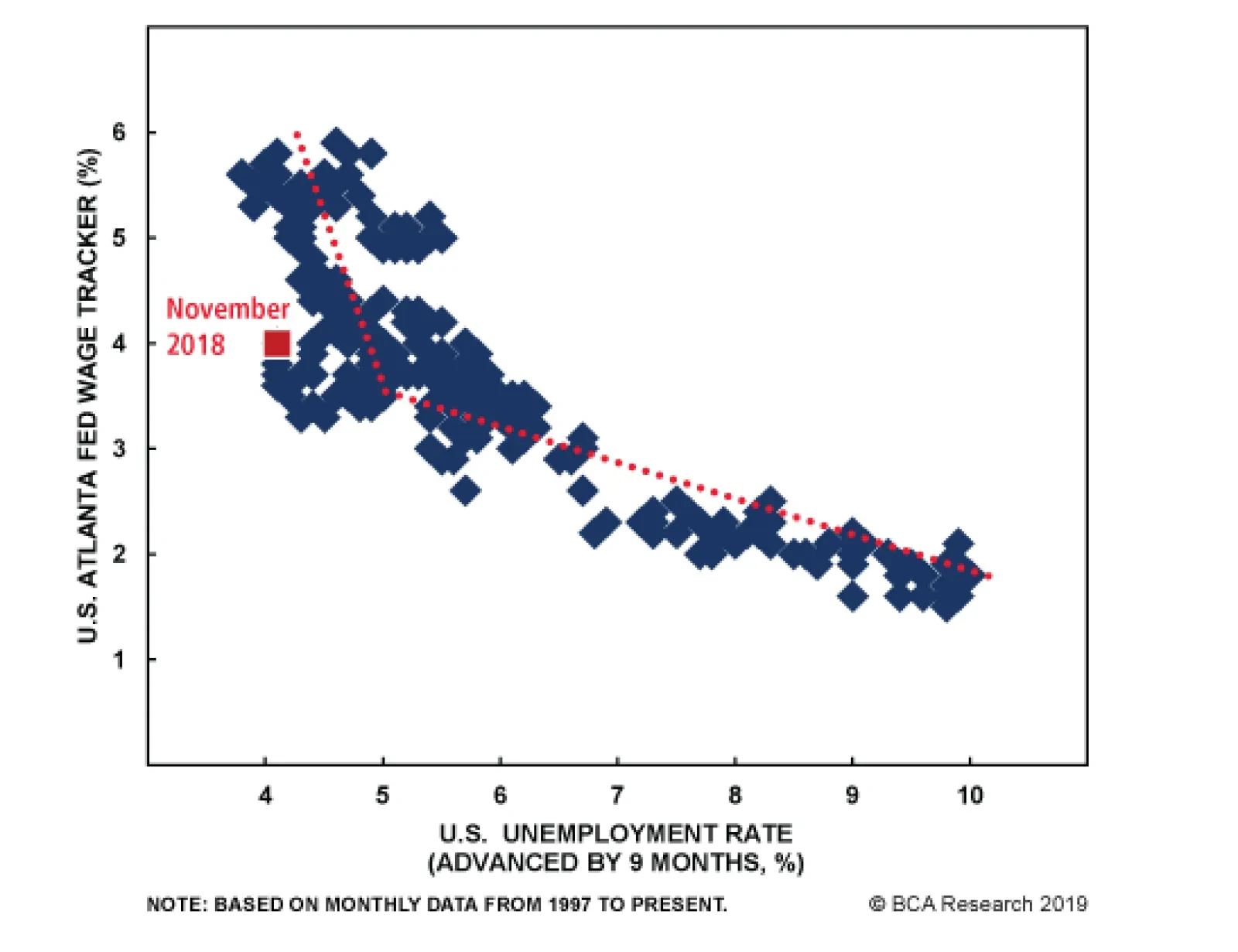

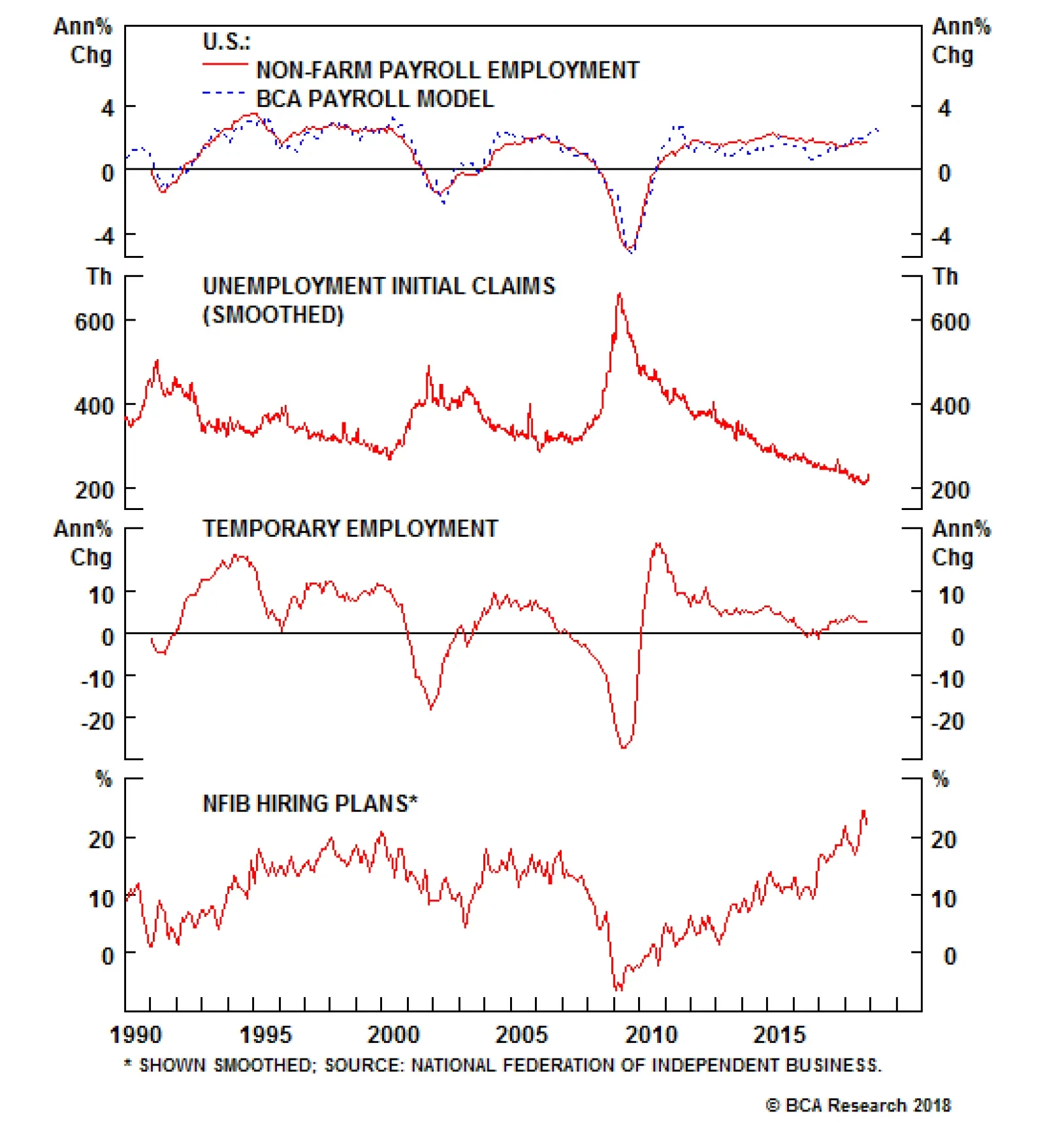

BCA has previously argued that the Phillips curve is “kinky” – that is it tends to be flat when unemployment is high, but to steepen sharply once unemployment falls below 5%. With the unemployment rate likely…

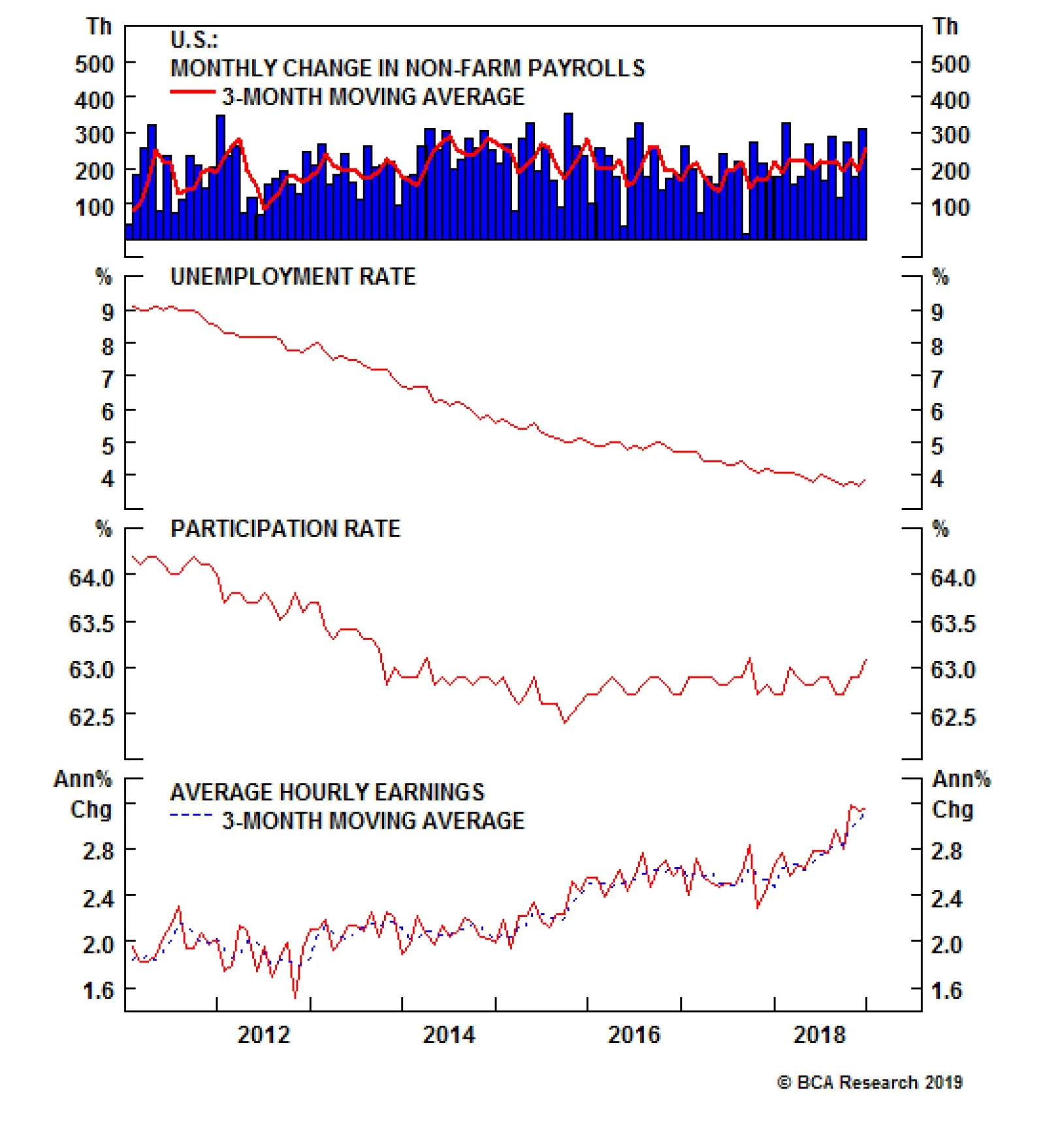

We learned today that December marked a horrible month for risk assets, but a great month for the U.S. labor market. Caught in the crosscurrents between these opposing conditions of weakness and strength is the Fed. Elements…

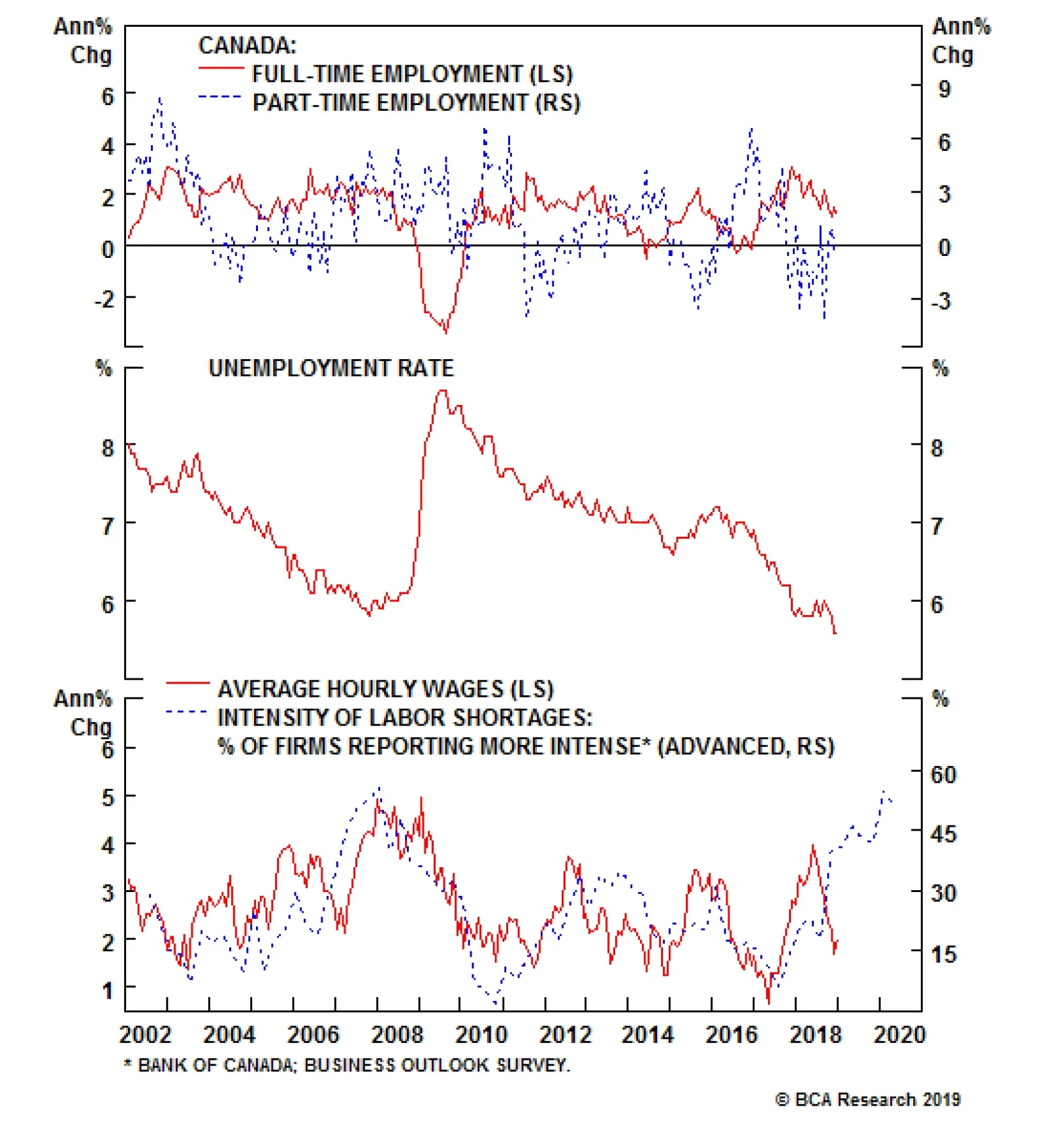

Unlike the very strong labor market conditions seen in the U.S. last December, the Canadian data came in slightly below expectations. Investors anticipated 10,000 Canadian jobs to be created in December against actual data of…

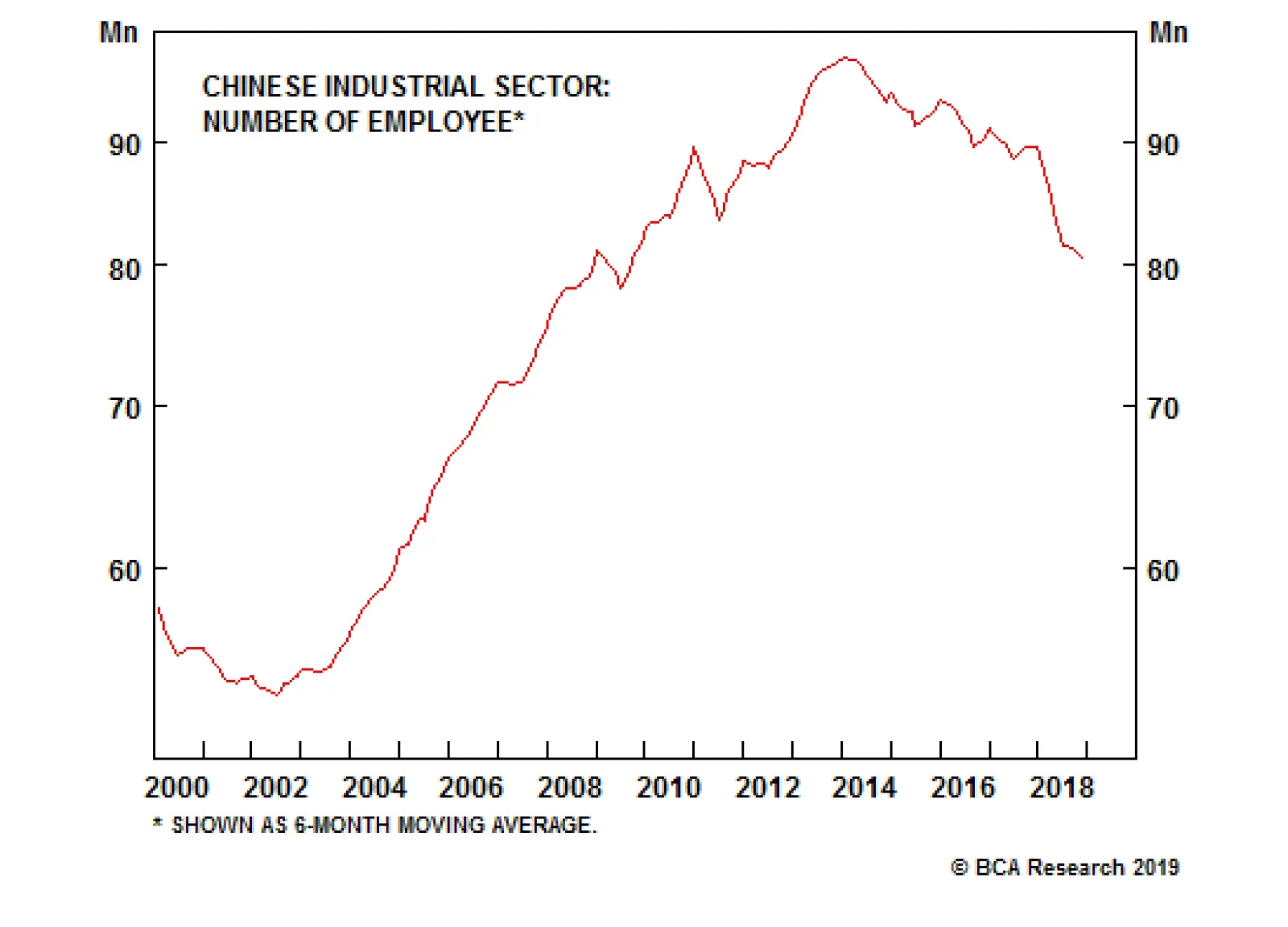

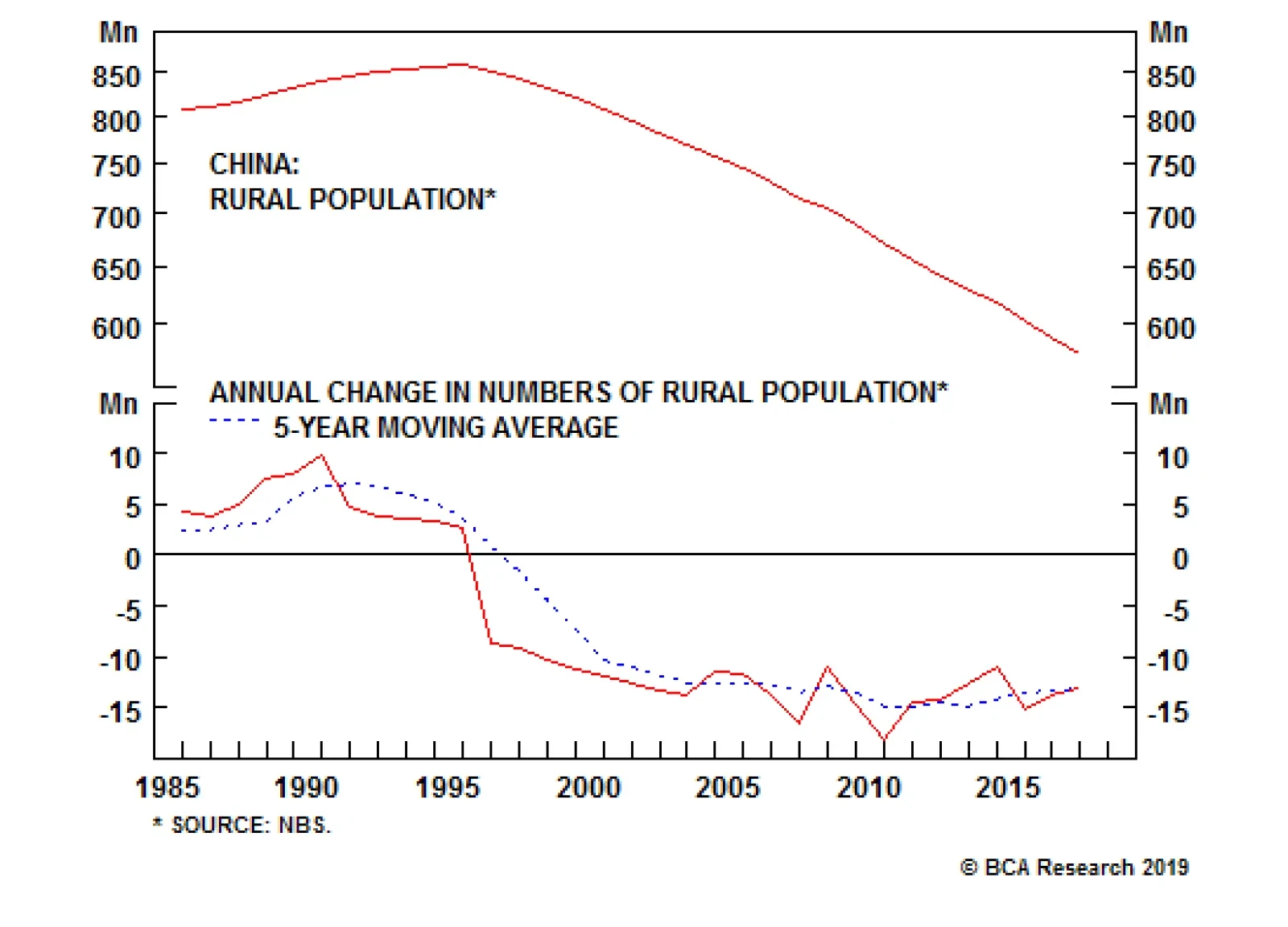

Our China strategists believe that the urbanization process will slow in China. There are several factors and trends that support their view on Chinese migration flows. First, rural-to-urban migration flows have already slowed…

China’s rural population has declined by 33% from its peak of about 860 million in 1995 to 577 million in 2017 (see chart). All else equal, the lower rural population base alone will result in smaller rural-to-city…

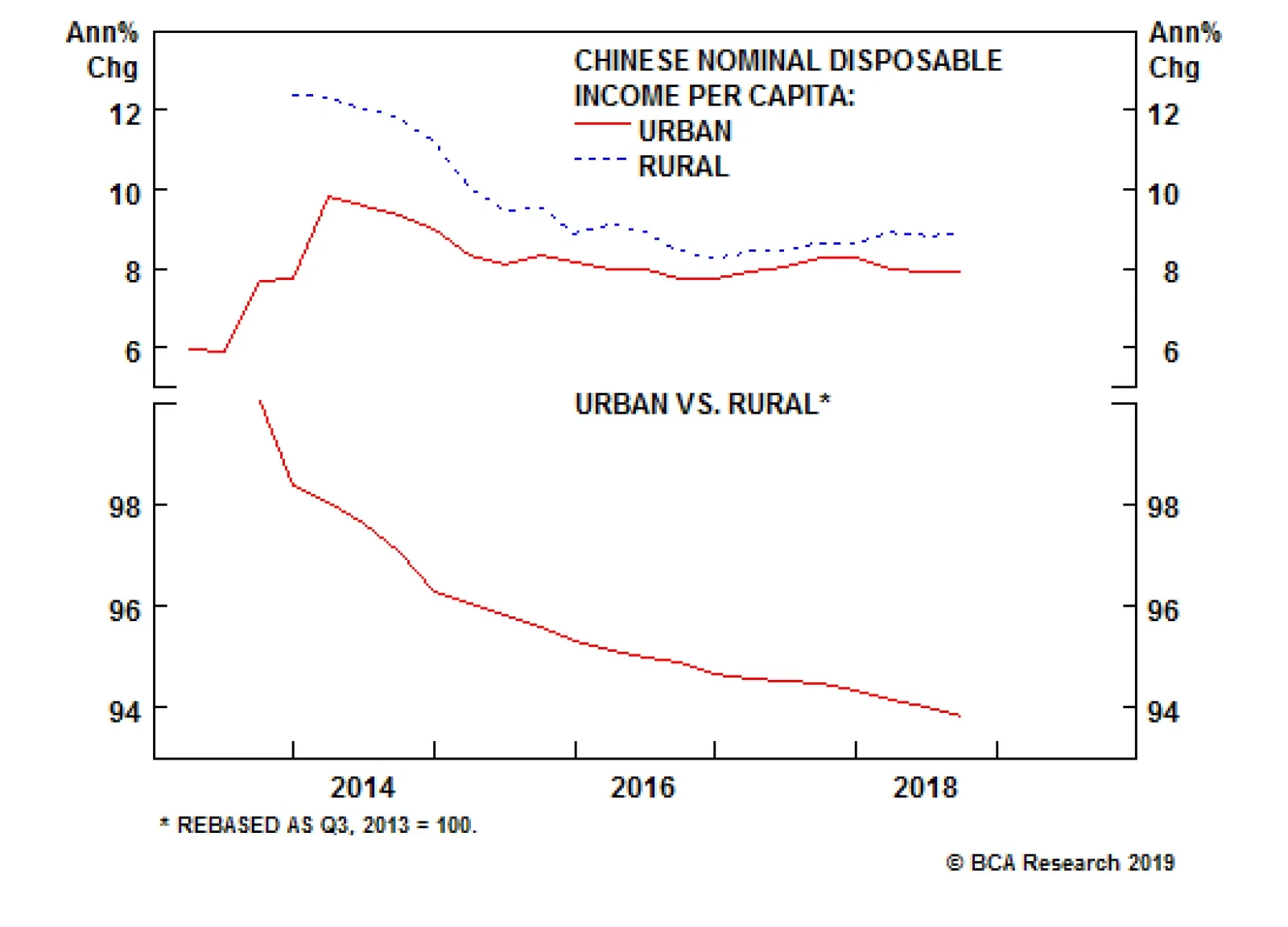

There are signs that the Chinese government is aiming to provide more support for less developed and urbanized parts of China. Beijing’s openness to rural-in-situ urbanization (i.e., urbanization without migration)…

In BCA we pay close attention to nonfarm payrolls. Employment may be a coincident indicator, but it is powerfully self-reinforcing, and the sub-NAIRU unemployment rate looms large in the Fed’s policy calculus. Payroll…

Highlights Differences of opinion are what make a market, and we’ve got a big one when it comes to the Fed: The money market says the fed funds rate goes no higher than 2.75%; BCA says 3.5% by the end of 2019, and possibly 4%…