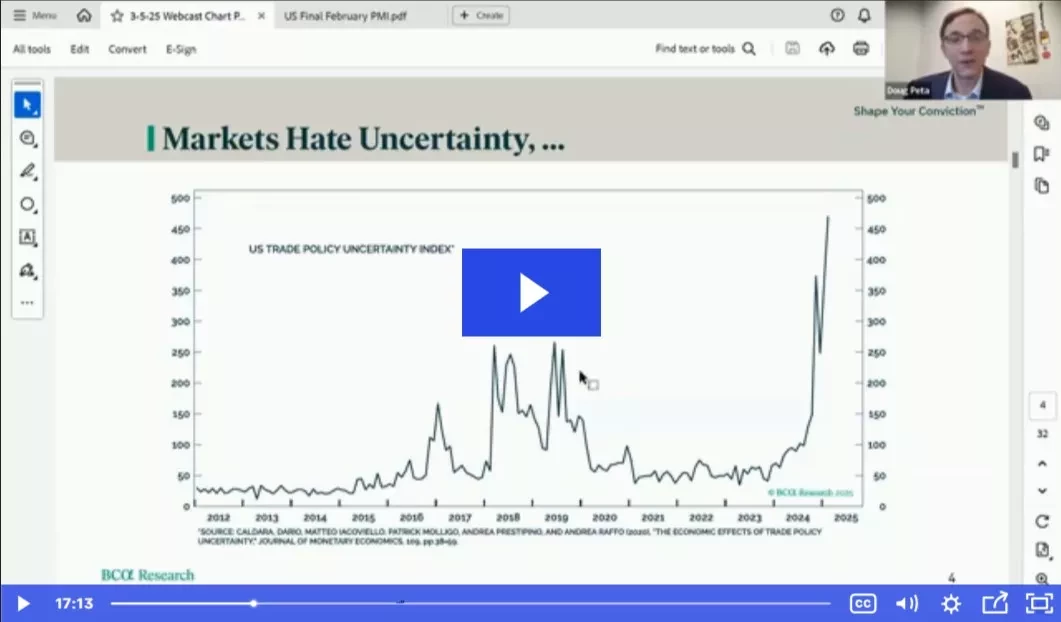

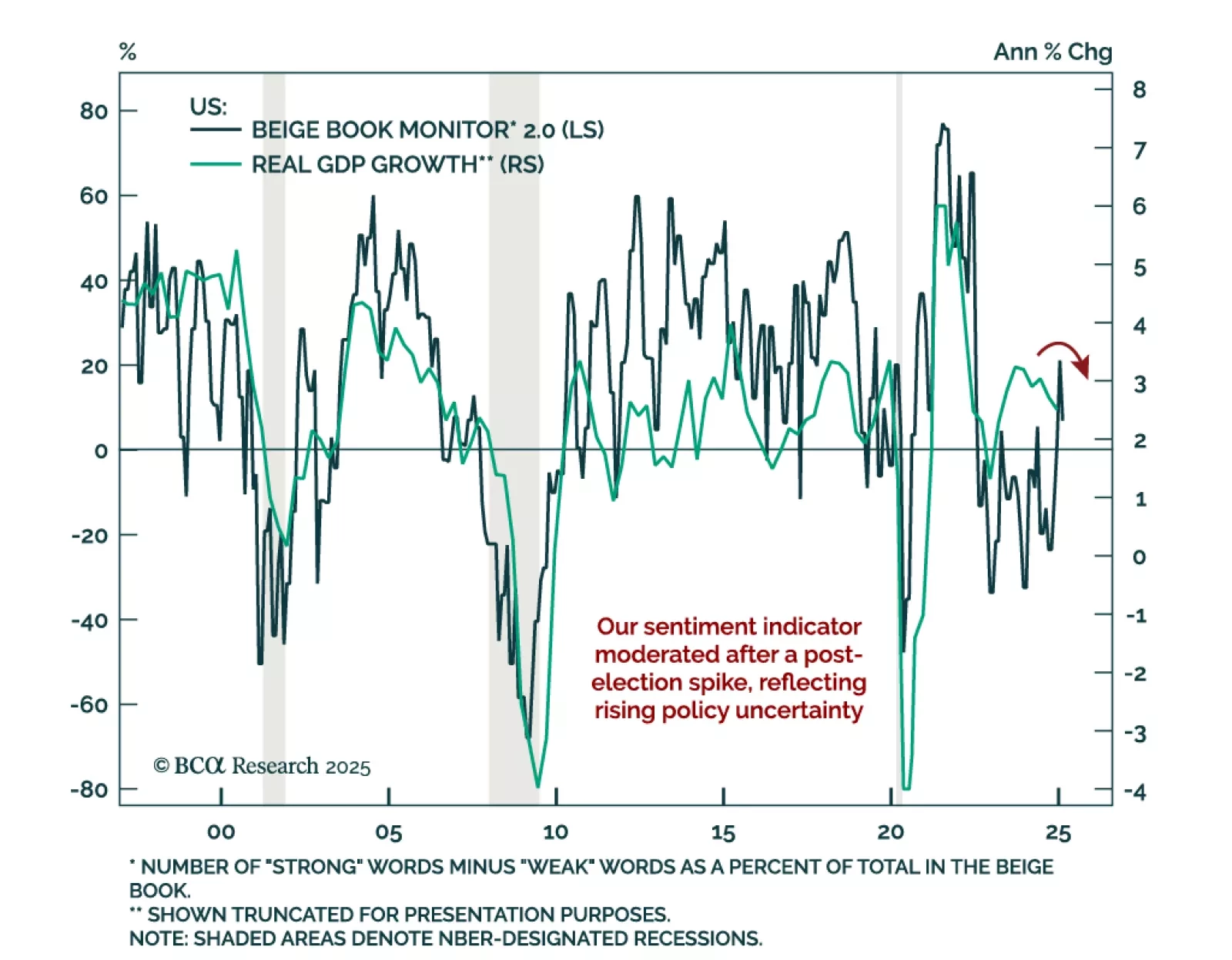

The Federal Reserve’s Beige Book shows a slowing economy, a moderating labor market, and rising price pressures. The latest Beige Book is in line with other sentiment indicators showing slower growth and decreased confidence…

Please join Doug Peta, Chief US Investment Strategist and co-author of The Bank Credit Analyst, for a Webcast on Wednesday, March 5 at 10:30 AM EST (3:30 PM GMT, 4:30 PM CET).

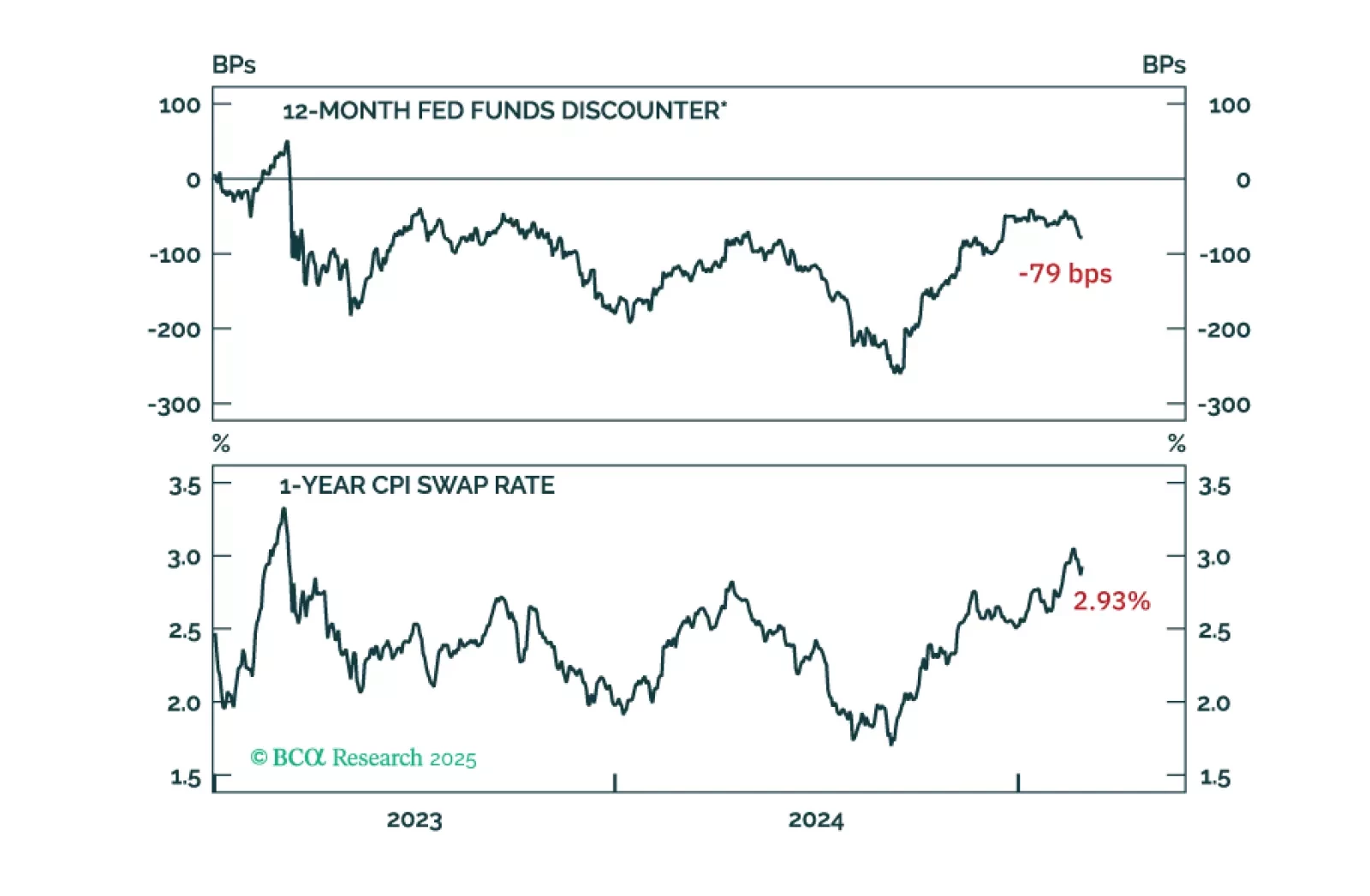

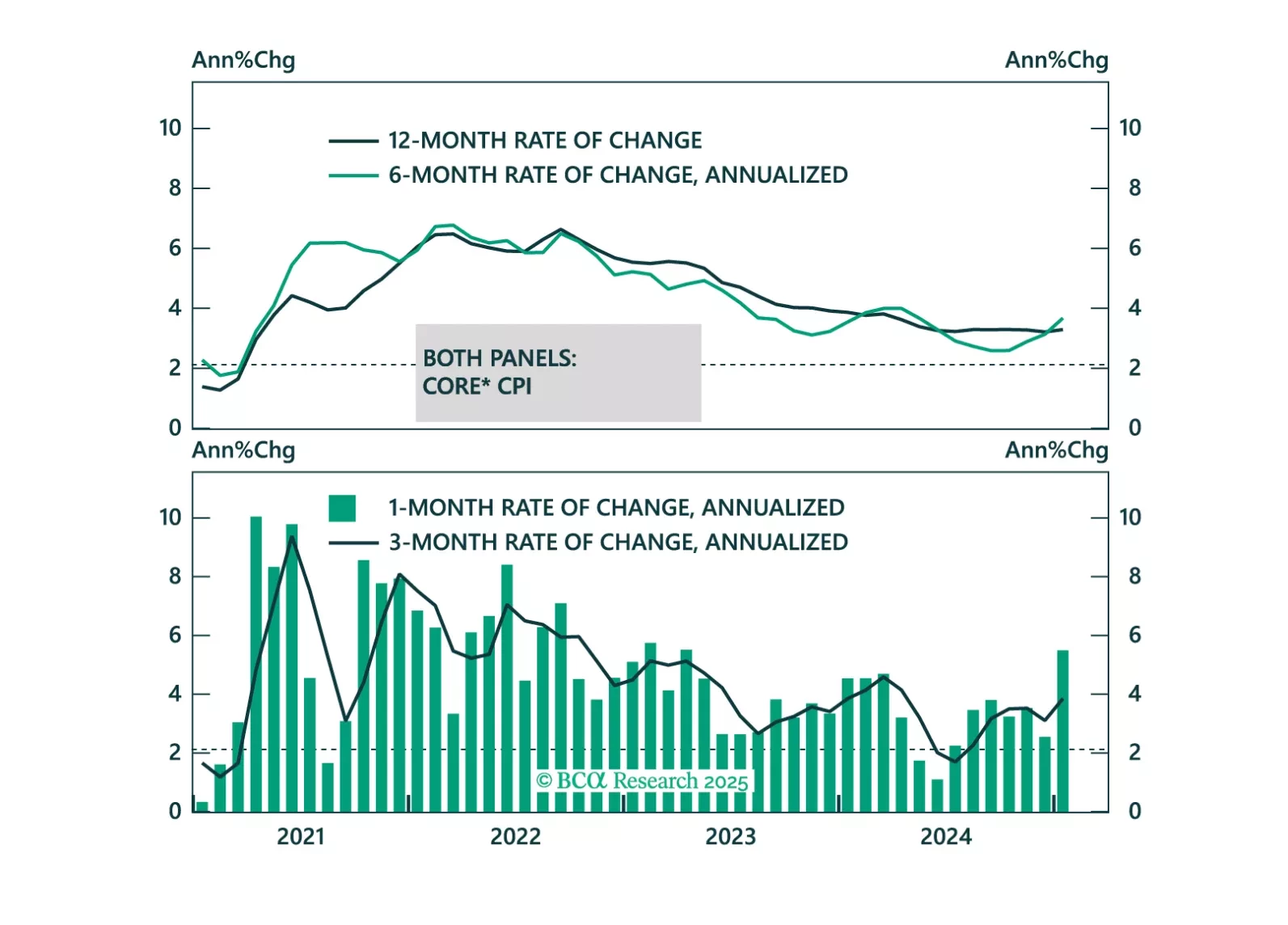

Core PCE inflation was tame this morning, but with large tariffs looming we anticipate loftier inflation readings in the months ahead.

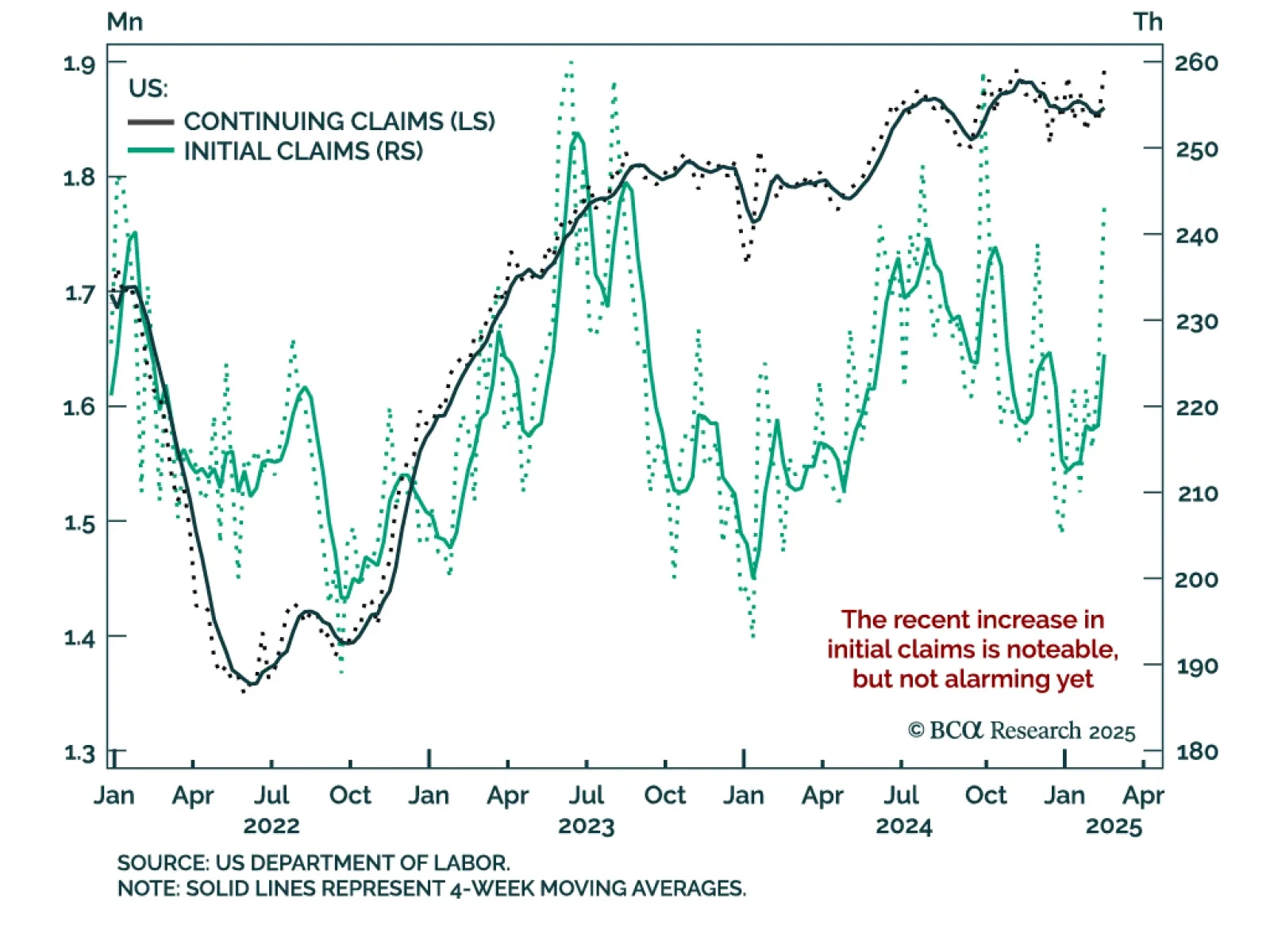

Weekly initial claims ticked up to 242k, near 2024 highs. The data is under the spotlight as the Trump administration implements a reduction of the federal workforce through the DOGE. Initial claims are not alarming yet; they…

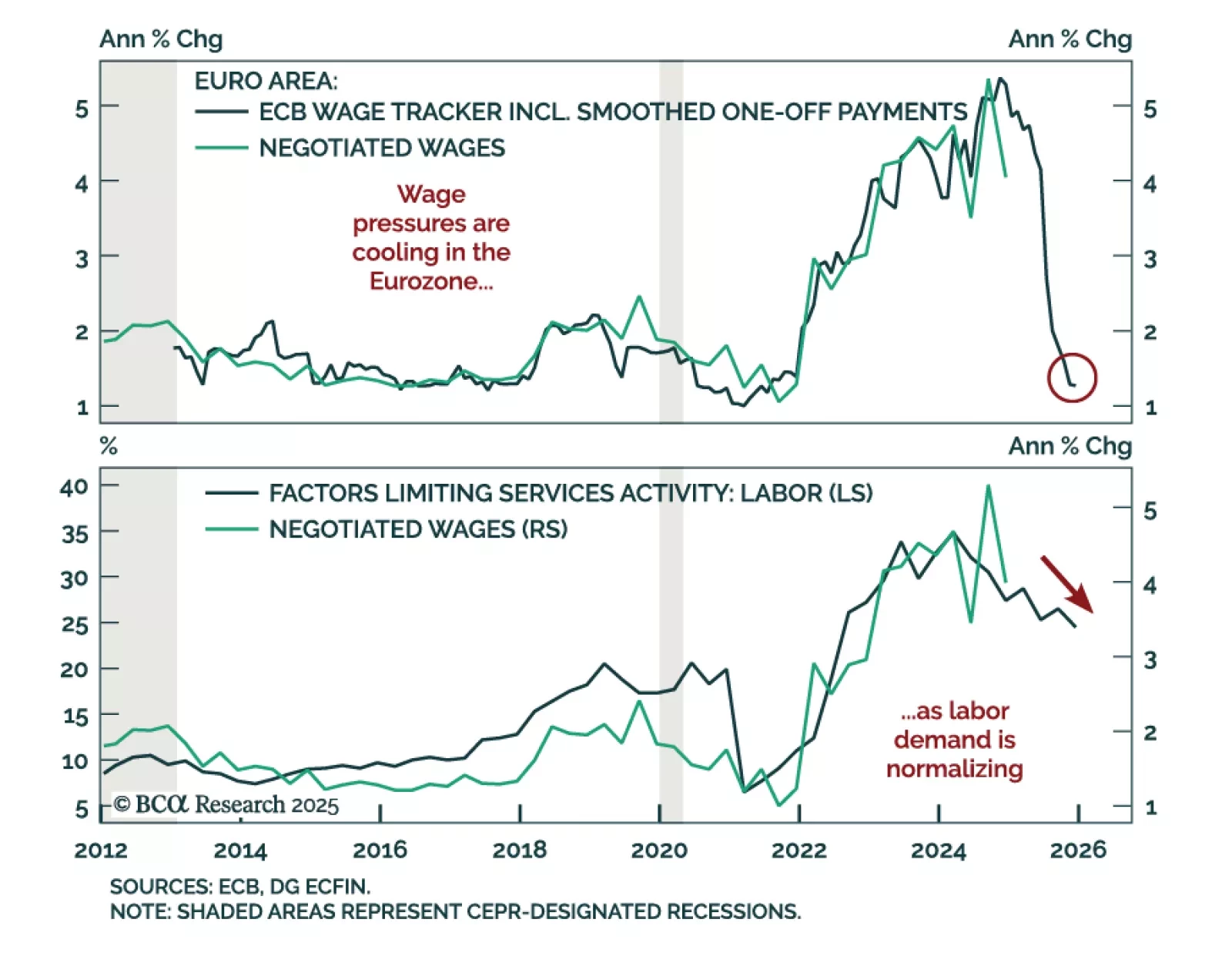

Fourth-quarter European negotiated wages growth cooled to 4.1% y/y, down from the 5.4% peak seen in Q3. The cooling is in line with the ECB’s Wage Tracker showing wage growth decelerating to 1.3% by the end of the year. Labor…

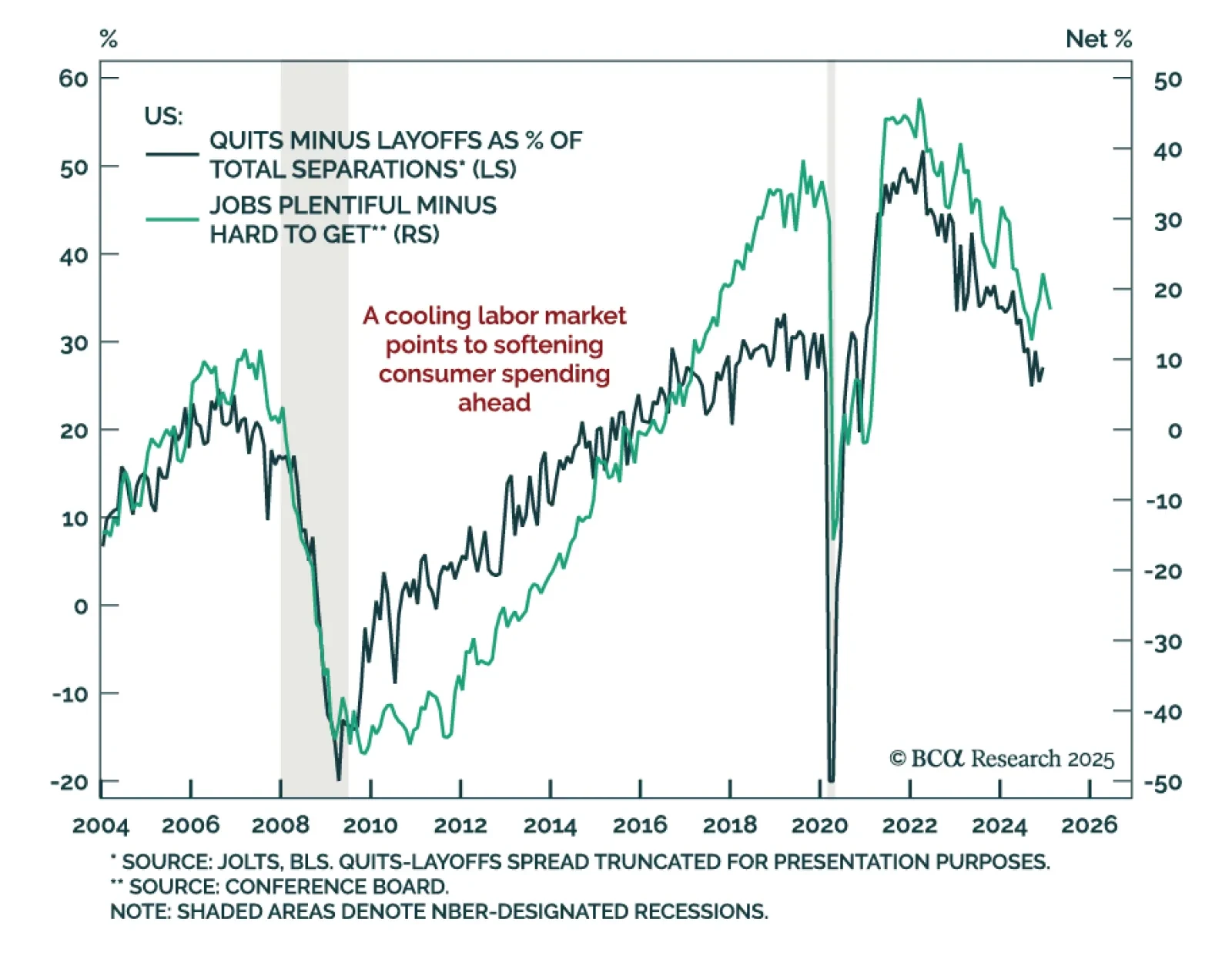

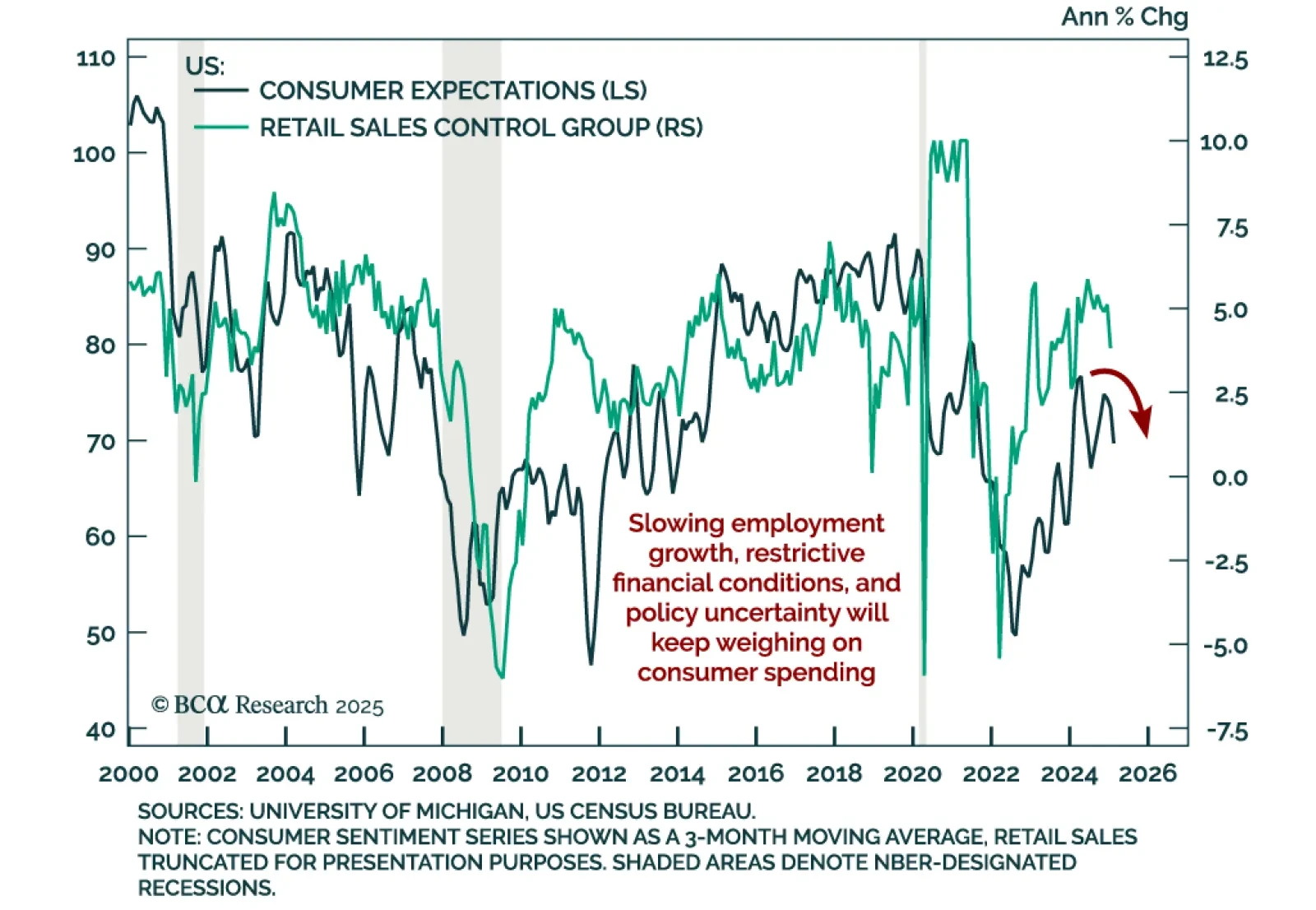

The February Conference Board Consumer Confidence index missed estimates for the third month in a row, falling to 98.3 from 105.3. Consumers’ assessment of both their current situation and their expectations worsened, with the latter…

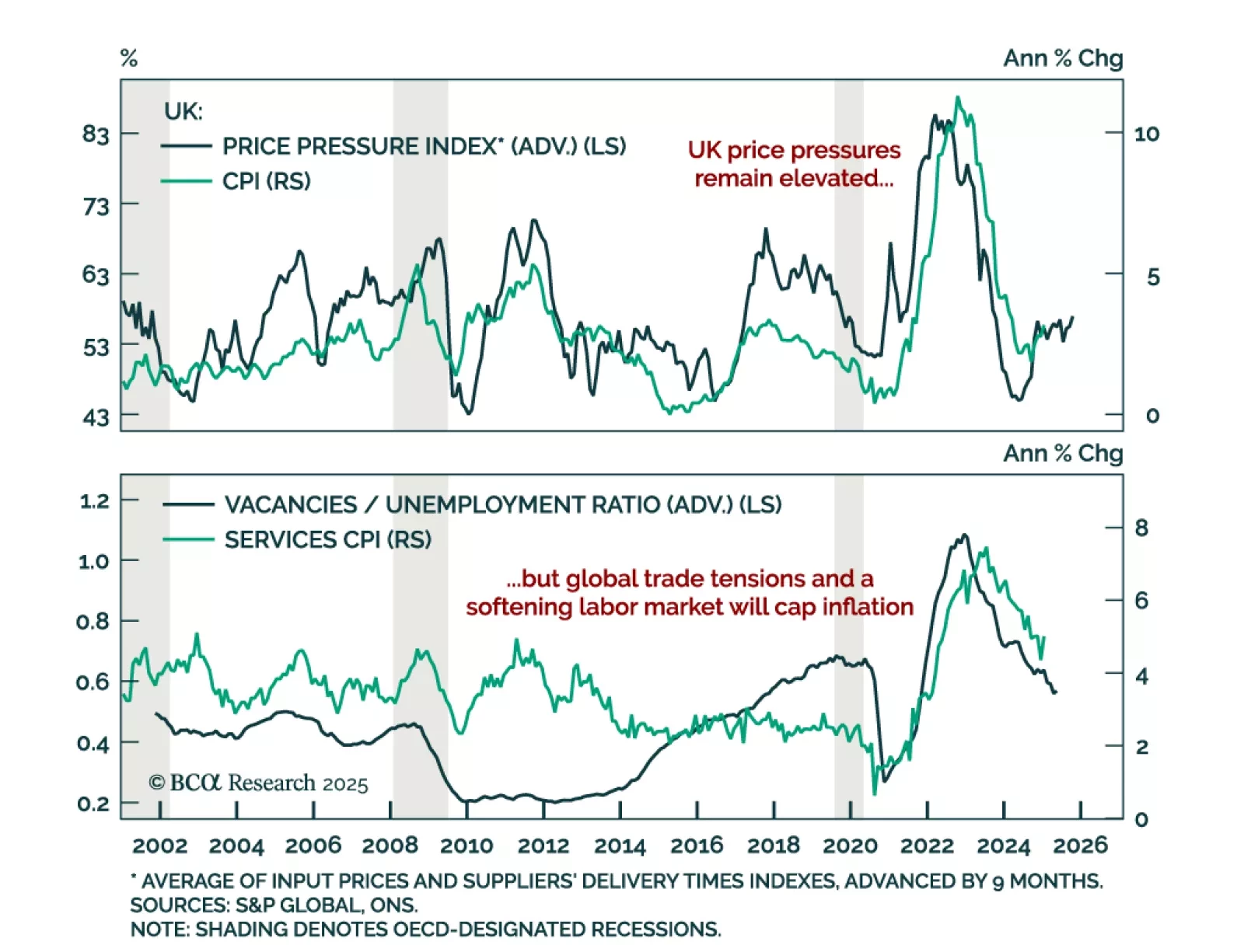

The January UK CPI was slightly hotter than expected. Headline inflation beat estimates, rising to 3.0% y/y from 2.5% in December. Core inflation also jumped but was in line with expectations at 3.7%. Services were strong, albeit…

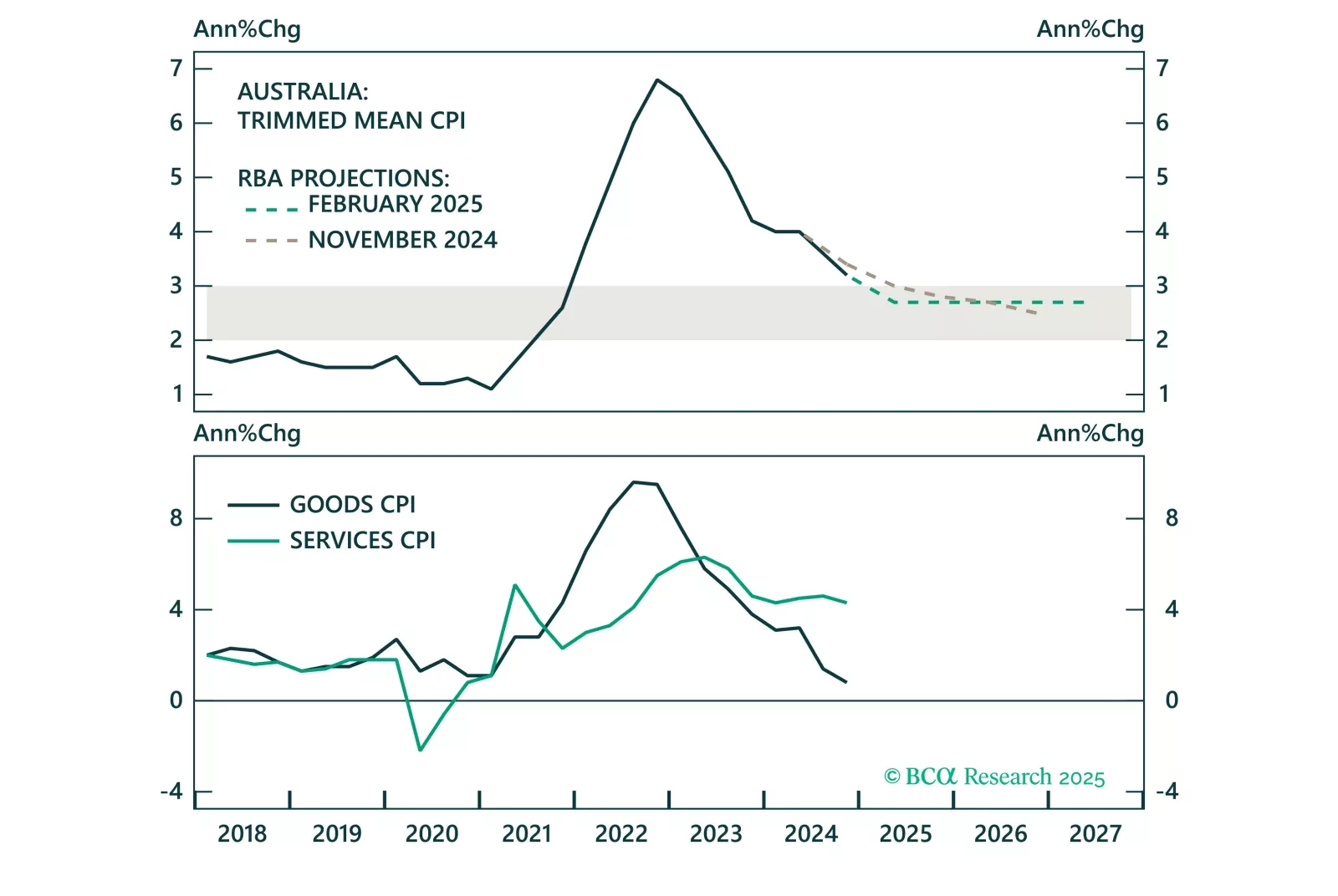

Overnight, the RBA cut the cash target rate for the first time since 2022, marking the beginning of the policy easing cycle in Australia. However, the RBA will proceed cautiously with further rate cuts, given a tight labor market and…

January US retail sales missed estimates, with the headline number contracting by 0.9% m/m. The decline was broad-based, with spending excluding autos and gas down 0.5%, and the control group also down 0.8%. The retail sales…

Some thoughts on this morning’s CPI report and its implications for the Fed and Treasury yields.