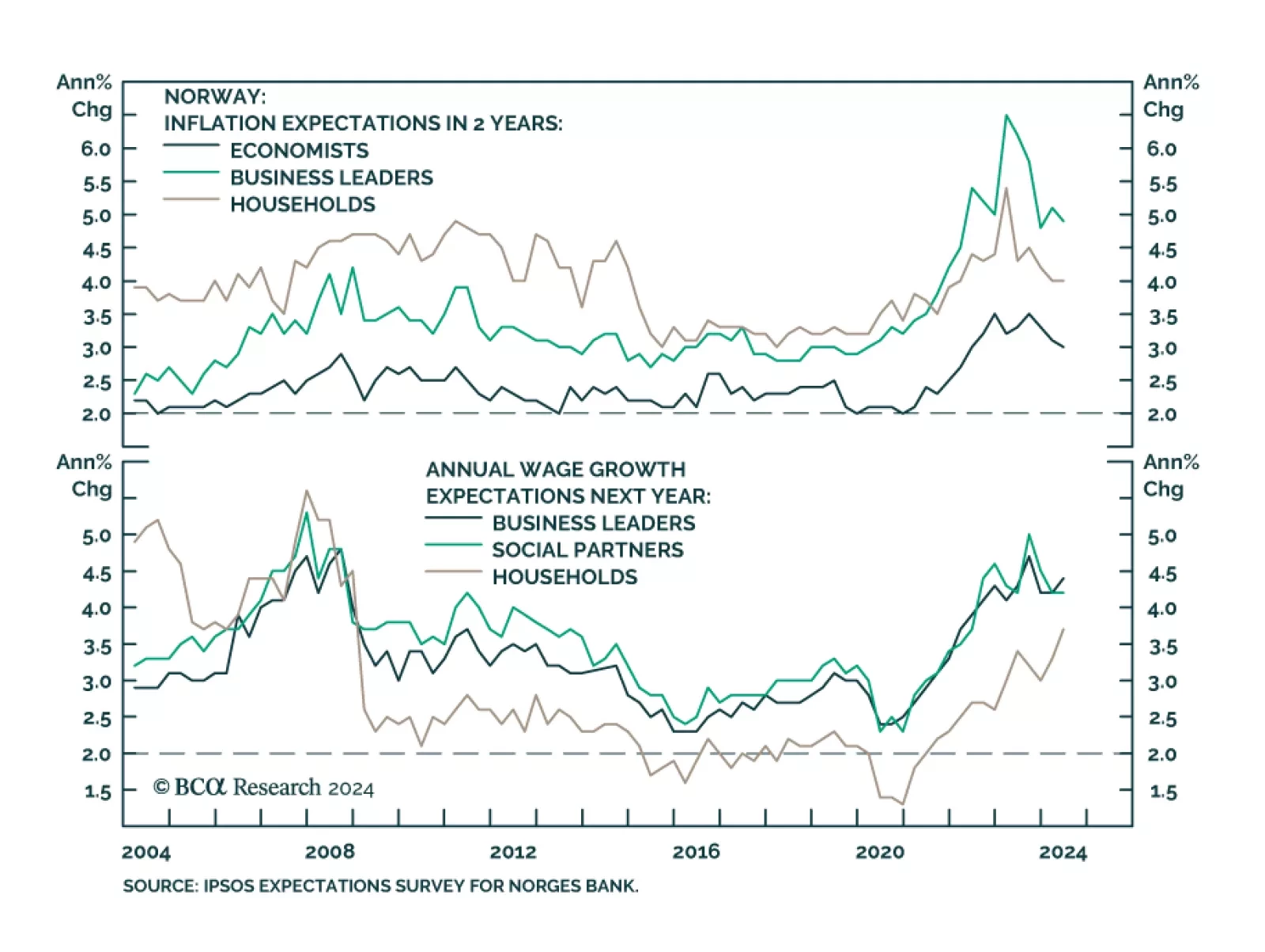

The Norges Bank kept its policy rate unchanged at 4.5% at its September meeting and signaled low odds of policy easing before the first quarter of 2025. The inflation backdrop does not warrant easing policy. Although core CPI…

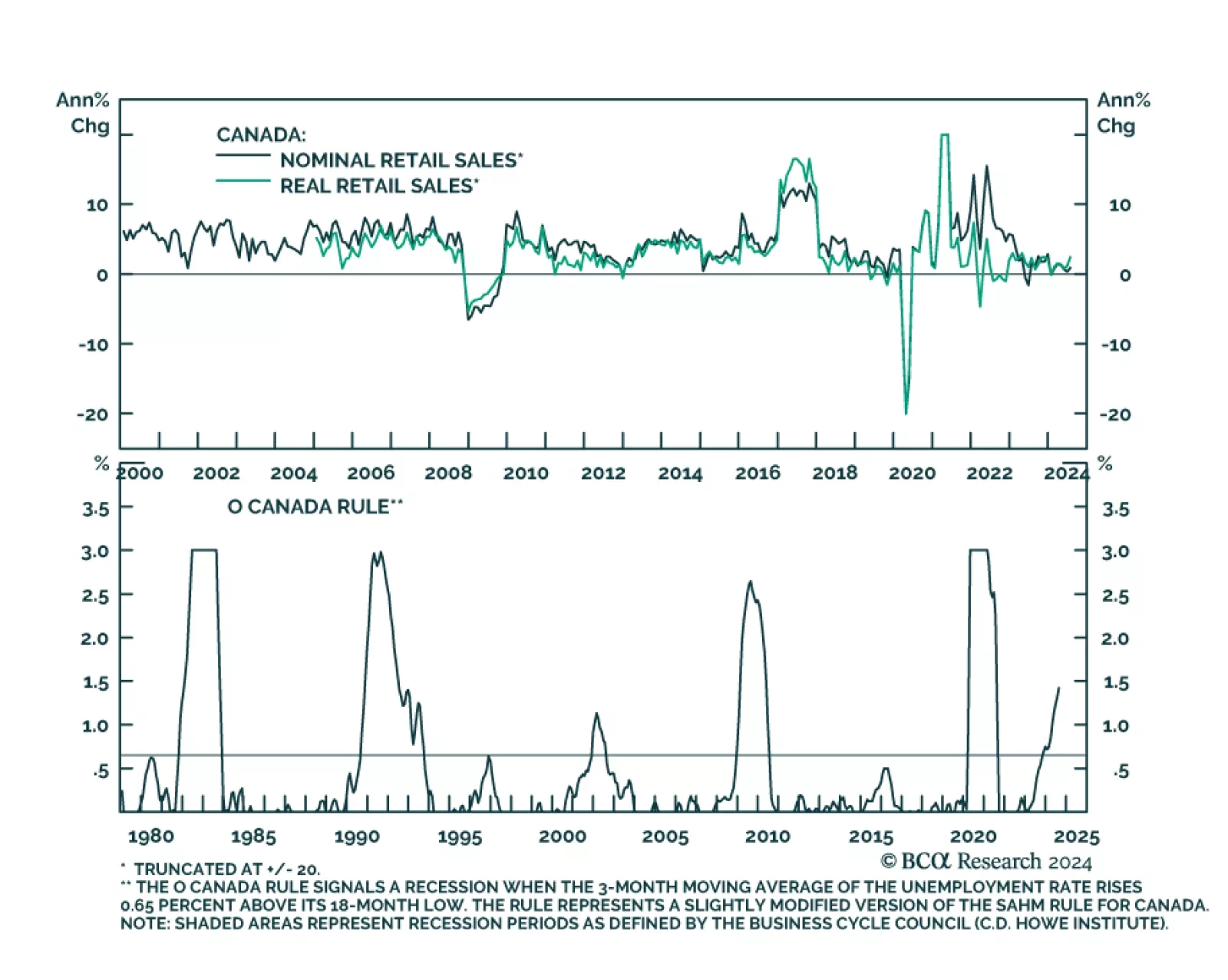

Canadian retail sales grew by a higher-than-expected 0.9% m/m in July from a 0.2% contraction in June. A 2.2% monthly rise in vehicle sales led an otherwise broad-based increase. Ex-auto retail sales also surprised positively,…

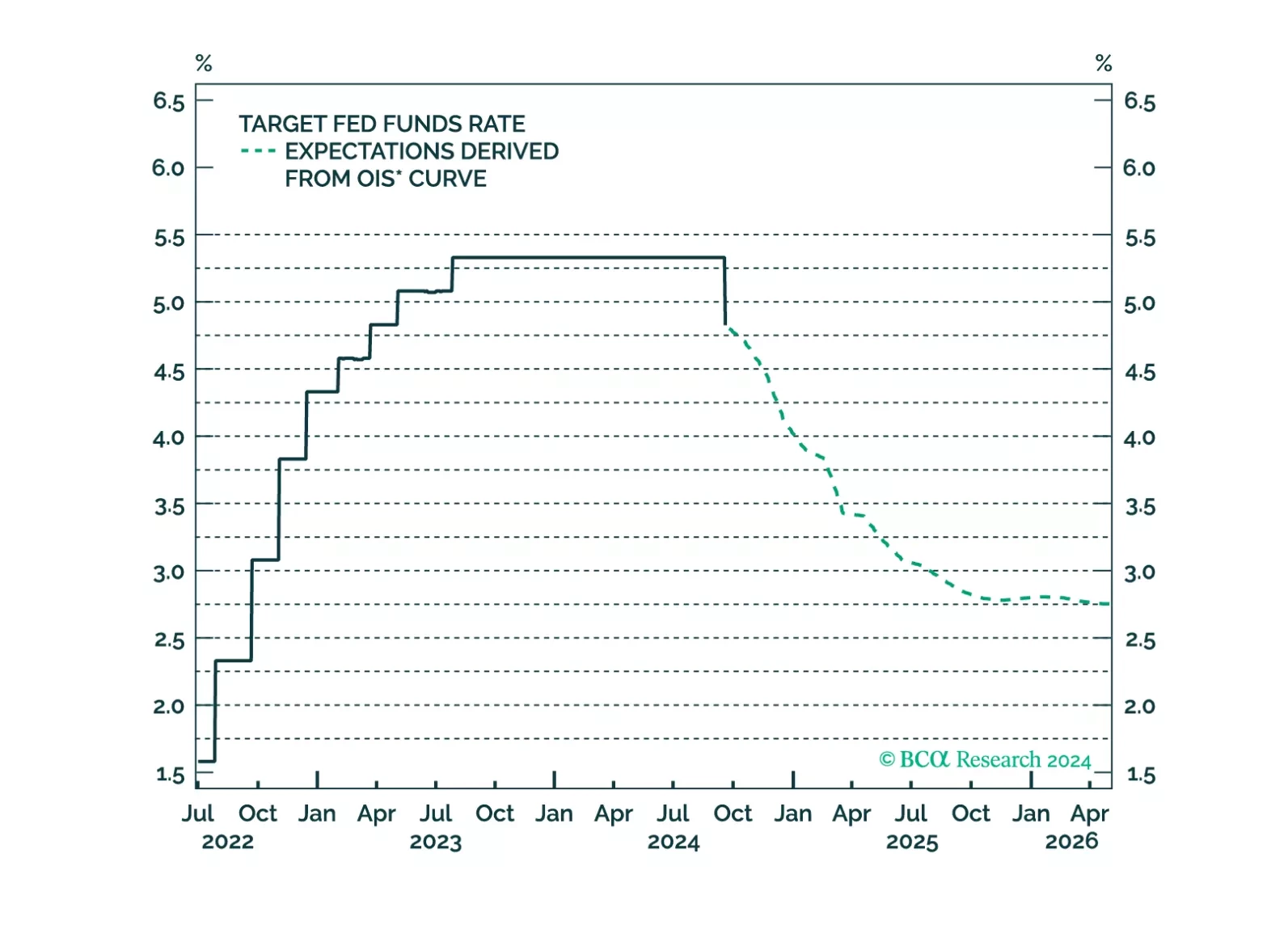

We update our bond views following today’s 50 bps rate cut.

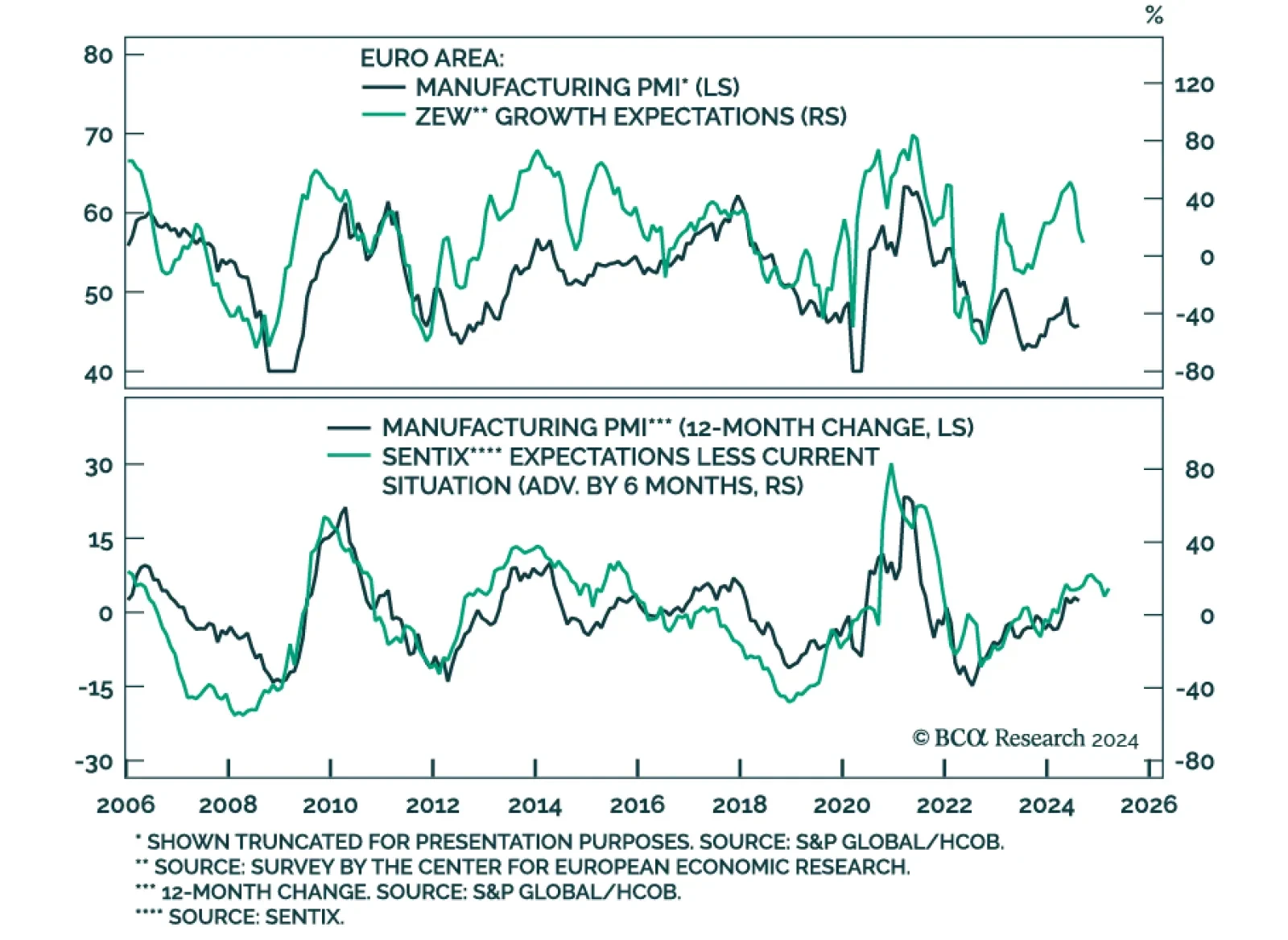

The ZEW survey of both German business expectations and current situation largely disappointed in September, decreasing by 15.6 points to 3.6 and by 7.2 points to -84.5, respectively. The ZEW survey of expectations for…

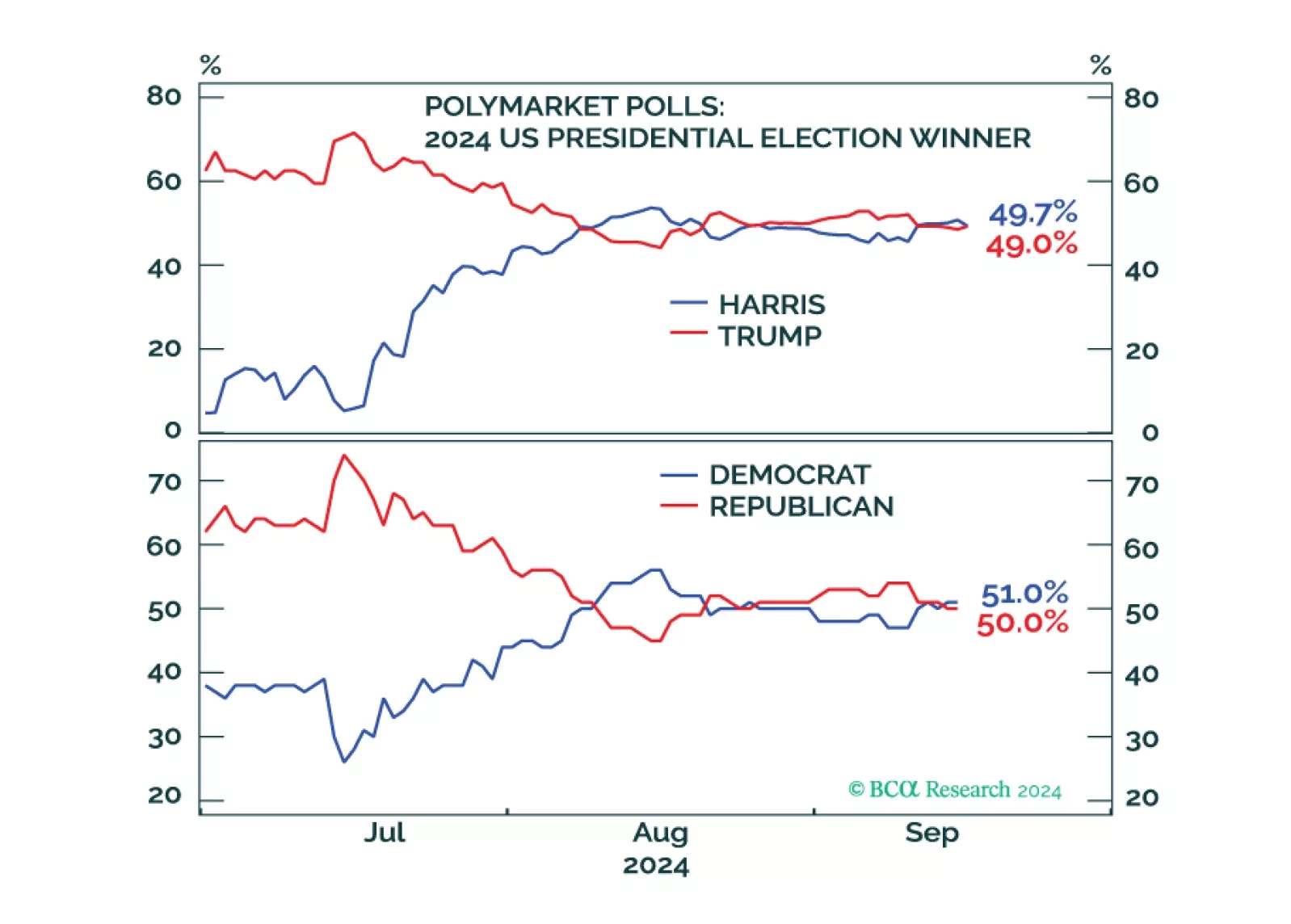

Investors should de-risk tactically in expectation of shocks and surprises ahead of the US election and an uncertain aftermath. Democratic victory with a gridlocked Congress is our base case but would bring minor tax hikes and…

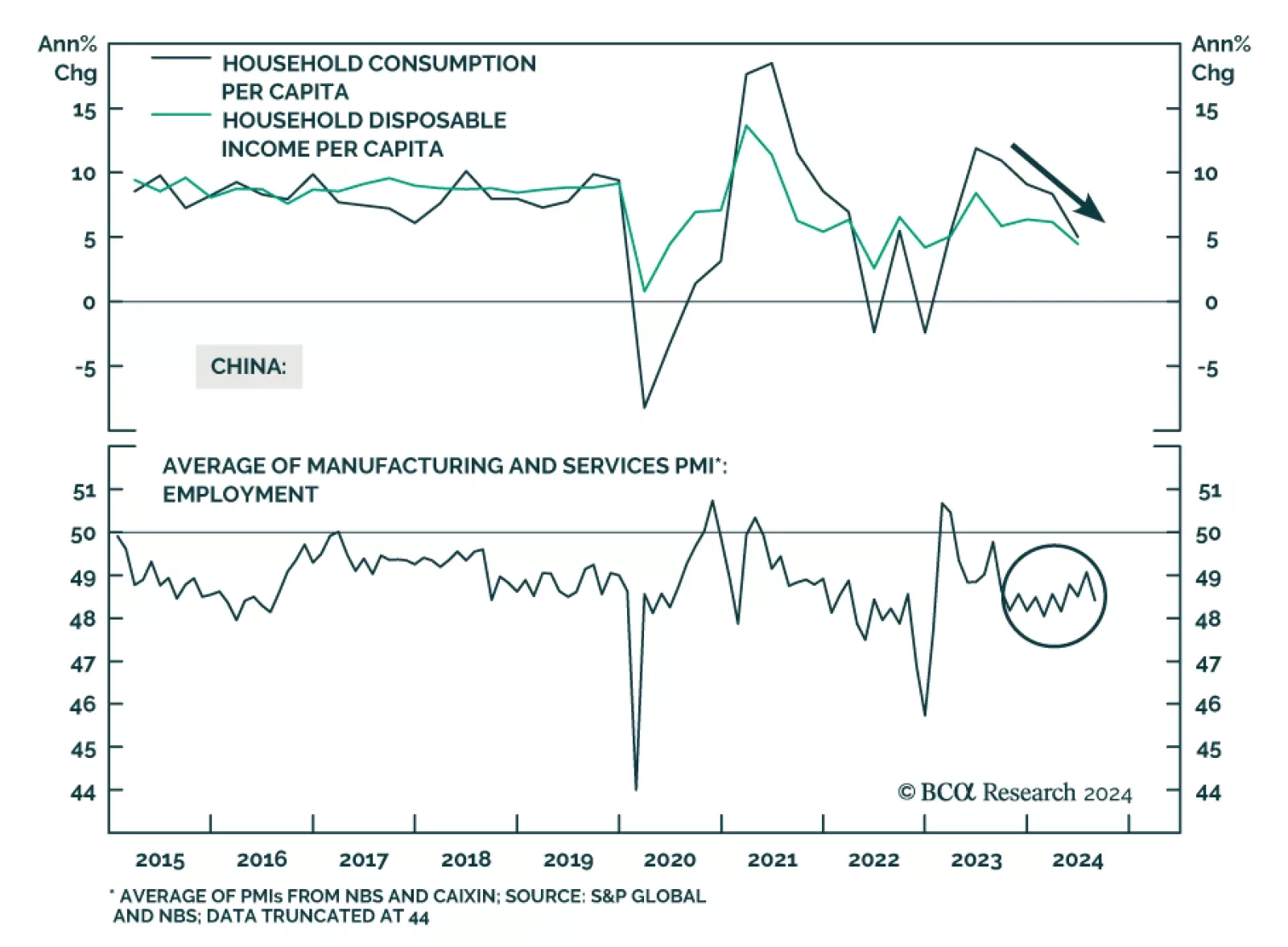

The Chinese economic data in its totality was uninspiring in August. Industrial production and retail sales growth decelerated year-on-year and corroborate the message from August’s import and credit growth data that…

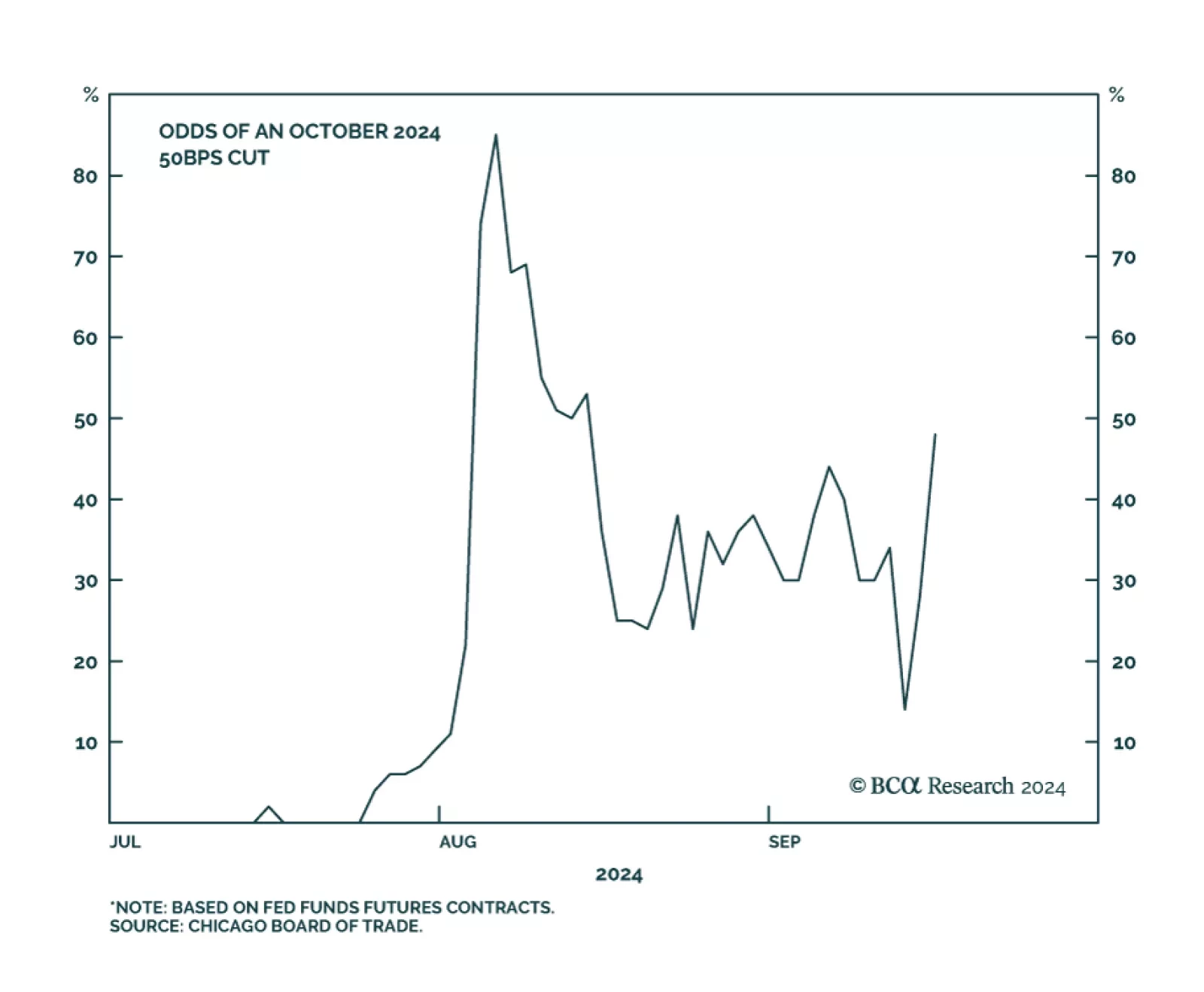

We noted earlier this month that the Fed would be unlikely to deliver a jumbo rate cut without telegraphing it first. President Williams' and Governor Waller’s September 6 speeches offered policymakers one last chance…