This morning NFIB survey dipped from 104.4 to 101.2, underperforming expectations. However, lengthy government shutdowns, such as the one we just experienced, normally cause this survey to weaken sharply, only to recover once the…

Highlights We always strive to develop new analytical methods to complement our focus on judging currencies based on global liquidity conditions and the business cycle. This week, we introduce a ranking method based strictly on…

Highlights Our non-consensus inflation and Fed views just got even more non-consensus: Media and sell-side commentators were quick to speculate about an end to the tightening cycle following Wednesday’s FOMC meeting, but we don…

This morning nonfarm payrolls headline number was very strong. The U.S. created 304 thousand jobs in January, yet it was expected to only create 165 thousand positions. However, December was revised down to 222 thousand from 312…

Highlights Duration: The U.S. economic data show few signs of restrictive monetary policy, despite the fact that the market is now priced for an end to the Fed’s rate hike cycle. Investors should position for further rate hikes…

Highlights We believe 2019 and 2020 will be a tale of two markets; … : The latter stages of the long post-crisis party may be rewarding, but the inflection points that will herald a bear market and a recession are not too far…

Highlights The Eurostoxx600’s short bursts of outperformance require either global technology to underperform or the euro to underperform. EM’s short bursts of outperformance usually coincide with the global healthcare…

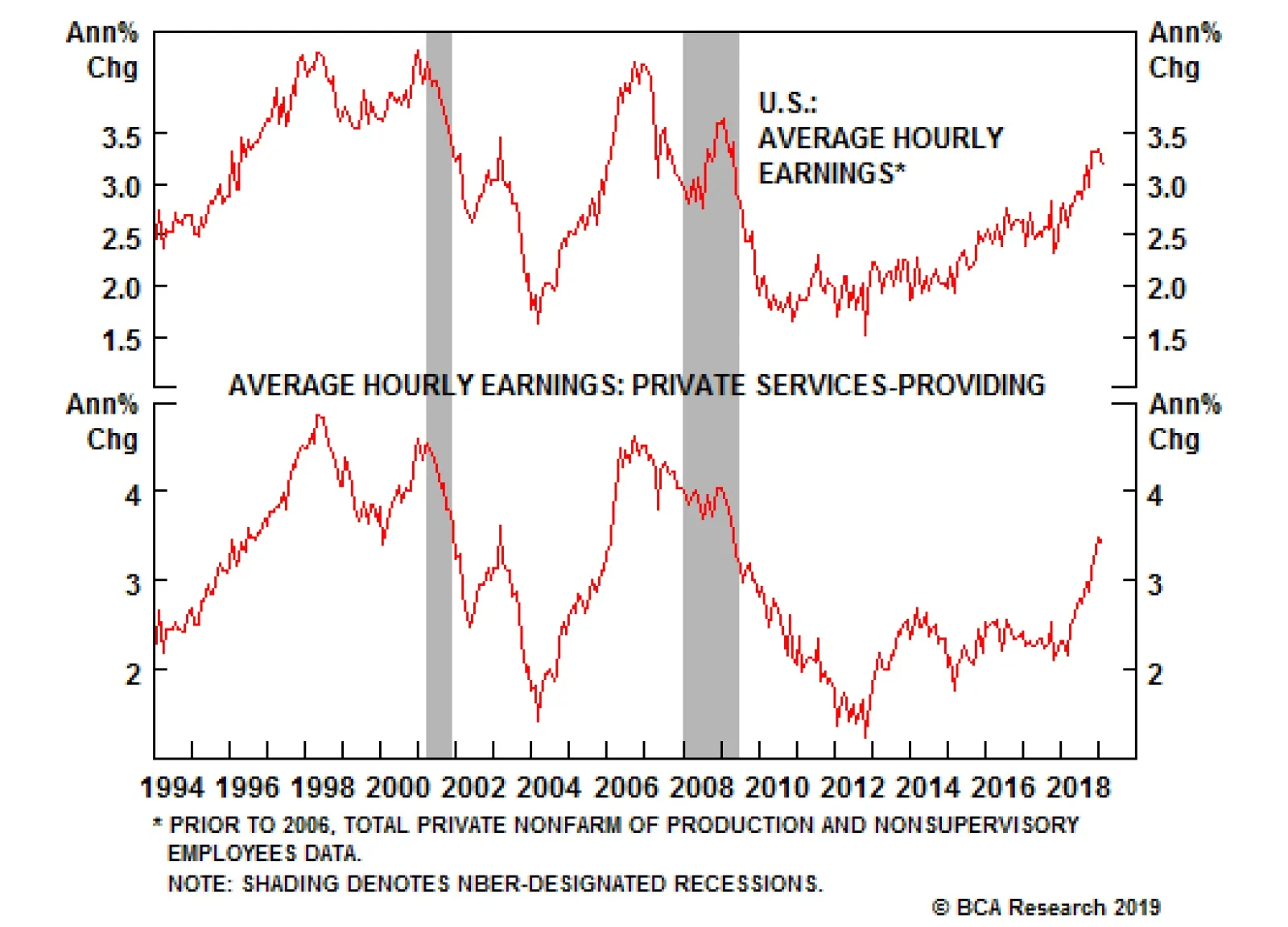

Highlights Yield Curve Drivers: A rebound in rate hike expectations will cause the curve to steepen somewhat during the next few months, though accelerating wages limit the upside. The yield curve will not invert until after long-dated…

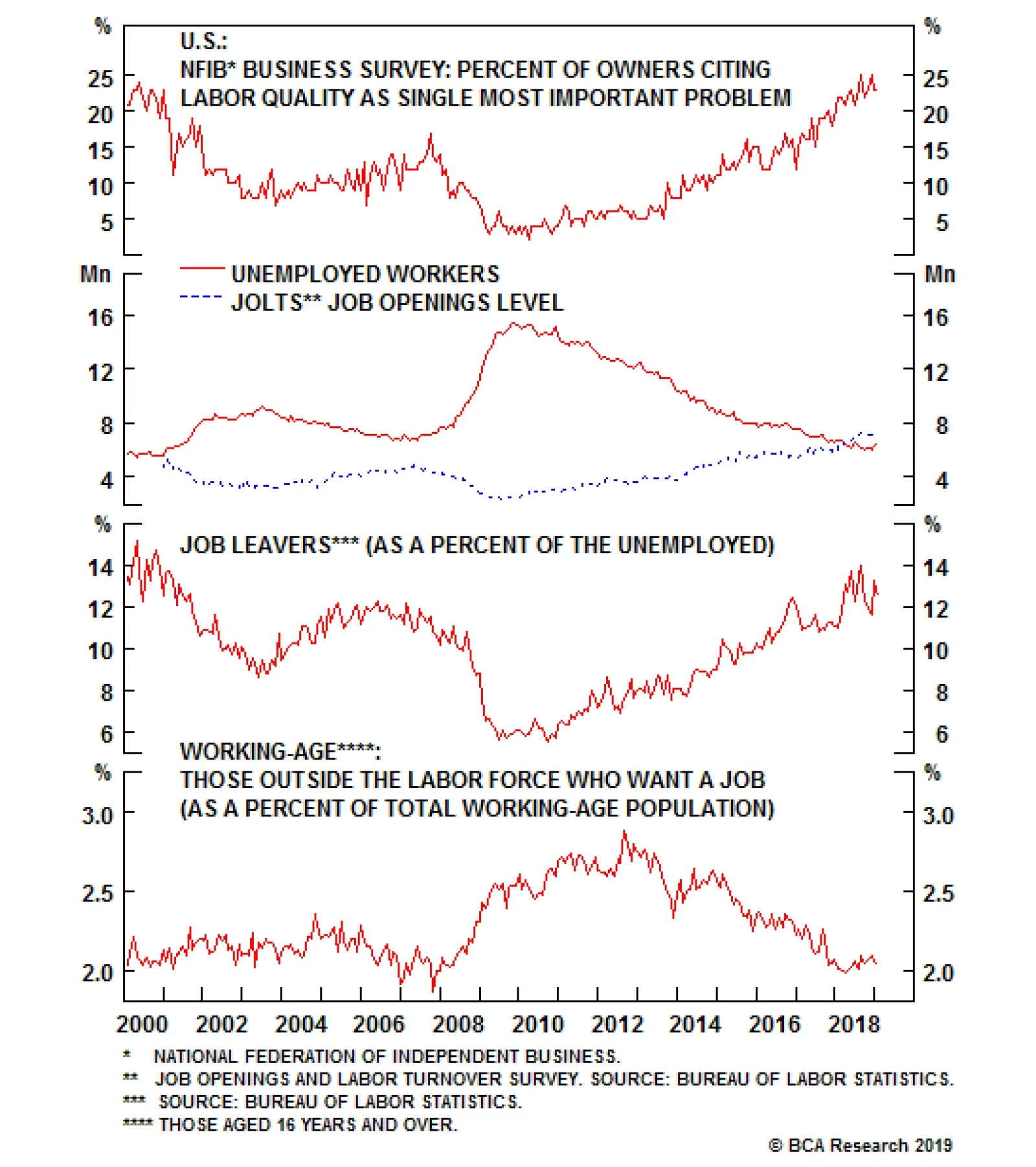

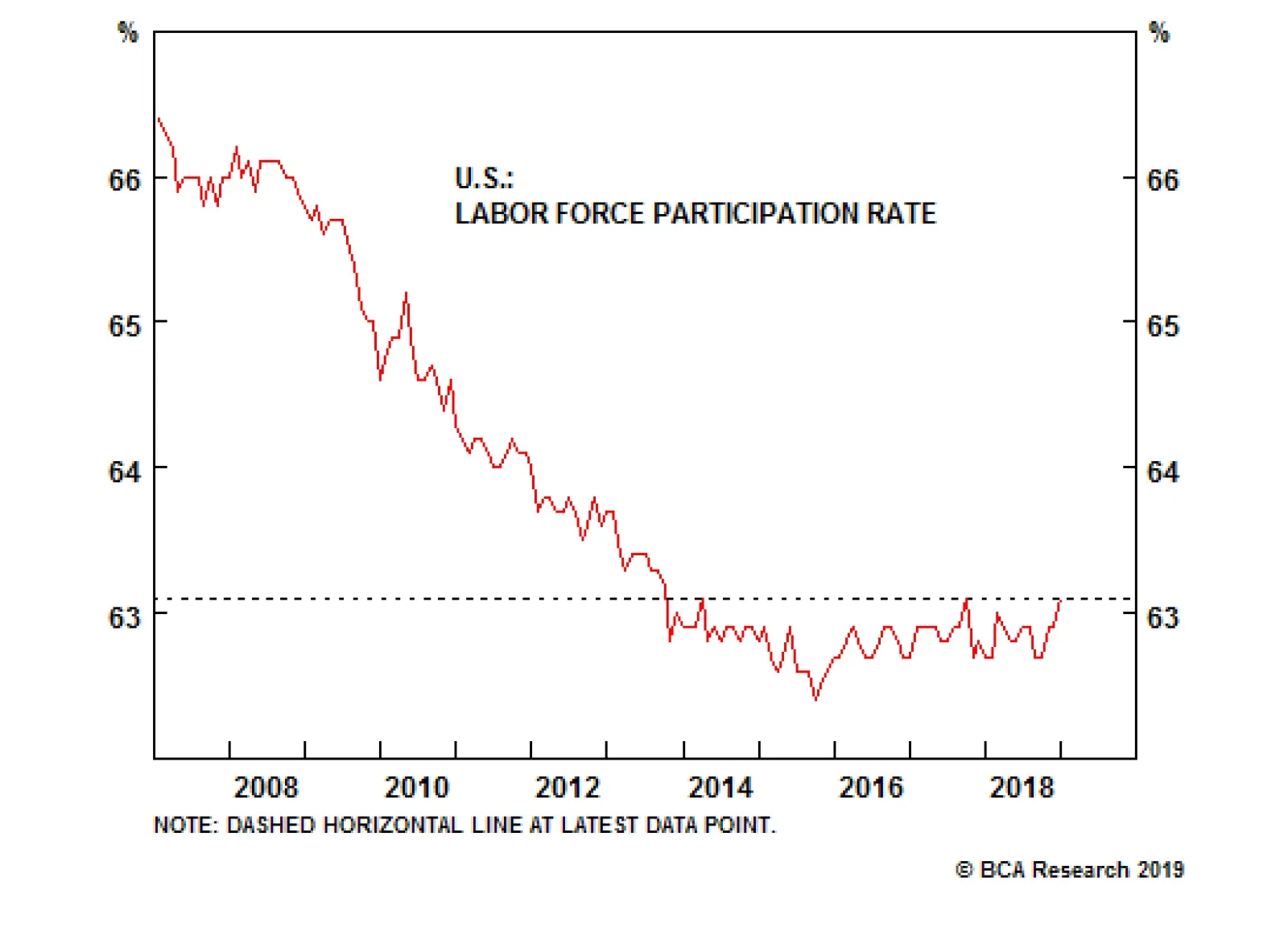

The December employment report pointed the way to an outcome that could satisfy financial markets and FOMC doves like Minneapolis president Kashkari. Despite the outsize expansion in nonfarm payrolls, the unemployment rate rose…

Highlights Survey data are easing, but that should not come as a surprise: The economy should decelerate as fiscal thrust is dialed back. Just a little patience (yeah-eah): A chorus of Fed speakers have taken to the podiums to…