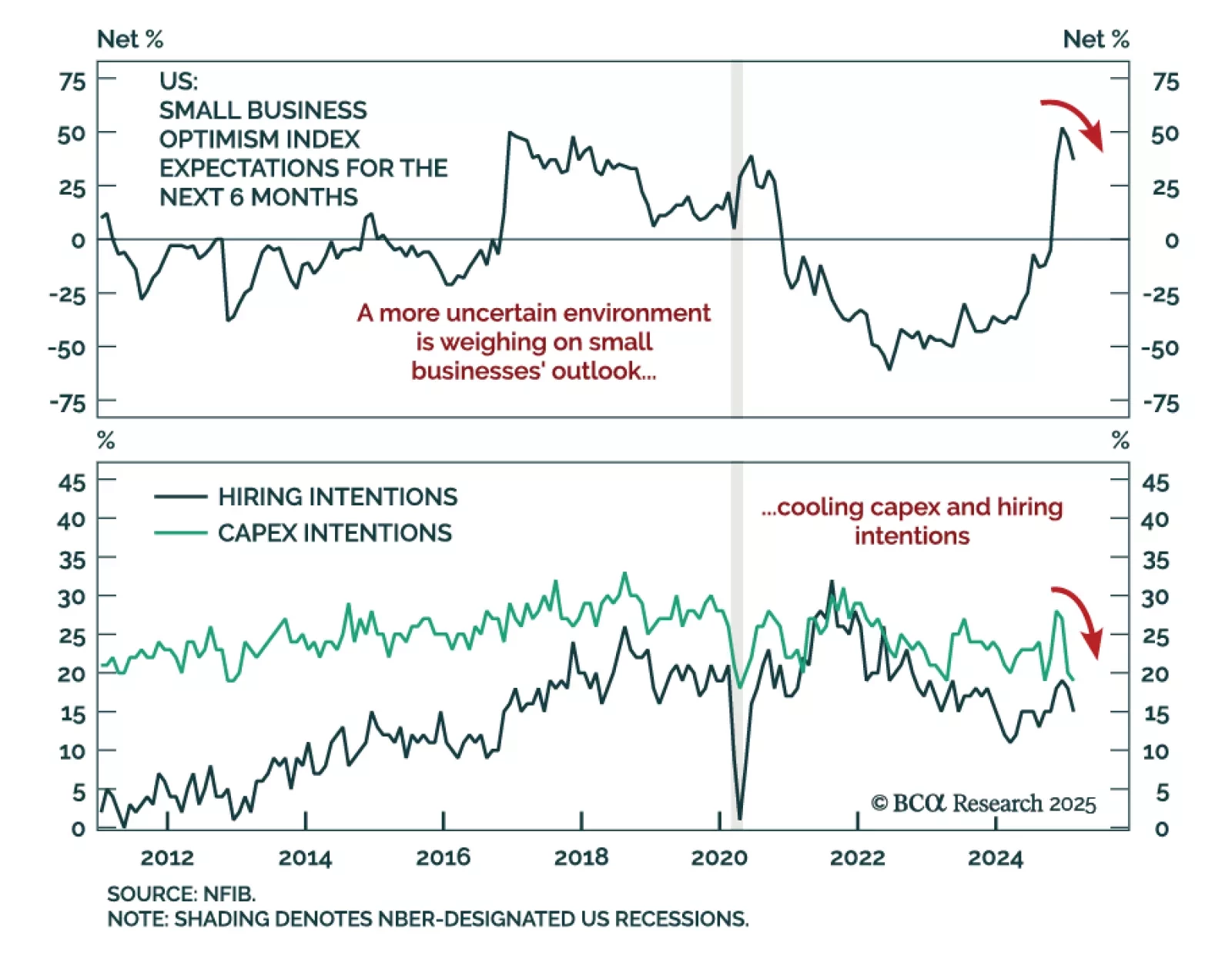

The February NFIB Small Business Optimism index decreased more than expected to 100.7 from 102.8. The decline extends the reversal seen since the November US election as policy optimism yields to uncertainty. The signal from the…

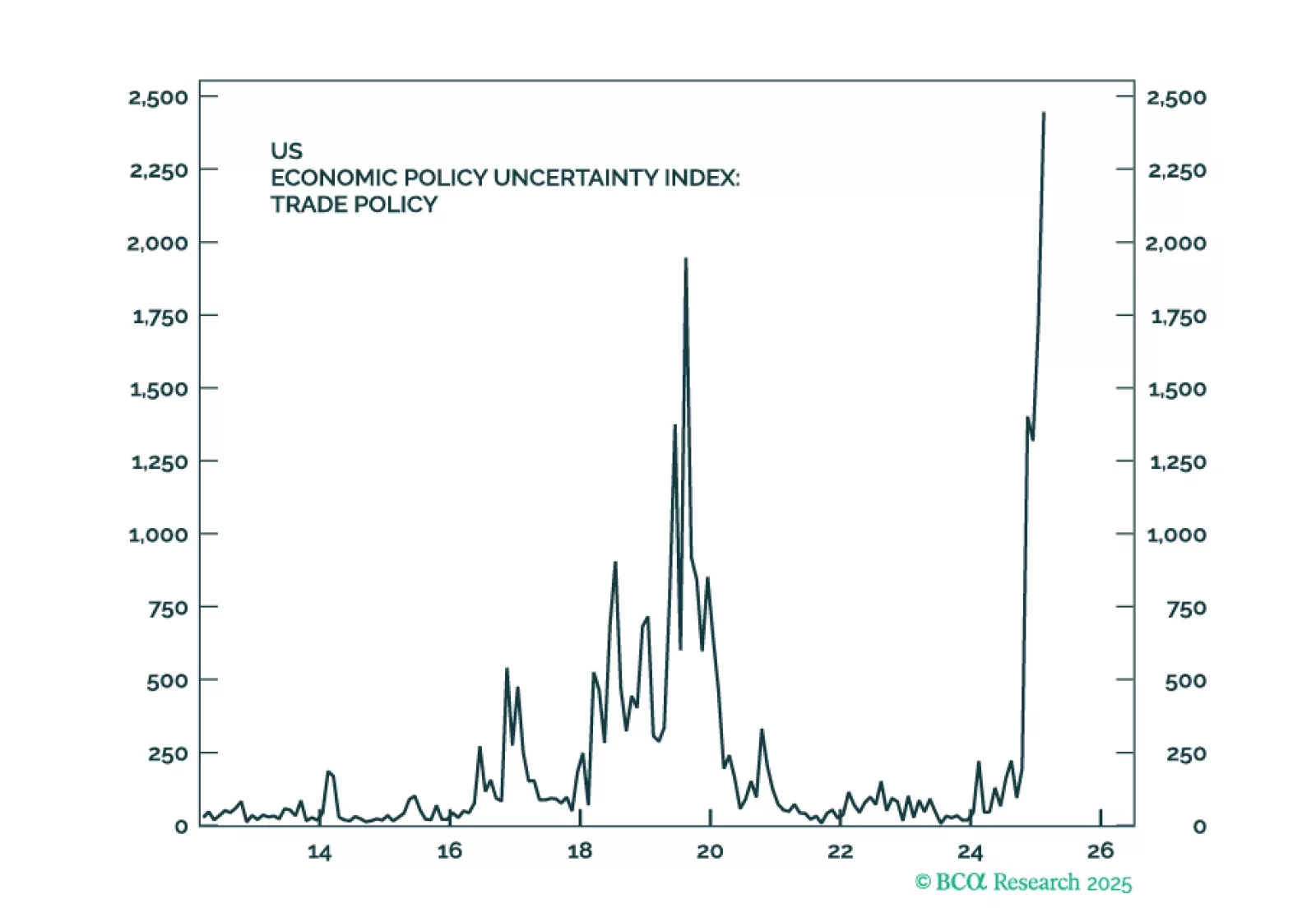

Although there may be a method to DOGE’s 100-mile-an-hour madness, we think the worries and uncertainty stoked by it and on-again, off-again tariff measures have increased the probability of a recession while bringing forward its…

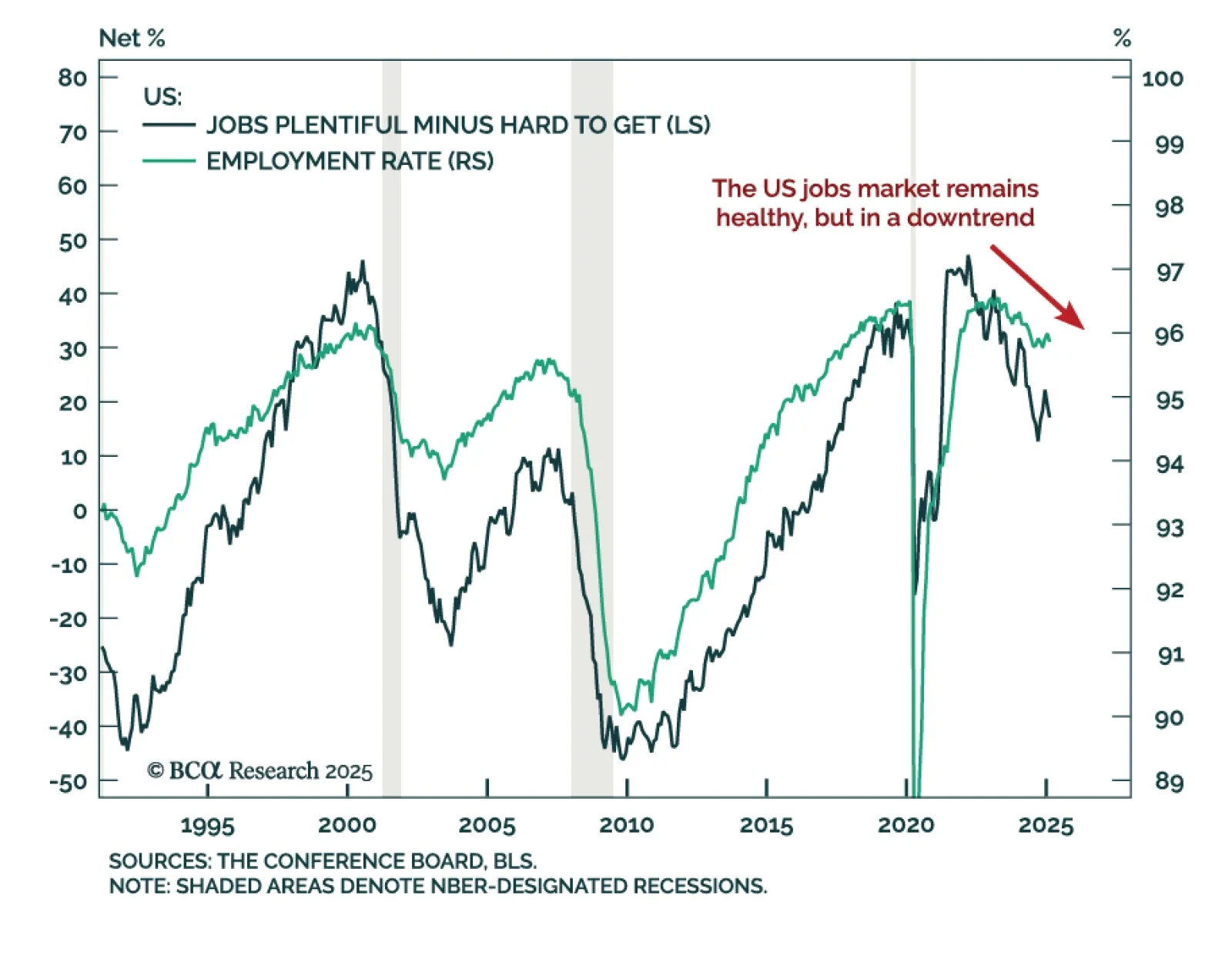

The February US jobs report was slightly weaker than expected, reflecting a slowing but still healthy labor market. At 151k, payrolls missed estimates. January’s number was revised down from 143k to 125k, bringing the 3-month moving…

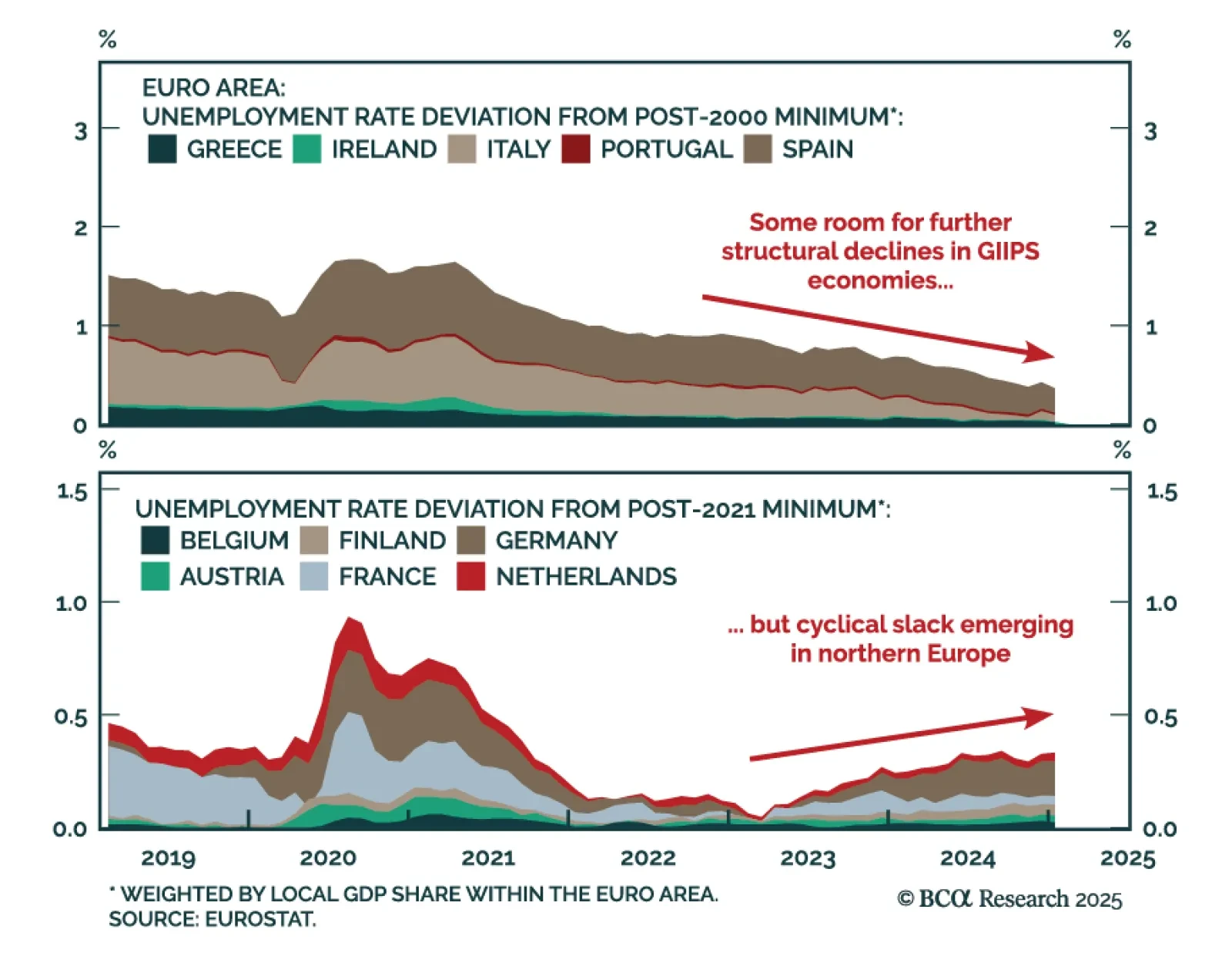

Our Chart Of The Week comes from Robert Timper, strategist in our Global Fixed Income strategy team. Robert digs into Eurozone employment dynamics. January data showed that unemployment remains at record lows, but regional…

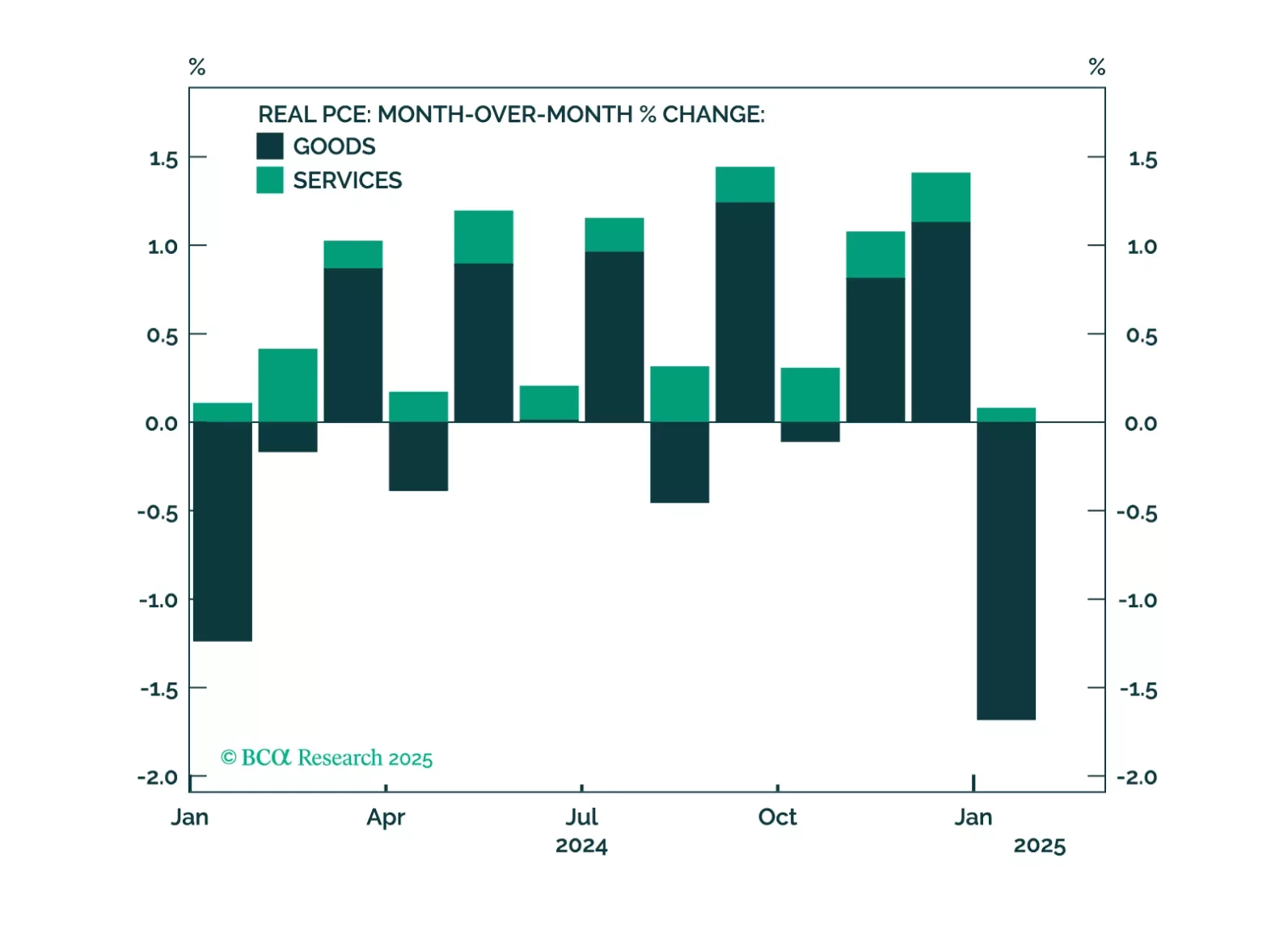

This morning’s employment report showed solid job growth, but recent consumer spending indicators are more concerning. The risk of recession starting within the next few months has increased. We suggest some important indicators for…

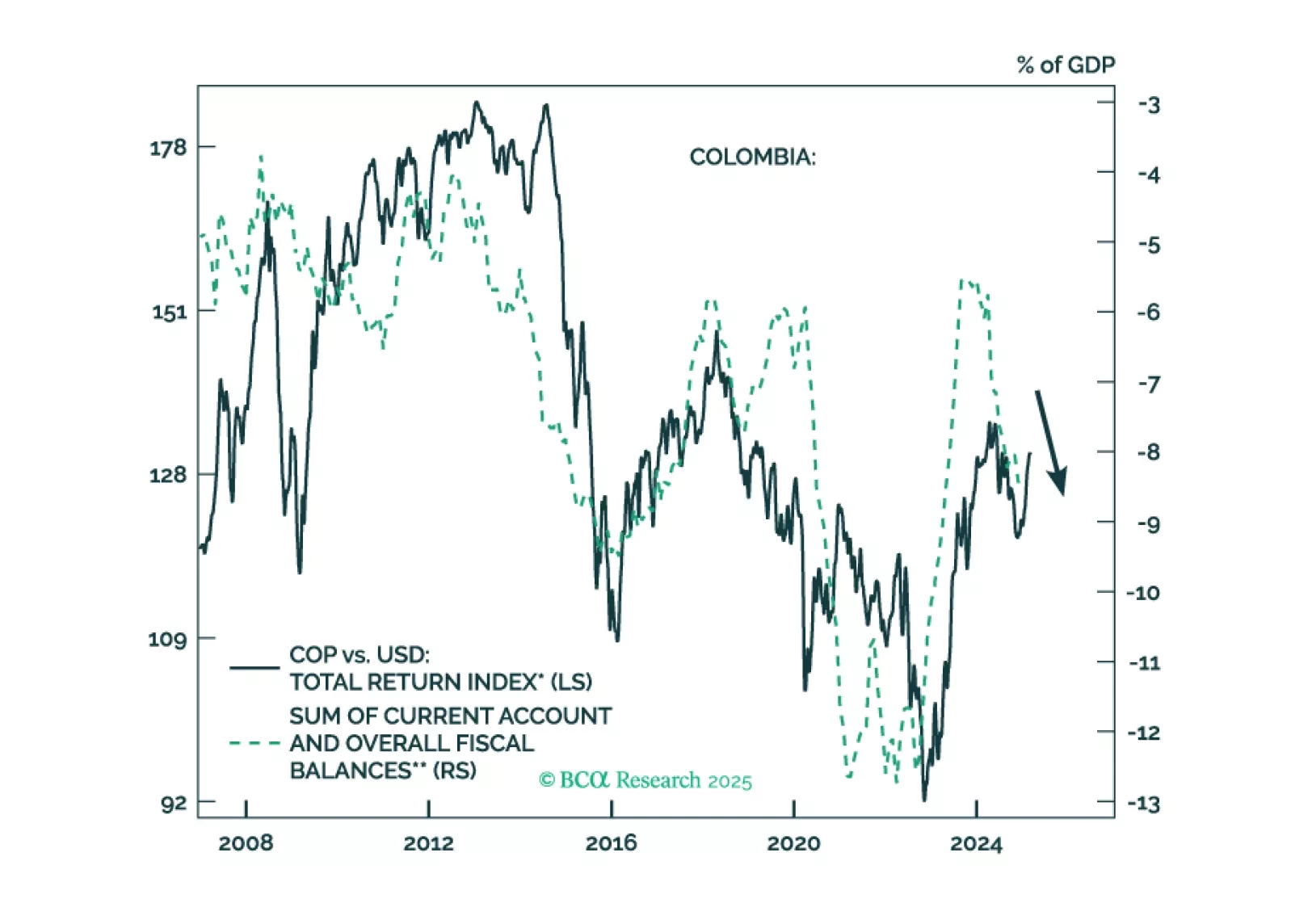

Colombian financial markets have rallied on the expectation that a right-wing government will be elected in 2026. We take a contrarian bearish stance on the nation's financial markets. Colombia is suffering from two…

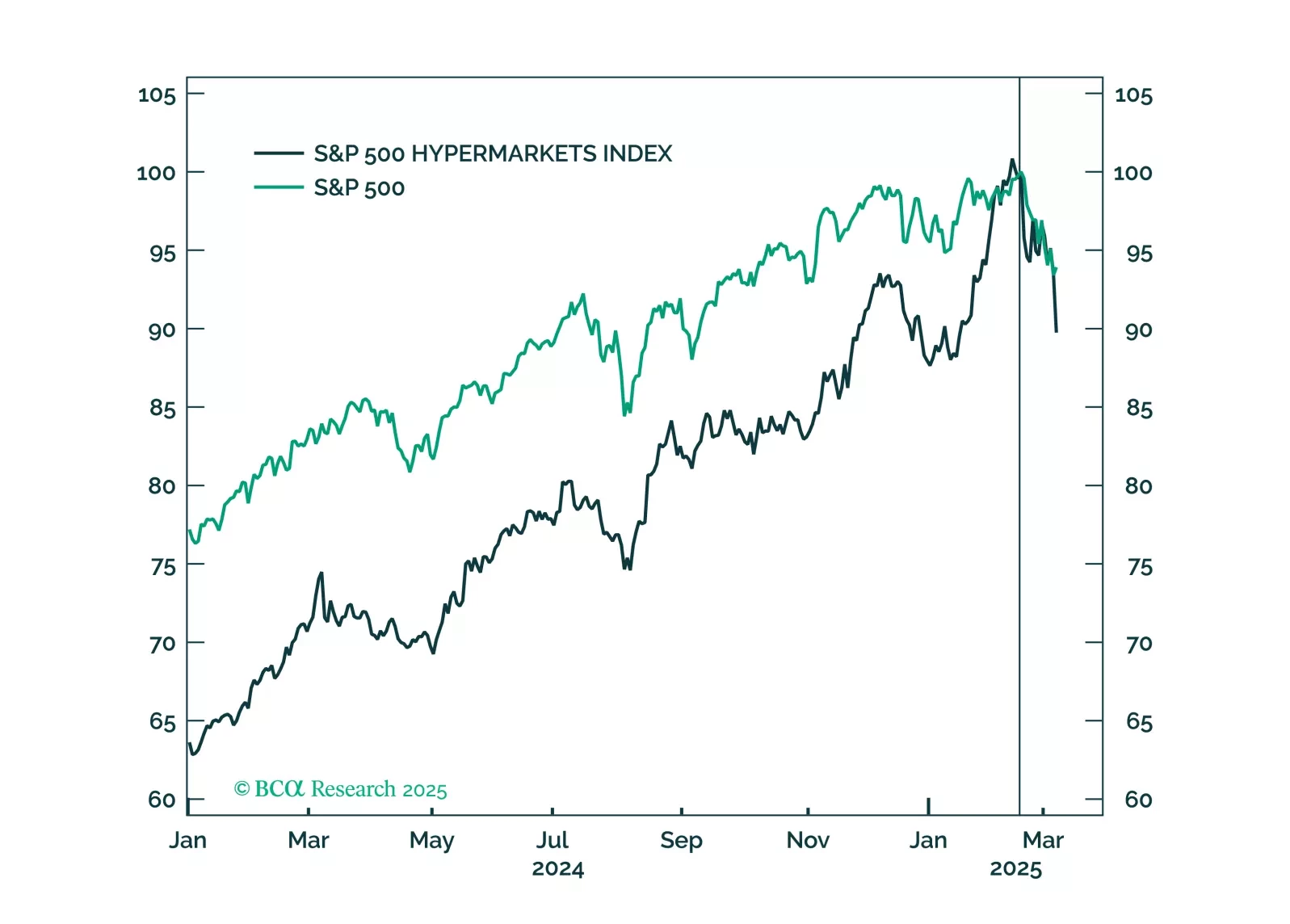

The US economy is set to enter a recession within the next few months. Stay underweight equities and overweight cash. Look to increase fixed-income duration exposure over the coming months. The euro is likely to strengthen and…

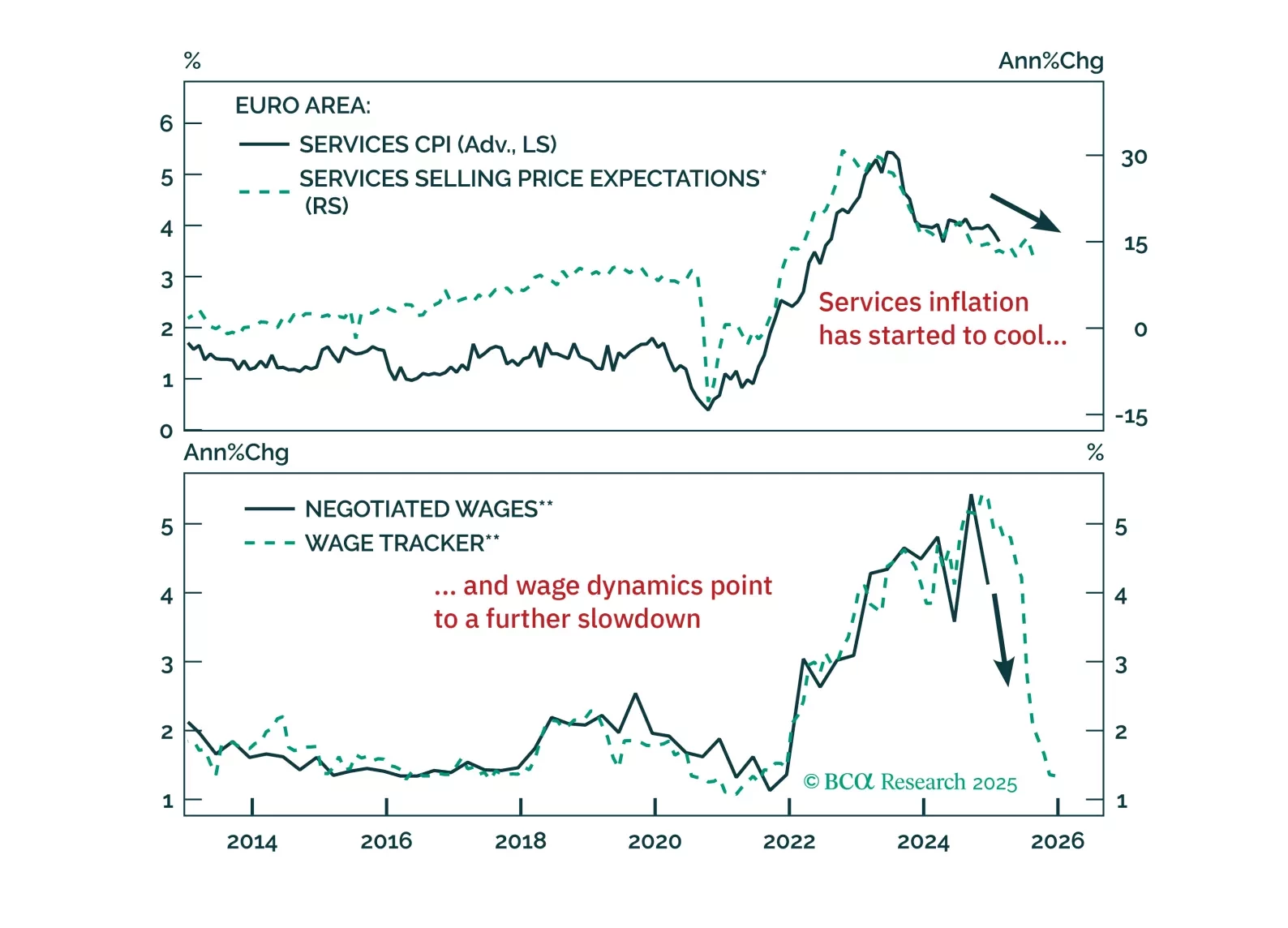

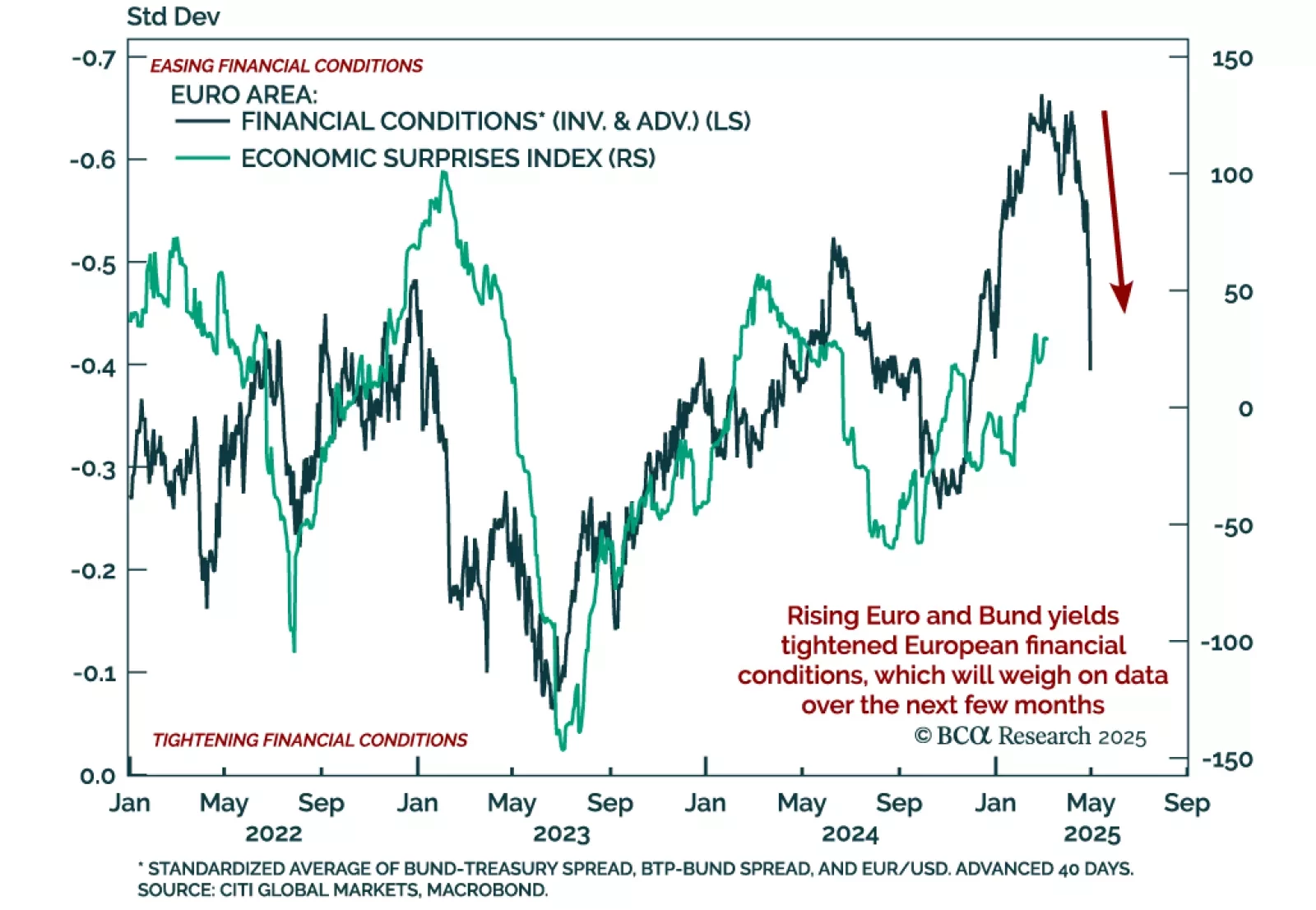

The ECB cut 25 bps as expected, bringing the deposit facility rate to 2.5%. President Lagarde reiterated the disinflationary process is “well on track” and described the policy stance as “meaningfully less restrictive”, signalling…

The ECB cut rates as expected, but rising yields and a stronger euro are tightening financial conditions just as fiscal policy shifts the macro landscape. With more rate cuts ahead and market positioning stretched, we outline the key…

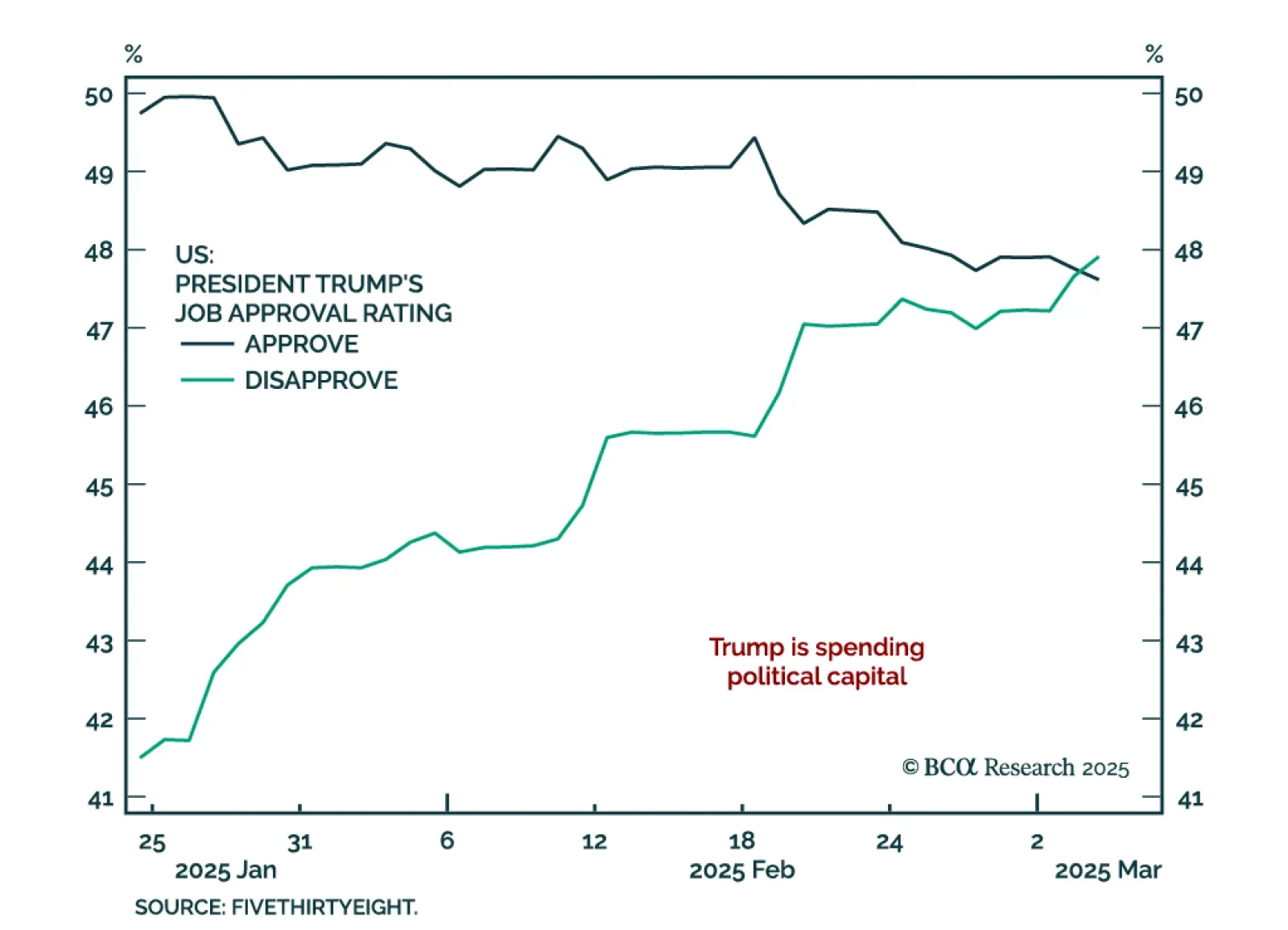

In light of President Trump’s address to Congress and the ebb-and-flow of tariff announcements, our Geopolitical strategists assessed the constraints on the administration’s disruptive agenda. Trump’s ability to implement his…