We still believe a recession looms, but it has yet to rear its ugly head. We continue to recommend investors position defensively, but we will change tack if clear signs of a recession don’t emerge soon.

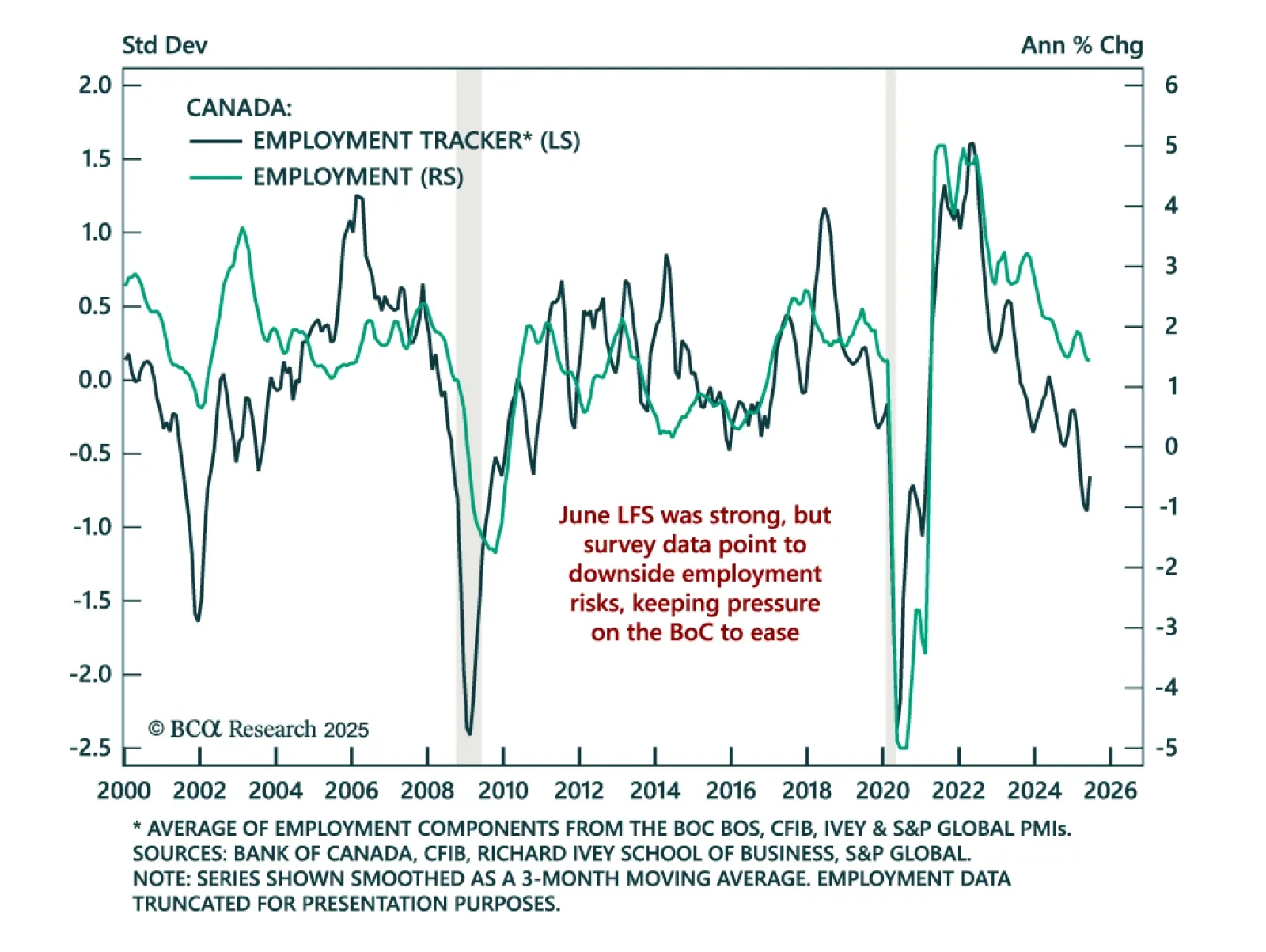

June’s strong Canadian jobs data does not argue against further easing and a CGBs overweight. Employment rose by 83.1k versus expectations for no growth, the first increase since January. The unemployment rate fell to 6.9% from 7.0…

We will abandon our recession call if US economic data show clear signs of stabilization over the summer months. For now, that has not happened. Maintain a modest underweight to stocks but look to get more defensive if MacroQuant’s…

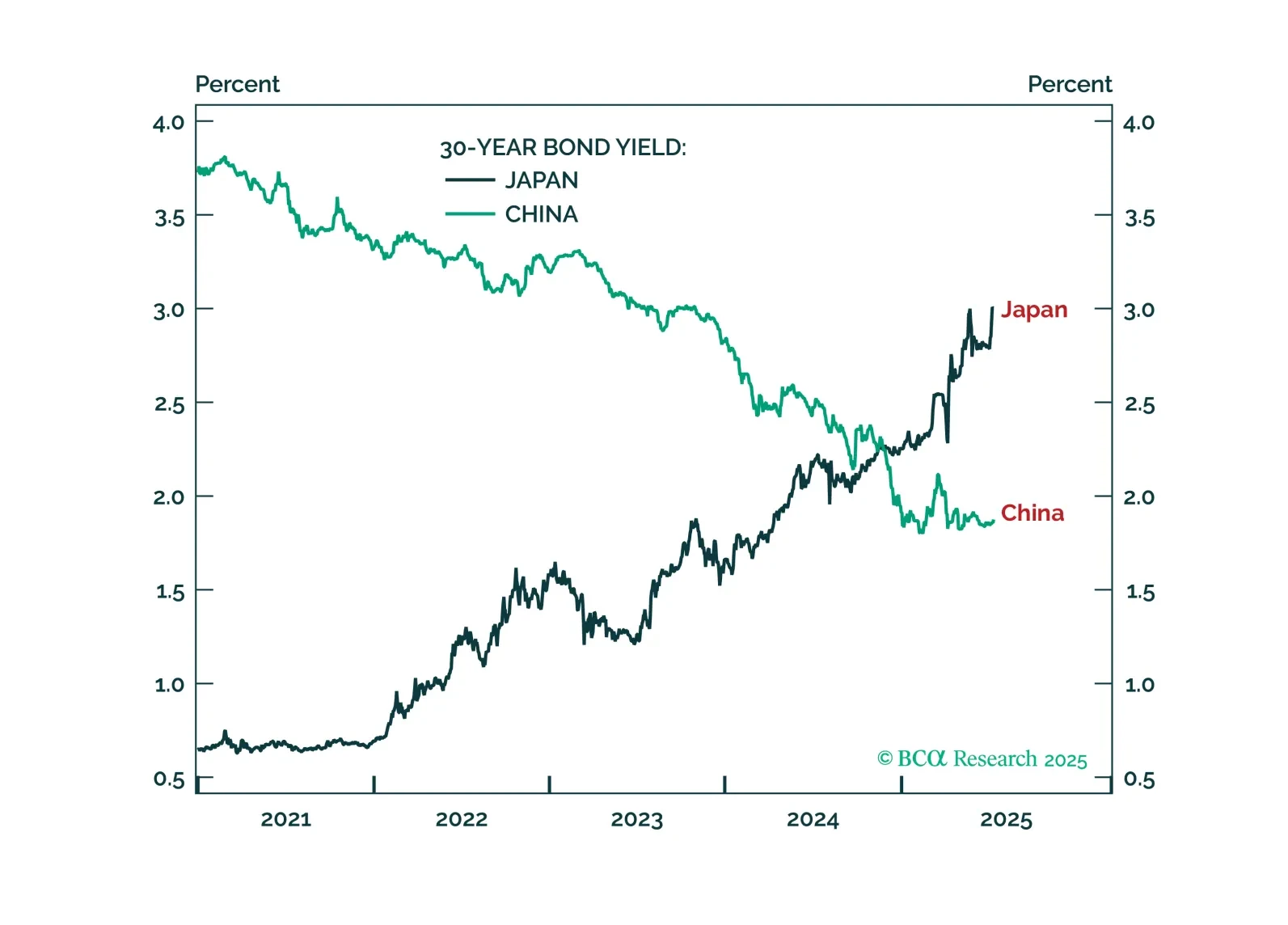

Upward pressure on Japan’s real bond yield justifies overweighting the yen and underweighting overvalued tech. Plus: two new tactical trades are long JPY/EUR and short platinum.

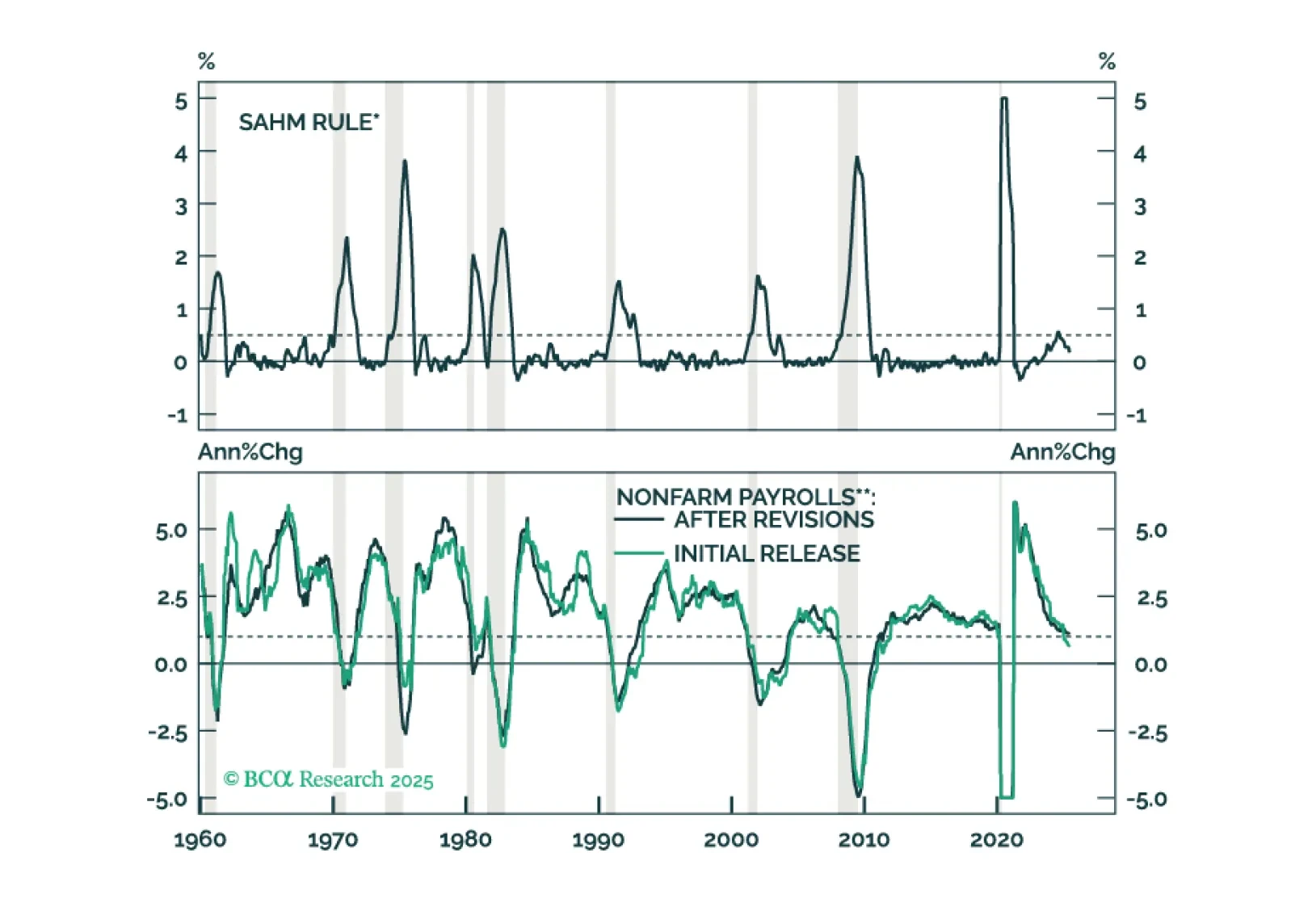

June’s employment report showed a tick down in the unemployment rate, an improvement that rules out a Fed rate cut later this month.

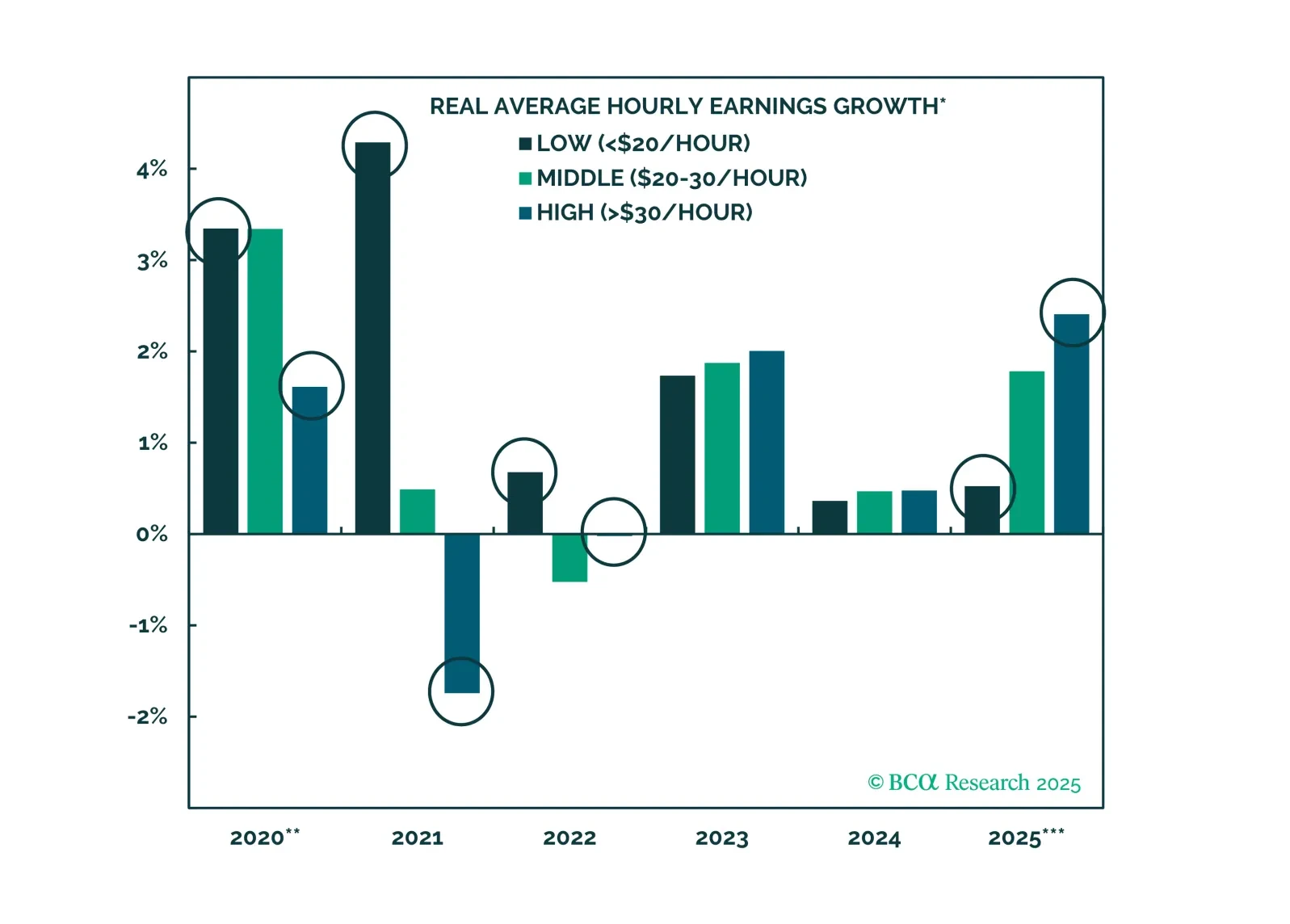

Stronger-than-expected June payrolls rule out a July Fed cut, but the report does not derail the case for long duration and curve steepeners. Nonfarm payrolls printed at 147k, with the two prior months revised up by 16k, leaving the…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

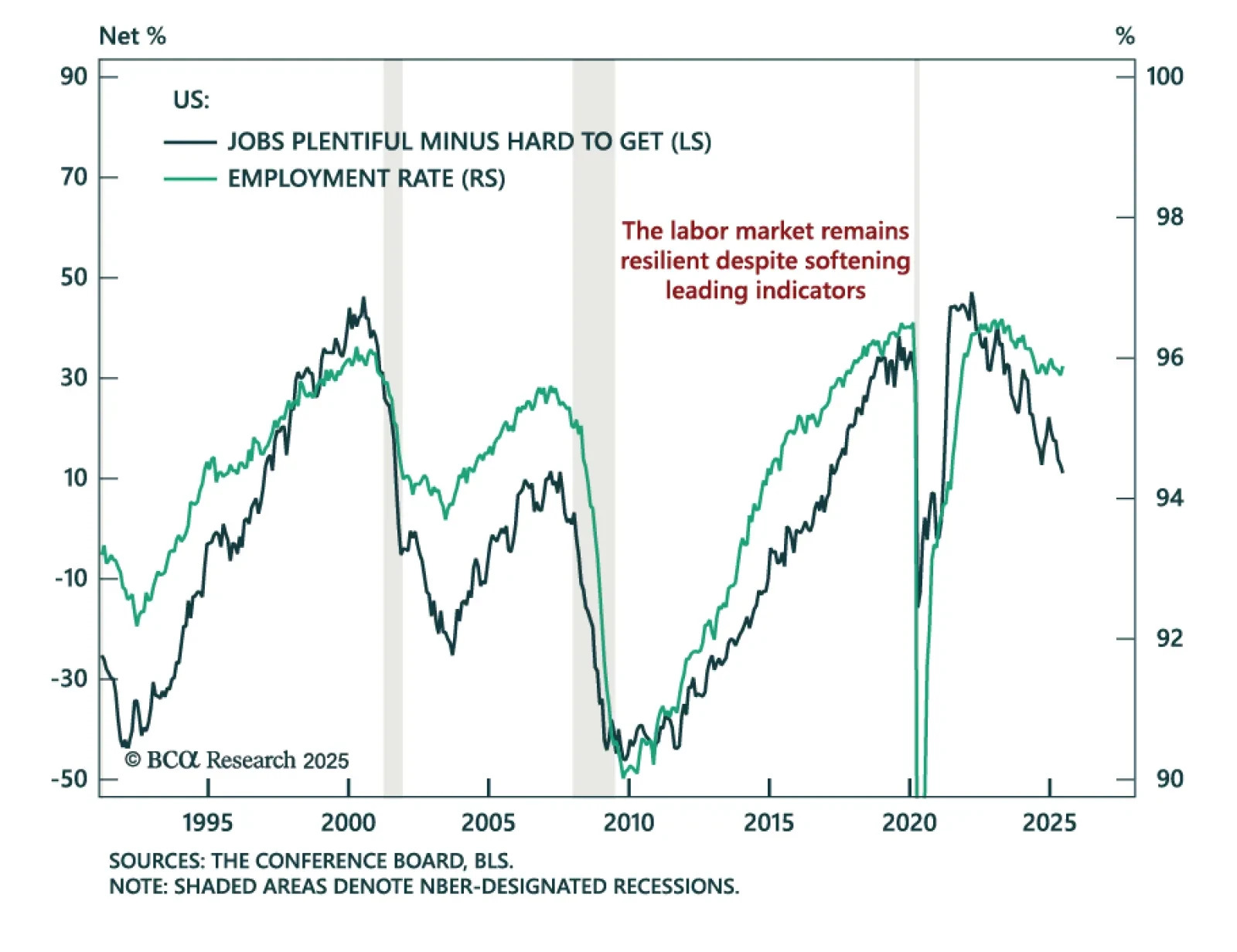

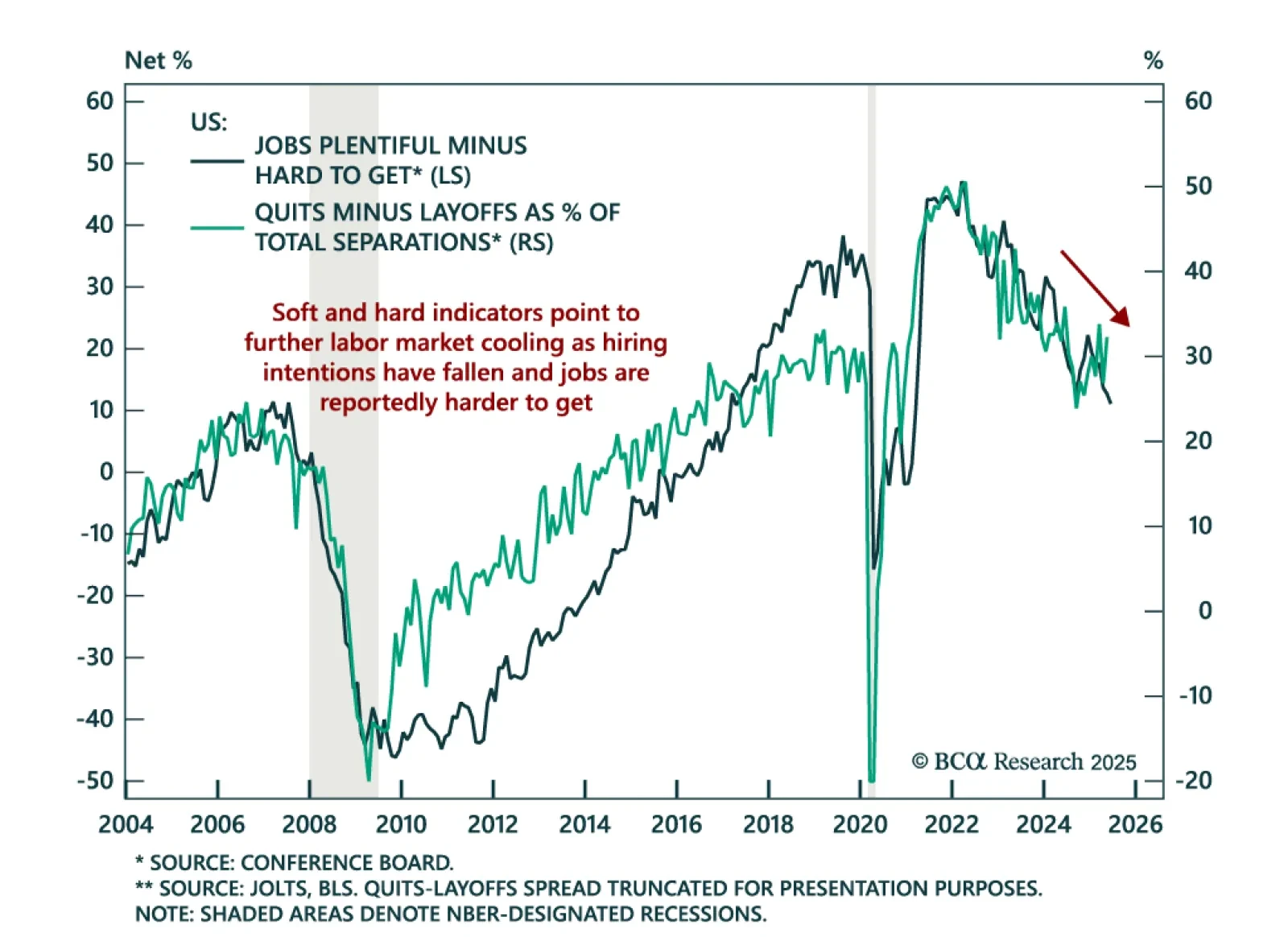

May JOLTS data suggest labor market softening beneath the surface, reinforcing a defensive stance across portfolios. Job openings rose to 7.7m from 7.4m, beating estimates, while quits ticked up to 3.3m and layoffs fell to 1.6m.…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

In Section I, Doug underscores that the full weight of tariffs has yet to be felt on the US and global economies, against the dangerous backdrop of a softening labor market. In Section II, Jonathan presents the bullish case for the…