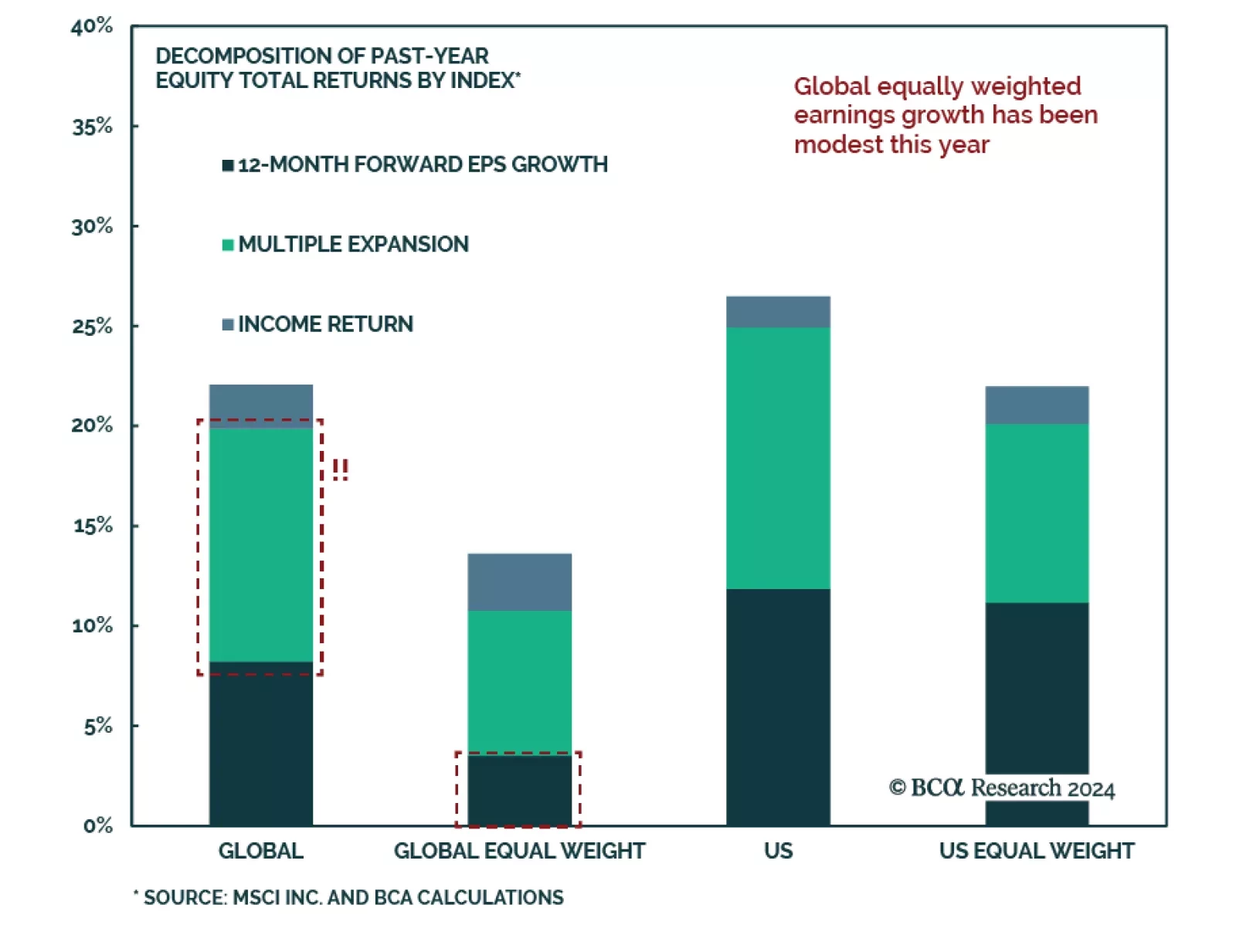

The post-COVID recovery has been one of excesses. Government deficits have ballooned, tight labor markets have led to a windfall of consumer spending, and equity valuations have soared on the back of lofty growth expectations. But…

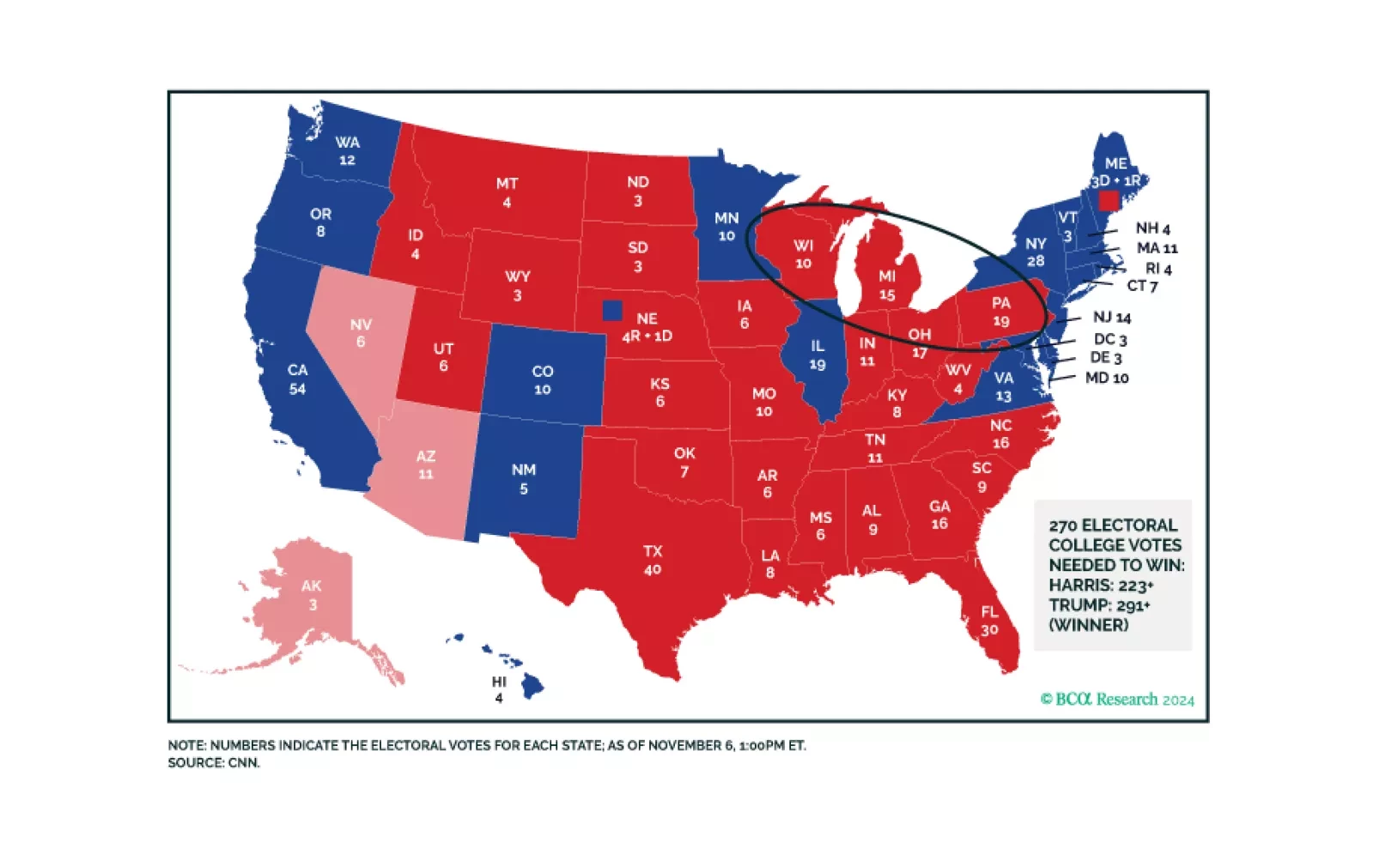

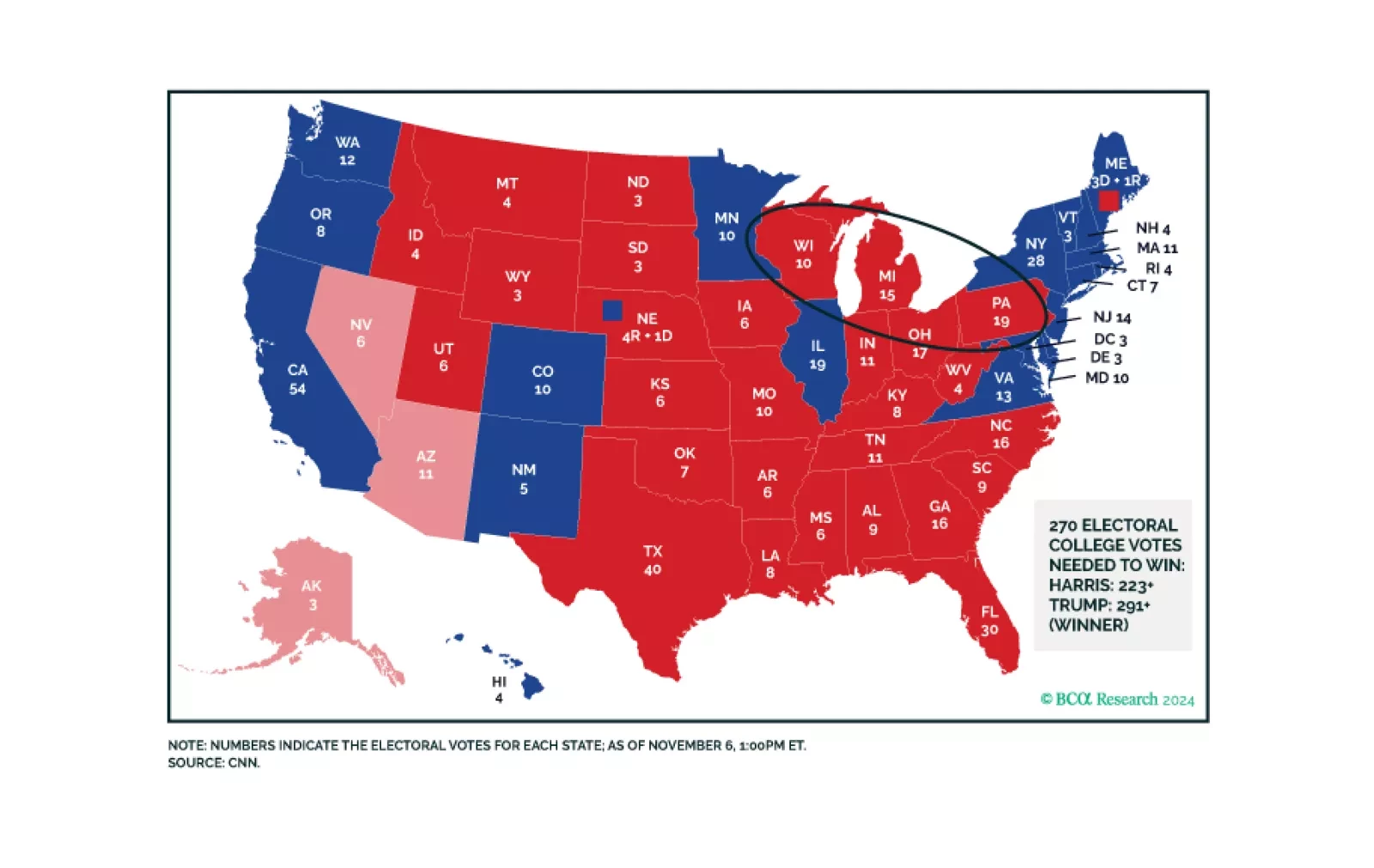

Our 2025 Outlook was just published. We revisit this year’s calls and discuss what we think is ahead for the global economy and markets for the next 12 months and beyond. The recent US election has significantly shifted…

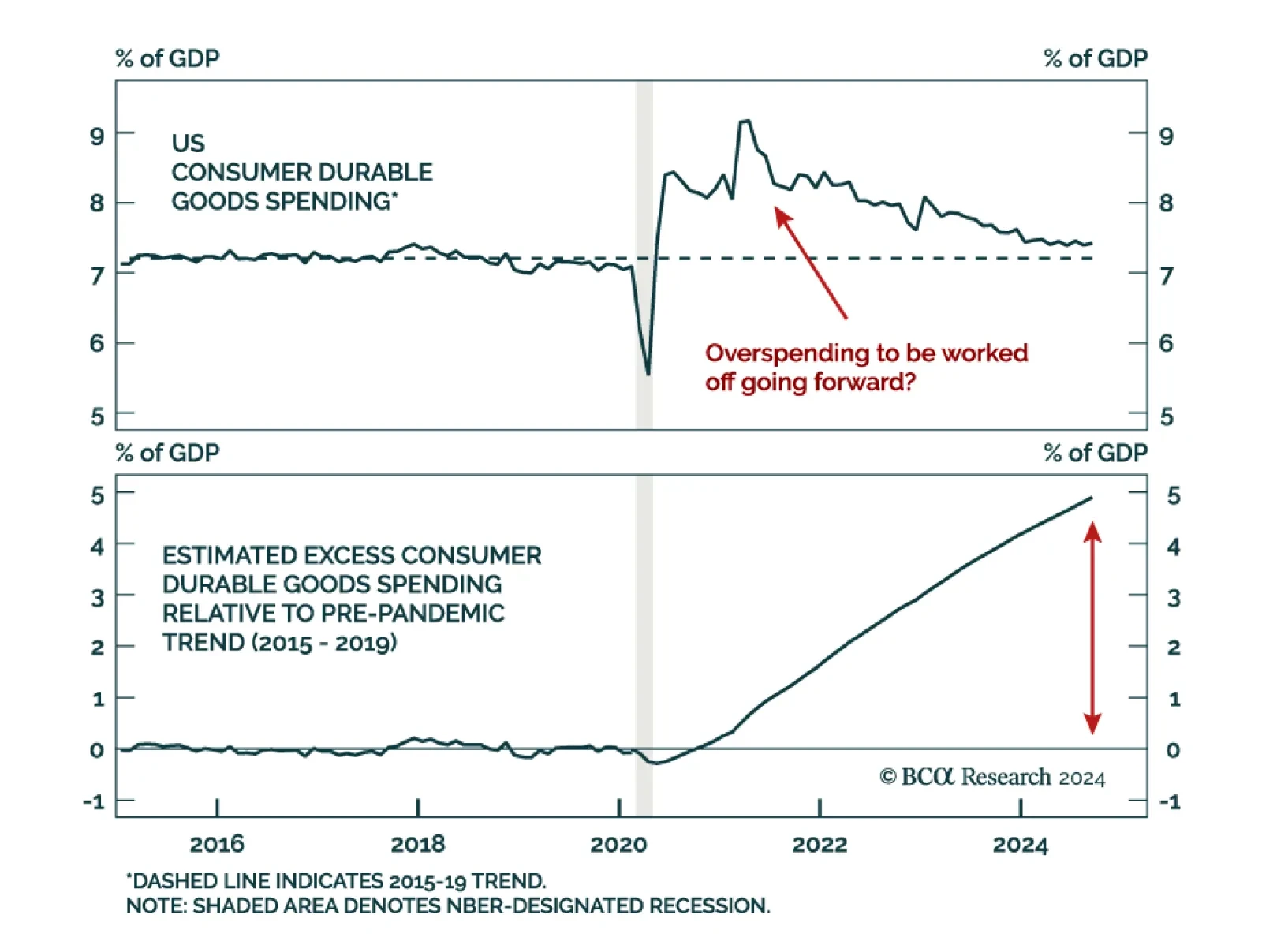

Our US Investment Strategy team analyzed recent US consumer trends through the lens of major retailers’ earnings calls, which highlighted increasingly prudent spending. Consumer caution is apparent in these earnings…

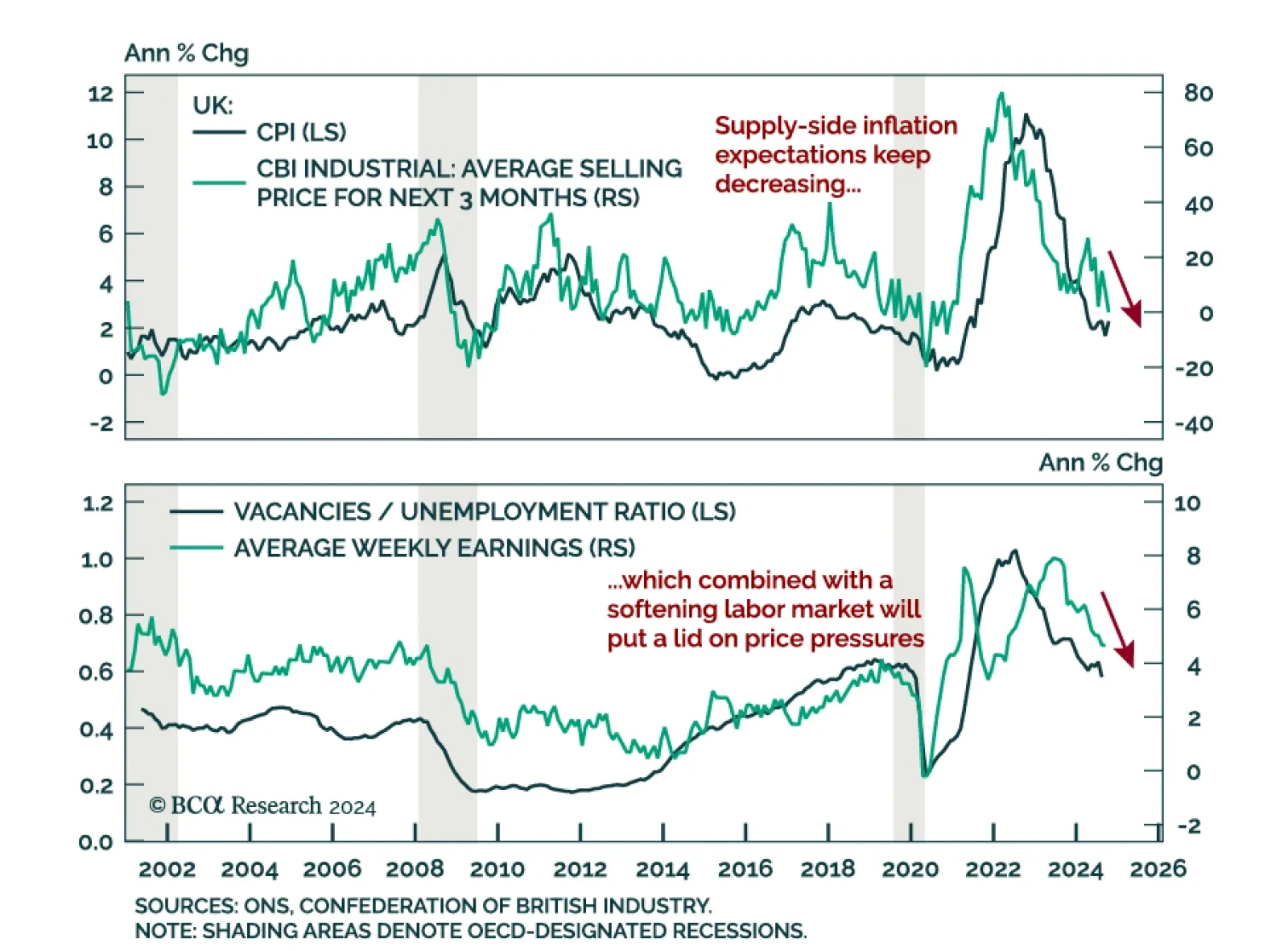

UK inflation was hotter than expected in October, rising to 0.6% m/m from being flat in September. Core inflation also ticked up, printing at 3.3% y/y vs. 3.2% a month prior. Services inflation remains elevated at 5.0% y/y.…

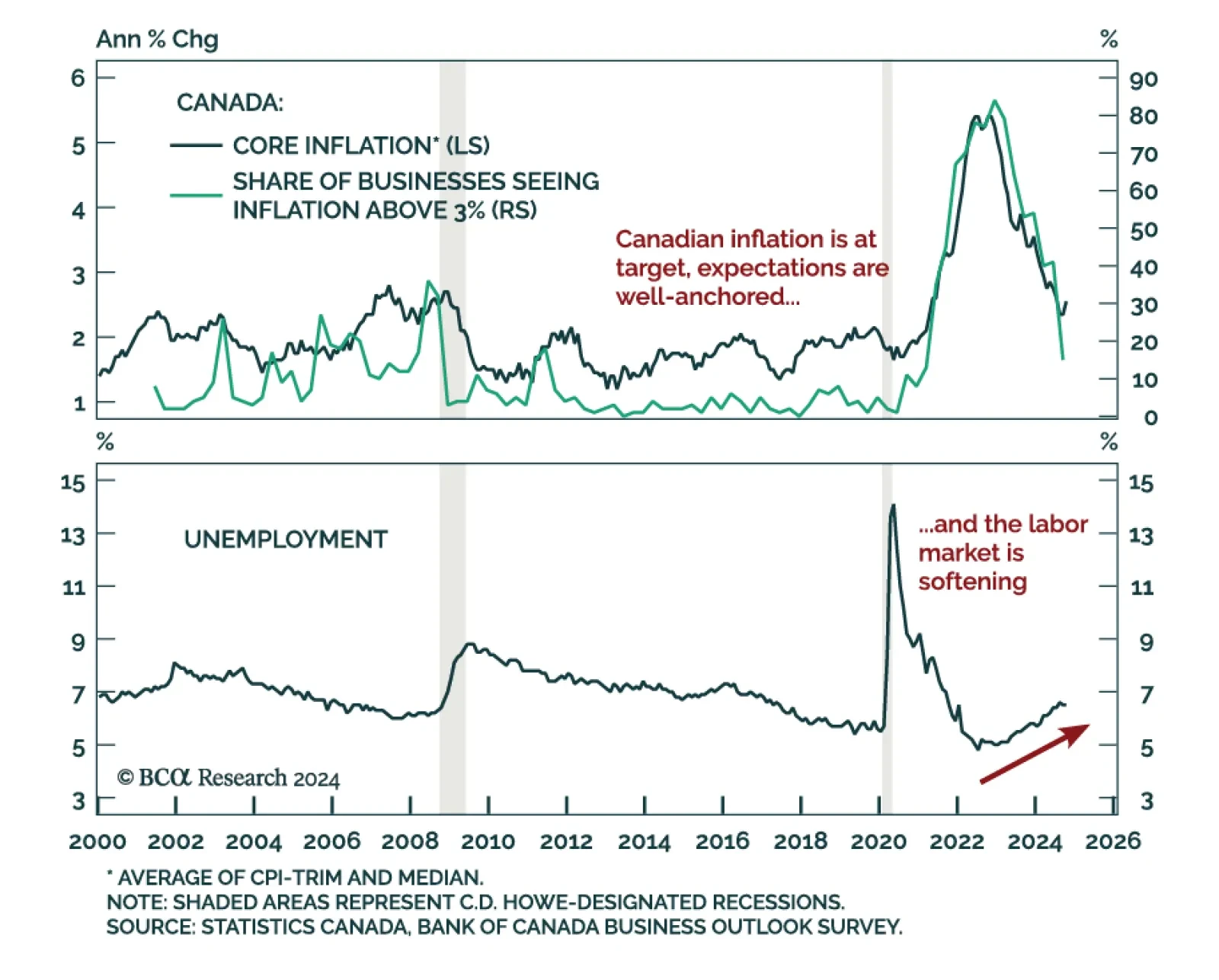

Canadian inflation was slightly hotter than expected in October, re-accelerating to 2.0% y/y from 1.6% in September. The BoC’s favored core measures, median and trim, re-accelerated to 2.5% and 2.6% respectively, and CPI-…

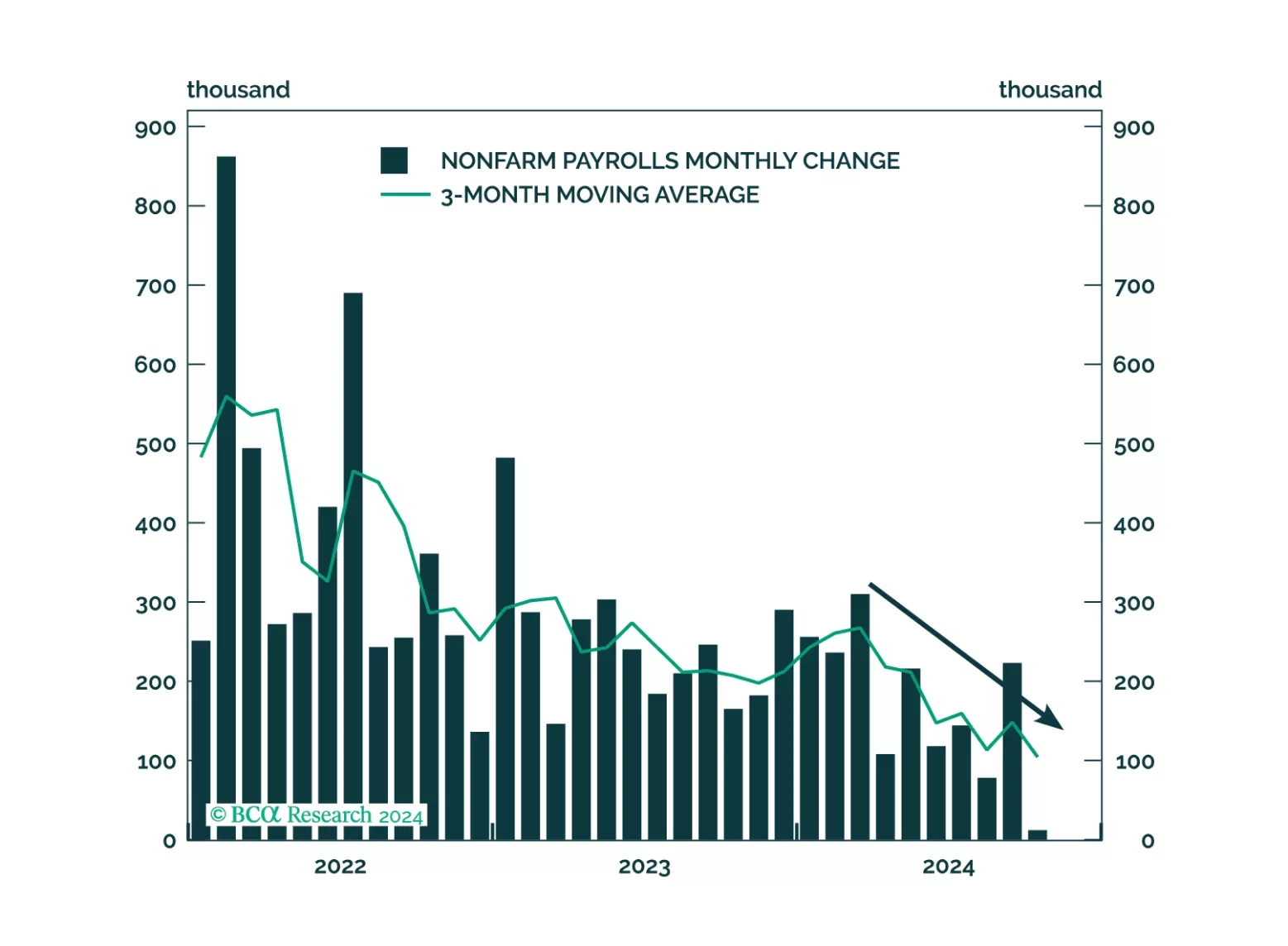

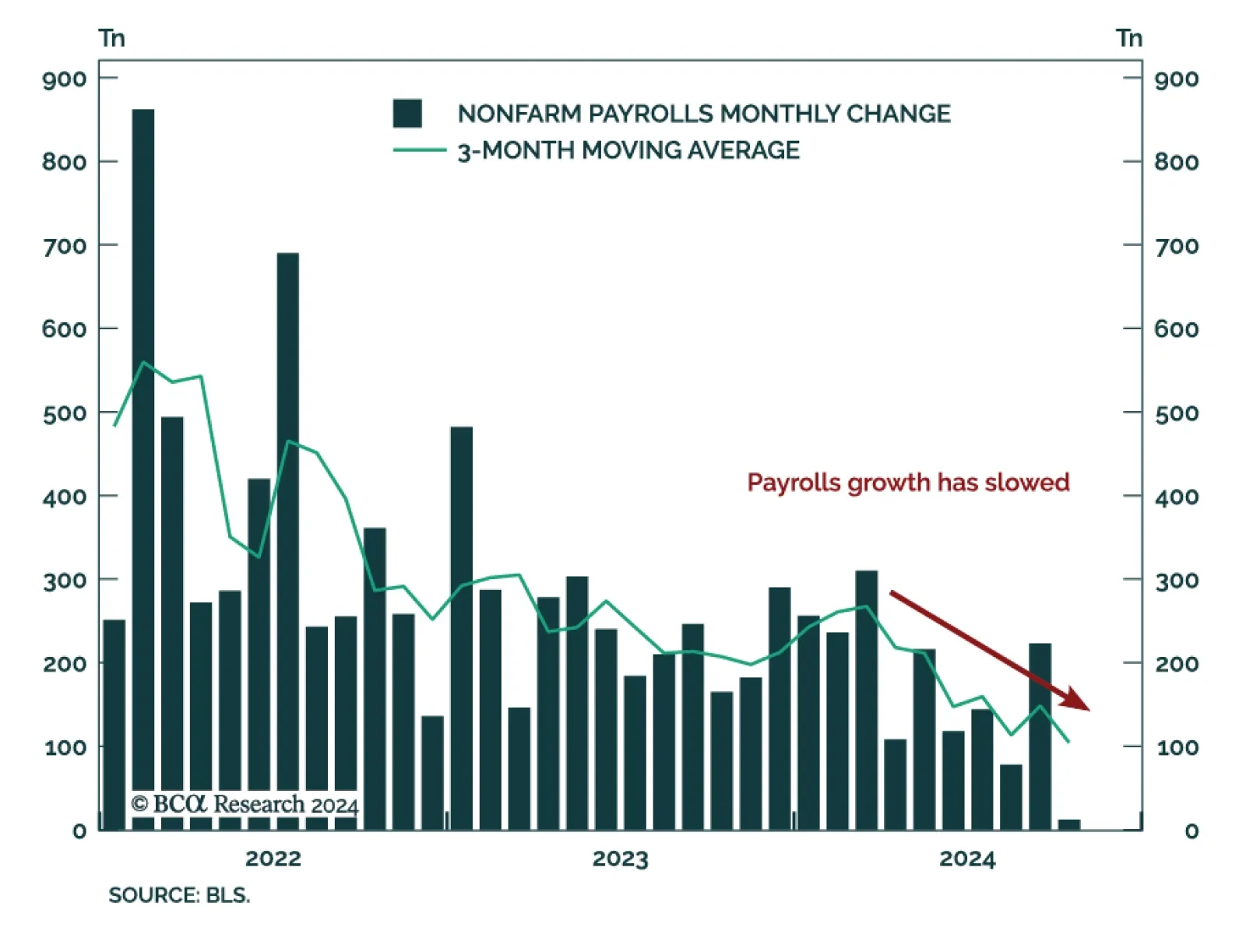

Amidst all the post-election noise, our US Investment Strategy colleagues took a step back and assessed where the US labor market stands. Despite the strong post-election equity rally, they maintain their recession outlook.…

The force of the post-election momentum leads us to believe we could be stopped out of our defensive positioning before the week is out, but we still believe in our recession call. If we are eventually stopped out, we will seek a…