We reiterate our defensive global asset allocation, as risk assets face an asymmetric outlook whether growth slows or re-accelerates. The March US jobs report came in stronger than expected, with payrolls rising by 228k. However, the…

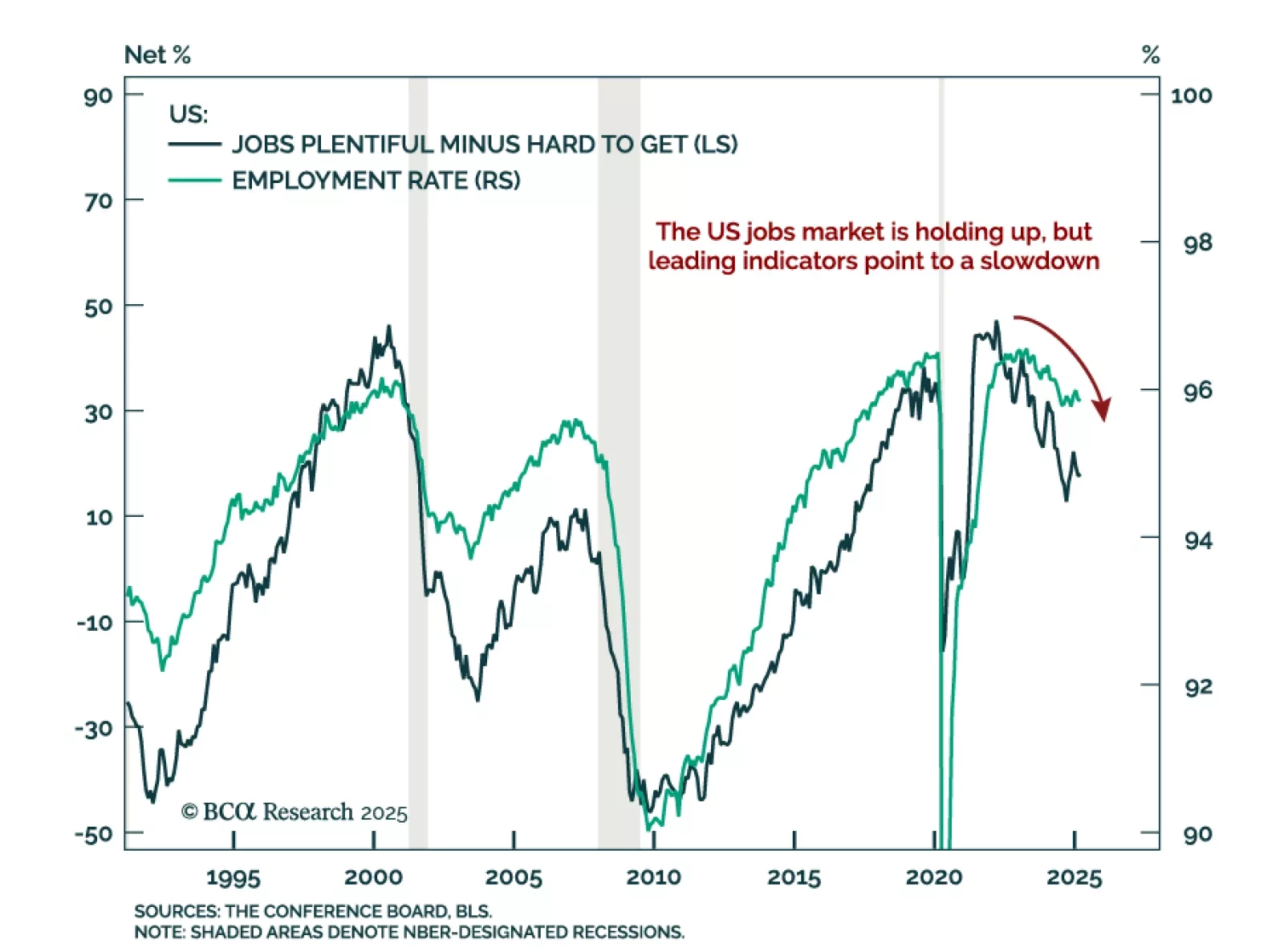

The March employment report showed strong job growth, but the labor market remains in a fragile state and the demand shock from tariffs could be the catalyst that tips it over the edge into recession.

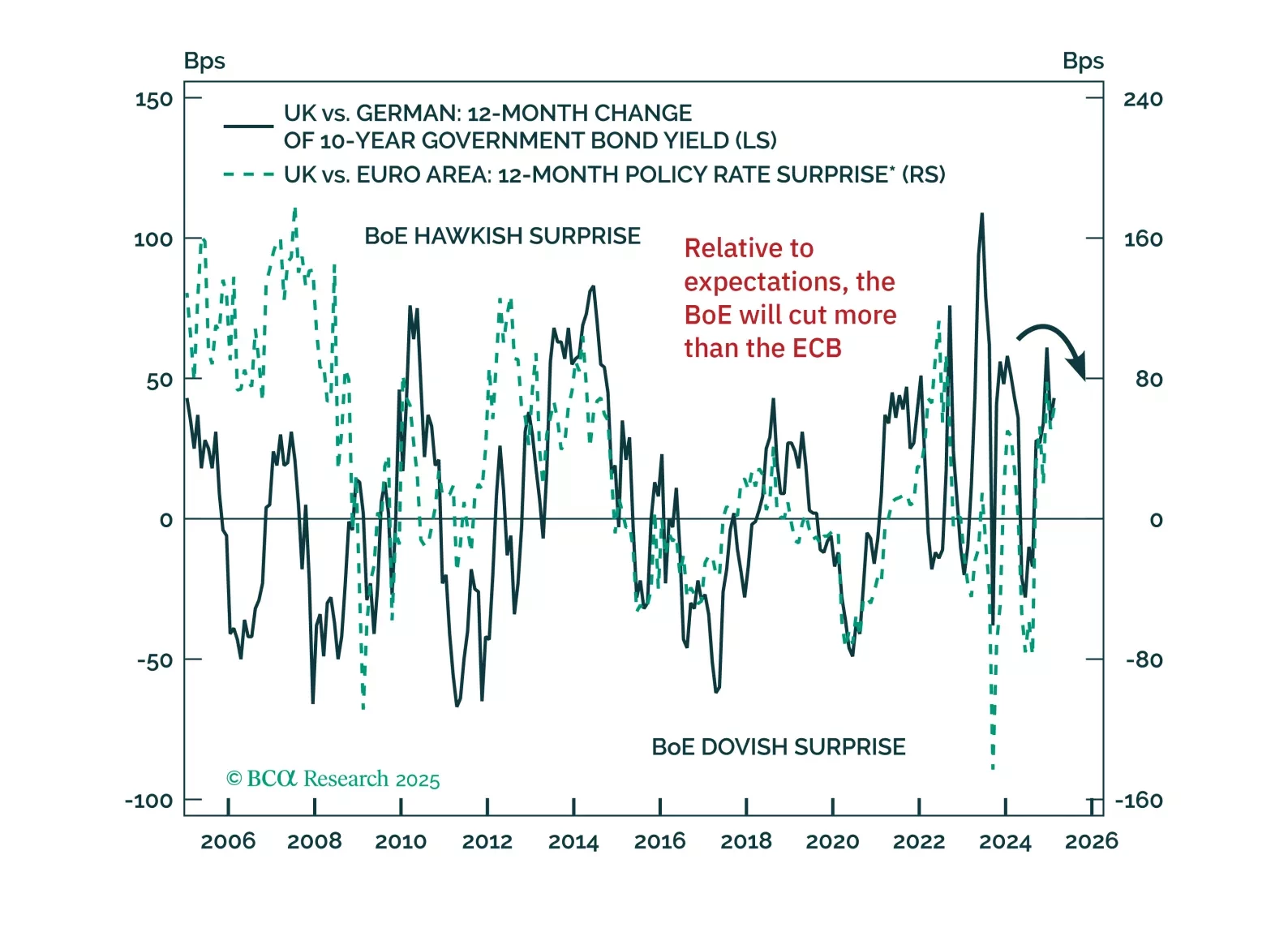

With economic headwinds building and fiscal dynamics shifting, bond markets are at a turning point. Our latest note outlines why German bund yields are set to decline and why UK gilts are poised to outperform — and how to position…

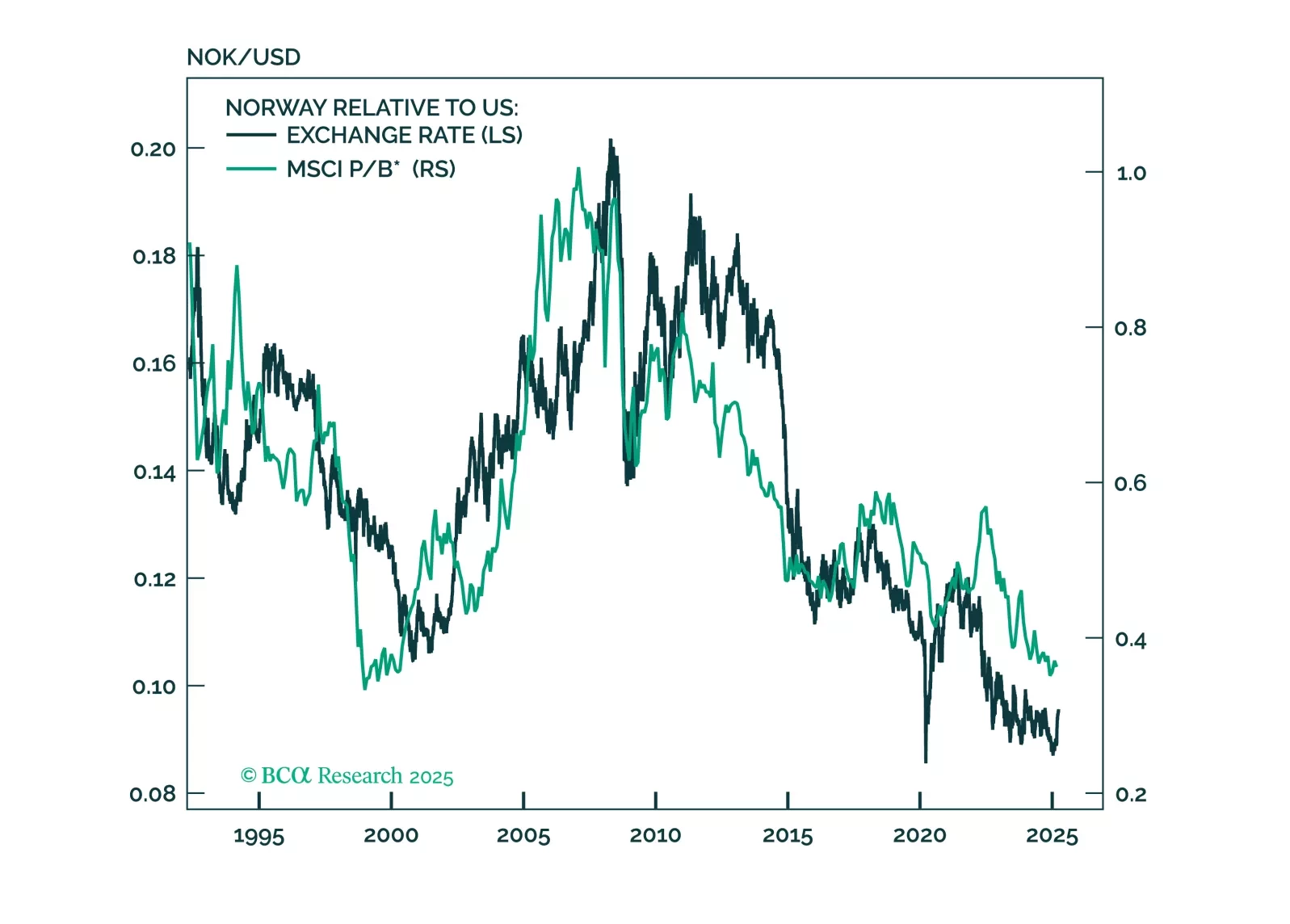

This report looks at investment implications, for Norwegian assets, given the recent meeting, from the Norges Bank.

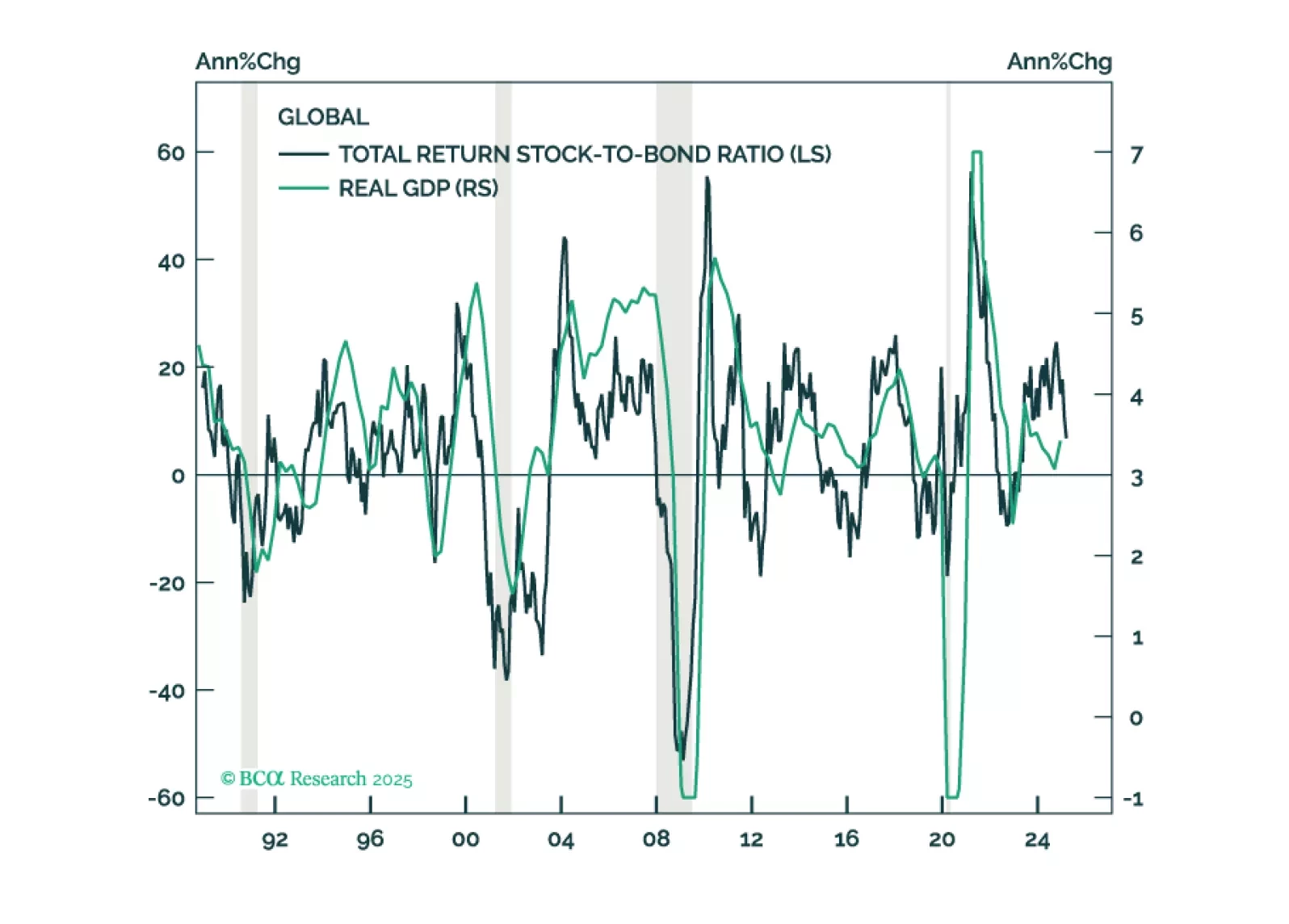

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

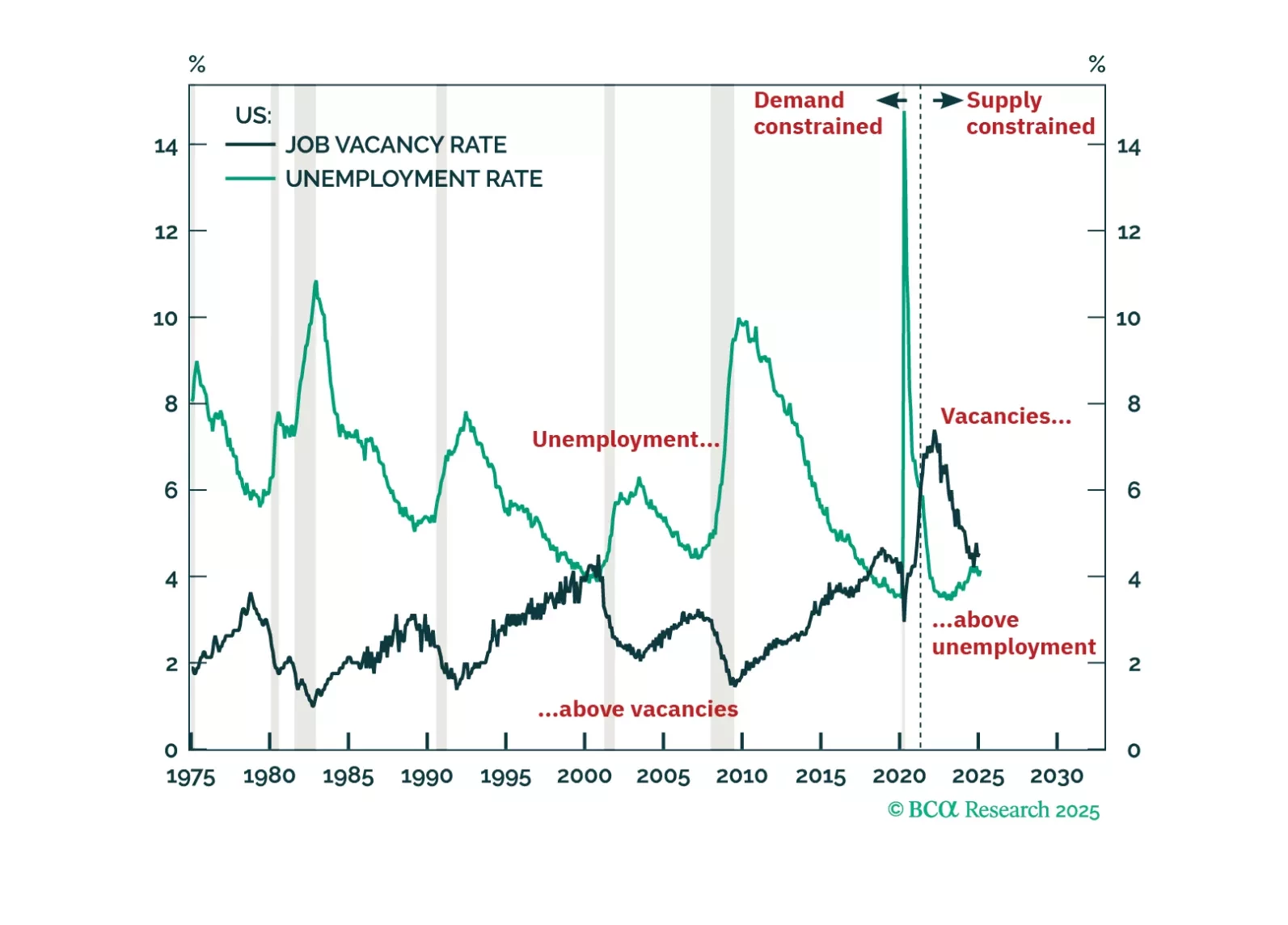

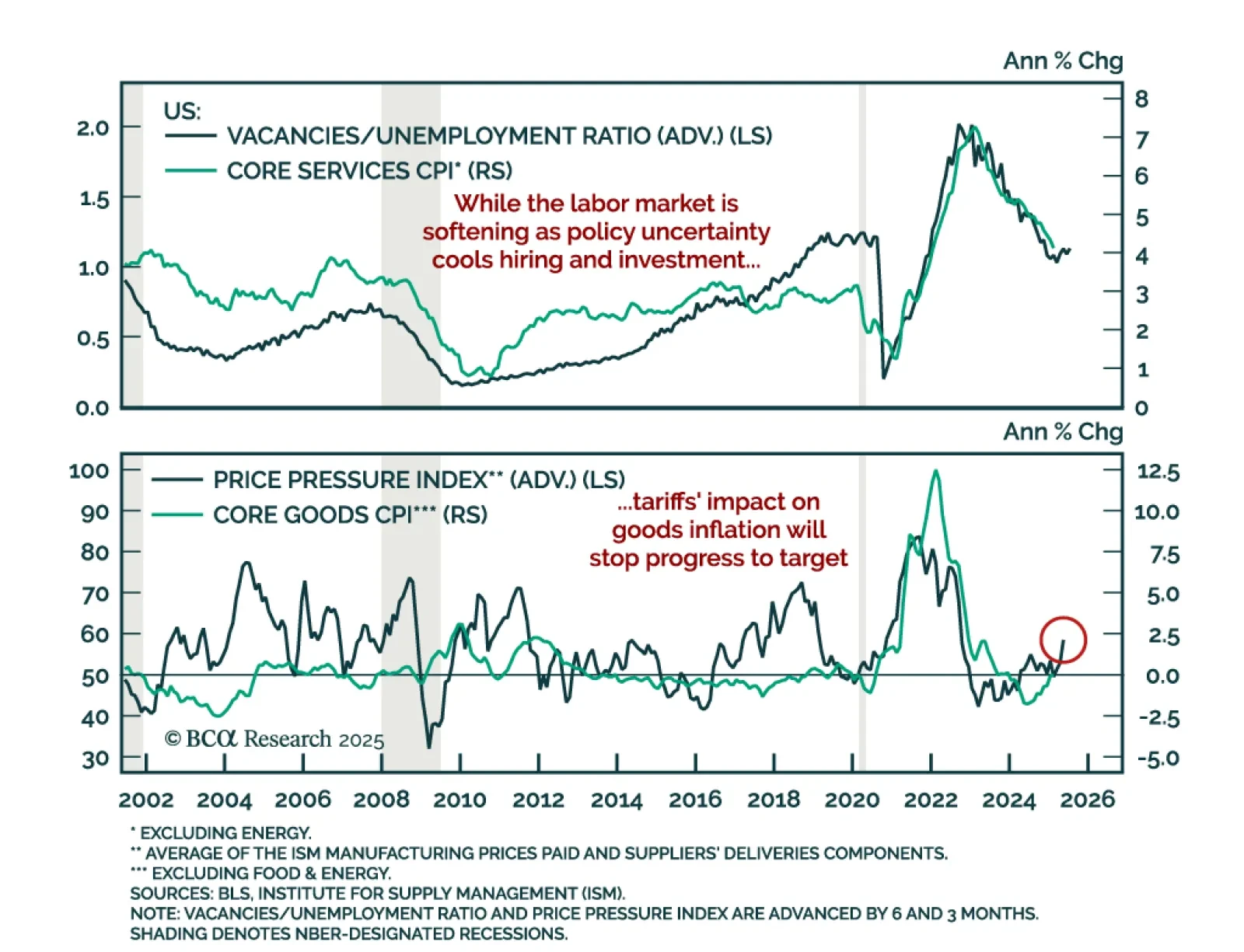

The US economy has never entered a demand-driven recession without labour demand running below labour supply and without the job vacancy rate running below the unemployment rate. Right now though, US labour demand is still running 1.…

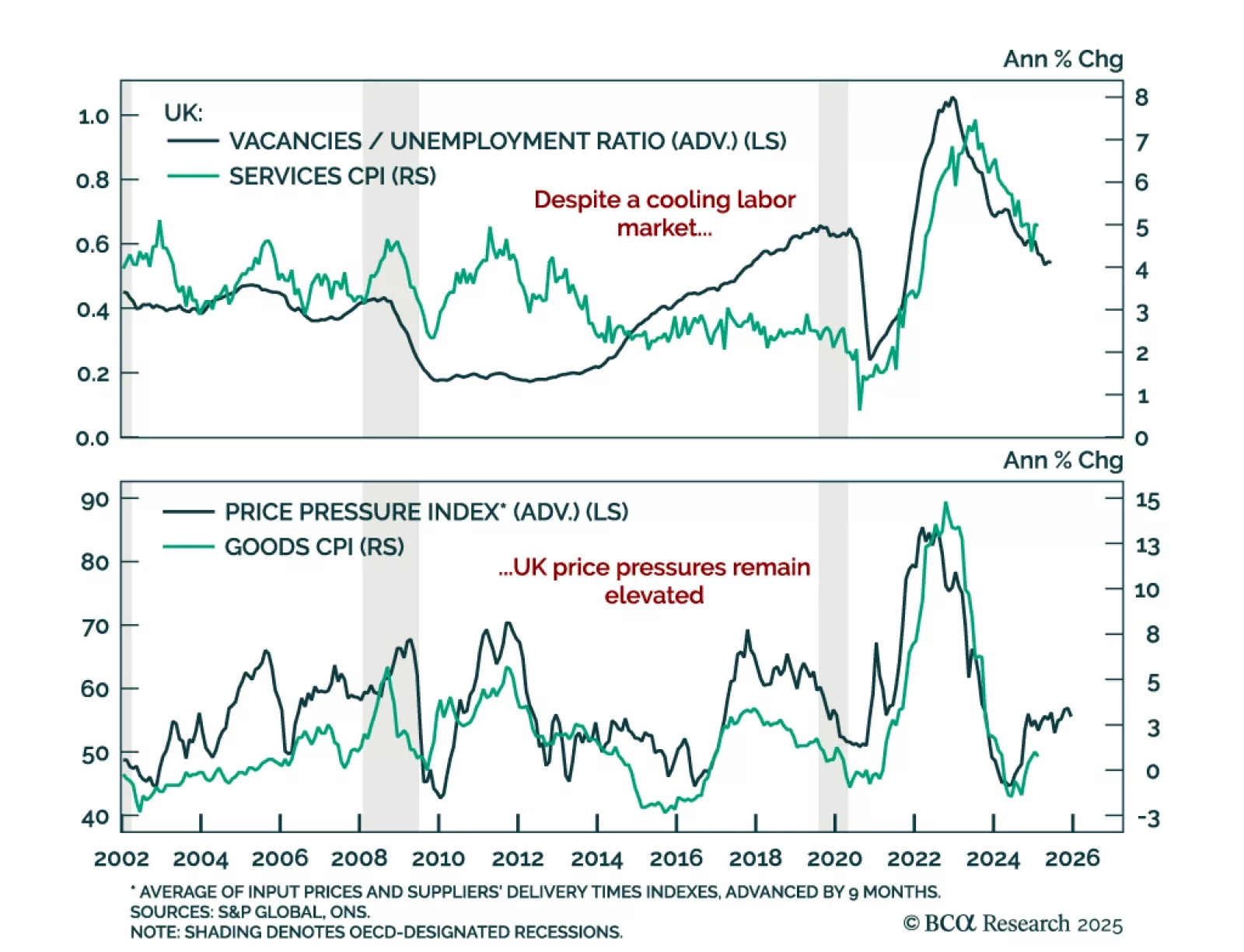

UK inflation came in cooler than expected in February, but lingering price pressures and a still-firm labor market keep the BoE sidelined, for now. Our Global Fixed-Income strategists view the BoE as the most likely DM central bank…

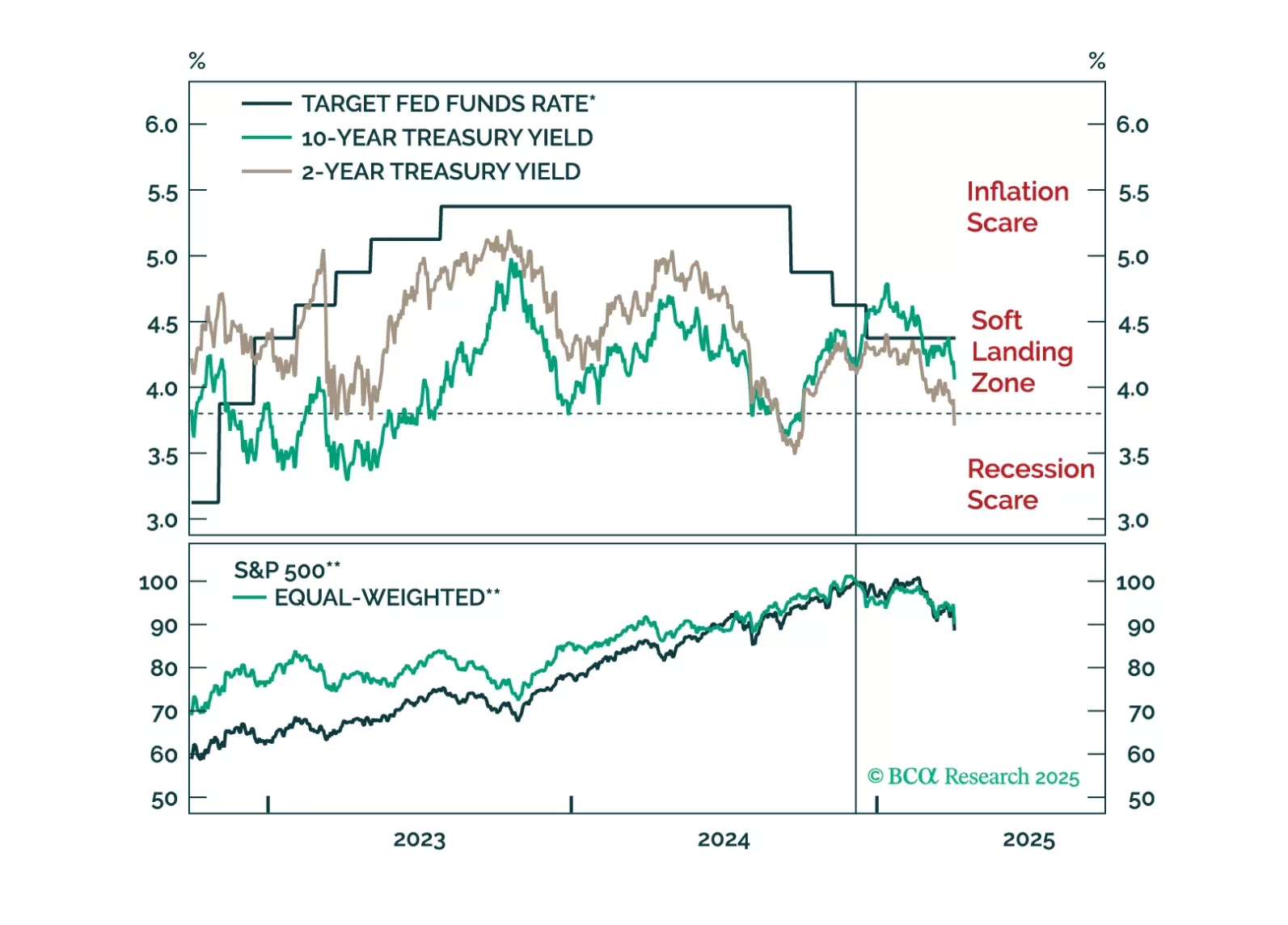

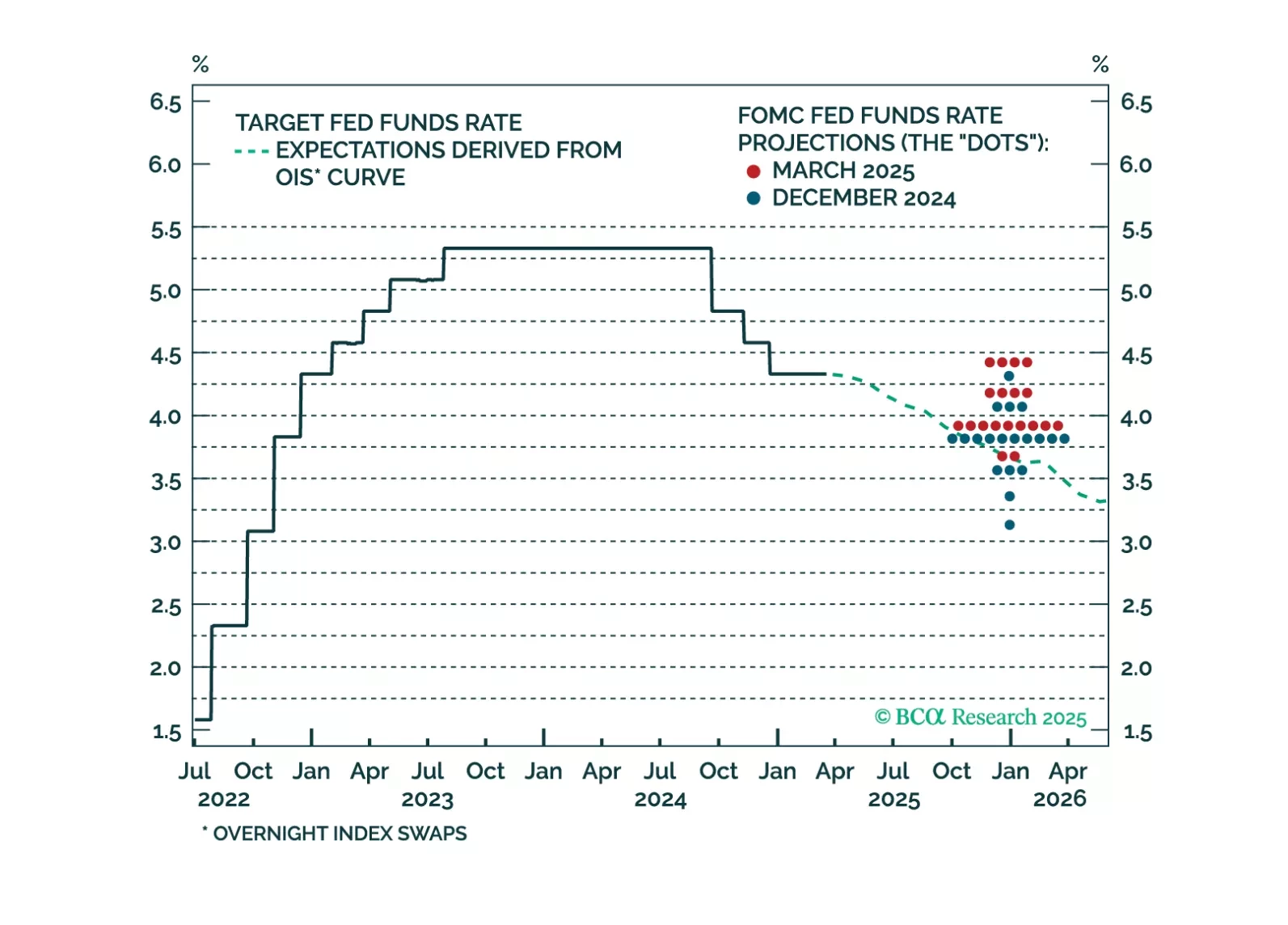

The market reaction to this afternoon’s Fed meeting looks overdone. Investors could be in for a hawkish surprise when it becomes apparent that the Fed won’t ease policy into higher tariff-driven inflation prints.

The February US CPI came in cooler than expected. Headline inflation decelerated to 0.2% m/m (2.8% y/y), as did core which now stands at 3.1% y/y. Core services inflation declined while core goods inflation was roughly unchanged.…

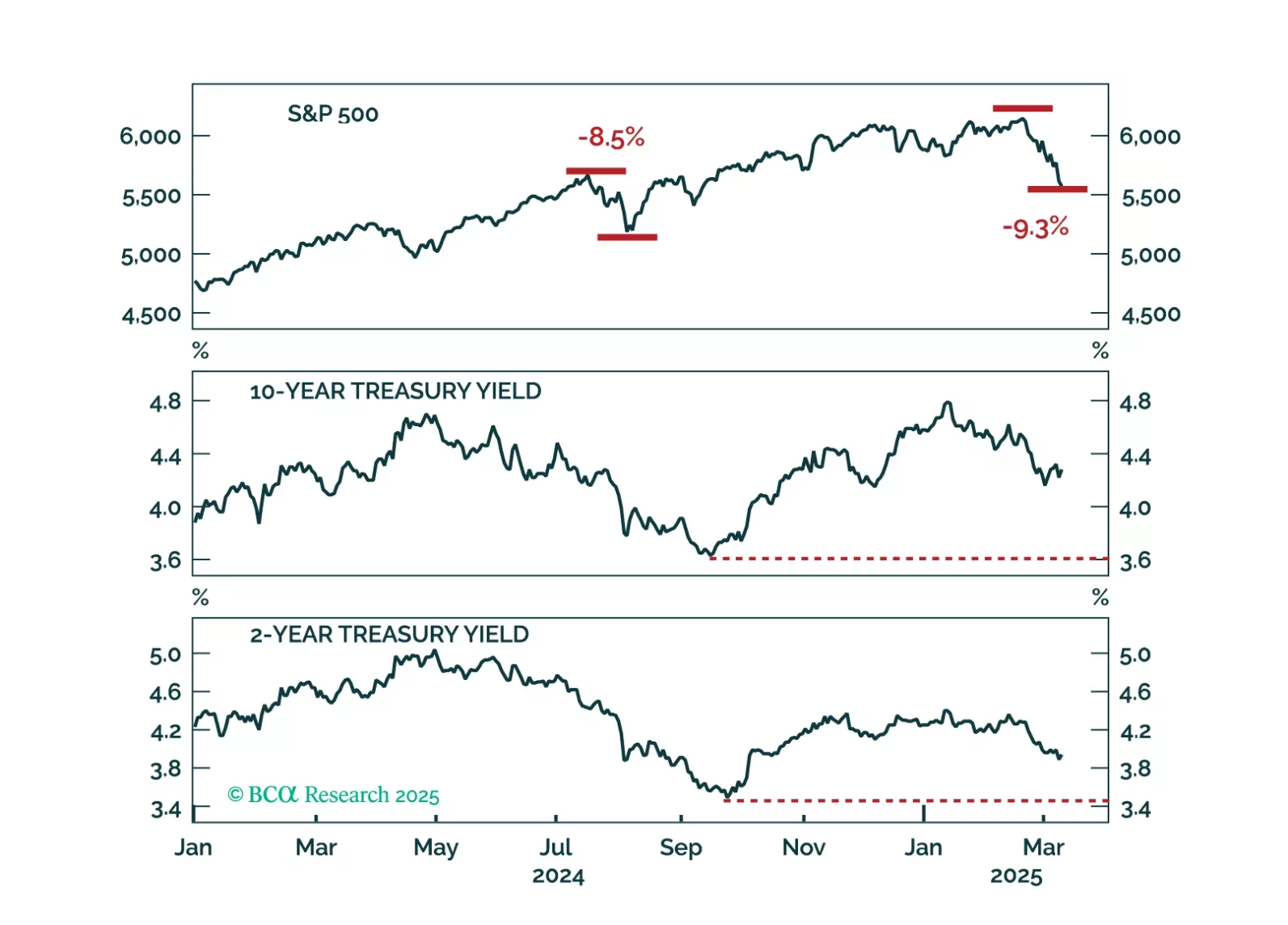

A falling stock market and sticky bond yields represent the worst of both worlds for investors. We interrogate why bond yields haven’t dropped more given the large selloff seen in equities.