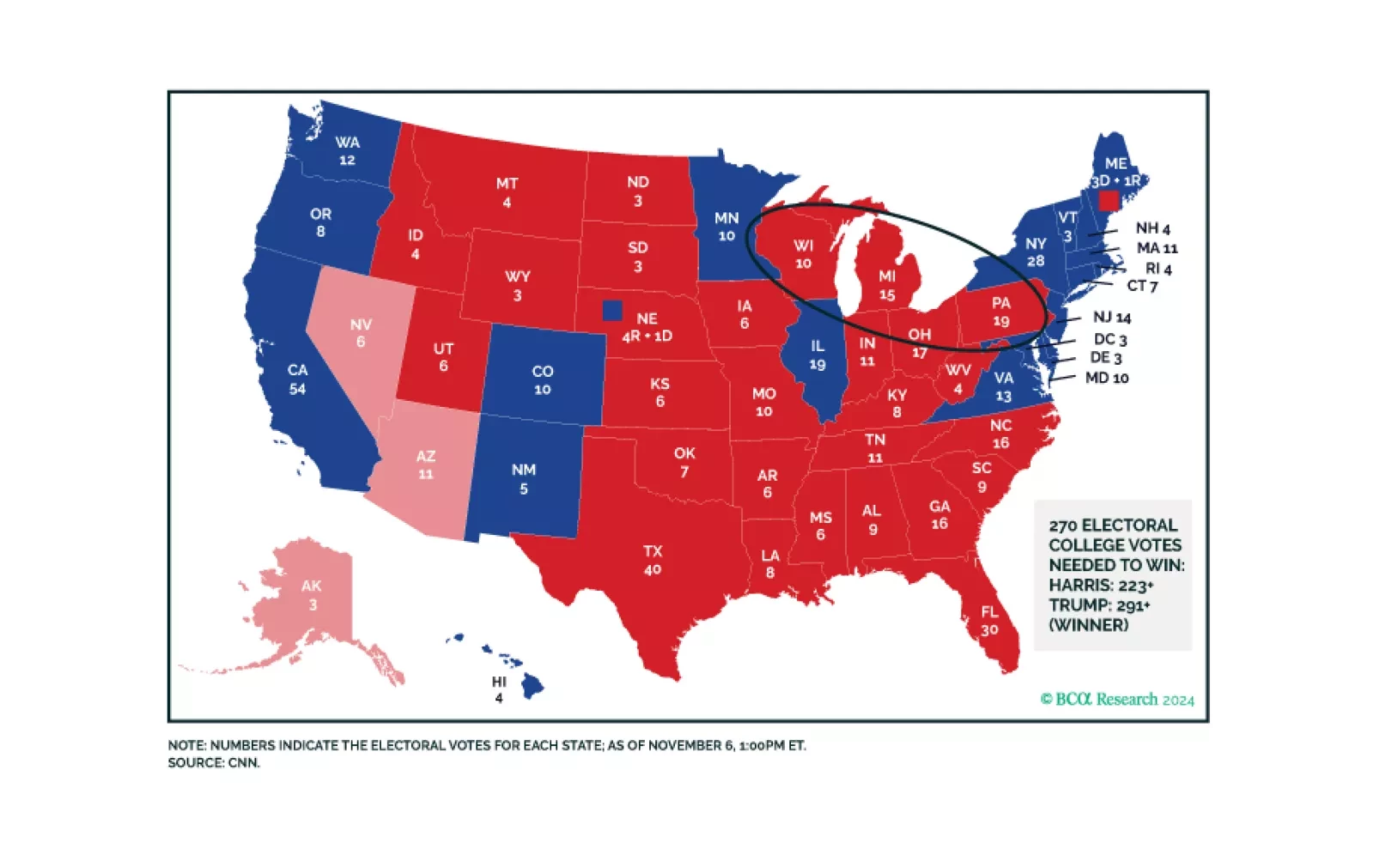

The prospect of a new trade war more than offsets the other pro-business parts of Trump’s agenda. With the labor market already weakening going into the election, we are raising our 12-month US recession probability from 65% to 75…

Our thoughts on the bond market’s reaction to the election and this afternoon’s FOMC meeting.

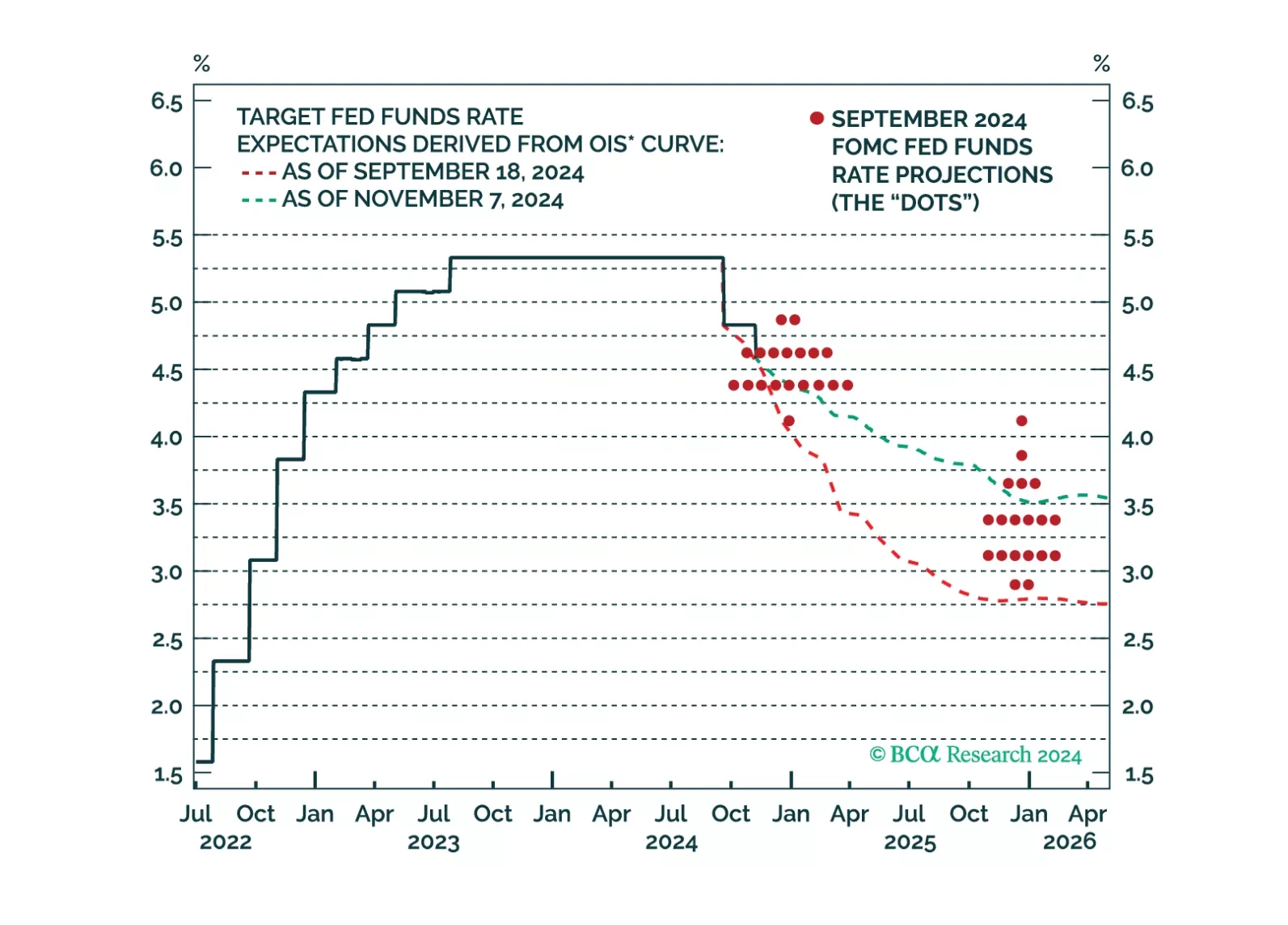

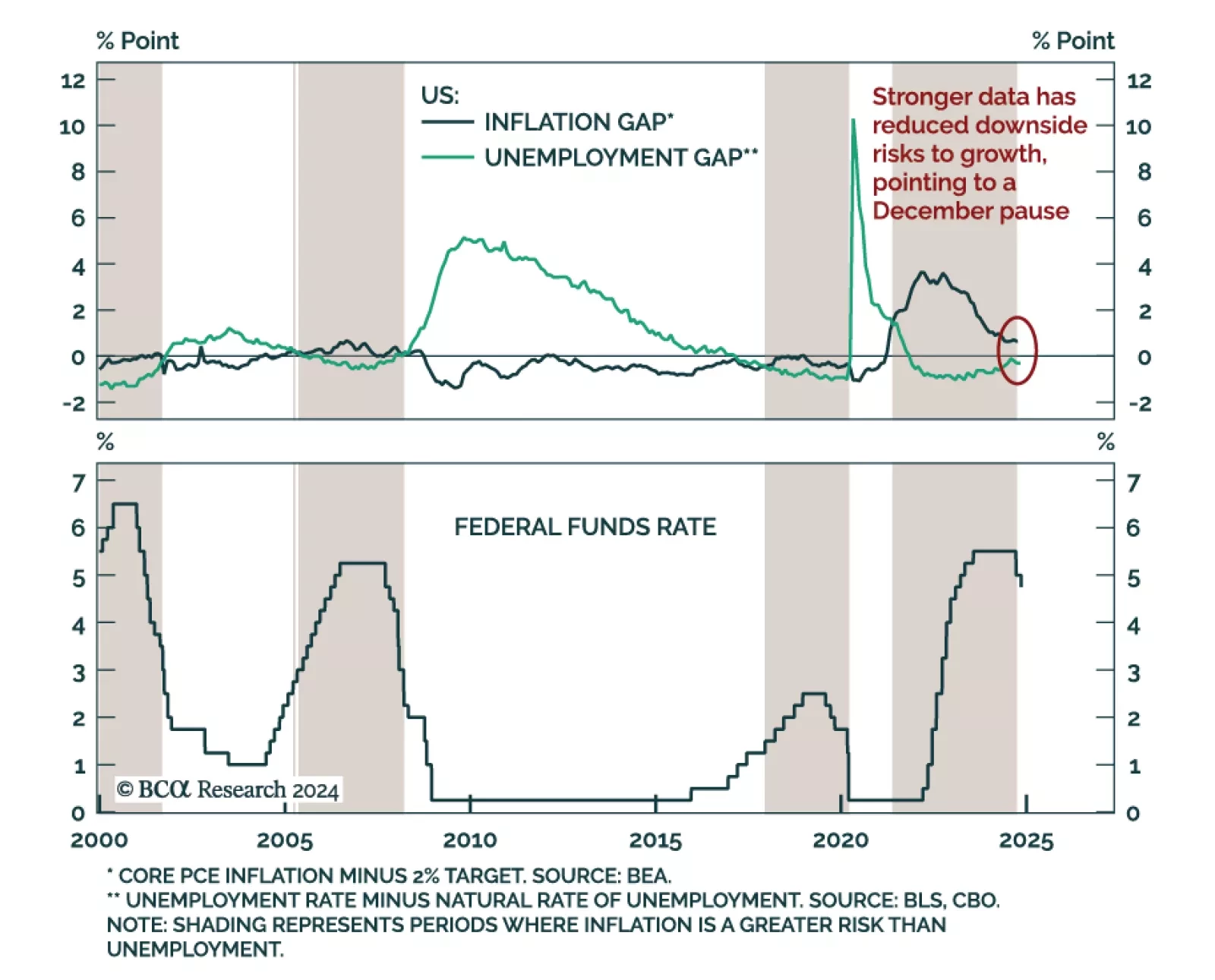

The Federal Reserve cut interest rates by 25 bps as expected yet introduced uncertainty on the timing of its next move. The statement was relatively unchanged, except for the removal of a segment from September highlighting they…

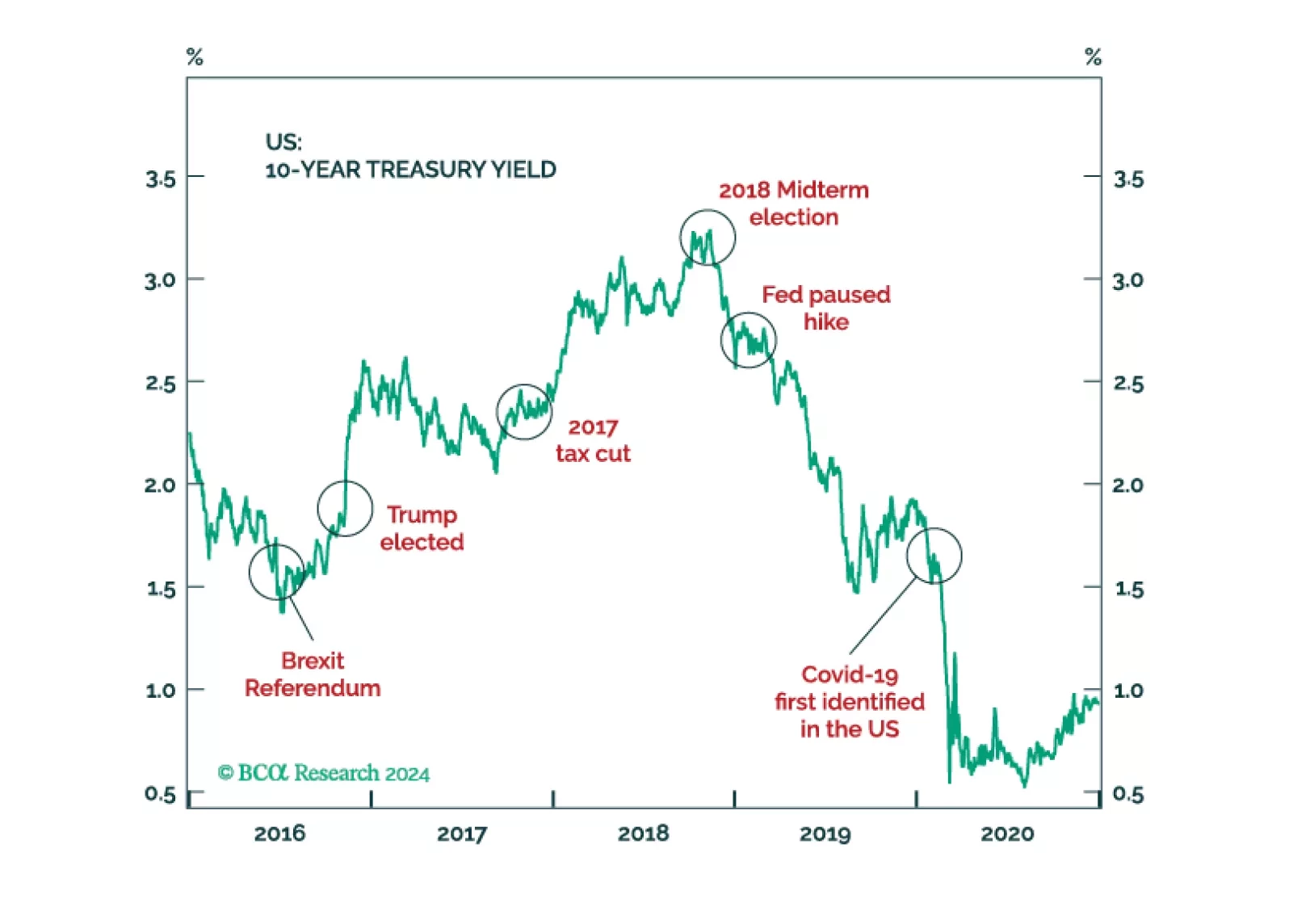

Trump’s resounding victory brings a popular mandate that ensures deregulation and higher trade tariffs. Higher budget deficit and immigration reform are also in the cards as the Republicans look like they may squeak a thin margin in…

The Election Day is finally upon us. No, there is no final “silver bullet” forecast contained in this email. Just our long-term forecast of how the election will, no matter who wins, impact the markets.

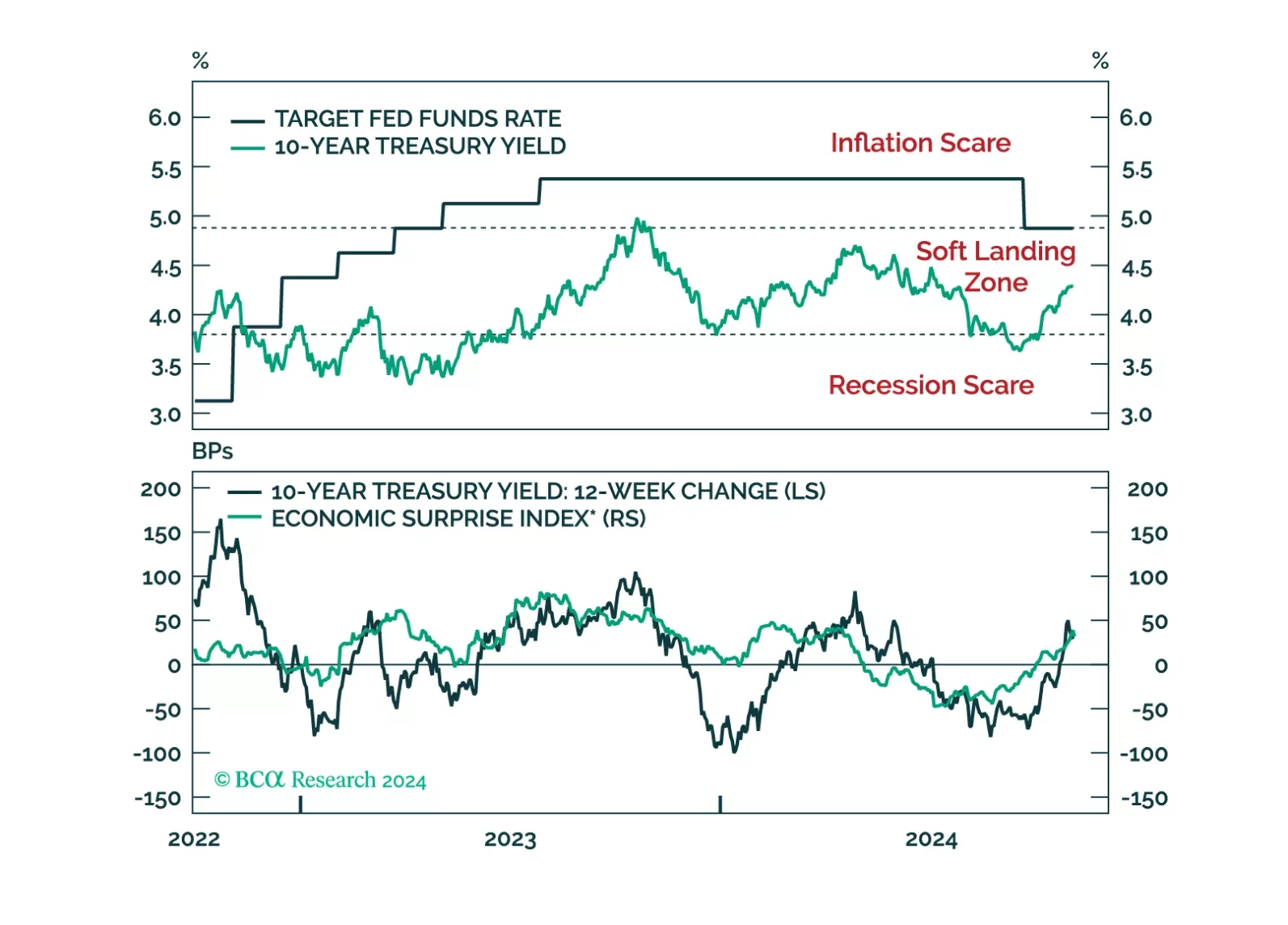

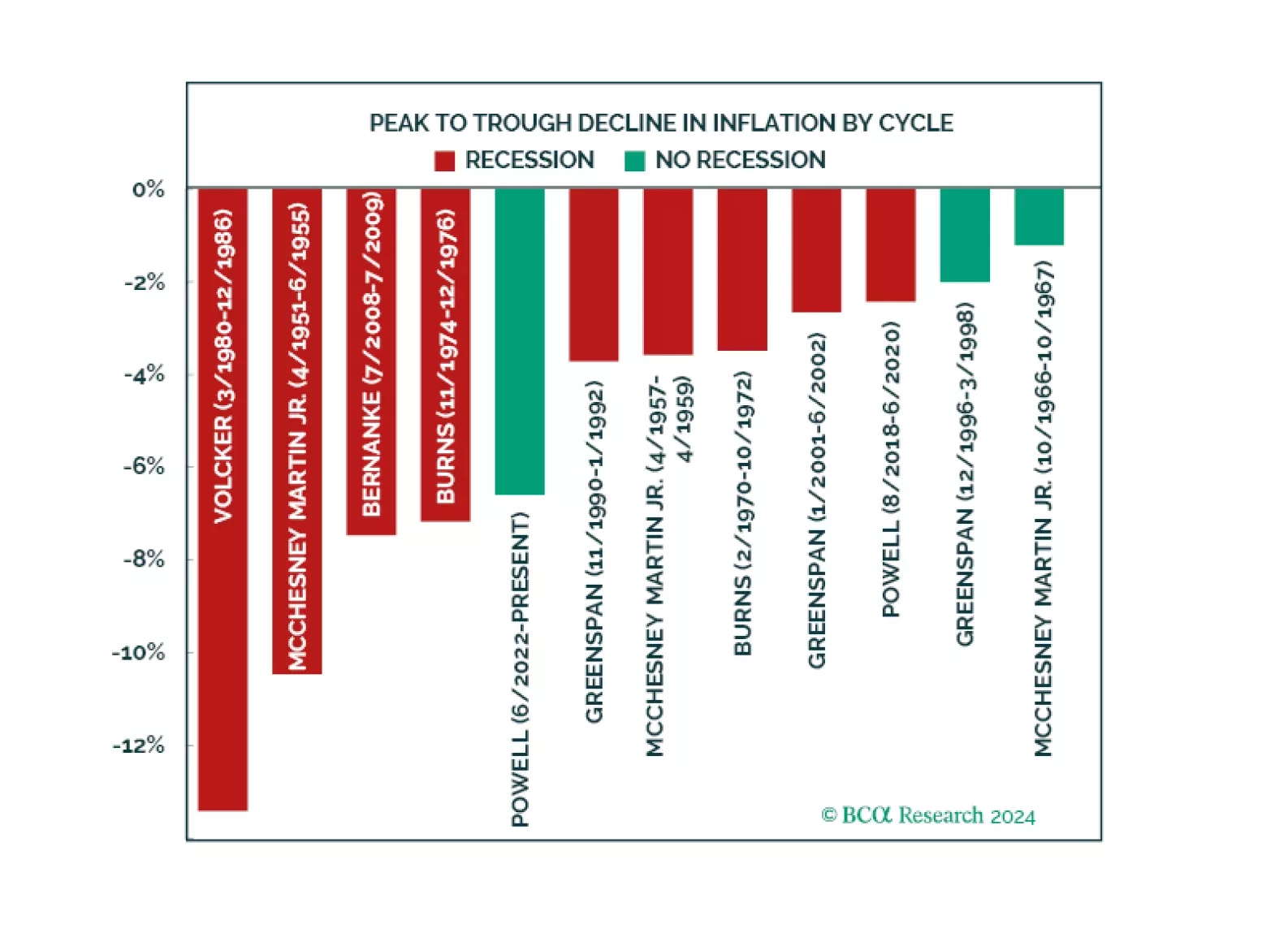

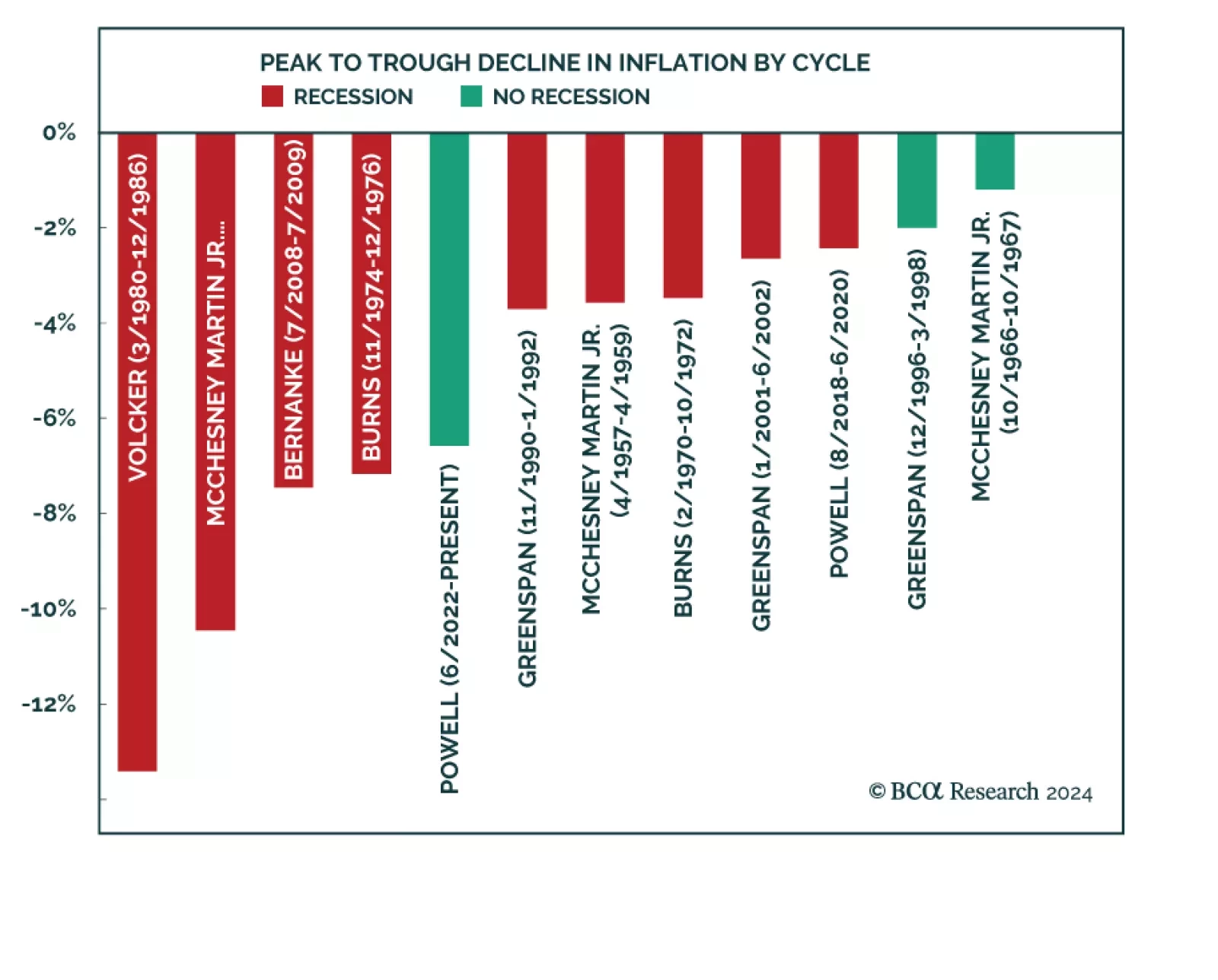

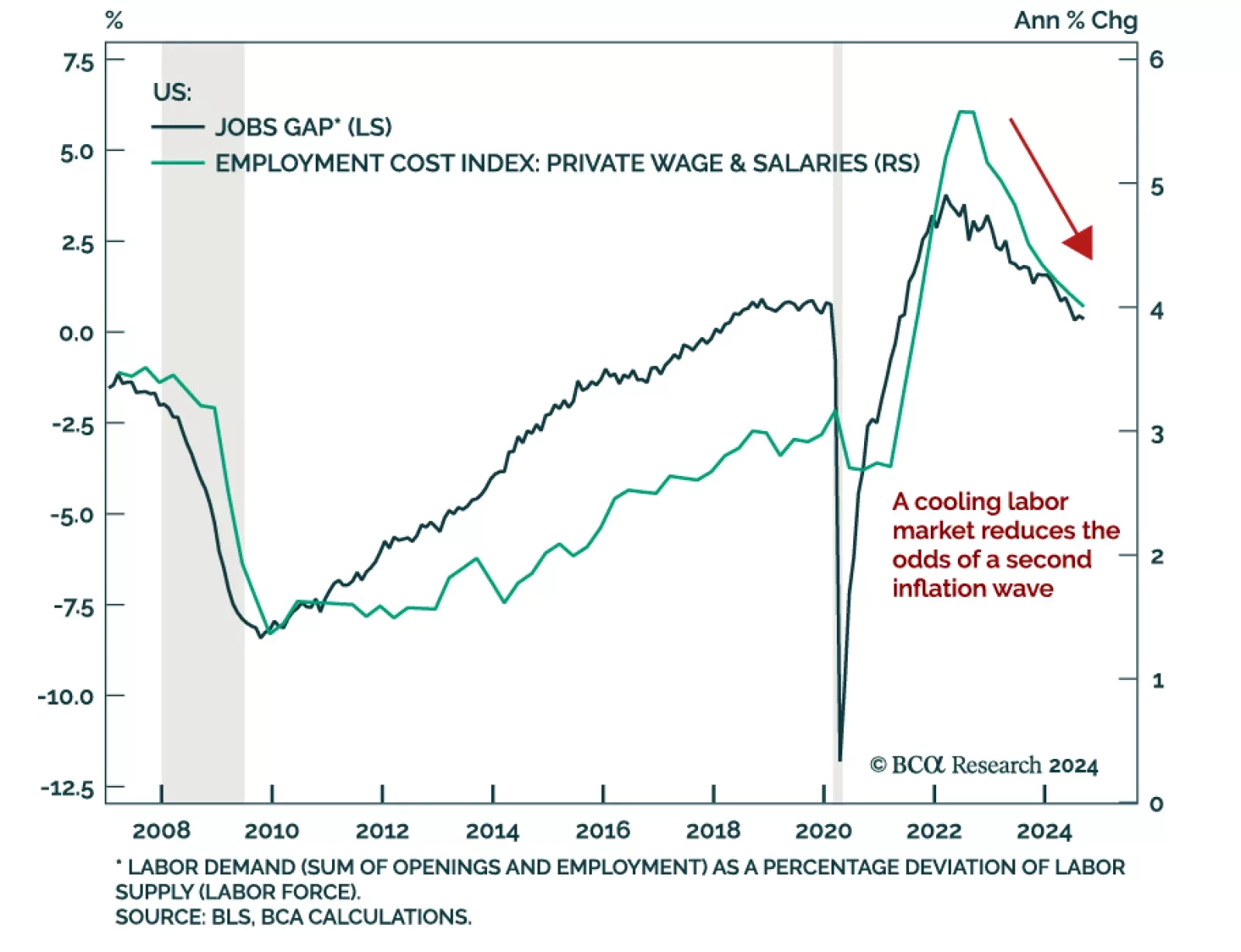

Our Global Asset Allocation Strategy colleagues argue in their monthly report that while a soft landing is a possibility, it is already reflected in asset pricing. A Trump victory would be a threat to this scenario. Inflation…

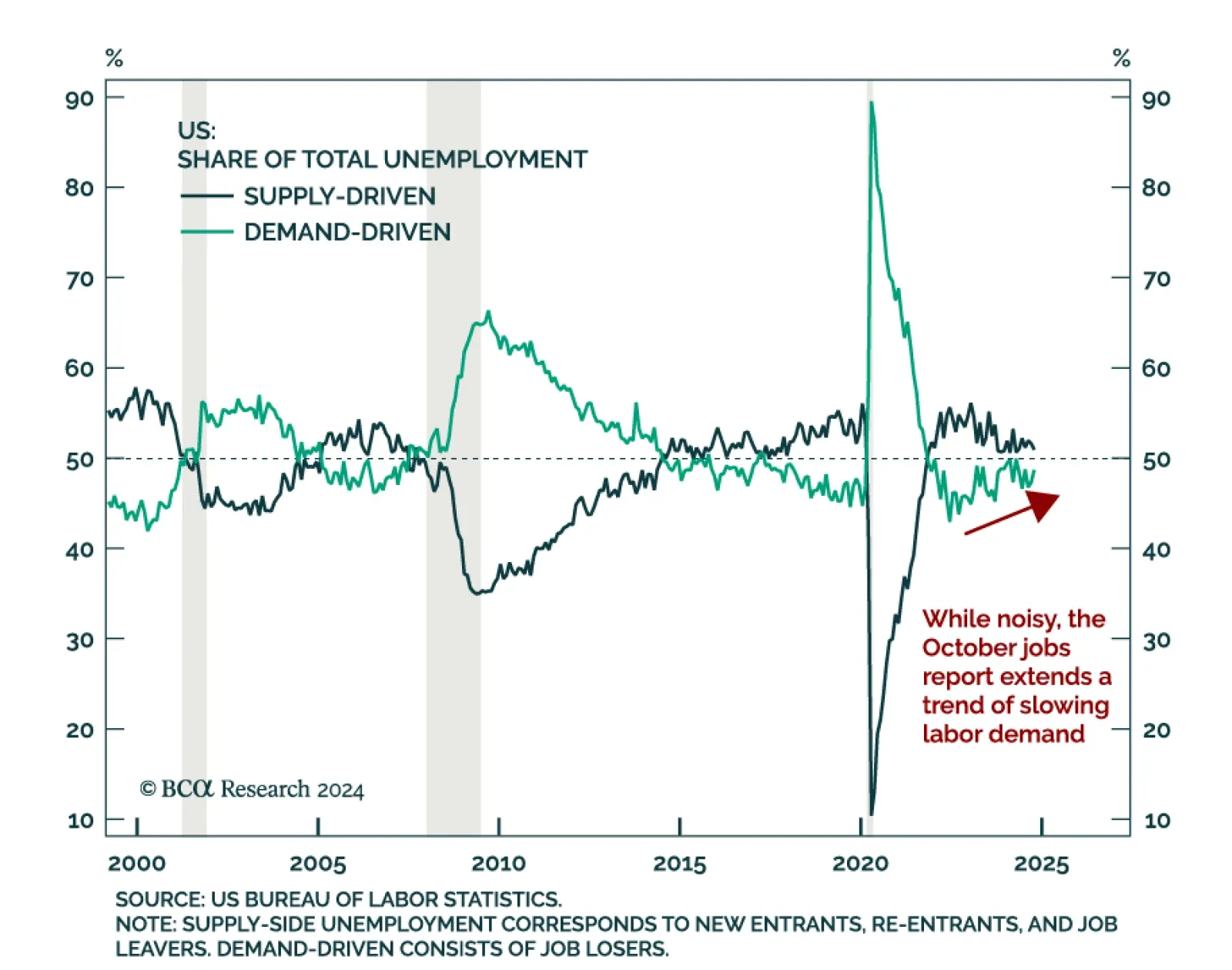

The October US jobs report had mixed signals and was skewed by hurricanes and industrial strikes. Unemployment met expectations by staying unchanged at 4.1%, although it rose nearly 0.1 percentage point on an unrounded basis.…

A reaction to this morning’s employment report and a preview of the potential bond market implications of next week’s US election and FOMC meeting.

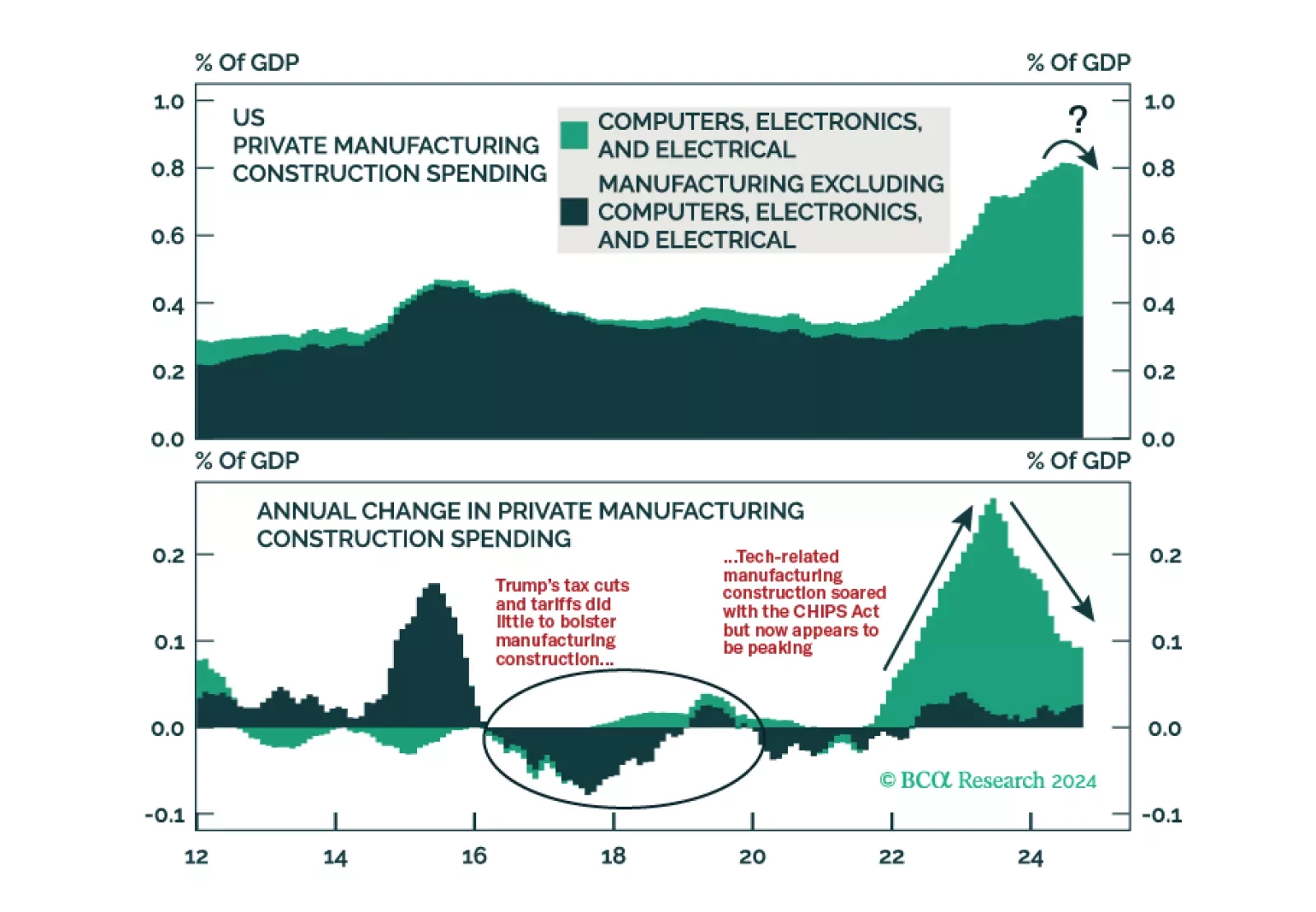

Can Powell achieve a soft landing? There are some indications he is doing it. We examine why our negative stance was wrong and analyze the four growth engines that kept recession at bay. Half of these forces remain while the other…

The Fed’s preferred measure of inflation, core PCE, met expectations of a reacceleration to 0.3% month-on-month, and reached 2.7% year-over-year. The rest of the Personal Income and Outlays report showed solid…