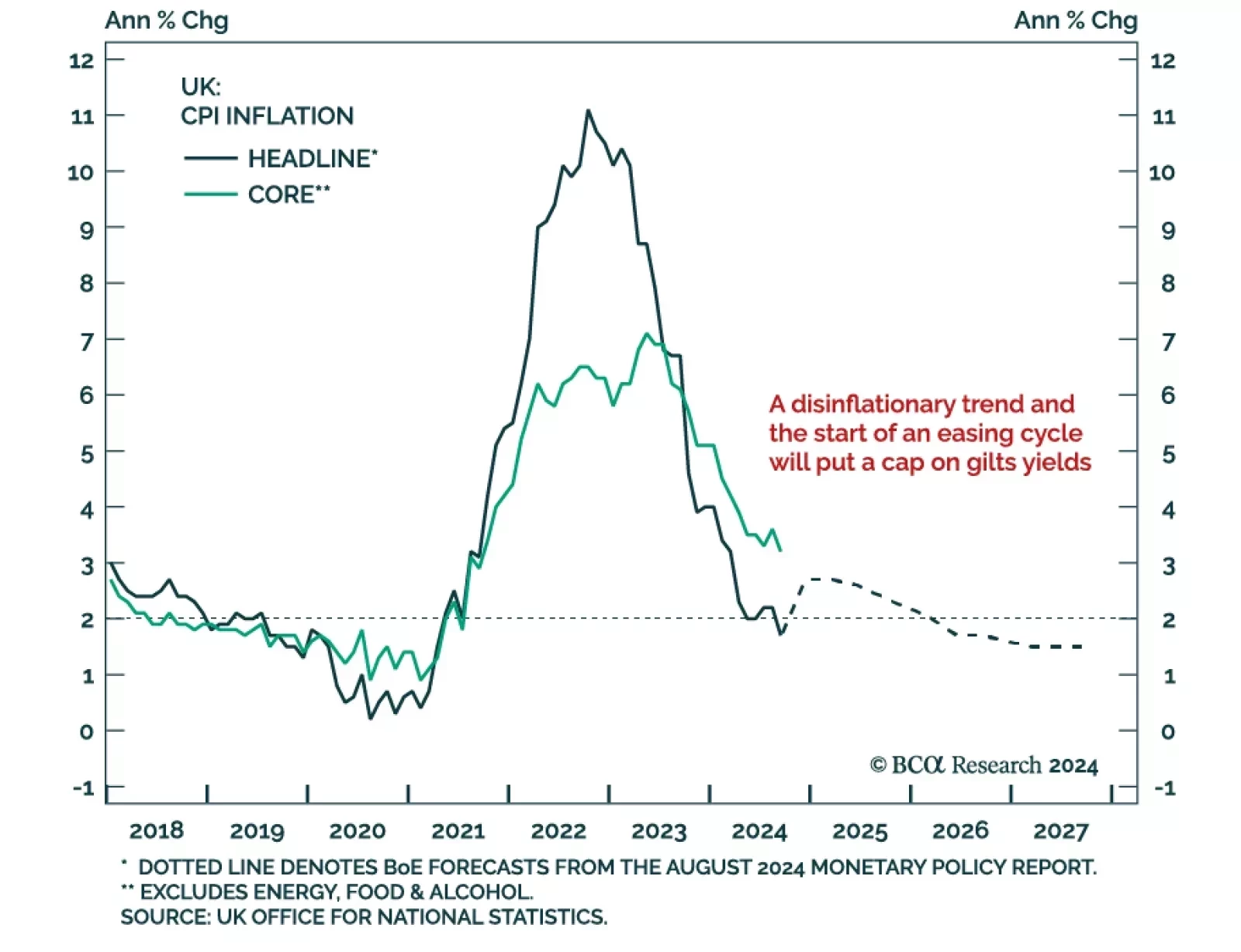

We recently pointed to the UK Budget announcement as a pivotal event for UK assets. Following an initially positive reception, the market has turned and priced in further fiscal premia in UK assets, with both gilts and the pound…

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

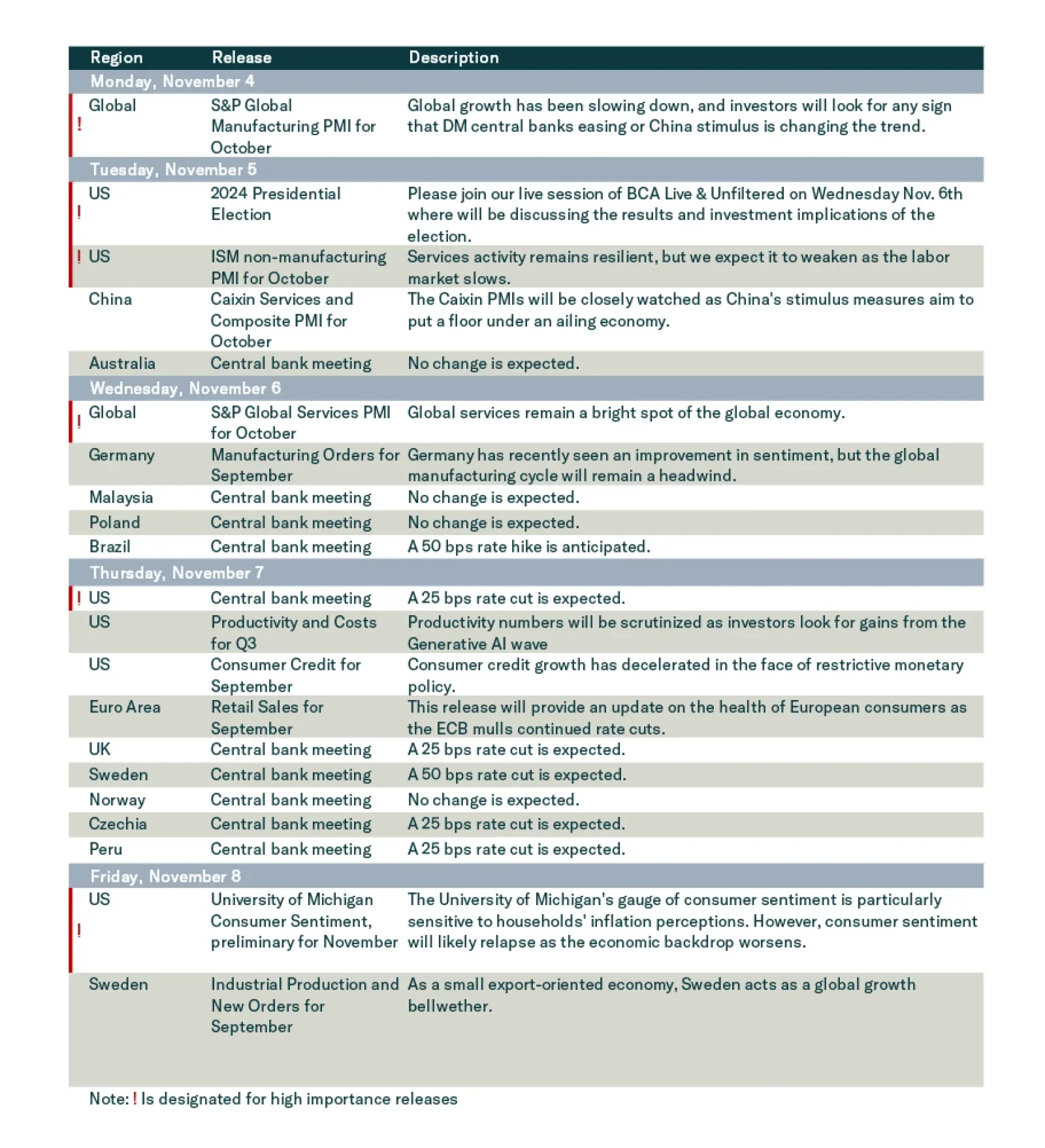

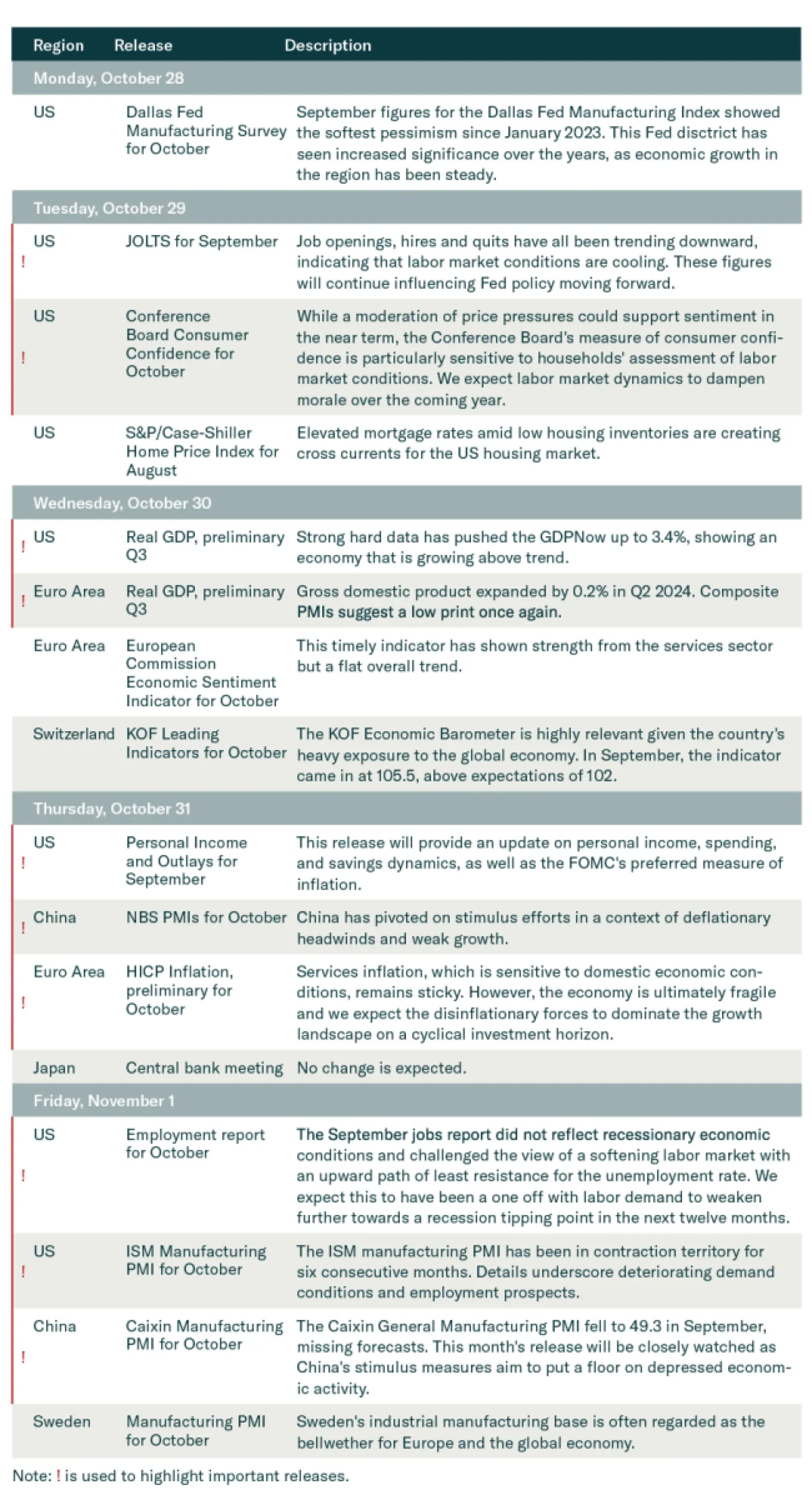

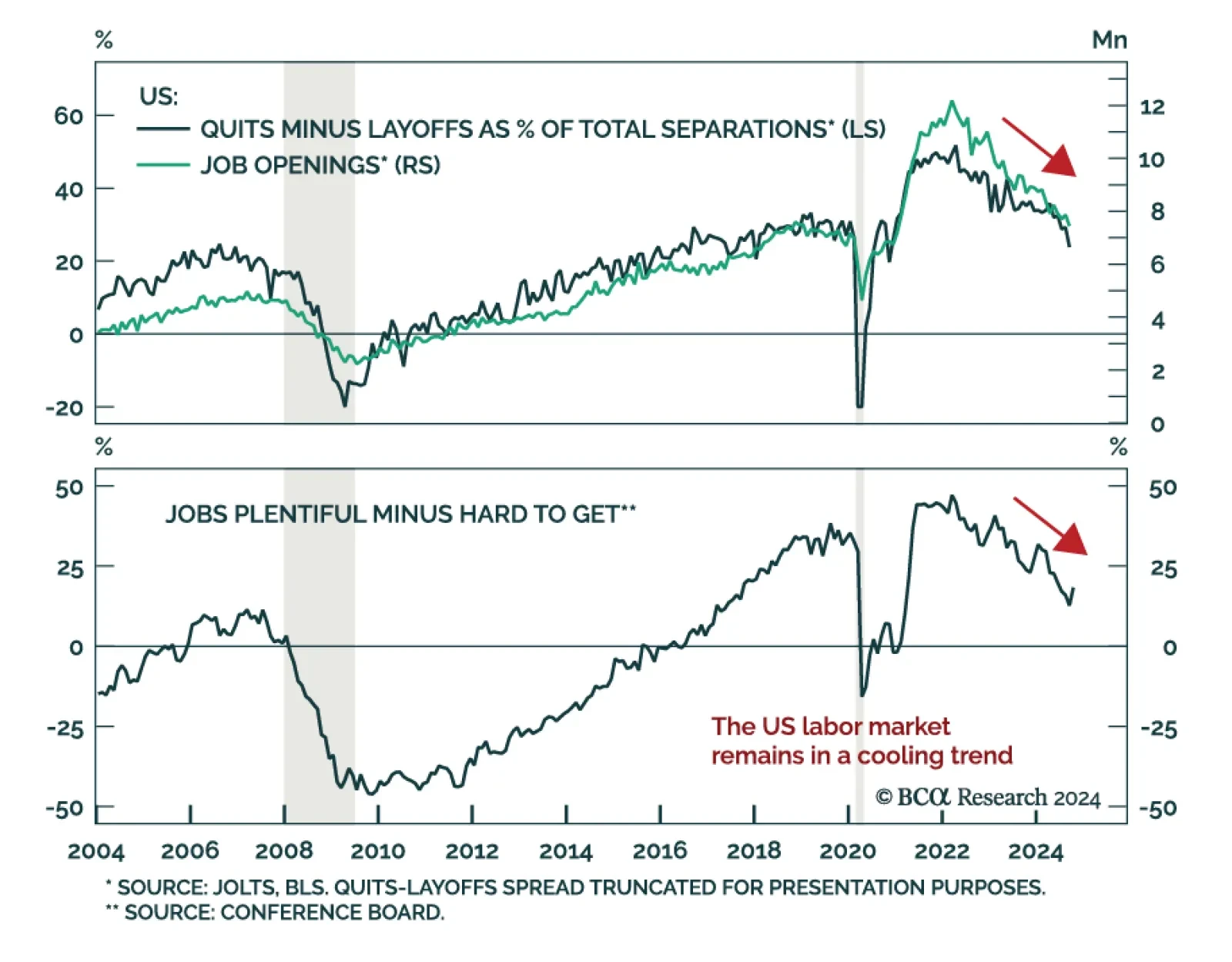

Job openings missed expectations at 7.44 million in September, a mild slowdown from August. The details of the JOLTS report were also negative, except for hirings which continue their June rebound. Meanwhile, consumer confidence…

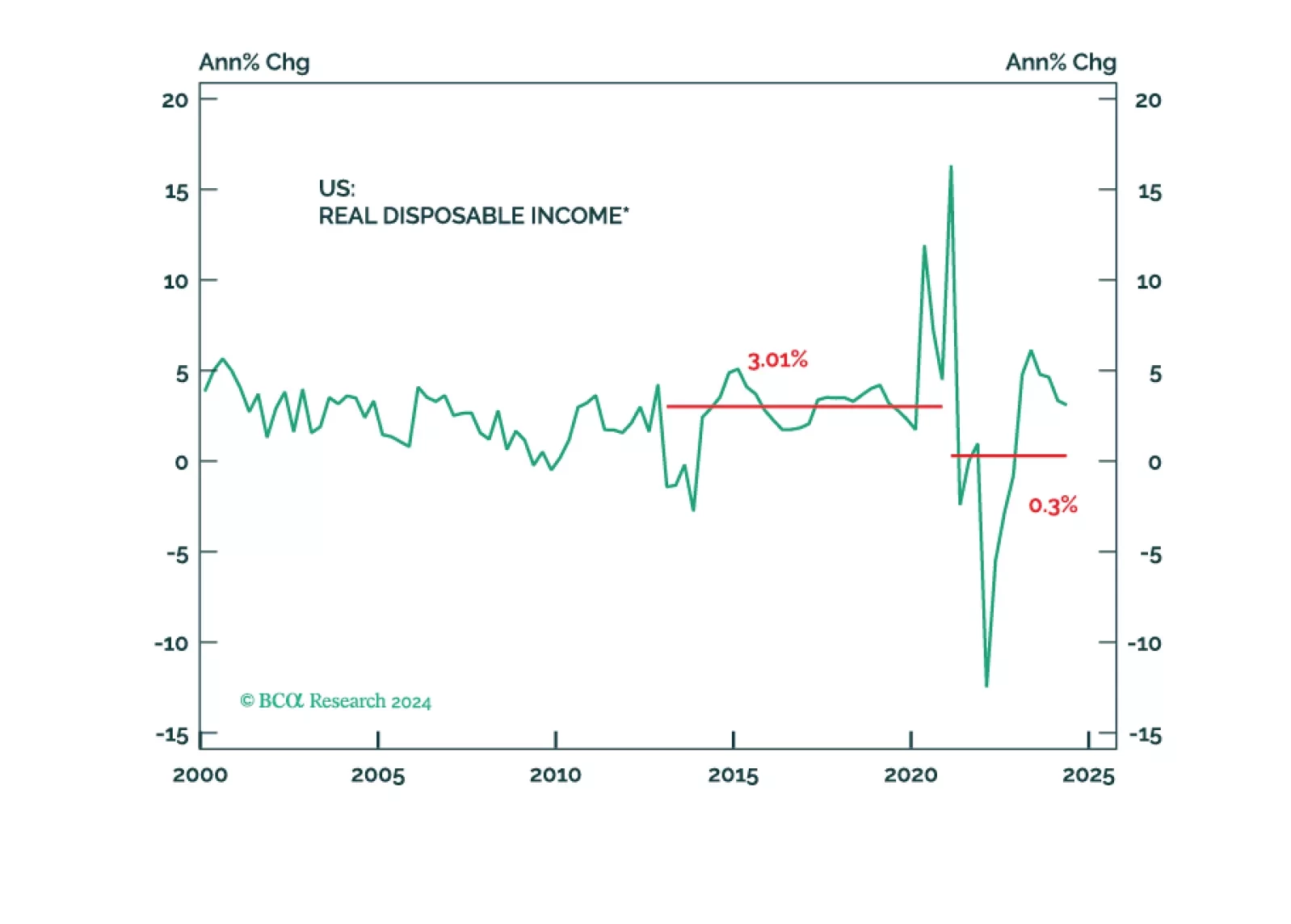

Middle-aged households have lagged youngish and older households since the pandemic and the 40-to-54 cohort is worse off than it was at the end of 2019. The fragmenting of the seemingly monolithic US consumer widens the path to a…

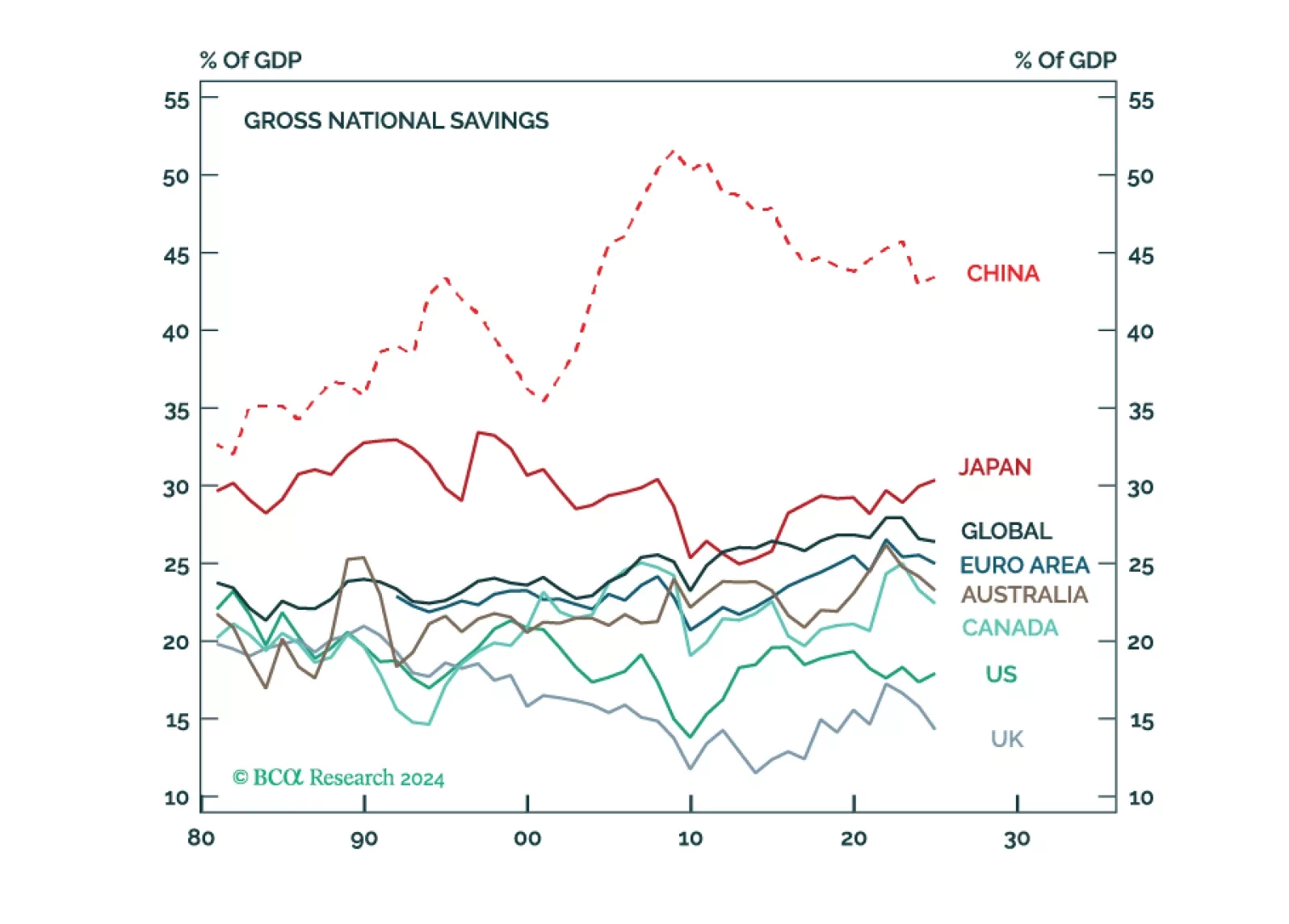

In this report, we discuss why we are lifting our US recession probability from 60% to 65% and explain why China’s latest stimulus announcements are welcome, but probably are “too little, too late.”

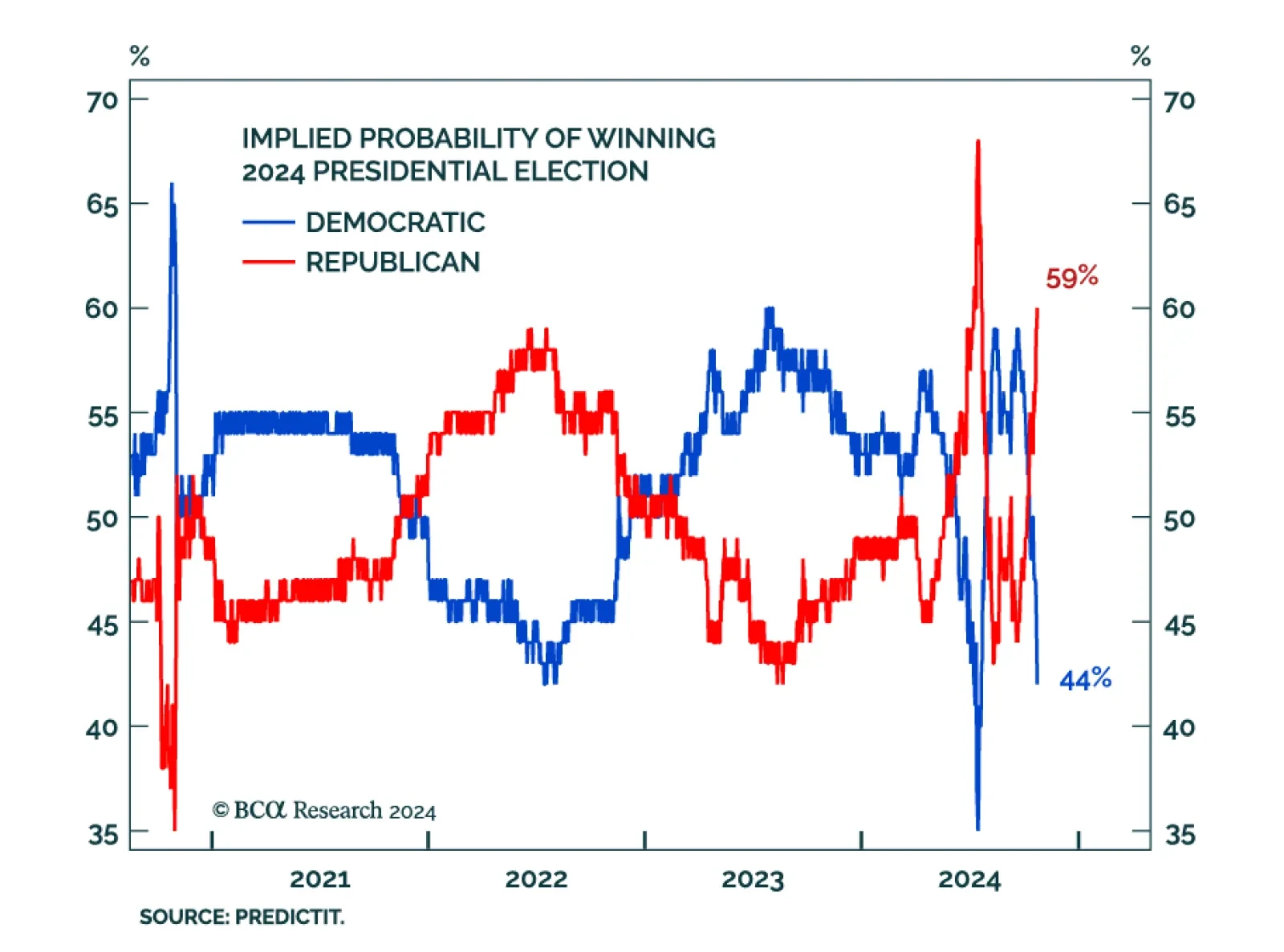

The US election is tightening in its final weeks, and the latest polls challenge our Geopolitical Strategy’s base case of a Democratic White House. The original thesis was built on the premise of a Democratic incumbent…