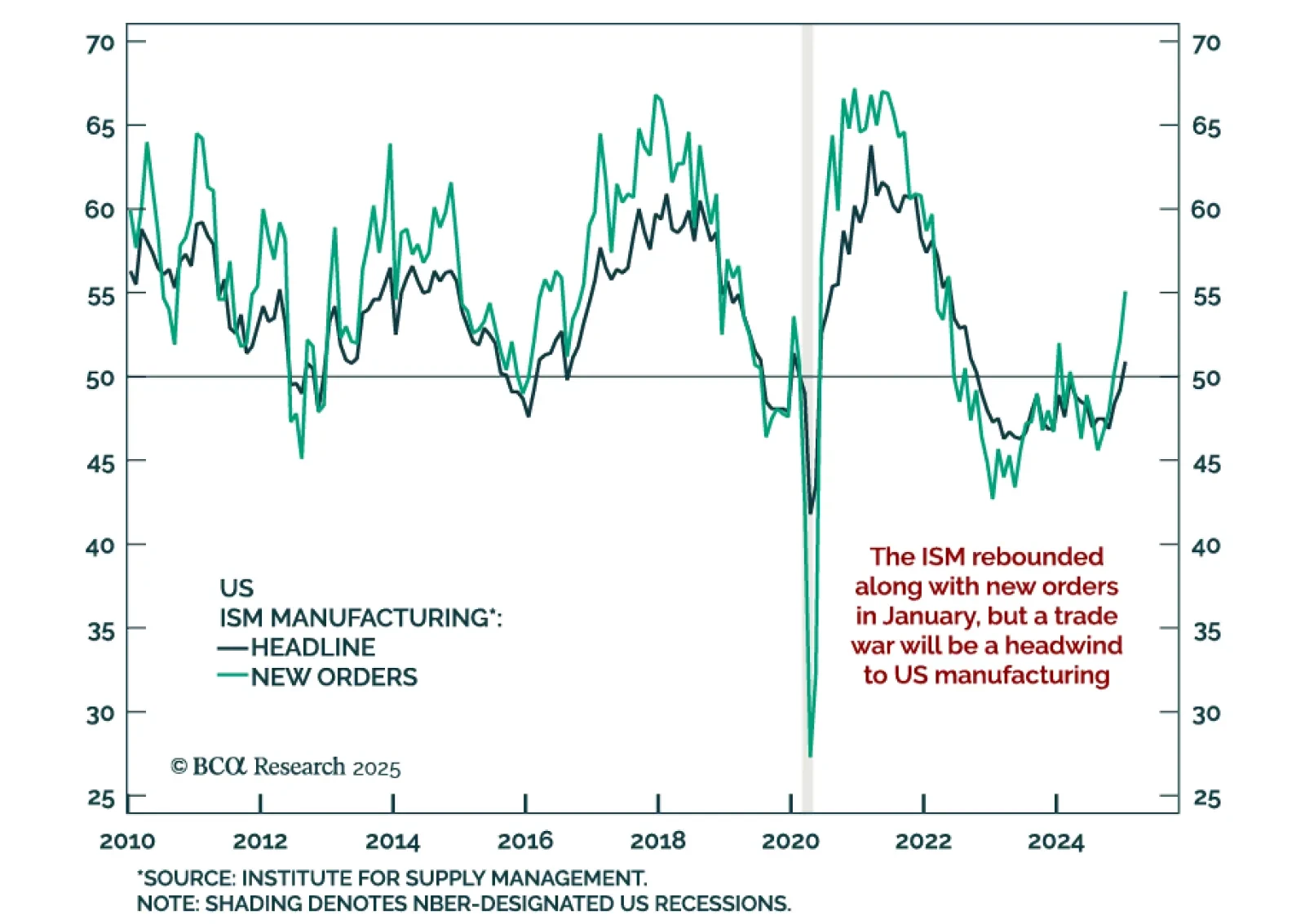

The January ISM Manufacturing index beat estimates, increasing to 50.9 to end a 26-month streak of manufacturing contraction. New orders rose to 55.1 from 52.1. Employment is also back in expansion. Prices paid strengthened as well,…

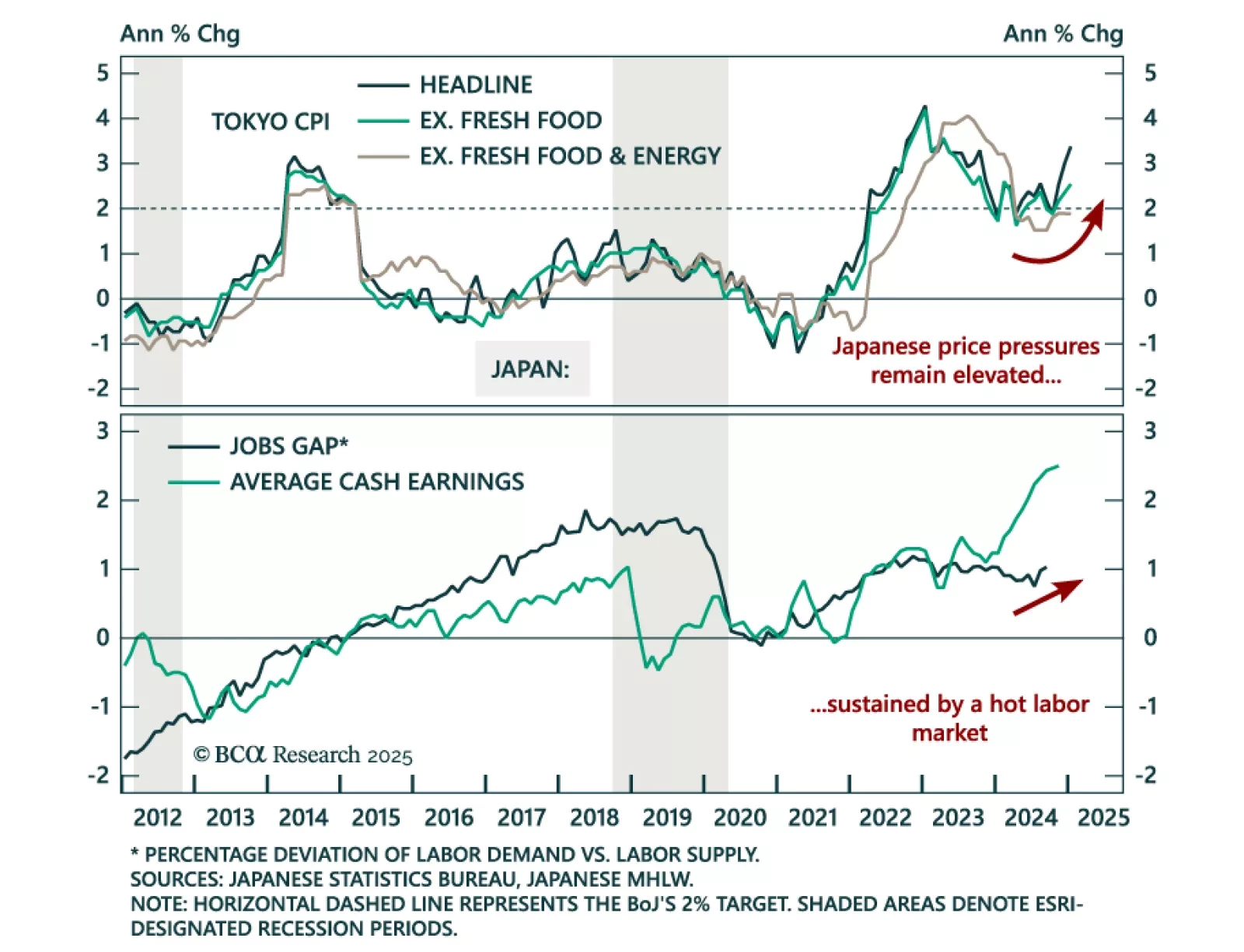

The January Tokyo CPI came in stronger than expected, with headline inflation accelerating to 3.4% y/y from 3.0%, and “core core” (ex. fresh food and energy) accelerating to 1.9% from 1.8%. The jobless rate also decreased 0.1% to 2.4…

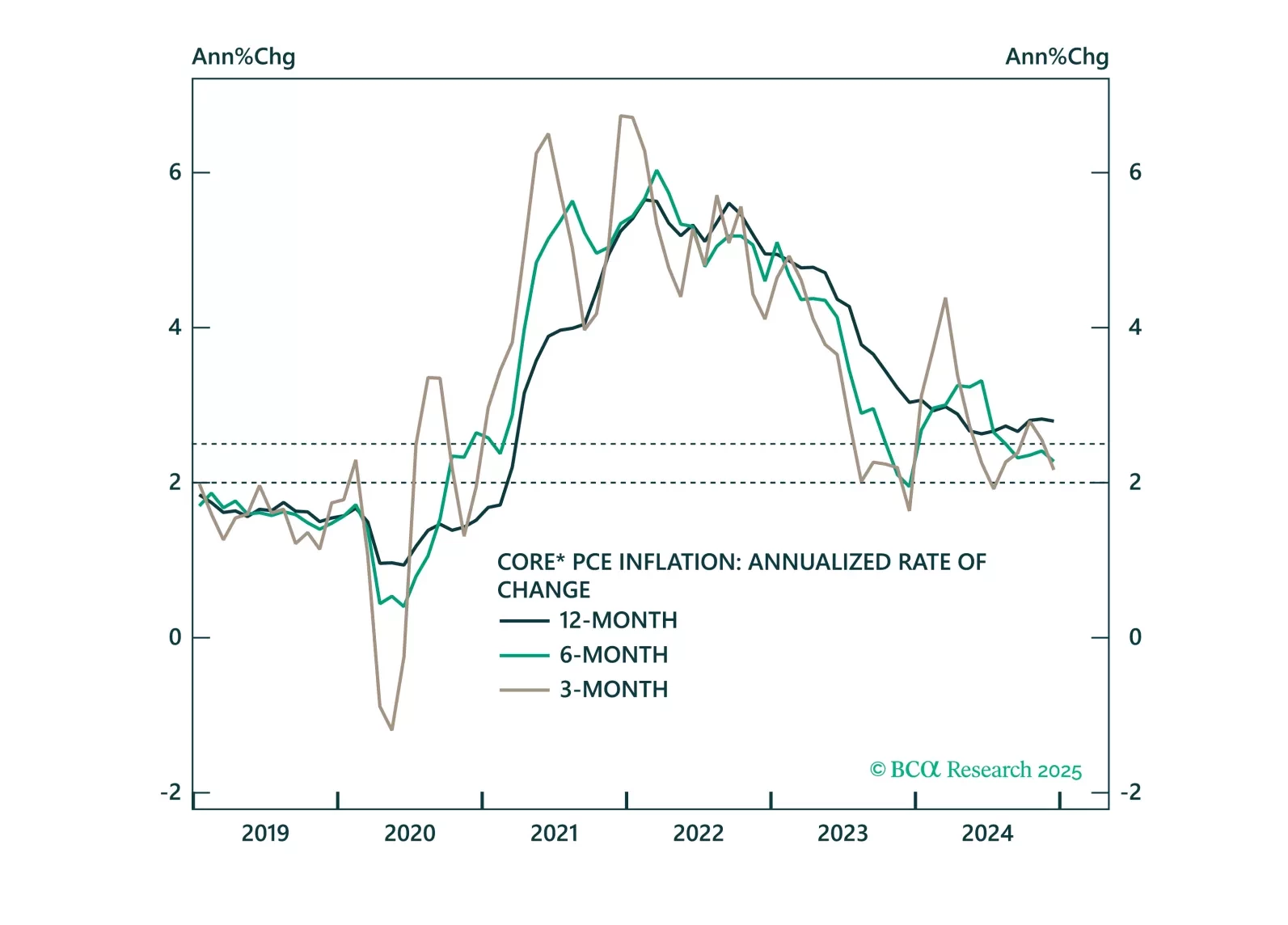

December PCE inflation was in line with expectations, with headline inflation at 0.3% m/m (2.6% y/y) and core at 0.2% m/m (2.8% y/y). The Q4 employment cost index also came in line with expectations at 0.9% q/q. Inflation is…

Core PCE inflation came in soft this morning and is tracking well below the Fed’s 2025 forecast. We highlight three upside risks to inflation and preview next week’s employment report.

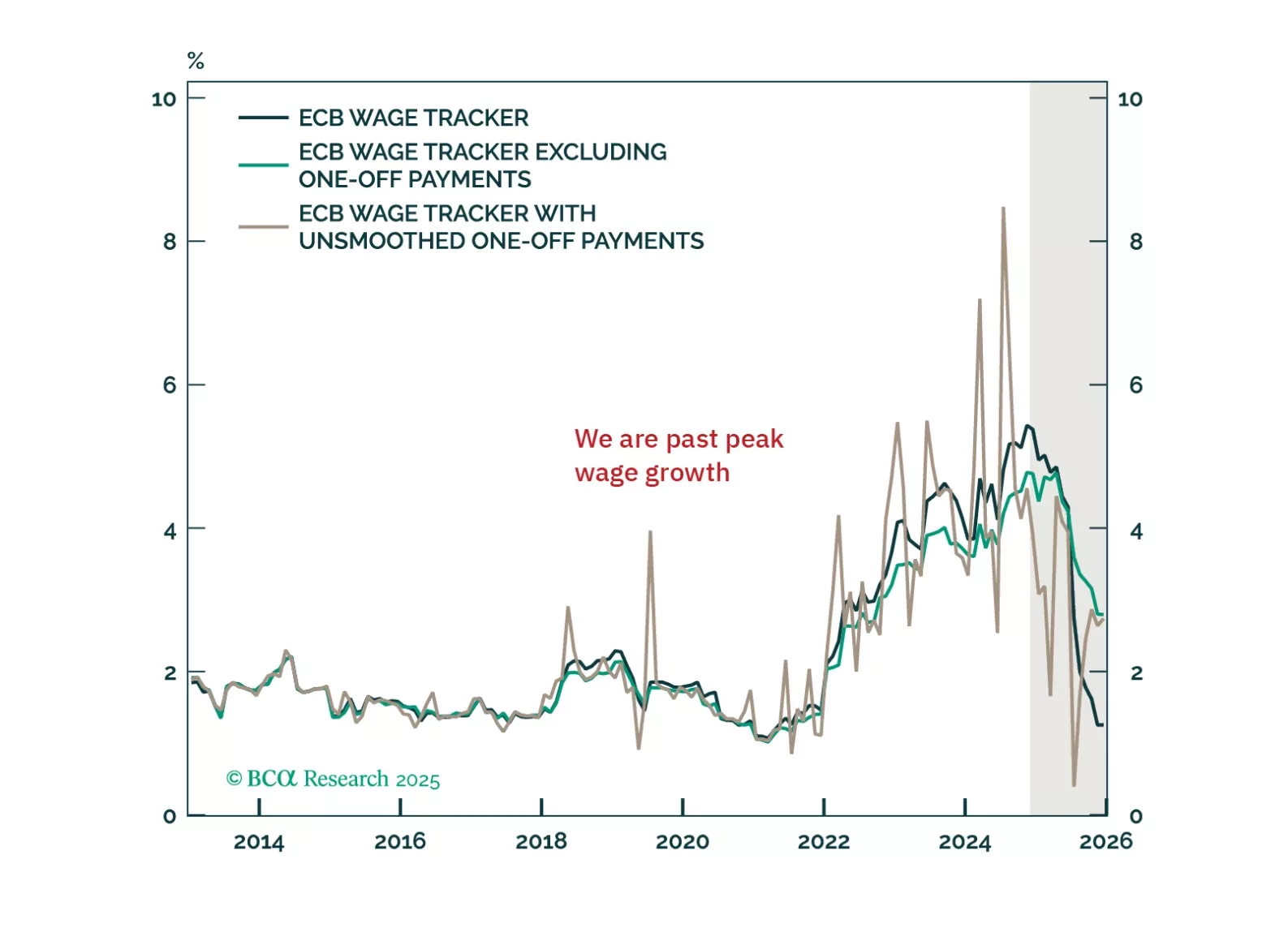

The ECB cut its deposit rate to 2.75%, as was widely anticipated. President Christine Lagarde did not provide any fireworks, but the Governing Council’s message was clear: Policy is restrictive, and inflation will fall further. As a…

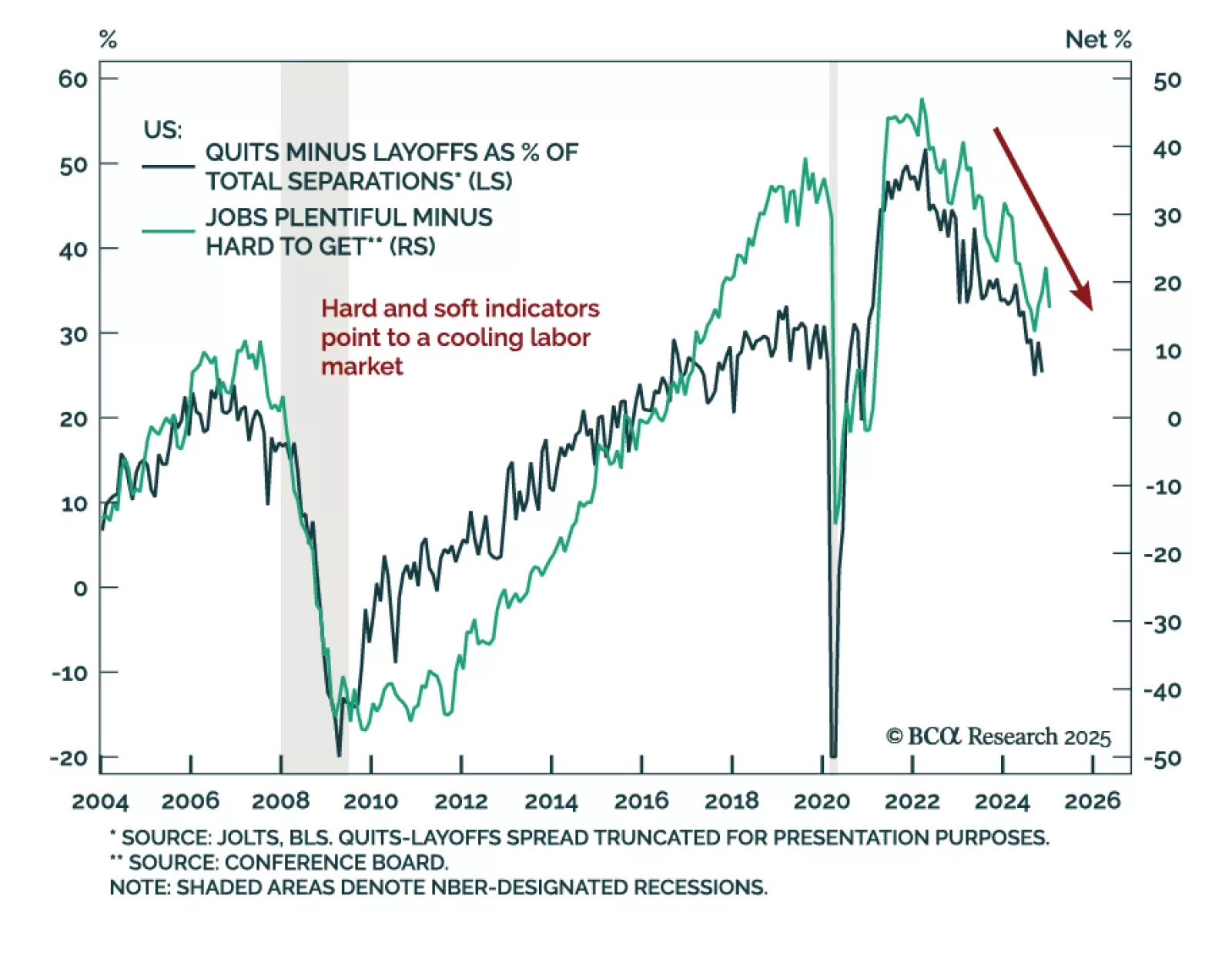

The January Conference Board Consumer Confidence index missed estimates, decreasing to 104.1 from an upwardly-revised 109.5 in December. The decrease was driven by both the present situation and expectations subcomponents. The…

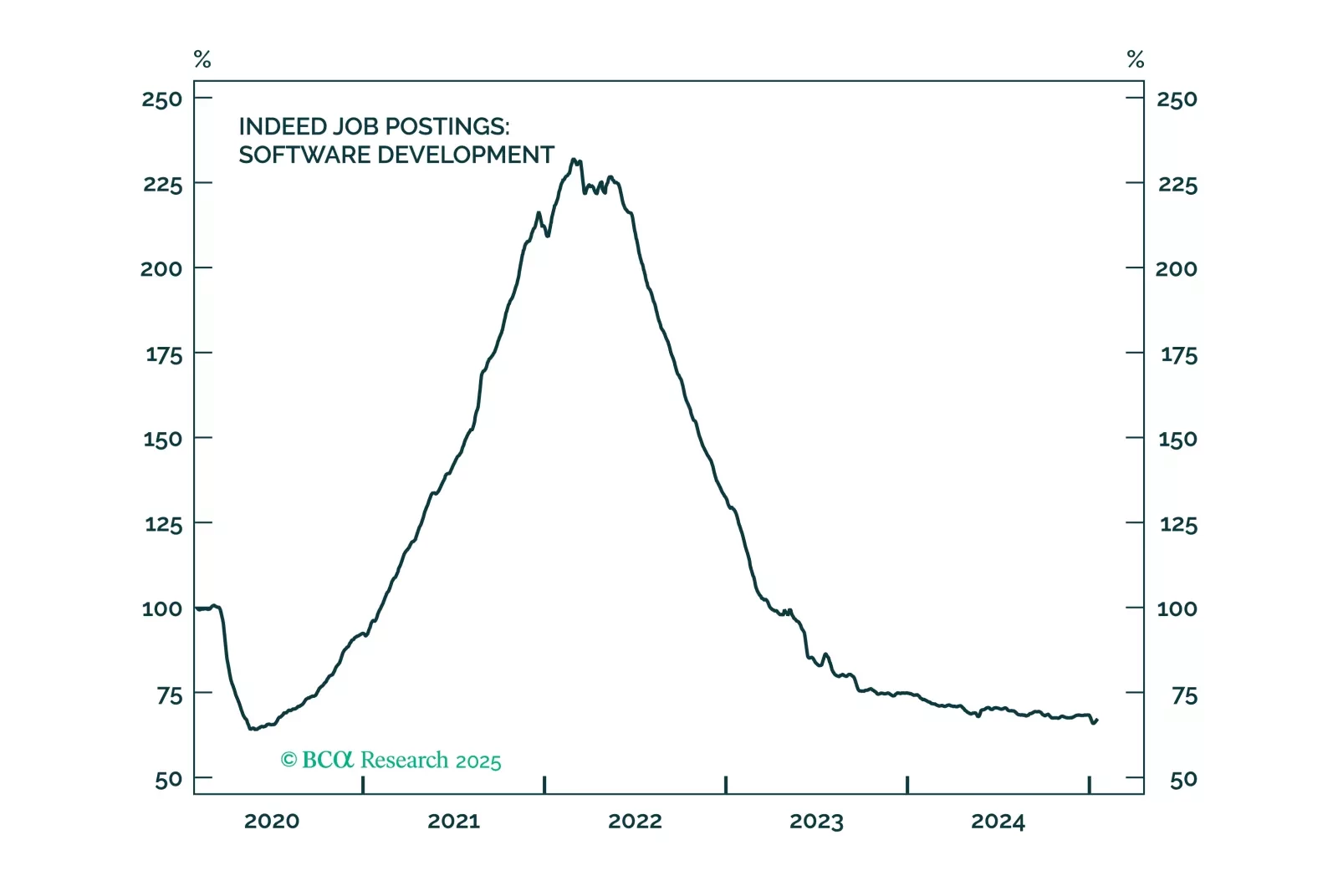

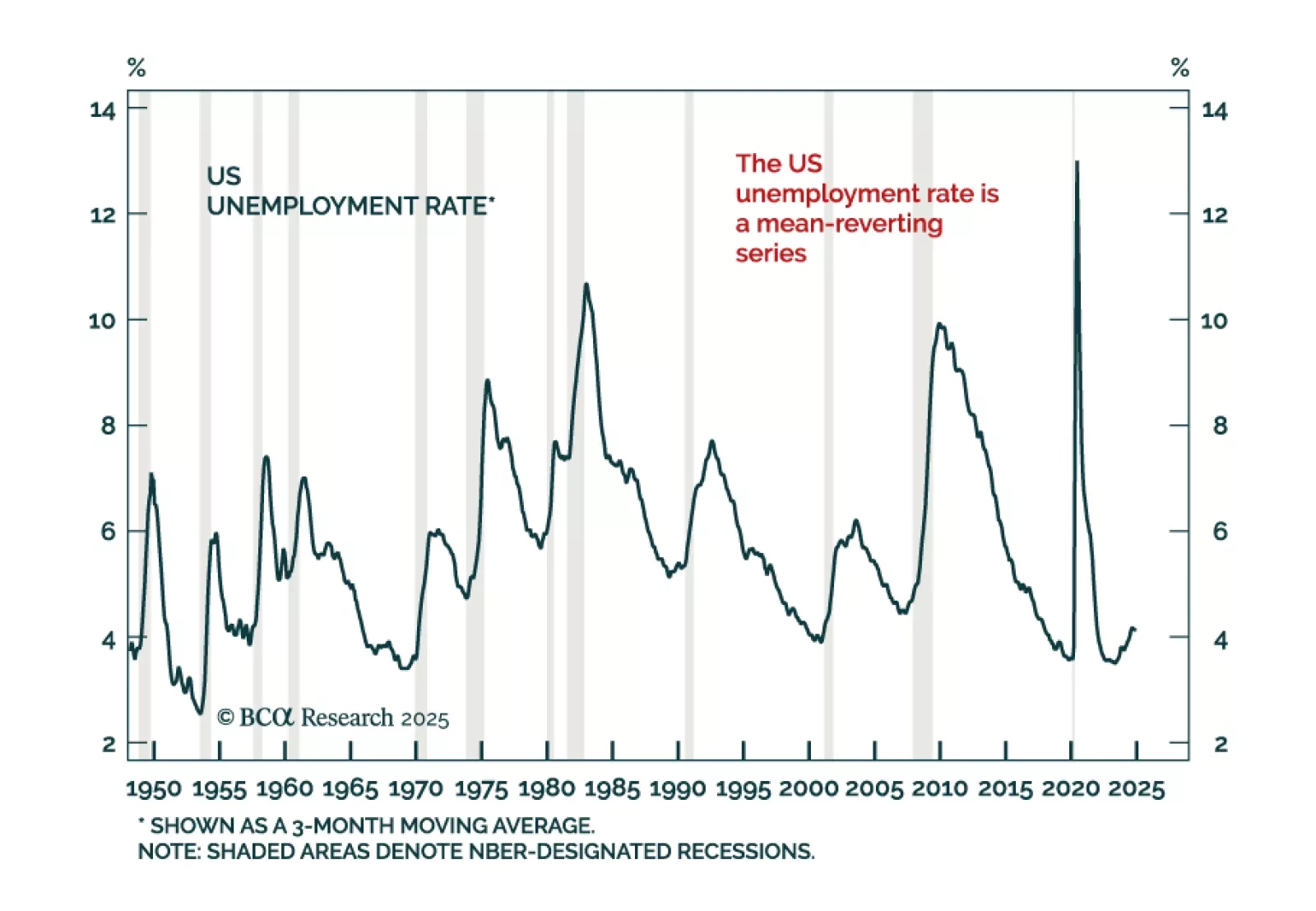

We were stopped out of our defensive asset allocation recommendations last Thursday, when the S&P 500 closed above 6,100, but our reading of the labor market tea leaves still supports a bearish fundamental view.

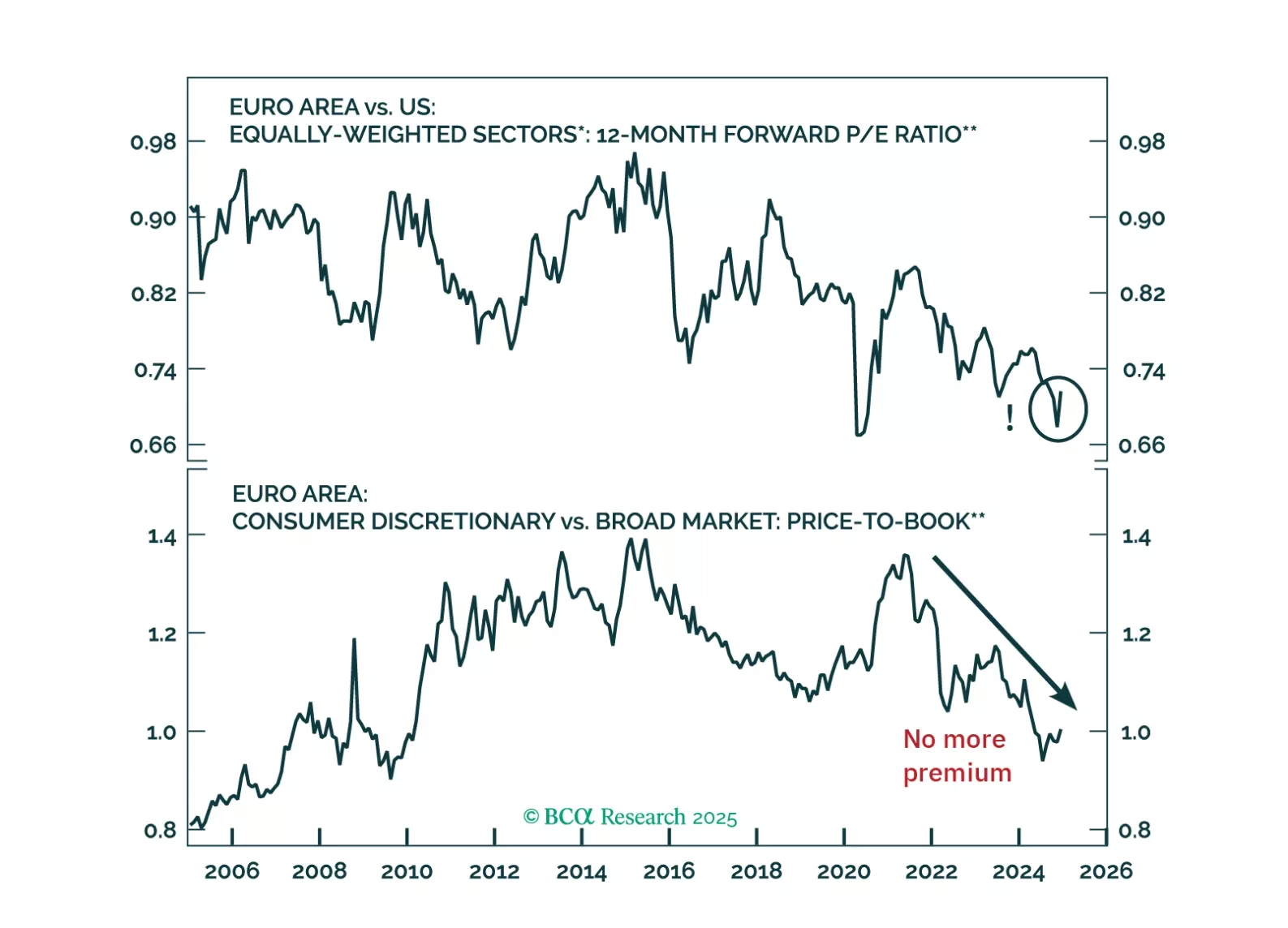

Global risk assets are engulfed in a wave of euphoria, which is pulling Europe higher along the way. However, risks still abound. How should investors adjust their allocation to Europe under these highly uncertain conditions?

Our Global Investment strategists believe the US economy is in a more precarious position than investors realize. A slowdown in growth could raise unemployment, while stronger activity may heighten inflation worries. The…

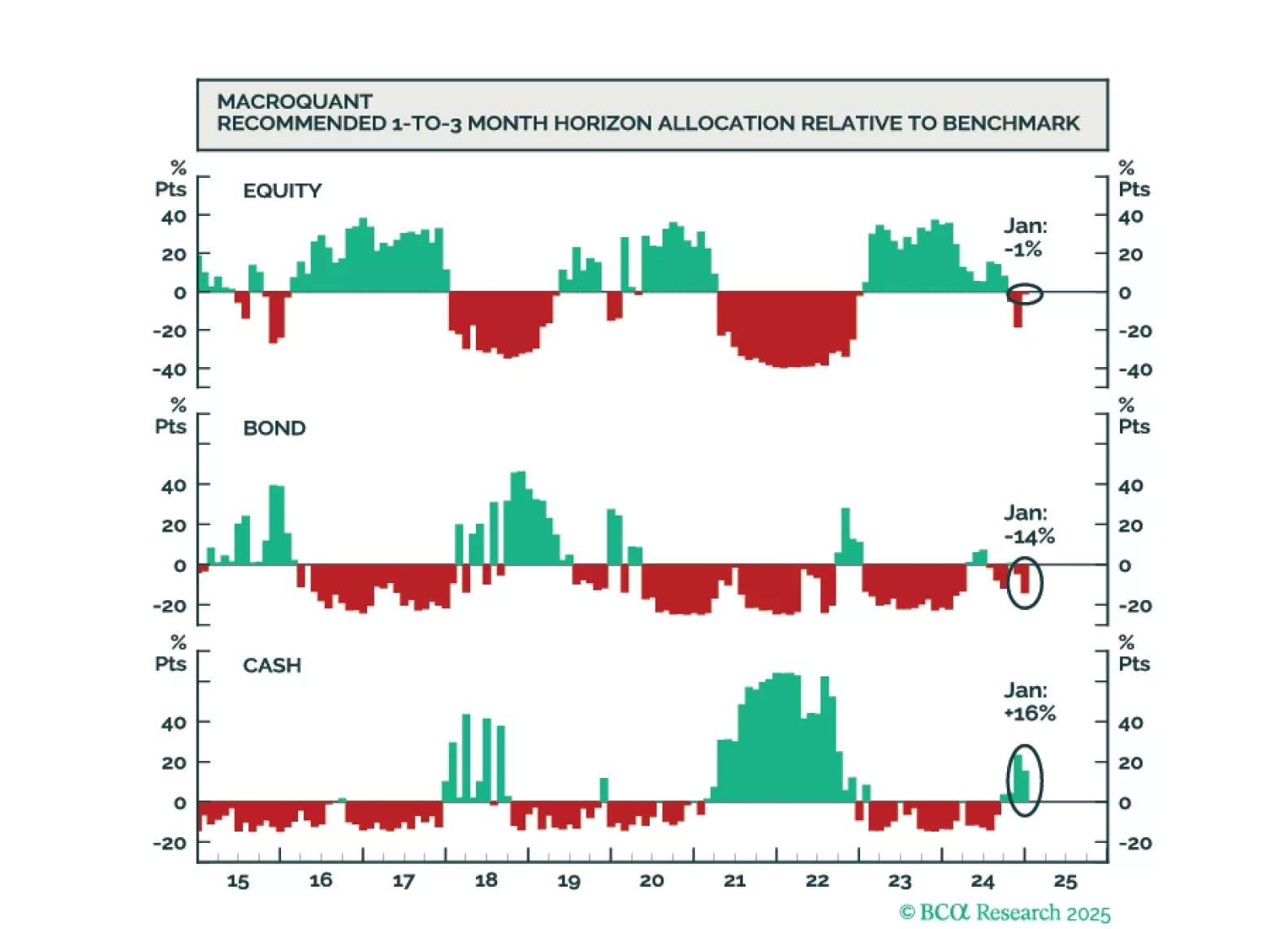

While the US economy could remain upright on the tightrope for a while longer, it will inevitably fall, leading to a major bear market in stocks. We will be looking to our MacroQuant model for guidance on when to turn fully defensive…