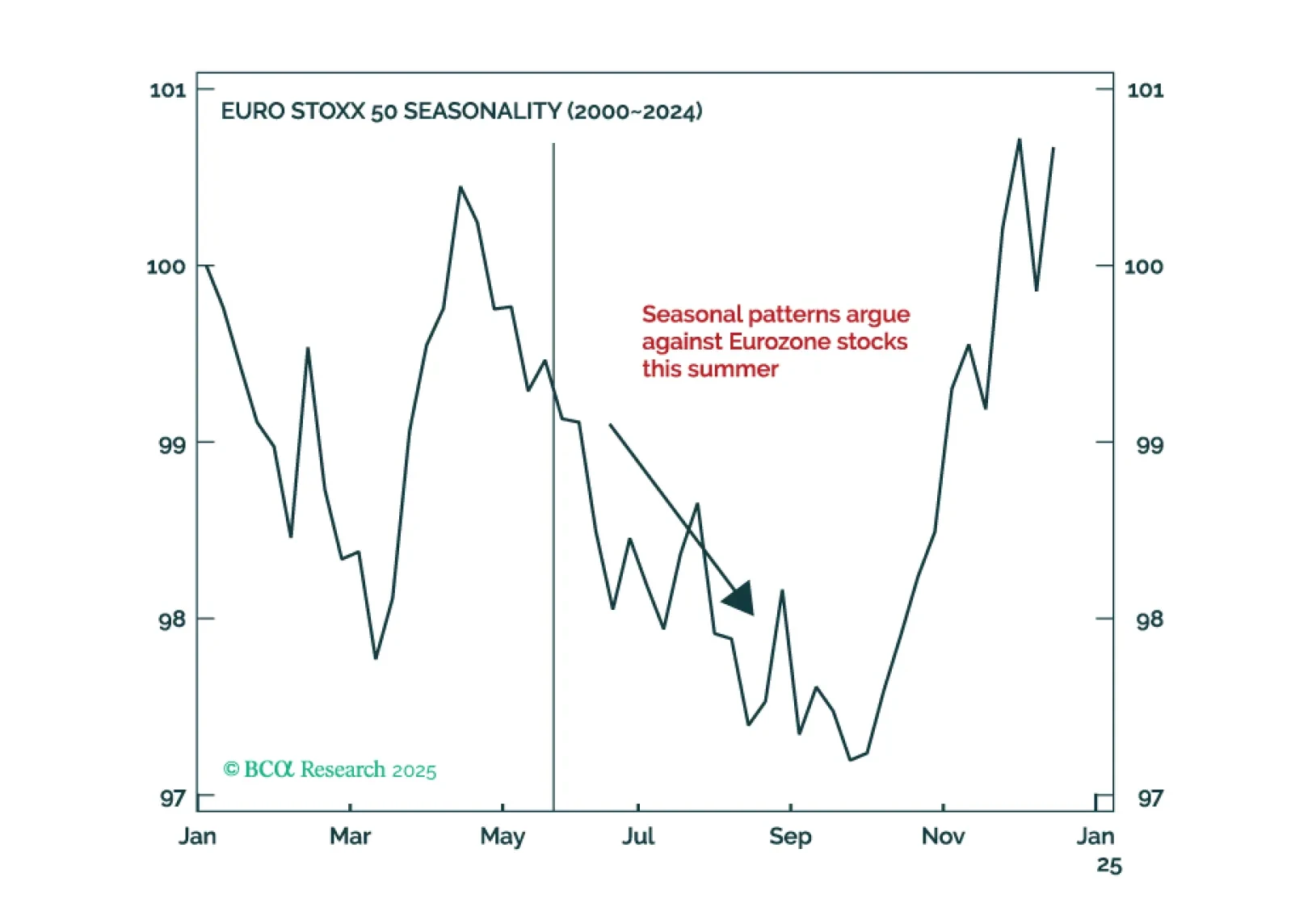

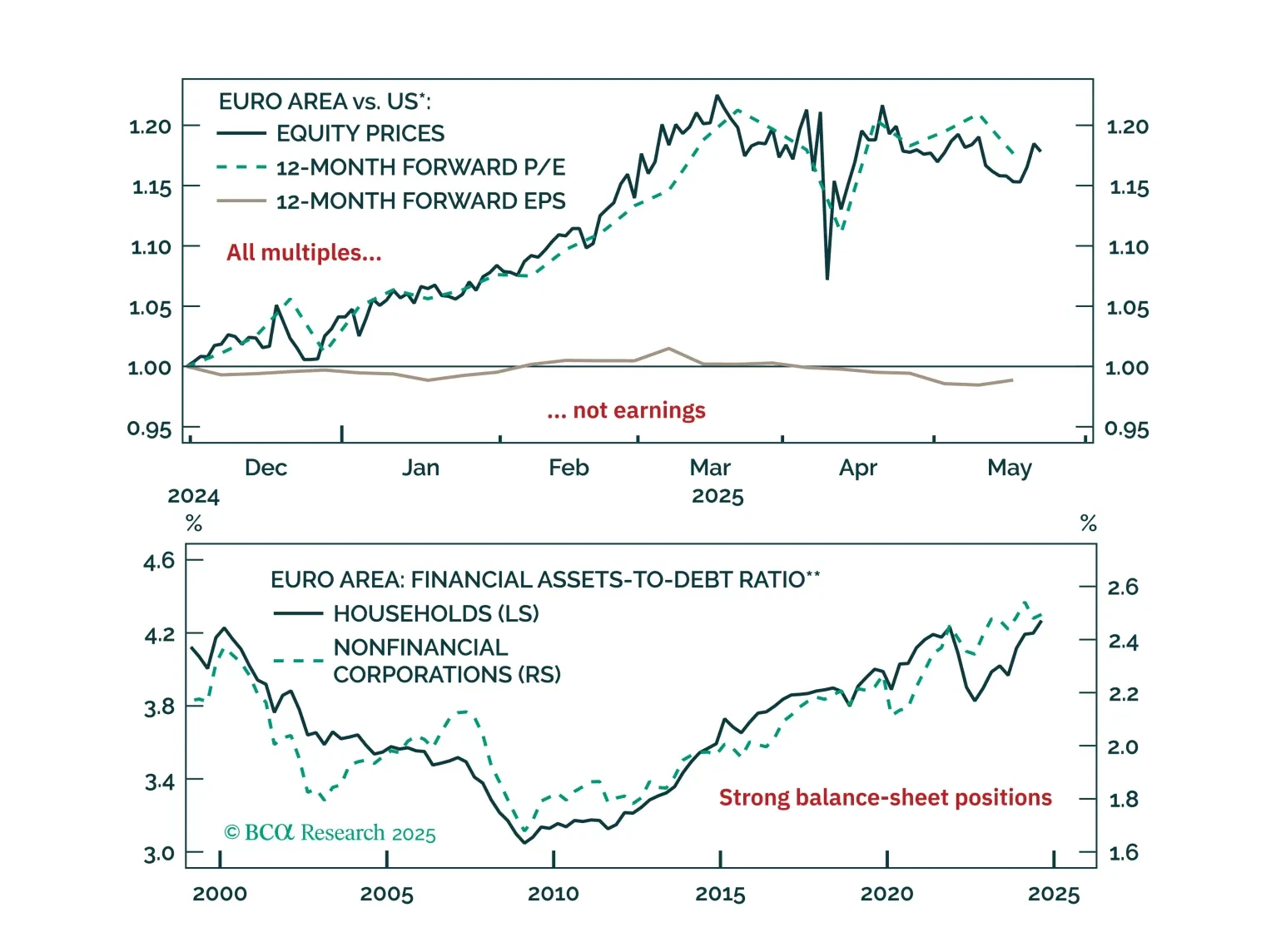

European equities will face a clash of powerful forces this summer. Expect sharp swings and false breaks, creating an ideal terrain for nimble traders but a minefield for buy-and-hold investors seeking steady gains.Within this backdrop,…

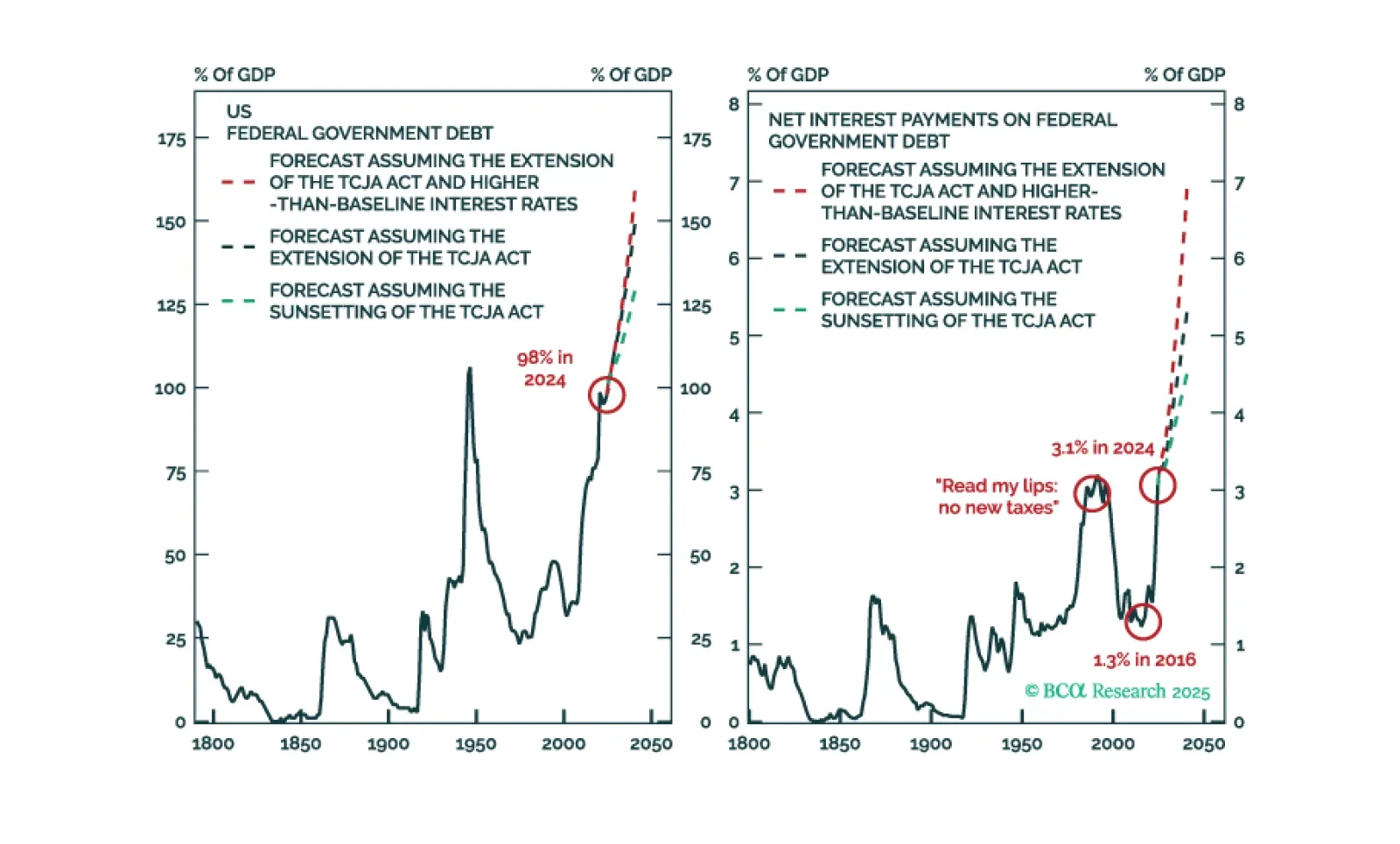

Rising bond yields may present an even greater danger to the global economy than the trade war. With equity valuations no longer discounting much economic risk, investors should position themselves defensively.

Five questions, five answers from the road. We unpack what Europe’s biggest investors are worried about right now, from trade‑war whiplash to bund‑versus‑Treasury positioning; and where the real opportunities still lie.

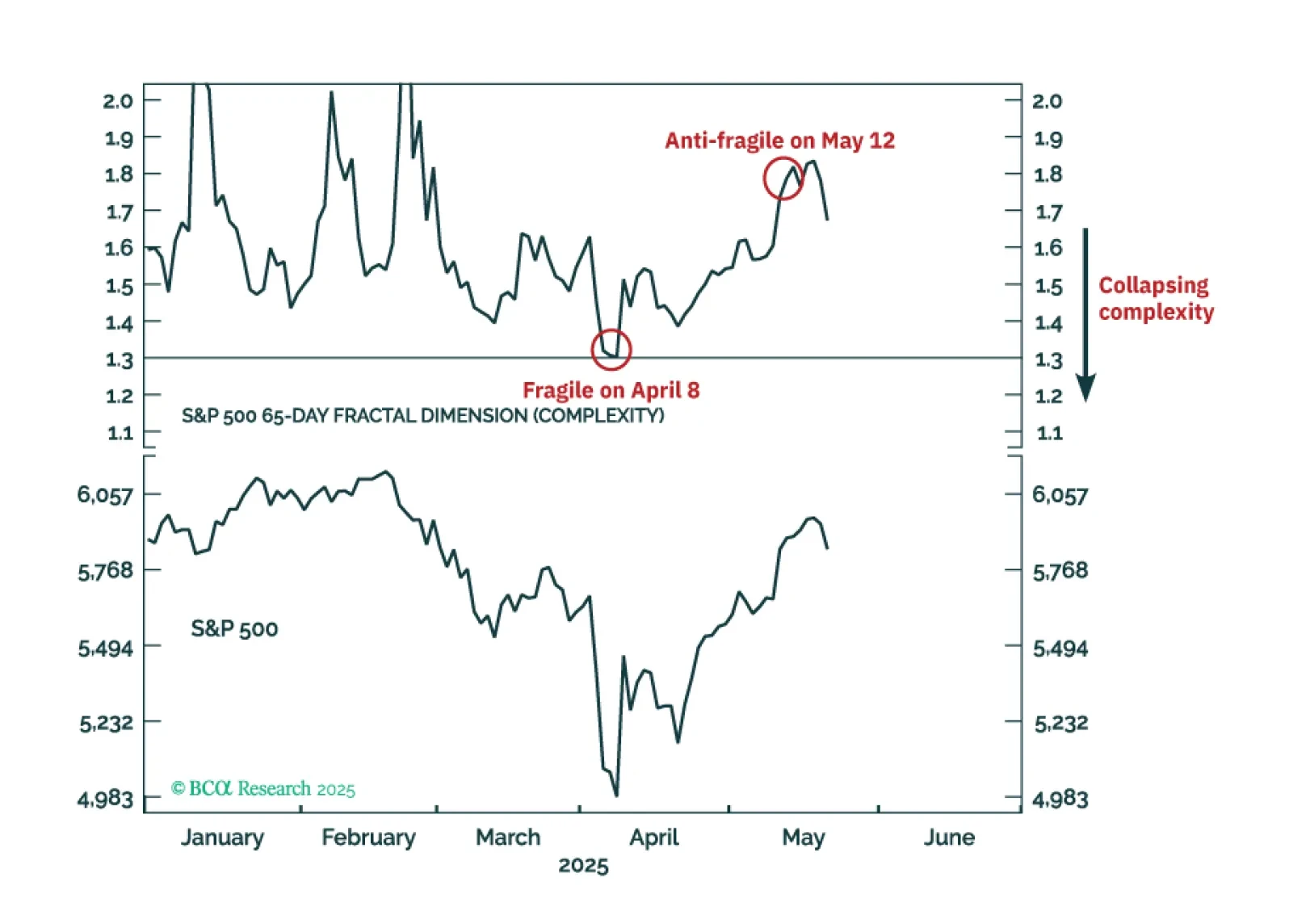

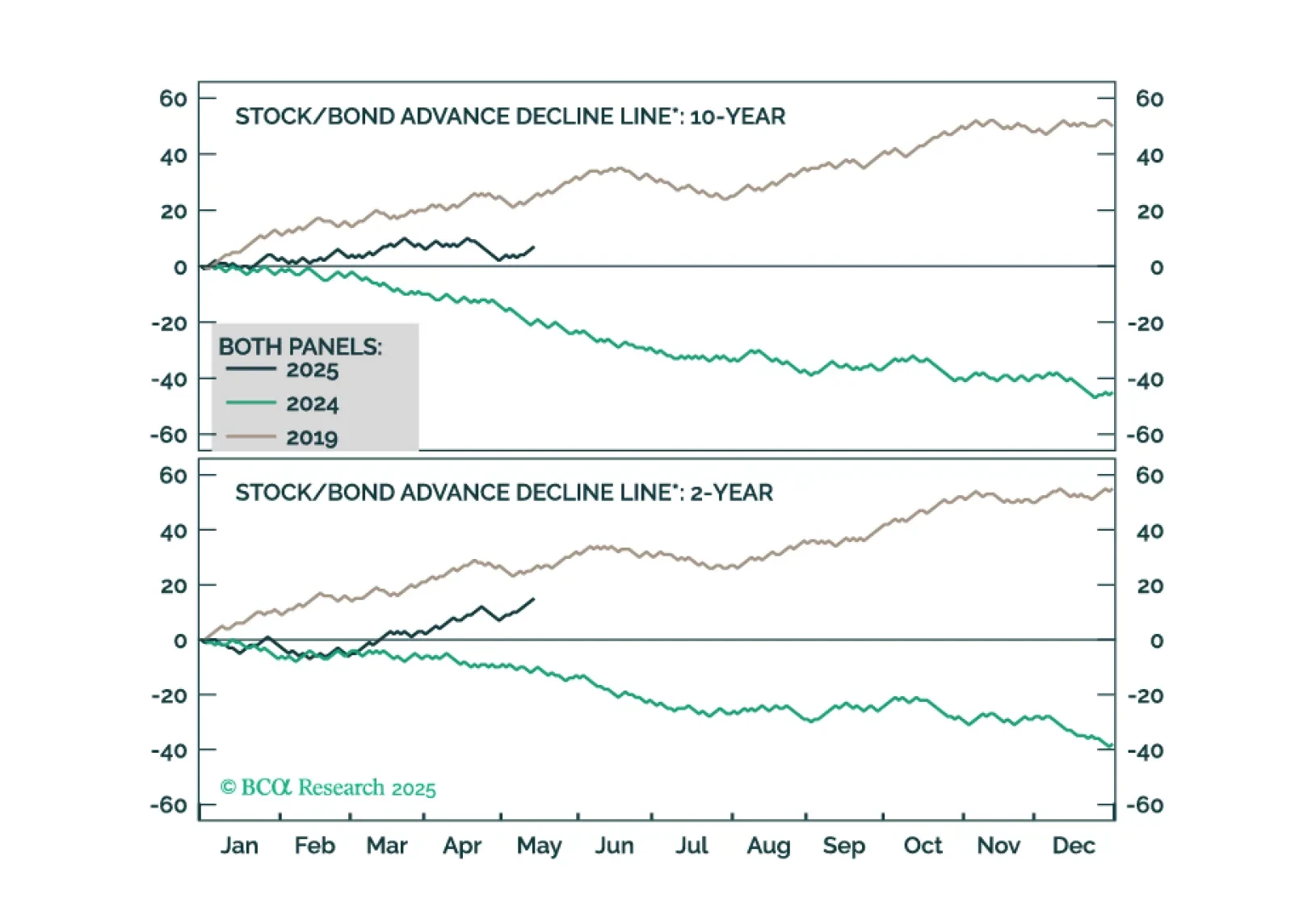

Right now, the major stock and bond markets are more ‘anti-fragile’ than fragile, and the Joshi rule recession indicators signal that a US recession is not imminent. This justifies a neutral, or default, tactical weighting to both…

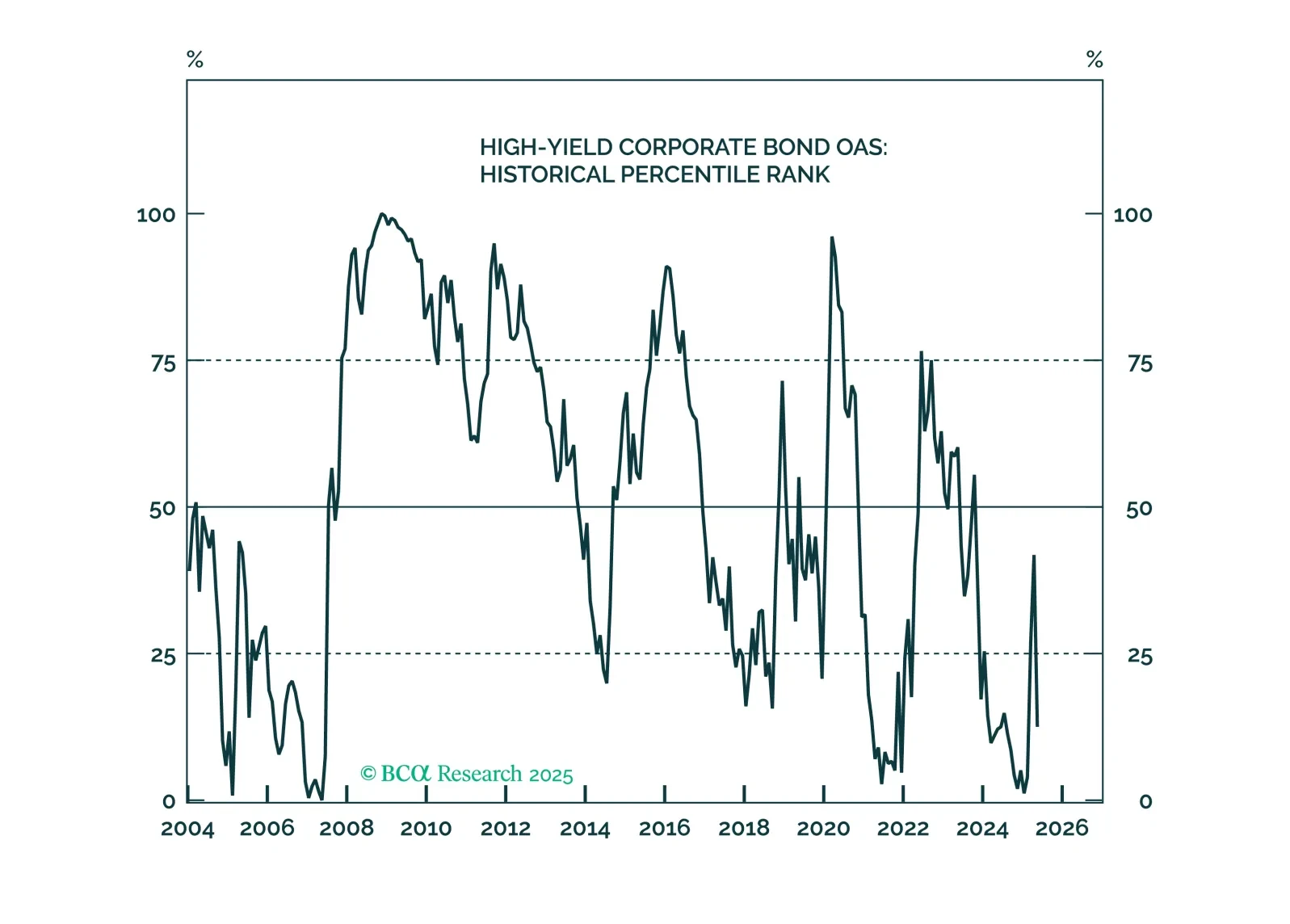

Risk assets rallied hard following the Great Geneva De-escalation, but we are not enamored of risk assets’ risk-reward profile. Forward-looking survey data remain awful on balance and we continue to recommend a defensive asset…

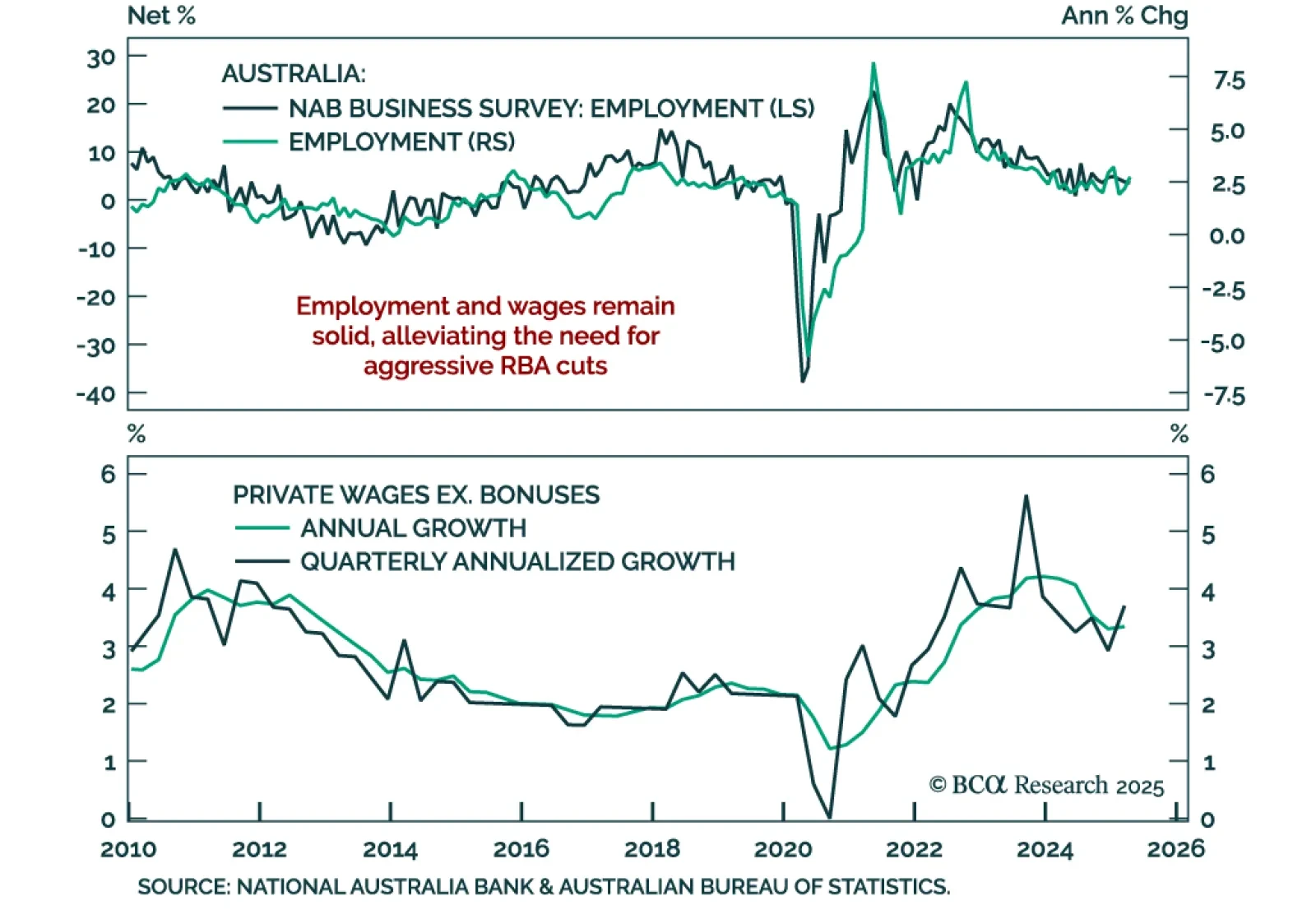

A strong Australian labor market is limiting the scope for RBA easing, reinforcing our underweight on Australian government bonds. Our Chart Of The Week comes from Robert Timper, strategist in our Global Fixed Income Strategy team.…

Tariff front-running behavior makes the April hard economic data difficult to interpret, but we take the strong reading from Food Services spending as a signal that the US consumer has not yet buckled.

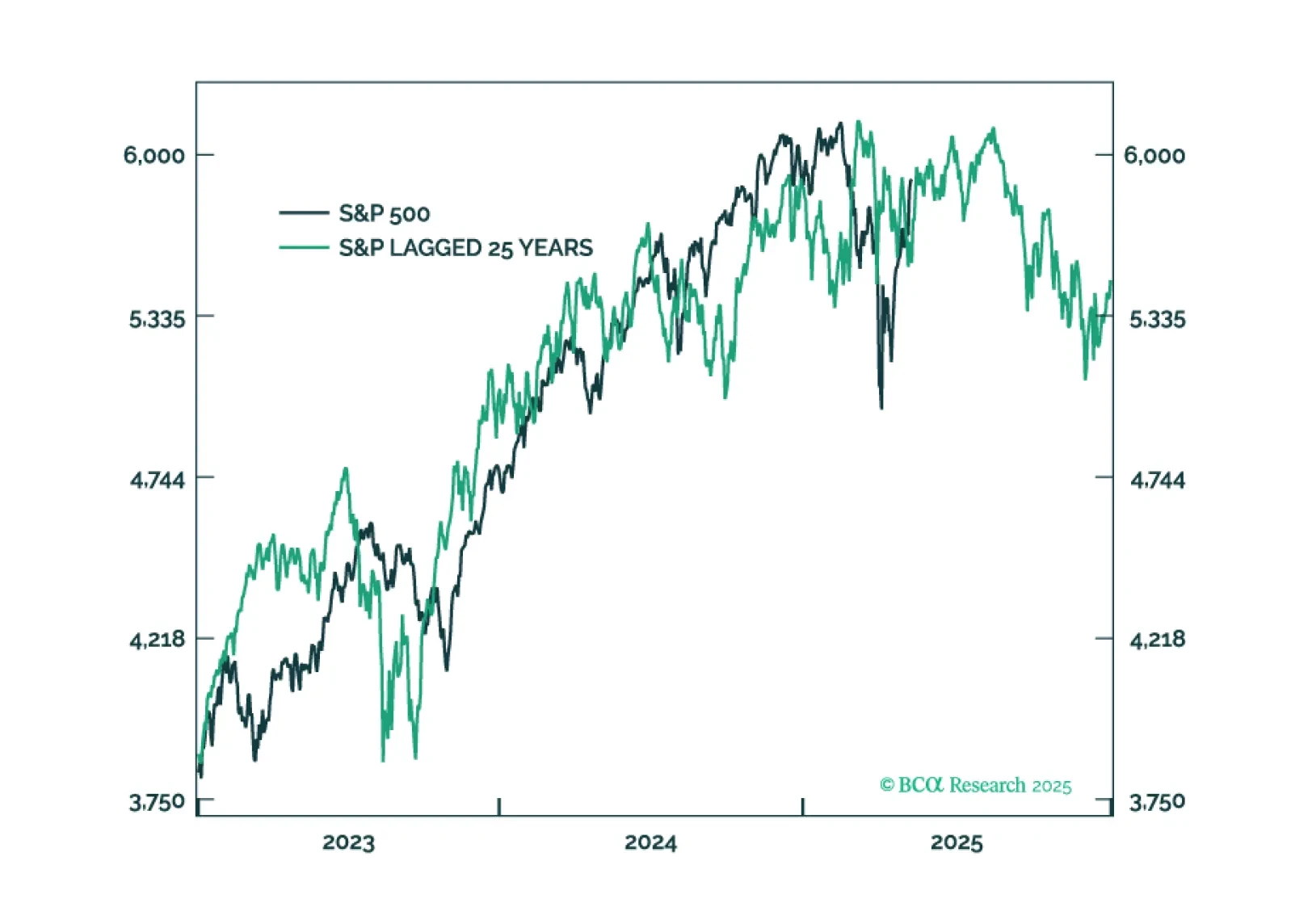

This year’s plunge in tech stocks followed by the recent strong countertrend rally is eerily reminiscent of 2000. But the market and economic parallels between 2025 and in 2000 run much deeper. This report lists 10 striking parallels…

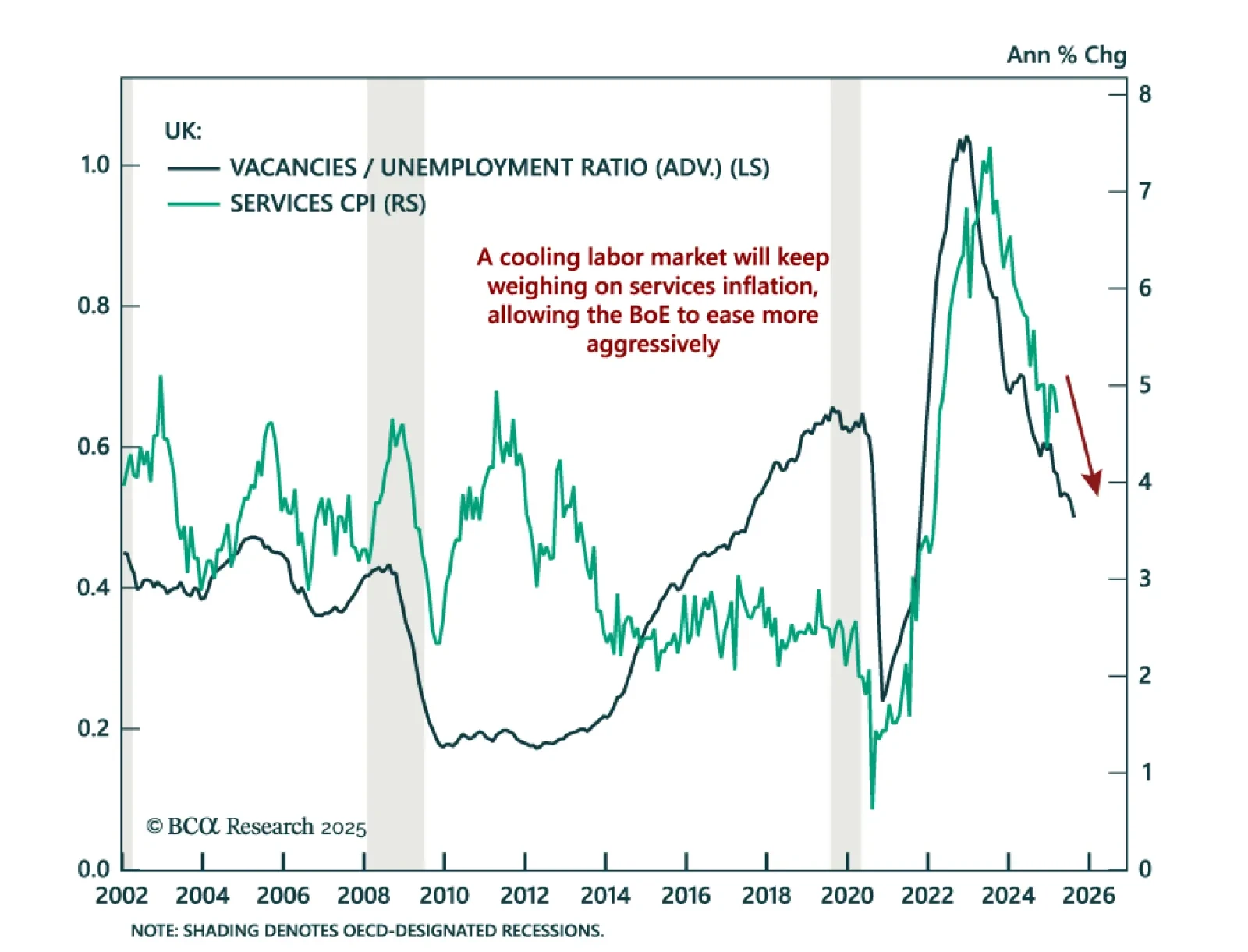

UK labor market weakness is reinforcing the case for BoE cuts and supporting our overweight in UK Gilts. April payrolls fell by 33k, marking a third consecutive monthly decline, while job vacancies remain below pre-COVID levels for…

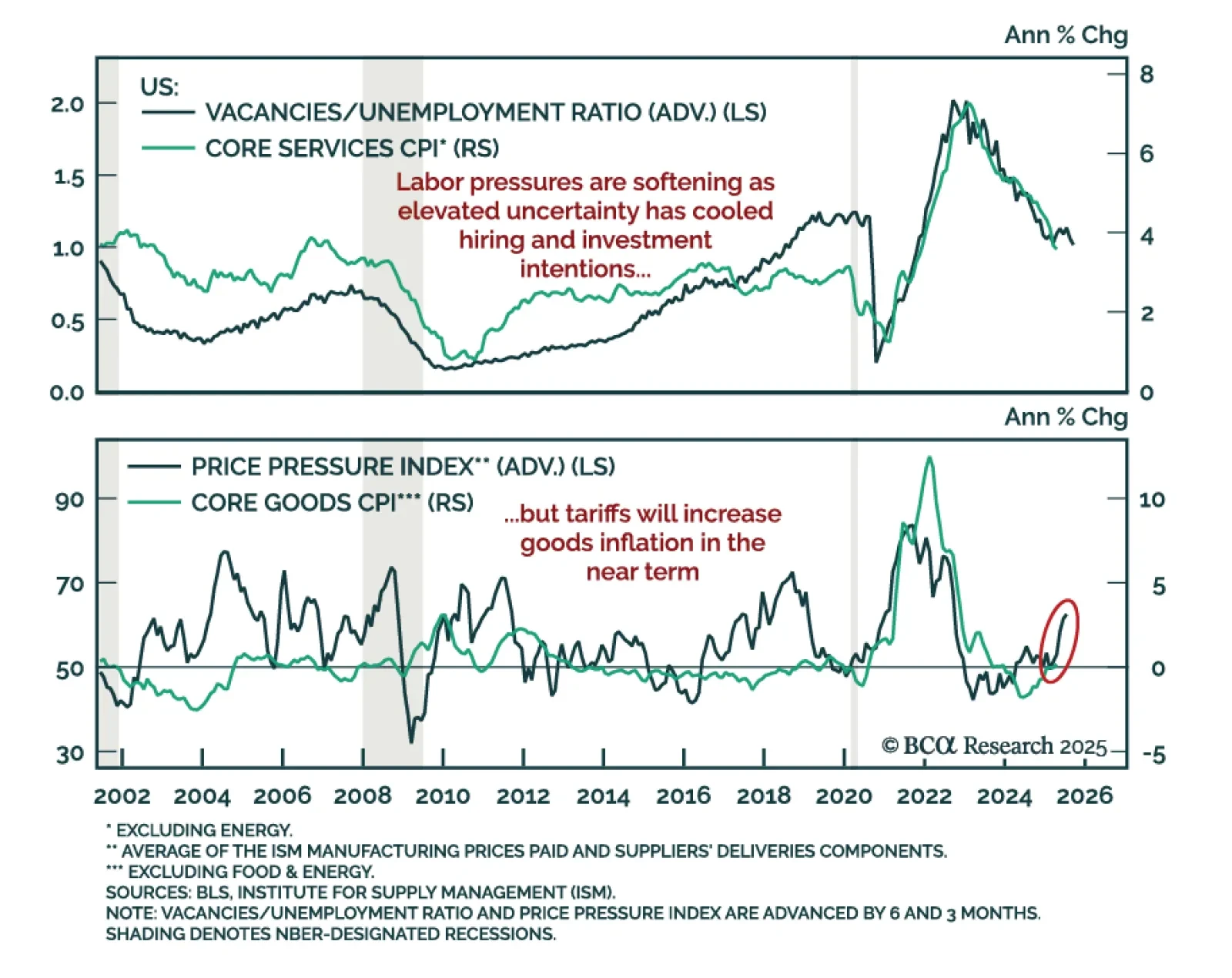

April’s CPI came in cooler than expected, but tariff-driven supply shocks will keep the Fed tight, supporting long-duration exposure. Headline CPI rose 0.2% m/m (2.3% y/y) while core inflation held steady at 2.8%. Services inflation…