Highlights Our cyclical view is unchanged, … : Despite the evident risks from escalating trade tensions, soft global economic data, and widespread recession concerns, we expect the expansion and the bull markets in spread…

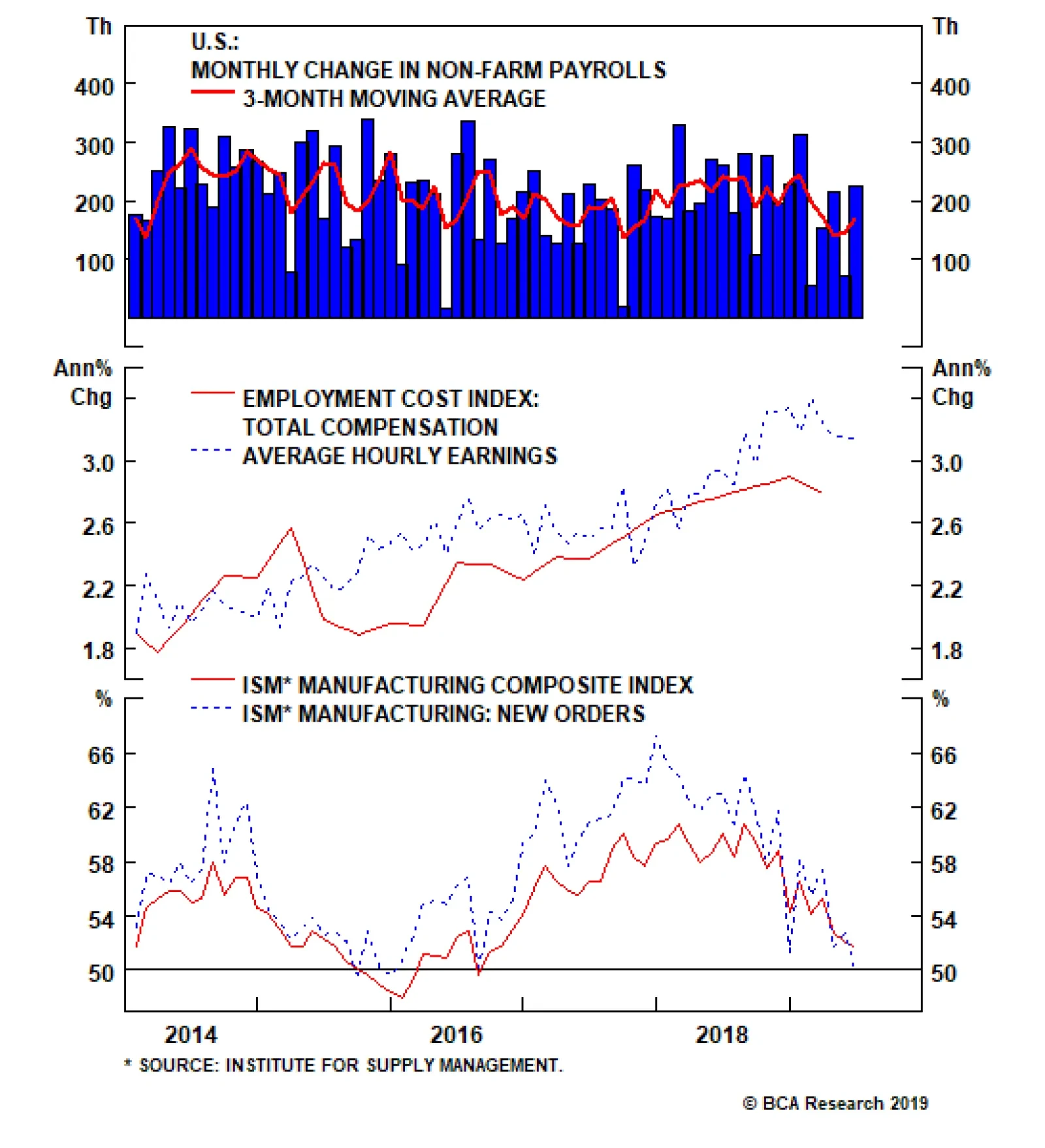

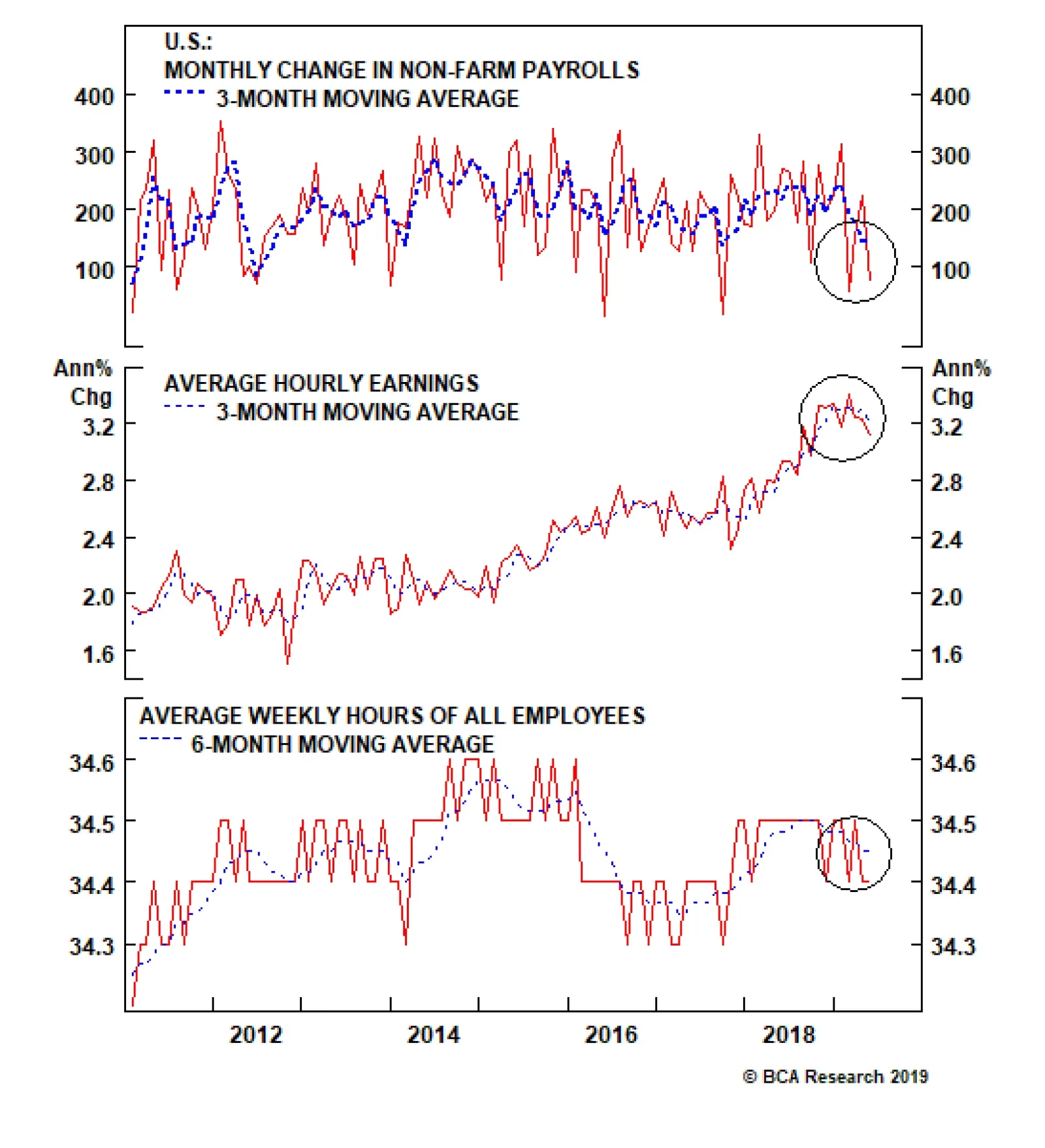

After a weak May reading, U.S. job creation rebounded in June. 224 thousand jobs were created last month, much more than the anticipated 160 thousand. However, the previous two months were revised down by a combined 11 thousand…

Highlights We are searching for evidence of an imminent end to this business cycle, … : Investors who recognize the onset of the recession in a timely fashion will have a leg up on the competition all the way through the…

Highlights A resurfacing of trade tensions could weigh on risk sentiment in the near term. A somewhat less dovish tone from the FOMC this month could further rattle risk assets. While we would not exclude the possibility of an…

Highlights 10-year real Spanish and Portuguese bond yields have already fallen below the neutral rate of interest for the entire euro zone. This suggests monetary conditions could now be favorable for all euro zone countries. Should…

The 3-month moving average of U.S. non-farm employment is still at a robust 150k. Yet, the bond market has gotten very excited - bond yields are making new cycle lows. Given that U.S. manufacturing and some…

Highlights Treasury yields have tumbled despite a solid U.S. economy: The 10-year Treasury bond yielded just under 3% when we started beating the below-benchmark-duration drum last summer; now it’s hovering around 2.3%. The…