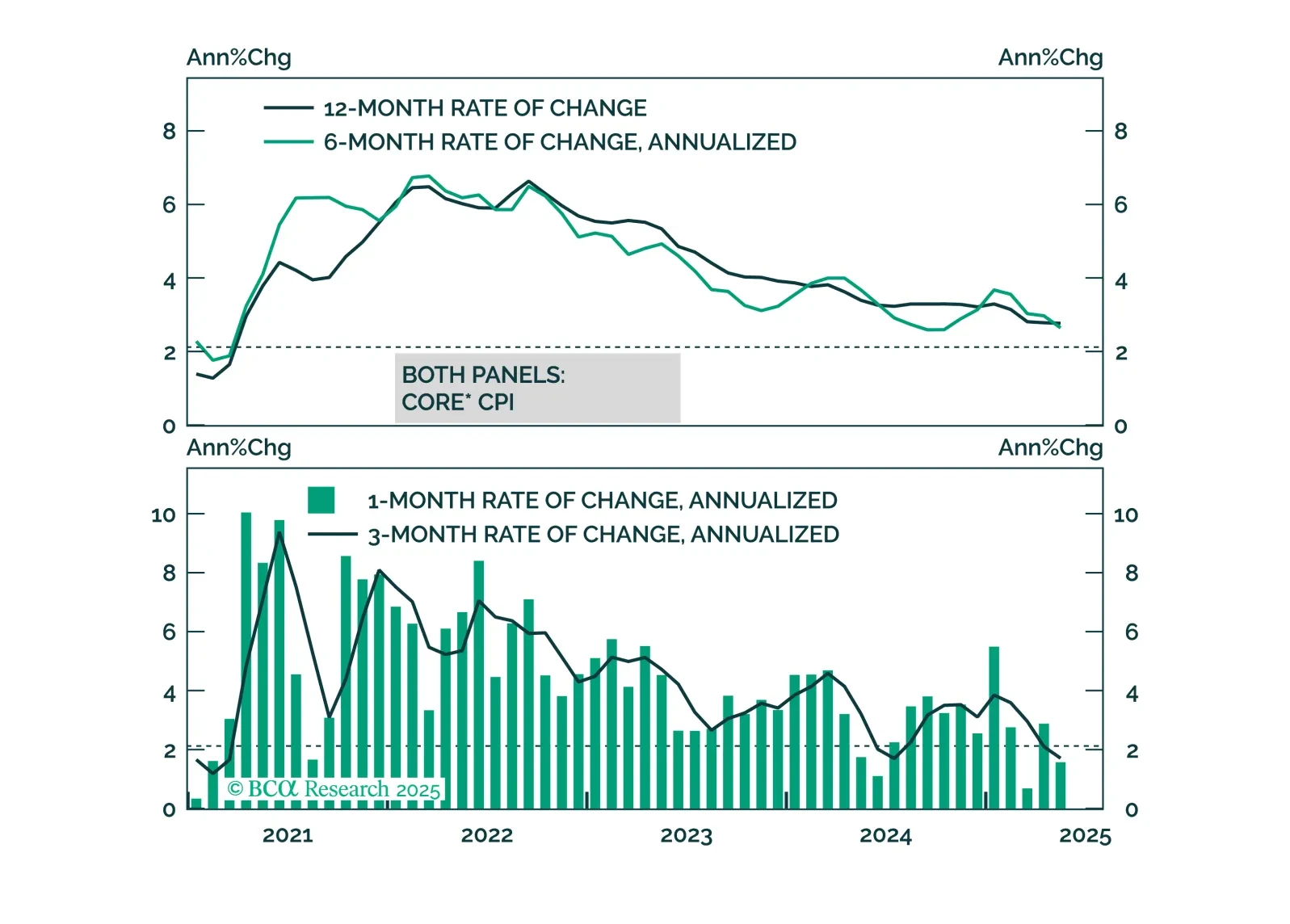

While we anticipate higher inflation in June, it looks increasingly likely that the price impact from tariffs will be less aggressive and long-lasting than many feared.

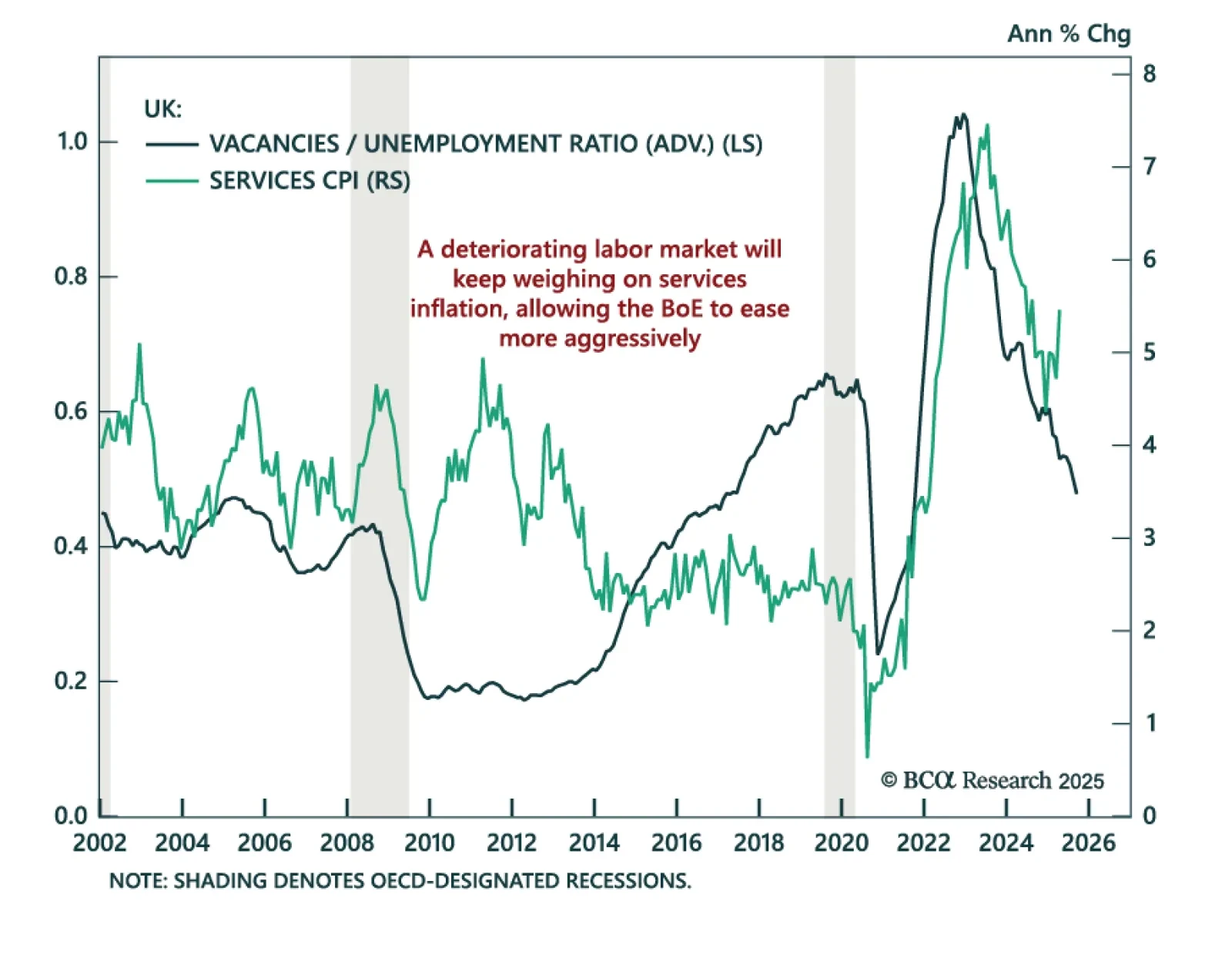

UK labor market deterioration reinforces our overweight on Gilts and dovish BoE policy trades. Payrolls fell by 109k in May, an acceleration from the 55k revised decline for April (originally reported as -33k), and job vacancies…

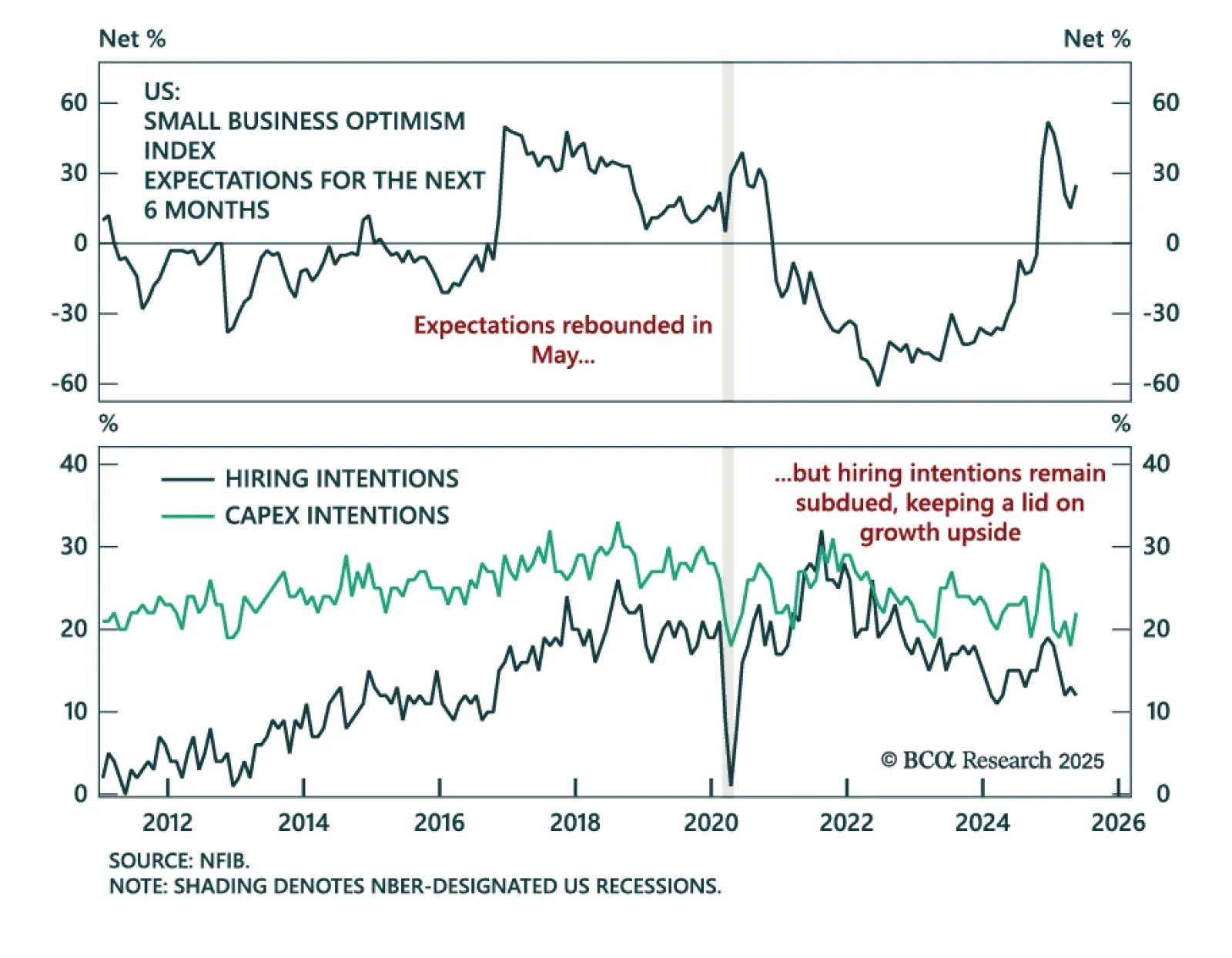

Small business confidence improved in May, but hiring intentions fell and activity remains sluggish, reinforcing our cautious equity stance. The NFIB Small Business Optimism Index rose to 98.8, beating expectations. However, most of…

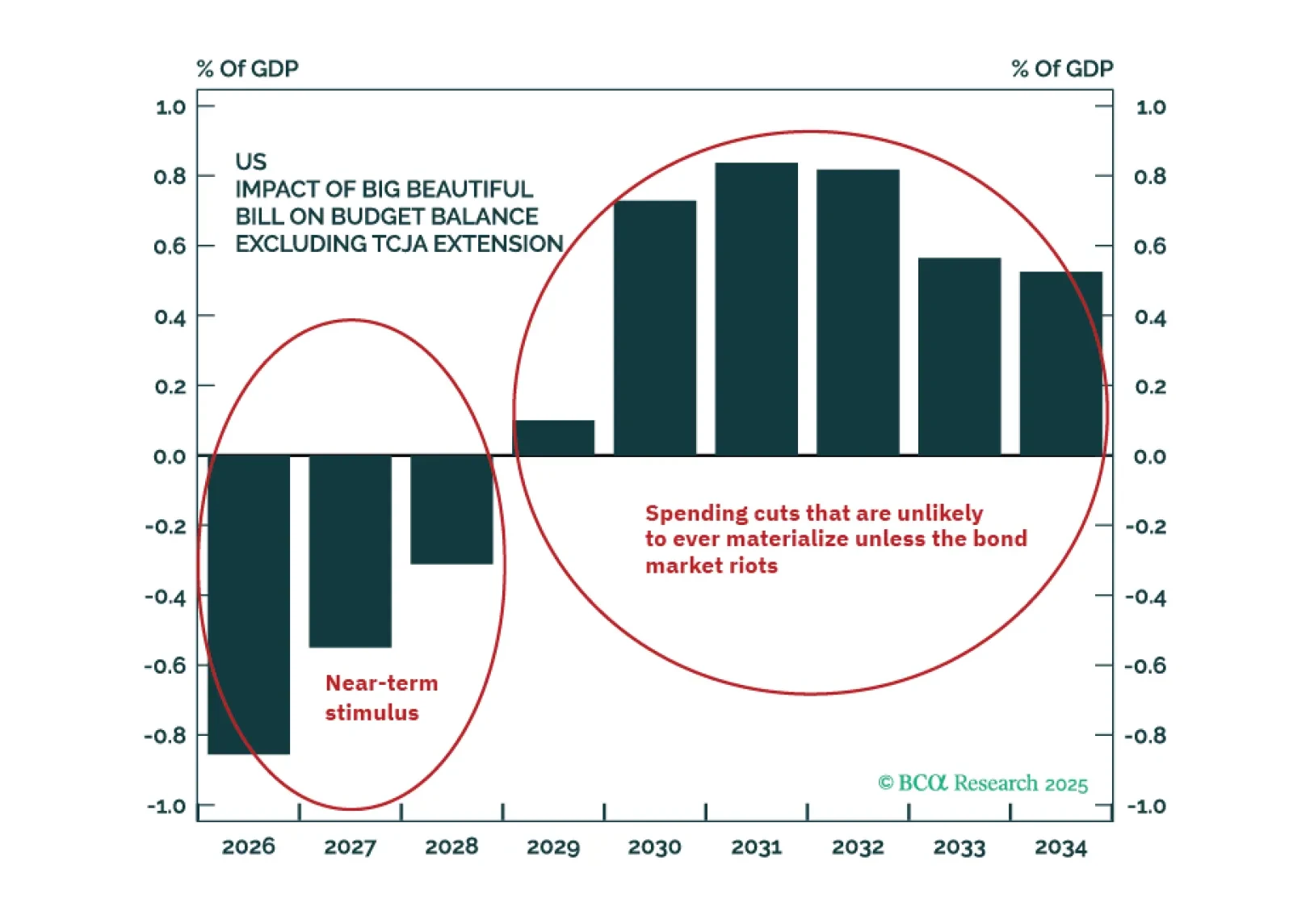

The US economy has held up better so far this year than we had expected. For the time being, investors should remain modestly underweight equities. A more aggressive underweight would be justified only once the “whites of the…

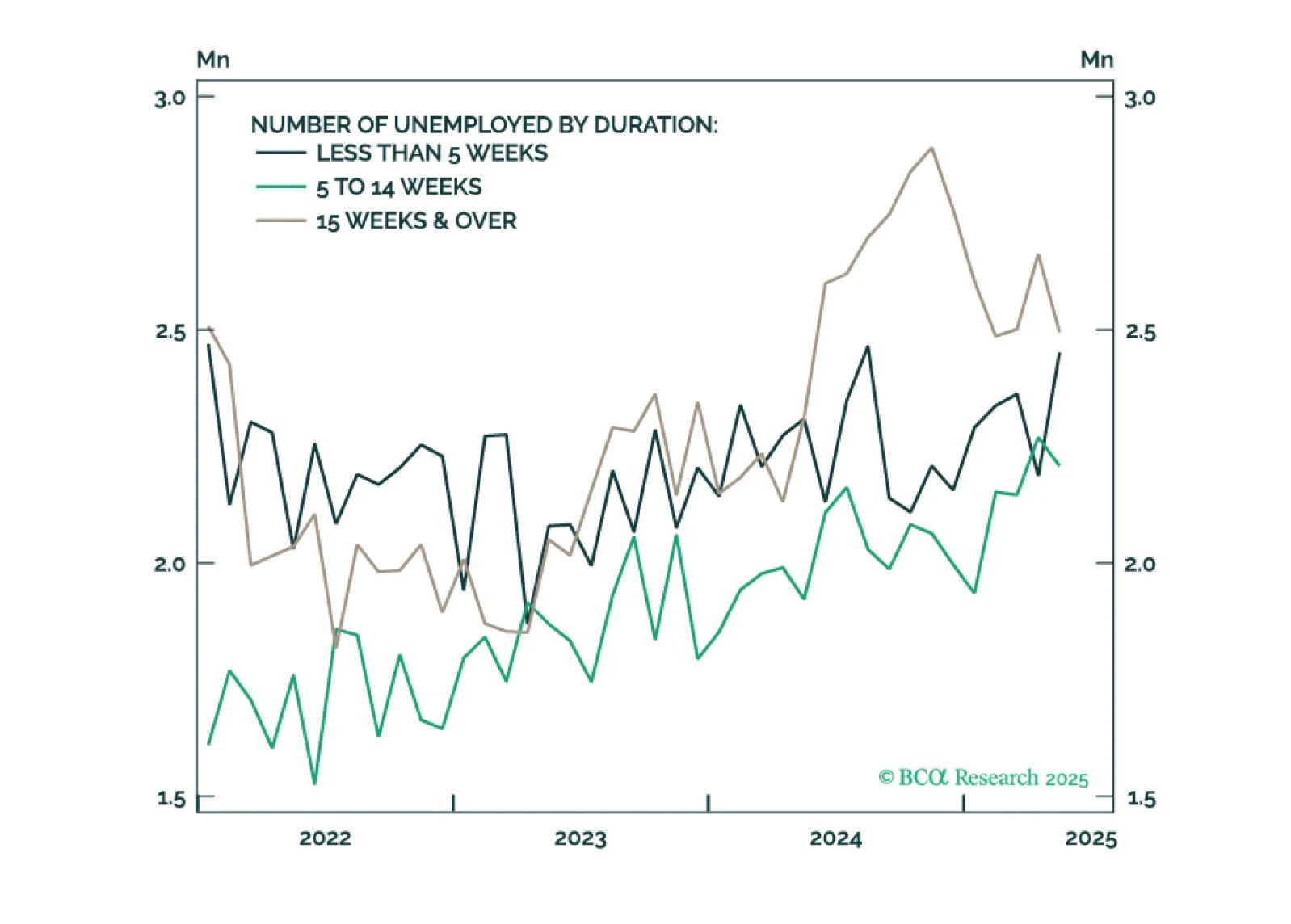

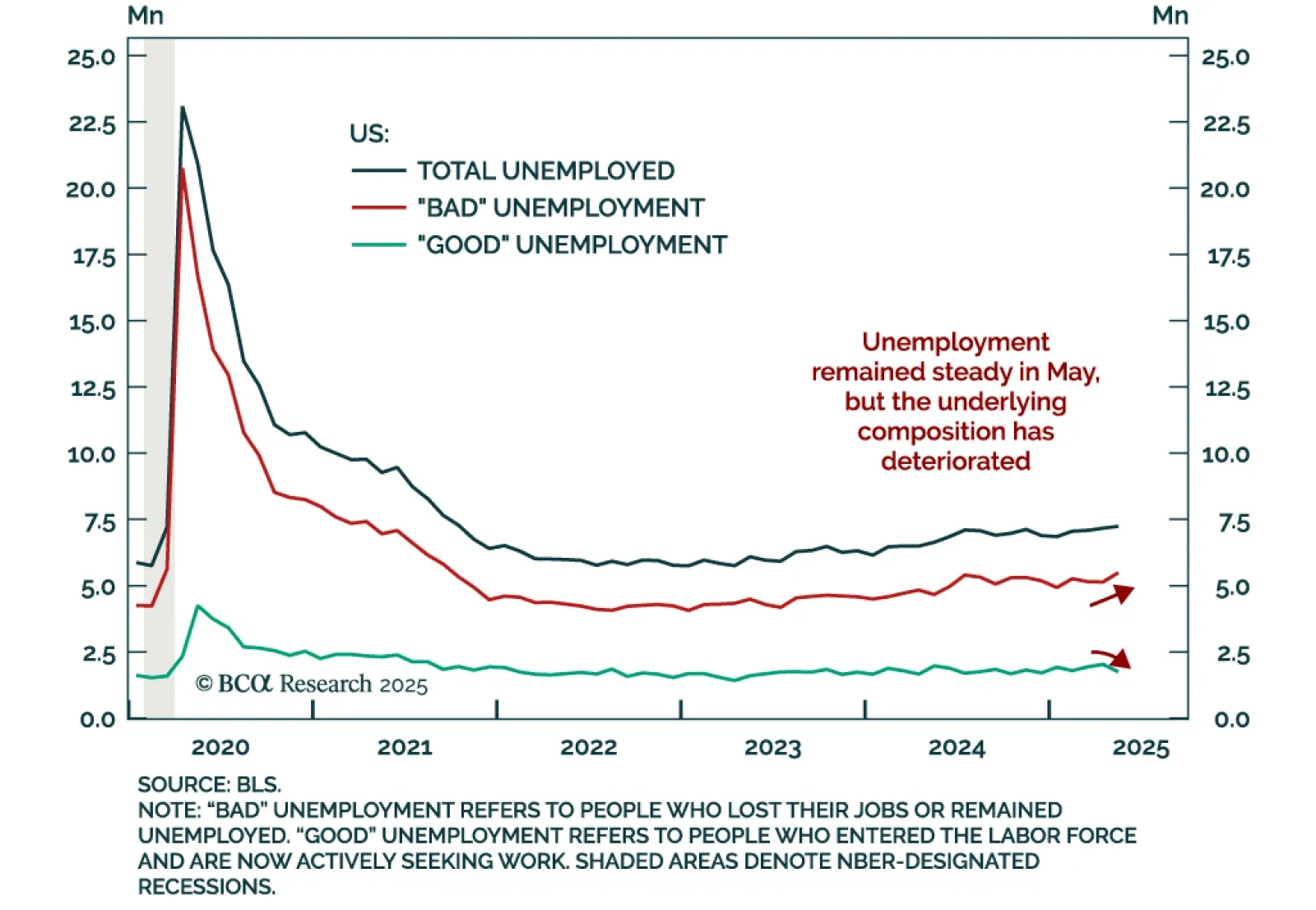

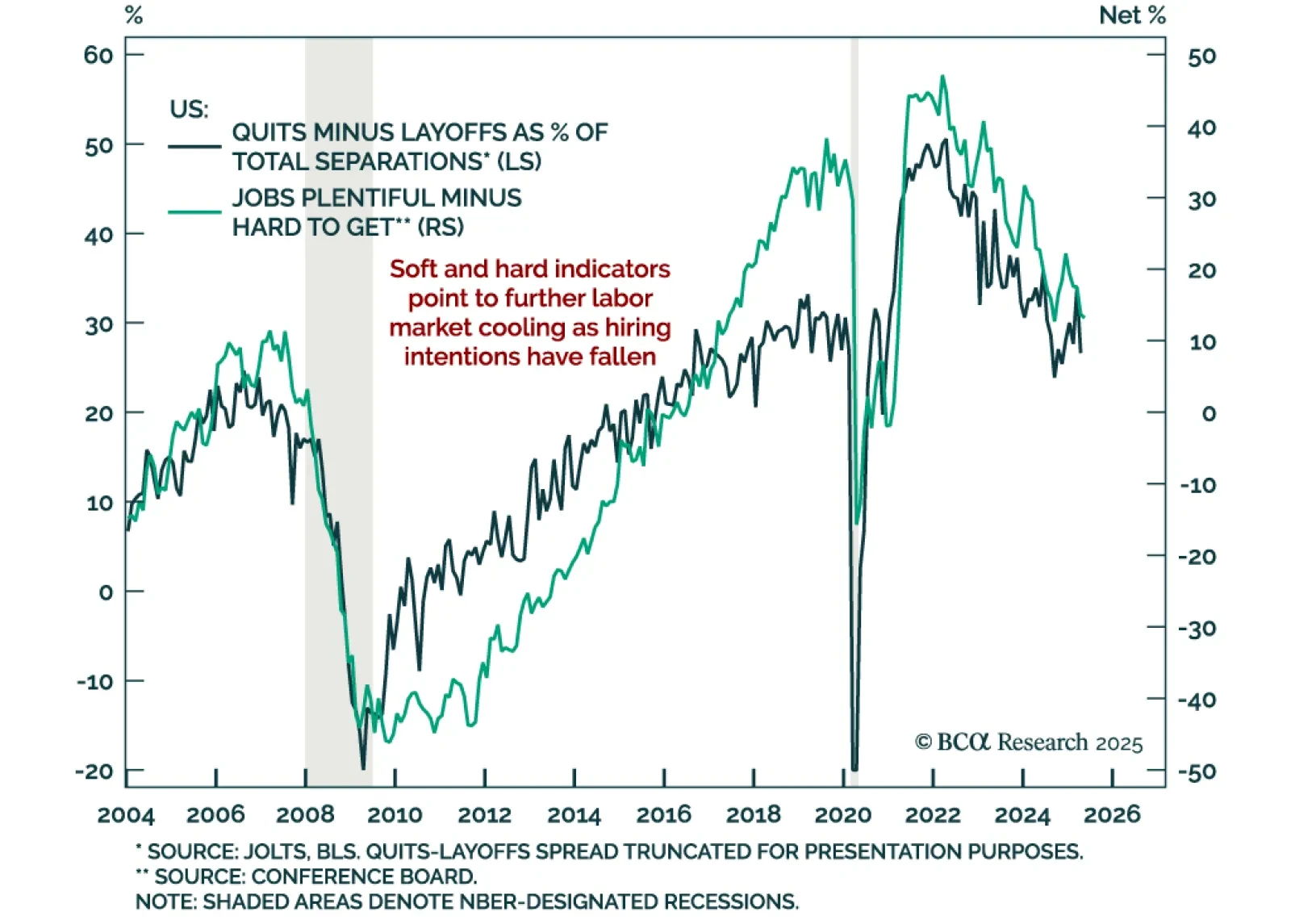

For now, measures of labor market utilization (like the unemployment rate) are only gradually weakening. But we know from history that these trends have a habit of quickly accelerating in advance of recession.

The May US jobs report reinforces our defensive stance as labor momentum is slowing even if not collapsing. Payrolls rose 139k, beating estimates, but decelerating from a downwardly revised 147k. Two-month revisions cut 95k jobs,…

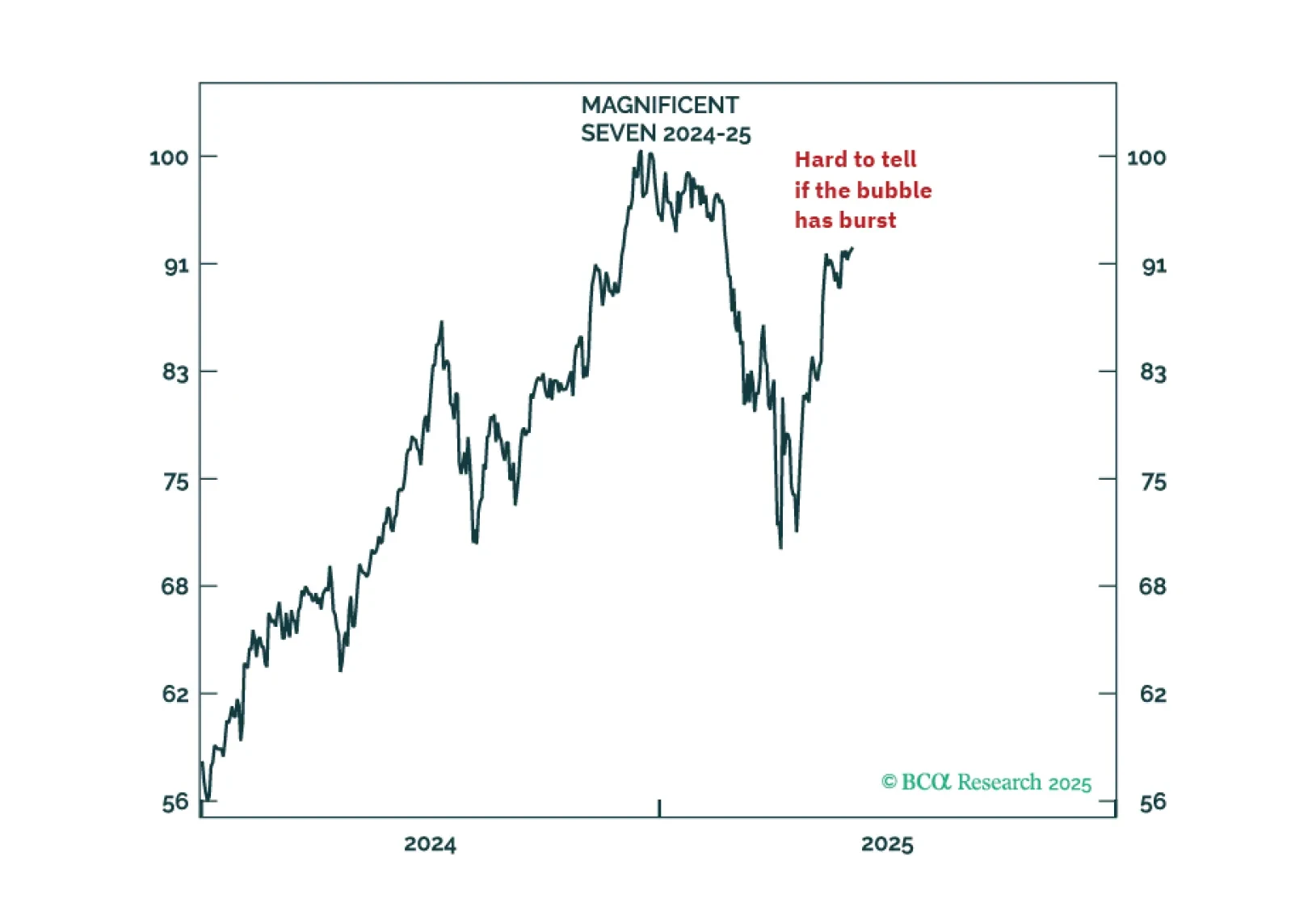

I am a structural disbeliever in the US superstar stocks because these winners of the previous technology, Web 2.0, are unlikely all to be the winners of the latest technology, AI. But I would suspend my disbelief if the Magnificent-…

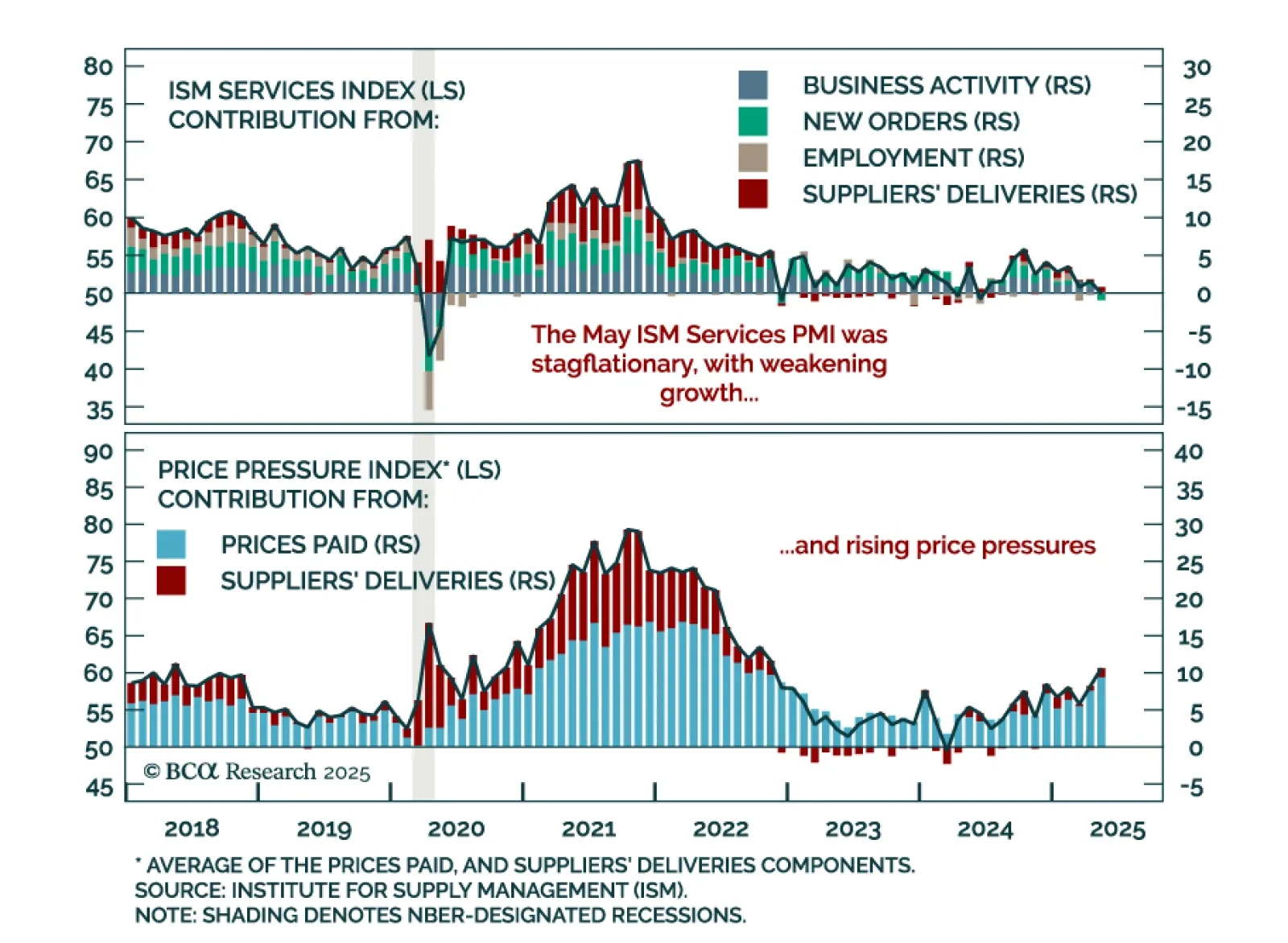

The May ISM Services PMI sent a stagflationary signal, reinforcing the case for defensive positioning. The headline index slipped into contraction at 49.9 from 51.6 in April, missing expectations. New orders collapsed to 46.4 from 52…

Our Portfolio Allocation Summary for June 2025.

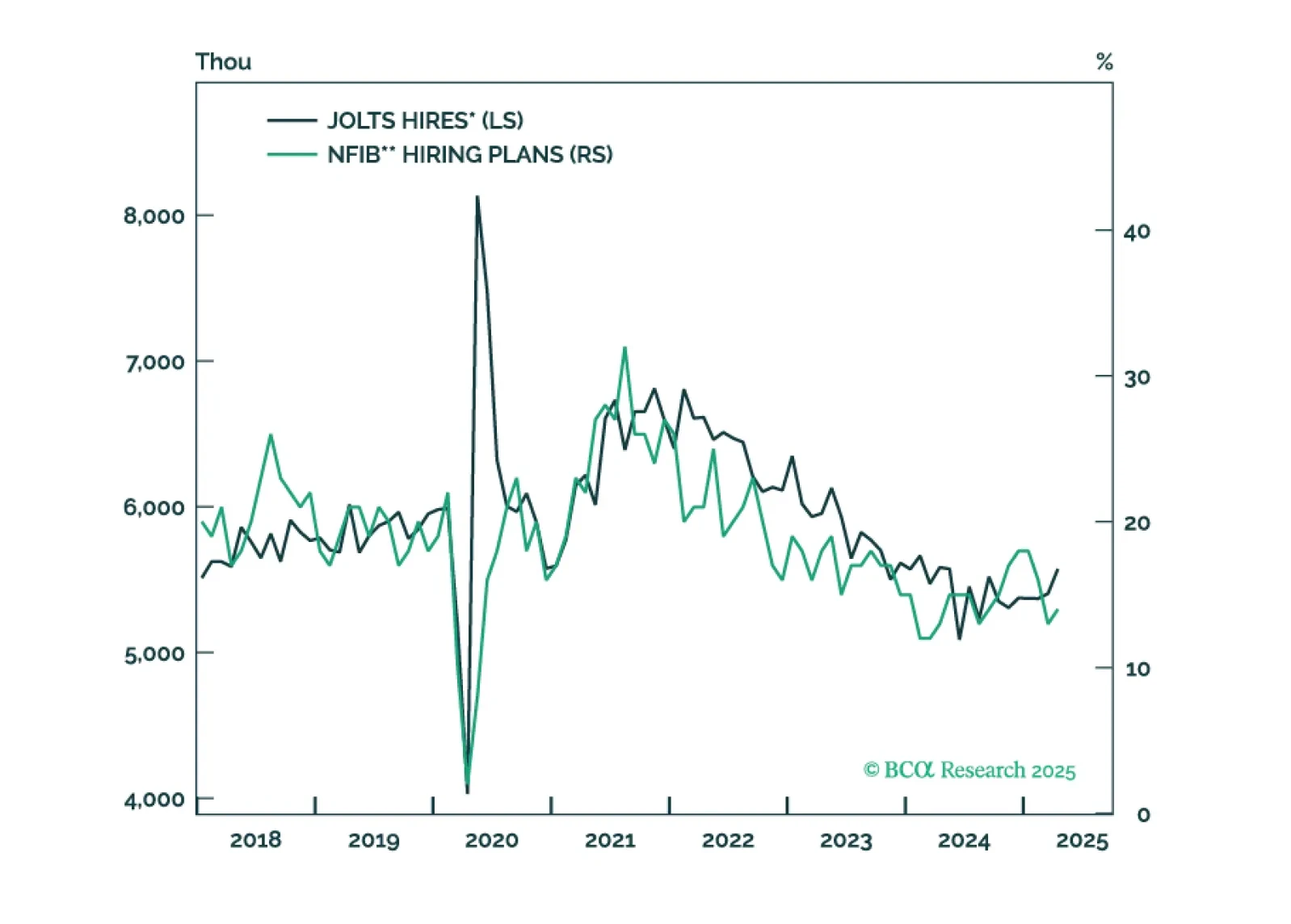

The April JOLTS report was mixed, but the underlying trend still points to a weakening labor market and reinforces our overweight in government bonds. Job openings rose to 7.5m from 7.2m, and hiring picked up, though gains were…