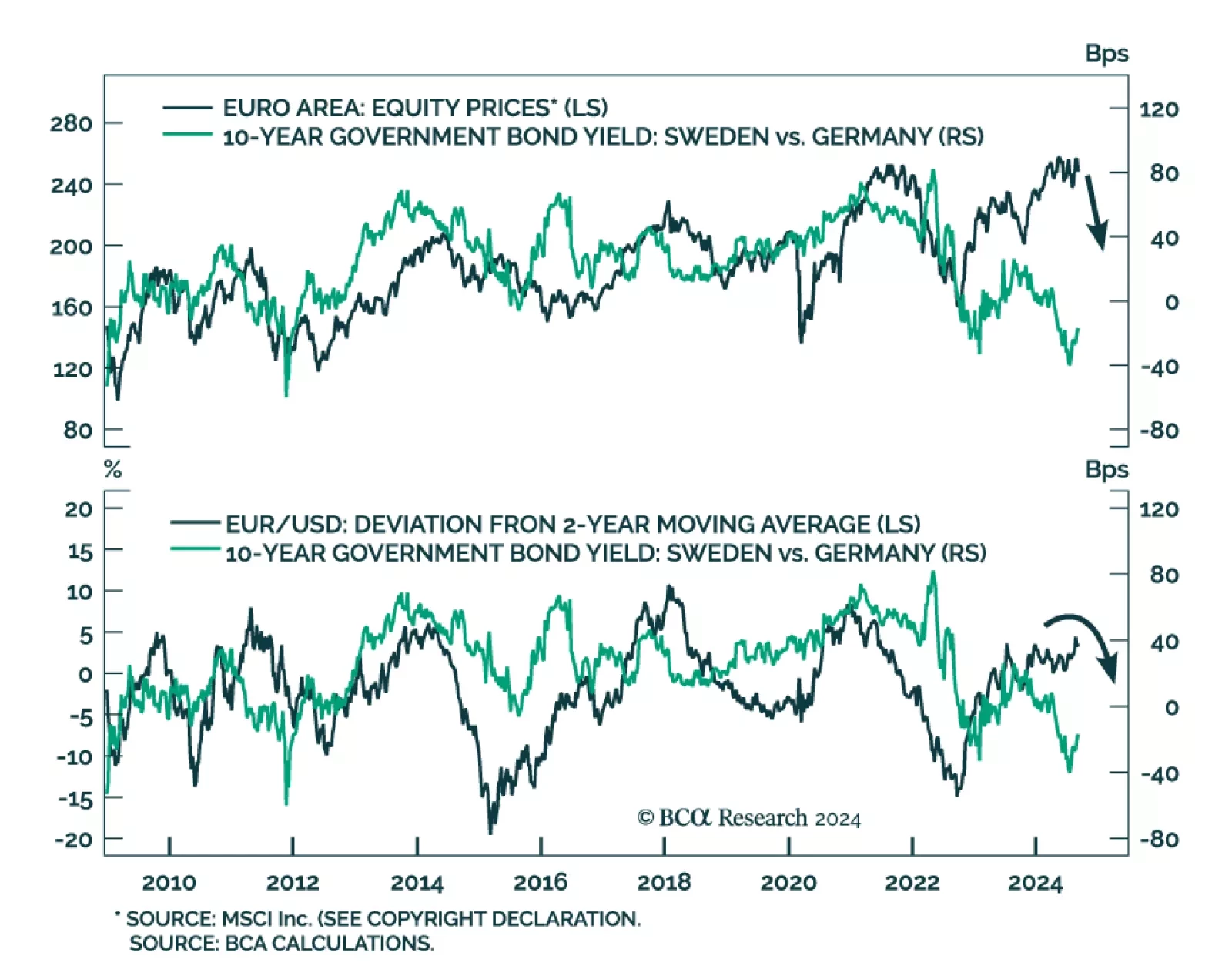

The Swedish economy’s cyclicality and sensitivity to global trade make it a reliable bellwether for global growth. Sweden is facing significant domestic weakness. Employment growth declined by 0.14% y/y in July and…

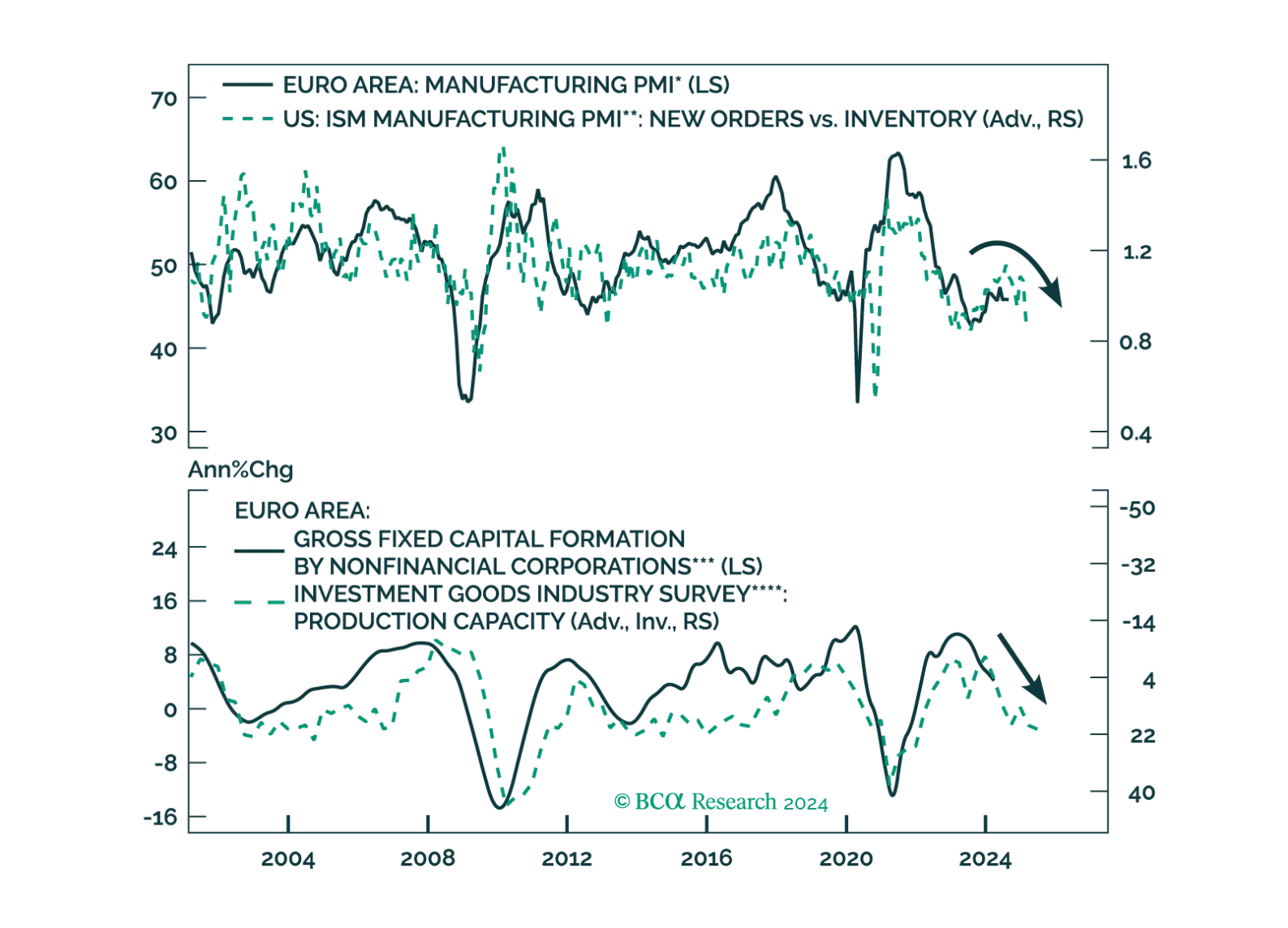

Crucial leading indicators of the global and European economies continue to deteriorate. How should investors position their European portfolios to benefit from these trends?

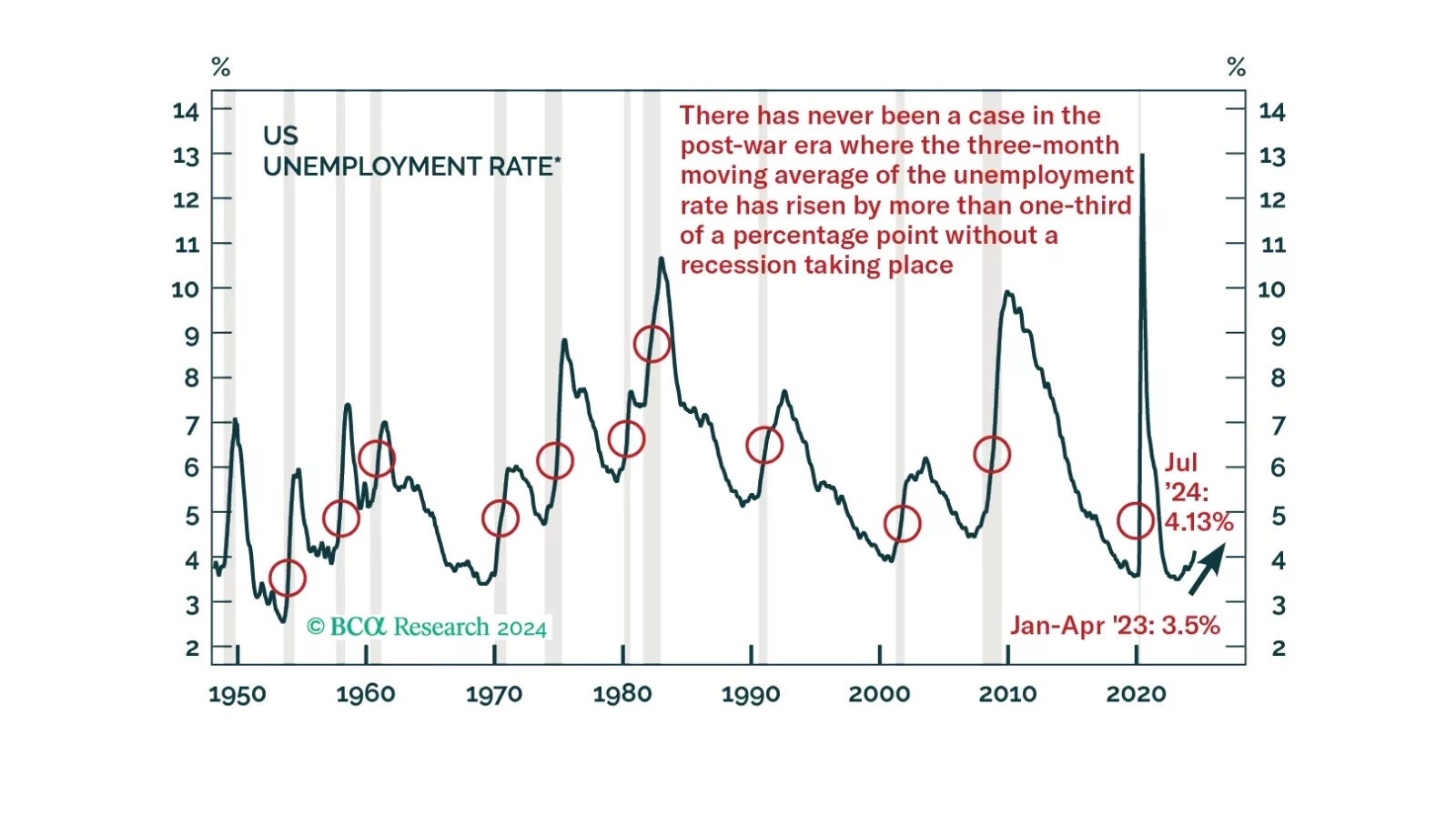

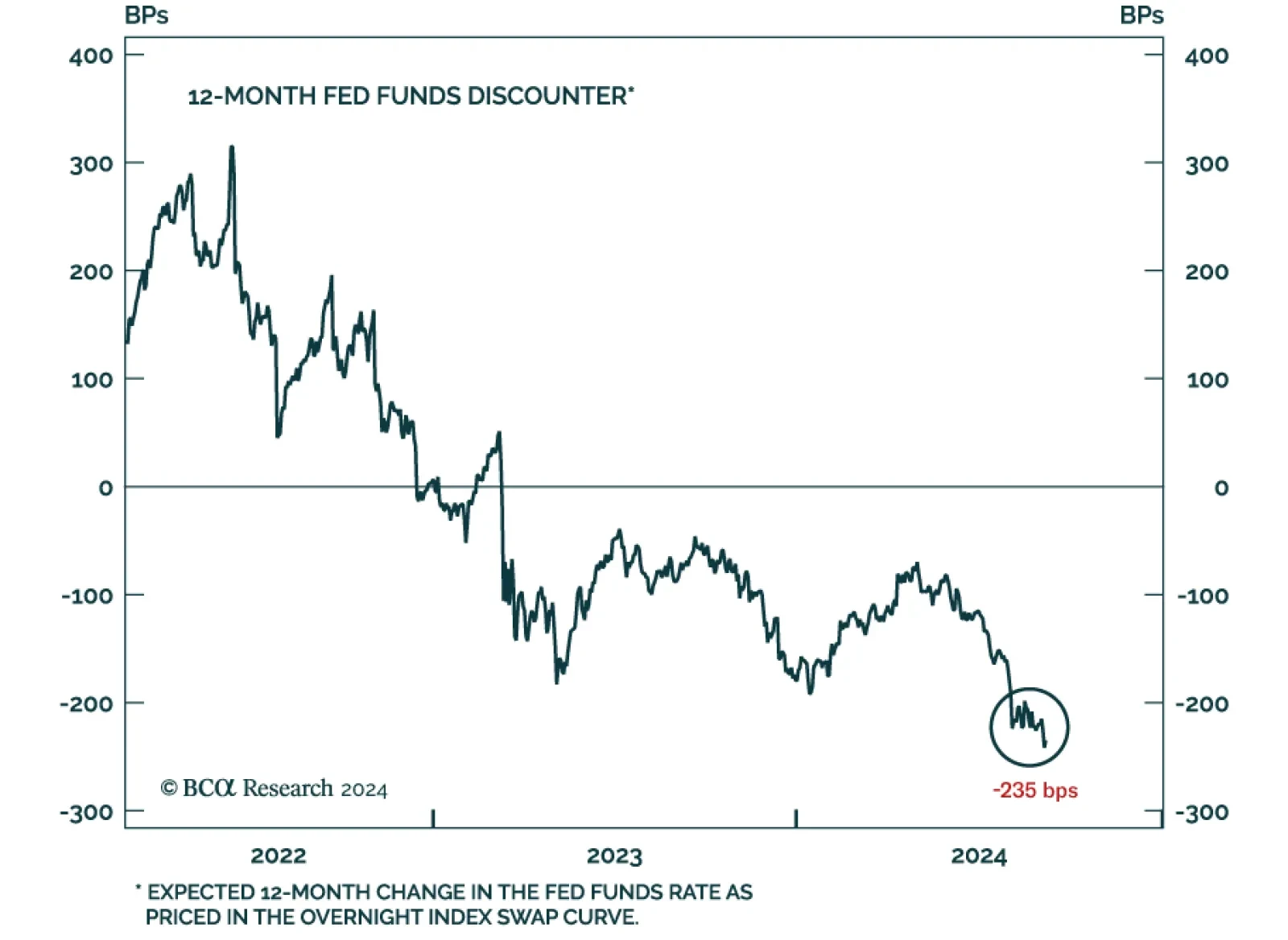

The July Employment Situation report had already cemented the case for a September rate cut and Chairman Powell’s Jackson Hole comments dispelled any remaining doubt about an imminent monetary easing cycle. All the labor…

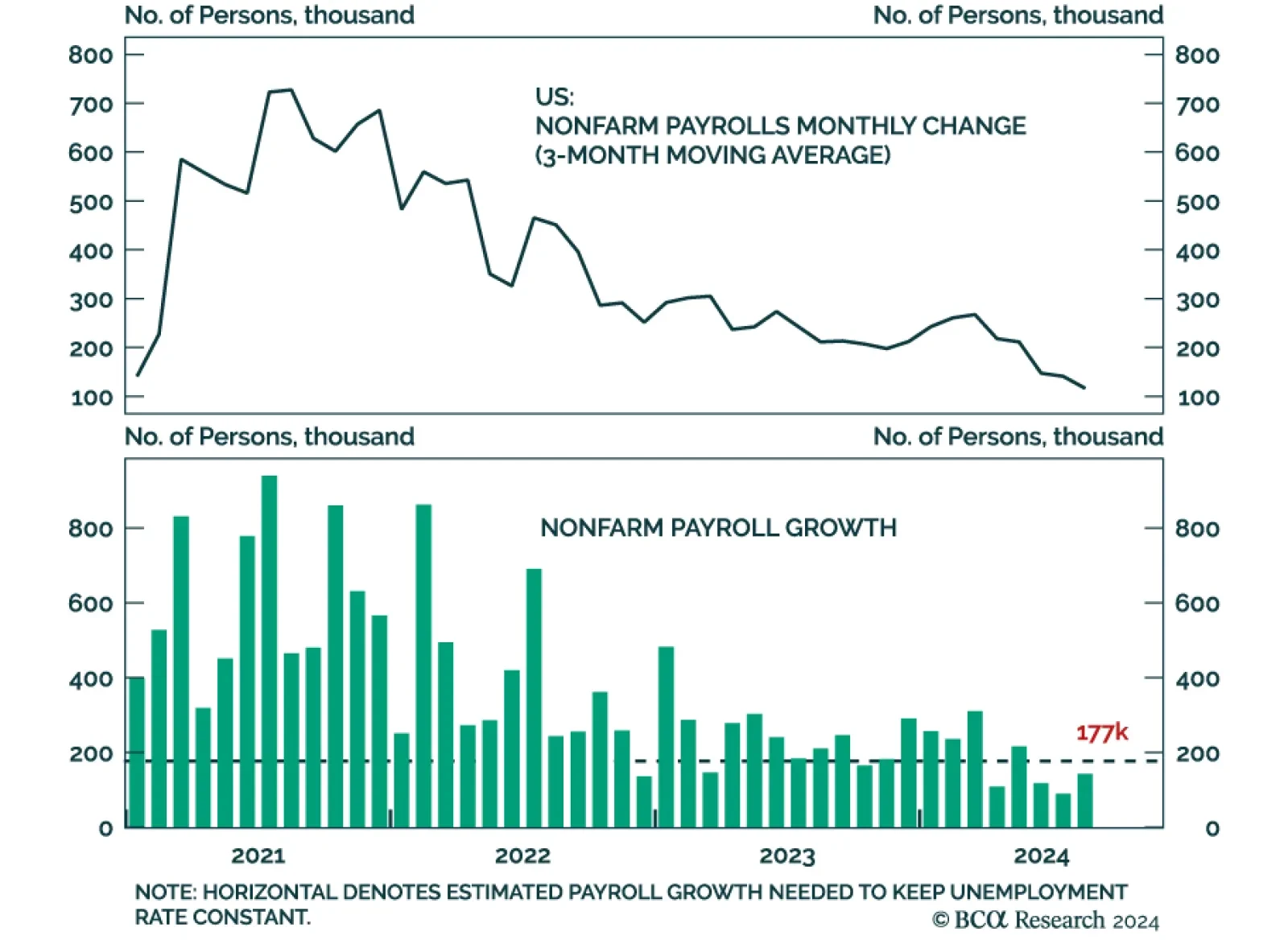

August nonfarm payrolls expanded by 142 thousand workers, from a downwardly revised 89 thousand and below expectations of 165 thousand. Payroll growth fell to a four-year-low of 116 thousand on a 3-month moving average basis.…

This morning's employment report, particularly the downward revisions to prior months, strengthens our conviction that the US economy is headed for recession.

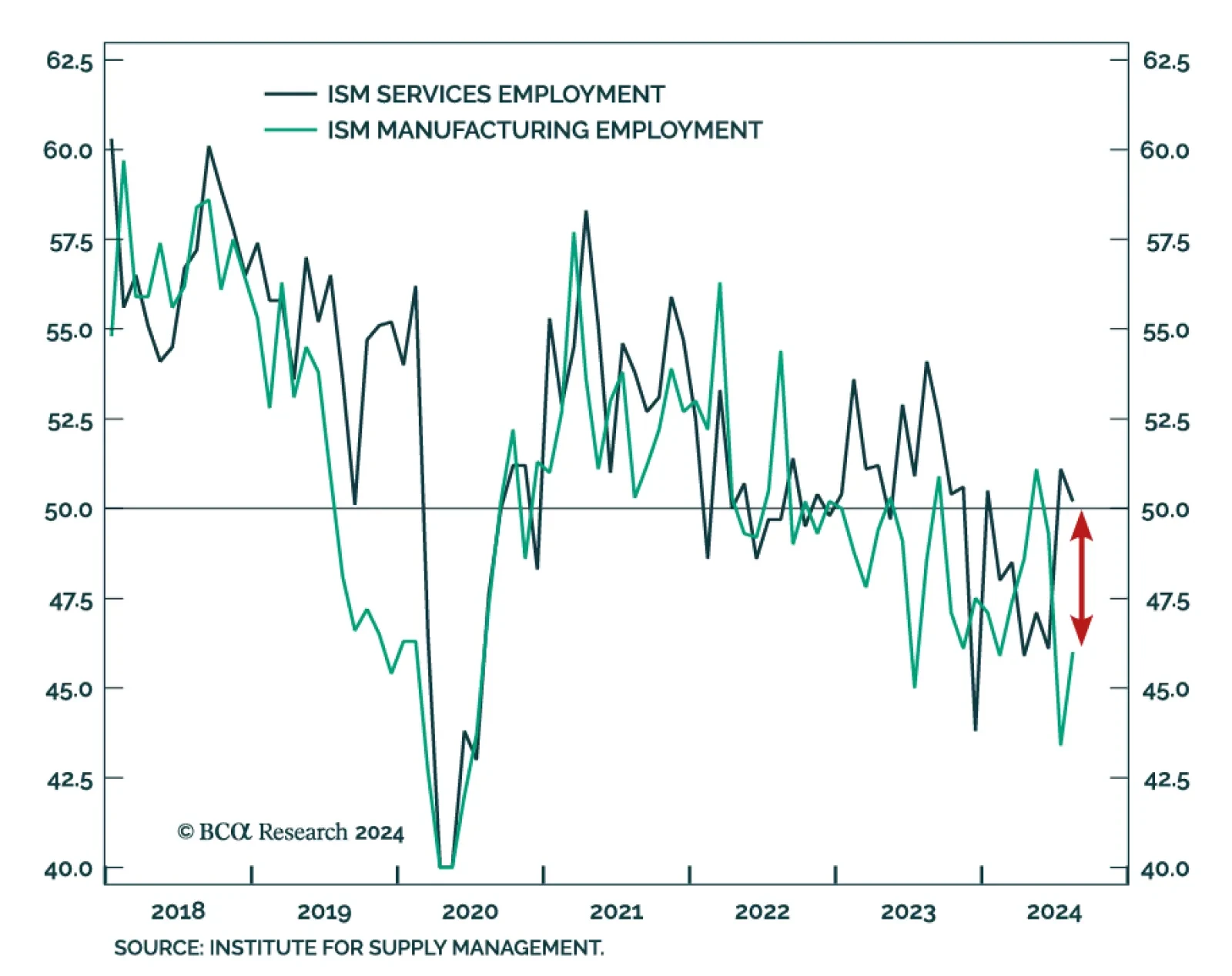

The ISM services PMI remained mostly stable in August, extending a second consecutive month of modest expansion. The headline index ticked 0.1 point higher to 51.5. However, although new orders continued to expand, new export…

In a widely expected move, the Bank of Canada (BoC) cut interest rates by a quarter of a percentage point for a third consecutive month in September, lowering the benchmark overnight rate to 4.25%. Policymakers also signaled…

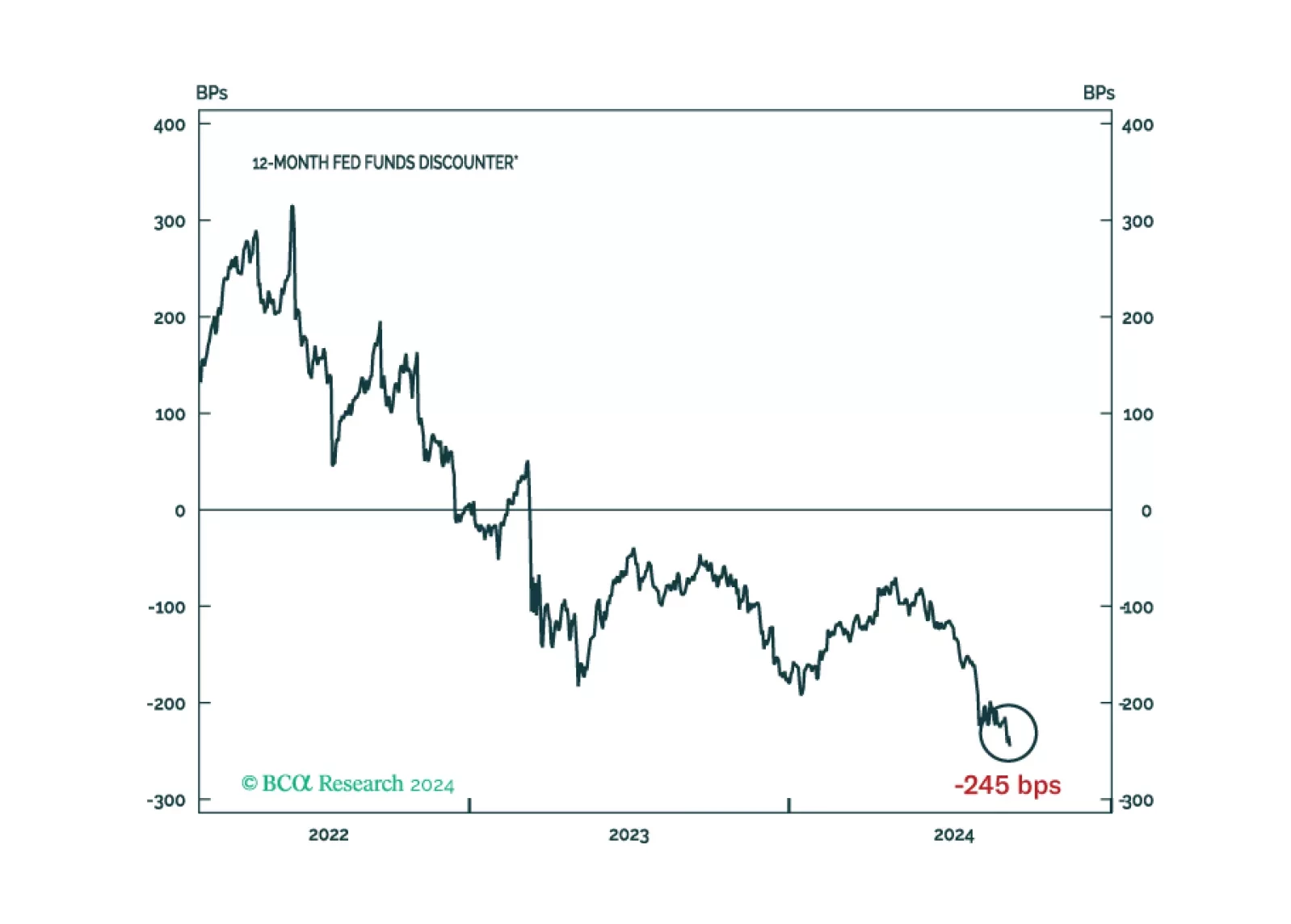

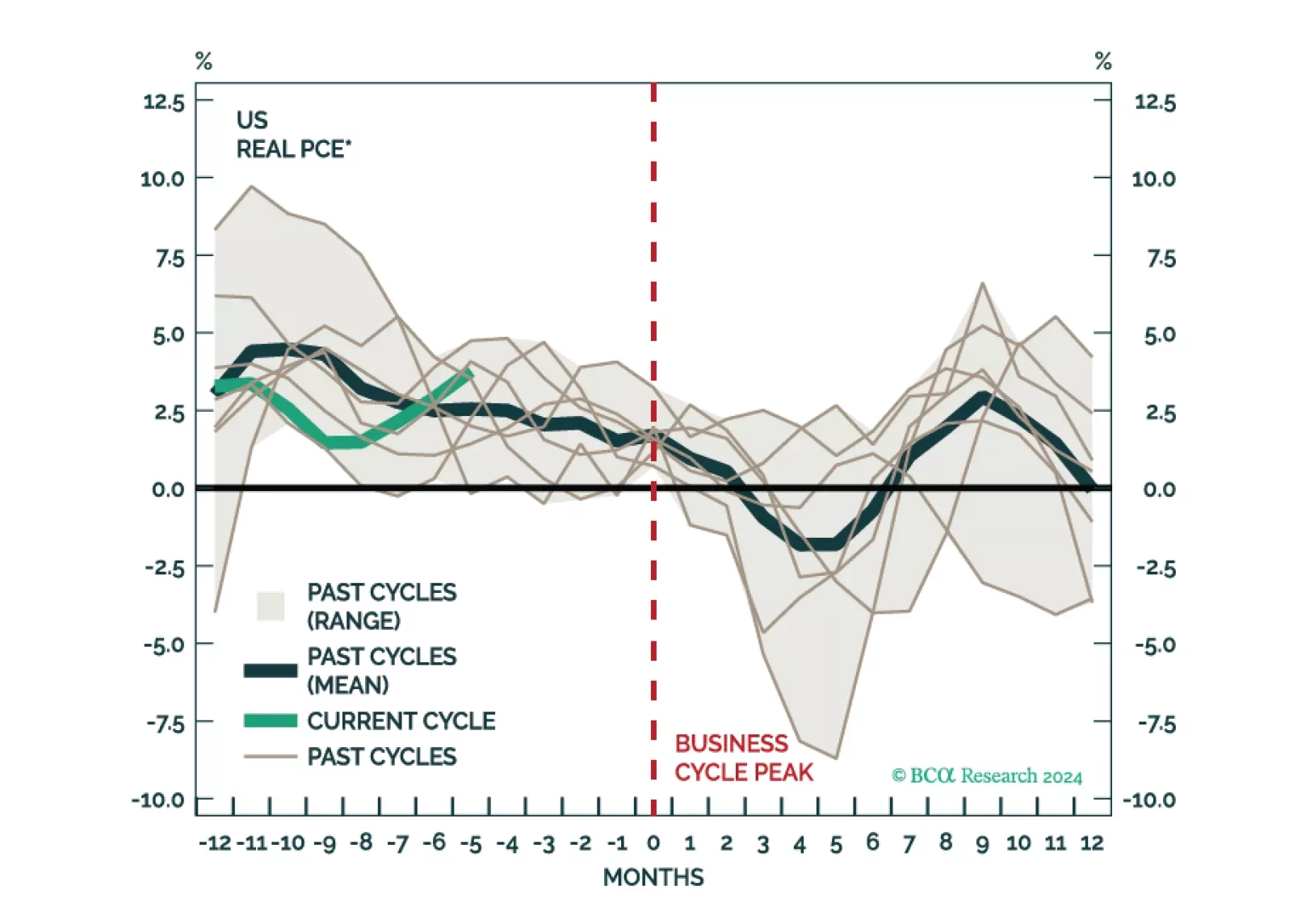

Even after the Fed cuts rates, policy will remain restrictive for some time. Moreover, in history, stocks have tended to fall around the first rate cut. We remain cautious on the outlook for the economy and risk assets.

Our annual end-of-summer chartbook report traces the labor market deterioration that led us to downgrade equities at the beginning of August. It also highlights the soft-landing expectations that the credit and equity markets are…