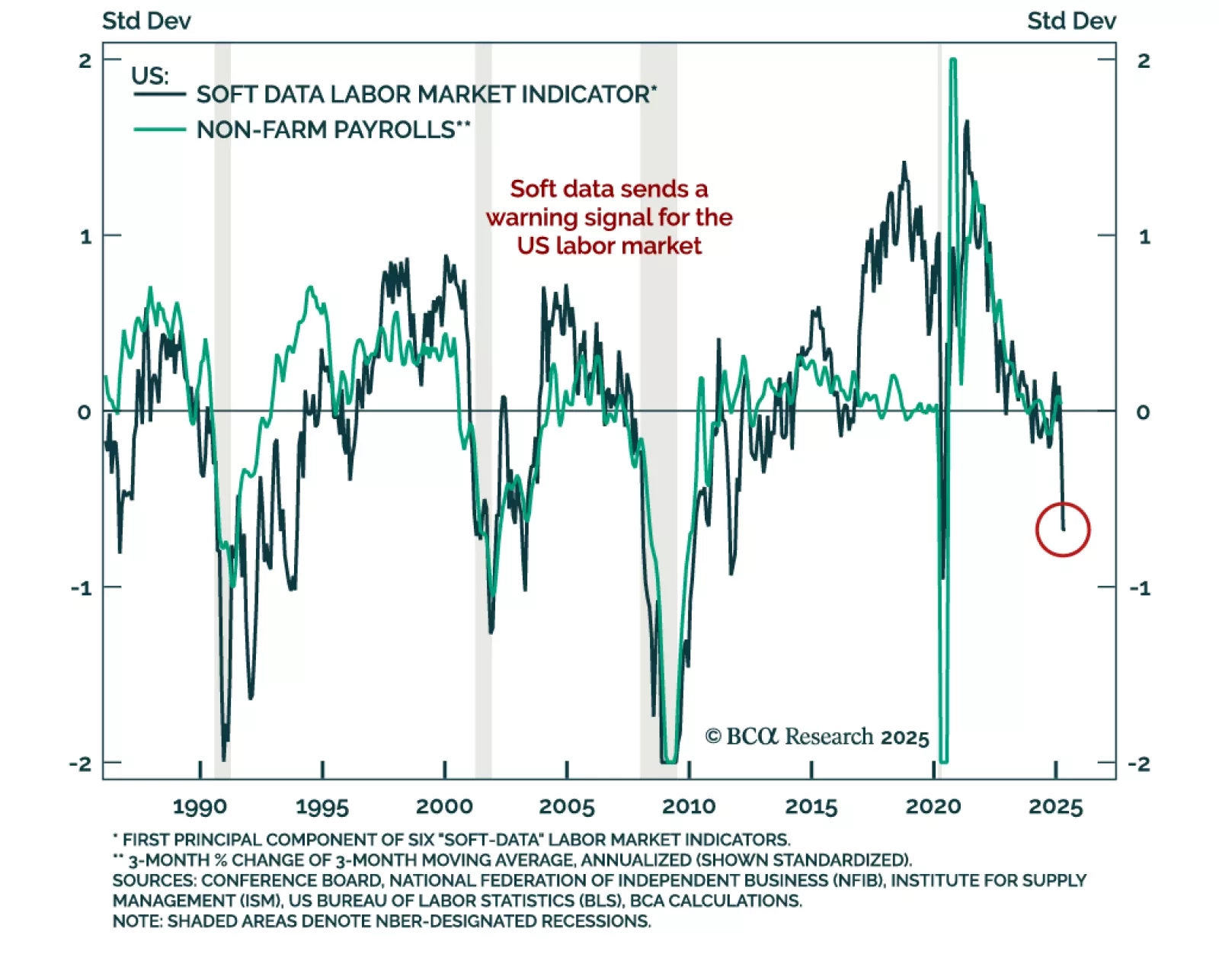

The policy-induced decline in consumer confidence has spread to businesses and investors, increasing the probability of a recession even if the administration reverses field on its aggressive tariff measures. We reiterate our…

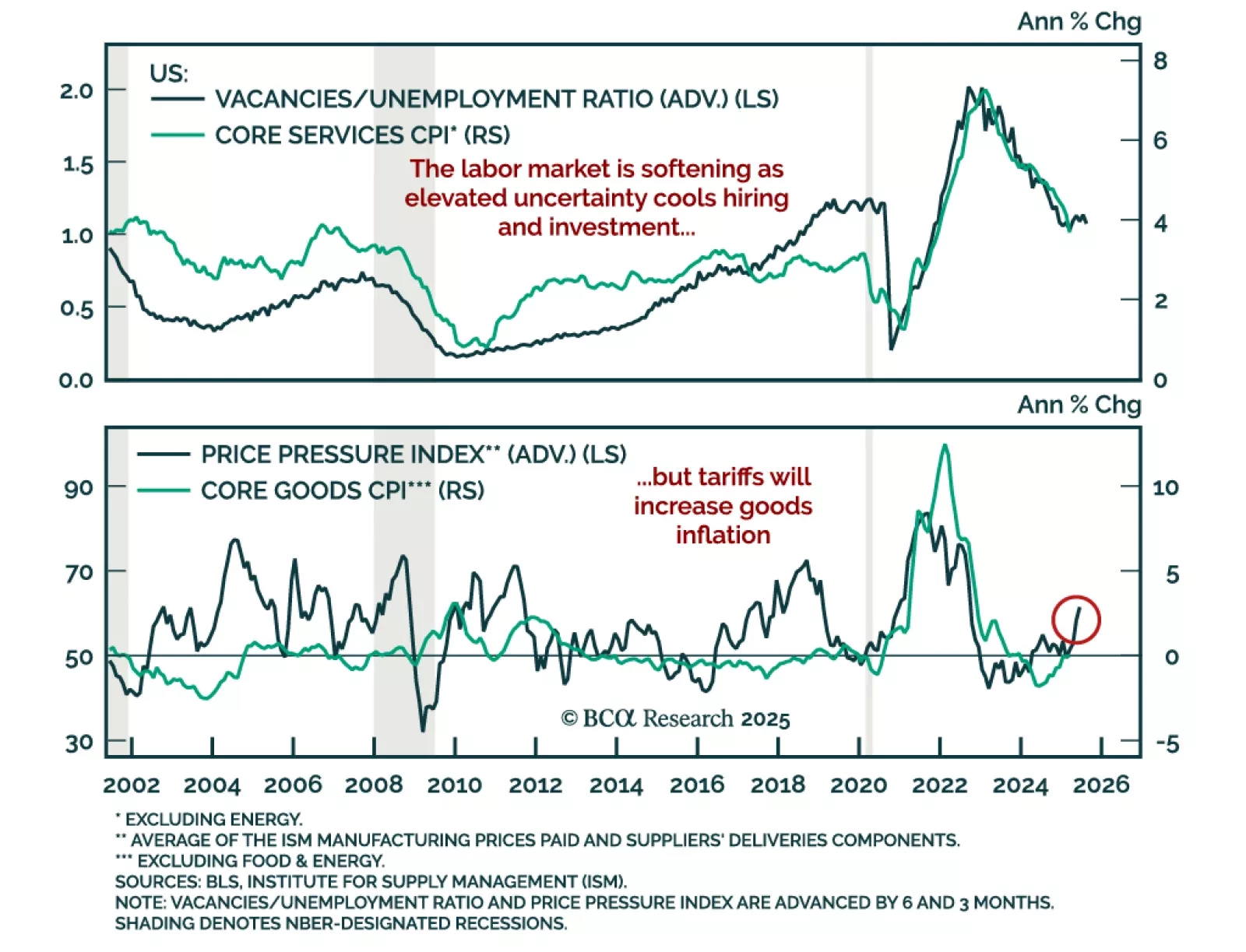

Soft data for the US labor market has turned sharply lower, reinforcing the case for a defensive asset allocation. Our Chart Of The Week comes from Miroslav Aradski from our Global Investment Strategy team. While it may take months…

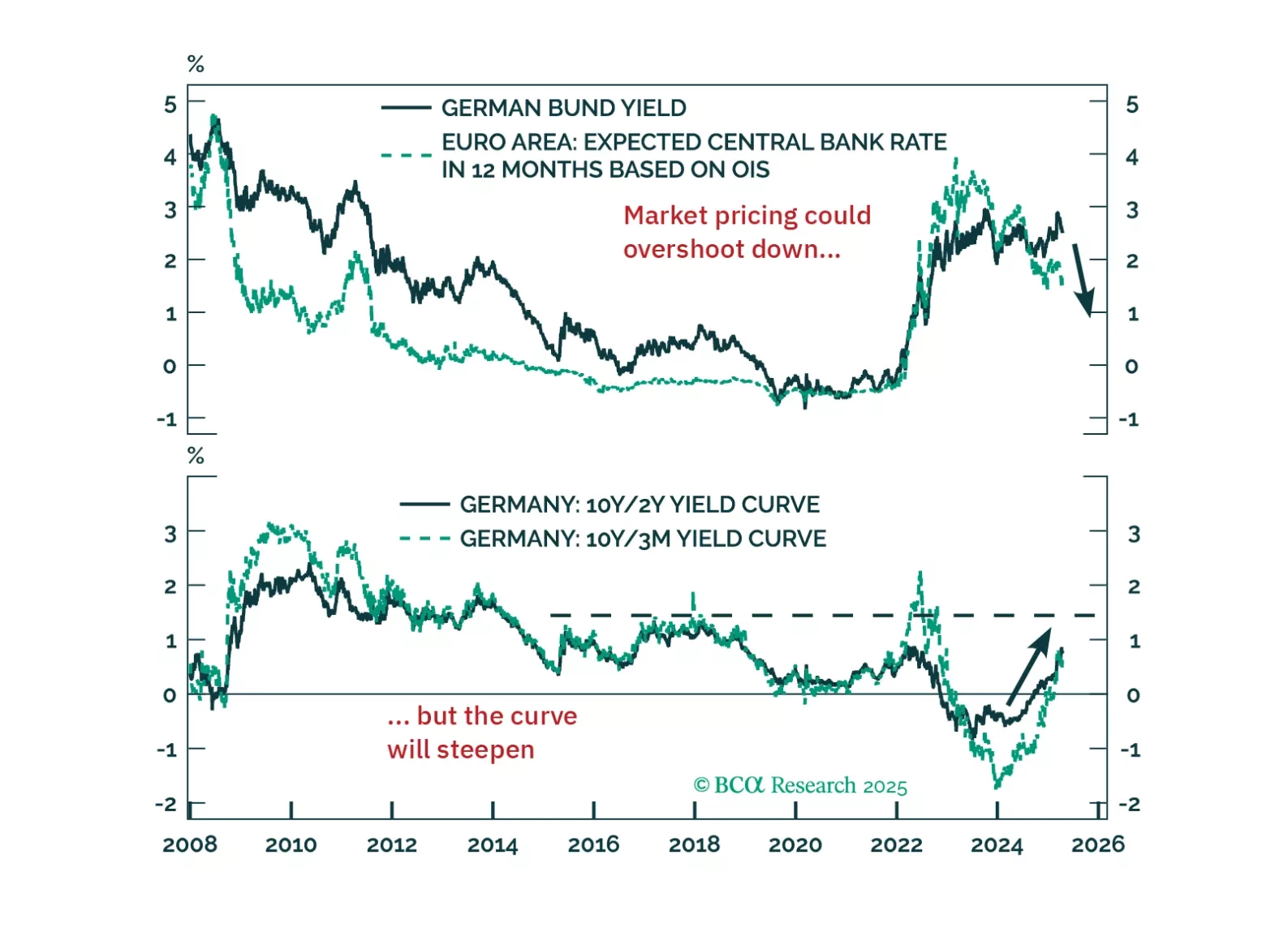

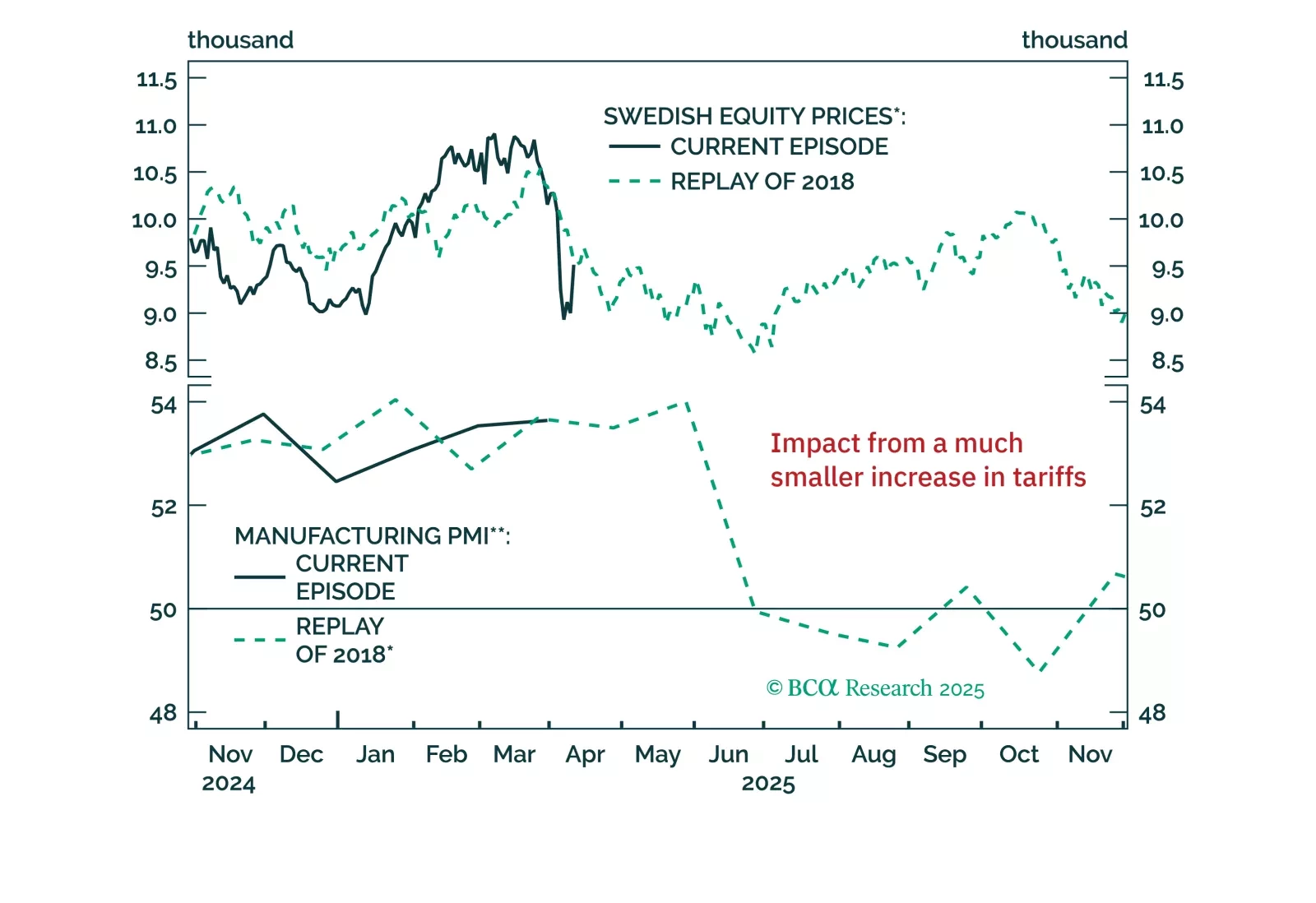

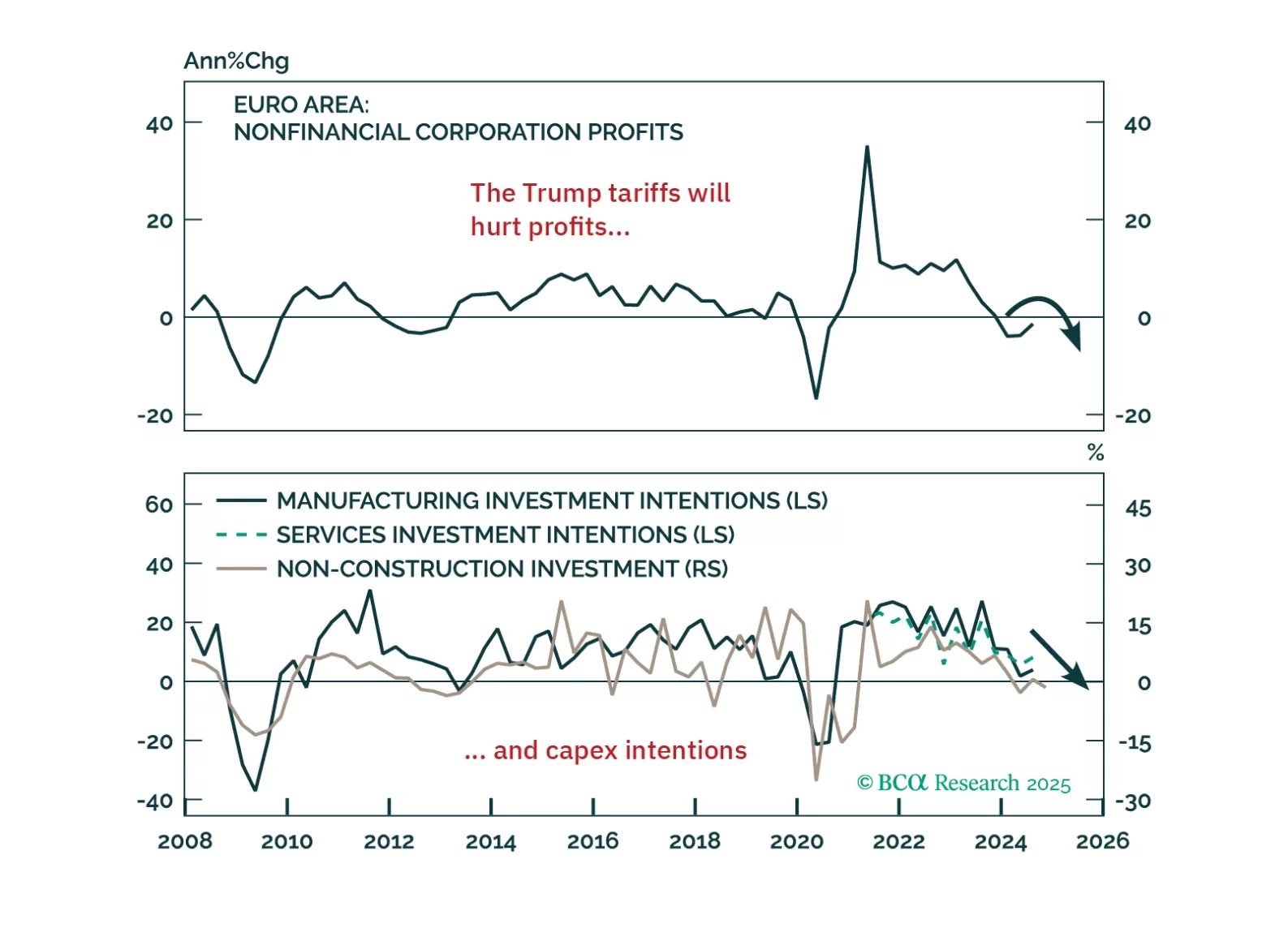

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…

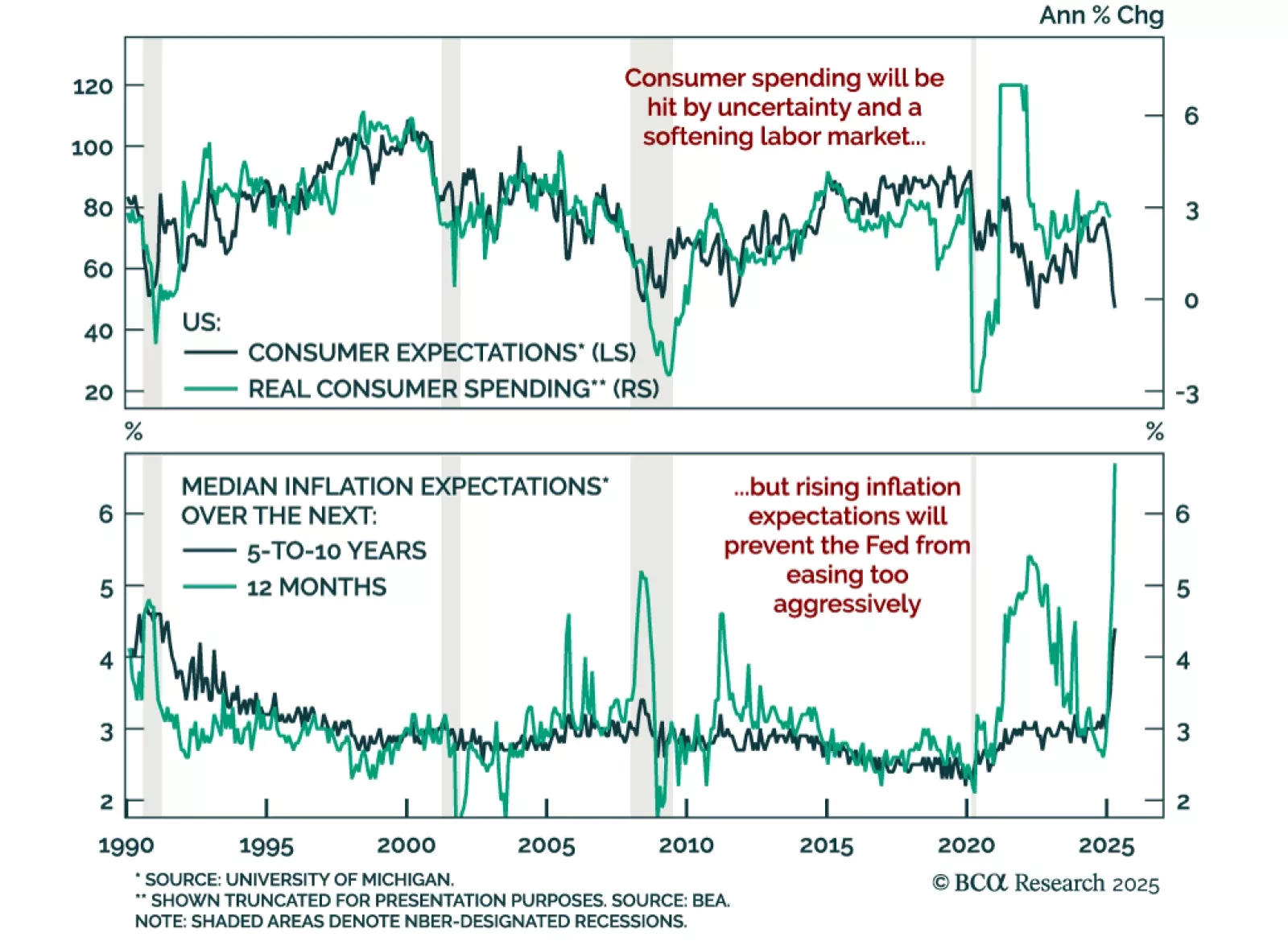

Fed Chair Jay Powell’s remarks yesterday were in-line with our base case expectation that the Fed will not cut rates proactively in the face of rising tariff-driven inflation.

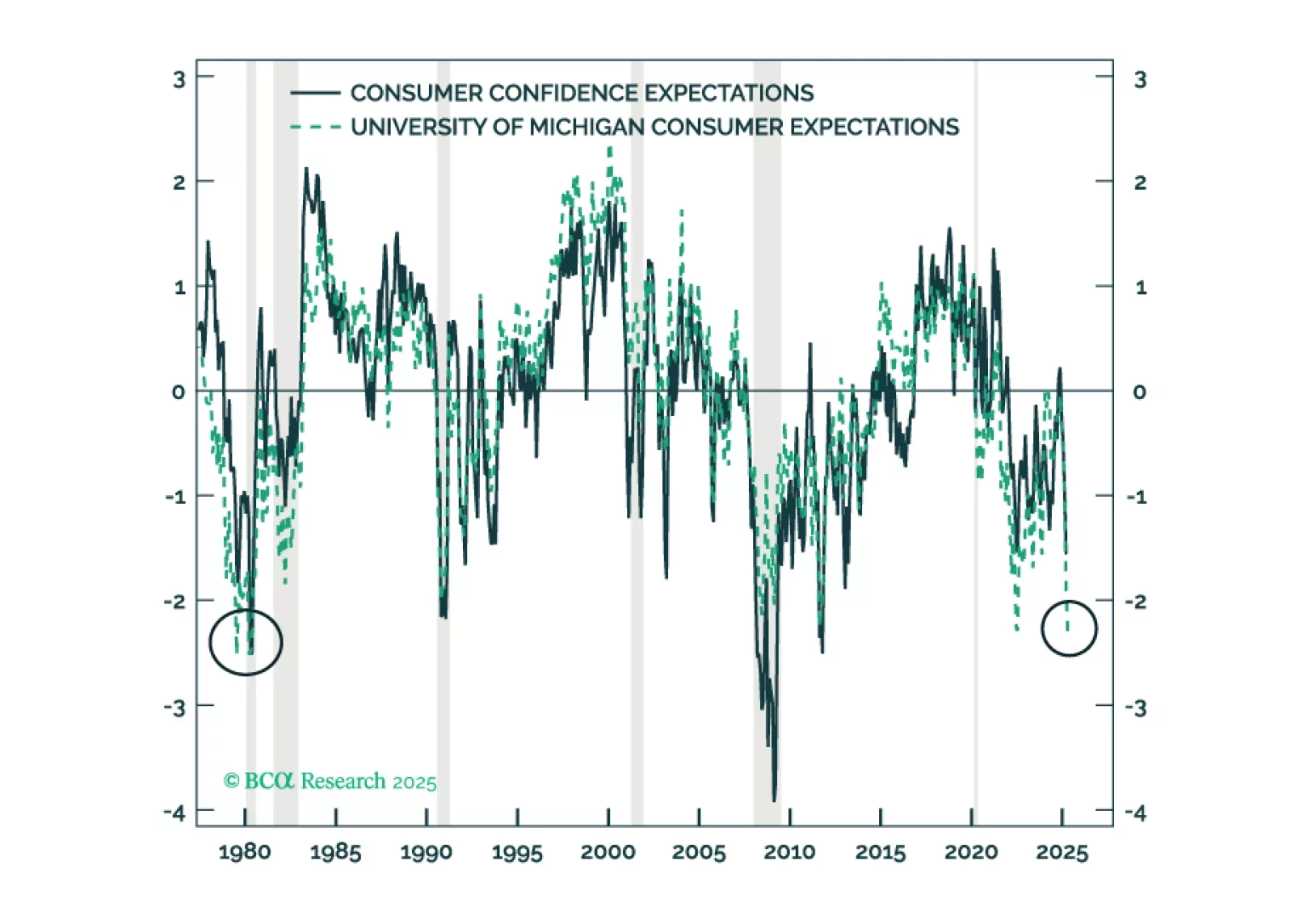

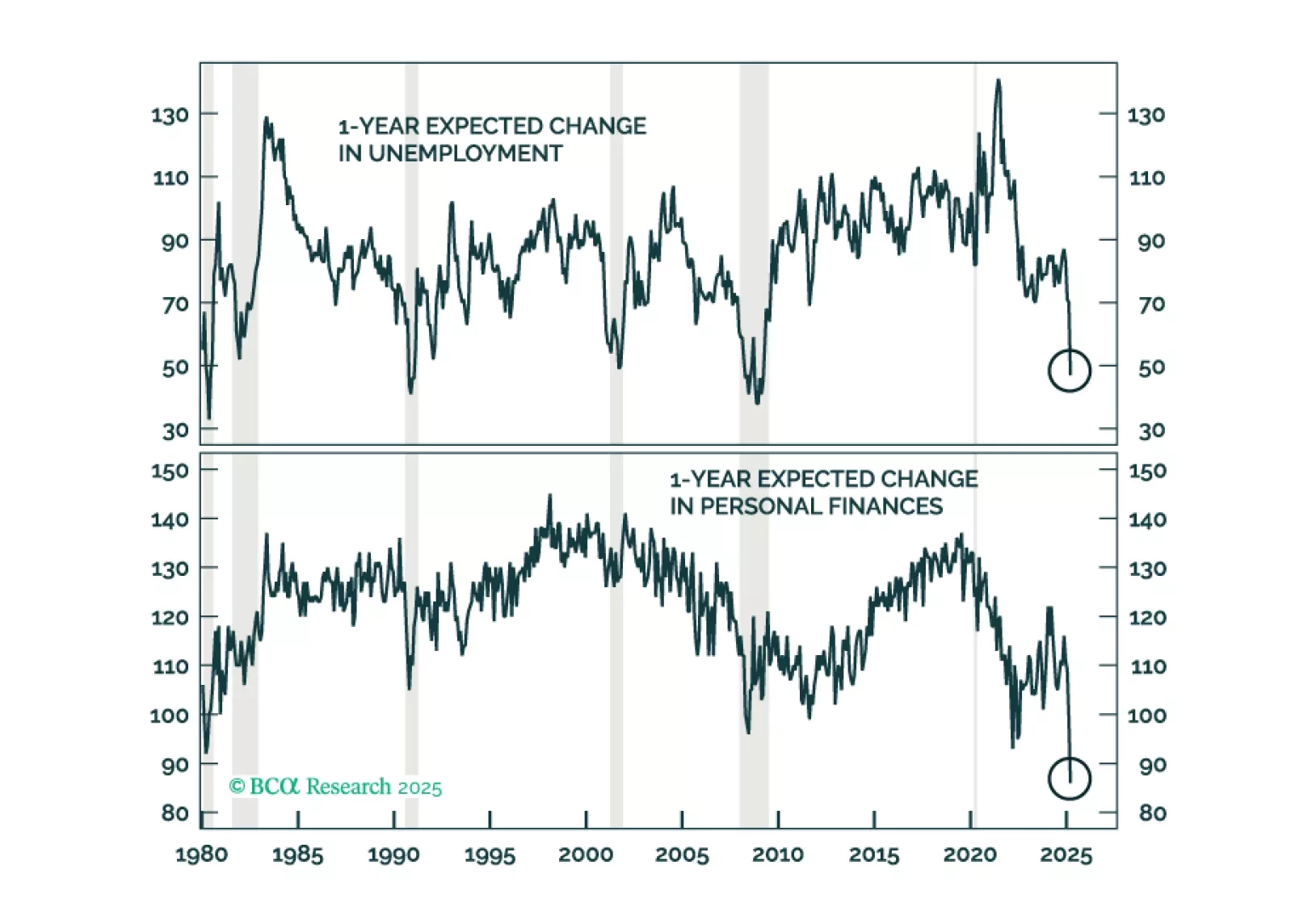

The sharp drop in consumer sentiment and rise in inflation expectations reinforce our defensive positioning and preference for long-duration bonds. The preliminary April University of Michigan Consumer Sentiment Index fell to 50.8…

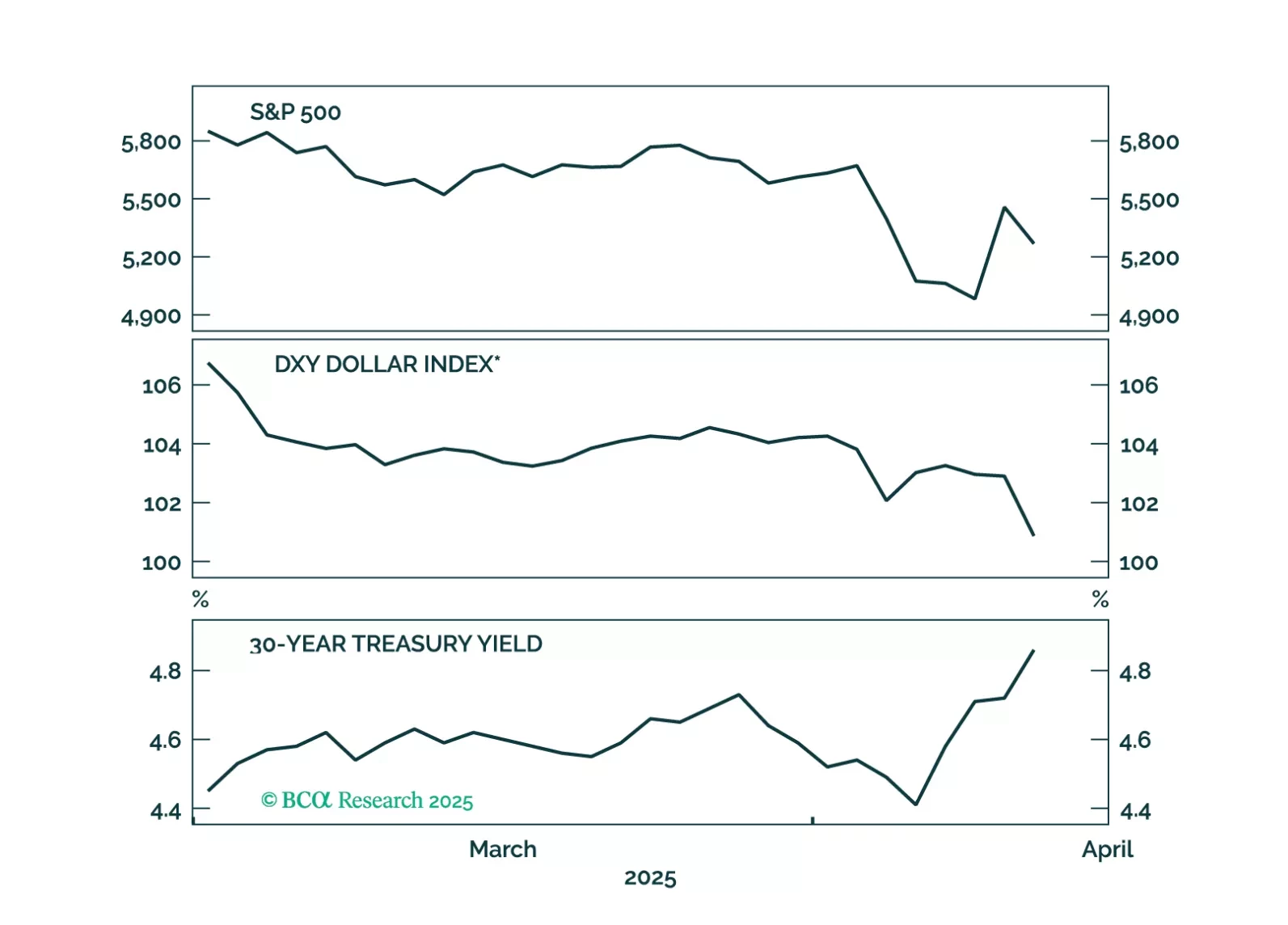

The combination of dollar weakness and rising US yields suggests global investors are questioning the safe-haven status of US Treasuries.

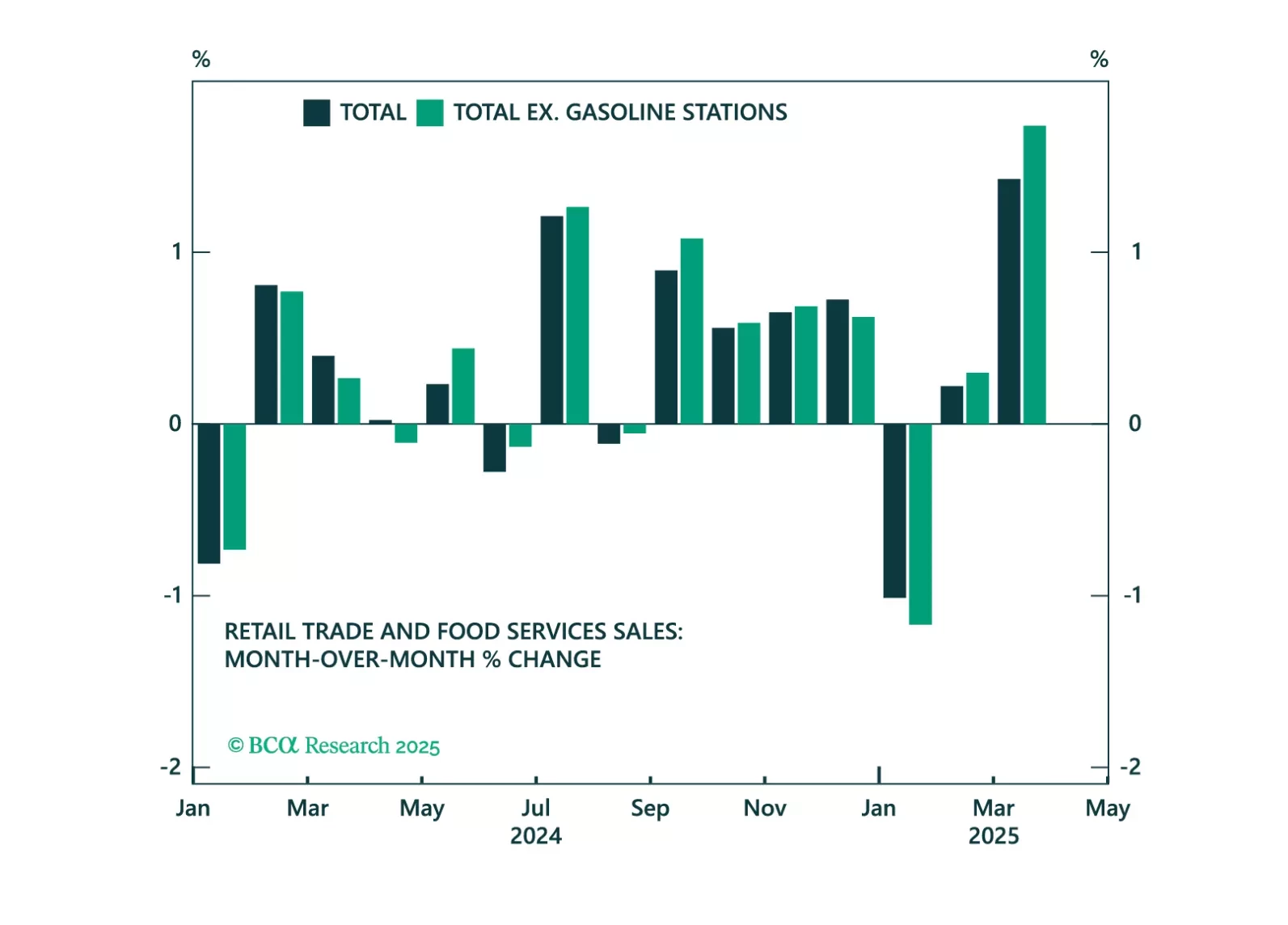

March’s cooler CPI print reinforces our defensive positioning as it points to softening growth that the Fed cannot address yet. Headline CPI came in at -0.1% m/m (2.4% y/y), and core rose just 0.1% m/m, slowing to 2.8% y/y from 3.1…

The stimulus measures driving the post-COVID expansion were beginning to wane after five years and pointing the economy in the direction of an organically occurring recession. Now that DOGE and the multi-front trade war have sped up…

Trump’s tariff shock will push Europe into recession — but it’s also triggering a powerful integration response. In this report, we lay out the tactical case for staying defensive and the structural case for going long European…