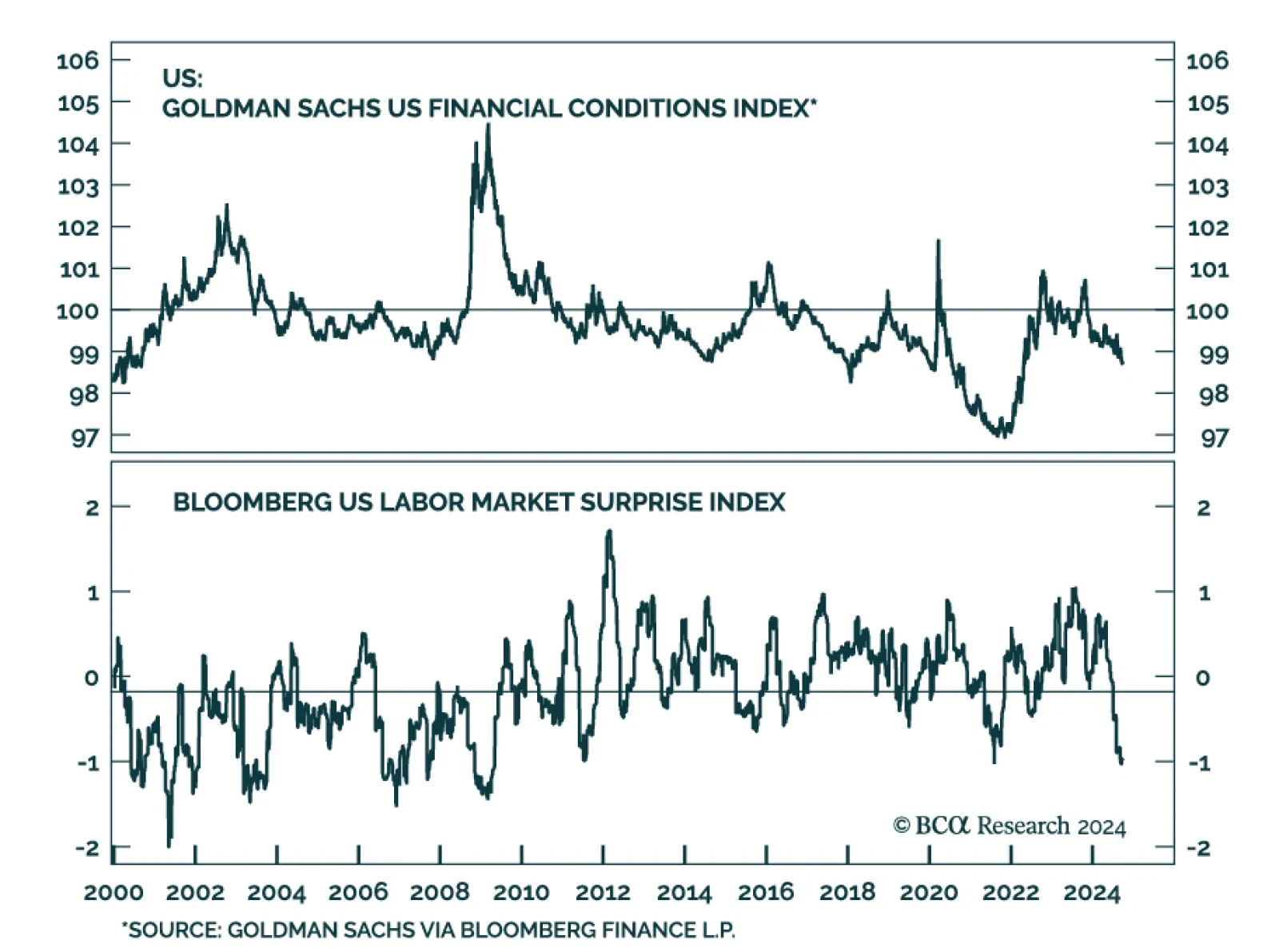

US financial conditions have become noticeably easier since August. The Fed has embarked on its easing cycle with a bang, sending equities higher and spreads lower, while the trade-weighted dollar gave back more than half of its…

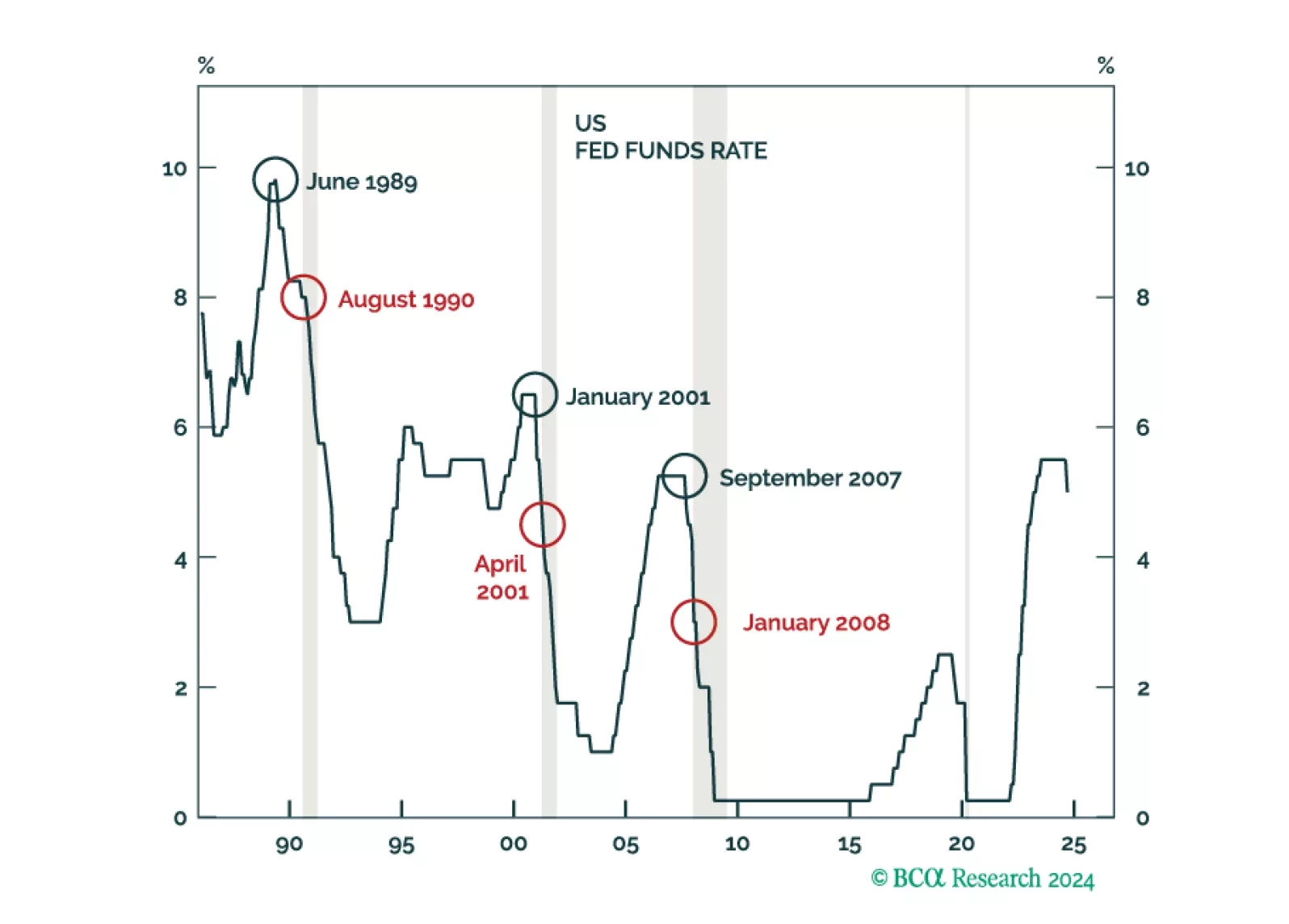

Our expectation that a looming US recession will morph into a global recession remains intact. US monetary easing will only take effect with a lag and current deteriorating economic conditions are the product of past…

After resisting the consensus narrative in 2022 that a US recession was imminent, and then predicting an immaculate disinflation for 2023, the Global Investment Strategy team has joined the dark side and is now expecting a recession…

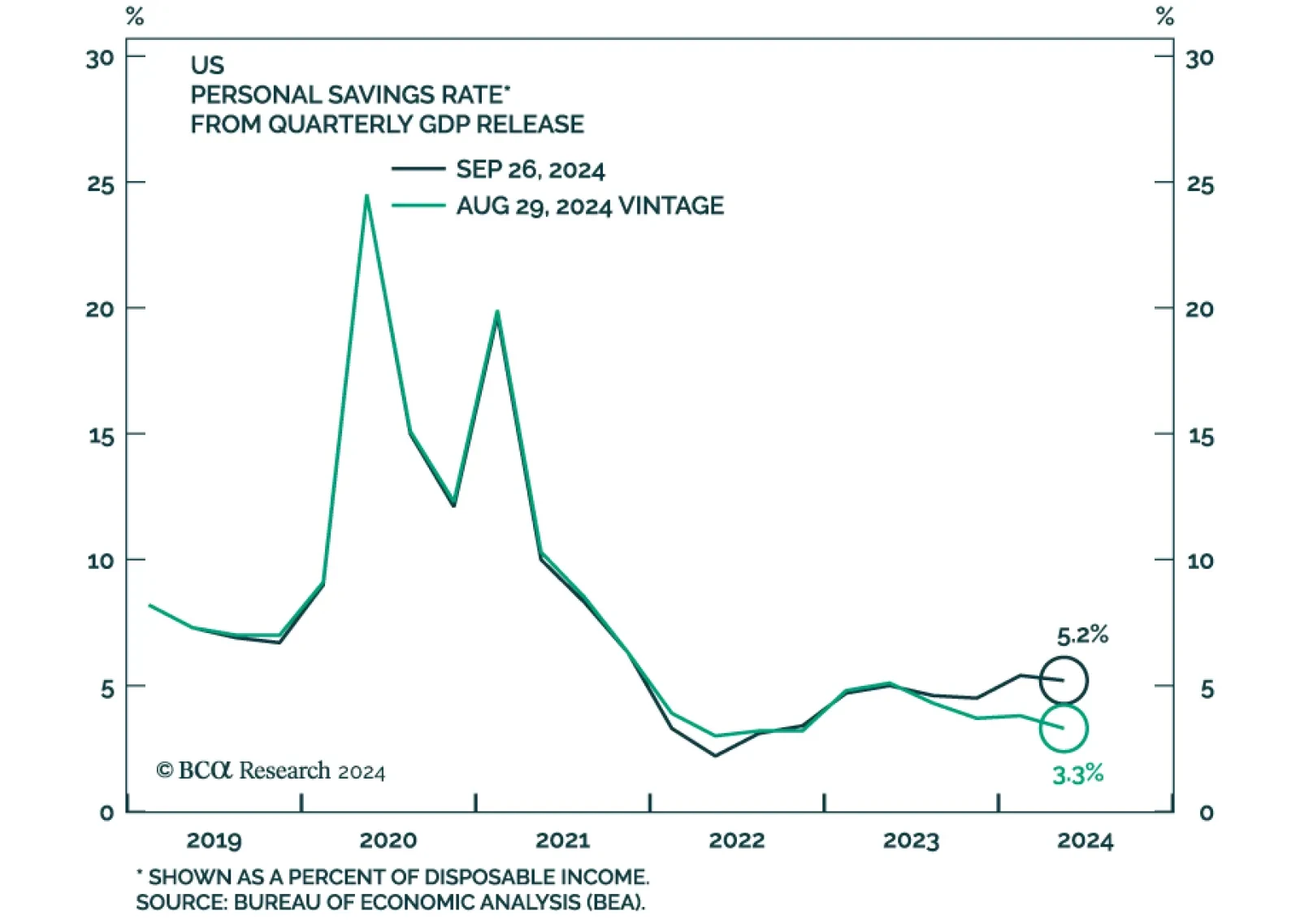

Annual BEA data revisions resulted in a significant upward revision in GDP growth since Q2 2020, led by stronger consumption growth and more robust real disposable income growth than previously believed. Revisions also show…

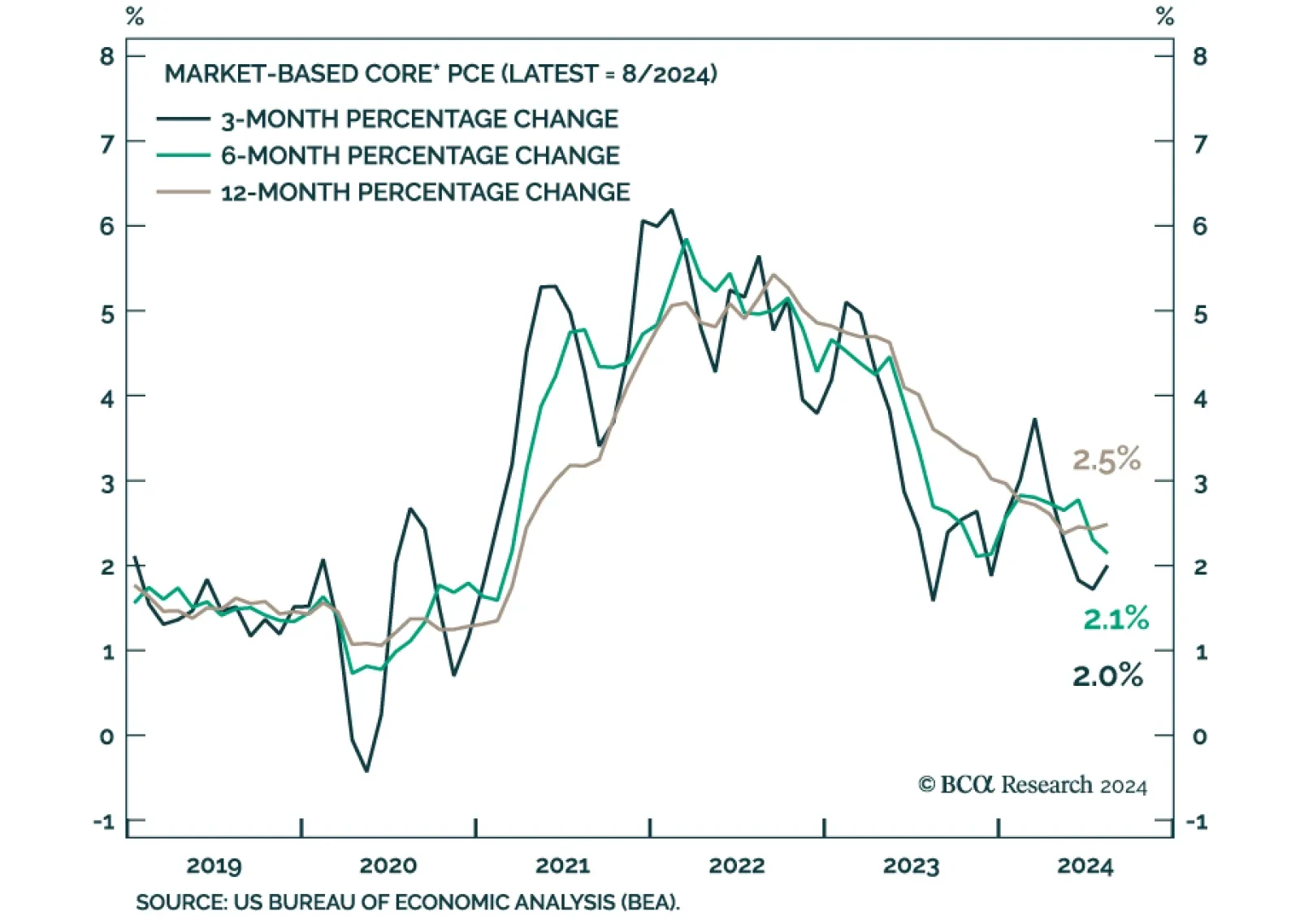

US nominal personal income growth decelerated to a 0.2% pace in August, from 0.3% in July, missing expectations that it would accelerate. Nominal personal spending also disappointed, growing at a slower 0.2% pace from 0.5%. In…

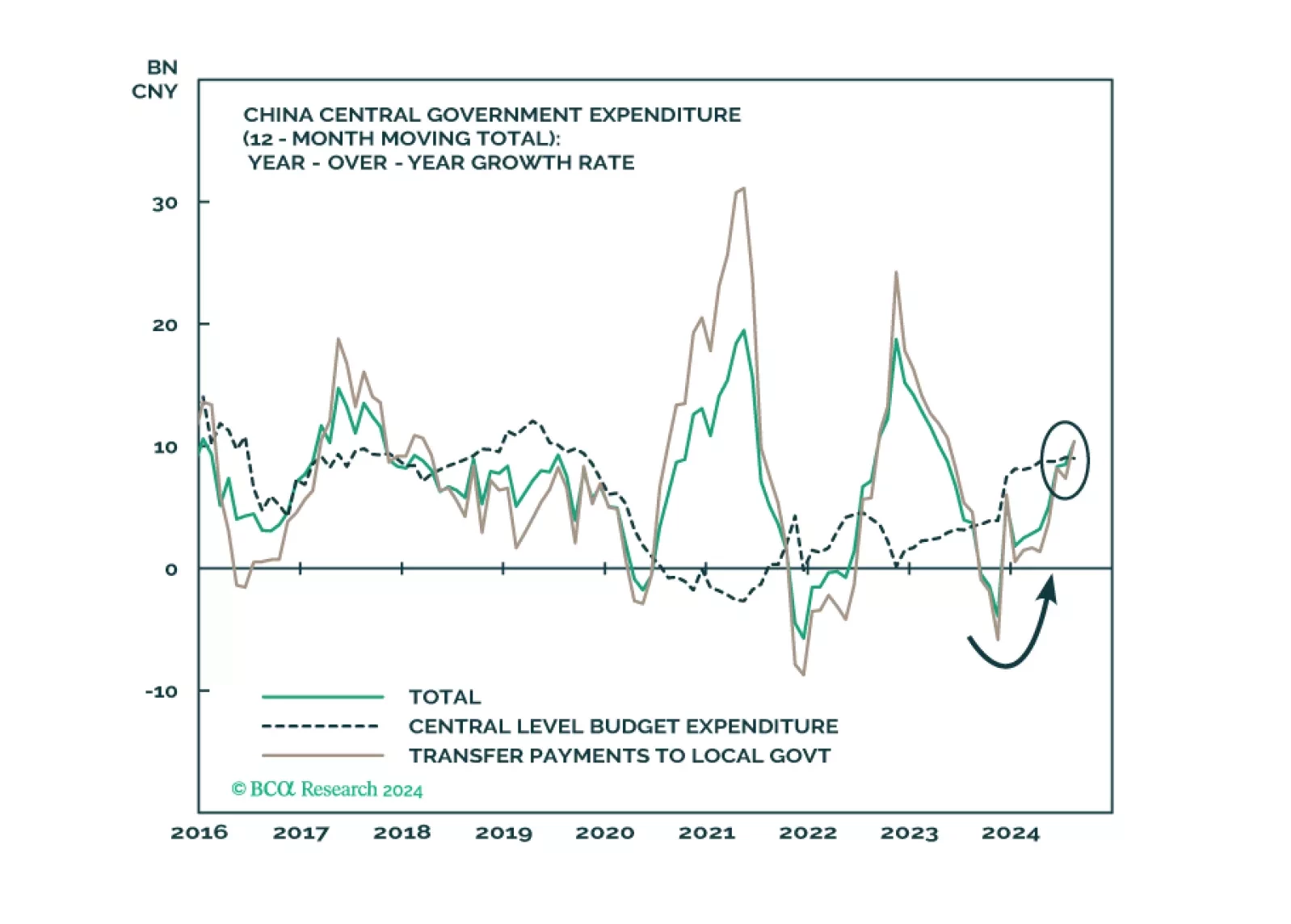

Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

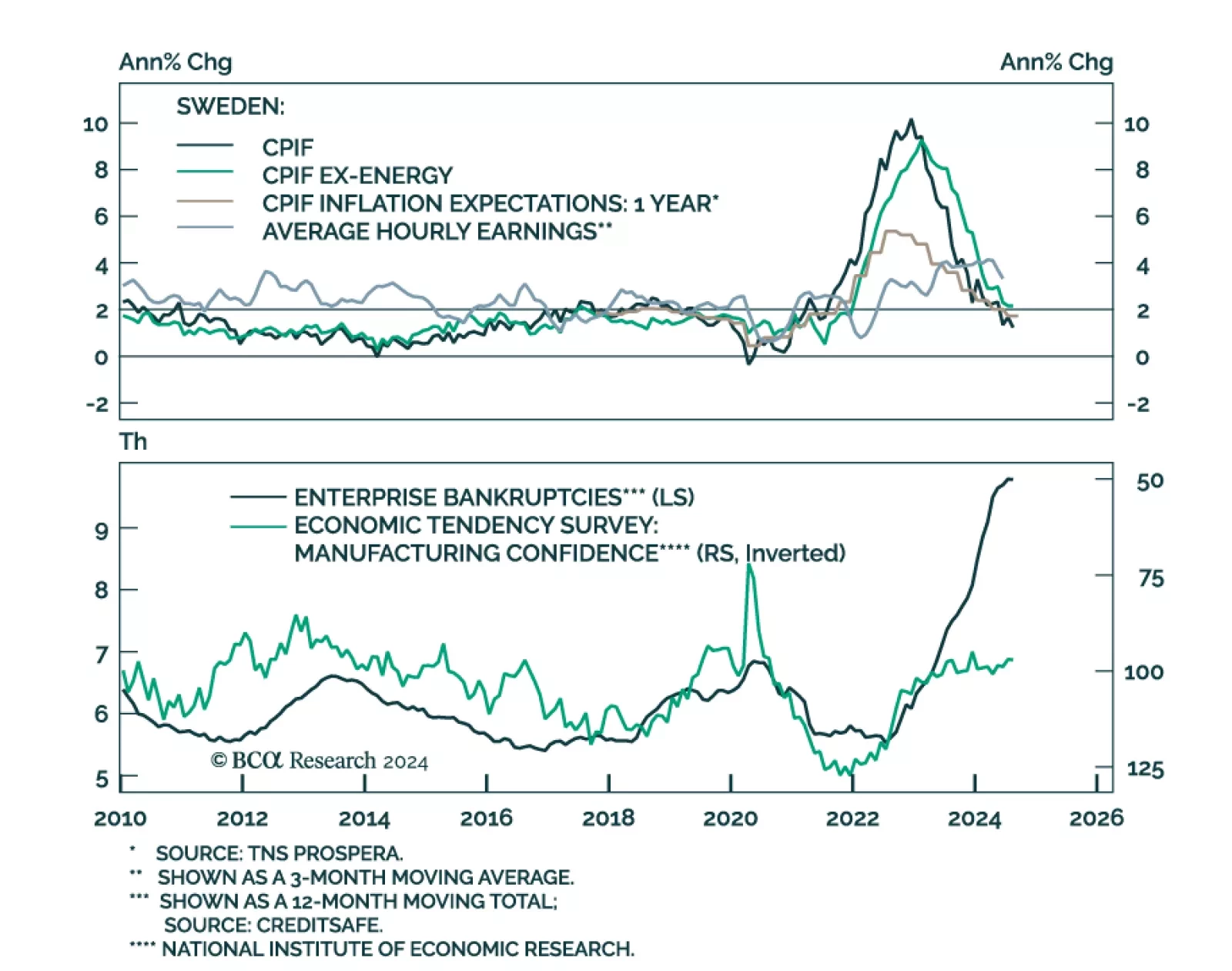

In a widely expected move, the Riksbank lowered its policy rate from 3.5% to 3.25% in September, marking its third cut this year. It embarked on its easing cycle in May, leading many other DM central banks, and has been…

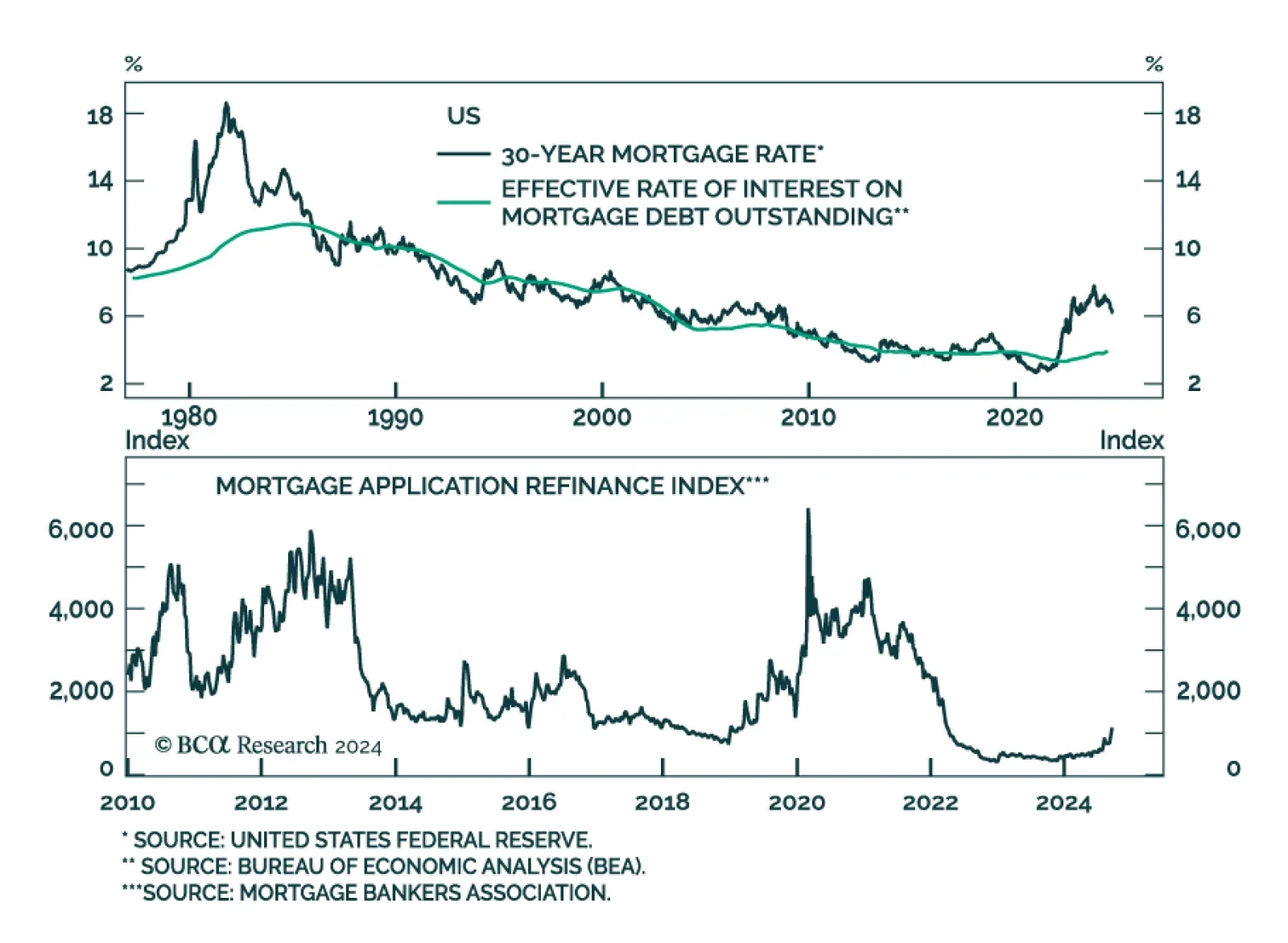

The conventional 30-year mortgage rate eased further to 6.2% from above 7% back in the spring, spurring a 20.3% surge in refinancing activity last week. Mortgage applications rose 11.0%, marking a fifth consecutive week of…

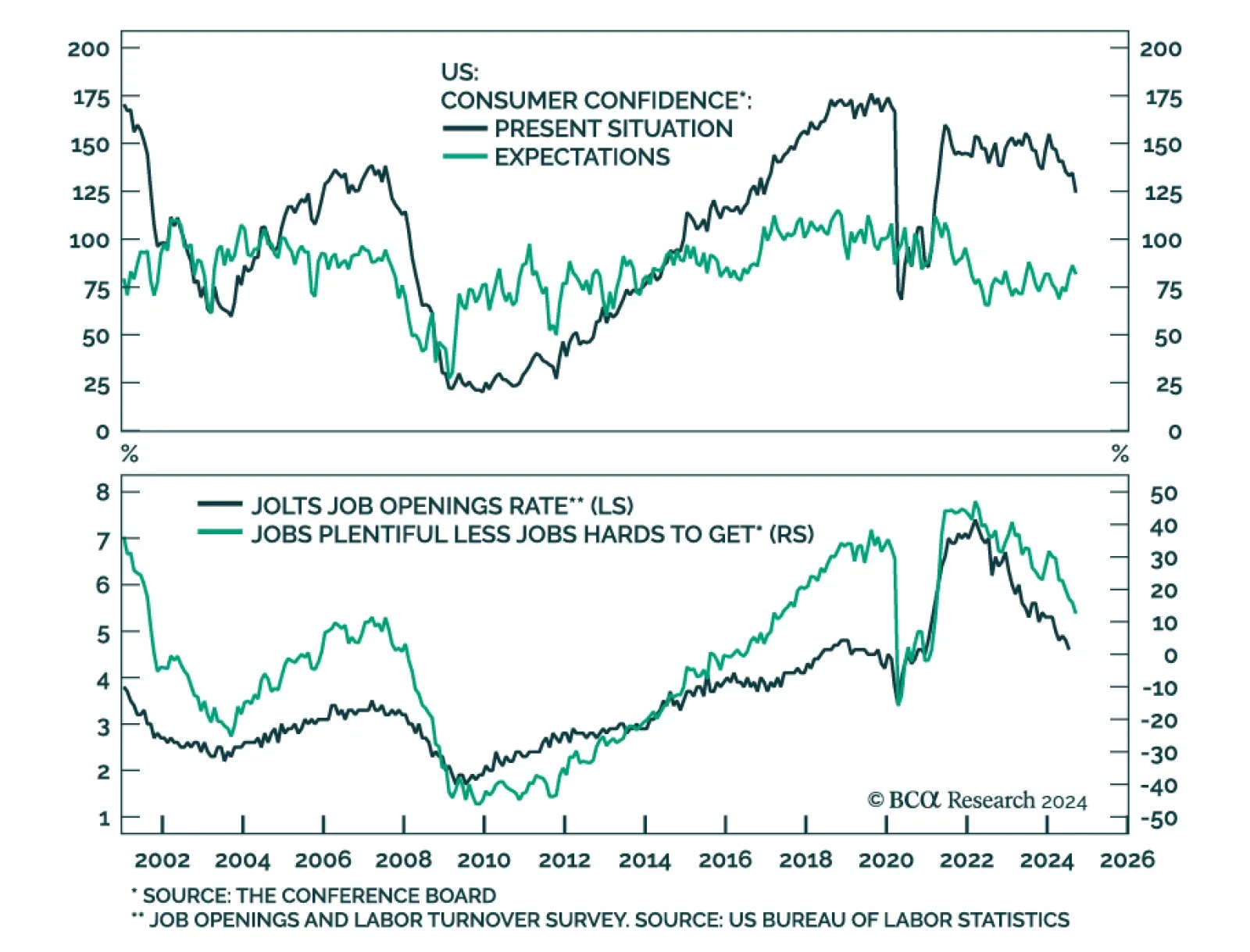

The Conference Board Consumer Confidence index unexpectedly shed 6.9 points to 98.7 in September. Both the Present Situation and Expectations components declined, by 10.3 and 4.6 points respectively. The decline in morale in…

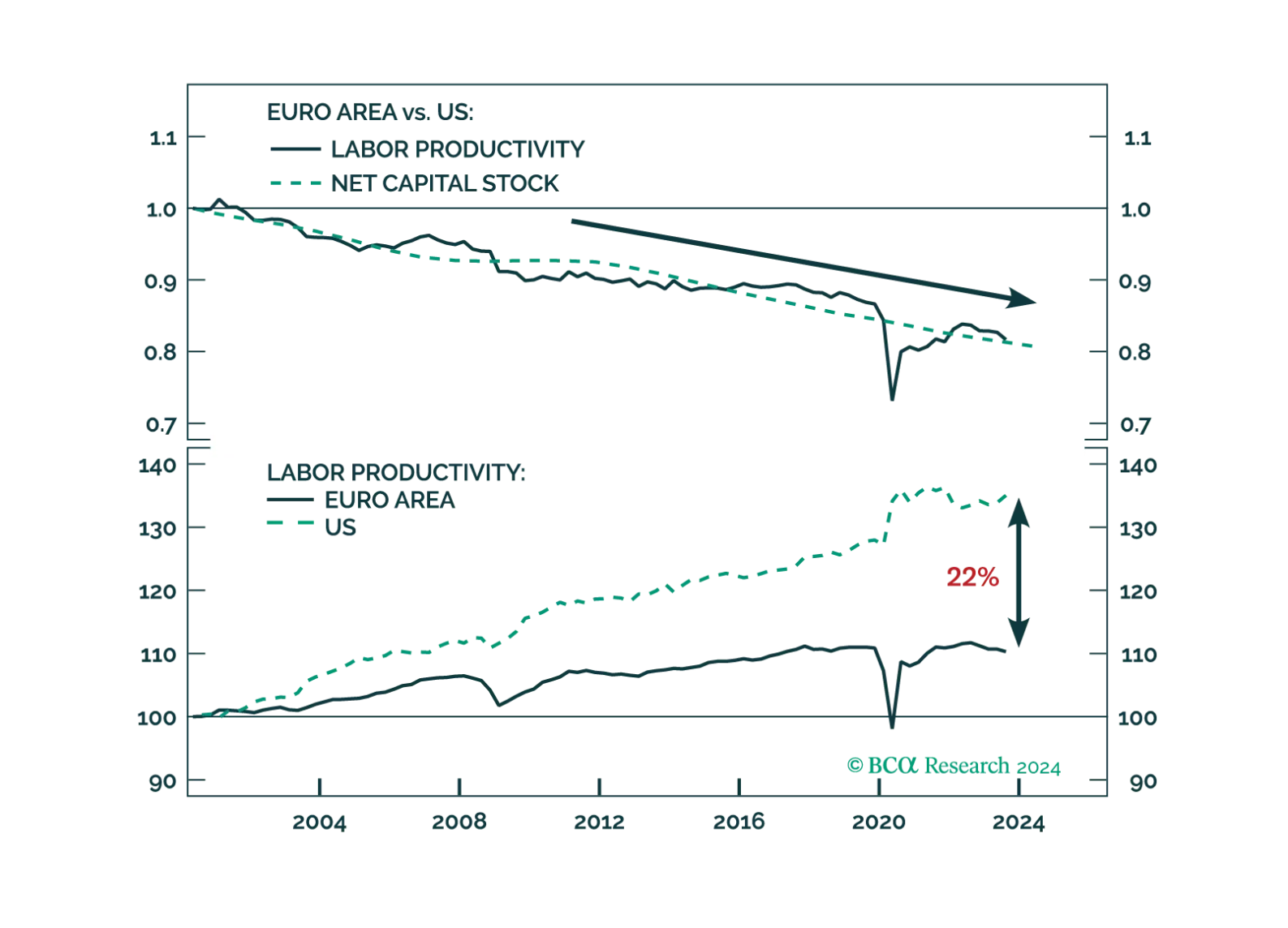

The Draghi report highlights sensible reforms that would address many of Europe’s productivity shortcomings. Whether European capitals heed Mario Draghi’s advices remains to be seen.