Highlights Equities had a wild ride in October, ... : The S&P 500 has bounced smartly off of its October 29th lows, but the decline that preceded the bounce was unusually severe. ... that unsettled a lot of investors, and made us…

Highlights Did October's equity rout ... : Before bouncing back in its final two sessions, October was the S&P 500's 12th-worst month of the postwar era. ... represent a watershed for financial markets?: Shaken investors…

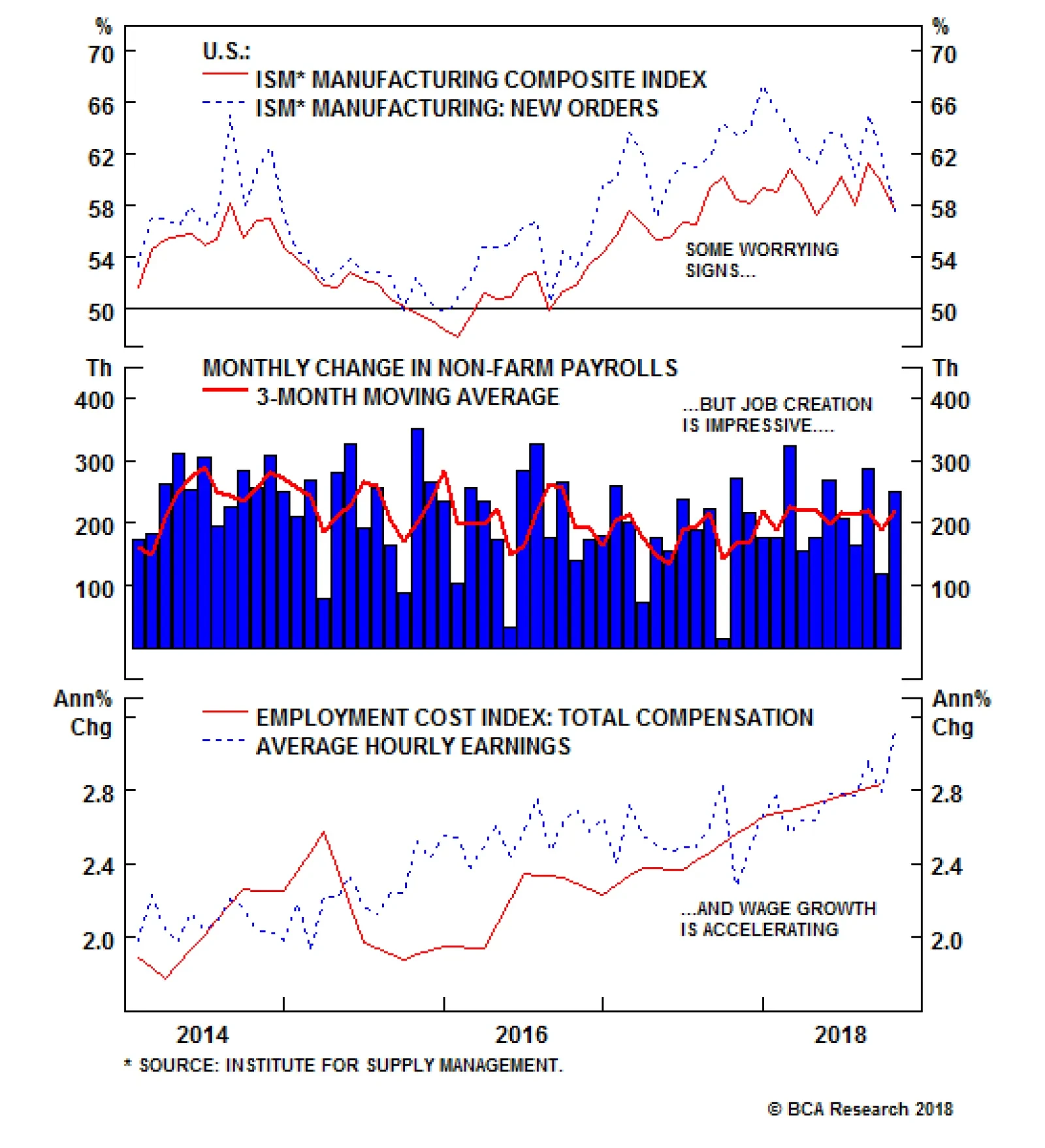

The equity market of late has been highly sensitive to any signs that the U.S. has reached peak economic and profit growth for the cycle, especially given this year’s disappointing housing data. The drop in both the ISM…

Highlights Duration: Foreign economic growth continues to diverge negatively from growth in the United States. The resulting upward pressure on the U.S. dollar will eventually drag U.S. growth down, and could temporarily threaten the…

Highlights Macro outlook: Global growth will continue to decelerate into early next year on the back of brewing EM stresses and an underwhelming policy response from China. Equities: Stay neutral for now, while underweighting EM…

Highlights When projecting the future course of interest rates, the Fed is the best place to start: Although the Fed only expressly controls short rates, its influence is felt across all maturities. Until it inverts the yield curve,…