In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

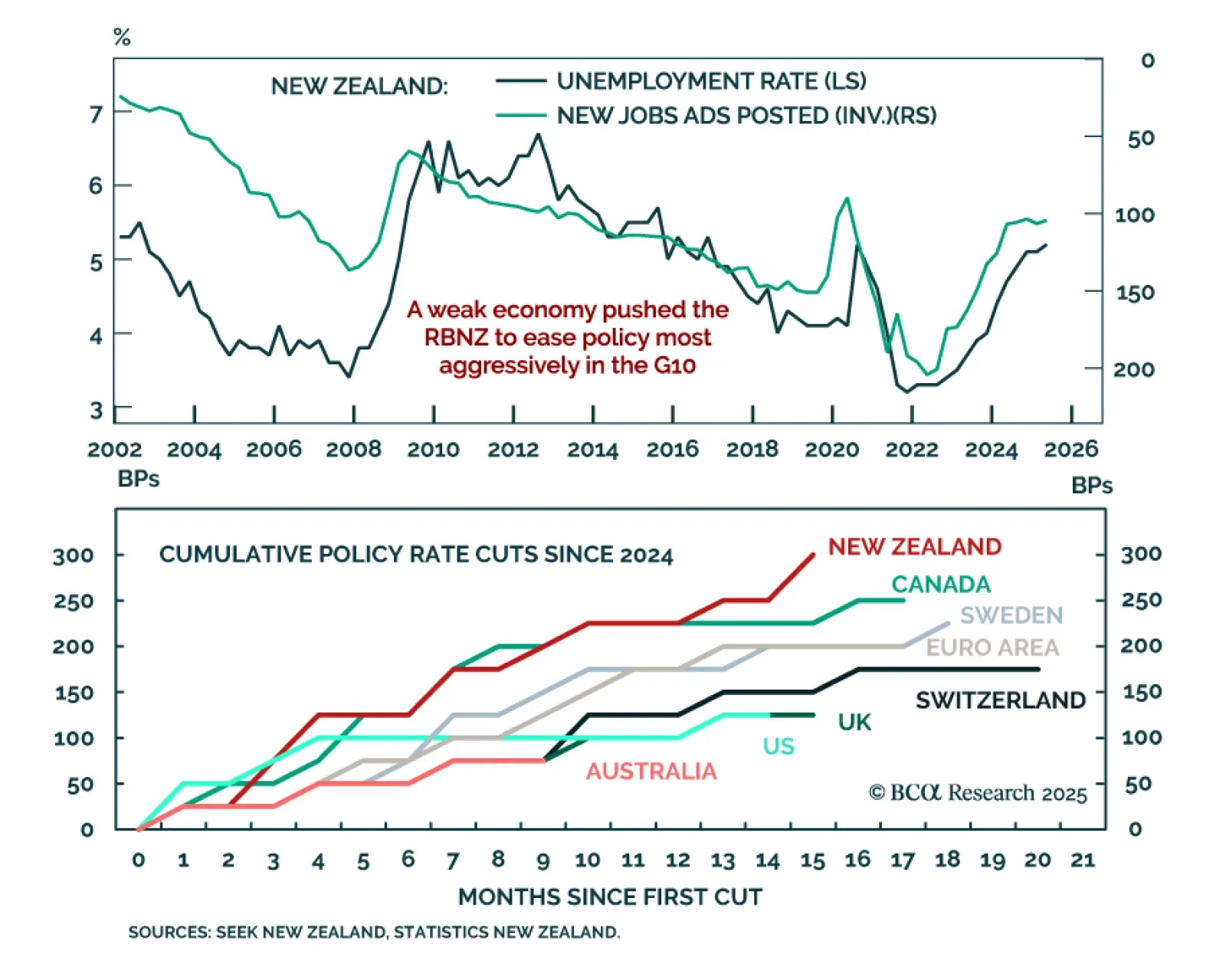

The Reserve Bank of New Zealand (RBNZ) cut the policy rate by 50 basis points to 2.5% and signaled further easing ahead, supporting an overweight stance in New Zealand government bonds and underweight in the NZD.The larger-than-…

Our Portfolio Allocation Summary for October 2025.

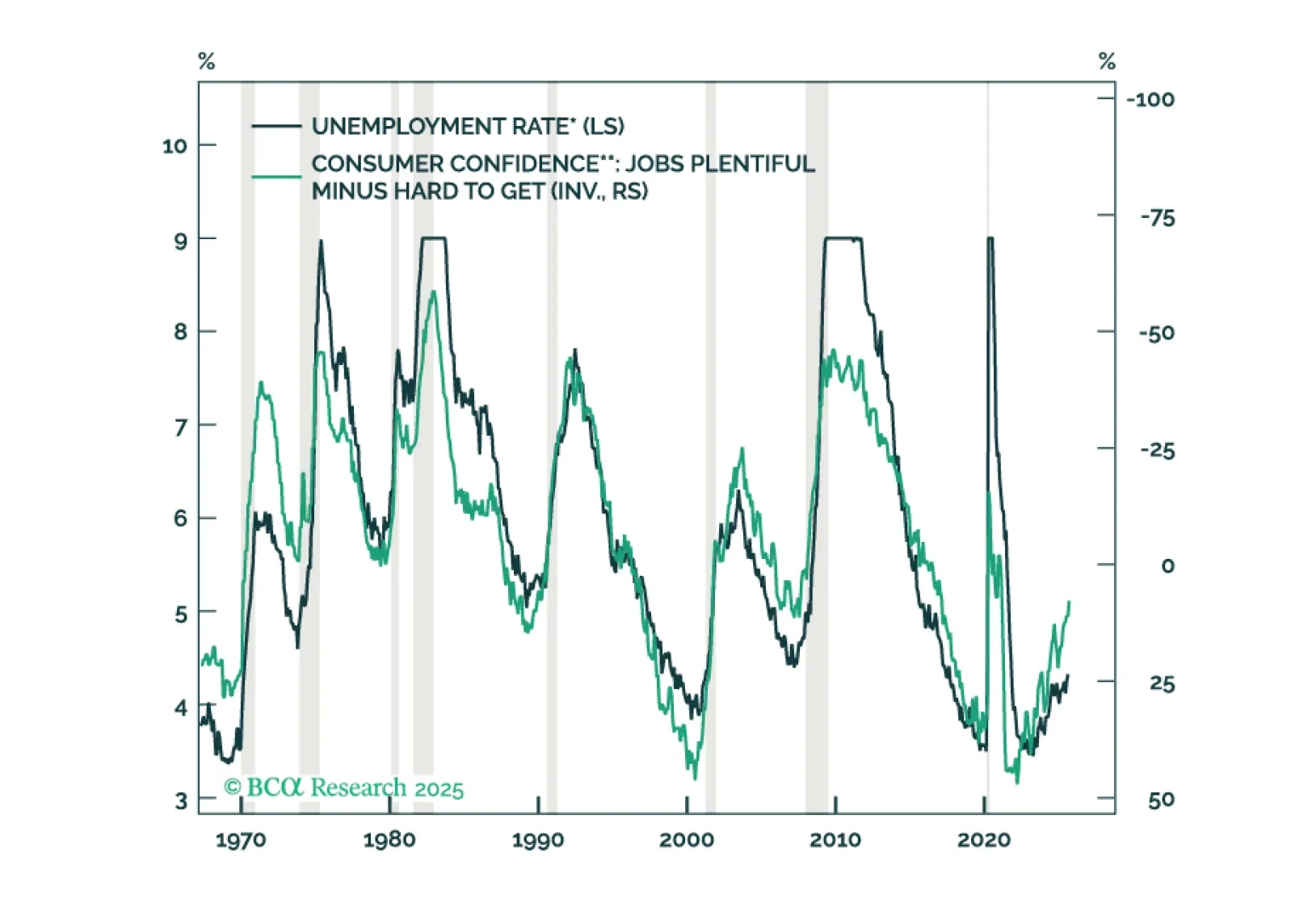

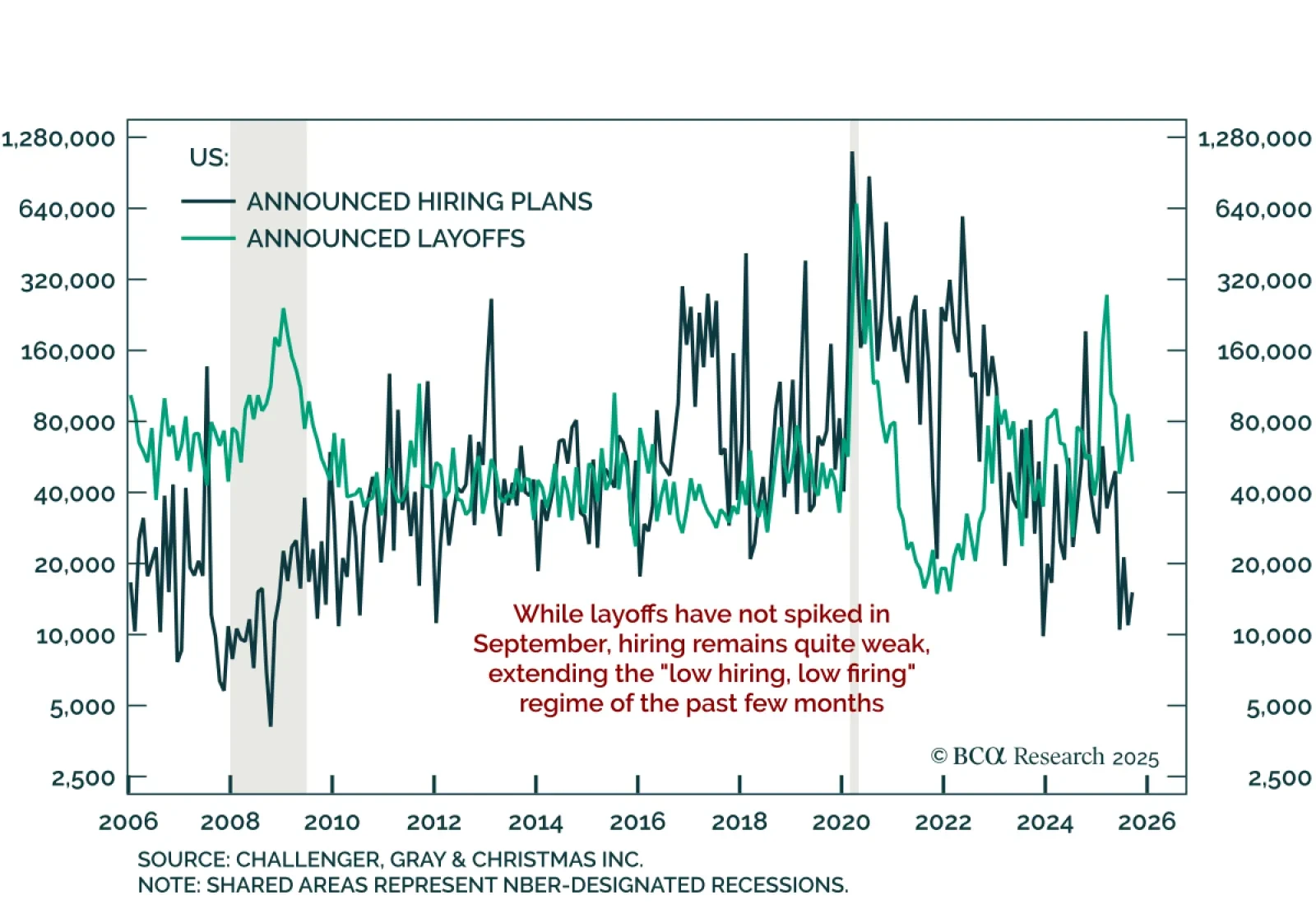

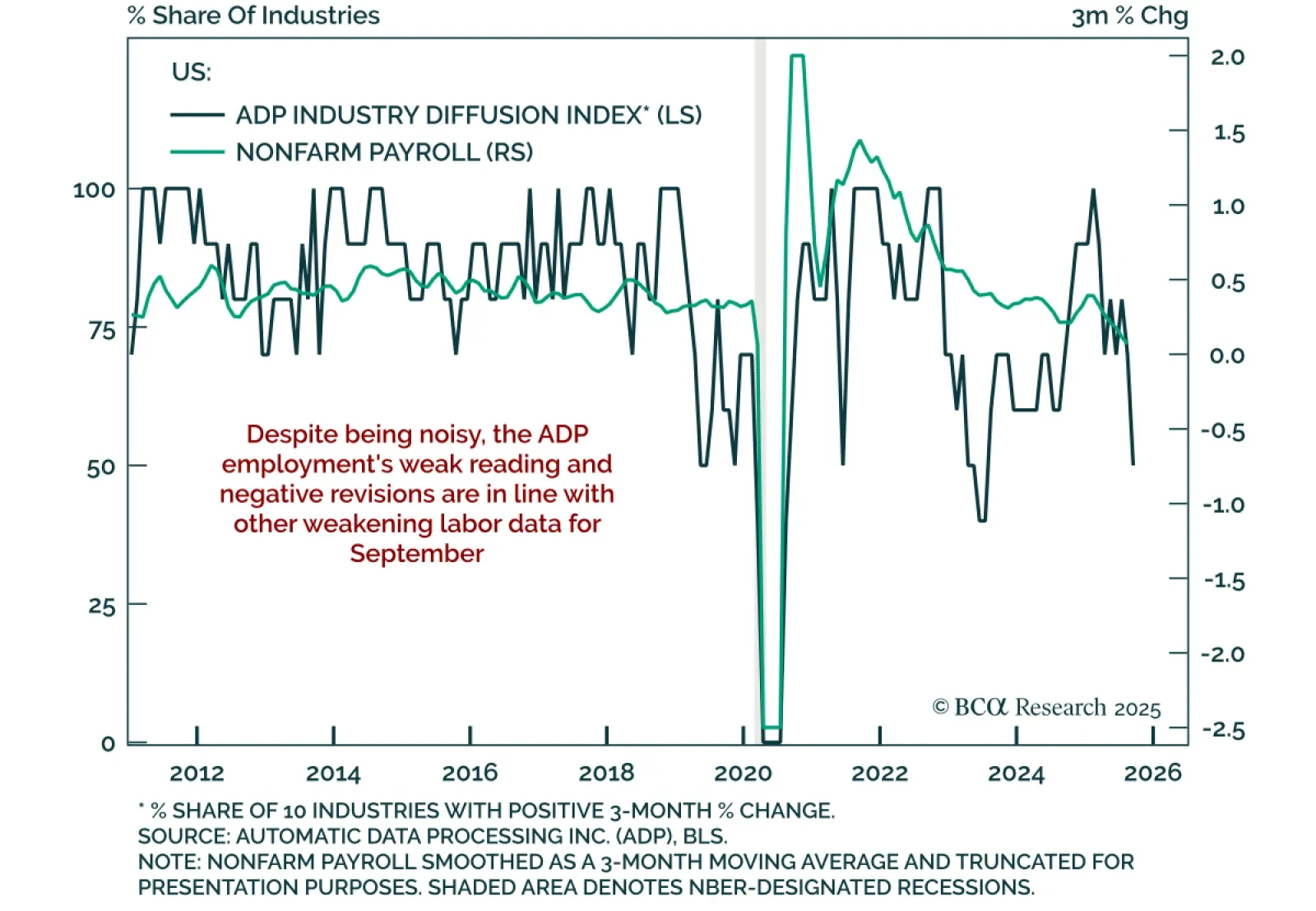

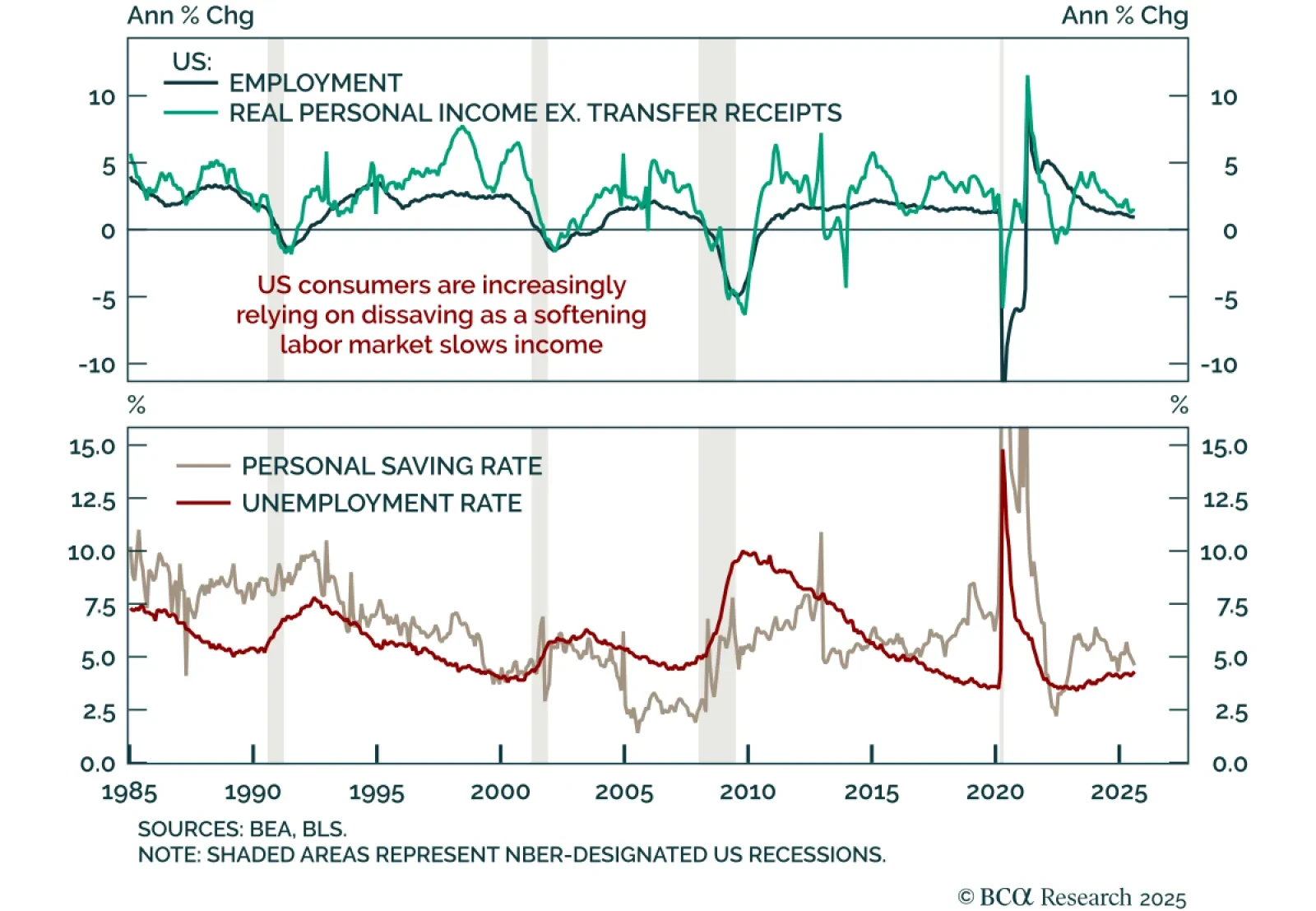

With the government shutdown delaying jobs data, alternative indicators point to a marginally weaker US labor market in September. The absence of the monthly employment report and weekly initial claims leaves us reliant on other…

The September ADP report contracted by 32k jobs, missing expectations and extending the trend of weakening employment. August was revised lower to a 3k contraction, marking two consecutive months of decline after also contracting in…

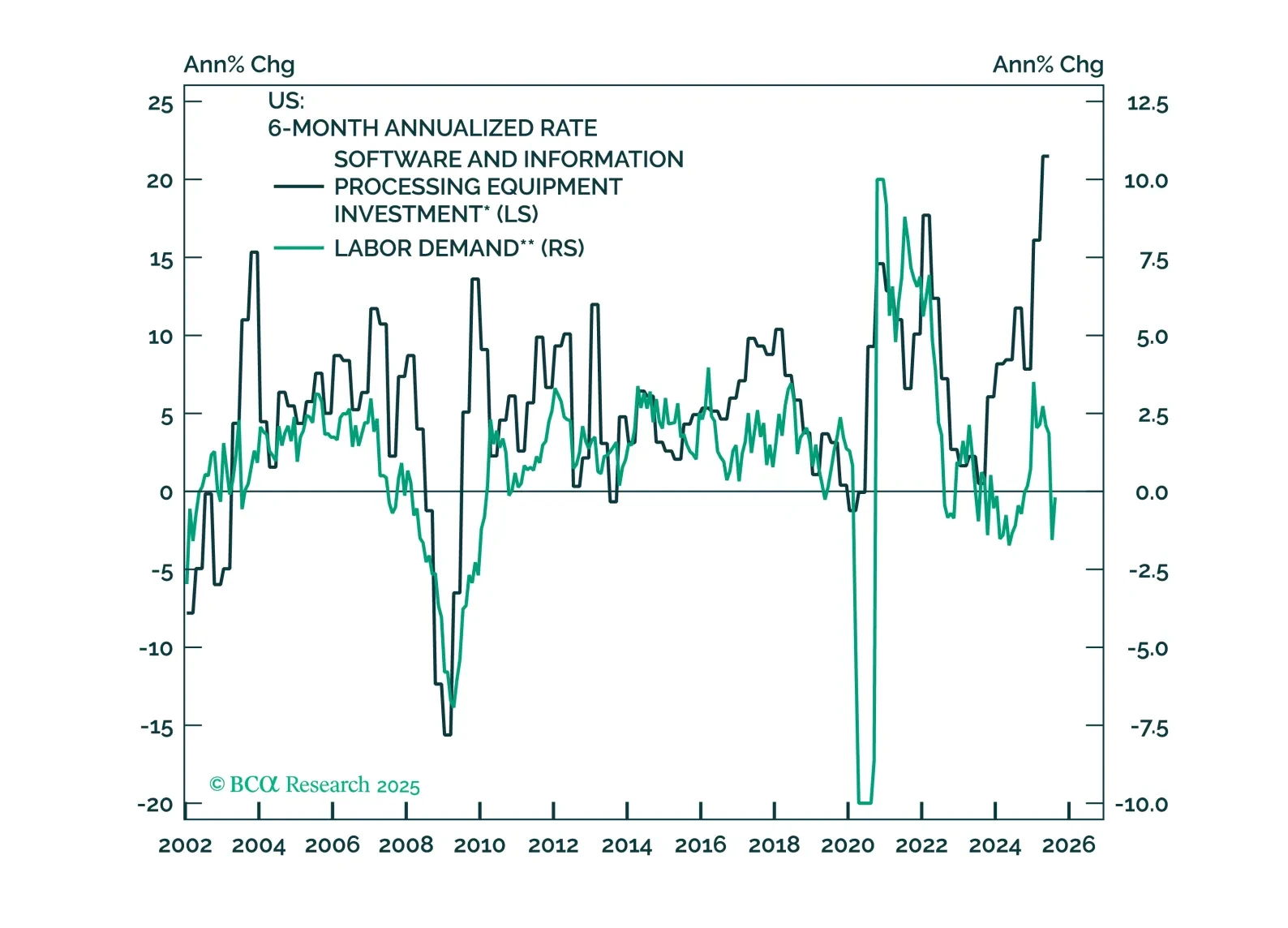

Big Tech and the Trump administration are engineering an industrial boom that favors American hardware over American workers. Economic growth will be robust in the US but the labor market will stay relatively sluggish. Adopt an…

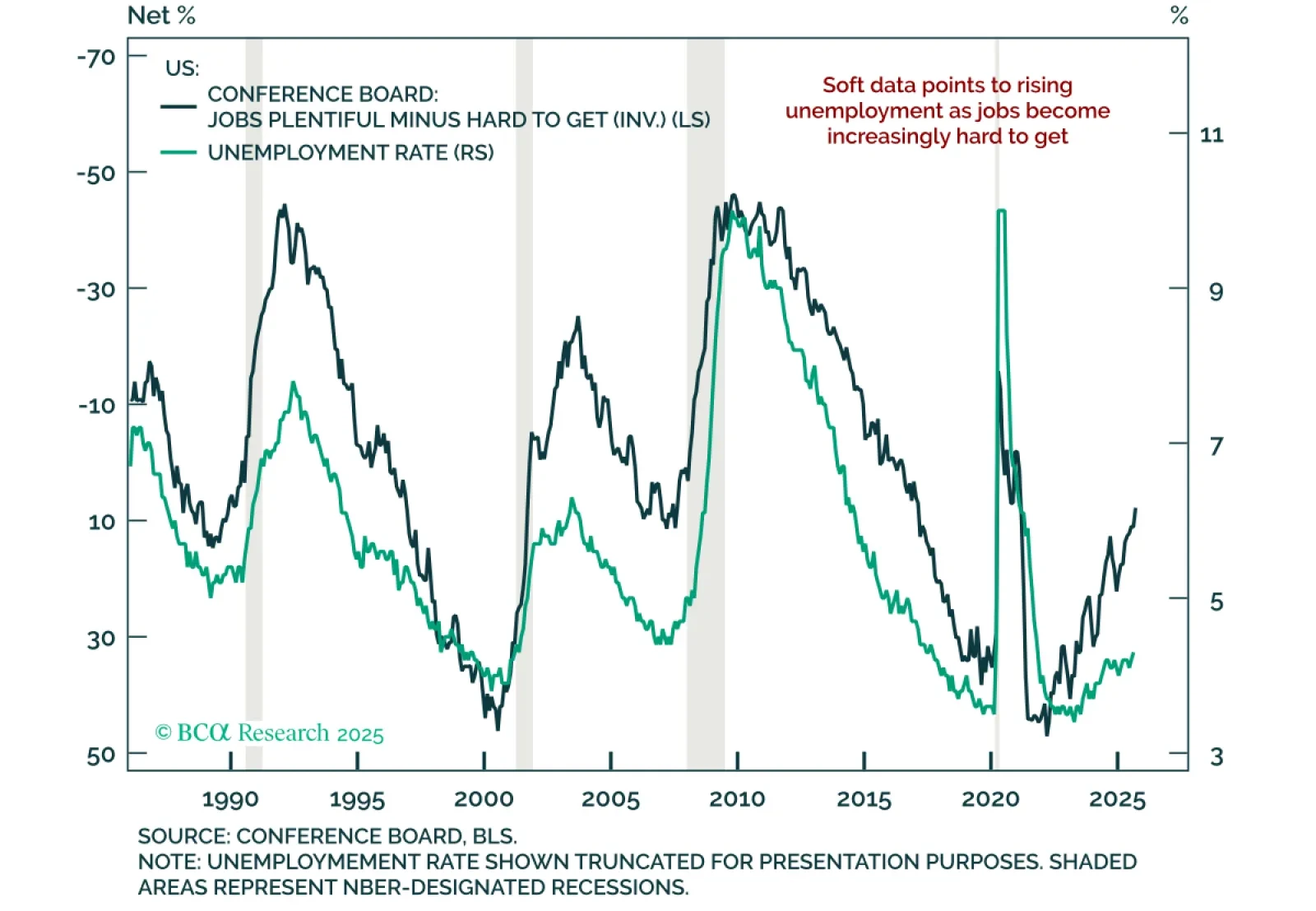

Consumer confidence fell further, reinforcing weakening labor signals and supporting a long duration stance. The September Conference Board Consumer Confidence Index dropped to 94.2 from 97.8, missing estimates. Both present…

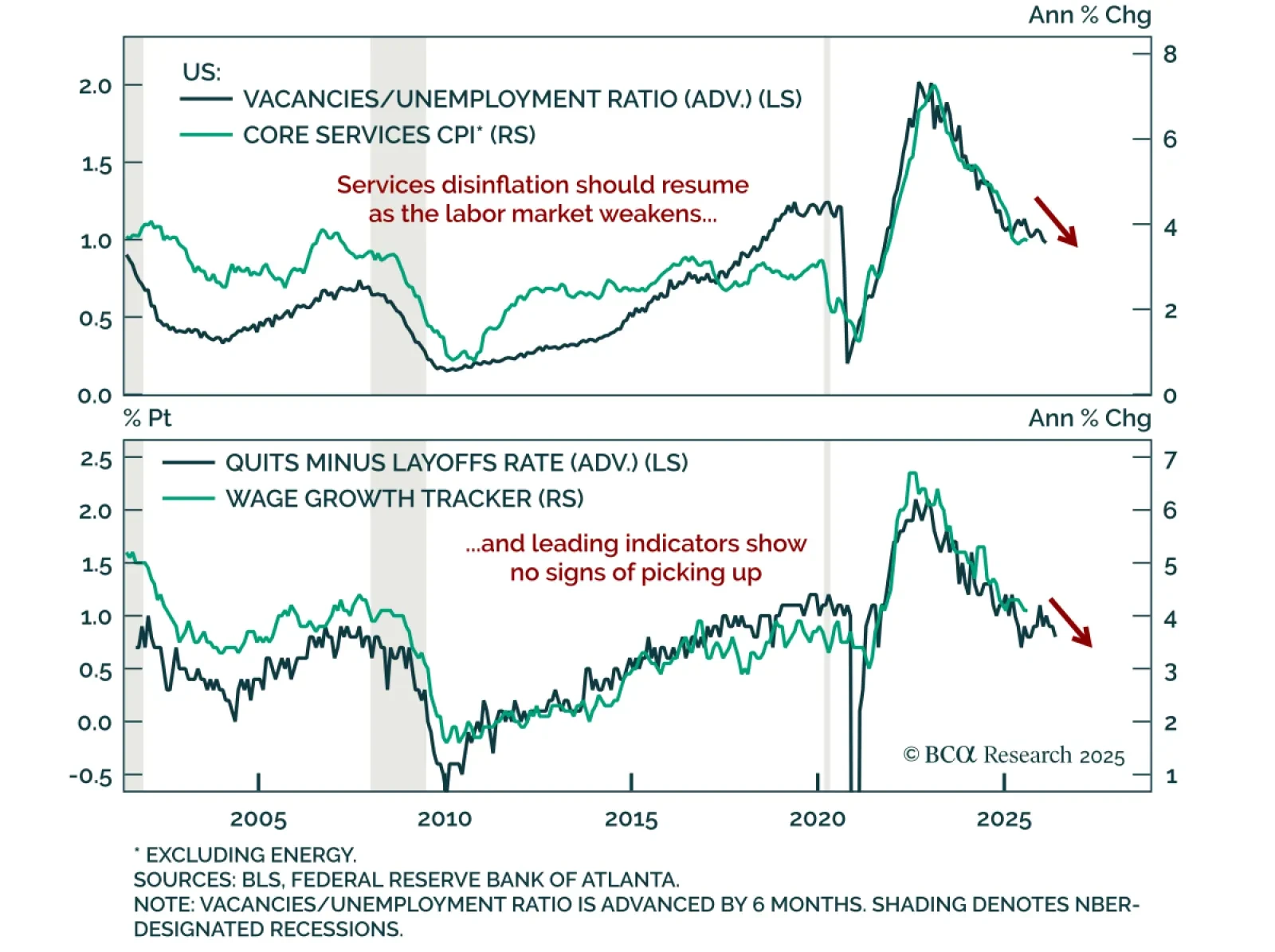

August JOLTS data confirm a loosening labor market, reinforcing a modestly defensive allocation stance. Job openings ticked up to 7.23m from 7.21m, yet gains came from non-cyclical sectors. Quits fell to 3.09m from 3.17m, pushing the…

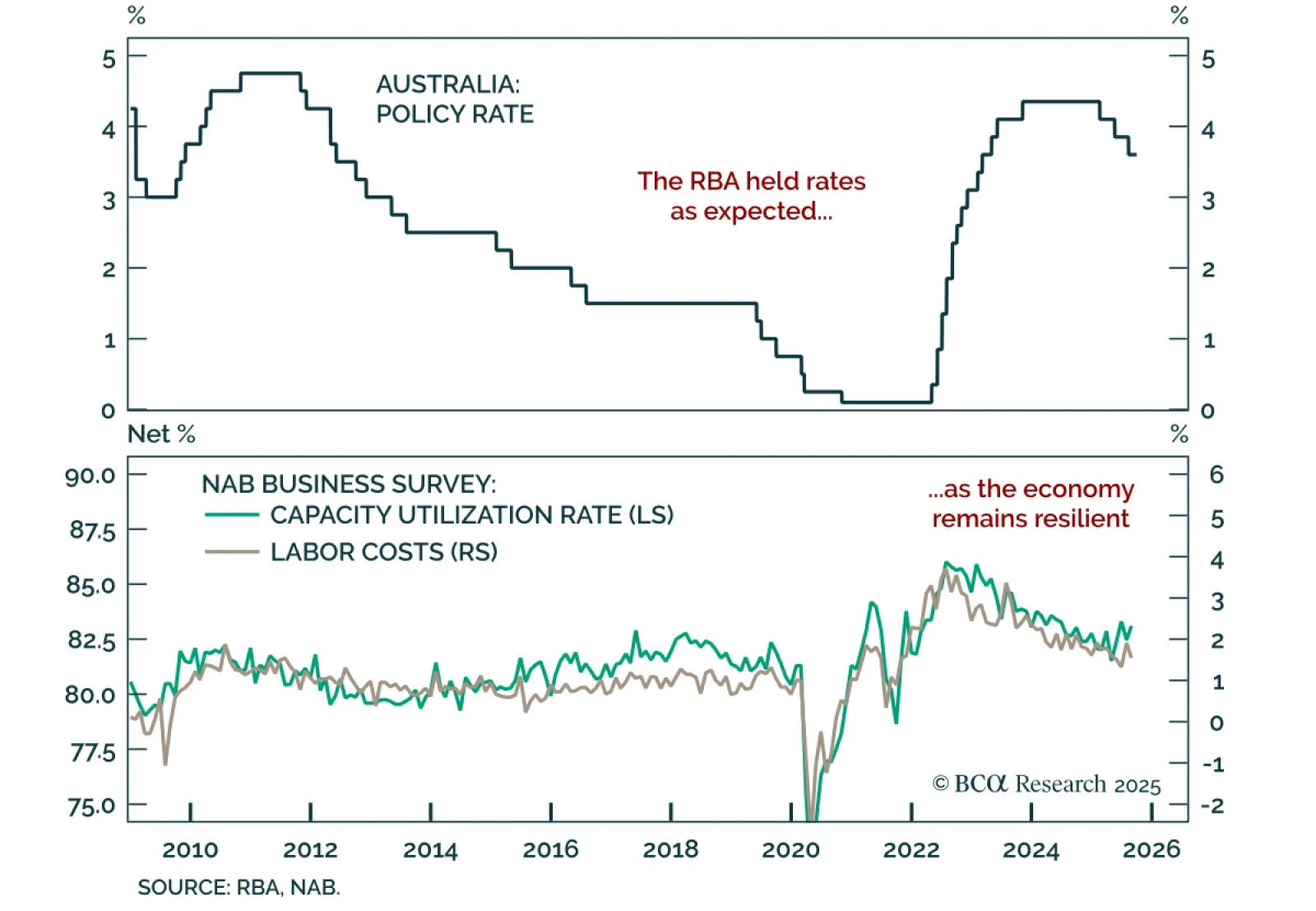

The RBA held rates at 3.6% as expected, maintaining caution as inflation could prove stronger than expected. Policy remains slightly restrictive, and at most one additional cut is on the table as the central bank has achieved a soft…

September consumption and income data beat estimates, showing a resilient US consumer but leaving the outlook fragile. Personal spending rose 0.6% m/m, outpacing income at 0.4%, pushing the saving rate down to 4.6%, its lowest level…