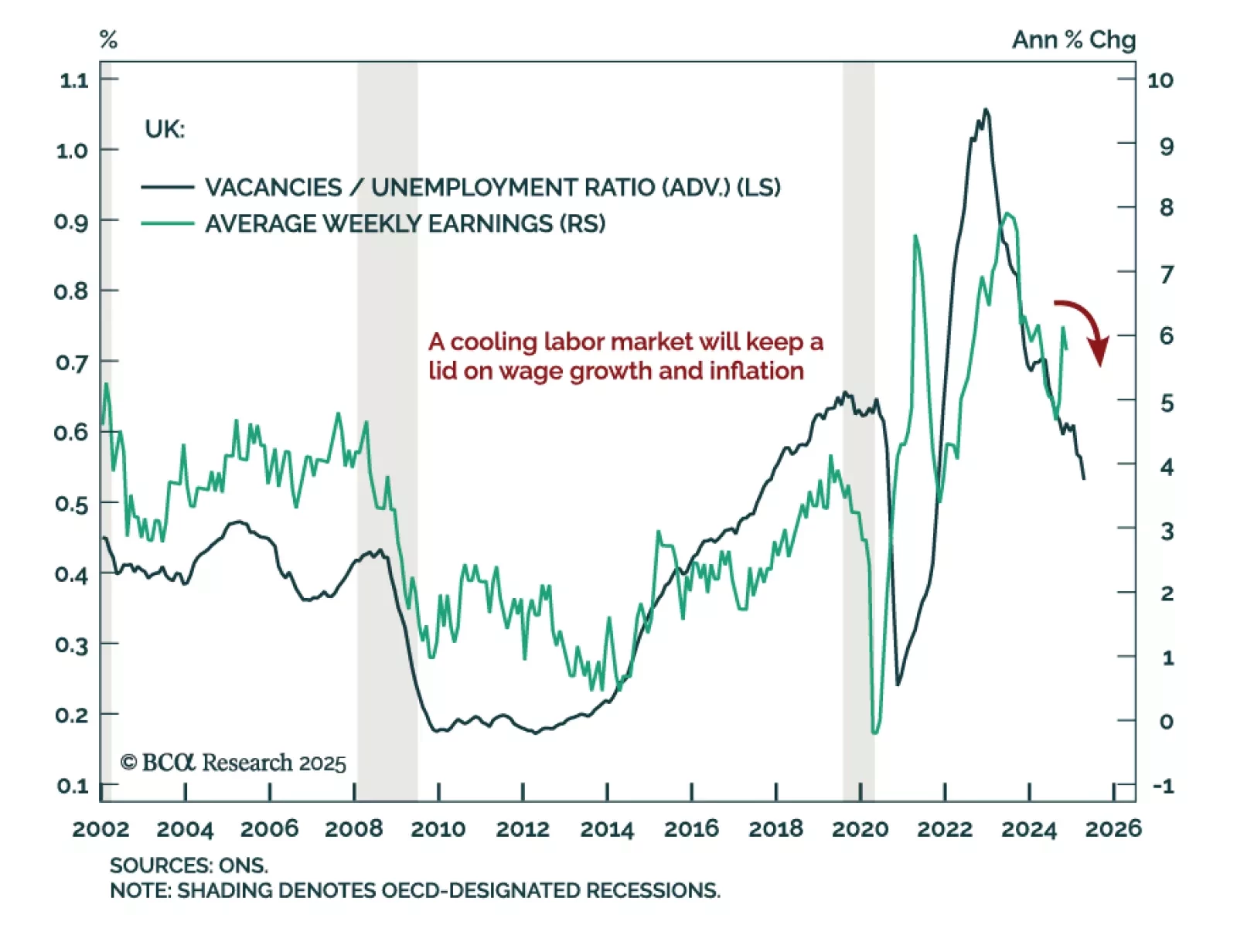

November/December UK employment data was mixed. The November unemployment rate rose 0.1% to 4.4%, in line with expectations. Payrolled employees decreased faster than expected at a 47k pace in December, surpassing the 35k contraction…

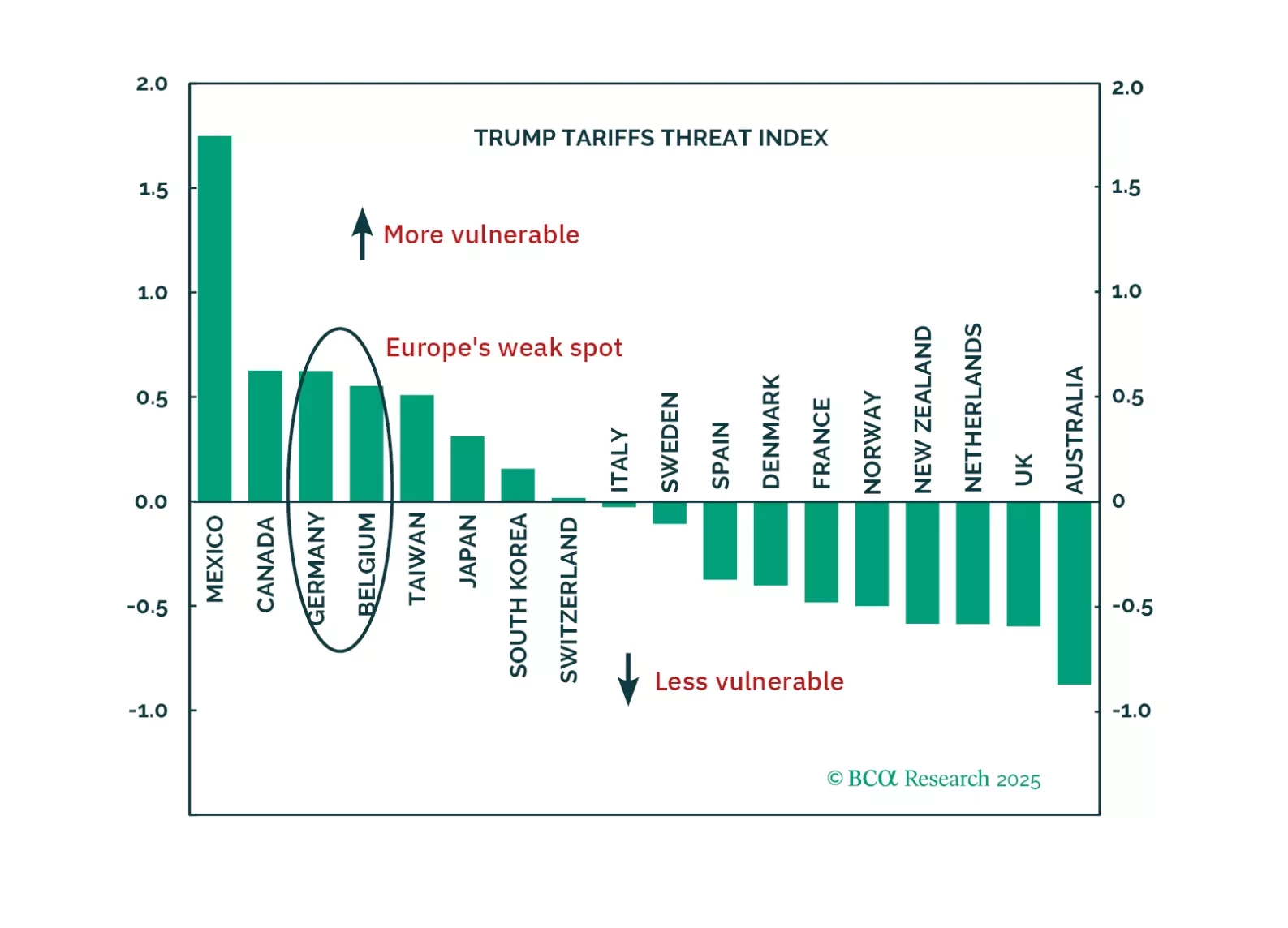

President Trump is about to be inaugurated. Investors often assume all his policies will hurt Europe, but the reality is more nuanced.

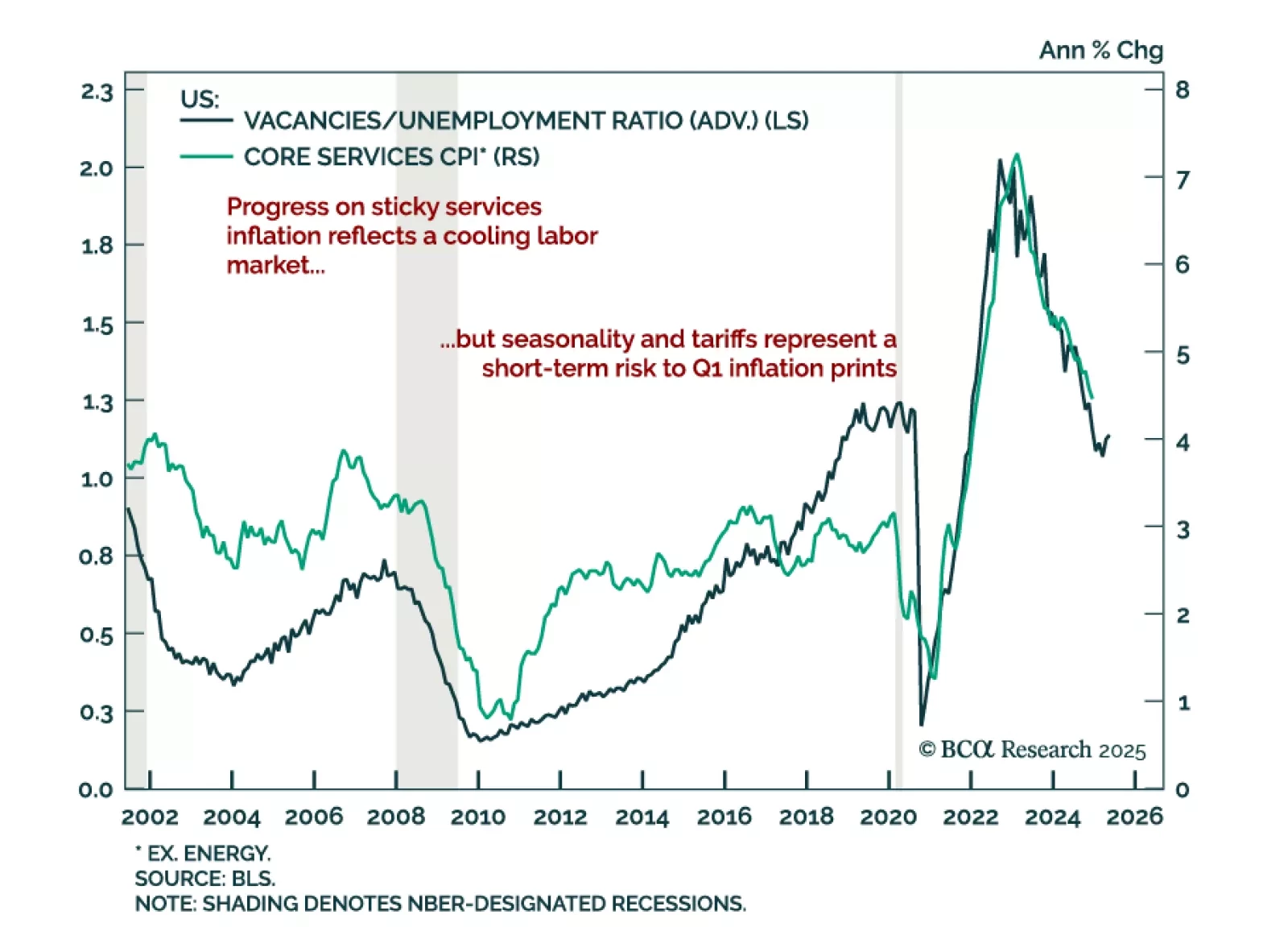

The December US CPI came in better than expected. While headline CPI met estimates of 0.4% m/m (2.9% y/y), core surprised to the downside at 0.2% m/m, decelerating to 3.2% y/y from 3.3%. Moderation in core annual inflation was driven…

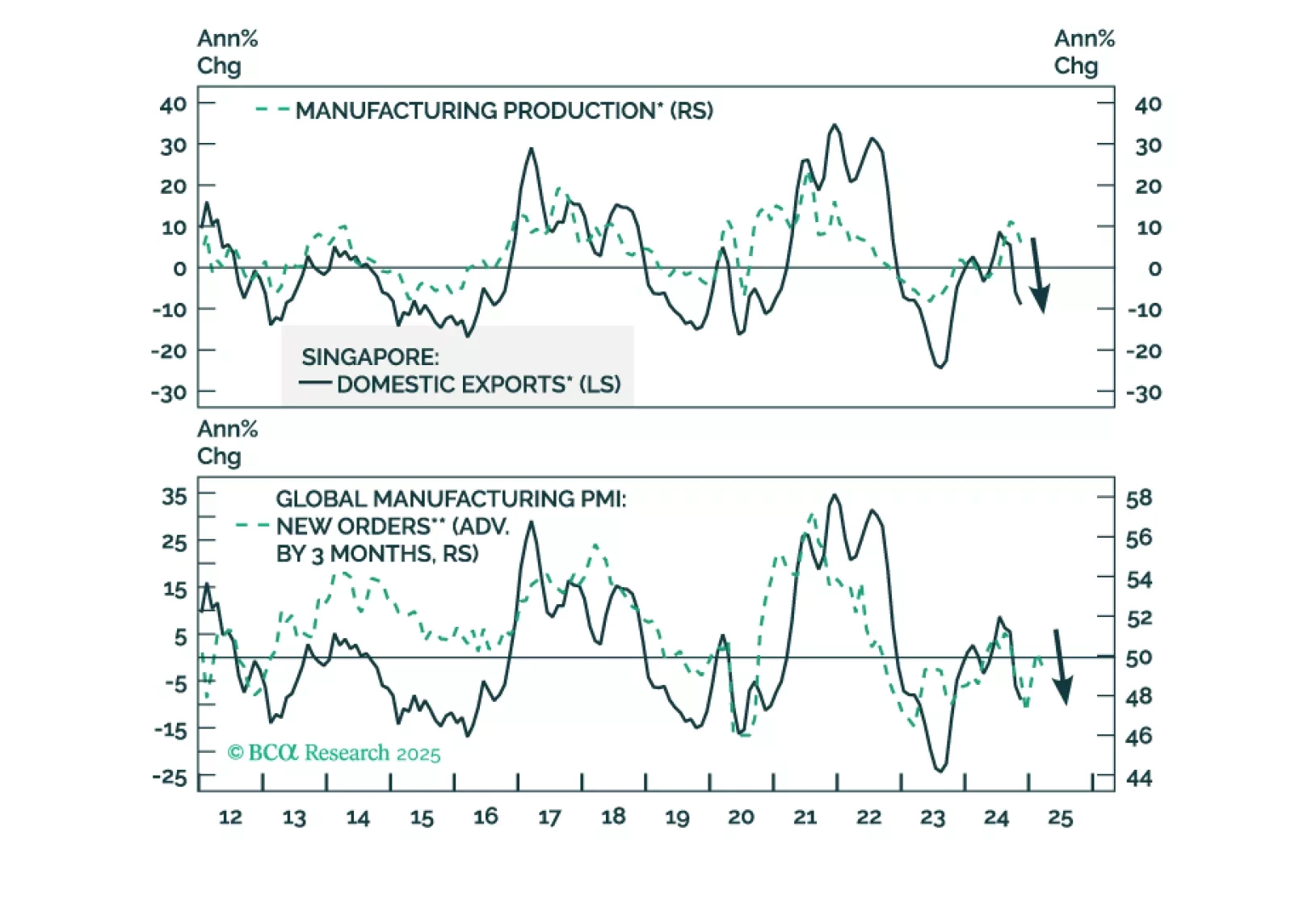

Can Singapore stocks continue the bull run into 2025? What does the city-state’s manufacturing and export outlook foretell? Is the Singapore dollar still competitive? See our analysis and investment recommendations in today’s…

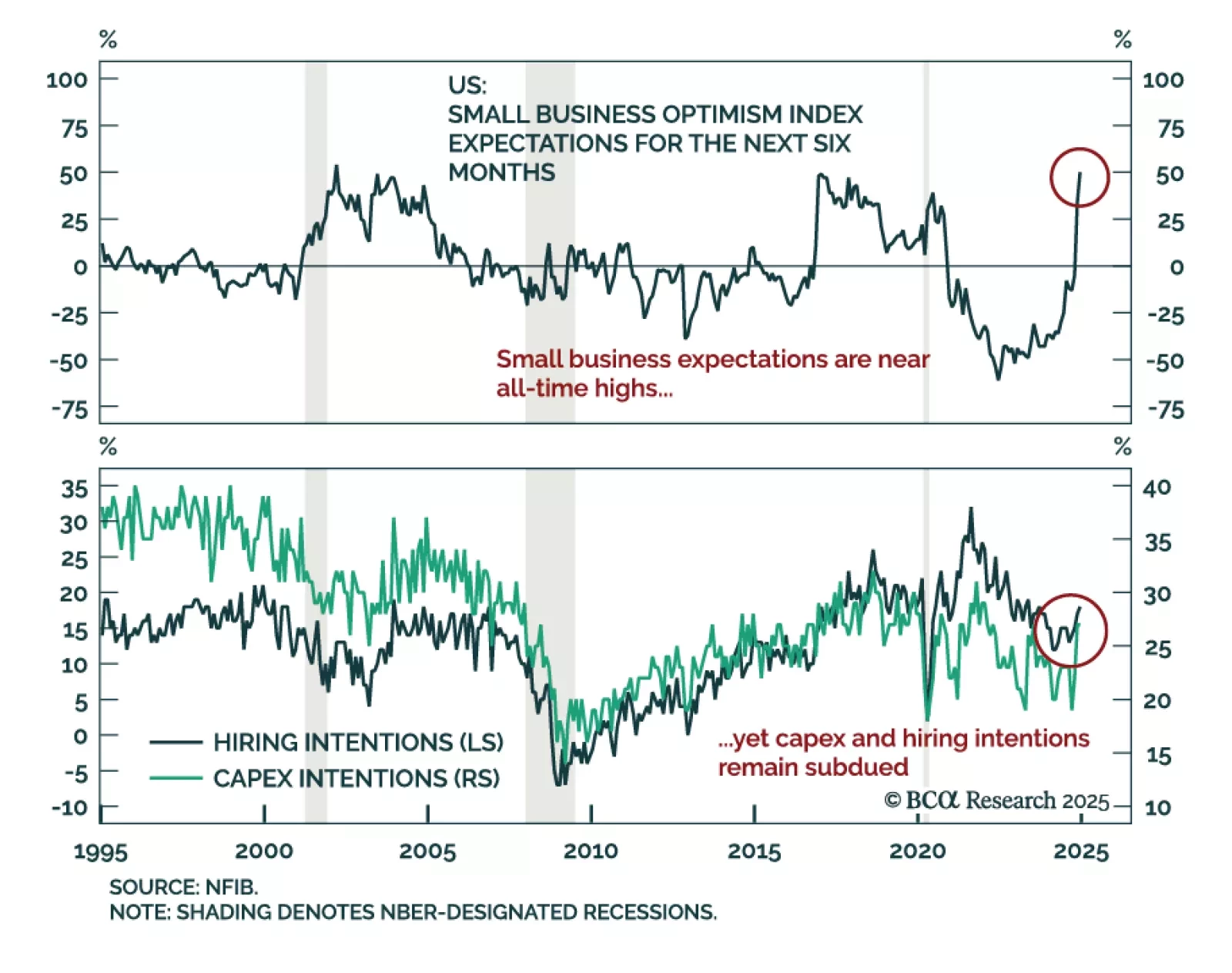

The December NFIB Small Business Optimism Index beat expectations, jumping to 105.1 from 101.7 in November. Most index subcomponents increased, led by measure of expectations, notably for the state of the economy and real sales.…

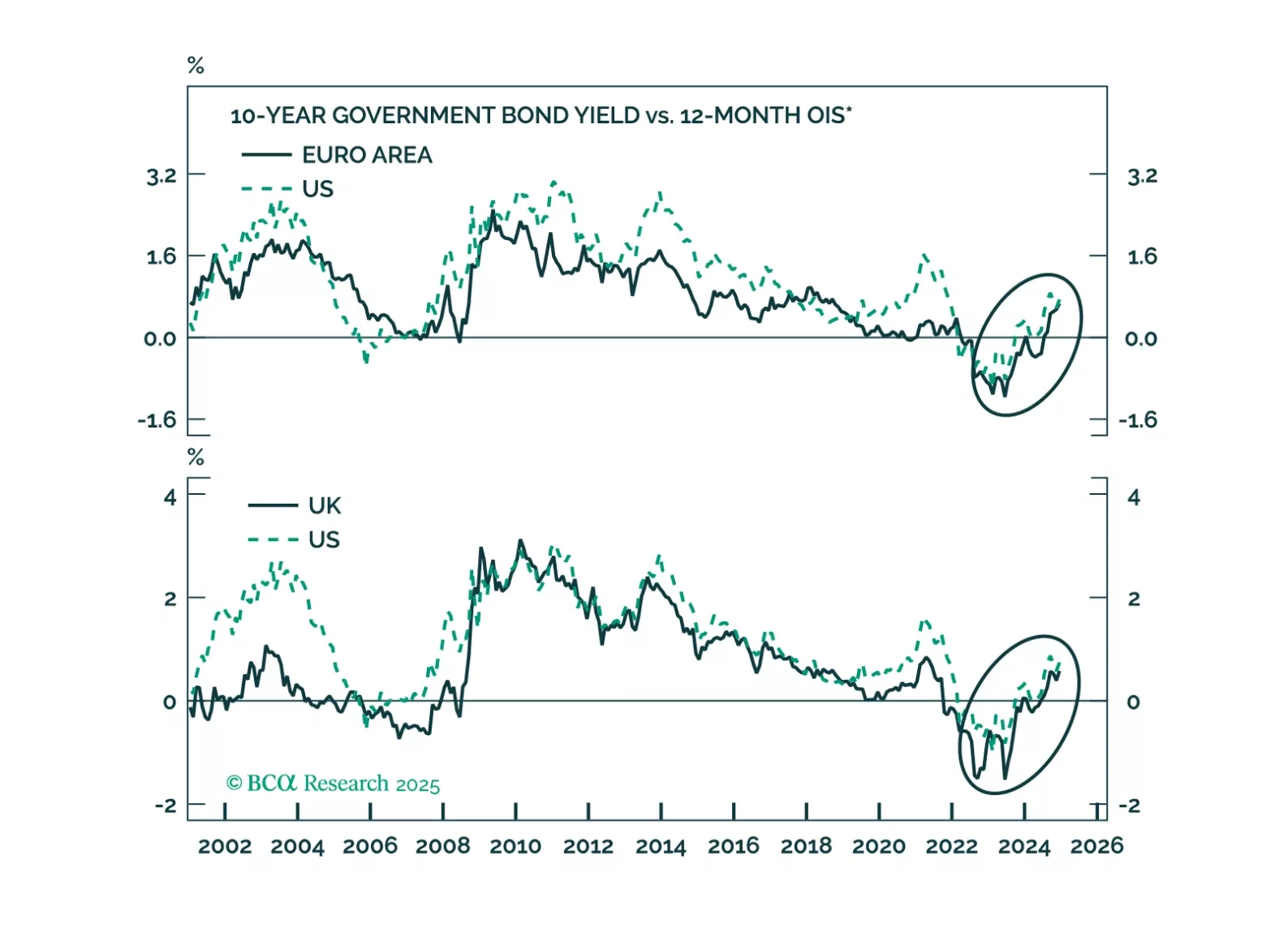

UK and German bonds are victims of the global bond market riots. Will European yields continue to move higher and will the euro and the pound find a floor anytime soon?

Thoughts on the increase in bond yields and this morning’s employment data.

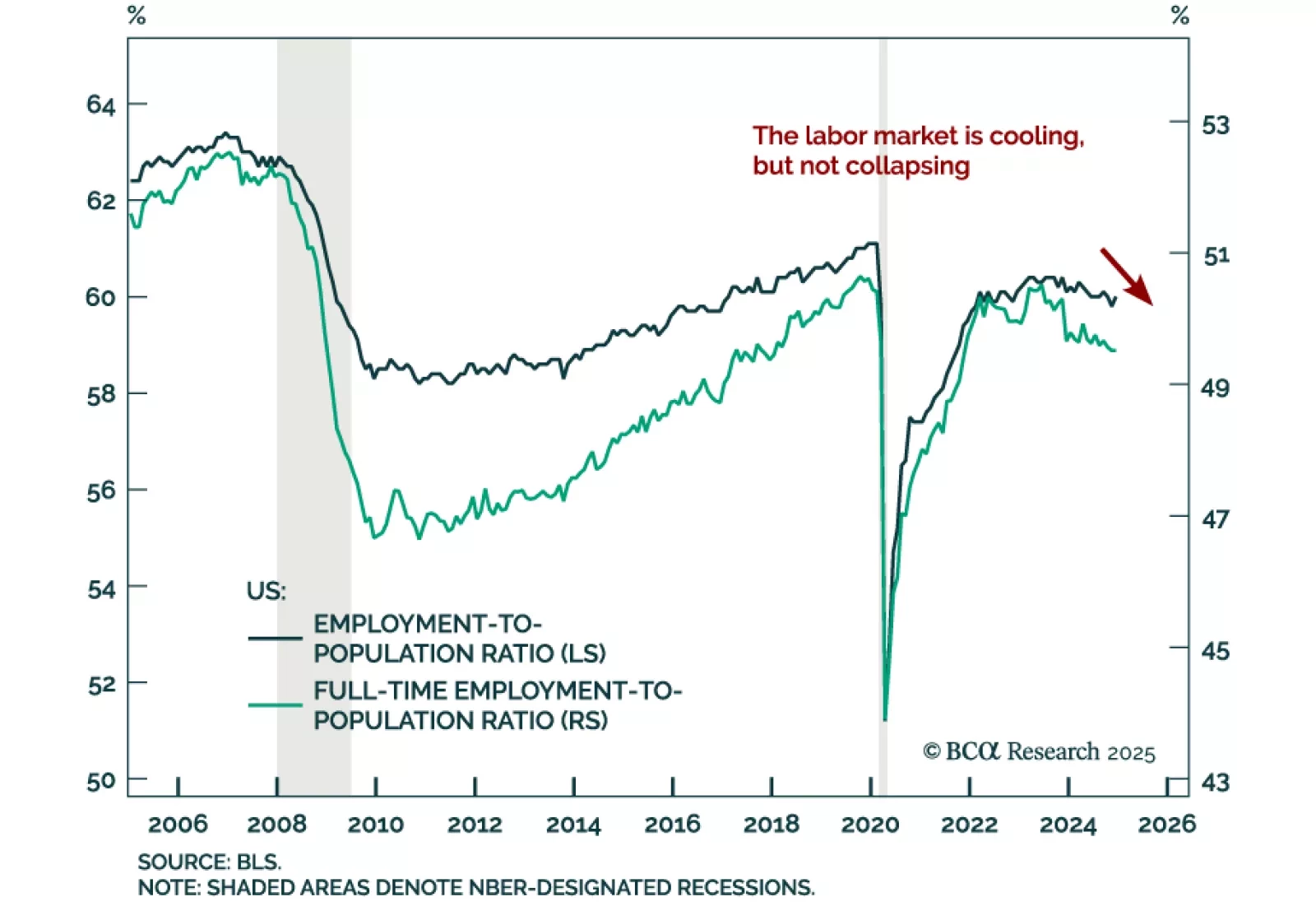

The US December jobs report came in stronger than expected. Payrolls rose by 256k vs. a downwardly revised 212k in November, leaving the 3-month moving average at about 170k. The unemployment and underemployment rates decreased to 4.…

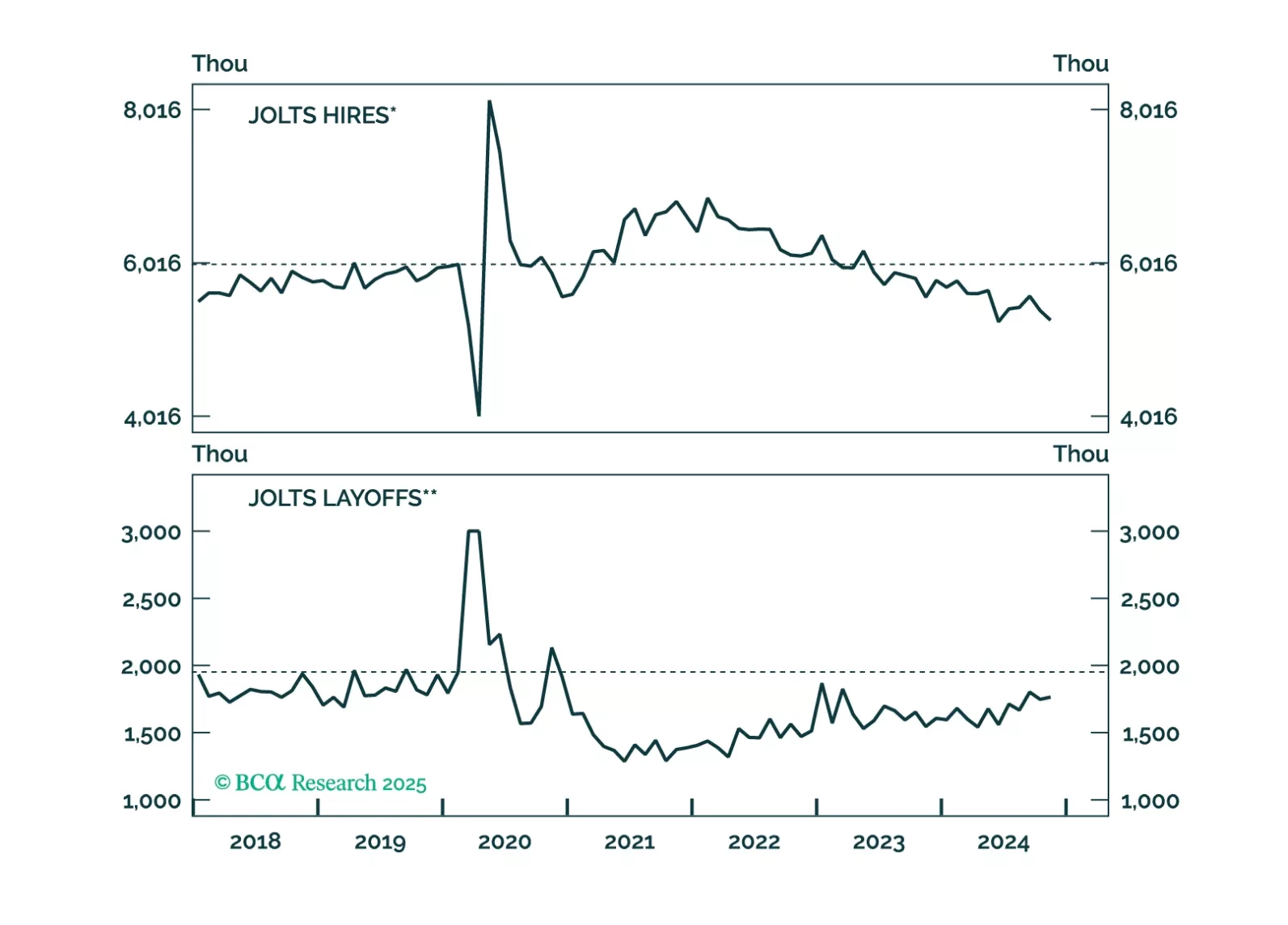

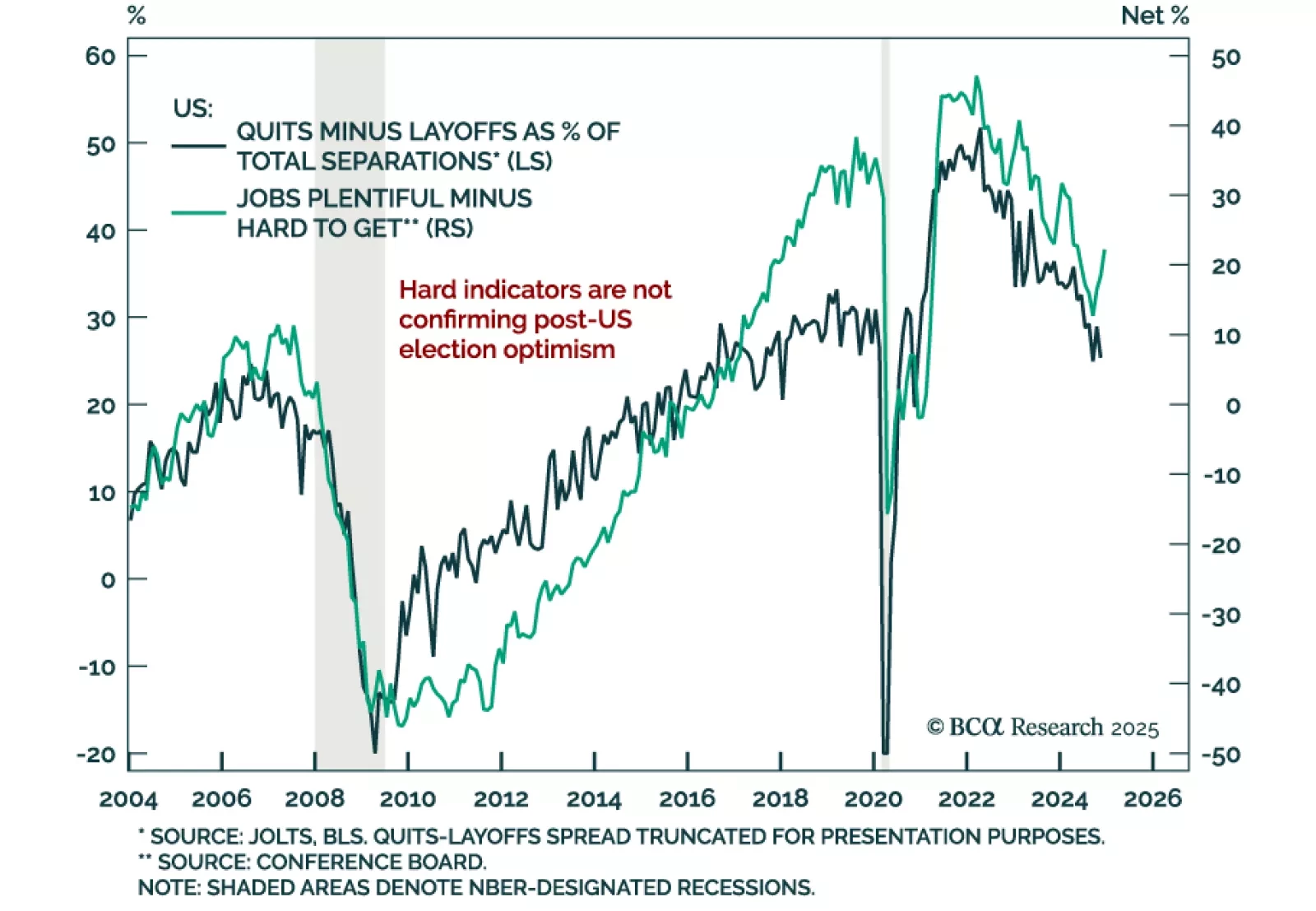

Job openings once again beat expectations in November, increasing to 8.1m from 7.8m in October. However, hires and quits decreased and layoffs increased. The gap between quits and layoffs, a leading indicator of labor market demand,…

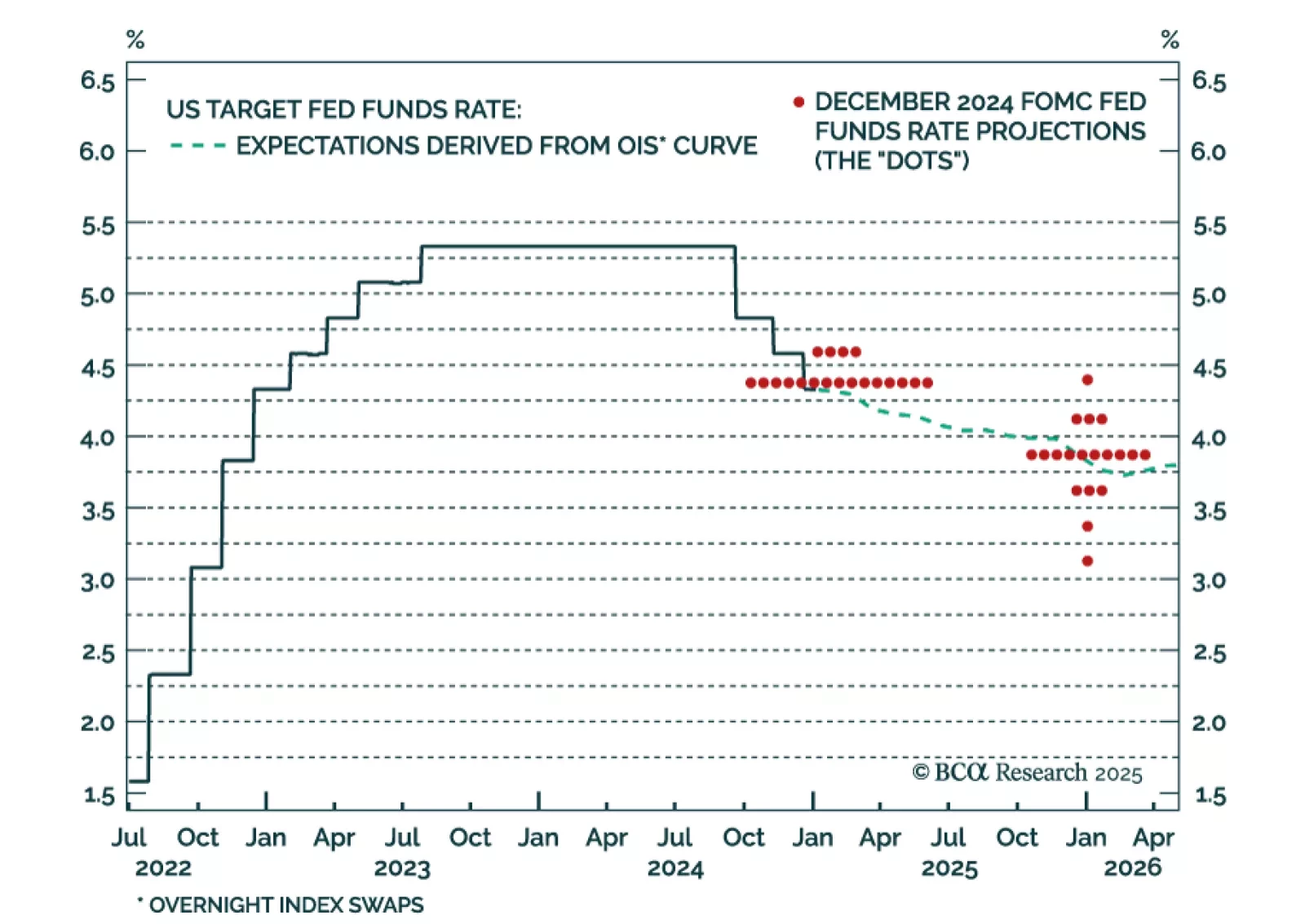

Our US Bond Strategy team published their outlook for the Fed in 2025. They expect more cuts than the 50 bps signaled by the Fed at its December meeting. Core PCE inflation is tracking well below the Fed’s 2.5% forecast, while…