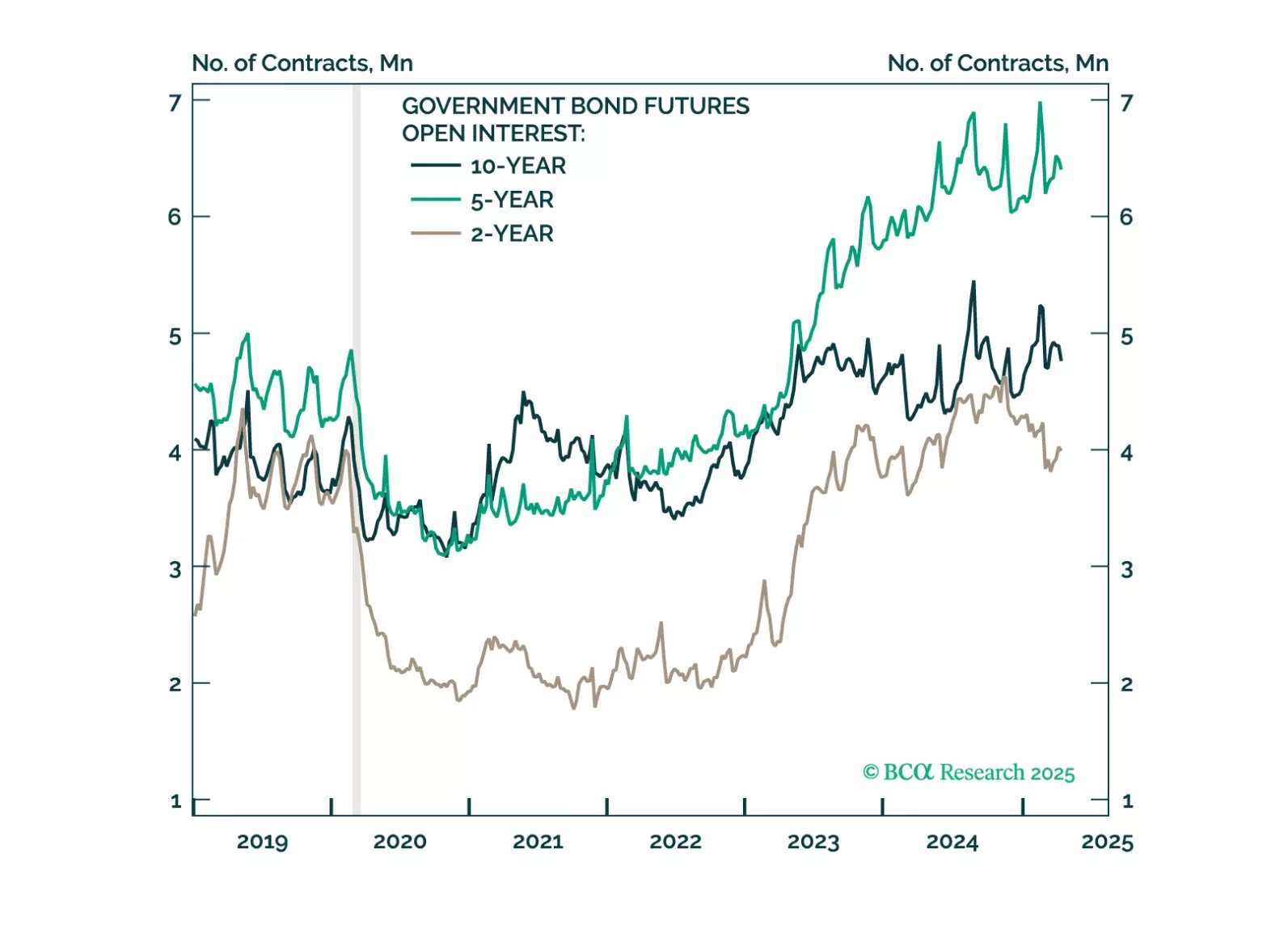

A weakening economy will apply downward pressure to Treasury yields, but the Trump term premium will keep long-dated yields higher than they would otherwise be. This makes Treasury curve steepeners the most attractive trade in US…

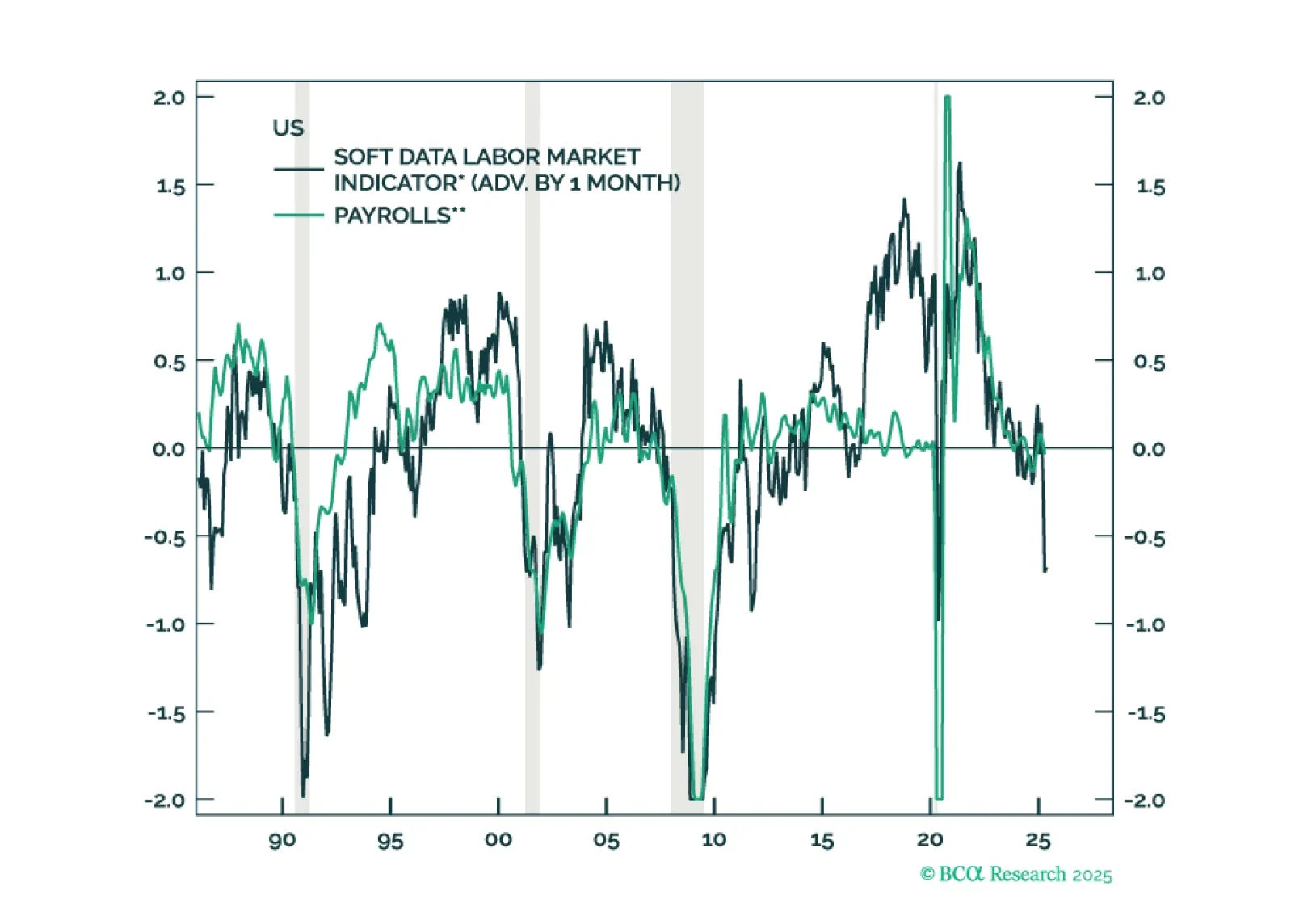

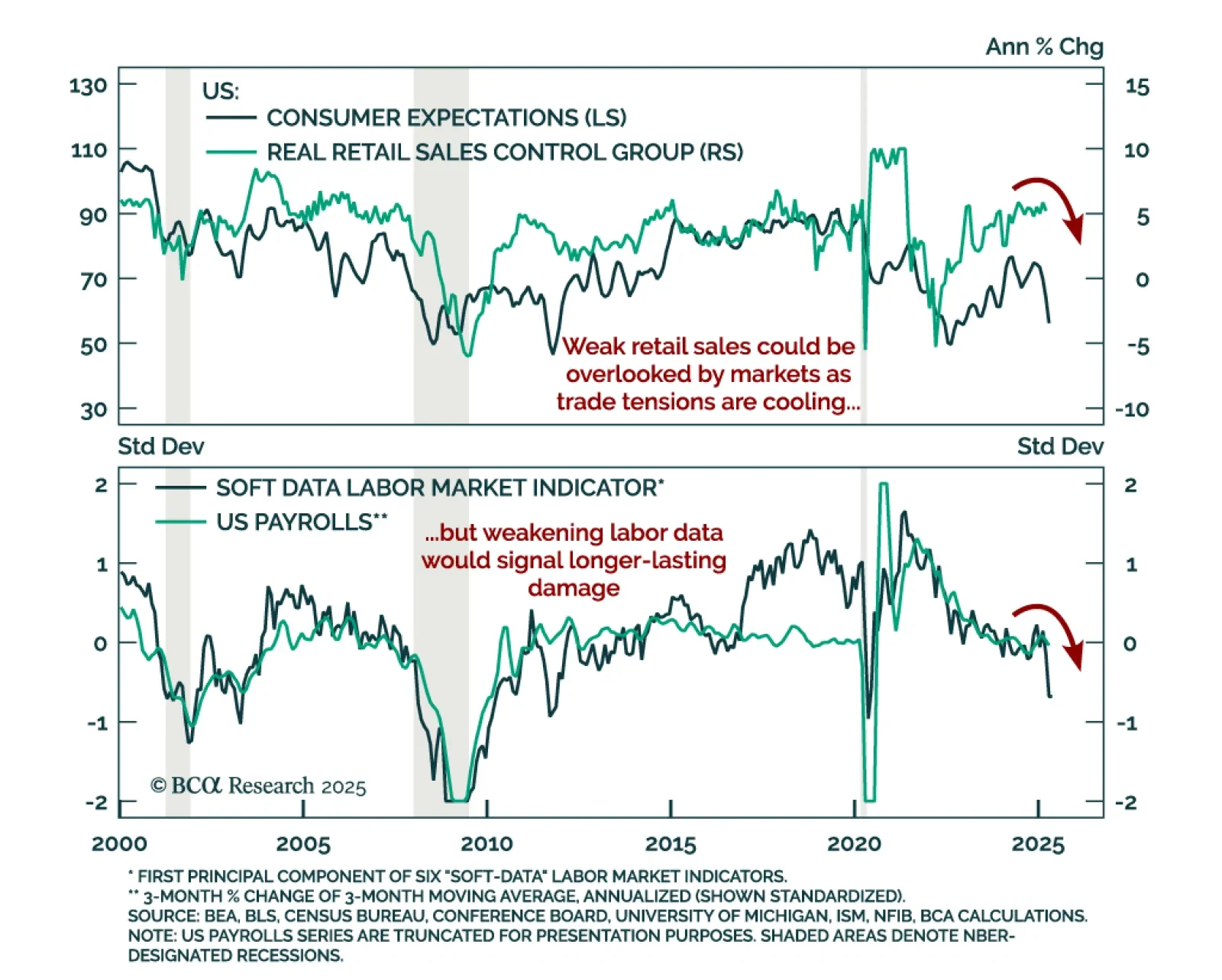

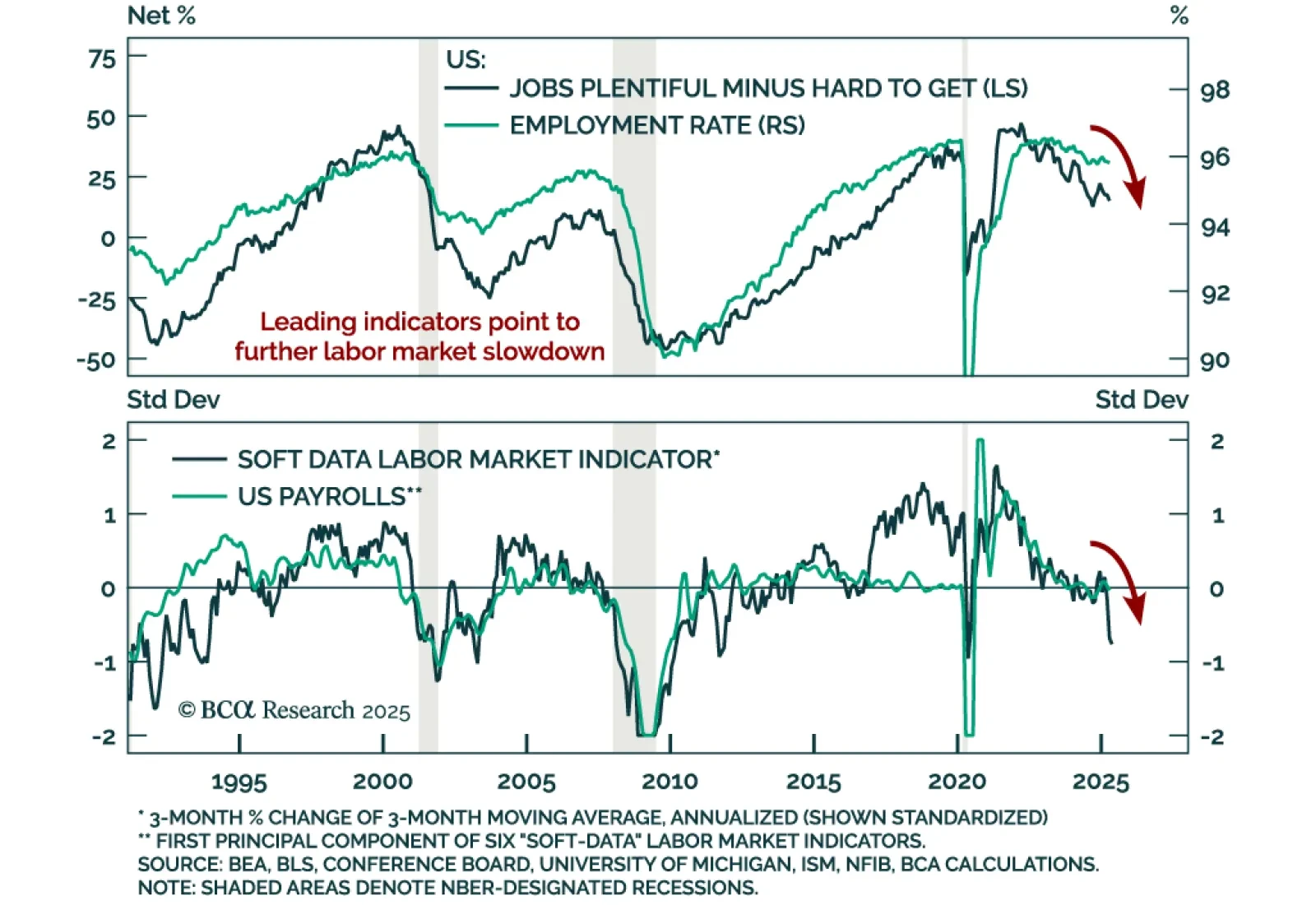

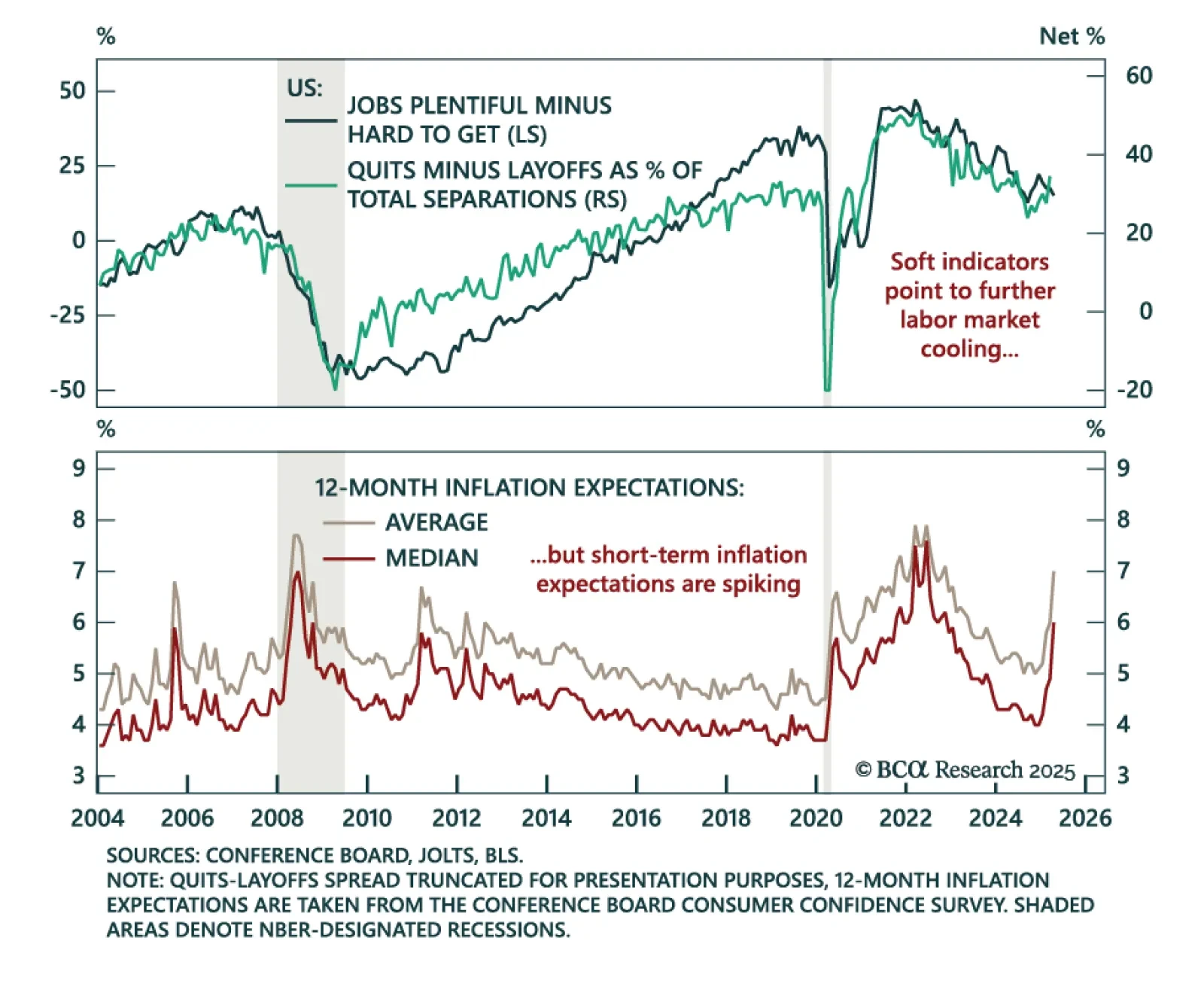

Markets remain indifferent to soft data, but hard labor data still matters; a rise in jobless claims would offer a chance to extend duration. Survey-based indicators have collapsed, while hard data has held up, partly thanks to front…

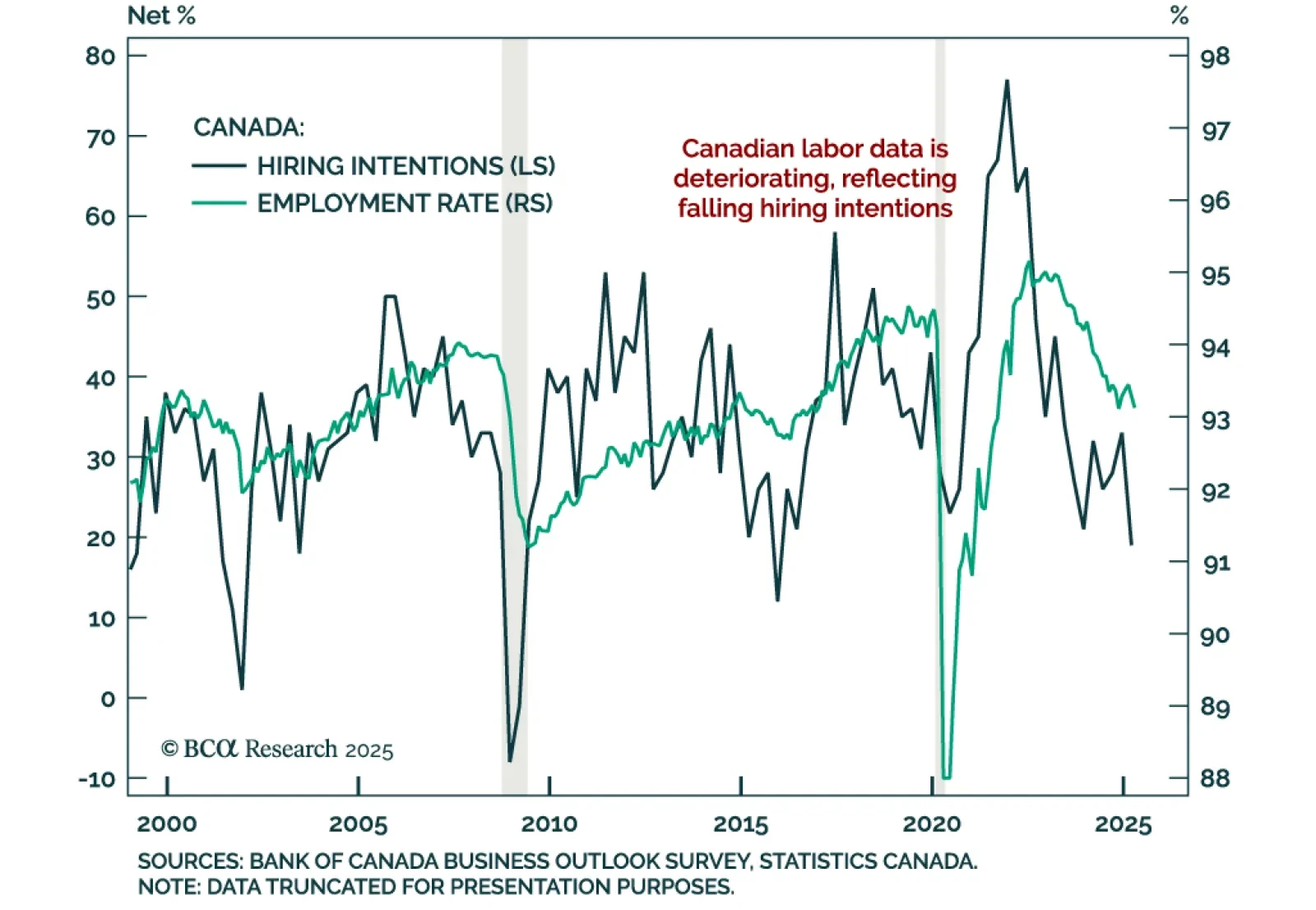

Soft April jobs confirm the Canadian labor market stall, yet we remain neutral on CGBs and structurally bullish on the CAD. The unemployment rate rose more than expected to 6.9% from 6.7%. Employment growth exceeded expectations but…

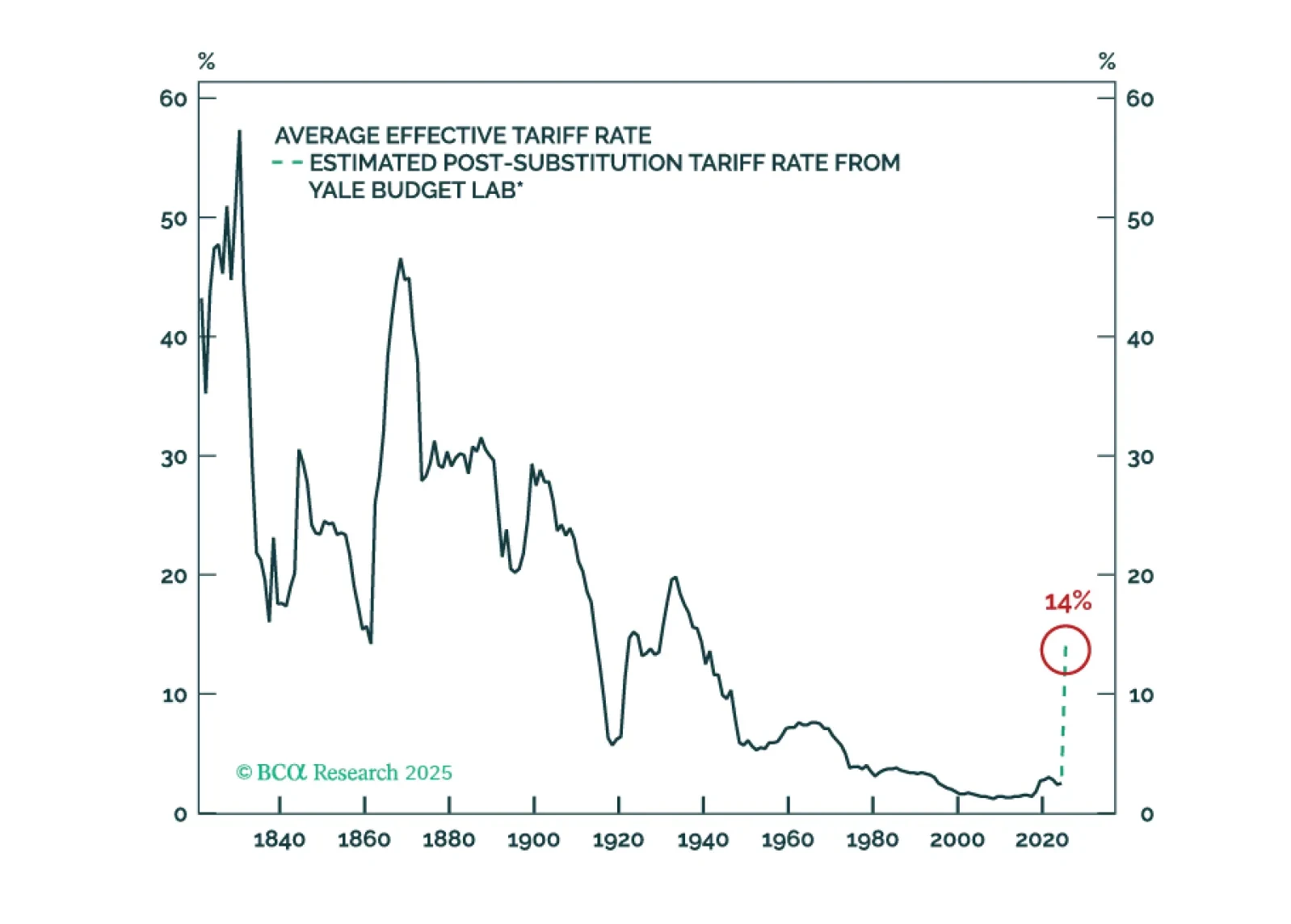

The Fed held rates steady this afternoon, and the timing of its next move will be dictated by whether the tariff shock to inflation is transitory or more long lasting.

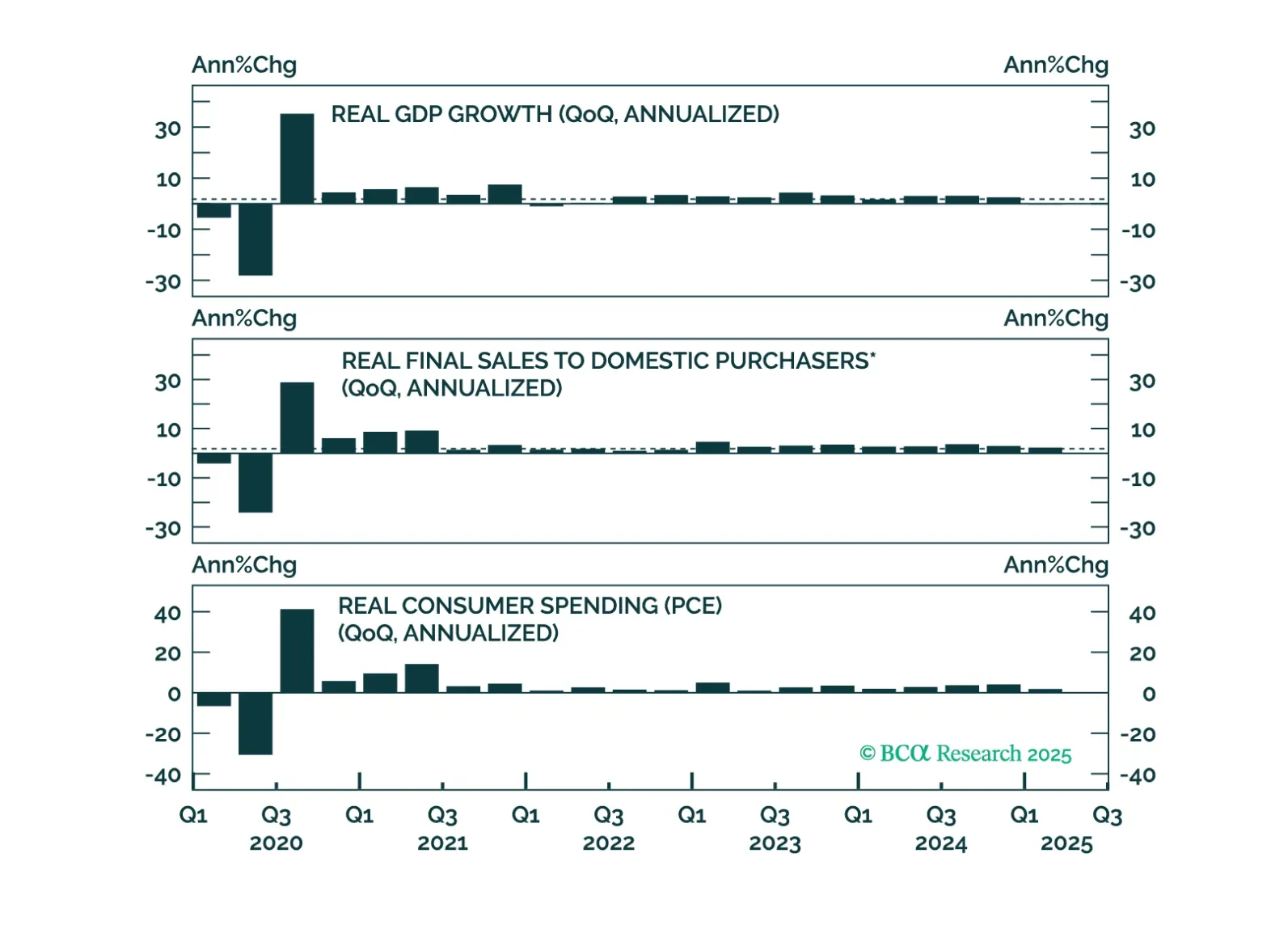

April’s stronger-than-expected US jobs report eased recession concerns, but underlying trends support our defensive positioning. Nonfarm payrolls rose 177k, but downward revisions to prior months totaled 58k, leaving the three-…

The April Conference Board survey adds to signs of labor market softening, reinforcing our defensive asset allocation. The Consumer Confidence index fell for the fifth consecutive month to 86.0 from 92.9. Expectations plunged to…

US Treasuries typically outperform both equities and global government bonds during downturns. Recent political shifts could lessen that outperformance this cycle, but we doubt it will disappear completely.